HubSpot Boosts Portfolio With Strategic Buyout: Will the Stock Gain?

HubSpot, Inc. HUBS recently inked a definitive agreement to acquire Cacheflow, an industry leader in B2B subscription billing management and configure, price, quote (CPQ) solution, for an undisclosed amount. Cacheflow will operate as HUBS’ wholly owned subsidiary following the completion of the buyout.

Cascheflow’s AI native billing and subscription management solution is designed to streamline software buying and selling processes in a B2B space. The solution provides a unified, no-code platform for automating the SaaS sales flow.

In 2023, HubSpot introduced Commerce Hubs’ on its smart CRM (Customer Relationship Management) to simplify various processes such as invoicing and payments. HUBS’ Commerce Hub offering has gained solid market traction over the past year. With this acquisition, the company is aiming to further strengthen Commerce Hubs’ functionalities and enhance its prospects across industries.

Cacheflow’s portfolio will make the quote-to-cash process easier, thereby simplifying the buying process and boosting customer satisfaction. It will also strengthen HUBS’ ability to address areas such as upselling, renewals and other commerce functions. Automation of subscription billing and CPQ will enable businesses to close deals faster and expedite revenue collection. A seamless purchasing process will also enhance customer retention. This will also bolster Commerce HUBS’ capabilities in managing clients and transaction data, enhancing enterprises’ visibility and decision-making.

Will This Buyout Drive HUBS’ Share Performance?

Customers appreciate flexibility and customization during product purchases. However, ensuring this in a legacy CPQ system, which involves several steps for product configuration, quote generation and pricing changes, is a time-consuming endeavor. This outdated billing and payment system leads to lengthy sales cycles and inefficient revenue collection. To tackle these challenges, enterprises are increasingly looking for a solution to automate key components of revenue management and enhance customer experience.

The subscription and billing management market is projected to grow at a substantial rate in the upcoming years. By integrating Cacheflow’s AI-powered capabilities into Commerce Hub, HUBS is aiming to capitalize on these evolving market trends. The buyout will augment HubSpot’s ability to address the complete commerce cycle for enterprises. This bodes well for long-term growth.

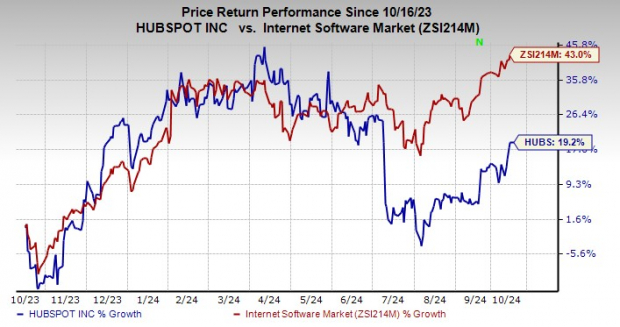

HUBS Stock’s Price Performance

Shares of HubSpot have gained 19.2% over the past year compared with the industry’s 43% growth.

Image Source: Zacks Investment Research

HUBS’ Zacks Rank and Key Picks

HubSpot currently carries a Zacks Rank #3 (Hold).

Zillow Group, Inc. ZG carries a Zacks Rank #2 (Buy) at present. In the last reported quarter, it delivered an earnings surprise of 25.81%.

ZG delivered an earnings surprise of 37.41%, on average, in the trailing four quarters. The company is witnessing solid momentum in rental revenues, driven by growth in both multi and single-family listings, which is a positive factor.

Ubiquiti Inc. sports a Zacks Rank of 1 at present. The company offers a comprehensive portfolio of networking products and solutions for service providers and enterprises.

Its excellent global business model, which is flexible and adaptable to evolving changes in markets, helps it to beat challenges and maximize growth. The company’s effective management of its strong global network of more than 100 distributors and master resellers improved its UI’s visibility for future demand and inventory management techniques.

Workday Inc. sports a Zacks Rank of 1 at present. In the last reported quarter, it delivered an earnings surprise of 7.36%.

WDAY is a leading provider of enterprise-level software solutions for financial management and human resource domains. The company’s cloud-based platform combines finance and HR in a single system that makes the process easier for organizations to provide analytical insights and decision support.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Is What Whales Are Betting On Hilton Worldwide Holdings

Investors with a lot of money to spend have taken a bearish stance on Hilton Worldwide Holdings HLT.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with HLT, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 10 uncommon options trades for Hilton Worldwide Holdings.

This isn’t normal.

The overall sentiment of these big-money traders is split between 30% bullish and 60%, bearish.

Out of all of the special options we uncovered, 4 are puts, for a total amount of $140,860, and 6 are calls, for a total amount of $734,796.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $200.0 and $240.0 for Hilton Worldwide Holdings, spanning the last three months.

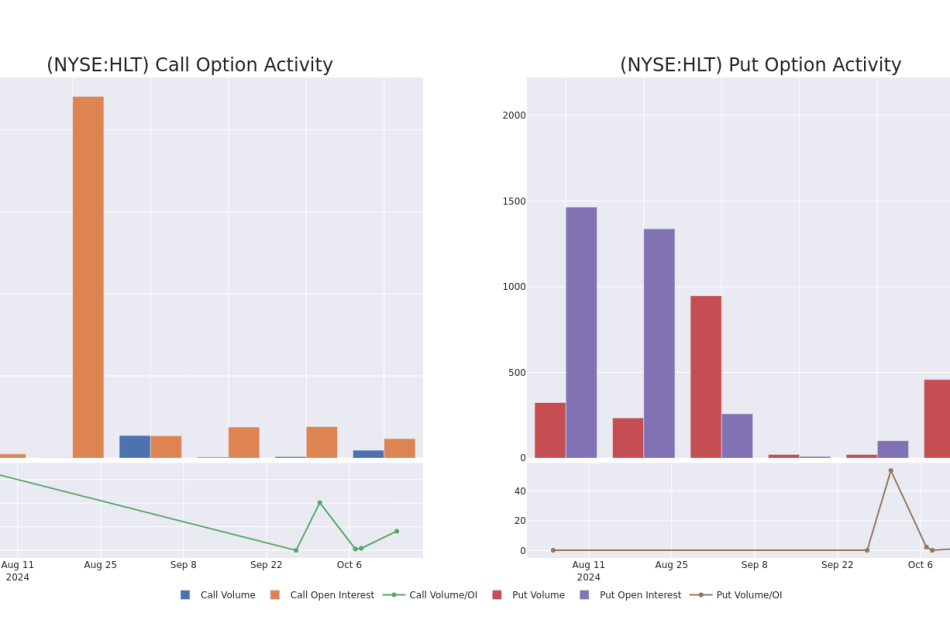

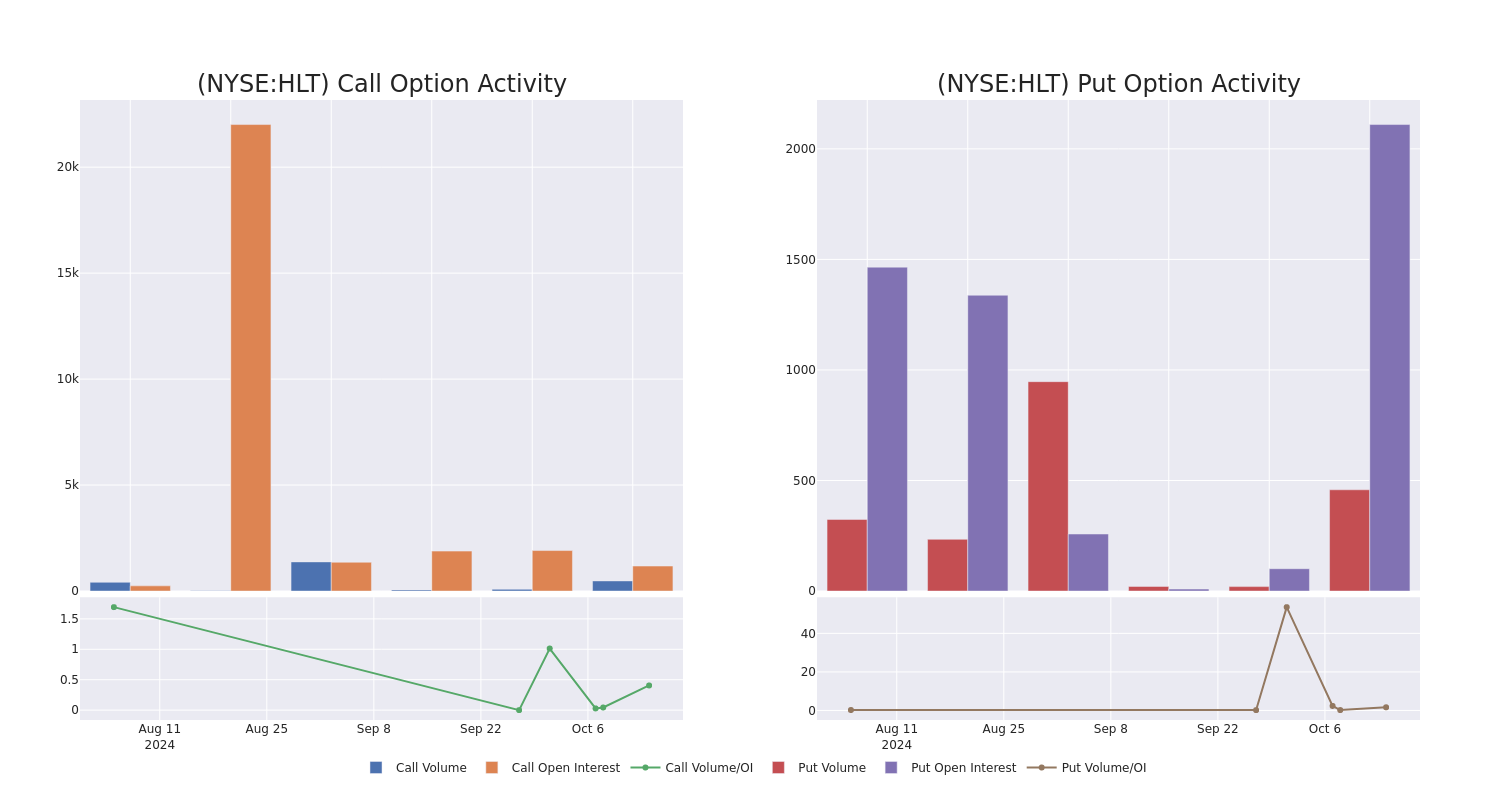

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Hilton Worldwide Holdings’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Hilton Worldwide Holdings’s substantial trades, within a strike price spectrum from $200.0 to $240.0 over the preceding 30 days.

Hilton Worldwide Holdings Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HLT | CALL | SWEEP | NEUTRAL | 11/15/24 | $13.7 | $12.3 | $13.0 | $230.00 | $497.6K | 78 | 401 |

| HLT | CALL | TRADE | BULLISH | 01/16/26 | $50.4 | $49.1 | $50.23 | $210.00 | $100.4K | 251 | 25 |

| HLT | CALL | SWEEP | BEARISH | 10/18/24 | $18.7 | $18.1 | $18.1 | $220.00 | $45.2K | 650 | 37 |

| HLT | PUT | SWEEP | BEARISH | 11/15/24 | $4.2 | $4.1 | $4.19 | $230.00 | $43.6K | 577 | 231 |

| HLT | CALL | TRADE | BEARISH | 10/18/24 | $38.9 | $37.5 | $37.5 | $200.00 | $37.5K | 115 | 10 |

About Hilton Worldwide Holdings

Hilton Worldwide Holdings operates 1.2 million rooms across its more than 20 brands serving the premium economy scale through luxury segments. Hampton and Hilton are the two largest brands, representing 28% and 19%, respectively, of the company’s total rooms, as of Dec. 31, 2023. Recent brands launched over the last few years include Home2, Curio, Canopy, Spark, Tru, Tempo, and LivSmart, as well as a partnership with Small Luxury Hotels and acquisitions of Nomad and Graduate Hotels. Managed and franchised hotels represent the vast majority of adjusted EBITDA, predominantly from the Americas regions.

Having examined the options trading patterns of Hilton Worldwide Holdings, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Hilton Worldwide Holdings Standing Right Now?

- With a trading volume of 1,027,306, the price of HLT is down by -0.16%, reaching $237.76.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 9 days from now.

What Analysts Are Saying About Hilton Worldwide Holdings

In the last month, 1 experts released ratings on this stock with an average target price of $245.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Goldman Sachs has revised its rating downward to Buy, adjusting the price target to $245.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Hilton Worldwide Holdings, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Higher Costs to Hurt Huntington Bancshares' Q3 Earnings, NII to Aid

Huntington Bancshares Incorporated HBAN is slated to report third-quarter 2024 results results on Oct. 17, before the opening bell. The company’s quarterly revenues and earnings are expected to have declined year over year.

In the last reported quarter, the bank recorded a positive earnings surprise of 7.14%. Results have reflected improvements in average loans and deposits. However, a fall in net interest income (NII) and elevated expenses were headwinds.

HBAN has an impressive earnings surprise history. Its earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, the average beat being 8.87%.

The Zacks Consensus Estimate for HBAN’s third-quarter earnings of 30 cents per share has remained unchanged in the past seven days. The figure indicates a 16.67% decline from the year-ago reported number.

The consensus estimate for revenues is pegged at $1.86 billion, indicating a year-over-year decline of 1.67%.

Key Factors & Estimates for HBAN’s Q3 Result

Loans & NII: On Sept. 18, the Federal Reserve cut the interest rates by 50 basis points to 4.75-5% for the first time since March 2020. While the rate cut is not expected to significantly affect HBAN’s NII in the quarter under review, greater clarity on the Fed’s rate cut path, along with a stabilizing macroeconomic environment, is likely to have aided the lending outlook.

The Zacks Consensus Estimate for NII is pegged at $1.35 billion, indicating a 3% rise sequentially.

Per the Fed’s latest data, the demand for commercial and industrial loans and consumer loans was decent in the third quarter of 2024, while real estate loan was subdued.

Given the company’s significant exposure to commercial loans, HBAN’s lending book is likely to have been supported by the decent demand in commercial loans while the subdued real estate loan demand might have offset growth to some extent.

The Zacks Consensus Estimate for average total earning assets of $180.5 billion for the quarter under review indicates a 1.4% rise from the prior quarter’s levels.

Non-Interest Income: As the central bank lowered the interest rates, mortgage rates started to come down. The rates declined to almost 6.2% by the end of the third quarter. Although mortgage origination volume remained subdued in the quarter under review, refinancing activities witnessed a significant surge supported by lower mortgage rates. This is likely to have supported HBAN’s mortgage banking fees. The Zacks Consensus Estimate for mortgage banking income is pegged at $30.6 million, suggesting a 1.8% increase from the prior quarter’s reported figure.

Global mergers and acquisitions in the third quarter of 2024 showed improvement after subdued 2023 and 2022.

Both deal value and volume were decent during the quarter, driven by solid financial performance, higher chances of a soft landing of the U.S. economy, buoyant markets and interest rate cuts. Also, the performance of the capital markets business, including issuance activities, improved. As a result, the company’s capital markets and advisory fees are expected to have increased.

The Zacks Consensus Estimate for capital markets and advisory fees is pegged at $76.14 million, indicating 4.3% growth sequentially.

The strong performance of the equity market is likely to have supported wealth and asset management revenues during the quarter under review.The Zacks Consensus Estimate for wealth and asset management revenues is pegged at $92 million, indicating a 2.3% rise from the previous quarter’s reported figure.

The consensus estimate for customer deposit and loan fees for the third quarter is pegged at $84.6 million, indicating a rise of 1.9% on a sequential basis. The consensus mark for insurance income of $18.3 million implies a sequential rise of 1.7%.

The consensus mark for total non-interest income is pegged at $507.4 million, indicating a 3.3% sequential rise.

Expenses: Huntington Bancshares’ higher outside data processing and other services expenses, deposit and marketing expenses are anticipated to have raised its costs in the third quarter. Also, the bank’s efforts to expand its commercial banking capabilities in high growth markets by adding more branches and hiring professionals are expected to have contributed to higher costs.

Though strategic efficiency initiatives are likely to reduce expenses to some extent, long-term investments in key growth initiatives are expected to have kept its expense base higher.

Asset Quality: HBAN is likely to have set aside a substantial amount of money for potential delinquent loans, given the expectations of an economic slowdown.

The Zacks Consensus Estimate for total non-performing assets of $780.08 million indicates a marginal increase from the figure reported in the prior quarter.

What Our Model Unveils for HBAN?

Per our proven model, the chances of Huntington Bancshares beating estimates this time are low. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is not the case here, as you can see below.

Earnings ESP: Huntington Bancshares has an Earnings ESP of -2.78%.

Zacks Rank: HBAN currently carries a Zacks Rank of 3.

Stocks to Consider

Here are some finance stocks that you may want to consider, as our model shows that these hold the right combination of elements to post an earnings beat this time around.

First Horizon Corporation FHN has an Earnings ESP of +3.18% and carries a Zacks Rank #3 at present. The company is scheduled to release its third-quarter 2024 earnings on Oct. 16.

FHN’s quarterly earnings estimates have been unchanged over the past seven days.

The Earnings ESP for M&T Bank Corporation MTB is +0.33% and it also carries a Zacks Rank #3 at present. The company is slated to report its third-quarter 2024 results on Oct. 17.

The Zacks Consensus Estimate for MTB’s quarterly earnings has remained unchanged in the past seven days.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stocks Hover Near Record High as Earnings in Sight: Markets Wrap

(Bloomberg) — Stocks hit fresh all-time highs as investors looked ahead to Corporate America for further vindication of soft-landing bets.

Most Read from Bloomberg

Without much in the way of economic data this week, earnings reports are poised to drive Wall Street sentiment. The S&P 500 rose almost 1%, notching another record — its 46th this year. That’s a hint investors are not deterred by the reduced forecasts for third-quarter results, and are instead betting this reporting season will once again deliver positive surprises.

Strategists are predicting S&P 500 firms will post their weakest results in the past four quarters, with just a 4.3% increase compared with a year ago, Bloomberg Intelligence data show. Meantime, corporate guidance implies a jump of about 16%. That solid outlook suggests companies could easily beat market expectations.

“Wall Street has underestimated Corporate America lately,” said Callie Cox at Ritholtz Wealth Management. “This environment is tough to get a read on, and I don’t blame anybody who’s approaching this rally with a bit of skepticism. We still think the biggest – and most expensive – risk here is to miss a rebound and an eventual rally higher.”

The S&P 500 hovered near 5,860 amid thin trading volume. The Nasdaq 100 added 0.8%. The Dow Jones Industrial Average climbed 0.5%. Nvidia Corp. led gains in megacaps, Apple Inc. gained on a bullish analyst call and Tesla Inc. rebounded after last week’s plunge. Goldman Sachs Group Inc. and Citigroup Inc. advanced ahead of results.

Treasury futures were marginally lower while cash trading was closed for a US holiday. The dollar edged up. Bitcoin jumped 5%. Oil declined after China’s highly anticipated Finance Ministry briefing on Saturday lacked specific new incentives to boost consumption in the world’s biggest crude importer.

Earnings season unofficially kicked off on Friday, led by financial bellwethers JPMorgan Chase & Co. and Wells Fargo & Co. On top of other big banks reporting this week, traders will be paying close attention to results from key companies like Netflix Inc. and JB Hunt Transport Services Inc.

An initial round of third-quarter financial results last week showed Corporate America is benefitting from lower rates early into the Federal Reserve’s easing cycle, according to Bank of America Corp. strategists.

Easing rates pressure was seen in a surge in debt underwriting, mortgage applications and refinancing activity, as well as signs of a bottom in manufacturing, the BofA team including Ohsung Kwon and Savita Subramanian said.

To Solita Marcelli at UBS Global Wealth Management, third-quarter results should confirm that large-cap corporate profit growth is solid against a resilient macro backdrop.

“We maintain our positive outlook for US equities, supported by healthy economic and profit growth, the Fed’s easing cycle, and AI’s growth story,” she said. “While valuations are high, we think they are reasonable against the favorable backdrop.”

Marcelli reiterated her S&P 500 price target of 6,200 by June 2025, and continues to like “AI beneficiaries and quality stocks.”

An improving trend in US macro data should continue to offer support for stocks tied to economic momentum, according to Morgan Stanley strategist Mike Wilson.

“Further stabilization in the economic surprise index should support quality cyclicals even if it comes amid higher yields,” Wilson and his team wrote in a note.

Better US data and supportive policy have helped lower downside risks near-term, according to Goldman Sachs Group Inc. strategists led by Christian Mueller-Glissmann. They shifted to overweight equities and underweight credit for the next three months.

The strategists noted equities can deliver attractive returns driven by earnings growth and valuation expansion in late-cycle backdrops, while credit total returns are usually constrained by tight credit spreads and rising yields.

While they think the risk of a bear market remains relatively low, the analysts see potential for volatility due to geopolitical shocks, US elections, and less favorable growth/inflation mix.

“Last week, the S&P 500 index surpassed our year-end price objective of 5,800,” said Craig Johnson at Piper Sandler. “We are leaving it unchanged for now but realize some ‘fine-tuning’ is needed as we expect equities to continue trending higher after the US presidential election.”

Despite the above-average gain in the first two years of this bull market, history says that investors need to be prepared for a possible setback in the coming 12 months, according to Sam Stovall at CFRA.

The average return following the 11 bull markets that celebrated their second anniversary was 2% (5.2% excluding those that became bear markets before the third year was out, Stovall noted. What’s more, all experienced a decline of 5%, while five endured selloffs in excess of 10% but less than 20%, and three succumbed to new bear markets. Despite this unsettling intra-year volatility, three bulls posted double-digit gains.

While bull markets that have made it this long have tended to go on a lot longer before they finally experience a 20% drop, that doesn’t mean there haven’t been hiccups along the way, according to Bespoke Investment Group.

Overall, the S&P has seen weaker-than-average returns in year three of bull markets, the firm said. The index has averaged a gain of just 3.7% in the 12 months following day 503 of past bull markets — with positive returns just 55% of the time. That compares to an average gain of 9.26% across all rolling 12-month periods for the market.

“What we’d note, however, is that of the 11 bull markets shown, only two of them came to an end at some point during the 12-month window following day 503, so this period between years two and three of long-lasting bulls has been more of a consolidation phase rather than an endpoint,” Bespoke concluded.

Corporate Highlights:

-

B. Riley Financial Inc., the money-losing broker-dealer and investment firm looking to cut debt, agreed to sell a majority stake in its Great American Holdings business to funds managed by Oaktree Capital Management LP.

-

Adobe Inc. unveiled artificial intelligence tools that can create and modify videos, joining Big Tech companies and startups in trying to capitalize on demand for the emerging technology.

-

Caterpillar Inc. was downgraded to underweight by Morgan Stanley, which flagged a disconnect between fundamentals and share price.

-

Amgen Inc. was downgraded to hold at Truist Securities, which said upcoming obesity data is already priced into the stock.

-

SoFi Technologies Inc. reached a deal to use $2 billion of Fortress Investment Group LLC funds for the origination of personal loans.

-

Elliott Investment Management has called for a special shareholder meeting at Southwest Airlines Co., officially kicking off the firm’s first US proxy fight since 2017.

Key events this week:

-

Eurozone industrial production, Tuesday

-

US Empire Manufacturing index, Tuesday

-

Goldman Sachs, Bank of America, Citigroup earnings, Tuesday

-

Donald Trump will be interviewed by Bloomberg editor-in-chief John Micklethwait at the Economic Club of Chicago, Tuesday

-

Fed’s Mary Daly, Adriana Kugler speak, Tuesday

-

Morgan Stanley earnings, Wednesday

-

ECB rate decision, Thursday

-

US retail sales, jobless claims, industrial production, Thursday

-

Fed’s Austan Goolsbee speaks, Thursday

-

China GDP, Friday

-

US housing starts, Friday

-

Fed’s Christopher Waller, Neel Kashkari speak, Friday

Some of the main moves in markets:

Stocks

-

The S&P 500 rose 0.8% as of 4 p.m. New York time

-

The Nasdaq 100 rose 0.8%

-

The Dow Jones Industrial Average rose 0.5%

-

The MSCI World Index rose 0.6%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.3%

-

The euro fell 0.3% to $1.0904

-

The British pound was little changed at $1.3055

-

The Japanese yen fell 0.4% to 149.78 per dollar

Cryptocurrencies

-

Bitcoin rose 5% to $65,865.01

-

Ether rose 6.5% to $2,619.04

Bonds

Commodities

-

West Texas Intermediate crude fell 2.1% to $73.97 a barrel

-

Spot gold fell 0.1% to $2,652.65 an ounce

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

The Clinician Partners with Queensland Health for Statewide Implementation of Patient Reported Measures and Patient Safety Culture Surveys

BRISBANE, Australia, Oct. 14, 2024 /PRNewswire/ — The Clinician has been awarded a statewide contract by Queensland Health to implement their ZEDOC platform. This platform will enhance the collection and analysis of Patient Reported Measures (PRMs) and patient safety culture (PSC) staff surveys across all Hospital and Health Services (HHS).

This Off-the-Shelf (OTS) application will capture and report real-time patient reported and staff feedback, driving improvements in healthcare delivery and supporting clinicians in partnering with patients to achieve safe, high quality care.

Key features of the ZEDOC system include:

- Ward and Hospital Experiences: Collects Patient-Reported Experience Measures (PREMs) to provide insights into the overall experience of Queensland Health services.

- Individual Patient Outcomes: Gathers Patient-Reported Outcome Measures (PROMs) in real-time to support shared decision-making between patients and clinical teams, empowering patients to participate in their healthcare decisions.

- Staff Feedback on Patient Safety Culture: Collects and reports real-time data from staff, enabling the implementation of interventions in HHSs.

- Integrated Platform: The Clinician’s PRM platform will act as a single system for collecting and analysing PRMs and PSC data, simplifying access for patients, parents, and carers, while providing healthcare staff with a comprehensive reporting tool.

- Automated Patient Communication: Patients will be contacted via SMS or email following or during their engagement with a health service.

Building on Success This landmark contract follows The Clinician’s previous success with similar statewide global and local implementations, such as Singapore and South Australia Health. Learnings from these large-scale deployments will be instrumental in ensuring a smooth rollout in Queensland. This marks a significant step in The Clinician’s growth, as the New Zealand-headquartered company continues to expand its footprint in Australia and internationally. The Clinician’s recent move to cloud-agnostic infrastructure for their platform also allows for greater flexibility and scalability, positioning The Clinician for continued success in large healthcare systems.

“It’s a significant opportunity to collaborate with Queensland Health on this transformative project,” said Dr. Ron Tenenbaum, CEO and principal founder of The Clinician. “Our goal is to equip healthcare providers with the tools and insights necessary to enhance patient experiences, outcomes, and safety. By utilising real-time data from both patients and staff, Queensland Health will be empowered to make informed, data-driven decisions to elevate the quality of care across the state.”

The Clinician continues to lead the way in digital health innovation, and this partnership with Queensland Health underscores its commitment to improving healthcare outcomes for patients and staff across Australia.

About The Clinician:

The Clinician is a healthcare company that helps organisations globally create more connected, convenient, and patient-centred care journeys. The Clinician’s integrated health platform enables care teams to digitally monitor, inform, and empower patients along their entire healthcare journey, from the comfort of their own homes. The platform’s interoperability capabilities allow seamless integration with existing healthcare systems, facilitating the exchange of patient health outcomes, experiences, and educational content between clinical visits. By supporting this timely exchange, The Clinician provides care teams and patients with real-time, actionable information to improve health outcomes and experiences while reducing administrative burden.

To learn more, visit theclinician.com or follow us on LinkedIn

For Media Enquiries media@theclinician.com

![]() View original content:https://www.prnewswire.com/news-releases/the-clinician-partners-with-queensland-health-for-statewide-implementation-of-patient-reported-measures-and-patient-safety-culture-surveys-302275634.html

View original content:https://www.prnewswire.com/news-releases/the-clinician-partners-with-queensland-health-for-statewide-implementation-of-patient-reported-measures-and-patient-safety-culture-surveys-302275634.html

SOURCE The Clinician

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

You Can Now Buy The Former Home Of NBA Legend Kareem Abdul-Jabbar Designed For His 7'2″ Height, For Around $3 Million

If you’re a basketball fan and its legend Kareem Abdul-Jabbar or love unique luxury homes, you can now own his former home in Marina del Rey, California, for $2,995,000. Despite its outward appearance, this house is anything but ordinary – it was created with Kareem’s impressive 7’2″ height in mind and is a remarkable home for anyone who values grace, space and a piece of sports history.

Don’t Miss:

Located in an exclusive gated community across from the Ritz Carlton and the California Yacht Club, this house is one of just twelve in the area. Kareem lived here from 2011 to 2021 and the home has several custom modifications to suit his height and lifestyle. Enlarged doorways, higher countertops and spacious rooms were all designed to make life comfortable for the basketball legend – features that also make the home feel incredibly roomy.

See Also: A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

The four-bedroom, three-bath house is 3,586 square feet. On the first floor, a big open space connects the living room, dining room and kitchen. The kitchen has granite countertops, a large island, custom cabinets and stainless steel appliances. Sliding doors lead to a garden patio, making it easy to enjoy indoor and outdoor spaces.

Go upstairs and see hardwood floors and a main bedroom designed for comfort. It has a fireplace, a walk-in closet and a private balcony with great views of the marina. The main bathroom feels like a spa, with two sinks, a separate jacuzzi tub and a steam shower – perfect for relaxing.

Trending: Commercial real estate has historically outperformed the stock market, and this platform allows individuals to invest in commercial real estate with as little as $5,000 offering a 12% target yield with a bonus 1% return boost today!

There’s also a third-floor loft that could be another bedroom, home office or workout area. It has its own balcony that looks out at the marina and the Ritz Carlton.

The area is a major selling factor, as noted by Top Ten Real Estate Deals. Marina del Rey is famous for its small-craft harbor, one of the largest in North America and is a popular spot for kayaking, bird-watching and enjoying waterfront views. The trendy Abbot Kinney stores, Trader Joe’s and several excellent restaurants are all within walking distance. The neighborhood is well-known for its star-studded locals and visitors, so you never know who you could run into.

Trending: These five entrepreneurs are worth $223 billion – they all believe in one platform that offers a 7-9% target yield with monthly dividends

Kareem Abdul-Jabbar is widely regarded as one of the greatest basketball players ever. He spent 20 seasons in the NBA with the Los Angeles Lakers and Milwaukee Bucks. He was well-known for his “skyhook” shot.

Abdul-Jabbar was also a 19-time NBA All-Star and a six-time NBA MVP. Standing at 7’2,” he dominated the game with his scoring, rebounding and defense and long held the record for the most points scored in NBA history.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Almost Every Major Cannabis Company Could See Positive Cash Flow If 280E Is Removed In 2025

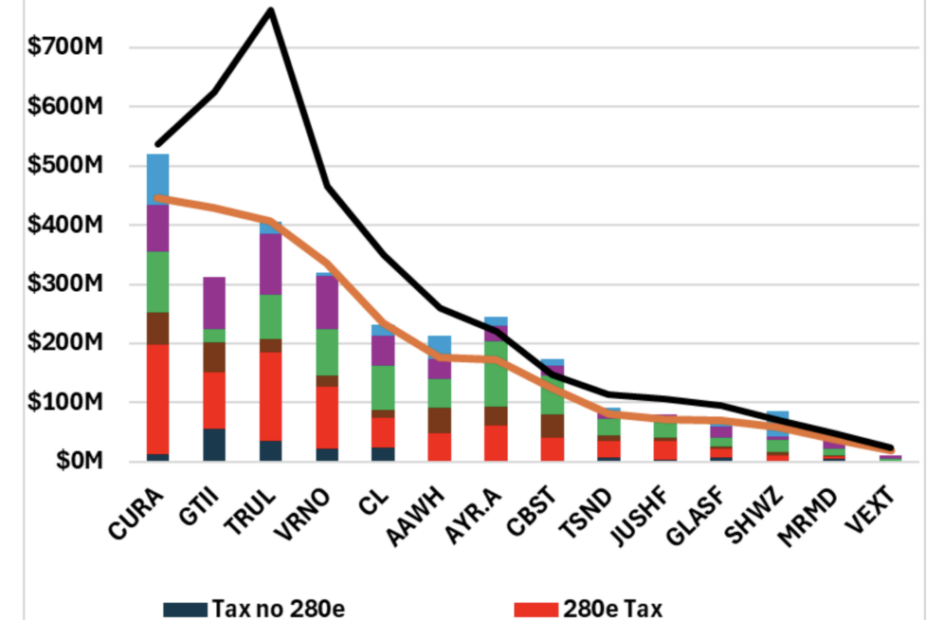

A recent analysis of 14 multi-state cannabis operators (MSOs) looks at how the potential removal of 280E in 2025 could impact their cash flows.

Section 280E of the U.S. tax code, which prevents cannabis companies from deducting normal business expenses due to federal prohibition, has long been a burden on the industry. If this tax provision were eliminated, cannabis companies would enjoy far better financial health.

Breakdown Of The Analysis

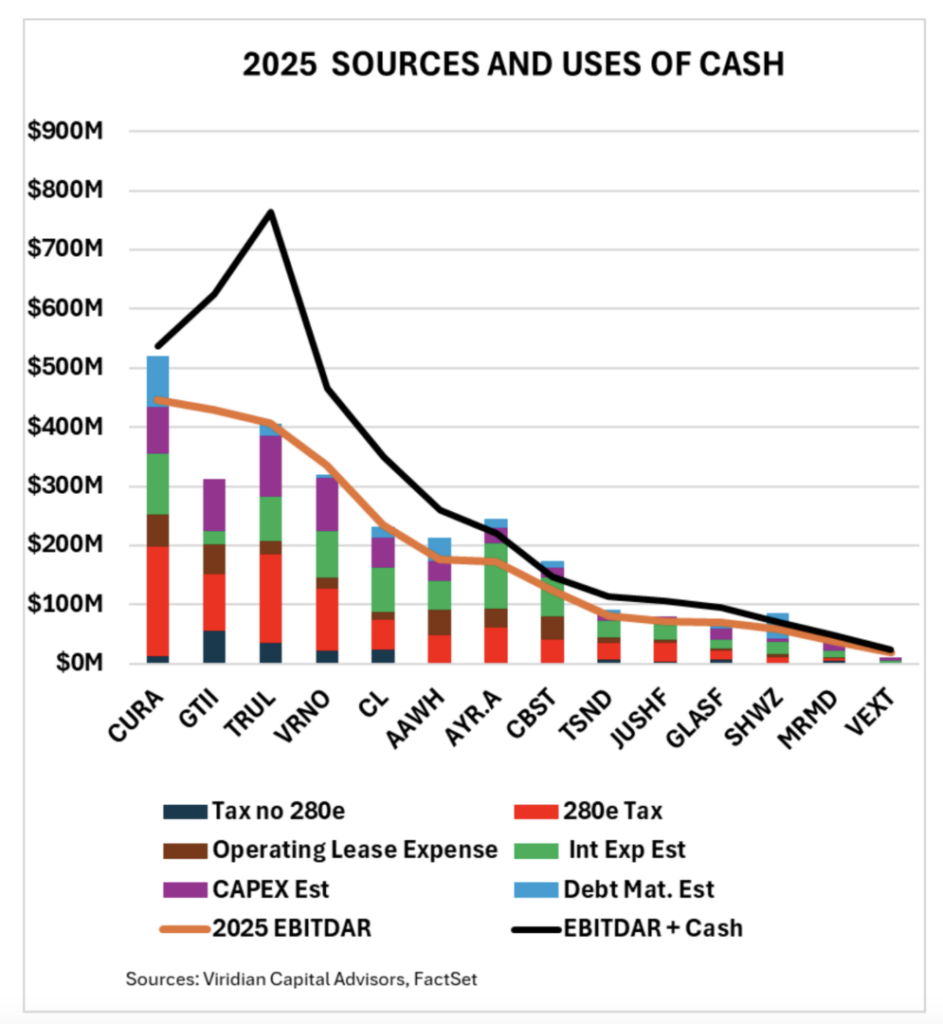

The chart provided by Viridian Capital Advisors shows the projected 2025 sources and uses of cash among the industry’s top MSOs, with an emphasis on how eliminating 280E could alter their financial standing.

- EBITDAR (Earnings Before Interest, Taxes, Depreciation and Rent): This is a critical metric because it represents the companies’ operational cash flow, excluding fixed charges.

- Additional Cash: Some companies are sitting on significant cash reserves, which serve as a buffer for covering operational needs. This is represented by the black line that shows EBITDAR plus existing cash.

- Impact of 280E: The red bars on the chart represent the additional tax expenses cannabis companies are incurring due to 280E. The black bars below reflect the estimated tax liability if 280E were removed. The significant gap between these bars shows how much relief companies could experience.

Financial Outlook For Major MSOs

According to the analysis, six companies, including Green Thumb GTBIF, Trulieve TCNNF, Verano VRNOF, Cresco CRLBF, Glass House GLASF, and MariMed MRMD, are projected to have enough cash flow to cover all fixed charges in 2025, even without the removal of 280E. Notably, every other company except Schwazze SHWZ would have positive cash flow if 280E were eliminated.

However, while 2025 looks relatively benign for MSO credit, 2026 could present challenges, with significant debt maturities that many companies will need to refinance, Viridian Capital analysts warn.

Additionally, companies like Curaleaf and Trulieve have substantial back taxes recorded as “uncertain tax liabilities,” which could become a financial strain depending on how repayment plans are structured.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. You can’t afford to miss out if you’re serious about the business.

What This Means For The Cannabis Industry

If 280E is eliminated in 2025, the financial outlook for most cannabis companies would significantly improve. Companies would have more flexibility with cash flow and this relief could lead to higher profitability and more strategic investments. The potential tax reform could mark a turning point for an industry that has struggled under the burden of high taxes and federal prohibition.

Cover: image generated with IA tools.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Iridium Gearing Up to Report Q3 Earnings: Here's What to Expect

Iridium Communications IRDM is slated to release third-quarter 2024 earnings on Oct. 17, before market open.

The Zacks Consensus estimate for revenues is pegged at $205.7 million, indicating an increase of 4.1% from the year-ago level. The consensus estimate for earnings per share is pegged at 20 cents, unchanged in the past 60 days. In the year-ago quarter, the company reported a loss of 1 cent.

IRDM’s earnings beat the Zacks Consensus Estimate in two of the trailing four quarters, missed once and matched the same in the remaining quarter with the average surprise being 202.2%. In the past year, shares have lost 31.2% against sub-industry’s gain of 1.3%.

Image Source: Zacks Investment Research

Factors to Focus on Ahead of IRDM’s Q3 Earnings

Iridium’s third-quarter performance is likely to have gained momentum in the Service segment’s revenues and increasing subscriber base. Our estimate for segmental revenues is pegged at $155.5 million, implying a jump of 2.3% from a year-ago reported figure.

Strengthening commercial service revenues is a key catalyst. Commercial service revenues are likely to have been aided by strength in voice and data, IoT data, broadband, hosted payload and other data service business lines. We estimate commercial service revenues to be $129 million, indicating a 2.8% climb from the prior-year actual.

Revenues from voice and data are gaining from higher demand for Iridium’s push-to-talk services. Commercial IoT revenues are likely to have benefited from steady demand for personal satellite communications and traditional industrial services.

Hosted payload and other data service segment is also expected to have benefited from the new Iridium Satellite Time and Location offering.

Key Recent Developments

On Sept. 25, 2024, Iridium announced that the 3rd Generation Partnership Project (3GPP) approved its offer to broaden the capability of Narrowband Internet of Things (NB-IoT) for Non-Terrestrial Networks into the official Work Plan for 3GPP Release 19 (set to conclude in the fourth quarter of 2025). This initiative expands the company’s reach in global connectivity through its latest service, Iridium NTN Direct, which is expected to be the world’s first global 5G NB-IoT service.

On Sept. 19, 2024, Iridium announced its fourth stock repurchase authorization in four years. The $500 million authorization, approved by its board of directors, is the largest in the company’s history. It extends the total buyback authorization to $1.5 billion through Dec. 31, 2027.

On Sept. 3, 2024, the company introduced Iridium Certus GMDSS, making significant strides in maritime safety, compliance and communication. These terminals form a significant part of any ship’s hybrid network system with improved cost structure, efficiency and performance in maritime safety and security.

What Does Our Model Say for IRDM in Q3?

Our proven model does not conclusively predict an earnings beat for Iridium this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. However, this is not the case here.

Earnings ESP: Iridium has an Earnings ESP of 0.00%.

Zacks Rank: Iridium currently carries a Zacks Rank #2.

Stocks to Consider

Here are some stocks you may consider, as our model shows that these have the right combination of elements to beat on earnings this season.

Equifax EFX currently has an Earnings ESP of +1.56% and a Zacks Rank #2.

It is scheduled to release results for the third quarter of 2024 on Oct. 16. The Zacks Consensus Estimate for Equifax’s to-be-reported quarter’s earnings and revenues is pegged at $1.84 per share and $1.44 billion, respectively. Shares of EFX have gained 58.5% in the past year.

Netflix NFLX has an Earnings ESP of +1.37% and a Zacks Rank #2 at present. It is scheduled to release third-quarter 2024 results on Oct. 17. The Zacks Consensus Estimate for Netflix’s to-be-reported quarter’s earnings and revenues is pegged at $5.07 per share and $9.77 billion, respectively. Shares of NFLX have gained 100.3% in the past year.

Abbott Laboratories has an Earnings ESP of +0.18% and a Zacks Rank #2 at present. It is scheduled to release third-quarter 2024 results on Oct. 16. The Zacks Consensus Estimate for Abbott’s to-be-reported quarter’s earnings and revenues is pegged at $1.20 per share and $10.56 billion, respectively. Shares of ABT have gained 25.9% in the past year.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.