Silicon Photonics Market is Expected to Expand at a Sluggish 28.30% CAGR through 2031 | SkyQuest Technology

Westford USA, Oct. 14, 2024 (GLOBE NEWSWIRE) — SkyQuest projects that the Silicon Photonics market will attain a value of USD 11.30 billion by 2031, with a CAGR of 28.30% over the forecast period (2024-2031). Rapid digitization around the world has boosted the demand for semiconductors and chips, which in turn is projected to drive silicon photonics market growth. Growing emphasis on the development of low-power electronics and chips is estimated to favor the demand for silicon photonics over the coming years.

Download a detailed overview:

https://www.skyquestt.com/sample-request/silicon-photonics-market

Browse in-depth TOC on “Silicon Photonics Market”

- Pages – 157

- Tables – 181

- Figures – 79

Silicon Photonics Market Overview:

| Report Coverage | Details |

| Market Revenue in 2023 | $ 1.50 billion |

| Estimated Value by 2031 | $ 11.30 billion |

| Growth Rate | Poised to grow at a CAGR of 28.30% |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Component, Waveguide, Product, Application, And Region |

| Geographies Covered | North America, Europe, Asia-Pacific, Middle East & Africa, Latin America |

| Report Highlights | Updated financial information / product portfolio of players |

| Key Market Opportunities | Demand for device miniaturization across different industry verticals |

| Key Market Drivers | Rising popularity of quantum technologies |

Laser Components are Estimated to Account for Dominant Share of the Global Market

Lasers play a vital role in generating and modulating optical signals in silicon photonics, which allows them to hold a dominant stance in the global market. Low energy consumption and improved thermal performance are other benefits of lasers that help them maintain their high market share. Surging demand for low-power components will also help market growth via this segment.

Demand for Optical Multiplexers is Projected to Surge at an Impressive Pace in the Future

Optical multiplexers allow transmission of data over different wavelengths through an optic fiber cable, making it an important part of modern chips and silicon photonics. Use of optical multiplexers also helps in improving the capacity of silicon photonics while reducing power losses. All these factors help this segment emerge as a fast-growing one in the global market landscape.

Presence of Key Semiconductor Manufacturing Companies Allows Asia Pacific Region to Hold a Dominant Stance

Asia Pacific region is home to some of the most prominent semiconductor manufacturers in the world and this is what makes it the most opportune market for zzz providers. Increasing digitization and rising demand for low-power electronics are also expected to favor sales of zzz in this region. Japan, China, South Korea, and India are forecasted to emerge as the most rewarding markets in this region across the study period and beyond.

Request Free Customization of this report:

https://www.skyquestt.com/speak-with-analyst/silicon-photonics-market

Silicon Photonics Market Insights:

Drivers

- Growing digital transformation around the world

- High demand for low-power electronics

- Rising popularity of quantum computing technologies

Restraints

- Limited standardization

- Complexities and high costs of manufacturing processes

- Availability of alternative technologies

Prominent Players in Silicon Photonics Market

The following are the Top Silicon Photonics Companies:

- Cisco Systems, Inc.

- Intel Corporation

- IBM Corporation

- Mellanox Technologies Ltd.

- Hamamatsu Photonics K.K.

- Infinera Corporation

- NeoPhotonics Corporation

- Luxtera, Inc.

- Finisar Corporation

- STMicroelectronics N.V.

View report summary and Table of Contents (TOC):

https://www.skyquestt.com/report/silicon-photonics-market

Key Questions Answered in Silicon Photonics Market Report

- What drives the global silicon photonics market growth?

- Who are the leading silicon photonics providers in the world?

- Which region leads the demand for silicon photonics in the world?

This report provides the following insights:

- Analysis of key drivers (increasing digital transformation, growing demand for low-power electronics, rising adoption of quantum technologies), restraints (lack of standardization, high costs of manufacturing), and opportunities (device miniaturization, high demand for low-latency electronics and chips), influencing the growth of Silicon Photonics market.

- Market Penetration: All-inclusive analysis of product portfolio of different market players and status of new product launches.

- Product Development/Innovation: Elaborate assessment of R&D activities, new product development, and upcoming trends of the Silicon Photonics market.

- Market Development: Detailed analysis of potential regions where the market has potential to grow.

- Market Diversification: Comprehensive assessment of new product launches, recent developments, and emerging regional markets.

- Competitive Landscape: Detailed analysis of growth strategies, revenue analysis, and product innovation by new and established market players.

Related Reports:

3D IC Market

Portable Projector Market

Silicon Battery Market

Abrasive Blasting Nozzle Market

Thin-Film Photovoltaic Market

About Us:

SkyQuest is an IP focused Research and Investment Bank and Accelerator of Technology and assets. We provide access to technologies, markets and finance across sectors viz. Life Sciences, CleanTech, AgriTech, NanoTech and Information & Communication Technology.

We work closely with innovators, inventors, innovation seekers, entrepreneurs, companies and investors alike in leveraging external sources of R&D. Moreover, we help them in optimizing the economic potential of their intellectual assets. Our experiences with innovation management and commercialization have expanded our reach across North America, Europe, ASEAN and Asia Pacific.

Contact:

Mr. Jagraj Singh

Skyquest Technology

1 Apache Way,

Westford,

Massachusetts 01886

USA (+1) 351-333-4748

Email: sales@skyquestt.com

Visit Our Website: https://www.skyquestt.com/

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

43 affordable housing units to be built, quickly, in Baie-Saint-Paul

BAIE-SAINT-PAUL, QC, Oct. 11, 2024 /CNW/ – The governments of Canada and Quebec are proud to announce that 43 new housing units will be built, quickly, in Baie-Saint-Paul. They are part of a project selected under the Société d’habitation du Québec’s Programme d’habitation abordable Québec (PHAQ).

This announcement was made in the presence of Jonatan Julien, Quebec Minister Responsible for Infrastructure and Quebec Minister Responsible for the Capitale-Nationale Region, Kariane Bourassa, Member of the National Assembly for Charlevoix–Côte-de-Beaupré, and Michaël Pilote, Mayor of Baie-Saint-Paul.

Here are the features of this project:

Municipality: Baie-Saint-Paul

Name of project: Habitations de la Lumière

Project developer: Habitations de la Lumière

Number of housing units: 43

Clientele: 38 units (one-bedroom, two-bedroom and three-bedroom), including 5 reserved for people living with intellectual or physical disabilities or autism spectrum disorder, in partnership with the Centre intégré universitaire de santé et de services sociaux (CIUSSS) de la Capitale-Nationale.

The Government of Canada’s contribution will come from the Canada–Quebec Agreement under the Housing Accelerator Fund (HAF), through which Quebec has received $900 million from the federal government. The Government of Quebec also invested $900 million in new housing projects in the November 2023 economic update. The Town of Baie-Saint-Paul is also a major financial partner for this project.

This project was selected as part of Phase 2 of the PHAQ, which allows projects to be submitted at any time since the units will be occupied, in whole or in part, by people with special housing needs. To ensure this project launches quickly, its developer must sign an agreement with a contractor within 12 months of being selected to remain eligible for the PHAQ.

Quotes:

“Every Quebecer deserves a safe and affordable place to call home. The Government of Canada is proud to join in the creation of 43 new affordable housing units in Baie-Saint-Paul for the most vulnerable residents through the Canada-Quebec Agreement under the Housing Accelerator Fund. This demonstrates our unwavering commitment to ensuring that no one is left behind.”

The Honourable Sean Fraser, Minister of Housing, Infrastructure and Communities

“Thanks to the historic agreement we signed with the Government of Canada, we’re in a position to announce the construction of 43 additional housing units under the Programme d’habitation abordable Québec. This good news for Baie-Saint-Paul shows our firm commitment to boosting construction of affordable housing across Quebec. Every Quebecer deserves a home that meets their needs.”

France-Élaine Duranceau, Quebec Minister Responsible for Housing

“Our fellow citizens can count on our government to step up and take concrete action to tackle the housing crisis in our big, beautiful region. Today’s announcement shows what happens when we work together. I applaud our local partners and, of course, Habitations de la Lumière, which believes in the value of social and affordable housing as a vector for better quality of life in our community.”

Kariane Bourassa, Member of the National Assembly for Charlevoix–Côte-de-Beaupré

“We have worked with our partners to meet the challenge of access to affordable housing in our municipality. With this announcement today, I’m extremely pleased to see the success of our efforts. Access to affordable housing is a key issue for our town. We want to be inclusive and welcoming to everyone. Baie-Saint-Paul should not just be for the wealthy; we want every citizen, whatever their financial situation, to be at home here.”

Michaël Pilote, Mayor of Baie-Saint-Paul

“We are proud to contribute to the creation of affordable housing units in Baie-Saint-Paul. This project is essential to keeping our community accessible to all, regardless of their financial situation. We’re working together to build a more inclusive and sustainable future.”

Annie Bouchard, President, Habitations de la Lumière

Highlights:

- To keep the other units affordable, a maintenance period for this assistance will be required. The length of time this assistance is maintained could be up to 35 years. Assistance rates will vary based on the term of the commitment. Rents may be indexed each year based on the percentages set by the Tribunal administratif du logement.

- The Programme d’habitation abordable Québec (PHAQ) aims to engage all partners who can develop affordable housing projects. Co-operatives, non-profits, housing bureaus and private-sector businesses can submit projects under the Program. The PHAQ also aims to accelerate residential construction, which is why its standards stipulate that projects must be started within 12 months of being selected.

- The Housing Accelerator Fund (HAF) is a $4-billion Government of Canada initiative launched in March 2023 that includes $900 million for Quebec. Its goal is to accelerate the construction of 100,000 additional housing units across the country.

- The Government of Quebec, as part of its fall 2023 economic update, also announced new investments of $900 million to accelerate housing construction.

- The Government of Quebec is firmly committed to continuing its work to accelerate the construction of residential units in the province through the Act respecting land use planning and development and other provisions. Furthermore, the government will set up an interdepartmental project acceleration group in collaboration with Quebec municipal authorities, and it will also adopt new government directions on land use planning, including metrics for residential construction that municipalities will be required to use as a basis for setting targets. The government also intends to propose legislative amendments (which are being drafted and are subject to adoption by the National Assembly) aimed at improving urban densification and streamlining multi-unit construction approval to reduce the associated timelines.

About Canada Mortgage and Housing Corporation

As Canada’s authority on housing, Canada Mortgage and Housing Corporation (CMHC) contributes to the stability of the housing market and financial system, provides support for Canadians in housing need, and offers unbiased housing research and advice to all levels of Canadian government, consumers and the housing industry. CMHC’s aim is that by 2030, everyone in Canada has a home they can afford, and that meets their needs. For more information, follow us on Twitter, Instagram, YouTube, LinkedIn and Facebook.

About the Société d’habitation du Québec

As a leader in housing, the SHQ’s mission is to meet the housing needs of Quebecers through its expertise and services to citizens. It does this by providing affordable and low-rental housing and offering a range of assistance programs to support the construction, renovation and adaptation of homes, and access to homeownership.

To find out more about its activities, visit www.habitation.gouv.qc.ca/english.html.

SocietehabitationQuebec

HabitationSHQ

LinkedIn

SOURCE Canada Mortgage and Housing Corporation (CMHC)

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/11/c3289.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/11/c3289.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

A Look Ahead: JB Hunt Transport Servs's Earnings Forecast

JB Hunt Transport Servs JBHT is gearing up to announce its quarterly earnings on Tuesday, 2024-10-15. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that JB Hunt Transport Servs will report an earnings per share (EPS) of $1.44.

The announcement from JB Hunt Transport Servs is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It’s worth noting for new investors that guidance can be a key determinant of stock price movements.

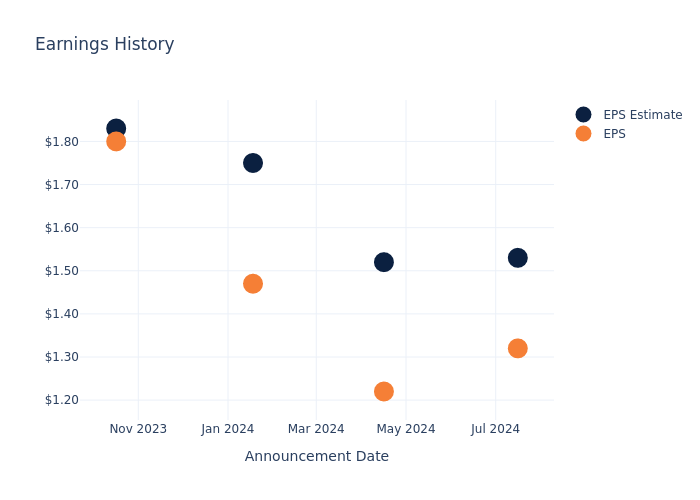

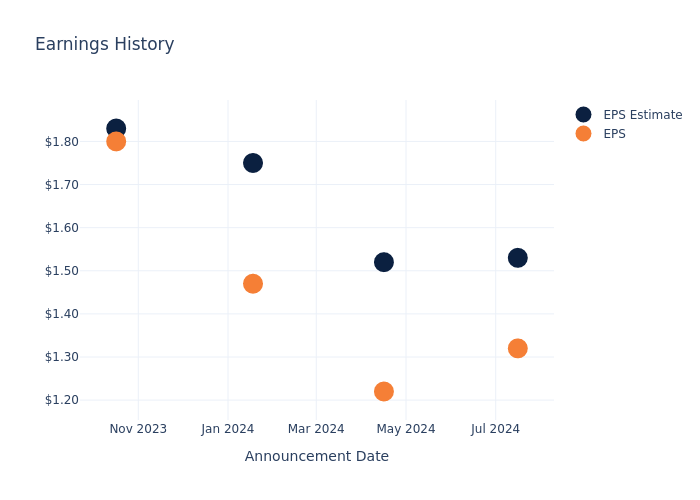

Earnings Track Record

Last quarter the company missed EPS by $0.21, which was followed by a 6.87% drop in the share price the next day.

Here’s a look at JB Hunt Transport Servs’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 1.53 | 1.52 | 1.75 | 1.83 |

| EPS Actual | 1.32 | 1.22 | 1.47 | 1.80 |

| Price Change % | -7.000000000000001% | -8.0% | 1.0% | -9.0% |

Tracking JB Hunt Transport Servs’s Stock Performance

Shares of JB Hunt Transport Servs were trading at $170.72 as of October 11. Over the last 52-week period, shares are down 13.76%. Given that these returns are generally negative, long-term shareholders are likely unhappy going into this earnings release.

Analysts’ Take on JB Hunt Transport Servs

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on JB Hunt Transport Servs.

Analysts have given JB Hunt Transport Servs a total of 15 ratings, with the consensus rating being Neutral. The average one-year price target is $173.2, indicating a potential 1.45% upside.

Understanding Analyst Ratings Among Peers

The analysis below examines the analyst ratings and average 1-year price targets of and XPO, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- XPO is maintaining an Buy status according to analysts, with an average 1-year price target of $137.0, indicating a potential 19.75% downside.

Peer Analysis Summary

The peer analysis summary presents essential metrics for and XPO, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| JB Hunt Transport Servs | Neutral | -6.51% | $502.68M | 3.30% |

| XPO | Buy | 8.45% | $265M | 10.60% |

Key Takeaway:

JB Hunt Transport Servs has a lower revenue growth compared to its peer. Its gross profit is higher than its peer. The return on equity of JB Hunt Transport Servs is lower than its peer. Overall, JB Hunt Transport Servs is positioned in the middle compared to its peer in terms of these financial metrics.

Discovering JB Hunt Transport Servs: A Closer Look

J.B. Hunt Transport Services ranks among the top surface transportation companies in North America by revenue. Its primary operating segments are intermodal delivery, which uses the Class I rail carriers for the underlying line-haul movement of its owned containers (48% of sales in 2023), dedicated trucking services that provide customer-specific fleet needs (28%), for-hire truckload (6%), heavy goods final-mile delivery (7%), and asset-light truck brokerage (11%).

JB Hunt Transport Servs: A Financial Overview

Market Capitalization: Positioned above industry average, the company’s market capitalization underscores its superiority in size, indicative of a strong market presence.

Negative Revenue Trend: Examining JB Hunt Transport Servs’s financials over 3 months reveals challenges. As of 30 June, 2024, the company experienced a decline of approximately -6.51% in revenue growth, reflecting a decrease in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: The company’s net margin is a standout performer, exceeding industry averages. With an impressive net margin of 4.64%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): JB Hunt Transport Servs’s financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 3.3%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): The company’s ROA is a standout performer, exceeding industry averages. With an impressive ROA of 1.61%, the company showcases effective utilization of assets.

Debt Management: JB Hunt Transport Servs’s debt-to-equity ratio is below the industry average at 0.36, reflecting a lower dependency on debt financing and a more conservative financial approach.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

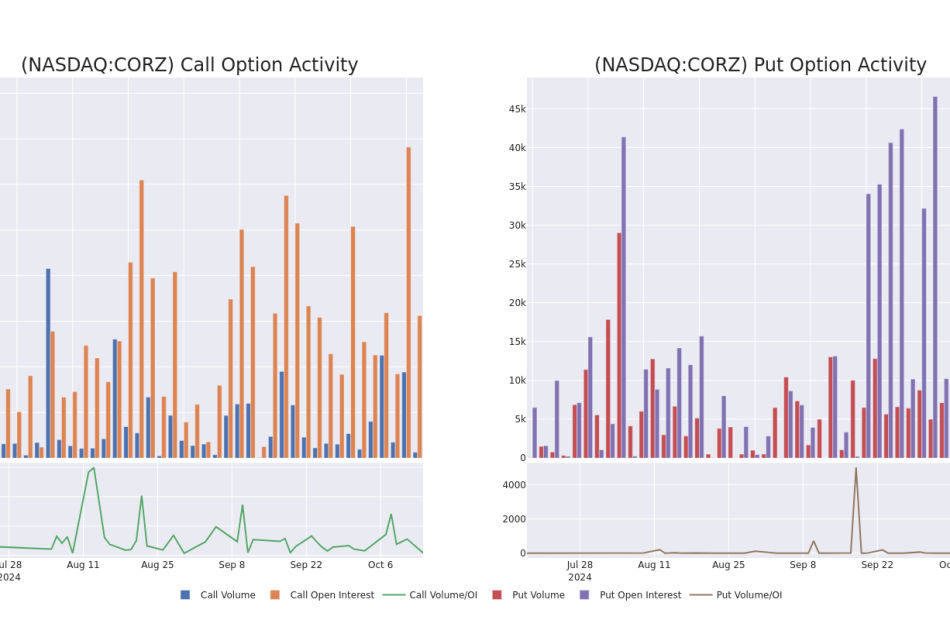

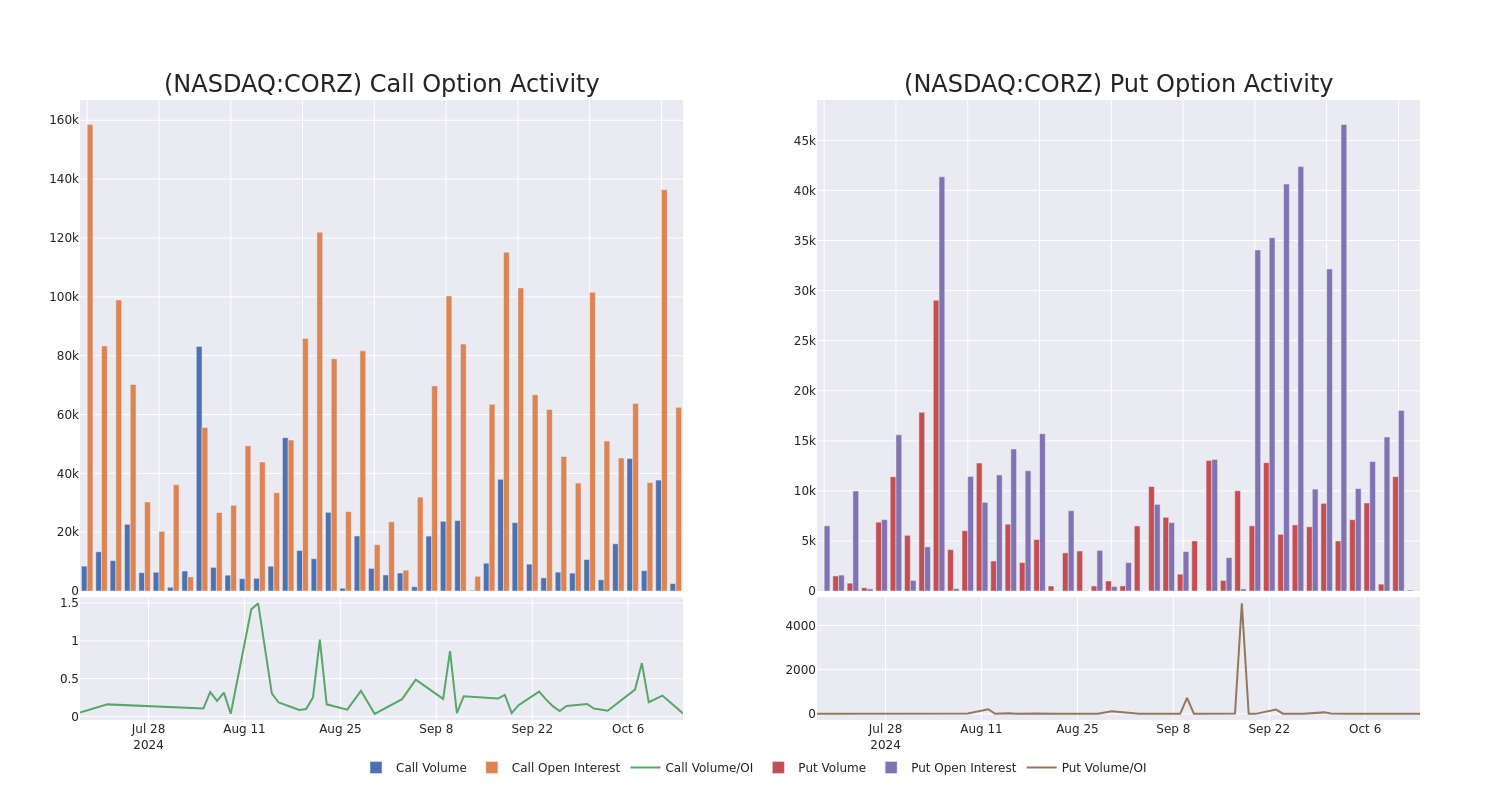

Looking At Core Scientific's Recent Unusual Options Activity

Investors with a lot of money to spend have taken a bullish stance on Core Scientific CORZ.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with CORZ, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 11 uncommon options trades for Core Scientific.

This isn’t normal.

The overall sentiment of these big-money traders is split between 36% bullish and 36%, bearish.

Out of all of the special options we uncovered, 2 are puts, for a total amount of $58,127, and 9 are calls, for a total amount of $528,990.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $7.0 to $20.0 for Core Scientific during the past quarter.

Insights into Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Core Scientific’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Core Scientific’s significant trades, within a strike price range of $7.0 to $20.0, over the past month.

Core Scientific 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CORZ | CALL | TRADE | BEARISH | 12/20/24 | $4.7 | $4.5 | $4.55 | $9.00 | $91.0K | 3.7K | 201 |

| CORZ | CALL | TRADE | NEUTRAL | 12/20/24 | $4.6 | $4.4 | $4.5 | $9.00 | $90.0K | 3.7K | 201 |

| CORZ | CALL | TRADE | NEUTRAL | 01/17/25 | $3.7 | $3.5 | $3.6 | $10.00 | $72.0K | 22.9K | 357 |

| CORZ | CALL | TRADE | BULLISH | 01/16/26 | $7.2 | $6.9 | $7.1 | $7.00 | $70.2K | 19.7K | 101 |

| CORZ | CALL | TRADE | BULLISH | 01/17/25 | $3.1 | $2.85 | $3.0 | $11.00 | $60.0K | 3.4K | 0 |

About Core Scientific

Core Scientific Inc is engaged in Blockchain and AI Infrastructure, Digital Asset Self-Mining, Premium Hosting, Blockchain Technology, and Artificial Intelligence related services. The business operates in two segments being; Equipment Sales and Hosting which consists of blockchain infrastructure, third-party hosting business and equipment sales to customers. Mining segment consists of digital asset mining for its account. The blockchain business generates revenue from the sale of consumption-based contracts and by providing hosting services. The digital asset mining segment earns revenue from operating a firm’s owned computer equipment as part of a pool of users that process transactions conducted on one or more blockchain networks. In exchange, it receives digital currency assets.

Having examined the options trading patterns of Core Scientific, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Core Scientific’s Current Market Status

- With a volume of 6,571,135, the price of CORZ is down -1.18% at $13.06.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 30 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Core Scientific, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

[Latest] Global Spray Painting Machine Market Size/Share Worth USD 7,823.1 Million by 2033 at a 5.42% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth, Growth Rate, Value)

Austin, TX, USA, Oct. 14, 2024 (GLOBE NEWSWIRE) — Custom Market Insights has published a new research report titled “Spray Painting Machine Market Size, Trends and Insights By Type (Air Spray Painting Machines, HVLP Spray Painting Machines, Electrostatic Spray Painting Machines, Airless Spray Painting Machines, Others), By Technology (Automatic Spray Painting Machines, Manual Spray Painting Machines), By End User (Automotive, Furniture and Woodworking, Aerospace and Aviation., Construction, Industrial Equipment, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ in its research database.

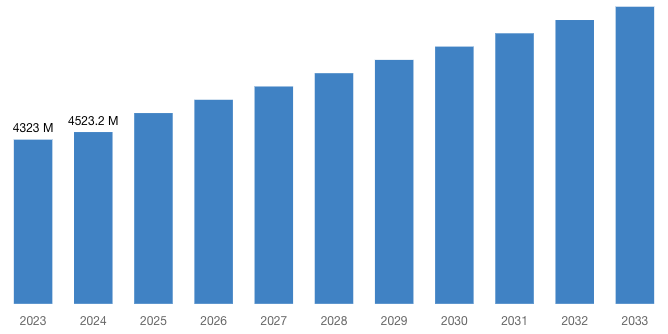

“According to the latest research study, the demand of global Spray Painting Machine Market size & share was valued at approximately USD 4,323 Million in 2023 and is expected to reach USD 4,523.2 Million in 2024 and is expected to reach a value of around USD 7,823.1 Million by 2033, at a compound annual growth rate (CAGR) of about 5.42% during the forecast period 2024 to 2033.”

Click Here to Access a Free Sample Report of the Global Spray Painting Machine Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=52622

Spray Painting Machine Market: Overview

A spray painting machine is a tool that uses a spray nozzle to apply paint to a surface. It is frequently used to paint surfaces fast and effectively in a variety of industries, including aerospace, automotive, and construction.

Spray painting machines are available in various varieties, including airless, HVLP (High Volume Low Pressure), and electrostatic, and they can be operated manually or automatically.

The market for spray painting machines has been expanding significantly as a result of rising demands for accurate and effective surface finishing. Its rise is driven by multiple factors. One major factor enhancing efficiency and reducing errors in industrial operations is the growing incorporation of automation.

The growth of the spray painting machine market is impeded by obstacles like large upfront costs and the need for skilled personnel to operate and maintain these devices. Additionally, when innovative technologies like robotics and AI-powered systems progress, opportunities present themselves.

These technologies have the potential to reduce operating costs and increase efficiency even further. Furthermore, the quickly growing construction, aerospace, and automotive industries present unrealized opportunities for the Spray Painting Machine Market to continue growing.

Request a Customized Copy of the Spray Painting Machine Market Report @ https://www.custommarketinsights.com/inquire-for-discount/?reportid=52622

By Type, air spray painting machines segment held the highest market share in 2023 and is expected to keep its dominance during the forecast period 2024-2033. Because of its consistency, accuracy, and efficiency in a time-efficient manner without wasting material.

These devices also reduce the need for highly qualified painters, making them a popular option for various industries, including construction, aerospace, and automotive.

By End User, the automotive segment held the highest market share in 2023 and is expected to keep its dominance during the forecast period 2024-2033.

Automated spray painting equipment meets strict industry requirements and regulations by ensuring consistent, high-quality finishes throughout intricate vehicle designs. This industry also drives technological innovation and market expansion.

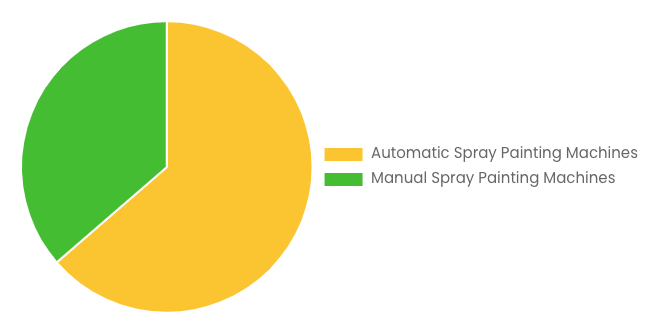

By Technology, the Automatic spray painting machines segment held the highest market share in 2023 and is expected to keep its dominance during the forecast period 2024-2033. these devices improve worker safety at work by reducing their exposure to dangerous pollutants. Industries benefit from its capability, customization, and data-driven optimization.

Automatic spray painting machines are the favoured option because of their long-term benefits such as increased production, decreased waste, and quality control, even though their initial investment may be more. This further solidifies their dominance in the market.

North America held the highest market share in the Spray Painting Machine Market in 2023 with a market share of 40.00% and is expected to keep its dominance during the forecast period 2024-2033. The market is shifting significantly in favour of eco-friendlier and efficient equipment, and this is made possible by the introduction of eco-friendly painting technologies.

Manufacturers are making significant investments in cutting-edge technologies that both improve technological capabilities and reduce their environmental impact. As automation and robotics become more common, painting production becomes more consistent and efficient.

The market in North America continues to be active due to a combination of technological innovation, environmental conscience, and industrial prowess. It emphasizes the region’s unwavering commitment to adopting sustainable practices and preserving its competitiveness in the manufacturing sector.

Wagner GmbH is a leading player in the Spray Painting Machine Market. They have a large selection of spray painting equipment, such as electrostatic, HVLP (High Volume Low Pressure), and airless models. These devices are made for a variety of uses, including coating, staining, and painting surfaces. Wagner GmbH is renowned for its cutting-edge goods and services that meet the demands of several markets, such as the aerospace, automotive, and construction industries.

Report Scope

| Feature of the Report | Details |

| Market Size in 2024 | USD 4,523.2 Million |

| Projected Market Size in 2033 | USD 7,823.1 Million |

| Market Size in 2023 | USD 4,323 Million |

| CAGR Growth Rate | 5.42% CAGR |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Key Segment | By Type, Technology, End User and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

(A free sample of the Spray Painting Machine report is available upon request; please contact us for more information.)

Request a Customized Copy of the Spray Painting Machine Market Report @ https://www.custommarketinsights.com/report/spray-painting-machine-market/

Our Free Sample Report Consists of the following:

- Introduction, Overview, and in-depth industry analysis are all included in the 2024 updated report.

- The COVID-19 Pandemic Outbreak Impact Analysis is included in the package.

- About 220+ Pages Research Report (Including Recent Research)

- Provide detailed chapter-by-chapter guidance on the Request.

- Updated Regional Analysis with a Graphical Representation of Size, Share, and Trends for the Year 2024

- Includes Tables and figures have been updated.

- The most recent version of the report includes the Top Market Players, their Business Strategies, Sales Volume, and Revenue Analysis

- Custom Market Insights (CMI) research methodology

(Please note that the sample of the Spray Painting Machine report has been modified to include the COVID-19 impact study prior to delivery.)

Request a Customized Copy of the Spray Painting Machine Market Report @ https://www.custommarketinsights.com/report/spray-painting-machine-market/

CMI has comprehensively analyzed the Spray Painting Machine Market. The driving forces, restraints, challenges, opportunities, and key trends have been explained in depth to depict the in-depth scenario of the market. Segment wise market size and market share during the forecast period are duly addressed to portray the probable picture of this Global Spray Painting Machine industry.

The competitive landscape includes key innovators, after market service providers, market giants as well as niche players are studied and analyzed extensively concerning their strengths, weaknesses as well as value addition prospects. In addition, this report covers key players profiling, market shares, mergers and acquisitions, consequent market fragmentation, new trends and dynamics in partnerships.

Key questions answered in this report:

- What is the size of the Spray Painting Machine market and what is its expected growth rate?

- What are the primary driving factors that push the Spray Painting Machine market forward?

- What are the Spray Painting Machine Industry’s top companies?

- What are the different categories that the Spray Painting Machine Market caters to?

- What will be the fastest-growing segment or region?

- In the value chain, what role do essential players play?

- What is the procedure for getting a free copy of the Spray Painting Machine market sample report and company profiles?

Key Offerings:

- Market Share, Size & Forecast by Revenue | 2024−2033

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Leading Trends

- Market Segmentation – A detailed analysis by Types of Services, by End-User Services, and by regions

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Buy this Premium Spray Painting Machine Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/spray-painting-machine-market/

Spray Painting Machine Market: Regional Analysis

By Region, the Spray Painting Machine Market is segmented into North America, Europe, Asia Pacific, Latin America, Middle East & Africa. North America led the spray painting machine market in 2023 with a market share of 41.50% and is expected to keep its dominance during the forecast period 2024-2033.

The spray painting industry is significantly driven by the robust building sector in the region. Spray paints are in high demand in the North American construction industry, especially in the residential and commercial segments.

Numerous reputable spray paint producers, including both local and international businesses, are based throughout North America. These businesses are well-known in the industry and provide a wide selection of spray paint goods.

Demand for ecologically friendly products is rising in the U.S. and Canada, which has caused spray paints with low volatile organic compounds (VOCs) and other eco-friendly qualities to become more popular.

Request a Customized Copy of the Spray Painting Machine Market Report @ https://www.custommarketinsights.com/report/spray-painting-machine-market/

(We customized your report to meet your specific research requirements. Inquire with our sales team about customizing your report.)

Still, Looking for More Information? Do OR Want Data for Inclusion in magazines, case studies, research papers, or Media?

Email Directly Here with Detail Information: support@custommarketinsights.com

Browse the full “Spray Painting Machine Market Size, Trends and Insights By Type (Air Spray Painting Machines, HVLP Spray Painting Machines, Electrostatic Spray Painting Machines, Airless Spray Painting Machines, Others), By Technology (Automatic Spray Painting Machines, Manual Spray Painting Machines), By End User (Automotive, Furniture and Woodworking, Aerospace and Aviation., Construction, Industrial Equipment, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ Report at https://www.custommarketinsights.com/report/spray-painting-machine-market/

List of the prominent players in the Spray Painting Machine Market:

- Wagner GmbH

- Nordson Corporation.

- Graco Inc.

- Kremlin Rexson

- Sames Kremlin

- ANEST IWATA

- SATA GmbH & Co. KG

- HomeRight

- Dino-power

- Fuji Spray

- Airprotool

- 3M Company

- Titan Tool Inc.

- A Technologies

- DeVilbiss Automotive Refinishing

- ASJ Spray Equipment Pvt Ltd

- METEX Corporation

- Apollo Sprayers International Inc.

- ECCO FINISHING

- RIGO S.R.L.

- Others

Click Here to Access a Free Sample Report of the Global Spray Painting Machine Market @ https://www.custommarketinsights.com/report/spray-painting-machine-market/

Spectacular Deals

- Comprehensive coverage

- Maximum number of market tables and figures

- The subscription-based option is offered.

- Best price guarantee

- Free 35% or 60 hours of customization.

- Free post-sale service assistance.

- 25% discount on your next purchase.

- Service guarantees are available.

- Personalized market brief by author.

Browse More Related Reports:

3D Laser Cutting Robot Market: 3D Laser Cutting Robot Market Size, Trends and Insights By Type (Fiber, CO2, Nd (Neodymium-doped Yttrium Aluminum Garnet), Other), By Application (Automotive, Aerospace & Defence, Consumer Electronics, Medical Devices, Industrial Manufacturing, Others), By End-User Industry (Automotive Industry, Aerospace Industry, Electronics and Semiconductor Industry, Medical Device Industry, Heavy Machinery Industry, Others), By Function (Cutting, Welding, Drilling, Engraving, Other), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Screw Compressor Market: Screw Compressor Market Size, Trends and Insights By Stage (Single-Stage, Multi-Stage), By End User (Manufacturing, Oil and Gas, Mining, Construction), By Technology (Oil-injected, Oil-free), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

AC Screw Air Compressor Market: AC Screw Air Compressor Market Size, Trends and Insights By Type (Oil-Free, Oil-Injected), By Application (Stationary, Portable), By End Use (Manufacturing, Energy, Automotive, Aerospace, Mining), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Oil Immersed Power Transformer Market: Oil Immersed Power Transformer Market Size, Trends and Insights By Installation (Pad Mounted, Pole Mounted, Substation Installation), By Phase (Single Phase, Three Phase), By Voltage (Low, Medium, High), By End Users (Industrial, Residential, Commercial, Utilities), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Hydraulic Motors Market: Hydraulic Motors Market Size, Trends and Insights By Product Type (Gear Motor, Vane Motor, Axial Piston Motors, Radial Piston Motors), By Speed (Low-Speed (< 500 Rpm), High-Speed (>500 Rpm)), By Pressure Rating (Low Pressure, Medium Pressure, High Pressure), By Application (Mining & Construction, Oil & Gas, Agriculture & Forestry, Automotive, Packaging, Machine Tool, Material Handling, Aerospace & Defense, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Spiral Freezer Market: Spiral Freezer Market Size, Trends and Insights By Application (Meat Processing, Bakery, Seafood, Others), By Capacity (Small Capacity, Medium Capacity, Large Capacity), By Business (Aftermarket, OEM), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Water Desalination Equipment Market: Water Desalination Equipment Market Size, Trends and Insights By Source (Sea water, Brackish water, River water, Others), By Technology (Reverse Osmosis (RO), Multi-stage Flash (MSF) distillation, Multi-effect Distillation (MED), Others), By Application (Drinking Water Supply, Process Water, Irrigation Water, Others), By End Users (Municipal, Industrial, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Air Compressor Rental Market: Air Compressor Rental Market Size, Trends and Insights By Type (Rotary Screw, Reciprocating), By End Use (Construction, Mining, Oil & Gas, Power, Manufacturing, Chemical, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

The Spray Painting Machine Market is segmented as follows:

By Type

- Air Spray Painting Machines

- HVLP Spray Painting Machines

- Electrostatic Spray Painting Machines

- Airless Spray Painting Machines

- Others

By Technology

- Automatic Spray Painting Machines

- Manual Spray Painting Machines

By End User

- Automotive

- Furniture and Woodworking

- Aerospace and Aviation

- Construction

- Industrial Equipment

- Others

Click Here to Get a Free Sample Report of the Global Spray Painting Machine Market @ https://www.custommarketinsights.com/report/spray-painting-machine-market/

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

This Spray Painting Machine Market Research/Analysis Report Contains Answers to the following Questions.

- Which Trends Are Causing These Developments?

- Who Are the Global Key Players in This Spray Painting Machine Market? What are Their Company Profile, Product Information, and Contact Information?

- What Was the Global Market Status of the Spray Painting Machine Market? What Was the Capacity, Production Value, Cost and PROFIT of the Spray Painting Machine Market?

- What Is the Current Market Status of the Spray Painting Machine Industry? What’s Market Competition in This Industry, Both Company and Country Wise? What’s Market Analysis of Spray Painting Machine Market by Considering Applications and Types?

- What Are Projections of the Global Spray Painting Machine Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about imports and exports?

- What Is Spray Painting Machine Market Chain Analysis by Upstream Raw Materials and Downstream Industry?

- What Is the Economic Impact On Spray Painting Machine Industry? What are Global Macroeconomic Environment Analysis Results? What Are Global Macroeconomic Environment Development Trends?

- What Are Market Dynamics of Spray Painting Machine Market? What Are Challenges and Opportunities?

- What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for Spray Painting Machine Industry?

Click Here to Access a Free Sample Report of the Global Spray Painting Machine Market @ https://www.custommarketinsights.com/report/spray-painting-machine-market/

Reasons to Purchase Spray Painting Machine Market Report

- Spray Painting Machine Market Report provides qualitative and quantitative analysis of the market based on segmentation involving economic and non-economic factors.

- Spray Painting Machine Market report outlines market value (USD) data for each segment and sub-segment.

- This report indicates the region and segment expected to witness the fastest growth and dominate the market.

- Spray Painting Machine Market Analysis by geography highlights the consumption of the product/service in the region and indicates the factors affecting the market within each region.

- The competitive landscape incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled.

- Extensive company profiles comprising company overview, company insights, product benchmarking, and SWOT analysis for the major market players.

- The Industry’s current and future market outlook concerning recent developments (which involve growth opportunities and drivers as well as challenges and restraints of both emerging and developed regions.

- Spray Painting Machine Market Includes in-depth market analysis from various perspectives through Porter’s five forces analysis and provides insight into the market through Value Chain.

Reasons for the Research Report

- The study provides a thorough overview of the global Spray Painting Machine market. Compare your performance to that of the market as a whole.

- Aim to maintain competitiveness while innovations from established key players fuel market growth.

Buy this Premium Spray Painting Machine Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/spray-painting-machine-market/

What does the report include?

- Drivers, restrictions, and opportunities are among the qualitative elements covered in the worldwide Spray Painting Machine market analysis.

- The competitive environment of current and potential participants in the Spray Painting Machine market is covered in the report, as well as those companies’ strategic product development ambitions.

- According to the component, application, and industry vertical, this study analyzes the market qualitatively and quantitatively. Additionally, the report offers comparable data for the important regions.

- For each segment mentioned above, actual market sizes and forecasts have been given.

Who should buy this report?

- Participants and stakeholders worldwide Spray Painting Machine market should find this report useful. The research will be useful to all market participants in the Spray Painting Machine industry.

- Managers in the Spray Painting Machine sector are interested in publishing up-to-date and projected data about the worldwide Spray Painting Machine market.

- Governmental agencies, regulatory bodies, decision-makers, and organizations want to invest in Spray Painting Machine products’ market trends.

- Market insights are sought for by analysts, researchers, educators, strategy managers, and government organizations to develop plans.

Request a Customized Copy of the Spray Painting Machine Market Report @ https://www.custommarketinsights.com/report/spray-painting-machine-market/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI provides a one-stop solution for data collection to investment advice. The expert analysis of our company digs out essential factors that help to understand the significance and impact of market dynamics. The professional experts apply clients inside on the aspects such as strategies for future estimation fall, forecasting or opportunity to grow, and consumer survey.

Follow Us: LinkedIn | Twitter | Facebook | YouTube

Contact Us:

Joel John

CMI Consulting LLC

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

USA: +1 801-639-9061

India: +91 20 46022736

Email: support@custommarketinsights.com

Web: https://www.custommarketinsights.com/

Blog: https://www.techyounme.com/

Blog: https://atozresearch.com/

Blog: https://www.technowalla.com/

Blog: https://marketresearchtrade.com/

Buy this Premium Spray Painting Machine Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/spray-painting-machine-market/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Exorbitant HOA Fees Are Driving Florida Retirees To Relocate – Here's Why Costs Are Spiraling So High In The Sunshine State

Living in a Florida condo might sound like a dream, but for many retirees, that dream becomes a nightmare. Homeowner’s association (HOA) fees across the state are skyrocketing and people with fixed incomes feel pressure to relocate.

A recent Redfin analysis found that HOA fees in several Florida metro areas have increased dramatically, surpassing the rate of hikes in other U.S. cities. This has left condo owners with tough choices: sell at a loss or stay in a home where monthly costs keep climbing.Don’t Miss:

Don’t Miss:

“Many buildings – even those without amenities – now have HOA dues north of $1,000 a month,” said Rafael Corrales, a Redfin Premier agent in Miami. “Special assessments are being tacked on and a lot of condo owners, especially retirees, are being forced to sell because they just can’t keep up.”

See Also: A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

According to Redfin’s data, HOA fees rose 6% on average nationwide during the three months ending July 31. But Florida’s numbers are much higher. Tampa saw the biggest spike, with dues up 17.2% year over year. Orlando followed close behind, with fees climbing 16.7%. Fort Lauderdale wasn’t far off either, experiencing a 16.2% increase.

Other Florida cities, like West Palm Beach and Jacksonville, also saw significant rises, with 12.8% and 7.6% respectively. On the surface, Miami seems to have escaped this trend with a smaller jump of 5.7%. However, that’s because Miami’s dues were already among the highest in the country, averaging $835 a month.

Trending: Commercial real estate has historically outperformed the stock market, and this platform allows individuals to invest in commercial real estate with as little as $5,000 offering a 12% target yield with a bonus 1% return boost today!

One of the main reasons why the costs are rising fast is the passage of Senate Bill 4-D, introduced after the tragic collapse of the Surfside Condo in 2021, which killed over 100 people. The new law requires stricter inspections and mandates higher reserve funds for repairs. To comply, HOAs are raising dues significantly.

Insurance is another major factor. As cited by Redfin survey, three-quarters of Florida homeowners reported sharp increases in property insurance premiums. These, combined with rising inflation, have increased the cost of living for condo owners across the state.

Trending: These five entrepreneurs are worth $223 billion – they all believe in one platform that offers a 7-9% target yield with monthly dividends

As HOA fees climb, property values are taking a hit. Condo sale prices in Jacksonville fell 6.6% year-over-year, the sharpest drop of any metro area. Tampa wasn’t far behind, with a 4.9% decline, while Fort Lauderdale saw prices fall by 4.2%. Even Miami and Orlando, usually more resilient markets, saw declines of 2.2% and 0.5%, respectively.

Property owners now face a tough dilemma: either hold on as rising dues become unaffordable or sell their condo at a reduced value. Mortgage rates remain high and other Florida condos are hit with similar fee hikes, making affordable housing even harder to find.

Read Next:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Exorbitant HOA Fees Are Driving Florida Retirees To Relocate – Here’s Why Costs Are Spiraling So High In The Sunshine State originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

An Overview of Telefonaktiebolaget L M's Earnings

Telefonaktiebolaget L M ERIC will release its quarterly earnings report on Tuesday, 2024-10-15. Here’s a brief overview for investors ahead of the announcement.

Analysts anticipate Telefonaktiebolaget L M to report an earnings per share (EPS) of $0.09.

Anticipation surrounds Telefonaktiebolaget L M’s announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

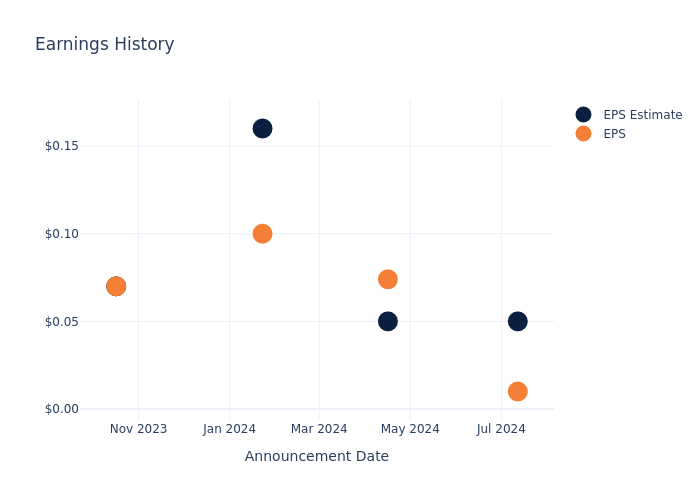

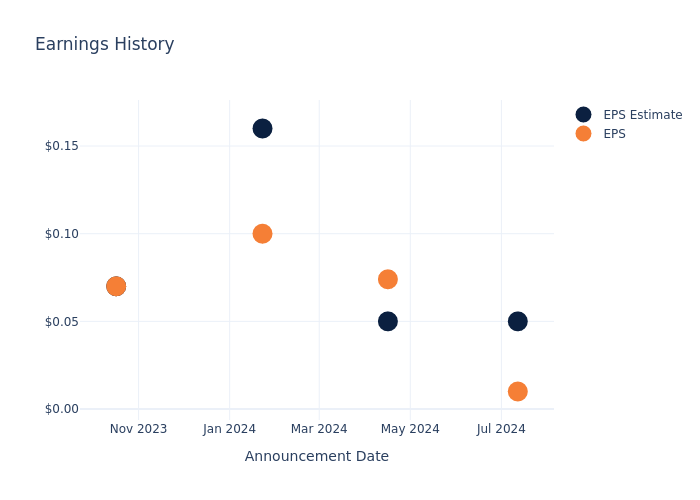

Overview of Past Earnings

Last quarter the company missed EPS by $0.04, which was followed by a 0.0% drop in the share price the next day.

Here’s a look at Telefonaktiebolaget L M’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.05 | 0.050 | 0.16 | 0.07 |

| EPS Actual | 0.01 | 0.074 | 0.10 | 0.07 |

| Price Change % | 5.0% | 1.0% | -4.0% | -3.0% |

Stock Performance

Shares of Telefonaktiebolaget L M were trading at $7.51 as of October 11. Over the last 52-week period, shares are up 63.1%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 Reasons to Buy Dutch Bros Stock Like There's No Tomorrow

Looking for a great growth stock? Believe it or not, you don’t have to look at artificial intelligence (AI) or even tech stocks to find one. In fact, you might be better off looking where other investors aren’t, because that’s where you can find great deals on lesser-known or non-hyped stocks.

Consider Dutch Bros (NYSE: BROS). This small coffee shop chain has big ambitions, and its stock could supercharge your portfolio. Here are three reasons to buy it right now.

1. People like its coffee

A great stock starts with a great business, and a great business starts with a great product. Anecdotal evidence supports the premise that customers like Dutch Bros coffee, both in beverage and culture. That’s backed up by increasing revenue, same-store sales, and a successful expansion plan.

Dutch Bros operated 912 stores as of the end of the 2024 second quarter, close to double the amount it had when it went public three years ago. It’s also now in 18 states, moving across the U.S. from its West Coast home base, and it already considers itself a “coast-to-coast” business.

The company opens at least 30 stores in a given quarter, which it has for the past 12 consecutive quarters, and it’s planning to open around 150 stores this year. Originally it had given guidance of 150 to 165, but in its last update, management said it would come in at the lower end of the guidance.

The market didn’t like that news, but the reasoning is that it’s recalibrating some of its real estate models as it opens more stores and gains experience. This looks like a short-term blip in favor of longer-term advantages, and the stock’s lower price looks like an opportunity to buy on the dip.

Management sees the potential for at least 4,000 stores over the next 10 to 15 years, providing years of growth opportunities.

2. It’s making money

Dutch Bros is moving from an unprofitable growth stock to a profitable one, which reduces much of the risk when buying young growth stocks. Revenue increased 30% year over year in the second quarter, with a 4.1% increase in same-store sales, and that’s trickling down to the bottom line.

The company reported full-year profits for the first time in 2023, and reported positive and increasing generally accepted accounting principles (GAAP) net income for the first two quarters of 2024. Wall Street is expecting that to continue in the third quarter and the full year.

Dutch Bros is still working on expanding margins and posting reliable profits, but it’s on a great trajectory. It doesn’t generate positive free cash flow because it has to invest in capital expenditures as it opens new stores at this early growth stage.

3. It’s just now going digital

I was surprised to learn that up until very recently, Dutch Bros did not offer digital ordering. But it recently started rolling it out, and management expects it to be in all stores by the end of the year.

It already has a robust membership rewards program, which accounts for 67% of sales, and adding mobile ordering to the membership program is a no-brainer for higher engagement. It’s also a way to get more customers to join the membership program and increase their loyalty to Dutch Bros.

In the pilot program, the company is already seeing traction from the mobile ordering program in its walk-up windows, which account for 10% of sales.

Mobile is a must for any food-order business today, but it very much complements Dutch Bros’ differentiated model. It has a focus on drive-thrus, sending runners through lines to take and deliver orders even before drivers get to order windows. It also has an “escape lane” for drivers to exit once they receive their drinks. The shops with both drive-thrus and walk-up windows have bars for each one, with extra bars at high-volume locations, and more use of the walk-up window distributes worker capacity more efficiently.

Over time, this could be a tremendous sales generator for Dutch Bros as it attracts new customers to the mobile app, and it could also help its margins as it functions more efficiently. This is an exciting development for Dutch Bros and another reason to add this growth stock to your buy list.

Should you invest $1,000 in Dutch Bros right now?

Before you buy stock in Dutch Bros, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Dutch Bros wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,069!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool recommends Dutch Bros. The Motley Fool has a disclosure policy.

3 Reasons to Buy Dutch Bros Stock Like There’s No Tomorrow was originally published by The Motley Fool