Nvidia and Advanced Micro Devices Just Gave Magnificent News to AI Chip Investors

How long will the strong artificial intelligence buildout last? The market appears optimistic, with AI chip leader Nvidia (NASDAQ: NVDA) trading at 34 times forward earnings estimates and challenger Advanced Micro Devices (NASDAQ: AMD) trading at 30 times.

However, there is a considerable debate among investors as to whether this hypergrowth is sustainable, or whether the AI buildout is going to pop like the dot-com bust.

This week, CEOs of AI chip leaders Nvidia and AMD made announcements, each of which gave even greater weight to the bull case for their stocks and AI chips stocks generally.

Bulls vs. bears on AI

AI stocks pulled back hard over the summer after a strong 18 months or so of performance, as skepticism worked its way into the story. After the Magnificent Seven, who are the main buyers of AI chips, reported good but not blowout earnings in July, investors appeared concerned that these big chip buyers weren’t seeing a requisite return on their investments in Nvidia chips. Most big tech stocks and AI chip plays sank in response.

Giant hedge fund Elliott Management piled onto the skepticism, giving especially bearish commentary on what it perceives as an AI “bubble.” Elliott wrote in its latest letter to investors that AI stocks were overhyped, declaring AI applications aren’t, “ever going to be cost-efficient, are never going to actually work right, will take up too much energy, or will prove to be untrustworthy.” Elliott dismissed the technology as only good for a few things such as summarizing reports and helping with computer coding.

That’s certainly a point of view that should be considered. It may even be true of the current models that are out today. However, virtually everyone participating in the technology industry believes in the benefits. If benefits weren’t likely going to be there, it seems unlikely every major technology company would be greatly expanding its AI investments today as they are.

For his part, Oracle Chairman Larry Ellison dismissed these concerns, declaring the race for AI supremacy “goes on forever, to build a better and better neural network.” Ellison believes that AI capabilities will improve with more compute and better models, and that the large tech companies can’t afford to cede the AI lead to competitors. With big tech armed with a ton of cash, he doesn’t see the buildout ending for five to 10 years.

Jensen Huang and Lisa Su just dropped the mic

This week then saw two massive announcements from the number one and two AI chip companies that should allay near-term fears about the durability of the AI trade. At the beginning of the month, Nvidia’s CEO Jensen Huang said demand for its next generation chip Blackwell was “insane.” Fast forward to last week, and analysts at Morgan Stanley revealed Blackwell is already sold out for the next 12 months, after the firm hosted Nvidia executives at their offices.

Then on Thursday, AMD held its “Advancing AI” event during which it unveiled its new EPYC 9005 CPUs and Instinct MI325X GPUs. During the presentation, CEO Lisa Su increased her projection for the market size for AI accelerators. Last year, Su surprised investors by forecasting the AI accelerator market would increase from $45 billion in 2023 to a whopping $400 billion in 2027.

So, has the past year made her more skeptical or anxious about all that spend, as Elliott surmises?

Just the opposite, in fact. During the conference, Su raised her guidance for the AI accelerator market to reach a whopping $500 billion by 2028, saying, “Since [last year], AI demand has continued to take off and exceed expectations. It’s clear that the rate of investment is continuing to grow everywhere, driven by more powerful models, new use cases, and actually just a wider adoption of AI use cases.”

If Su’s and Huang’s projections hold, more companies will benefit than just Nvidia and AMD. Any company with a strong competitive position in the related foundry, semicap equipment, server, or AI-integrated software industries should also see a benefit from this medium-term demand. Additionally, electricity and transmission providers should also see strong growth, as AI data centers consume a huge amount of energy.

Bubble brewing? Not just yet

While the dot-com bubble burst in the year 2000, remember that there was a five-year “boom” that preceded it. The boom coincided with the period after the Federal Reserve cut interest rates between 1995 through 1998. Looking at today’s situation, the AI boom is only about two years old, and the Fed similarly just began a rate-cutting cycle in September.

To this investor, it appears we may be more in the “mid-90s” analogy rather than the precipice of an enormous bubble bursting. There’s also a case for the boom to go on for a longer time than the internet boom did, as the companies investing AI, the Mag Seven, are all extremely strong financially — much stronger than a lot of the newer start-up tech companies of the mid-1990s. In addition, for all their success, the Mag Seven really don’t trade at the crazy valuations seen by big tech in the late 1990s.

That doesn’t mean the AI buildout couldn’t become a bubble — it could. But it still seems early, and AI stocks are too reasonably priced for a huge fall, barring any outside exogenous shocks.

Should you invest $1,000 in Advanced Micro Devices right now?

Before you buy stock in Advanced Micro Devices, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Advanced Micro Devices wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,069!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

Billy Duberstein and/or his clients have no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, and Oracle. The Motley Fool has a disclosure policy.

Nvidia and Advanced Micro Devices Just Gave Magnificent News to AI Chip Investors was originally published by The Motley Fool

John Bolton Says Israel Should Strike Iran By 'Going After Its Nuclear Weapons Program' — Tehran's Nukes Threaten America's Security

Trump-Era White House national security advisor, John Bolton, has called on Israel to target Iran’s nuclear program, despite worldwide appeals for moderation following Iran’s recent missile attack.

What Happened: Bolton said on X on Monday, “The Israeli government should consider retaliating against Iran by going after its nuclear weapons program.”

“Iran having nuclear weapons directly threatens Israel’s national security as well as America’s.”

He shared an article from Canada’s Global News in which he was quoted as saying, “I think that’s the point where Israel can have the maximum impact, precisely by going after the nuclear weapons program.” The former U.S. official said that there was “no guarantee” that Israel would have another opportunity that was as good.

In an interview with Mercedes Stephenson on The West Block, Bolton underscored the need for Israel to prevent Iran’s next attack from involving a nuclear warhead, according to the report.

“If you’re Israel, and you’ve seen in both the April attack from Iran and the Oct. 1 attack hundreds of ballistic missiles launched at you, you could have no confidence that the next time you see a ballistic missile coming from Iran, that under its nose cone it might not have a nuclear weapon.”

Why It Matters: Bolton has previously advocated for regime change in Iran and has criticized Iran’s role in attacks on Israeli civilians. His latest call for action comes after Israeli Prime Minister Benjamin Netanyahu expressed willingness to strike military targets rather than oil or nuclear facilities in Iran. This decision was seen as a move to avoid political interference in the U.S. elections and to prevent a surge in energy prices.

However, experts have warned that any Israeli military action targeting Iranian facilities could significantly impact global oil prices and lead to potential disruptions in the energy markets. This adds another layer of complexity to the already tense geopolitical situation.

Notably oil prices fell on Monday after Netanyahu said that Israel will not target Iran’s oil or nuclear targets.At the time of writing WTI Crude November 2024 futures traded 2.9% lower at $71.70. ICE Brent Crude December 2024 futures were down 2.8% at $75.28.

The United States Oil Fund LP USO ended Monday lower by 2% at $75.93 while the iShares US Oil & Gas Exploration & Production ETF IEO closed 1.1% lower at $96.03.

Image via Flickr/ Gage Skidmore

Did You Know?

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

B. Riley Financial to Establish Partnership with Oaktree in the Great American Group Businesses

Concludes Previously Announced Review of Strategic Alternatives for the Great American Group Businesses

LOS ANGELES, Oct. 14, 2024 /PRNewswire/ — B. Riley Financial, Inc. RILY (“B. Riley” and the “Company”), a diversified financial services platform, and funds managed by Oaktree Capital Management, L.P. (“Oaktree”), have signed a definitive agreement (the “Agreement”) to establish a partnership in Great American Holdings, LLC, a newly formed holding company (“Great American NewCo”).

Prior to the closing of the transactions contemplated by the Agreement, B. Riley will undertake a pre-closing internal reorganization and will contribute all of the interests in B. Riley’s Appraisal and Valuation Services, Retail, Wholesale & Industrial Solutions and Real Estate Advisory businesses (collectively known as the “Great American Group”) to Great American NewCo.

At the closing of the transaction, B. Riley will receive total consideration consisting of approximately $203 million in cash, subject to certain purchase price adjustments, Class B Preferred Units of Great American NewCo with an initial aggregate liquidation preference of approximately $183 million, and Class A Common Units of NewCo representing approximately 47% of the total outstanding common units. Oaktree will acquire Class A Preferred Units of Great American NewCo with an initial liquidation preference of approximately $203 million, as well as Class A Common Units representing approximately 53% of the aggregate amount of the issued and outstanding Class A Common Units of Great American NewCo, in exchange for cash consideration of approximately $203 million (the “Proposed Transaction”), implying a total enterprise value for the Great American NewCo of $386 million. The transaction has been approved by the Board of Directors of the Company and is subject to the receipt of required regulatory approvals and other customary closing conditions. It is expected to close in the fourth quarter of 2024.

Bryant Riley, Chairman and Co-Chief Executive Officer of B. Riley, said, “I am pleased to be partnering with Oaktree given its stellar track record and reputation as one of the world’s leading asset managers. We believe Oaktree’s scale and expertise in alternative investments and their strength as a capital provider, combined with the Great American Group’s leading position as a provider of asset disposition, financial advisory and real estate advisory services, will prove complementary as we join forces to deliver financial products and services to better serve our clients.”

Mr. Riley continued, “As we communicated last month, this transaction is an important step in our plan to reduce our debt while reinvesting in our core financial services businesses. We are very excited about this new partnership we established with Oaktree in the Great American Group as it will enable meaningful debt reduction while retaining significant equity upside in the business with a highly capable new partner that will increase its future growth prospects.”

“Great American offers an exciting investment opportunity for Oaktree in a leading valuation appraisal, asset disposition and real estate advisory platform. We are eager to provide both capital and our extensive operating expertise to support the future growth of the business,” said Nick Basso, Managing Director at Oaktree.

“As an experienced capital provider to the financial services sector, we are thrilled to partner with B. Riley and Great American’s talented leadership team. We look forward to bringing our resources and relationships to support Great American’s growth as an independent platform,” said Thomas Casarella, Managing Director at Oaktree.

Advisors

Moelis & Company LLC served as the exclusive financial advisor to B. Riley, and Sullivan & Cromwell LLP served as legal advisor to B. Riley. Wachtell, Lipton, Rosen & Katz served as legal advisor to Oaktree.

About B. Riley Financial

B. Riley Financial is a diversified financial services platform that delivers tailored solutions to meet the strategic, operational, and capital needs of its clients and partners. B. Riley leverages cross-platform expertise to provide clients with full service, collaborative solutions at every stage of the business life cycle. Through its affiliated subsidiaries, B. Riley provides end-to-end financial services across investment banking, institutional brokerage, private wealth and investment management, financial consulting, corporate restructuring, operations management, risk and compliance, due diligence, forensic accounting, litigation support, appraisal and valuation, auction, and liquidation services. B. Riley opportunistically invests to benefit its shareholders, and certain affiliates originate and underwrite senior secured loans for asset-rich companies. B. Riley refers to B. Riley Financial, Inc. and/or one or more of its subsidiaries or affiliates. For more information, please visit www.brileyfin.com.

About Oaktree

Oaktree is a leader among global investment managers specializing in alternative investments, with $193 billion in assets under management as of June 30, 2024. The firm emphasizes an opportunistic, value-oriented and risk-controlled approach to investments in credit, private equity, real estate and listed equities. The firm has over 1,200 employees and offices in 23 cities worldwide. For additional information, please visit Oaktree’s website at http://www.oaktreecapital.com/.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact are forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the Company’s performance or achievements to be materially different from any expected future results, performance, or achievements. Forward-looking statements speak only as of the date they are made and the Company assumes no duty to update forward looking statements, except as required by law. Actual future results, performance or achievements may differ materially from historical results or those anticipated depending on a variety of factors, some of which are beyond the control of the Company, including, but not limited to, the occurrence of any event, change or other circumstances that could give rise to the termination of the Agreement; the inability to consummate the transactions contemplated therein or the failure to satisfy other conditions to completion of the Proposed Transaction; potential litigation relating to the Proposed Transaction that could be instituted in connection with the Agreement; and the risk that the Proposed Transaction will not be consummated in a timely manner, if at all. In addition to these factors, we encourage you to review the “Risk Factors” set forth in B. Riley’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and other filings with the United States Securities and Exchange Commission, which identify important factors, though not necessarily all such factors, that could cause future outcomes to differ materially from those set forth in the forward-looking statements in this communication.

Contacts

B. Riley

Investors

ir@brileyfin.com

Media

press@briley.com

![]() View original content:https://www.prnewswire.com/news-releases/b-riley-financial-to-establish-partnership-with-oaktree-in-the-great-american-group-businesses-302275072.html

View original content:https://www.prnewswire.com/news-releases/b-riley-financial-to-establish-partnership-with-oaktree-in-the-great-american-group-businesses-302275072.html

SOURCE B. Riley Financial

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Earnings Outlook For Fulton Financial

Fulton Financial FULT is set to give its latest quarterly earnings report on Tuesday, 2024-10-15. Here’s what investors need to know before the announcement.

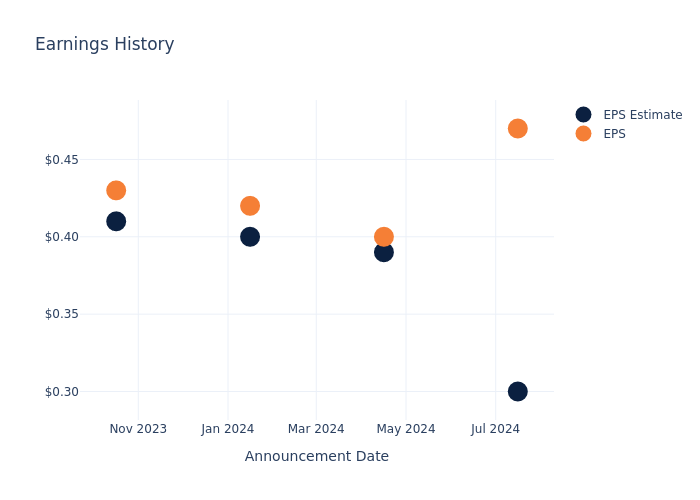

Analysts estimate that Fulton Financial will report an earnings per share (EPS) of $0.44.

Investors in Fulton Financial are eagerly awaiting the company’s announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It’s worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

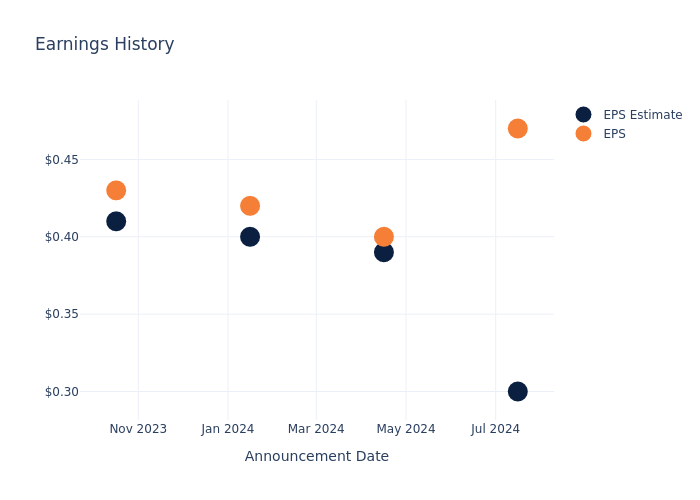

Earnings History Snapshot

Last quarter the company beat EPS by $0.17, which was followed by a 4.47% increase in the share price the next day.

Here’s a look at Fulton Financial’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.30 | 0.39 | 0.40 | 0.41 |

| EPS Actual | 0.47 | 0.40 | 0.42 | 0.43 |

| Price Change % | 4.0% | 0.0% | -1.0% | -2.0% |

Stock Performance

Shares of Fulton Financial were trading at $17.95 as of October 11. Over the last 52-week period, shares are up 41.74%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

To track all earnings releases for Fulton Financial visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fed's Waller Signals Caution On Interest-Rate Cuts: 'Latest Inflation Data Was Disappointing'

Federal Reserve Gov. Christopher J. Waller voiced concerns Monday over recent inflation data, signaling that the central bank must proceed cautiously on interest rate cuts.

Speaking at a conference at Stanford University, Waller struck a slightly hawkish tone, highlighting the U.S. economy’s strength while acknowledging worries over recent inflation upticks.

Waller emphasized the economy is on “solid footing,” with employment near the Federal Open Market Committee’s (FOMC) maximum objective. But he added, “The latest inflation data was disappointing.”

Despite progress in reducing inflation, recent figures suggest uneven progress toward the Fed’s 2% target.

Waller praised the economy’s resilience, noting that real GDP grew at a 2.2% annual rate in the first half of 2024 and is expected to accelerate in the third quarter.

He also mentioned that household resources remain in good shape, though lower-income groups continue to face financial strain. “These revisions suggest that the economy is much stronger than previously thought, with little indication of a major slowdown in economic activity,” Waller said.

Waller highlighted continued strength in consumer spending, despite some moderation.

Growth in personal consumption expenditures (PCE) has averaged around 2.5% this year. Waller’s business contacts expressed optimism about “considerable pent-up demand” for durable goods and home improvements, demand that has been delayed due to high interest rates.

As interest rates for credit cards and home equity loans begin to decline, Waller expects consumers to resume purchasing “durable goods, home improvements, and other big-ticket items.”

“Now that rates have started to come down and are expected to come down more, consumers will be eager to make those purchases,” he said.

Read Also: ‘Most Widely Hated’ Bull Market Reaches 2-Year Milestone: Top 20 S&P 500 Stocks Driving The Rally

Waller also addressed the September jobs report, which far exceeded expectations. “The labor market remains quite healthy,” he said, pushing back against speculation that the Fed might have considered an emergency rate cut earlier in the summer.

While Waller expects payroll gains to slow, he believes job growth will continue at a “solid rate.”

He did, however, caution that interpreting the October jobs report may be difficult due to temporary disruptions from recent hurricanes and the Boeing strike, which are expected to skew the numbers.

Turning to inflation, Waller expressed concern over September’s likely increase in PCE inflation, the Fed’s preferred measure. “We have made a lot of progress on inflation over the last year and a half, but that progress has clearly been uneven — at times it feels like being on a rollercoaster,” Waller said.

He remains uncertain whether the recent uptick in inflation is a temporary blip or a signal of more persistent inflationary pressures. “I will be watching the data carefully to see how persistent this recent uptick is,” he added.

Despite these concerns, Waller reaffirmed his outlook for gradual rate reductions over the next year, aligning with the FOMC’s median projection of 3.4% for the federal funds rate by the end of 2025.

However, he acknowledged, “There is less certainty about the final destination.”

Waller’s remarks have not significantly shifted interest-rate expectations. According to the CME FedWatch Tool, the odds of a 25-basis-point rate cut remained steady at 86%.

However, if more Fed policymakers also express concerns about inflation in the days to come, and if Thursday’s retail sales data exceeds expectations, the likelihood of the Fed holding rates unchanged could rise from here.

On Monday, Treasury yields were largely stable, with the two-year note yield — sensitive to rate policy — hovering around 4%. The U.S. dollar index (DXY), tracked by the Invesco DB USD Index Bullish Fund ETF UUP, rose 0.3%, reaching its highest level since late July.

Meanwhile, the S&P 500 index, monitored via the SPDR S&P 500 ETF Trust SPY, gained 0.8% to close at 5,859 points, extending its record highs.

Read Now:

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 Must-Buy Gaming Stocks to Thrive on Promising Market Trends

The Zacks Gaming industry benefits from macroeconomic tailwinds, particularly the Federal Reserve’s interest rate reduction and strong demand for sports betting. The industry is experiencing an upside, thanks to increased visitation and spending per visit, especially from younger demographics. Stocks like Flutter Entertainment plc FLUT, DoubleDown Interactive Co., Ltd. DDI and GDEV Inc. GDEV will likely gain traction from this upbeat demand.

Industry Description

The Zacks Gaming industry includes companies that own and operate integrated casinos, hotels and entertainment resorts. Some industry players also deliver technology products and services across lotteries, electronic gaming machines, sports betting and interactive gaming. Some firms develop and operate gaming establishments and associated lodging, restaurants, horse racing and entertainment amenities. Many companies are involved in developing and selling gaming applications. E-sports or sporting events or tournament services, content management systems, video software, mobile applications and e-sports data platform solutions are provided as well.

Key Themes Shaping the Gaming Industry

Interest Rate Cut to Aid Gaming Industry: In its latest policy meeting, the Federal Reserve reduced interest rates by 50 basis points to stimulate the economy and support the labor market. The Fed has kept the key interest rates at 4.75-5% and eased its monetary policy for the first time in four years. According to the Fed’s Summary of Economic Projections, officials anticipate another half-point rate cut later this year, with additional cuts expected in 2025 and 2026. Most gaming companies rely on debt to finance their operations, expansion projects and renovations. A reduction in interest rates lowers the cost of borrowing, allowing gaming companies to take on new loans or refinance existing debt at more favorable terms. This can free up capital for growth initiatives and reduce interest expenses.

Macau Gaming Revenues Improving: The industry benefits from improving visitation. In September, Macau’s gross gaming revenues rallied 15.5% year over year. Robust investment will continue to aid the gaming industry in Macau. Casino operators are adopting a disciplined operational strategy by streamlining business processes, enhancing marketing approaches, and renegotiating contracts with vendors and third parties. There is an intense emphasis on improving service quality and staffing levels to cater to gamers better.

U.S. Commercial Gaming Revenues Robust: The gaming industry in the United States continues to boost investor sentiment. Per the American Gaming Association data, revenues from gambling hit a record high of $17.63 billion in second-quarter 2024, up 8.9% year over year. The U.S. gaming industry will continue to improve. This marked the industry’s 14th straight quarter of annual revenue growth.

Sports Betting Acts as Major Driver: The legalization of sports betting in Delaware, Mississippi, New Jersey, New Mexico, West Virginia, Pennsylvania, Rhode Island, Montana, Indiana, Tennessee, Illinois and New Hampshire has been driving growth for a while. Bettors can place wagers via digital platforms in Connecticut, Kentucky, Michigan, Massachusetts, Maryland, Minnesota, Missouri, Kansas, Louisiana, Oklahoma, South Carolina, California, Oregon, Arizona, Montana, Colorado and other states. Some popular gaming applications include DraftKings, Barstool, FanDuel, BetMGM, BetRivers, Fox Bet and BetMonarch.

Zacks Industry Rank Indicates Bright Prospects

The Zacks Gaming industry is grouped within the broader Zacks Consumer Discretionary sector. It carries a Zacks Industry Rank #103, which places it in the top 41% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bright near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s position in the top 50% of the Zacks-ranked industries is a result of a positive earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually gaining confidence in this group’s earnings growth potential. Since April 30, 2024, the industry’s northbound estimate for the current year increased 9.5%.

We will present a few gaming stocks that you can add to your investment portfolio, given their strong fundamentals. But it is worth looking at the industry’s shareholder returns and its current valuation first.

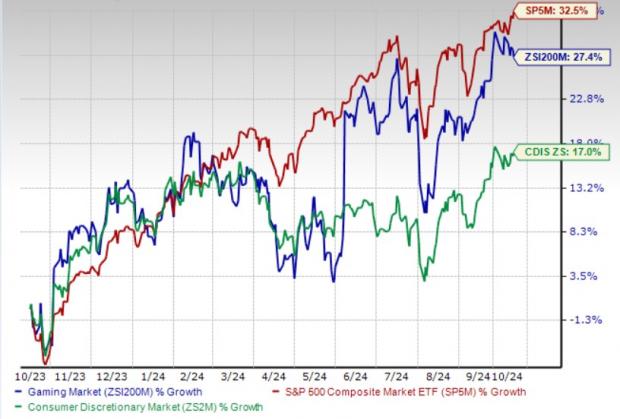

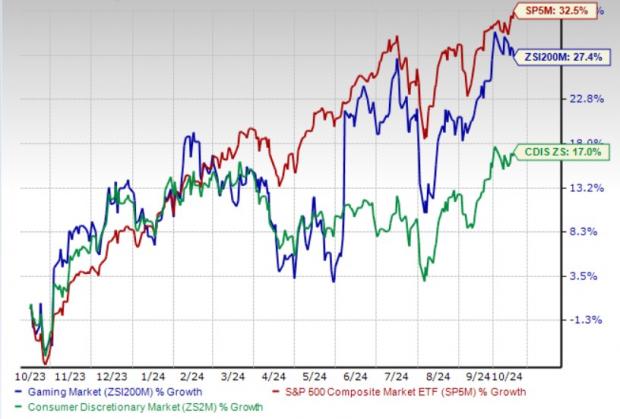

Industry Underperforms the S&P 500

The Zacks Gaming industry has lagged the S&P 500 Index and the broader Zacks Consumer Discretionary sector in the past year.

The industry has risen 27.4% over this period compared with the S&P 500 Index’s growth of 32.5%. In the same time frame, the sector has rallied 17%.

One-Year Price Performance

Gaming Industry’s Valuation

Since gaming companies are debt-laden, valuing the same based on the EV/EBITDA (Enterprise Value/ Earnings before Interest Tax Depreciation and Amortization) ratio makes sense. The industry currently has a forward 12-month EV/EBITDA ratio of 11.93. The space is trading at a discount compared with the market at large, as the forward 12-month EV/EBITDA ratio for the S&P 500 is 14.47.

In the past five years, the industry has traded as high as 22.53X and as low as 6.56X, with a median of 15.30X, as the chart below shows.

Enterprise Value-to-EBITDA Ratio (Past 5 Years)

.jpg)

3 Gaming Stocks to Watch for

Flutter Entertainment: The company has been witnessing excellent growth across its brands in the U.K., achieving market share gains for 10 consecutive quarters based on gambling commission data. Flutter Entertainment completed the migration of FanDuel Casino to its proprietary technology, enhancing platform stability and allowing access to exclusive content.

This Zacks Rank #1 (Strong Buy) company’s shares have gained 6% in the past three months. Earnings estimates for 2024 have increased to $5.71 from $4.07 in the past 60 days.

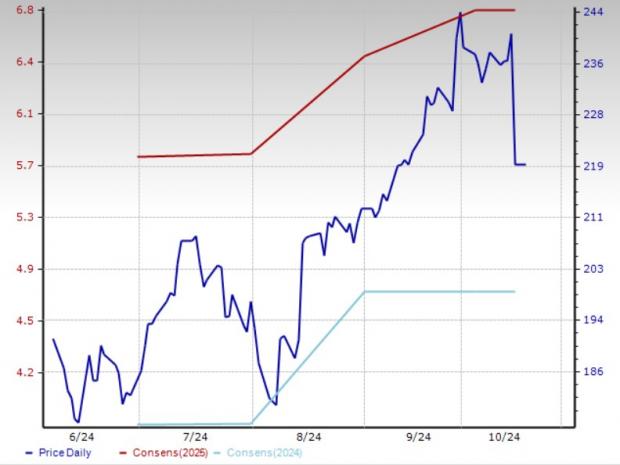

Price & Consensus: FLUT

DoubleDown Interactive: The company is benefiting from its robust social casino business. In second-quarter 2024, the company’s social casino business saw a 7% revenue increase, marking its third consecutive quarter of year-over-year growth, which indicates a growing market share.

This Zacks Rank #1 player’s shares have gained 12.8% in the past three months. DoubleDown Interactive’s 2024 earnings estimates have increased 13.5% to $2.35 in the past 60 days.

Price & Consensus: DDI

GDEV: The company’s refined vision, which emphasizes sustainable growth and operational efficiency, bodes well. Its focus on delivering top games, coupled with the recruitment of industry talent, supports its commitment to creating exceptional player experiences and solidifying its market position for long-term success.

Shares of this Zacks Rank #1 player have grown 29.4% in the three months. GDEV’s 2024 earnings estimates have increased to 60 cents from 15 cents in the past 60 days.

Price & Consensus: GDEV

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

[Latest] Global Retail Robotics Market Size/Share Worth USD 249.3 Billion by 2033 at a 28.73% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth, Growth Rate, Value)

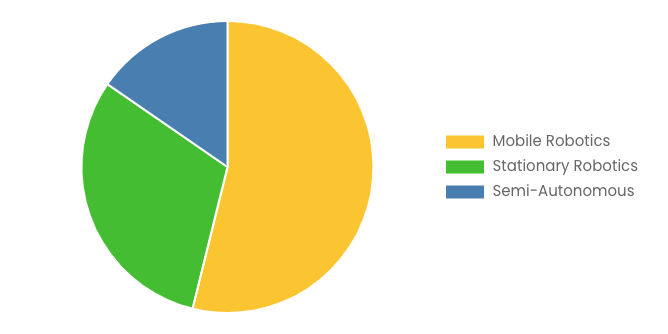

Austin, TX, USA, Oct. 14, 2024 (GLOBE NEWSWIRE) — Custom Market Insights has published a new research report titled “Retail Robotics Market Size, Trends and Insights By Type (Mobile Robotics, Stationary Robotics, Semi-Autonomous), By Deployment (Cloud/Web-Based, In-Premise, Third Party Deployment Server), By Application (Delivery Robots, Inventory Robots, In-Store Service Robots, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ in its research database.

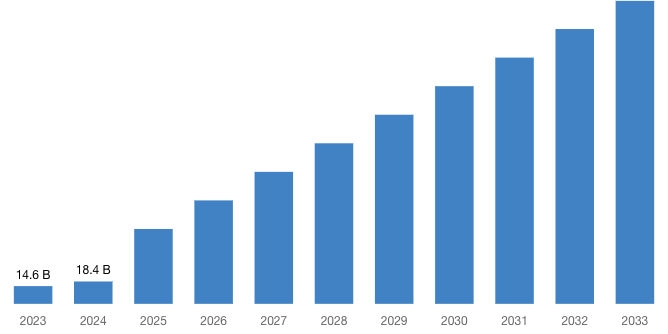

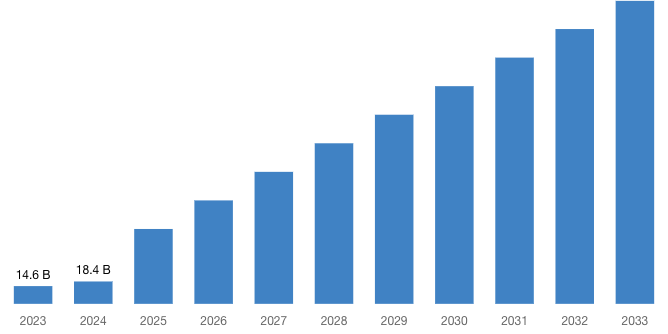

“According to the latest research study, the demand of global Retail Robotics Market size & share was valued at approximately USD 14.6 Billion in 2023 and is expected to reach USD 18.4 Billion in 2024 and is expected to reach a value of around USD 249.3 Billion by 2033, at a compound annual growth rate (CAGR) of about 28.73% during the forecast period 2024 to 2033.”

Click Here to Access a Free Sample Report of the Global Retail Robotics Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=52616

Retail Robotics Market: Overview

The use of robotic technologies in retail settings to automate various operations, increase productivity, and enhance customer experiences is known as retail robotics. These robots can perform a variety of tasks in physical retail establishments, warehouses, and distribution centers, including customer service and inventory management.

Retail robotics provide a personalized experience and increase client interaction, which in turn raises customer satisfaction. The market is expanding because retail robots can provide personalized customer service. Applying robotics to one or more of these procedures boosts operational effectiveness and fosters corporate expansion.

Retailers can do jobs like stocking, processing, and analyzing vast volumes of data, and Artificial Intelligence (AI) programs, by utilizing retail robotics. Retail robots’ capacity to track customers eventually makes it possible for them to learn about the demand for different products and help them make more informed selections.

Due to the e-commerce boom, the logistics sector is experiencing a manpower deficit, yet demand for faster parcel shipments that also require a wide range of packing options is rising. Though it is still in its infancy and hasn’t had much of an impact, the use of robots in logistics is a viable solution to the industry’s labour shortage problem.

Retail robots may seem intimidating to retailers who are just beginning to integrate technology into their operations due to their high initial costs. For retail robots, security and data privacy include managing consent, storing it securely, and shielding it from hackers.

Request a Customized Copy of the Retail Robotics Market Report @ https://www.custommarketinsights.com/inquire-for-discount/?reportid=52616

By Type, the mobile robotics segment held the highest market share in 2023 and is expected to keep its dominance during the forecast period 2024-2033. Mobile robots can automate processes including in-store services, delivery management, and inventory control, increasing productivity and lowering human expenses.

By automating processes like delivery, inventory, and in-store services, mobile robots can lower errors by increasing accuracy and decreasing human error.

By Application, the inventory robots segment held the highest market share in 2023 and is expected to keep its dominance during the forecast period 2024-2033. Inventory robots increase productivity and lower labor costs by automating processes like inventory management, tracking, and monitoring. Robotic inventory managers can precisely monitor and control stock levels, which lowers mistakes and boosts client satisfaction.

By Deployment, the cloud/web-based segment held the highest market share in 2023 and is expected to keep its dominance during the forecast period 2024-2033. The retail robotics market is dominated by the “cloud/web-based” deployment category because of its quick growth, benefits including affordability and availability, and large market share in comparison to on-premise and third-party deployment strategies.

North America leading the Retail Robotics Market in 2023 with a market share of 40.00% and is expected to keep its dominance during the forecast period 2024-2033. Retail robotics adoption in North America is well-founded due to the region’s well-established retail infrastructure.

Retail robotics solutions that can help manage inventory, fulfill orders, and provide efficient delivery services are becoming more and more necessary in this region due to the rising rate of e-commerce adoption. Retail robotics solutions that can enhance operational efficiency and offer personalized experiences are in high demand due to the huge and tech-savvy consumer base in North America.

Report Scope

| Feature of the Report | Details |

| Market Size in 2024 | USD 18.4 Billion |

| Projected Market Size in 2033 | USD 249.3 Billion |

| Market Size in 2023 | USD 14.6 Billion |

| CAGR Growth Rate | 28.73% CAGR |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Key Segment | By Type, Deployment, Application and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

(A free sample of the Retail Robotics report is available upon request; please contact us for more information.)

Request a Customized Copy of the Retail Robotics Market Report @ https://www.custommarketinsights.com/report/retail-robotics-market/

Our Free Sample Report Consists of the following:

- Introduction, Overview, and in-depth industry analysis are all included in the 2024 updated report.

- The COVID-19 Pandemic Outbreak Impact Analysis is included in the package.

- About 220+ Pages Research Report (Including Recent Research)

- Provide detailed chapter-by-chapter guidance on the Request.

- Updated Regional Analysis with a Graphical Representation of Size, Share, and Trends for the Year 2024

- Includes Tables and figures have been updated.

- The most recent version of the report includes the Top Market Players, their Business Strategies, Sales Volume, and Revenue Analysis

- Custom Market Insights (CMI) research methodology

(Please note that the sample of the Retail Robotics report has been modified to include the COVID-19 impact study prior to delivery.)

Request a Customized Copy of the Retail Robotics Market Report @ https://www.custommarketinsights.com/report/retail-robotics-market/

CMI has comprehensively analyzed Retail Robotics Market. The driving forces, restraints, challenges, opportunities, and key trends have been explained in depth to depict an in-depth scenario of the market. Segment wise market size and market share during the forecast period are duly addressed to portray the probable picture of this global retail robotics application.

The competitive landscape includes key innovators, after market service providers, market giants as well as niche players are studied and analyzed extensively concerning their strengths, weaknesses as well as value addition prospects. In addition, this report covers key players profiling, market shares, mergers and acquisitions, consequent market fragmentation, new trends and dynamics in partnerships.

Key questions answered in this report:

- What is the size of the Retail Robotics market and what is its expected growth rate?

- What are the primary driving factors that push the Retail Robotics market forward?

- What are the Retail Robotics Industry’s top companies?

- What are the different categories that the Retail Robotics Market caters to?

- What will be the fastest-growing segment or region?

- In the value chain, what role do essential players play?

- What is the procedure for getting a free copy of the Retail Robotics market sample report and company profiles?

Key Offerings:

- Market Share, Size & Forecast by Revenue | 2024−2033

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Leading Trends

- Market Segmentation – A detailed analysis by Types of Services, by End-User Services, and by regions

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Buy this Premium Retail Robotics Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/retail-robotics-market/

Retail Robotics Market: Regional Analysis

By Region, Retail Robotics Market is segmented into North America, Europe, Asia Pacific, Latin America, the Middle East & Africa. Among all of these regions, North America led the Retail Robotics Market in 2023 with a market share of 41.50% and is expected to keep its dominance during the forecast period 2024-2033.

North America is expected to have the largest growth rate in the retail automation market both now and in the future due to its well-established retail infrastructures, the presence of major manufacturers, and its large consumer base.

To increase operational effectiveness, cut expenses, and improve customer experiences, retailers in North America are progressively implementing automation technology, such as retail robotics. Through programs like tax breaks and financing for R&D, governments in North America are encouraging the adoption of automation technology, including retail robotics.

The Asia Pacific region is expected to grow at a faster rate due to factors such as rising per-capita disposable income, shifting consumer preferences, an increase in digital payments, and advancements in technology.

Request a Customized Copy of the Retail Robotics Market Report @ https://www.custommarketinsights.com/report/retail-robotics-market/

(We customized your report to meet your specific research requirements. Inquire with our sales team about customizing your report.)

Still, Looking for More Information? Do OR Want Data for Inclusion in magazines, case studies, research papers, or Media?

Email Directly Here with Detail Information: support@custommarketinsights.com

Browse the full “Retail Robotics Market Size, Trends and Insights By Type (Mobile Robotics, Stationary Robotics, Semi-Autonomous), By Deployment (Cloud/Web-Based, In-Premise, Third Party Deployment Server), By Application (Delivery Robots, Inventory Robots, In-Store Service Robots, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ Report at https://www.custommarketinsights.com/report/retail-robotics-market/

List of the prominent players in the Retail Robotics Market:

- Honeybee Robotics

- Piaggio Fast Forward

- Amazon Robotics

- Bossa Nova Robotics

- Simbe Robotics

- ABB Robotics

- GreyOrange

- SoftBank Robotics

- Honda Motor Co. Ltd.

- Locus Robotics

- Soft Robotics

- Universal Robots

- Aethon

- Alphabet Inc.

- Rethink Robotics

- Robotiq

- Savioke

- DJI

- Fetch Robotics

- KNAPP AG

- Others

Click Here to Access a Free Sample Report of the Global Retail Robotics Market @ https://www.custommarketinsights.com/report/retail-robotics-market/

Spectacular Deals

- Comprehensive coverage

- Maximum number of market tables and figures

- The subscription-based option is offered.

- Best price guarantee

- Free 35% or 60 hours of customization.

- Free post-sale service assistance.

- 25% discount on your next purchase.

- Service guarantees are available.

- Personalized market brief by author.

Browse More Related Reports:

3D Laser Cutting Robot Market: 3D Laser Cutting Robot Market Size, Trends and Insights By Type (Fiber, CO2, Nd (Neodymium-doped Yttrium Aluminum Garnet), Other), By Application (Automotive, Aerospace & Defence, Consumer Electronics, Medical Devices, Industrial Manufacturing, Others), By End-User Industry (Automotive Industry, Aerospace Industry, Electronics and Semiconductor Industry, Medical Device Industry, Heavy Machinery Industry, Others), By Function (Cutting, Welding, Drilling, Engraving, Other), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Screw Compressor Market: Screw Compressor Market Size, Trends and Insights By Stage (Single-Stage, Multi-Stage), By End User (Manufacturing, Oil and Gas, Mining, Construction), By Technology (Oil-injected, Oil-free), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

AC Screw Air Compressor Market: AC Screw Air Compressor Market Size, Trends and Insights By Type (Oil-Free, Oil-Injected), By Application (Stationary, Portable), By End Use (Manufacturing, Energy, Automotive, Aerospace, Mining), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

US Oil Filled Transformer Market: US Oil Filled Transformer Market Size, Trends and Insights By Core (Berry, Closed, Shell), By Product Type (Instrument Transformer, Distribution Transformer, Power Transformer, Others), By Modes of Cooling (Oil Natural Air Natural, Oil Natural Air Forced, Oil Natural Water Forced), By Substation Connectivity (Transmission, Distribution), By Rating (< 5 MVA, > 5 MVA to < 10 MVA, > 10 MVA), By Mounting (Pad, Pole, Foundation, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Oil Immersed Power Transformer Market: Oil Immersed Power Transformer Market Size, Trends and Insights By Installation (Pad Mounted, Pole Mounted, Substation Installation), By Phase (Single Phase, Three Phase), By Voltage (Low, Medium, High), By End Users (Industrial, Residential, Commercial, Utilities), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Hydraulic Motors Market: Hydraulic Motors Market Size, Trends and Insights By Product Type (Gear Motor, Vane Motor, Axial Piston Motors, Radial Piston Motors), By Speed (Low-Speed (< 500 Rpm), High-Speed (>500 Rpm)), By Pressure Rating (Low Pressure, Medium Pressure, High Pressure), By Application (Mining & Construction, Oil & Gas, Agriculture & Forestry, Automotive, Packaging, Machine Tool, Material Handling, Aerospace & Defense, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Spiral Freezer Market: Spiral Freezer Market Size, Trends and Insights By Application (Meat Processing, Bakery, Seafood, Others), By Capacity (Small Capacity, Medium Capacity, Large Capacity), By Business (Aftermarket, OEM), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Water Desalination Equipment Market: Water Desalination Equipment Market Size, Trends and Insights By Source (Sea water, Brackish water, River water, Others), By Technology (Reverse Osmosis (RO), Multi-stage Flash (MSF) distillation, Multi-effect Distillation (MED), Others), By Application (Drinking Water Supply, Process Water, Irrigation Water, Others), By End Users (Municipal, Industrial, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

The Retail Robotics Market is segmented as follows:

By Type

- Mobile Robotics

- Stationary Robotics

- Semi-Autonomous

By Deployment

- Cloud/Web-Based

- In-Premise

- Third Party Deployment Server

By Application

- Delivery Robots

- Inventory Robots

- In-Store Service Robots

- Others

Click Here to Get a Free Sample Report of the Global Retail Robotics Market @ https://www.custommarketinsights.com/report/retail-robotics-market/

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

This Retail Robotics Market Research/Analysis Report Contains Answers to the following Questions.

- Which Trends Are Causing These Developments?

- Who Are the Global Key Players in This Retail Robotics Market? What are Their Company Profile, Product Information, and Contact Information?

- What Was the Global Market Status of the Retail Robotics Market? What Was the Capacity, Production Value, Cost and PROFIT of the Retail Robotics Market?

- What Is the Current Market Status of the Retail Robotics Industry? What’s Market Competition in This Industry, Both Company and Country Wise? What’s Market Analysis of Retail Robotics Market by Considering Applications and Types?

- What Are Projections of the Global Retail Robotics Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about imports and exports?

- What Is Retail Robotics Market Chain Analysis by Upstream Raw Materials and Downstream Industry?

- What Is the Economic Impact On Retail Robotics Industry? What are Global Macroeconomic Environment Analysis Results? What Are Global Macroeconomic Environment Development Trends?

- What Are Market Dynamics of Retail Robotics Market? What Are Challenges and Opportunities?

- What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for Retail Robotics Industry?

Click Here to Access a Free Sample Report of the Global Retail Robotics Market @ https://www.custommarketinsights.com/report/retail-robotics-market/

Reasons to Purchase Retail Robotics Market Report

- Retail Robotics Market Report provides qualitative and quantitative analysis of the market based on segmentation involving economic and non-economic factors.

- Retail Robotics Market report outlines market value (USD) data for each segment and sub-segment.

- This report indicates the region and segment expected to witness the fastest growth and dominate the market.

- Retail Robotics Market Analysis by geography highlights the consumption of the product/service in the region and indicates the factors affecting the market within each region.

- The competitive landscape incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled.

- Extensive company profiles comprising company overview, company insights, product benchmarking, and SWOT analysis for the major market players.

- The Industry’s current and future market outlook concerning recent developments (which involve growth opportunities and drivers as well as challenges and restraints of both emerging and developed regions.

- Retail Robotics Market Includes in-depth market analysis from various perspectives through Porter’s five forces analysis and provides insight into the market through Value Chain.

Reasons for the Research Report

- The study provides a thorough overview of the global Retail Robotics market. Compare your performance to that of the market as a whole.

- Aim to maintain competitiveness while innovations from established key players fuel market growth.

Buy this Premium Retail Robotics Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/retail-robotics-market/

What does the report include?

- Drivers, restrictions, and opportunities are among the qualitative elements covered in the worldwide Retail Robotics market analysis.

- The competitive environment of current and potential participants in the Retail Robotics market is covered in the report, as well as those companies’ strategic product development ambitions.

- According to the component, application, and industry vertical, this study analyzes the market qualitatively and quantitatively. Additionally, the report offers comparable data for the important regions.

- For each segment mentioned above, actual market sizes and forecasts have been given.

Who should buy this report?

- Participants and stakeholders worldwide Retail Robotics market should find this report useful. The research will be useful to all market participants in the Retail Robotics industry.

- Managers in the Retail Robotics sector are interested in publishing up-to-date and projected data about the worldwide Retail Robotics market.

- Governmental agencies, regulatory bodies, decision-makers, and organizations want to invest in Retail Robotics products’ market trends.

- Market insights are sought for by analysts, researchers, educators, strategy managers, and government organizations to develop plans.

Request a Customized Copy of the Retail Robotics Market Report @ https://www.custommarketinsights.com/report/retail-robotics-market/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI provides a one-stop solution for data collection to investment advice. The expert analysis of our company digs out essential factors that help to understand the significance and impact of market dynamics. The professional experts apply clients inside on the aspects such as strategies for future estimation fall, forecasting or opportunity to grow, and consumer survey.

Follow Us: LinkedIn | Twitter | Facebook | YouTube

Contact Us:

Joel John

CMI Consulting LLC

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

USA: +1 801-639-9061

India: +91 20 46022736

Email: support@custommarketinsights.com

Web: https://www.custommarketinsights.com/

Blog: https://www.techyounme.com/

Blog: https://atozresearch.com/

Blog: https://www.technowalla.com/

Blog: https://marketresearchtrade.com/

Buy this Premium Retail Robotics Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/retail-robotics-market/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.