Qualcomm Set For 50% Surge In Snapdragon 8 Gen 4 Shipments By Late 2024, Analyst Predicts

Qualcomm Inc (NASDAQ:QCOM) stock is shooting upward after analyst Ming-Chi Kuo commented on the company’s Snapdragon 8 Gen 4 shipments.

The analyst noted that Qualcomm’s stock price has already factored in the negative impact of Apple Inc (NASDAQ:AAPL) developing its own 5G chips. The company is poised to benefit from better-than-expected momentum in the fourth quarter of 2024 and favorable trends in 2025, including AI smartphone and AI PC growth and increased System on Chip (SoC) prices due to the adoption of Taiwan Semiconductor Manufacturing Co’s (NYSE:TSM) 3-nanometer process, as per Ming-Chi Kuo.

Also Read: China Is Eating Apple’s Lunch: Where Smartphone Maker Ranks Vs Asian Competitors

According to the analyst, among Qualcomm’s mobile SoCs this year, the most expensive and profitable Snapdragon 8 Gen 4 (SD8G4) will see most of its 2024 shipments in the fourth quarter of 2024.

Ming-Chi Kuo noted that compared to SD8G3, SD8G4’s second-half 2024 shipments would likely increase 50% to 9 million units, with an ASP increase of 15% to $180, contributing significantly to fourth-quarter 2024 revenue and profit.

The analyst noted that the significant growth in SD8G4 shipments is attributed to a more extended shipping period, increased demand from Samsung, and recent Chinese smartphone market dynamics.

Chinese brand smartphones reached about 80% market share during the recent Golden Week holiday sales, with shipments growing 20% (versus iPhone, which was flattish), which will likely continue through the fourth quarter of 2024, Ming-Chi Kuo said.

As per the analyst, the market share of high-end smartphones (above 4000 RMB) in China will likely grow from 25%–30% in 2023 to 30%–35% in 2024.

He added that Chinese smartphone market shipments will likely grow by 3% to 280 million units in 2024, and continued growth is likely in 2025.

Price Action: QCOM stock is up 3.32% at $175.63 at last check Monday.

Photo via Shutterstock

Also Read:

Latest Ratings for QCOM

|

Date |

Firm |

Action |

From |

To |

|---|---|---|---|---|

|

Feb 2022 |

Mizuho |

Maintains |

Buy |

|

|

Feb 2022 |

Morgan Stanley |

Maintains |

Overweight |

|

|

Feb 2022 |

JP Morgan |

Maintains |

Overweight |

View More Analyst Ratings for QCOM

View the Latest Analyst Ratings

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article Qualcomm Set For 50% Surge In Snapdragon 8 Gen 4 Shipments By Late 2024, Analyst Predicts originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

FLXS or SN: Which Is the Better Value Stock Right Now?

Investors interested in Furniture stocks are likely familiar with Flexsteel Industries FLXS and SharkNinja, Inc. SN. But which of these two stocks presents investors with the better value opportunity right now? Let’s take a closer look.

Everyone has their own methods for finding great value opportunities, but our model includes pairing an impressive grade in the Value category of our Style Scores system with a strong Zacks Rank. The Zacks Rank favors stocks with strong earnings estimate revision trends, and our Style Scores highlight companies with specific traits.

Flexsteel Industries and SharkNinja, Inc. are both sporting a Zacks Rank of # 1 (Strong Buy) right now. The Zacks Rank favors stocks that have recently seen positive revisions to their earnings estimates, so investors should rest assured that both of these companies have improving earnings outlooks. But this is just one piece of the puzzle for value investors.

Value investors analyze a variety of traditional, tried-and-true metrics to help find companies that they believe are undervalued at their current share price levels.

The Style Score Value grade factors in a variety of key fundamental metrics, including the popular P/E ratio, P/S ratio, earnings yield, cash flow per share, and a number of other key stats that are commonly used by value investors.

FLXS currently has a forward P/E ratio of 13.79, while SN has a forward P/E of 25.42. We also note that FLXS has a PEG ratio of 1.15. This popular metric is similar to the widely-known P/E ratio, with the difference being that the PEG ratio also takes into account the company’s expected earnings growth rate. SN currently has a PEG ratio of 1.72.

Another notable valuation metric for FLXS is its P/B ratio of 1.42. Investors use the P/B ratio to look at a stock’s market value versus its book value, which is defined as total assets minus total liabilities. By comparison, SN has a P/B of 9.12.

Based on these metrics and many more, FLXS holds a Value grade of A, while SN has a Value grade of D.

Both FLXS and SN are impressive stocks with solid earnings outlooks, but based on these valuation figures, we feel that FLXS is the superior value option right now.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

VW, BMW and Mercedes Are Getting Left in the Dust by China’s EVs

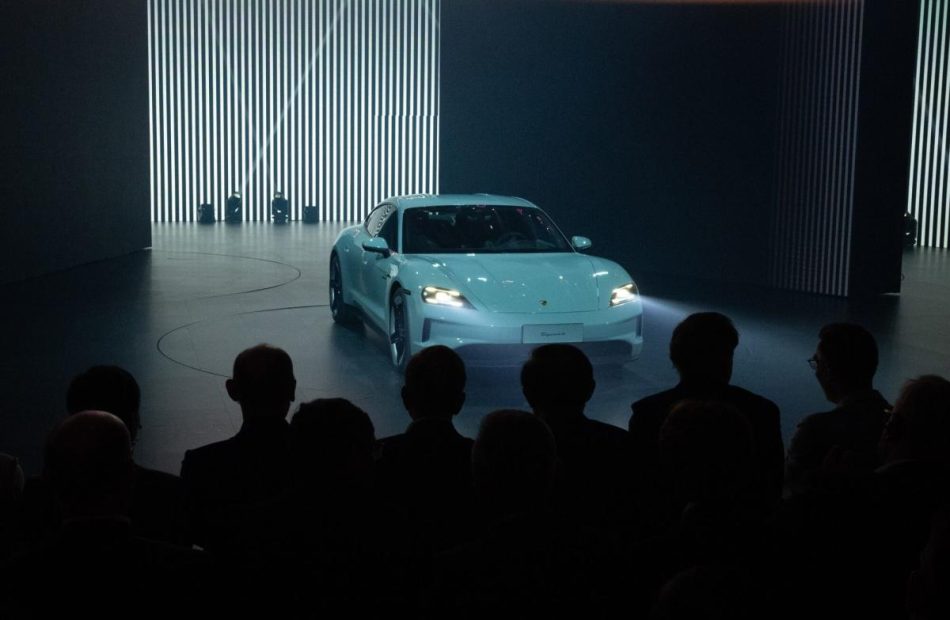

(Bloomberg) — Ryan Xu was a dream customer for Germany’s automakers. The Guangdong-based entrepreneur and her husband own a Porsche 911 and a Mercedes-Benz G-Class and were among the first buyers of the electric Porsche Taycan.

Most Read from Bloomberg

But her views on German cars have soured as Chinese consumers increasingly favor tech refinement over traditional selling points like horsepower and handling. The software systems in the Taycan, which costs well over $100,000, were “terrible,” the 36-year-old mother of three said. It was “just an electrified Porsche — and that’s it.”

Her assessment isn’t isolated. As China moves away from combustion-engine cars, Volkswagen AG, Mercedes-Benz Group AG and BMW AG are struggling to offer electric vehicles that appeal to customers in their largest and most lucrative market, putting €35 billion ($38 billion) of investment on the line.

The latest warning signs came last week, when all three German manufacturers reported slumping third-quarter sales in China. BMW posted its steepest sales drop there in more than four years, a 30% plunge, and Mercedes’ deliveries declined 13% amid poor demand for its priciest cars, including S-Class and Maybach limousines.

Porsche’s sales in China tumbled 19% to its worst third-quarter performance in a decade as global demand for the Taycan nearly halved. Volkswagen — the parent of Porsche and Audi — reported a 15% decline. “The competitive situation in China is particularly intense,” said Marco Schubert, who oversees sales for VW.

After dominating the gas-guzzler era, German manufacturers became complacent, underestimating the threats posed by new rivals and reluctant to abandon the profits generated by big-engine cars. That allowed Tesla Inc. and local manufacturers led by BYD Co. to speed by with tech-savvy and affordable plug-ins, and now China no longer needs or wants them there.

“The turning point is happening now for these automakers,” said Stephen Dyer, a Shanghai-based managing director at consultant AlixPartners. “They need to dramatically change their strategy in the market.”

The next challenge is already on display at this week’s Paris auto show, where Chinese manufacturers are stepping up their efforts to take market share in Europe. Companies including BYD and Xpeng Inc. will showcase their latest technology at the biggest European car event this year.

At least one response effort didn’t go as planned. The microphone and slide show cut out for several minutes in the midst of Volkswagen’s presentation about future electric vehicles, leaving sales and marketing chief Martin Sander visibly frustrated.

It’s an emotion shared by drivers in China. After dealing with braking and other quality issues, the Xu family sold their Taycan and bought an ET5 from Chinese brand Nio Inc. The car was about a third cheaper than a Mercedes EQE, which Xu also considered, but offered a more luxurious interior design, smooth voice controls, and greeted their kids by name as they climbed in.

“German cars can hardly match” that level of technology, said Xu, who runs a business with her husband. Mercedes, BMW and Audi “can hardly be seen as luxury cars now.”

While German automakers still control nearly 15% of the Chinese market, that’s down from a quarter before the pandemic and worse yet, their share of EVs is less than 10%. Without a quick turnaround, the slump risks turning into a rout and tipping German’s Big Three into an existential fight. As it is, VW, Mercedes and BMW are each only worth about half of BYD’s stock-market value.

Even more than other international peers, Germany’s automakers have gone all in on China. While some rivals have cut their losses, the Germans aren’t giving up, shifting more resources in an effort to claw back market share. But it looks like an uphill fight as Beijing actively seeks to build up its own manufacturers.

Volkswagen plans to play the long game. A spokesperson for the Wolfsburg-based company said the Chinese car market has been marked by steep discounts, and it wouldn’t buy market share at the expense of profitability.

The company plans to continue its “in China, for China” strategy to protect its long-term prospects. BMW and Mercedes are also planning to stick with a localization approach to appeal to buyers there.

The reasons for doubling down are clear. With Europe’s auto market probably past its peak and the US saturated, there’s no viable alternative to China for a similar level of volumes and profits.

That raises concerns given their massive footprint in China. As a group, Germany’s carmakers operate a network of over 40 factories — more than in their homeland. That’s too much investment to simply give up on — and explains why they oppose the European Union’s plans to levy tariffs on China’s cheap electric cars.

Pulling out of China — as General Motors Co. and smaller Japanese brands Suzuki Motor Corp. and Mitsubishi Motors Corp. have done — is almost unthinkable. And any restructuring would be complicated, given the operations are caught in a complex web of relations with government entities. That puts the focus on developing the kinds of features that Chinese customers want.

Urgency started to intensify in late 2022. After Volkswagen’s China chief Ralf Brandstätter warned the supervisory board that Chinese carmakers had leaped ahead, the company then chartered flights to send hundreds of staff to the Shanghai auto show in April 2023 — the first installment after years of Covid lockdowns — to see for themselves.

It was a sobering reality check. The German executives were confronted with a rapid rollout of affordable Chinese models, tech-loaded products and an intensified price war. There was also a slew of gimmicky innovations like a hopping sports car and in-car karaoke, which may have been quirky but reset the bar for Chinese consumers about the source of automotive trends.

Since then, there has been an intense competitive response. A few weeks after the auto show, VW Chief Executive Officer Oliver Blume ousted the head of software unit Cariad in the latest effort to accelerate and improve technology. Alongside new Chinese partnerships for autonomous driving, infotainment and user experience, VW also invested in Guangzhou-based Xpeng to underpin a plan to build cars using the startup’s EV expertise.

After a profit warning in September, one of the first actions by Mercedes CEO Ola Källenius was to fly to China to check on progress in reshaping its presence there including tapping CATL for batteries and Tencent Holdings Ltd. for digital services. BMW responded by joining forces with Great Wall Motor Co. to build EVs for its Mini brand.

The cumulative result is that German cars will become progressively less German in their largest market. The expansion is also exactly the opposite of the government’s aim to reduce exposure to China, according to Gregor Sebastian, an analyst at Rhodium Group.

Clinging to their position in China is “a huge gamble,” he said, noting that the German state might need to bail them out if it all goes wrong. “They’re hoping they’re too big to fail.”

While Chinese consumers eagerly bought up German cars for years, the market has changed and reclaiming that enthusiasm from a clientele that’s younger, more tech-oriented than in Europe is a major challenge. With the switch to electrics, local brands have shown they can match VW, BMW and Mercedes on quality and beat them on price and technology.

What that means for Germany can be seen inside a production hall at Mercedes’ Sindelfingen site near Stuttgart. It’s home of the flagship S-Class, long a favorite of China’s nouveau riche. But demand has slumped and production has been reduced to a single shift for the first time.

While cost-cutting has started to roll over Germany’s auto industry — most notably with VW’s threats to close factories in its homeland — Chinese operations are still insulated. It’s a sign that executives are hopeful for a turnaround. But they also have little choice.

Downsizing operations in China is difficult because large-scale job cuts often need to be discussed with domestic partners and approved by local authorities, which have little incentive to be cooperative. More drastic changes like shutting a plant is even harder.

Land in China is owned by the government and that means a factory can’t simply be shuttered and sold — even if a buyer could be found. The case of Hyundai Motor Co.’s exit from a plant in Chongqing illustrates the risk. After several attempts to sell the factory building and the machinery, the Korean carmaker ultimately accepted an offer from the local state-operated industrial zone for a fifth of its investment.

That puts pressure on Germany’s carmakers to revive sales, but the playing field has tilted in favor of domestic players. Beijing has directed several key state-owned automakers, including VW partner FAW Group, to prioritize technology and market share over profitability. That’s hardly an option for Germany’s publicly-listed carmakers.

Despite the structural headwinds, the downturn might have been prevented by more forward-looking investment in the Chinese market. But after decades at the pinnacle of the auto industry, Chinese rivals weren’t taken seriously and local insight was bypassed as decisions were funneled through boardrooms thousands of miles away.

There also wasn’t enough attention paid to the fact that the switch to EVs was about more than swapping out one powertrain for another, and early software was buggy. For instance, VW only managed to turn on over-the-air updates years after launching its first Chinese electric model in 2020.

That meant owners had to send their cars to dealers for in-store upgrades — which could at times take days. To overcome resistance, some dealers offered cash incentives to encourage customers to fix faults.

Zhou, an IT engineer living in Wuhan, had to endure the frustration after buying an ID.4 in early 2022. With screens going black several times in the middle of driving, he got glitches instead of German quality. Updates were also regularly behind schedule or available only via the dealer.

He’s now seeking a replacement. It will be another EV, but this time “I won’t visit any German dealerships,” he said. “I’ll only go for local brands, or Tesla.”

–With assistance from Stefan Nicola and Monica Raymunt.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Hurricane Milton To Deliver $2.5B Blow To Florida's Homebuilding Sector, Goldman Sachs Says

Hurricane Milton has left a significant mark on the Florida housing market, with cities such as Orlando, Tampa, Lakeland, Sarasota and Daytona Beach facing the brunt of the storm.

As recovery efforts begin, analysts expect the state’s homebuilding sector to absorb an estimated $1.7 billion to $2.5 billion hit, according to a report from Goldman Sachs analyst Susan Maklari.

Homebuilders with significant exposure in the affected regions face potential delays in construction and home closings.

Maklari notes that major homebuilders such as PulteGroup Inc. PHM, Lennar Corp. LEN, and D.R. Horton Inc DHI have significant exposure in the impacted regions, with 17%, 14%, and 11% of their 2023 closings, respectively, concentrated in these areas.

In contrast, builders like KB Home KBH and Toll Brothers Inc. TOL have minimal exposure, with less than 3% each. Historically, homebuilders in Florida have faced delays of around 4-6 weeks following severe weather events, primarily due to resource allocation to existing community recovery efforts and labor shortages.

Given Hurricane Milton’s strength, widespread geographic reach, and timing — just two weeks after Hurricane Helene — Maklari believes these delays could be extended even further.

“We expect some closings to be delayed, but this appears to be more of a timing issue. Any potential shortfall in Q4 will likely be made up in early 2025,” Maklari said.

The good news for builders is that many homes are already in later construction stages as they aim to hit year-end targets, and most builders tend to avoid constructing in floodplains.

Goldman Sachs estimates the total industry impact to fall between $1.7 billion and $2.5 billion, based on historical delays and local median home prices.

The Orlando and Tampa metropolitan areas are two of the hardest-hit regions.

In Orlando, D.R. Horton leads the market with 2,351 closings in 2023, accounting for 16.7% market share, followed closely by Lennar Corp. with 2,242 closings and a 15.9% share.

In Tampa, Lennar has an even larger presence, with 3,570 closings making up 28.7% of the market, while D.R. Horton holds 21.6%.

| # Company | Closings | Mkt. Share | % of Homes Closed by Company |

| 1 D.R. Horton | 2,351 | 16.7% | 2.6% |

| 2 Lennar Corp. | 2,242 | 15.9% | 3.1% |

| 3 The Villages of Lake Sumter | 2,129 | 15.1% | 77.9% |

| 4 PulteGroup | 1,852 | 13.2% | 6.5% |

| 5 Dream Finders Homes Inc. DFH | 791 | 5.6% | 10.8% |

| Rank | Company | Closings | Market Share (%) |

|---|---|---|---|

| 1 | Lennar Corp. | 3,570 | 28.7 |

| 2 | D.R. Horton | 2,692 | 21.6 |

| 3 | Homes by Westbay | 792 | 6.4 |

| 4 | PulteGroup | 756 | 6.1 |

| 5 | M/I Homes | 747 | 6.0 |

The broader building products sector is expected to experience a relatively muted response, with demand for materials such as roofing, flooring and insulation likely spread out over several months.

While Goldman Sachs does not anticipate a significant rise in overall product volumes, the short-term need for repairs could lead to temporary spikes in activity.

When it comes to damage to existing homes, the extent of destruction depends on the storm’s specific characteristics, such as wind speed and flooding levels.

Roofs, windows, and siding are typically most affected by wind damage, while floors, wallboard and insulation often suffer during flooding events. Key players in these product categories include:

- Roofing: Owens Corning Inc. OC, Carlisle Companies Inc. CSL

- Windows: JELD-WEN Holding Inc. JELD

- Siding: Louisiana-Pacific Corp. LPX

- Flooring: Mohawk Industries Inc. MHK

- Insulation: Owens Corning Inc., TopBuild Corp. BLD, Installed Building Products Inc. IBP

“Reconstruction demand typically spans several months,” Maklari said, citing past hurricanes.

Cleanup and insurance claims processing often delay actual repairs, with the full rebuilding efforts sometimes extending over 4 to 6 months.

For example, Owens Corning reported that Hurricane Ian in 2022 resulted in 4 million squares of roofing damage, representing approximately 2.5% of annual roofing shipments.

Goldman Sachs does not foresee a sharp rise in overall building product volumes from Hurricane Milton. Instead, they expect a “pull-forward” in demand, meaning that short-term rebuilding activity might be strong, but it won’t significantly raise long-term volumes. This could result in choppy revenue comparisons as the industry moves past the initial recovery phase.

Read Now:

Photo: Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Man Who Accidentally Threw Hard Drive Containing 8,000 Bitcoins Worth Half A Billion Dollars In Landfill Sues Local City Council For Not Excavating The Site

James Howells, etched in the history books for accidentally discarding Bitcoin (CRYPTO: BTC), which is worth more than half a billion dollars today, took a major step in retrieving them.

What Happened: In a last-ditch effort, the Wales-based software engineer filed a lawsuit against Newport City Council for roughly 495.31 million British pounds, or about $647 million, in damages for repeatedly denying his request to excavate the landfill site housing the discarded hard drive, which contains around 8,000 units of Bitcoin, as reported by WalesOnline.

Howells explained that the lawsuit is a strategy to convince the council to allow an excavation of its landfill, not a reflection of the actual situation.

See Also: Groundbreaking trading app with a ‘Buy-Now-Pay-Later’ feature for stocks tackles the $644 billion margin lending market – here’s how to get equity in it with just $500

Howells has assembled a team of specialists to carry out the excavation at no cost to the council. He has also proposed to give the council 10% of the recovered coins’ value.

The case is set for a hearing in December. Newport Council, however, has dismissed the lawsuit as “weak” and expressed concerns over potential environmental impacts of the proposed excavation.

Why It Matters: The bizarre case dates back to 2013 when Howells unintentionally put a hard drive containing 8,000 BTCs in the trash while cleaning his office.

The compensation that Howells sought was the peak valuation of the stash from earlier this year when the leading cryptocurrency spiked to a new all-time high.

As of this writing, 8,000 BTCs are worth $514.37 million, at a market price of $64,296.34 per unit.

Read Next:

Image generated using Dall-E

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article Man Who Accidentally Threw Hard Drive Containing 8,000 Bitcoins Worth Half A Billion Dollars In Landfill Sues Local City Council For Not Excavating The Site originally appeared on Benzinga.com

Tesla's Chinese Rivals Move To Calm Fears Of An European 'Invasion' That Threatens Legacy Players: 'Not Going To Overthrow Anybody Who's Developed Over 100 Years'

Leading Chinese carmakers have dismissed the idea of challenging Europe’s legacy manufacturers with cheaper electric vehicles.

What Happened: At the Paris motor show, Chinese carmakers, including Xpeng Inc. XPEV and Guangzhou Automobile Group Co. Ltd. GNZUF, emphasized their long-term commitment to the European market. This comes amidst a trade war between Beijing and Brussels and fears of a potential “invasion,” reported the Financial Times on Sunday.

“We’re a 10-year-old company. We’re not going to overthrow anybody who’s developed over 100 years,” said Xpeng co-president Brian Gu, while showcasing an electric saloon with advanced artificial intelligence technology. He added that Xpeng aims to be the provider of “premium electric vehicles” in Europe and does not intend to compete on price.

Chinese state-owned carmaker GAC, which is also making inroads in the region, echoed a similar sentiment, emphasizing the potential economic benefits of its entry into the European markets and its willingness to collaborate with European suppliers.

These statements come amid growing political anxiety in Europe over the potential risks posed to the region’s industry. In early October, EU member states agreed on tariffs of up to 45% on Chinese EVs in an effort to counter their advance. This has led to a series of profit warnings from local manufacturers.

Why It Matters: The European Union’s protectionist stance against Chinese EVs has been a point of contention in the industry. The EU’s decision on tariffs for Chinese EVs could potentially lead to a wider trade war with China, as the 27-member bloc’s protectionist stance could hurt its export-dependent companies, and its EV targets, and threaten critical raw material supplies.

China has also warned the EU about the potential negative impacts on trade, especially with Germany, if the EU imposes tariffs on Chinese EVs. The situation has raised concerns about increased costs for consumers and potential impacts on the automotive market.

Meanwhile, Tesla Inc. TSLA rival BYD Co. Ltd. BYDDF BYDDY has slammed the proposed EU tariffs on Chinese-made EVs, warning that they could increase costs and discourage buyers. This warning comes as European and Chinese automakers compete at the Paris car show, the largest in Europe, during a time of weak demand and rising costs.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

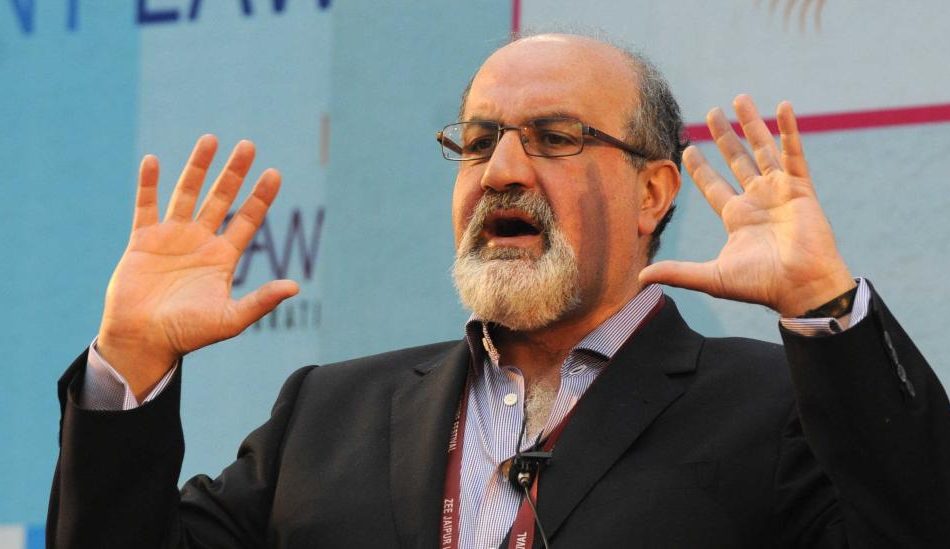

Collapse risks loom as markets are the most fragile they've been in 20 years, 'Black Swan' author Nassim Taleb says

-

“The Black Swan” author Nassim Taleb says he’s focused on hedging against a market collapse.

-

He said the market is flashing parallels to prior crashes, noting that it is the most fragile in 20 years.

-

He pointed to risks like high debt levels and “crazy” stock prices in an interview with Bloomberg.

A top economist and risk expert says the US is in one of the most precarious investing environments in decades — and while some investors are cheering on the rally in stocks, he has his eye on a potential market collapse.

Nassim Taleb, author of “The Black Swan,” the famed treatise on the risks related to improbable events, aired concerns over the state of the market in a recent interview with Bloomberg.

The environment, he said, mirrors prior crashes, and he added that he was focused on preparing for such an event.

“We have a lot of risks building up,” the Universa Investments advisor told Bloomberg on Friday. “I would say that … my focus would be more on being hedged against an eventual market collapse because we’re more fragile than we were probably at any point in the last 20 years, if not, you know, 30 years,” he later added.

Taleb pointed to a handful of risks looming over the market despite the bullish backdrop for stocks over the past year.

Stock prices look “crazy,” he said, noting that most of the S&P 500’s rally has been concentrated in a small pool of companies linked to artificial intelligence.

Yet, it’s unclear if those companies hold the most growth potential, he said, pointing to the rotation of top-performing companies during the dot-com bubble.

“AI is going to be the best investment. But maybe not at these firms,” he said.

Meanwhile, the US economy has been “confusing,” with uncertainty over whether some sectors are overheating, Taleb said.

World economies are also more dependent on each other, thanks to increased globalization since the pandemic. That means foreign shocks are more likely to spread, he noted, another factor that complicates the investing environment.

The West is also holding on to more debt “than we can handle,” Taleb said, with the debt-to-GDP ratio in the US notching 124% at the end of September. If high debt levels are combined with an external shock, that could result in a “death spiral,” Taleb has previously predicted.

Meanwhile, investors are coming out of a period dominated by lower interest rates. Many market participants are used to steering away from more “conservative” assets, and that risk-on attitude could put traders in a vulnerable position, he suggested.

“These crises happen when you expect them the least,” Taleb said. “And I think we’re very similar to the environment we’ve had in previous collapses, and the market becomes complacent. People are used to it. They might have some precaution in the beginning, but then they throw precaution to the wind … and that’s when the vulnerability is going to be at its maximum.”

Universa Investments is technically “market blind,” Taleb said, as the firm employs an investment strategy that disregards short-term market forecasts.

Taleb and other forecasters at the firm, though, have repeatedly issued downbeat predictions on stocks and the economy over the short term. Mark Spitznagel, Universa’s founder, said earlier this year he foresaw the S&P 500 entering a “face-ripping rally” before seeing the worst crash since 1929, thanks partly to precarious conditions brewing in the credit market.

Read the original article on Business Insider

Brady Is a Great Choice for 'Trend' Investors, Here's Why

While “the trend is your friend” when it comes to short-term investing or trading, timing entries into the trend is a key determinant of success. And increasing the odds of success by making sure the sustainability of a trend isn’t easy.

The trend often reverses before exiting the trade, leading to a short-term capital loss for investors. So, for a profitable trade, one should confirm factors such as sound fundamentals, positive earnings estimate revisions, etc. that could keep the momentum in the stock alive.

Our “Recent Price Strength” screen, which is created on a unique short-term trading strategy, could be pretty useful in this regard. This predefined screen makes it really easy to shortlist the stocks that have enough fundamental strength to maintain their recent uptrend. Also, the screen passes only the stocks that are trading in the upper portion of their 52-week high-low range, which is usually an indicator of bullishness.

There are several stocks that passed through the screen:

Brady

BRC is one of them. Here are the key reasons why this stock is a solid choice for “trend” investing.

A solid price increase over a period of 12 weeks reflects investors’ continued willingness to pay more for the potential upside in a stock. BRC is quite a good fit in this regard, gaining 7.5% over this period.

However, it’s not enough to look at the price change for around three months, as it doesn’t reflect any trend reversal that might have happened in a shorter time frame. It’s important for a potential winner to maintain the price trend. A price increase of 0.5% over the past four weeks ensures that the trend is still in place for the stock of this identification and security products maker.

Moreover, BRC is currently trading at 92.2% of its 52-week High-Low Range, hinting that it can be on the verge of a breakout.

Looking at the fundamentals, the stock currently carries a Zacks Rank #1 (Strong Buy), which means it is in the top 5% of more than the 4,000 stocks that we rank based on trends in earnings estimate revisions and EPS surprises — the key factors that impact a stock’s near-term price movements.

The Zacks Rank stock-rating system, which uses four factors related to earnings estimates to classify stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), has an impressive externally-audited track record, with Zacks Rank #1 stocks generating an average annual return of +25% since 1988.

Another factor that confirms the company’s fundamental strength is its Average Broker Recommendation of #1 (Strong Buy). This indicates that the brokerage community is highly optimistic about the stock’s near-term price performance.

So, the price trend in BRC may not reverse anytime soon.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.