Brady Is a Great Choice for 'Trend' Investors, Here's Why

While “the trend is your friend” when it comes to short-term investing or trading, timing entries into the trend is a key determinant of success. And increasing the odds of success by making sure the sustainability of a trend isn’t easy.

The trend often reverses before exiting the trade, leading to a short-term capital loss for investors. So, for a profitable trade, one should confirm factors such as sound fundamentals, positive earnings estimate revisions, etc. that could keep the momentum in the stock alive.

Our “Recent Price Strength” screen, which is created on a unique short-term trading strategy, could be pretty useful in this regard. This predefined screen makes it really easy to shortlist the stocks that have enough fundamental strength to maintain their recent uptrend. Also, the screen passes only the stocks that are trading in the upper portion of their 52-week high-low range, which is usually an indicator of bullishness.

There are several stocks that passed through the screen:

Brady

BRC is one of them. Here are the key reasons why this stock is a solid choice for “trend” investing.

A solid price increase over a period of 12 weeks reflects investors’ continued willingness to pay more for the potential upside in a stock. BRC is quite a good fit in this regard, gaining 7.5% over this period.

However, it’s not enough to look at the price change for around three months, as it doesn’t reflect any trend reversal that might have happened in a shorter time frame. It’s important for a potential winner to maintain the price trend. A price increase of 0.5% over the past four weeks ensures that the trend is still in place for the stock of this identification and security products maker.

Moreover, BRC is currently trading at 92.2% of its 52-week High-Low Range, hinting that it can be on the verge of a breakout.

Looking at the fundamentals, the stock currently carries a Zacks Rank #1 (Strong Buy), which means it is in the top 5% of more than the 4,000 stocks that we rank based on trends in earnings estimate revisions and EPS surprises — the key factors that impact a stock’s near-term price movements.

The Zacks Rank stock-rating system, which uses four factors related to earnings estimates to classify stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), has an impressive externally-audited track record, with Zacks Rank #1 stocks generating an average annual return of +25% since 1988.

Another factor that confirms the company’s fundamental strength is its Average Broker Recommendation of #1 (Strong Buy). This indicates that the brokerage community is highly optimistic about the stock’s near-term price performance.

So, the price trend in BRC may not reverse anytime soon.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bitcoin, Ethereum, Dogecoin Soar As Stocks Register New All-Time Highs: Top Analyst Says King Crypto On Track Toward $78K

Leading cryptocurrencies rallied handsomely Monday, coinciding with fresh highs scaled by stocks.

| Cryptocurrency | Gains +/- | Price (Recorded at 9:30 p.m. EDT) |

| Bitcoin BTC/USD | +5.40% | $65,895.00 |

| Ethereum ETH/USD |

+6.86% | $2,620.94 |

| Dogecoin DOGE/USD | +6.43% | $0.1175 |

What Happened: Bitcoin jumped above $65,000 during morning trading hours and rose to $66,434 late evening, the highest it has been since July 30.

Ethereum also rose to a two-week high of $2,630, representing a nearly 7% jump in the last 24 hours.

Digital asset trading firm QCP Capital highlighted historical similarities with Bitcoin’s upward price action preceding the U.S. elections.

More than $245 million was liquidated from leveraged positions in the last 24 hours, with downside bets worth $209 million getting wiped out.

Bitcoin’s Open Interest-Weighted Funding Rate surged to levels not seen since late July, signaling the dominance of bullish leveraged traders.

The market sentiment dramatically shifted from “Neutral” to “Greed,” according to the Cryptocurrency Fear & Greed index, indicating a potential surge in buying pressure.

Top Gainers (24-Hours)

| Cryptocurrency | Gains +/- | Price (Recorded at 9:30 p.m. EDT) |

| BOOK OF MEME (BOME) | +37.17% | $0.01069 |

| Cat in a dogs world (MEW) | +28.53% | $0.008632 |

| Bitcoin Cash (BCH) | +18.28% | $380.39 |

The global cryptocurrency stood at $2.29 trillion, following a jump of 4.75% in the last 24 hours.

Stocks registered a blockbuster opening in the new trading week. The Dow Jones Industrial Average popped 201.36 points, or 0.47%, to close at a record high of 43,065.22. The S&P 500 jumped 0.77% to end at 5,859.85, also a record high. The tech-heavy Nasdaq Composite gained 0.87% to hit 18,502.69.

The rally was fueled by AI juggernaut Nvidia Corp.’s NVDA record close Monday after its shares rose 2.4% in the regular trading session.

The earnings season kicked off with JPMorgan Chase & Co. JPM reporting their third-quarter numbers last week. This week, investors were keeping a careful eye on the next batch of big earnings reports from major banks and technology companies, including Goldman Sachs Group Inc. GS and Netflix Inc. NFLX.

See More: Best Cryptocurrency Scanners

Analyst Notes: Cryptocurrency analyst Ali Martinez drew attention to his projection from last month and how things were going as anticipated.

On Sept. 23, the analyst had predicted Bitcoin’s fall to $60,000, followed by a rebound to $66,000, a retrace to $57,000, and finally a breakout toward $78,000.

Martinez remarked that with the first three prerequisites met, King Crypto was on track for $78,000.

Another widely-followed technical analyst, Rekt Capital stated that Bitcoin needed one daily close above $65,000 and a subsequent retest to sail into the $65000-$71350 area.

“Each of these moves have ended in lower highs, but there is a good chance that this series of lower highs could end with a daily close above $65,000,” the analyst said.

Photo by Igor Faun on Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Prediction: This Artificial Intelligence (AI) Stock Will Outperform Nvidia Over the Next Decade

A couple of years ago, semiconductor specialist Nvidia attempted to acquire a little-known company called Arm Holdings (NASDAQ: ARM).

Unfortunately for Nvidia, the company abandoned the deal as long-winded court cases revolving around antitrust concerns seemed to have no end in sight. Following the failed acquisition, Arm pursued an initial public offering (IPO) — hitting the Nasdaq last September.

Since going public, Arm stock has surged 138% on the backdrop of the artificial intelligence (AI) movement. But even after such a meteoric rise, I see much better days ahead for Arm. In fact, I think Arm stock will handily outperform Nvidia over the next decade.

Below, I’ll detail why I’m so bullish on Arm and explain how rising competition in the chip realm could ignite Nvidia’s first uphill battle in quite some time.

Why Arm stock might outperform Nvidia

The semiconductor industry has many different components. Not all chip companies make graphics processing units (GPUs) like Nvidia or Advanced Micro Devices. There are far more applications for chips, and Arm dominates a pretty singular pocket of the market.

At its core, Arm designs chip architecture for mobile devices, consumer electronics, networking equipment inside data centers, and other Internet of Things (IoT) devices. The company makes money from licensing out its intellectual property (IP), and earns a royalty based on its various architectures.

As illustrated in the graphic above, Arm’s architecture is deeply embedded across various applications. This provides the company with an enviable level of flexibility regarding new chips hitting the market in the future. In other words, companies running on Arm’s architecture are less inclined to develop a new hardware and software system that is incongruent with Arm’s architecture.

Furthermore, the slide above shows that Arm’s market share has increased across the board over the last two years. With that in mind, I think the company is well positioned to continue benefiting from new chip-based devices, since Arm’s IP is already leveraged across so many devices around the world.

For this reason, I see Arm as less vulnerable to competitive forces in the chip space compared to peers such as Nvidia.

Why Nvidia’s best days may be in the rearview mirror

Like Arm, Nvidia has a massive presence in its core end market. The company’s A100 and H100 chipsets have helped Nvidia acquire an estimated 88% of the GPU market.

However, I see some obvious risks that could expose Nvidia over the next several years, and I would not be surprised to see the company begin to lose market share.

First, companies including Microsoft, Alphabet, Tesla, Amazon, and Meta Platforms are all investing in their own custom chip designs. Moreover, these companies have been labeled by Wall Street analysts as Nvidia’s largest customers — accounting for nearly half of the company’s revenue.

While you could argue that more competition is a good thing for Nvidia, I don’t see it that way in this case. These companies will probably remain customers of Nvidia for the next several years, but the introduction of their own hardware could wind up being a bargaining chip in the long run.

What I mean by that is that more GPUs on the market will likely weaken Nvidia’s pricing power. In turn, I think Nvidia’s revenue and profit growth could have a dramatic slowdown — a dynamic that growth investors won’t want to see.

But rising competition isn’t the only risk facing Nvidia. Given the company’s near-monopoly position, there is a possibility that the Department of Justice (DOJ) could investigate Nvidia’s business practices and force the company to loosen up its ecosystem.

With so many unknowns revolving around Nvidia’s future, I’m skeptical that the stock is a no-brainer at this juncture.

Is Arm stock a buy right now?

There have been many periods of expansion and contraction in Arm’s trading activity. But with a forward price-to-earnings (P/E) multiple of 96, it’s hard to say the stock is cheap.

The forward P/E of the S&P 500 is about 23, less than one-quarter that of Arm.

Here’s how I think about it: The market is clearly placing a premium on Arm stock for a reason. I think there are two core themes to unpack.

At a macro level, AI appears to be here for the long run, and technology’s biggest companies are committed to spending billions on future artificial intelligence initiatives. While spending will change from year to year, the secular tailwinds presented by AI should bode well for Arm.

At a company-specific level, Arm’s unique position in the chip space and its lucrative business model suggest that the company’s growth will remain robust over time.

For these reasons, I see Arm as the superior investment over Nvidia in the next decade. While the stock isn’t a bargain, I think it still looks like a compelling opportunity for long-term investors.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,266!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,047!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $389,794!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Prediction: This Artificial Intelligence (AI) Stock Will Outperform Nvidia Over the Next Decade was originally published by The Motley Fool

Gold Miners Could Be on the Verge of an Epic Quarter

The gold miners are on the verge of reporting another best quarter ever. Q3’s earnings season ramping up soon will prove epic, fueled by dazzling record gold prices and slightly-lower mining costs. That ought to double sector unit profits, extending gold stocks’ long trend of massive earnings growth. Such fantastic results should increasingly catch fund investors’ attention, with their inflows driving this sector way higher.

Gold stocks remain out of favor, greatly lagging gold’s monster upleg over this past year. This has proven one of gold’s mightiest advances in many years, soaring 46.8% over 11.7 months! Historically larger gold miners dominating the leading GDX gold-stock ETF have seen their stock prices amplify gold uplegs by 2x to 3x. Yet instead of seeing normal 95%- to-140% upleg gains, GDX has merely rallied 60.7% at best!

That very-poor 1.3x upside leverage to gold has been a real kick in the teeth for contrarian speculators and investors. Gold stocks need to way outperform their metal to compensate for the big additional operational, geological, and geopolitical risks they heap on top of gold price trends. Yet so far that sure hasn’t happened in this upleg, leaving traders increasingly disappointed with this lucrative high-potential sector.

Two major factors contributed to this surprising anomaly. First gold-stock sentiment was crushed in mid-2022 and hasn’t recovered. Then the Fed’s most-violent rate-hike cycle ever catapulted the US Dollar Index up an incredible 16.7% in 6.0 months to an extreme 20.4-year secular peak! That spawned colossal gold-futures selling, slamming gold 20.9% lower in 6.6 months. GDX cratered a brutal 46.5% during that!

Second while gold blasted up 26.4% year-to-date, traders have been overwhelmingly distracted by the AI stock bubble. While gold achieved 35 nominal-record closing highs so far this year, the S&P 500 bested that with a whopping 44 of its own! Gold and gold stocks are alternative investments, thriving the most when general stock markets grind lower. Instead they’ve been surging, spinning off vast greed and euphoria.

But sooner or later all that will pass, and gold stocks will be bid way higher to reflect these lofty prevailing gold prices. The gold miners’ phenomenal fundamentals overwhelmingly support this bullish thesis. For 33 quarters in a row now, I’ve painstakingly analyzed the latest results reported by GDX’s 25-biggest component stocks. Right after each quarterly earnings season, I write essays explaining how they are performing.

Across individual gold miners, there are always plenty of distorted bottom-line earnings. These include big noncash gains and losses arising from unusual items ranging from acquisitions to impairment charges. But that noise can be distilled out with an excellent proxy for sector unit profits. It simply averages the GDX top 25’s all-in sustaining costs in any quarter, then subtracts them from its average gold price.

These implied per-ounce profits have been skyrocketing, leaving gold stocks deeply undervalued relative to their metal. A year ago in Q3’23, the GDX top 25 reported $622 in unit earnings which soared 94% YoY. Then in Q4’23, those grew again to $659 per ounce which shot up another 42% YoY. That trend persisted in Q1’24, with these major gold miners averaging earning $795 per ounce which powered up 35% YoY.

Then all that accelerated dramatically in the spectacular Q2’24, which I analyzed in depth in a mid-August essay. That quarter’s record average gold price of $2,337 combined with GDX-top-25 AISCs plunging 10.2% YoY to $1,239 catapulted unit earnings to a dazzling record $1,099! That blasted up another 84% YoY. So miners’ last four reported quarters have seen per-ounce profits soar 94%, 42%, 35%, and 84% YoY!

Such explosive profits growth has naturally slammed gold miners’ price-to-earnings ratios dramatically lower, into the teens and even single digits in some cases. With fantastically-bullish fundamentals like this, you’d think traders would be rushing into this high-potential sector. But gold stocks remain mired in apathy, lost in the shadow of this crazy AI stock bubble stealing all the limelight. Yet its days are numbered.

Eventually, stock prices always mean revert to some reasonable multiple of underlying corporate earnings. Market-darling AI stocks can’t trade with 60x+ P/Es indefinitely, and good gold stocks can’t remain at sub-15x multiples. Sooner or later some catalyst will spark overdue capital flows to start normalizing all this. It could be the AI stock bubble finally bursting and decisively rolling over, it could prove gold surging even higher.

But maybe the gold miners will stack enough sensational earnings seasons to convince fund managers to return. Their relatively-big buying in this relatively-small sector will drive stock prices way higher, which will eventually fuel greed, euphoria, and maybe even a popular speculative mania. Gold stocks are about to report absolutely-epic Q3 results, their best ever achieved by far! That could prove this sector’s tipping point.

Q3’24’s average gold price soared an amazing 28.6% YoY to a new all-time record $2,477! This is utterly stunning considering just a year ago that highwater mark had been $1,978. Gold’s phenomenal prices last quarter were fueled by major buying from gold-futures speculators, central banks around the world, Chinese investors, and a huge surge in Indian gold imports. I could write entire essays discussing each.

But today realize Q3’s record gold levels have been set in stone, they can’t be revised lower like Biden Administration jobs reports. So the only variable driving sector unit profitability is the GDX top 25’s average all-in sustaining costs. Over the past four quarters they have been trending lower on balance, clocking in at $1,304, $1,317, $1,277, and $1,239 per ounce. That averages $1,284, a conservative baseline.

The majority of these elite major gold miners provide and update AISC guidance throughout the year. And many of them are forecasting higher production and thus lower mining costs in H2’24 compared to H1. Gold mining has massive fixed costs, which growing output spreads across more ounces reducing unit costs. A surprising number of major gold miners continued guiding to considerably-lower costs in Q3 and Q4.

The world’s largest gold miner and GDX’s biggest component by far with a huge 14.6% weighting is a great example. In Q1 and Q2, Newmont reported AISCs of $1,439 and $1,562 per ounce. That averaged a little over $1,500 in H1. Yet in late July NEM reaffirmed its full-year-2024 AISC guidance at just $1,400 per ounce. Unlike most of its peers, Newmont didn’t even give a range. And its 2024 output was H2-weighted.

Back in late February this super-major forecast 47% of this year’s production would come in H1, then 53% in H2. That alone is going to force AISCs lower. To hit that $1,400 AISC target for all of 2024, Q3’s and Q4’s would have to average just $1,300! That is sharply lower from Q1’s and Q2’s, and would make for a big improvement. We are talking about H2 AISCs plunging 13%+ from H1 levels, which would be amazing.

While I really doubt NEM will achieve such low Q3 and Q4 AISCs, they will definitely materially improve. And there are plenty of other GDX-top-25 majors with similar much-better-mining-cost forecasts for H2 compared to H1. Collectively these elite gold miners averaged $1,258 AISCs in H1’24. It seems pretty conservative to imagine them improving 2%ish in this soon-to-be-reported Q3, which would be near $1,230.

We won’t know what the actual average is until Q3 earnings season ends in mid-November, after which I’ll write another essay fully analyzing those collective results. But if GDX-top-25 AISCs come in around $1,230, subtracted from Q3’s phenomenal $2,477 average gold price that yields implied sector profits of $1,247 per ounce! That would crush Q2’24’s previous record of $1,099, and skyrocket over 100% YoY!

You’d sure think a doubling in gold miners’ already-massive profits would impress some fund managers, motivating them to add gold-stock positions. But even if GDX-top-25 Q3 AISCs come in way higher for some reason, profitability is still going to soar. Even if those average AISCs prove much worse up near $1,350, Q3’s unit earnings would still soar 81% YoY to a new record $1,127. Those profits will prove epic.

Crazily due to this AI stock bubble and funds dangerously concentrated in a handful of wildly-overcrowded AI plays, American stock investors’ overall allocations to gold are effectively zero. Entering October, the S&P 500 stocks collectively commanded a staggering $51,247b market capitalization. Yet the combined holdings of the world-dominant American GLD and IAU gold ETFs were merely worth $106b that same day.

That implies a trivial 0.2% gold allocation, despite gold’s record-shattering year! That should be 5% to 10%, since gold has always been an essential portfolio diversifier. Even if it grows to 1%, gold is heading way higher. And fund managers’ allocations to gold miners’ stocks are similarly-tiny. At some point gold miners’ earnings will grow so fat and rich that their stocks can no longer be ignored, and capital inflows will soar.

While the major gold stocks’ imminent Q3 results are going to be jaw-droppingly awesome, this sector does face a near-term speedbump. Gold stocks leverage gold, and it faces high selloff risks during coming weeks. My essay last week analyzed this in depth. Gold simply blasted too far too fast to extremely-overbought levels driven by heavy gold-futures buying, leaving speculators’ positioning extreme.

But despite gold growing really overextended, gold stocks are not since they have lagged their metal so much this year. This chart divides GDX by its own 200-day moving average, creating an overbought-and-oversold indicator I call the Relative GDX. This renders gold-stock moves in constant-percentage terms around a 200dma flattened to horizontal at 1.00x. Over time this rGDX indicator tends to form trading ranges.

The current one based on the last five years of data runs from extremely-oversold levels under 0.75x GDX’s 200dma to extremely-overbought ones over 1.30x. Unlike its metal, GDX still hasn’t yet reached the latter warning levels in this year-long upleg! At the major gold stocks’ latest interim high achieved in late September, the rGDX was merely running 1.249x! Gold stocks don’t need to fully amplify gold’s selloff.

Of course they will to some extent, as they are leveraged plays on the metal they mine. At worst since its latest interim high, gold has pulled back 2.4% as of midweek. GDX did fall 6.8% in that span, making for 2.9x downside leverage on the higher side of that usual 2x-to-3x range. But that ought to moderate since gold stocks remain really undervalued after seriously lagging gold’s powerful advance, as precedent shows.

Gold’s last healthy mid-upleg pullback ran from late May to early June, when it dropped 5.7% rebalancing sentiment. During that span gold bled off excessive greed, GDX only retreated 10.0% making for mere 1.8x downside leverage! Any coming gold-stock downside on another gold pullback should prove relatively-muted as well. The gold stocks never challenged extreme overboughtness, and popular greed never flared.

If gold pulling back forces a gold-stock selloff ahead of or into Q3 earnings, that should prove an excellent buying opportunity. Mid-upleg pullbacks offer the best buy-relatively-low opportunities within ongoing bull-market uplegs. We ratcheted up trailing stop losses on our newsletter gold-stock trades preparing for a retreat, and I’m researching fundamentally-superior mid-tiers and juniors to buy into as it runs its course.

Even with this sector still languishing out of favor, the getting has been good. As of the end of Q3, our two newsletters have realized 54 gold-stock trades so far in 2024. Their average annualized realized gains including all losers are running +31.1%! Over the past quarter-century we’ve run through 1,531 newsletter stock trades averaging 16.0% annualized realized gains, doubling the long-term stock-market average!

So if you’re a speculator and not trading gold stocks, you’re missing out on a volatile sector with lots of opportunities. And if you’re an investor not yet diversified into gold stocks, you’re forgoing huge upside as gold continues powering higher on balance. Gold and its miners’ stocks should be included to some reasonable extent in every portfolio, as they can increase returns while lowering overall portfolio risks.

The bottom line is gold miners are about to start reporting epic Q3 results. Last quarter’s dazzling record gold prices combined with forecast lower mining costs will catapult unit earnings to astounding levels. They are likely to about double to amazing records, extending gold stocks’ massive-earnings-growth streak to five consecutive quarters. That should increasingly attract fund managers to this long-neglected sector.

While gold faces a healthy rebalancing selloff after getting extremely overbought on excessive gold-futures buying, resulting short-term gold-stock selling should prove muted. This sector remains deeply-undervalued after seriously lagging gold this year, limiting gold stocks’ downside leverage to gold. Any selling is an opportunity to add gold-stock positions relatively-low, before this sector soars to reflect lofty gold levels.

Related Articles

Gold Miners Could Be on the Verge of an Epic Quarter

2 Charts to Track as S&P 500, Nasdaq 100 Rally Faces Exhaustion Risks This Week

S&P 500: This Bull Market Is Young and Still Has Plenty of Momentum

Nvidia, Microstrategy, Trump Media & Technology, Sofi Technologies, And Tesla: Why These 5 Stocks Are On Investors' Radars Today

The stock market continued its bullish run on Monday, with the S&P 500 and the Dow Jones Industrial Average hitting record highs. The S&P 500 surged past 5,850 points, while the Dow Jones broke the 43,000 mark for the first time. However, the Nasdaq 100 lagged behind, gaining 0.9% but remaining about 1% below its all-time high set on July 10. Amidst this market performance, certain stocks caught the attention of retail traders and investors.

NVIDIA Corporation NVDA saw a rise of 2.43%, closing at $138.07. The stock’s intraday high was $139.60, with a low of $136.30. Its 52-week high and low are $140.76 and $39.23 respectively. A Chinese government-backed think tank has urged the country’s data centers to continue using Nvidia’s high-performance chips, citing the substantial costs and complexity involved in transitioning to domestic alternatives.

MicroStrategy Incorporated MSTR dropped by 5.14% to close at $201.67. The stock reached a 52-week high of $227.15 before pulling back. Its intraday low was $201.43, and its 52-week low stands at $32.1. The company’s shares were influenced by the surge in Bitcoin BTC/USD prices, given MicroStrategy’s significant Bitcoin holdings.

See Also: Columbus Day: Is Stock Market Open Today?

Trump Media & Technology Group Corp. DJT surged 18.47% to close at $29.95. The stock’s intraday high and low were $30.47 and $25.25, respectively, with a 52-week high of $79.38 and a low of $22.55. The company announced the release of its Truth+ streaming service, contributing to the stock’s rise.

SoFi Technologies Inc SOFI jumped 11.43% to close at $10.04. The stock’s intraday high was $10.07, with a low of $9.38. Its 52-week high and low are $10.49 and $6.01, respectively. The company announced a $2 billion loan agreement with Fortress Investment Group, boosting its stock.

Tesla Inc. TSLA saw a modest increase of 0.62%, closing at $219.16. The stock’s intraday high was $221.91 and its low was $213.74. Its 52-week high and low are $271 and $138.8, respectively. Tesla’s aggressive discounts on new models have led to a significant drop in used EV prices, creating a challenging scenario for EV owners and dealers.

Prepare for the day’s trading with top premarket movers and news by Benzinga.

Image via Shutterstock

Read Next:

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stock market today: S&P 500 hits another record close as rally presses on amid earnings

-

US stocks hit record highs on Monday as investors get ready for a wave of earnings reports.

-

Over 80 S&P 500 companies, including Netflix and Goldman Sachs, report earnings this week.

-

Fed Governor Waller advised caution on future rate cuts.

US stocks surged about 1% on Monday, driving the S&P 500 and Dow Jones Industrial Average to record closing highs as investors gear up for a wave of third-quarter earnings this week.

Monday’s close marked the S&P 500’s 46th record close of the year, as investors continue to power the two-year-old bull market higher. The Dow closed above 43,000 for the first time.

More than 80 S&P 500 companies are scheduled to report third-quarter earnings results this week, with major names like Netflix, Goldman Sachs, and Morgan Stanley on deck.

According to data from Fundstrat, 6% of S&P 500 companies have already reported their results. Of those, 74% beat profit estimates by a median of 6%, while 58% beat revenue estimates by a median of 2%.

It’s a relatively muted week on the economic data front, with investors likely to focus on the Thursday releases of September retail sales and initial jobless claims.

Both data points will give investors insights into the health of the consumer and job market, respectively.

There is also some Fedspeak this week, with Federal Reserve Governor Adriana Kugler set to speak on Tuesday.

Fed Governor Christopher Waller spoke on Monday, saying that there should be “more caution” on future interest rate cuts as the economy remains on solid footing.

“I view the totality of the data as saying monetary policy should proceed with more caution on the pace of rate cuts than was needed at the September meeting,” Waller said at Stanford University’s Hoover Institution.

He added: “I will be watching to see whether data, due out before our next meeting, on inflation, the labor market and economic activity confirms or undercuts my inclination to be more cautious about loosening monetary policy.”

According to the CME FedWatch Tool, markets are pricing in a 25-basis point interest rate cut at both of the Fed’s remaining FOMC meetings this year in November and December.

Here’s where US indexes stood at the 4:00 p.m. closing bell on Monday:

Here’s what else is going on:

In commodities, bonds, and crypto:

-

West Texas Intermediate crude oil was down 2.32% to $73.81 a barrel. Brent crude, the international benchmark, was lower by 2.05% to $77.42 a barrel.

-

Gold was down 0.32% to $2,667.70 an ounce.

-

The 10-year Treasury yield was flat at 4.096%.

-

Bitcoin was higher by 4.98% to $65,987.

Read the original article on Business Insider

UnitedHealth Group's Earnings Outlook

UnitedHealth Group UNH will release its quarterly earnings report on Tuesday, 2024-10-15. Here’s a brief overview for investors ahead of the announcement.

Analysts anticipate UnitedHealth Group to report an earnings per share (EPS) of $7.03.

Investors in UnitedHealth Group are eagerly awaiting the company’s announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It’s worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

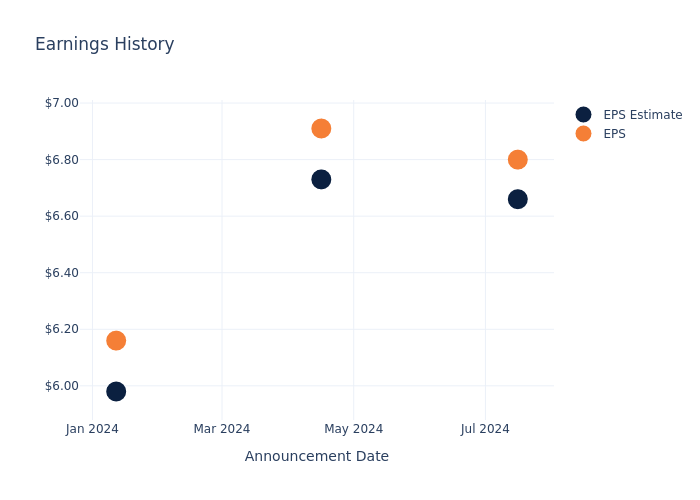

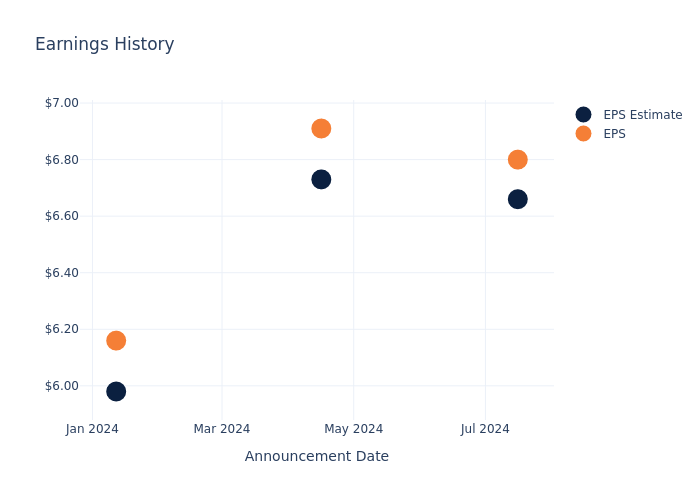

Performance in Previous Earnings

The company’s EPS beat by $0.14 in the last quarter, leading to a 4.45% increase in the share price on the following day.

Here’s a look at UnitedHealth Group’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 6.66 | 6.73 | 5.98 | 6.32 |

| EPS Actual | 6.80 | 6.91 | 6.16 | 6.56 |

| Price Change % | 4.0% | 2.0% | -3.0% | 3.0% |

Performance of UnitedHealth Group Shares

Shares of UnitedHealth Group were trading at $598.05 as of October 11. Over the last 52-week period, shares are up 13.13%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Insights Shared by Analysts on UnitedHealth Group

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on UnitedHealth Group.

With 18 analyst ratings, UnitedHealth Group has a consensus rating of Outperform. The average one-year price target is $615.78, indicating a potential 2.96% upside.

Peer Ratings Comparison

In this analysis, we delve into the analyst ratings and average 1-year price targets of Centene, Molina Healthcare and HealthEquity, three key industry players, offering insights into their relative performance expectations and market positioning.

- Centene is maintaining an Outperform status according to analysts, with an average 1-year price target of $88.0, indicating a potential 85.29% downside.

- As per analysts’ assessments, Molina Healthcare is favoring an Neutral trajectory, with an average 1-year price target of $367.0, suggesting a potential 38.63% downside.

- As per analysts’ assessments, HealthEquity is favoring an Outperform trajectory, with an average 1-year price target of $102.14, suggesting a potential 82.92% downside.

Peer Metrics Summary

The peer analysis summary outlines pivotal metrics for Centene, Molina Healthcare and HealthEquity, demonstrating their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| UnitedHealth Group | Outperform | 6.61% | $21.06B | 4.79% |

| Centene | Outperform | 5.92% | $4.43B | 4.22% |

| Molina Healthcare | Neutral | 18.65% | $1.21B | 6.45% |

| HealthEquity | Outperform | 23.15% | $204.05M | 1.68% |

Key Takeaway:

UnitedHealth Group ranks at the top for Gross Profit and Return on Equity among its peers. It is in the middle for Revenue Growth.

About UnitedHealth Group

UnitedHealth Group is one of the largest private health insurers, providing medical benefits to about 50 million members globally, including 1 million outside the us as June 2024. As a leader in employer-sponsored, self-directed, and government-backed insurance plans, UnitedHealth has obtained massive scale in managed care. Along with its insurance assets, UnitedHealth’s continued investments in its Optum franchises have created a healthcare services colossus that spans everything from medical and pharmaceutical benefits to providing outpatient care and analytics to both affiliated and third-party customers.

Key Indicators: UnitedHealth Group’s Financial Health

Market Capitalization Analysis: With a profound presence, the company’s market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Positive Revenue Trend: Examining UnitedHealth Group’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 6.61% as of 30 June, 2024, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: The company’s net margin is a standout performer, exceeding industry averages. With an impressive net margin of 4.31%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): UnitedHealth Group’s ROE excels beyond industry benchmarks, reaching 4.79%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): UnitedHealth Group’s ROA stands out, surpassing industry averages. With an impressive ROA of 1.48%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 0.84, caution is advised due to increased financial risk.

To track all earnings releases for UnitedHealth Group visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

A Glimpse of Bank of America's Earnings Potential

Bank of America BAC is preparing to release its quarterly earnings on Tuesday, 2024-10-15. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect Bank of America to report an earnings per share (EPS) of $0.77.

Anticipation surrounds Bank of America’s announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

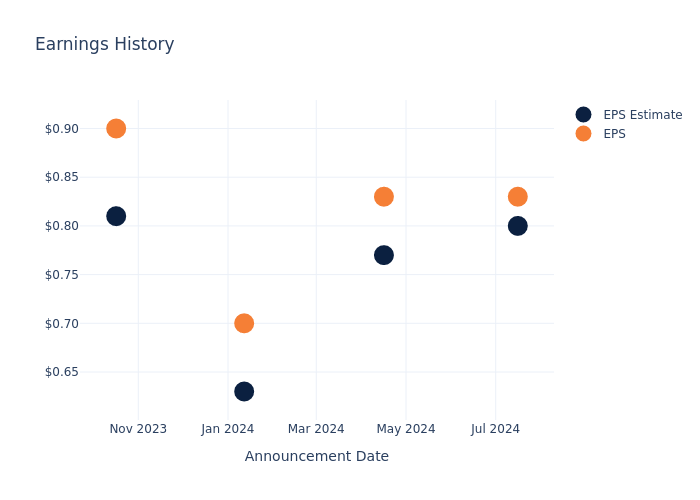

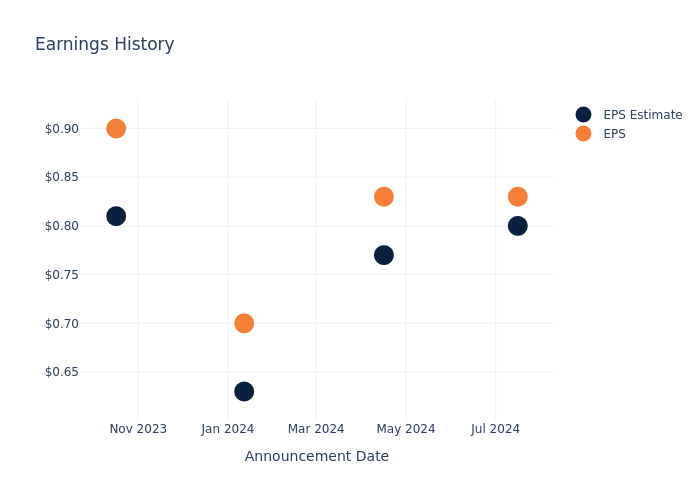

Earnings History Snapshot

In the previous earnings release, the company beat EPS by $0.03, leading to a 0.34% drop in the share price the following trading session.

Here’s a look at Bank of America’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.80 | 0.77 | 0.63 | 0.81 |

| EPS Actual | 0.83 | 0.83 | 0.70 | 0.90 |

| Price Change % | -0.0% | 2.0% | -1.0% | -1.0% |

Stock Performance

Shares of Bank of America were trading at $41.95 as of October 11. Over the last 52-week period, shares are up 51.74%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

To track all earnings releases for Bank of America visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.