Mark Cuban Defends Kamala Harris' Crypto Knowledge, Appears To Take Dig At Trump For Selling Tokens And Merchandise: 'Unlike Your Guy, She Doesn't Pretend'

Mark Cuban, billionaire entrepreneur and vocal supporter of Vice President Kamala Harris, defended the Democratic presidential candidate’s grasp of cryptocurrencies and the significance they hold for young people.

What Happened: On Monday, Cuban defended Harris against allegations that the vice president lacked even a basic understanding of cryptocurrency and monetary policy.

“She doesn’t know everything. Unlike your guy [Trump], she doesn’t pretend. She understands the connection cryptocurrency has to young people. And she spoke about it today,” Cuban said, highlighting Harris’ latest cryptocurrency regulatory framework.

Cuban also took potshots at Republican challenger Donald Trump, stating that Harris was not trying to sell tokens, sneakers, bibles, etc.

The famous ‘Shark Tank’ celebrity also replied to concerns about why Harris cannot transfer state-owned Bitcoin BTC/USD to the Treasury Department to demonstrate her support for the leading cryptocurrency.

“There is a law in place that currently prevents it. Obviously, it’s been discussed. But no one can change it unilaterally,” Cuban said.

Considered a close advisor to the Harris campaign team, Cuban said he argued for holding onto confiscated cryptocurrency assets and warned against the consequences of dumping a huge quantity of Bitcoins into the market in quick successions.

Why It Matters: Harris recently unveiled a cryptocurrency regulatory framework as part of her “Opportunity Agenda for Black Men,” signaling a potential shift in the Democratic approach to digital assets. However, the decision faced criticism from some industry leaders over the narrow focus on black men.

Earlier, Cuban criticized Trump’s upcoming sale of tokens, which were tied to his much-touted decentralized finance (DeFi) project, World Liberty Financial (WLFI).

Cuban has expressed dissatisfaction with the current SEC Chair Gary Gensler‘s approach to regulating the cryptocurrency industry and floated his name as a potential SEC chair candidate should Harris win the U.S. presidency.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Where Will Nvidia Stock Be in 1 Year?

The roller coaster doesn’t seem to be stopping as Nvidia (NASDAQ: NVDA). The centerpiece of the artificial intelligence (AI) boom has also been the main driver of the S&P 500 index’s performance since late 2022. This year alone, roughly a quarter of the index’s 20% rise can be attributed to the chipmaker.

That’s a lot of weight on Nvidia’s shoulders. Investors are hyperfocused on its every move, seeing it as a bellwether for the market at large. The good news for investors, then, is that the AI giant is charging full steam ahead. It will face challenges and overcome obstacles, but Nvidia has several catalysts that could boost its bottom line in the not-too-distant future. What will the next year bring for Nvidia?

Demand is still extremely high for its bread and butter

The uber-powerful chips the company designs and sells are the backbone of its success. That’s why investors were spooked when the company announced its first real snafu since the AI boom took off. Production issues were discovered in the newest version of its AI chips originally set to begin rolling out in the third quarter. These chips, dubbed Blackwell, are now expected to hit the market a quarter later in Q4. Luckily, this delay is shorter than some feared, and the company assured investors that the delay had been accounted for in its guidance.

Critically, any loss from Blackwell chips in the short term is being compensated for by the still extremely high demand for its current-generation Hopper chips. When Blackwell does begin rolling out, the company expects the demand to be even stronger. As CEO Jensen Huang put it, “The anticipation for Blackwell is incredible.”

Now, while Nvidia has generally delivered on its promises in the past, it’s a good idea to take a company’s promises with a grain of salt. Company brass was a little light on details around the delay, and there is always a chance that things won’t go as planned. If more delays are announced, it could spell trouble for Nvidia. Still, I don’t see any reason to believe that will happen here or that this will develop into a major problem.

Nvidia makes more than its flagship chips

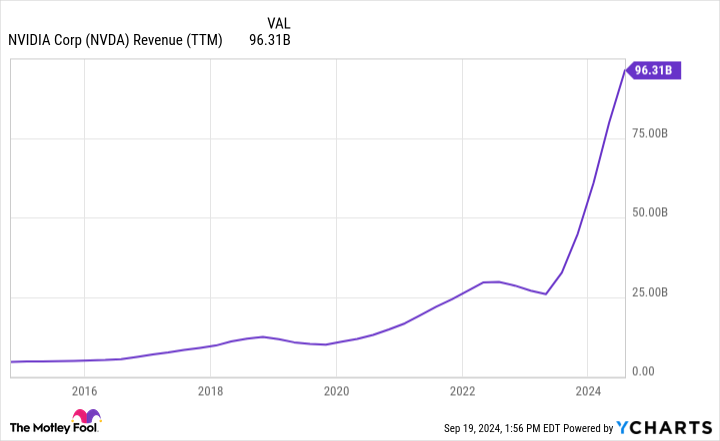

Nvidia’s data center segment, under which its AI chips fall, is by far its most lucrative. I think the chart below puts into perspective just how important the segment is for the company.

See that incredible inflection point in 2023? That is almost entirely coming from its data center growth.

Now, its chips are undoubtedly the heart of this, but it’s not the only product the company offers in this segment. Nvidia aims to be a full-service provider of data center hardware and software. Nvidia has a platform called Spectrum-X that, although launched as recently as last year, has already seen a big uptick in sales.

The platform is a networking solution that allows customers to keep up with the intensive networking demands of AI computing without abandoning ethernet. Ethernet — a networking technology — has been the standard for decades and is used in almost every data center in the world. As Nvidia continues to build ever more powerful chips, existing ethernet networks are struggling to keep up with the flow of data, creating a bottleneck.

This could mean having to retrofit a data center, removing the miles and miles of ethernet cables and associated hardware, and replacing it with faster technology. Remember, these data centers are massive — we’re talking the size of multiple football fields in some cases — so you can imagine this would be incredibly costly. Spectrum-X allows the bones of these networks to remain, upgrading only critical parts of the network infrastructure. This is a huge cost saver for data centers.

Nvidia leadership was excited by Spectrum-X in the company’s latest earnings call. CFO, Colette Kress reported that Nvidia’s “Ethernet for AI” — of which Spectrum-X is a primary part — revenue “doubled sequentially with hundreds of customers adopting our Ethernet offerings” and that the platform “has broad market support from OEM and ODM partners.” The company expects Spectrum to be a multibillion-dollar product line in a year.

Beyond this, Nvidia is rolling out new software to help companies build custom AI solutions and is pushing further into the automotive industry, a segment that could be massive in a few years’ time once driverless technology matures. In the short term, however, this will still be a significant revenue source as AI is integrated into car “infotainment” systems. This is already happening, but expect to see more car companies advertise this system in the coming year.

Nvidia is on the right path

Without getting specific about a price target, I think Nvidia will outperform the market over the coming year. Yes, at a price-to-earnings ratio (P/E) of 56.07, it does carry a premium, but this is pretty much at or below where it has been trading since the beginning of 2020. Furthermore, its forward P/E is currently sitting at 34.2, slightly below its average since the AI boom took off. These figures look fine to me considering Nvidia’s growth potential.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,266!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,047!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $389,794!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

Johnny Rice has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Where Will Nvidia Stock Be in 1 Year? was originally published by The Motley Fool

Here's How Investing $50 per Week in This Top ETF Can Generate $65,000 in Annual-Dividend Income

Who couldn’t use $65,000 per year in dividends? Bolstering your income can mean retiring early, planning more vacations, and having a more financially sound future. If you invest early and keep up a habit of putting aside $50 per week, it’s entirely possible that you end up with that much in dividends.

By accumulating a large-enough balance, you also won’t need to invest into risky dividend stocks with high payouts which may not be sustainable. And you wouldn’t want to put all that money at risk, anyway. By deploying a slow-and-steady approach to investing, you can keep your risk low while significantly growing your portfolio. Here’s how you can put yourself on a path to generating $65,000 in annual dividends.

Save and put the money into a top-growth fund

If you can save $50 per week, a good strategy can be to put that money into an exchange-traded fund (ETF) at the end of every week. On a typical four-week month, that means you’re putting away $200, on average, into an ETF. Over the course of a year, that’s going to total $2,600, and over 30 years it will be $78,000.

But the real magic is in the compounding, which can turn that $78,000 into a portfolio that’s worth well over $1 million and provide you with the nest egg you need to generate some mammoth-dividend income.

A great way to grow all that savings is by investing in tech stocks. I don’t mean loading up on Nvidia or a hot new artificial intelligence (AI) stock. Instead, you can just target a broad range of tech stocks with the iShares U.S. Technology ETF (NYSEMKT: IYW). As the name suggests, you’ll get exposure to the top names in tech. That includes Nvidia along with many other tech stocks, including Apple and Microsoft. Collectively, those three make up 44% of the fund’s overall weight. While the composition of the fund may change over the years, you’ll be invested in the top names in tech. And that’s a good way to ensure your gains will be significant.

The risk is that in a down year the fund could struggle because tech stocks can be volatile. But in the long term, they can generate some life-changing returns. Going back 20 years, the fund has amassed total returns (which include dividends) of around 1,500% — far higher than the 650% gains you would have accumulated with the more diversified S&P 500. And at 1,500%, that averages out to a compounded annual growth rate of about 14.8%.

Returns are never a guarantee, but if you were to average that type of a return over a 30-year period, then your $50 weekly investment could grow to a value of nearly $1.5 million. Compare that with the total investment of just $78,000. The effect of compounding and targeting tech stocks can lead to much more significant gains for your portfolio.

Turning that money into dividend income

The hard part is getting your balance that high, but if you can get it to around $1.5 million, then you’ve obviously got many ways to turn that into plenty of dividend income. But a safe way to do that is to invest in yet another ETF, this time one which focuses on dividends. A good example here is the Vanguard International High Dividend Yield Index Fund ETF (NASDAQ: VYMI), which yields 4.3%. That would be a high-enough yield to turn $1.5 million into nearly $65,000 in annual dividends.

In 30 years, there will be other ETFs and investment options to consider, and the Vanguard International High Dividend Yield Index is just one example. You may also want to opt for multiple ETFs to help balance out the risk even further.

There’s plenty of incentive to invest as much as you can afford

Regardless of how much you can invest, there’s always plenty of reason to do so, as investing in a top-growth fund can make the most of your savings. Investing tax refunds and profits from other investments can be other ways you can add to your position and help accelerate your gains even further, potentially putting you on a path to $65,000 in dividends even quicker.

Should you invest $1,000 in iShares Trust – iShares U.s. Technology ETF right now?

Before you buy stock in iShares Trust – iShares U.s. Technology ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and iShares Trust – iShares U.s. Technology ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,069!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Here’s How Investing $50 per Week in This Top ETF Can Generate $65,000 in Annual-Dividend Income was originally published by The Motley Fool

2 Reasons to Jump on Apple Stock Now and 1 Reason to Think Twice

Though it hasn’t been without its ups and downs, Apple Inc‘s AAPL stock has effectively been trading sideways since July. In fact, the tech titan’s shares closed Tuesday’s session at the same price they were just one week before they popped to their last all-time high. In the three months since then, they’ve fallen as much as 20% and rallied about the same.

Speaking from a technical perspective, at least, Apple’s shares haven’t been forming the most bullish pattern. Sure, they’ve managed a run of higher lows since August’s dip, but it’s the lack of higher highs that could give some investors pause for concern. Especially as it’s coming at a time when the Fed has signaled its intent to cut rates, and the likes of the benchmark S&P 500 index are back at highs and looking like they could be on the verge of a major breakout.

But it’s perhaps this apparent divergence that is creating a decent entry opportunity here. MarketBeat readers will be familiar with our past analysis of Apple stock and how it can often take a broader market move upwards to pull it from its lethargy. However, Apple tends to outpace most of its peers easily once it does.

As we head into the final few months of the year, it’s worth exploring the opportunities opening up in Apple. Here are two reasons to buy and one reason to avoid it.

One Reason to Buy: Fundamentals

There’s simply no getting away from the fact that as far as fundamental performance goes, Apple is a powerhouse. The company’s most recent earning report smashed analyst expectations for both headline numbers, with both EPS and revenue coming in at record levels for the June quarter.

Coupled with the fact that the company is still working through an eye-watering $110 billion share buyback program, it’s clear management feels there’s no sign of this solid performance abating.

Earlier this year, they also raised their dividend, which, along with a share buyback program, is one of the most bullish signals a company can give to the market.

A Second Reason to Buy: Bullish Analysts

No doubt, based on Apple’s fundamental performance, there has been a consistent stream of analysts rating the stock a solid Buy in recent weeks.

Last month saw both Evercore ISI and Needham & Company do this, with price targets of $250 and $260, respectively.

This month, the teams at Oppenheimer, Citigroup, and Bank of America have already taken a similarly bullish stance with similar price targets.

Their reasoning is mostly the same, and they focus on what Bank of America analyst Wamsi Mohan called “continued strength in the App Store.”

One Reason to Avoid: iPhone Worries

For all the bullish performance, though, and optimistic analyst expectations, there are some concerns about the company’s iPhone numbers. Both J.P. Morgan and Jefferies have urged caution in the past week and suggested that the market’s expectations for Apple’s iPhone sales are “too high.”

Jefferies analyst Edison Lee argued that while Apple remains attractive over the long run due to its unique positioning as the “only hardware-software integrated player in the AI space,” its smartphone hardware needs work to fully take advantage of this.

It was a similar stance from J.P. Morgan’s Samik Chatterjee, who lowered his forecast for iPhone sales in the current quarter from 80 million to 76 million. He cited “more muted consumer demand” compared to previous models, but again, his longer-term outlook on the stock remains bullish. While there may be some near-term volatility as the iPhone story gets played out, Chatterjee reiterated his Overweight rating on Apple shares, along with his $265 price target.

Considering the stock closed at $225 on Tuesday night, the target upside is at least 20%.

The article “2 Reasons to Jump on Apple Stock Now and 1 Reason to Think Twice” first appeared on MarketBeat.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump-Backed World Liberty Financial Says Dollar-Pegged Stablecoin And Not Bitcoin Is The Best Way To 'Make America Great'

The team behind World Liberty Financial, a decentralized finance (DeFi) project backed by former President Donald Trump, stated that the best way to “Make “America Great” using cryptocurrencies was to encourage the usage of U.S. dollar-backed stablecoins rather than speculative, risky assets.

What happened: The team held a live stream via X Spaces Monday to give details about the widely-publicized project ahead of a token sale.

Zak Folkman, part of the founding team, said that the platform was inspired by the ideals envisioned by Donald Trump, which is to make financial opportunities accessible to everyone while at the same time supporting the U.S. economy

“Through stablecoins, we can in fact make the dollar not only strong but make it safe as the world’s reserve currency for the next 5000 years,” Folkman said.

He emphasized several advantages of the cryptocurrency derivatives of the dollar, such as their stable value and the 1:1 redemption feature.

“We really believe that’s the best way to make America great through crypto,” Holkman stated. “It’s not through speculating on risky assets.”

“Nobody’s gonna walk into a store and figure out ok, my groceries are $230, how many Satoshis is that? It just doesn’t make sense,” Zolkman added further, pointing toward Bitcoin BTC/USD.

Why It Matters: The much-touted DeFi project was launched by Trump last month, with the sale of the project’s governance token WLFI set for Tuesday.

The project aims to raise $300 million from the initial sale of the token by offering 20% of the supply at a $1.5 billion fully diluted valuation.

Mark Cuban, a leading cryptocurrency advocate, and a Trump critic, questioned the rationale behind such a move, stating, “I’ll let this stand on its own.”

Price Action: At the time of writing, Bitcoin was exchanging hands at $64,093.01, up 1.91% in the last 24 hours, according to data from Benzinga Pro.

Image via Wikimedia Commons

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Global High Pressure Grinding Roller Market to Reach $701.1 Million, Globally, by 2031 at 5.8% CAGR: Allied Market Research

Wilmington, Delaware, Oct. 14, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “High Pressure Grinding Roller Market Size, Share, Competitive Landscape and Trend Analysis Report by Type (Ferrous Material Processing and Non-Ferrous Material Processing), Application (Diamond Liberation, Base Metal Liberation, Precious Metal Beneficiation, and Pellet Feed Preparation), and End User Industry (Cement and Ore & Mineral Processing): Global Opportunity Analysis and Industry Forecast, 2022-2031”. The global high pressure grinding roller market size was valued at $399 million in 2021, and is projected to reach $701.1 million by 2031, growing at a CAGR of 5.8% from 2022 to 2031.

Prime determinants of growth

HPGR technology is significantly more energy-efficient compared to conventional grinding methods, such as ball mills. As industries strive to reduce operational costs and energy consumption, the demand for energy-efficient solutions like HPGR has risen. Stringent environmental regulations and a growing focus on sustainability are pushing industries to adopt greener technologies. HPGRs reduce energy consumption, water usage, and CO₂ emissions, aligning with global environmental standards. The mining sector is one of the largest consumers of HPGR technology, particularly in the grinding of hard rock ores. Increased demand for precious and industrial metals, such as copper, gold, and iron ore, is driving the expansion of HPGR applications in mining. HPGR offers lower operational costs compared to traditional milling, as it reduces wear on grinding components, requires less maintenance, and has lower energy requirements. This cost efficiency is a key factor driving its adoption in various industries.

Download Sample Copy @ https://www.alliedmarketresearch.com/request-sample/605

Report coverage & details:

| Report Coverage | Details |

| Forecast Period | 2022–2031 |

| Base Year | 2021 |

| Market Size in 2021 | $399 million |

| Market Size in 2031 | $701.1 |

| CAGR | 5.8% |

| No. of Pages in Report | 275 |

| Segments Covered | Type, Application, End User Industry, and Region |

| Drivers |

|

| Opportunities |

|

| Restraint |

|

Segment Highlights

On the basis of type, the high-pressure grinding roller market is segregated into ferrous material processing and non-ferrous material processing. The non-ferrous material processing segment dominated the market in 2021, and the ferrous material processing segment is expected to grow at a significant CAGR of 6.2% during the forecast period. The surge in penetration of the advanced technologies in high-pressure grinding roller for different industries is driving the growth of the market. The incorporation of the technologies helps in saving the cost and time for operations. In addition, it leads to more accuracy and enhanced customer satisfaction. For instance, in August 2020, ThyssenKrupp introduces new HPGR Pro – the next-generation high-pressure grinding roll with advance features rotating side-plates, controlled mechanical skew, oil lubrication and continuous optimization. Thus, this tends to drive the use of the high-pressure grinding roller. This, in turn, is expected to drive the growth of the market.

Buy This Research Report ( 290 Pages PDF with Insights, Charts, Tables, Figures):

https://bit.ly/3U3SsOM

On the basis of end user, the ore & mineral processing segment registered highest revenue in the market in 2021, and is expected to grow with high CAGR during the forecast period. Ores output from HPGR are with high ratio of fine particle, and the internal of the ore will have a lot of micro cracks. The micro cracks in the ores made by HPGR significantly improve the ore grinding efficiency, increase the mineral liberation degree, improve the flotation performance, and increase the recovery ratio of final concentrate ores. All such factors are expected to drive the high-pressure grinding roller market growth.

On the basis of end user industry, the high-pressure grinding roller market is divided into cement and ore & mineral processing. The ore and mineral processing segment dominated the market in 2021 and is expected to grow at a significant CAGR of 6.0% during the forecast period. Demand for high-pressure grinding rollers would be fueled by both the growing trend toward reducing mining costs and the rising demand for such rollers. By crushing and compressing the feed between two parallel, counter-rotating rollers, they are renowned as essential machinery that minimizes particles. The ore and mineral processing are expected to be driven by significant increase in needs and rise in population. This in turn is expected to drive the market growth.

Regional Outlook

By region, the high-pressure grinding roller market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Asia-Pacific was the largest contributor to the high-pressure grinding roller market revenue in 2021. However, it is expected to grow with highest CAGR during the forecast period. The high-pressure grinding roller market in Asia-Pacific has gained traction in the recent years, owing to ongoing cement and ore and mineral processing development in China, Japan and India. Mineral production in India showcased growth of 7.5% in June 2022, according to latest data of index of Mineral Production of Mining and Quarrying Sector for June 2022. The rapid growth of the manufacturing sector in the region is expected to boost the manufacturing of high-pressure grinding roller in the coming years.

Inquire Before Buying @ https://www.alliedmarketresearch.com/purchase-enquiry/605

Players: –

- AGICO Cement International Engineering Co., Ltd.

- Cast Steel Products

- Chengdu Leejun Industrial Co., Ltd.

- FLSmidth & Co. A/S

- HOSOKAWA MICRON POWDER SYSTEMS

- KHD Humboldt Wedag International AG

- Maschinenfabrik Köppern GmbH & Co. KG

- Metso Outotec Corporation

- Schenck Process Holding GmbH

- Sinosteel New Materials Co., Ltd.

- Zenith Mining & Construction Machinery Co. Ltd.

The report provides a detailed analysis of these key players in the global high pressure grinding roller market. These players have adopted strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Recent Development:

- In March 2019 – TAKRAF launched new range high-pressure grinding roller and l displayed a scale model of HPGR at the booth. The new machines can each handle more than 1,000 t/h of cement clinker, with each machine incorporating rolls with a diameter of 1,800 mm and a weight of more than 50 t per roller.

- In April 2021 – Weir group won an order to supply equipment such as high-pressure grinding rolls and screens to Swiss based Ferrexpo which is one of the largest exporters of iron ore pellets to the steel industry. Introduction of HPGRs will cut energy consumption by more than 40% compared with traditional mining technologies and will help Ferrexpo to increase output from its operations.

Trending Reports in Construction industry:

Crushing, Screening, and Mineral Processing Equipment Market : Global Opportunity Analysis and Industry Forecast, 2023-2032

Cone Crushers Market : Global Opportunity Analysis and Industry Forecast, 2021-2030

Natural Stone Market : Global Opportunity Analysis and Industry Forecast, 2023-2032

Mining Equipment Market : Global Opportunity Analysis and Industry Forecast, 2023-2032

Mining Drills and Breakers Market : Global Opportunity Analysis and Industry Forecast, 2021-2030

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” Allied Market Research has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact us:

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int’l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Elon Musk-Linked Organization Donates $500,000 To Scuttle Florida Cannabis Legalization Amendment

A political committee opposing Florida’s cannabis legalization measure has received a $500,000 donation from an organization reportedly linked to Tesla Inc. TSLA CEO Elon Musk‘s prior support of Gov. Ron DeSantis’s primary presidential bid. The financial boost comes as the campaign pushing for cannabis legalization crosses $100 million in contributions.

Florida’s cannabis legalization initiative, known as Amendment 3, is set to go before Florida voters in the upcoming November elections.

The Florida branch of the American Civil Liberties Union (ACLU) posted a familiar video while commenting on Musk’s anti-cannabis move, which is followed by a breakdown of the campaign finance database provided by Florida investigative reporter Jason Garcia, who covers corporate influence in Florida.

The so-called Faithful & Strong Policies, Inc., which is headed by Florida attorney Scott Wagner, made the contribution to Keep Florida Clean, a group dedicated to defeating Amendment 3, according to campaign filings (seen above). Keep Florida Clean and the Florida Freedom Fund are both chaired by James Uthmeier, DeSantis’ chief of staff and former campaign manager when the governor ran for president.

The half-million dollar injection into the anti-legalization campaign comes with just three weeks to go before the election and shortly after a new poll showing majority support for the cannabis measure, though not quite enough to meet the 60% requirement to pass the constitutional amendment. The latest NBC 6 poll, conducted from October 1-4 showed 58% of voters support the measure, falling just two points short of the threshold.

That said, the $500,000 pales in comparison to the over $100 million raised by Smart & Safe Florida, the committee that helped put the cannabis legalization amendment on the ballot. As of late August, the legalization amendment had pulled in at least $91 million according to Ballotpedia, the vast majority of which was provided by the state’s largest medical marijuana operator Trulieve Cannabis Corp TCNNF.

While Musk’s connection to Faithful & Strong Policies at the moment is uncertain, The Wall Street Journal reported that he previously contributed $10 million to the organization, with about half of that supporting DeSantis’s presidential campaign. Marijuana Moment first reported this story.

Meanwhile, DeSantis has been actively rallying opposition to the initiative as his administration has faced criticism over a taxpayer-funded public service announcement warning of impaired driving in states with legalized cannabis. At the same time, Trulieve filed a defamation lawsuit against Florida’s Republican Party, accusing it of misleading voters about the implications of Amendment 3.

Now Read:

Photos: Eugenio Cuppone via Pixabay; Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Implied Volatility Surging for Canadian Natural Resources Stock Options

Investors in Canadian Natural Resources Limited CNQ need to pay close attention to the stock based on moves in the options market lately. That is because the Nov. 15, 2024 $60.00 Call had some of the highest implied volatility of all equity options today.

What is Implied Volatility?

Implied volatility shows how much movement the market is expecting in the future. Options with high levels of implied volatility suggest that investors in the underlying stocks are expecting a big move in one direction or the other. It could also mean there is an event coming up soon that may cause a big rally or a huge sell-off. However, implied volatility is only one piece of the puzzle when putting together an options trading strategy.

What do the Analysts Think?

Clearly, options traders are pricing in a big move for Canadian Natural Resources shares, but what is the fundamental picture for the company? Currently, Canadian Natural Resources is a Zacks Rank #3 (Hold) in the Oil and Gas – Exploration and Production – Canadian industry that ranks in the Bottom 27% of our Zacks Industry Rank. Over the last 60 days, no analysts have increased their earnings estimates for the current quarter, while three analysts have revised their estimates downward. The net effect has taken our Zacks Consensus Estimate for the current quarter from 82 cents per share to 71 cents in that period.

Given the way analysts feel about Canadian Natural Resources right now, this huge implied volatility could mean there’s a trade developing. Oftentimes, options traders look for options with high levels of implied volatility to sell premium. This is a strategy many seasoned traders use because it captures decay. At expiration, the hope for these traders is that the underlying stock does not move as much as originally expected.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.