3 Reasons to Buy Dutch Bros Stock Like There's No Tomorrow

Looking for a great growth stock? Believe it or not, you don’t have to look at artificial intelligence (AI) or even tech stocks to find one. In fact, you might be better off looking where other investors aren’t, because that’s where you can find great deals on lesser-known or non-hyped stocks.

Consider Dutch Bros (NYSE: BROS). This small coffee shop chain has big ambitions, and its stock could supercharge your portfolio. Here are three reasons to buy it right now.

1. People like its coffee

A great stock starts with a great business, and a great business starts with a great product. Anecdotal evidence supports the premise that customers like Dutch Bros coffee, both in beverage and culture. That’s backed up by increasing revenue, same-store sales, and a successful expansion plan.

Dutch Bros operated 912 stores as of the end of the 2024 second quarter, close to double the amount it had when it went public three years ago. It’s also now in 18 states, moving across the U.S. from its West Coast home base, and it already considers itself a “coast-to-coast” business.

The company opens at least 30 stores in a given quarter, which it has for the past 12 consecutive quarters, and it’s planning to open around 150 stores this year. Originally it had given guidance of 150 to 165, but in its last update, management said it would come in at the lower end of the guidance.

The market didn’t like that news, but the reasoning is that it’s recalibrating some of its real estate models as it opens more stores and gains experience. This looks like a short-term blip in favor of longer-term advantages, and the stock’s lower price looks like an opportunity to buy on the dip.

Management sees the potential for at least 4,000 stores over the next 10 to 15 years, providing years of growth opportunities.

2. It’s making money

Dutch Bros is moving from an unprofitable growth stock to a profitable one, which reduces much of the risk when buying young growth stocks. Revenue increased 30% year over year in the second quarter, with a 4.1% increase in same-store sales, and that’s trickling down to the bottom line.

The company reported full-year profits for the first time in 2023, and reported positive and increasing generally accepted accounting principles (GAAP) net income for the first two quarters of 2024. Wall Street is expecting that to continue in the third quarter and the full year.

Dutch Bros is still working on expanding margins and posting reliable profits, but it’s on a great trajectory. It doesn’t generate positive free cash flow because it has to invest in capital expenditures as it opens new stores at this early growth stage.

3. It’s just now going digital

I was surprised to learn that up until very recently, Dutch Bros did not offer digital ordering. But it recently started rolling it out, and management expects it to be in all stores by the end of the year.

It already has a robust membership rewards program, which accounts for 67% of sales, and adding mobile ordering to the membership program is a no-brainer for higher engagement. It’s also a way to get more customers to join the membership program and increase their loyalty to Dutch Bros.

In the pilot program, the company is already seeing traction from the mobile ordering program in its walk-up windows, which account for 10% of sales.

Mobile is a must for any food-order business today, but it very much complements Dutch Bros’ differentiated model. It has a focus on drive-thrus, sending runners through lines to take and deliver orders even before drivers get to order windows. It also has an “escape lane” for drivers to exit once they receive their drinks. The shops with both drive-thrus and walk-up windows have bars for each one, with extra bars at high-volume locations, and more use of the walk-up window distributes worker capacity more efficiently.

Over time, this could be a tremendous sales generator for Dutch Bros as it attracts new customers to the mobile app, and it could also help its margins as it functions more efficiently. This is an exciting development for Dutch Bros and another reason to add this growth stock to your buy list.

Should you invest $1,000 in Dutch Bros right now?

Before you buy stock in Dutch Bros, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Dutch Bros wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,069!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool recommends Dutch Bros. The Motley Fool has a disclosure policy.

3 Reasons to Buy Dutch Bros Stock Like There’s No Tomorrow was originally published by The Motley Fool

Billionaire Israel Englander Is Selling Nvidia and Palantir and Piling Into a Historically Cheap, Yet Potentially Troubled, Artificial Intelligence (AI) Stock

In mid-August, Wall Street received its most important data dump of the third quarter — and I’m not talking about an inflation report from the Bureau of Labor Statistics.

August 14 marked the deadline for institutional investors and money managers with at least $100 million in assets under management to file Form 13F with the Securities and Exchange Commission. A 13F offers an under-the-hood look at which stocks Wall Street’s smartest and most-successful money managers purchased and sold in the latest quarter (in this instance, the June-ended quarter).

Although 13Fs have their flaws — e.g., they’re usually 45 days old when filed, which can lead to stale data for active funds — they’re invaluable when it comes to helping investors figure out which stocks, industries, sectors, and trends are piquing the interest of Wall Street’s top asset managers.

Billionaire Israel Englander of Millennium Management is one of the prominent money managers that investors tend to pay very close attention to. Based on Millennium’s latest 13F, Englander and his team are overseeing close to $216 billion in managed securities, which is spread out across thousands of positions, including various put and call options.

But what stands out most about Englander’s trading activity during the June-ended quarter is how he approached artificial intelligence (AI) stocks. Englander showed shares of two of Wall Street’s favorite high-flying AI stocks to the door, while absolutely piling into another historically cheap AI company that’s encountering some serious headwinds.

Englander’s Millennium sends shares of Nvidia and Palantir to the chopping block

The two ultra-popular artificial intelligence stocks in question that Englander’s Millennium Management pared down during the second quarter are semiconductor colossus Nvidia (NASDAQ: NVDA) and cloud-based data-mining specialist Palantir Technologies (NYSE: PLTR).

Millennium has held shares of Nvidia since 2008, so it’s certainly been a prime beneficiary of the AI revolution. But during the June-ended quarter, Englander’s fund reduced its position in Nvidia by 676,242 shares.

It’s certainly possible that this represents nothing more than simple profit-taking and asset reallocation. Nvidia has grown from a $360 billion company to end 2022 into a $3.25 trillion business, as of the closing bell on Oct. 9, 2024. Locking in gains following a nearly parabolic move higher would seem to be a prudent move.

But there are other concerns that may be compelling Englander to reduce Millennium’s stake in Nvidia. For instance, even though Nvidia’s AI-graphics processing units (GPUs) are the undisputed top choice as the “brains” of AI-accelerated data centers, external and internal competition are picking up. In particular, Nvidia’s four-largest customers by net sales are internally developing AI-GPUs for use in their data centers. This suggests future opportunities to win valuable data center real estate will be limited for the AI hardware kingpin.

History has also been incredibly unkind to leading businesses of next-big-thing innovations. Investors have overestimated the utility and uptake of every game-changing technology for the last 30 years, and AI seems unlikely to be the exception to this unwritten rule.

In addition to selling shares of Nvidia, Englander’s fund slashed its stake in Palantir Technologies by 7,074,815 shares. Millennium has been a continuous holder of Palantir’s stock since its initial public offering in 2020.

On one hand, Palantir is riding the wave of irreplaceability to astronomical gains. The company’s AI-driven Gotham platform, which collects data and helps with mission planning for federal governments, coupled with its enterprise-focused Foundry platform, have no competitors at scale. Wall Street often rewards companies that have sustainable moats with premium valuations.

But at some point, a nosebleed valuation, even with a sustainable moat, can become a tough pill to swallow. As of Oct. 9, Palantir is valued at 100 times forward-year earnings per share (EPS) and a jaw-dropping 35 times forecast revenue for the current year. It’s almost impossible to justify this valuation given annual sales growth of around 20%.

Furthermore, the long-term potential of Palantir’s Gotham segment is naturally limited. This is a platform that Palantir’s leaders will only allow the U.S. and its allies to access. This means future growth and profits will be heavily reliant on Foundry. Though this isn’t a bad thing, Foundry is still in its very early stages of expansion, which makes Palantir’s $96.6 billion market cap an eyesore.

Here’s the historically inexpensive AI stock Israel Englander can’t stop buying

While Englander was a busy seller of two of Wall Street’s top artificial intelligence stocks, he was also an avid buyer of a jaw-droppingly cheap AI stock whose path forward has become clouded in recent months. I’m talking about customizable rack server and storage solutions specialist Super Micro Computer (NASDAQ: SMCI).

When adjusted for the 10-for-1 stock split Super Micro completed two weeks ago, Englander’s Millennium Management purchased 5,533,230 shares during the second quarter, which increased the fund’s existing stake in the company by more than 800% since the end of March.

Just as Nvidia has become the go-to provider of AI-GPUs for high-compute data centers, Super Micro Computer has been a top infrastructure player for businesses looking to build out their AI data centers. Super Micro incorporates Nvidia’s ultra-popular H100 GPU into its customizable rack servers, which is enhancing the desirability of its solutions.

In fiscal 2024, which ended on June 30, the company delivered net sales growth of 110% to $14.94 billion. For fiscal 2025, the midpoint of Super Micro’s revenue forecast calls for $28 billion. Despite a forecast annualized earnings growth rate of 62% through fiscal 2029, shares of the company are currently trading at less than 11 times EPS for fiscal 2026.

The reason Super Micro Computer’s stock isn’t trading at a more aggressive premium given its lofty growth projections is because of mounting headwinds. For example, it was the target of a short-seller report from Hindenburg Research in late August. Hindenburg has alleged “accounting manipulation” at Super Micro. Although the company has denied these allegations, it’s also delayed the filing of its annual report and is reportedly facing an early stage probe from the U.S. Justice Department.

There’s also concern that supply chains may hamper Super Micro Computer’s ability to meet its clients’ needs. Nvidia’s H100 GPUs are in such high demand that Super Micro’s rack servers may fall victim to supply backlogs.

Suffice it to say that, despite its relative cheapness, Super Micro Computer is a risky wager for Englander and Millennium Management.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,069!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Palantir Technologies. The Motley Fool has a disclosure policy.

Billionaire Israel Englander Is Selling Nvidia and Palantir and Piling Into a Historically Cheap, Yet Potentially Troubled, Artificial Intelligence (AI) Stock was originally published by The Motley Fool

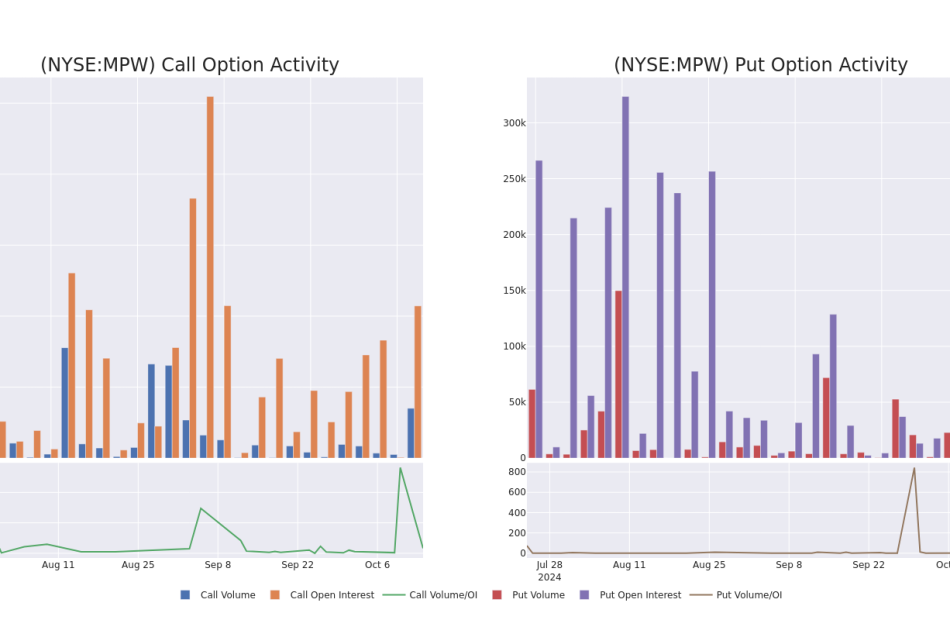

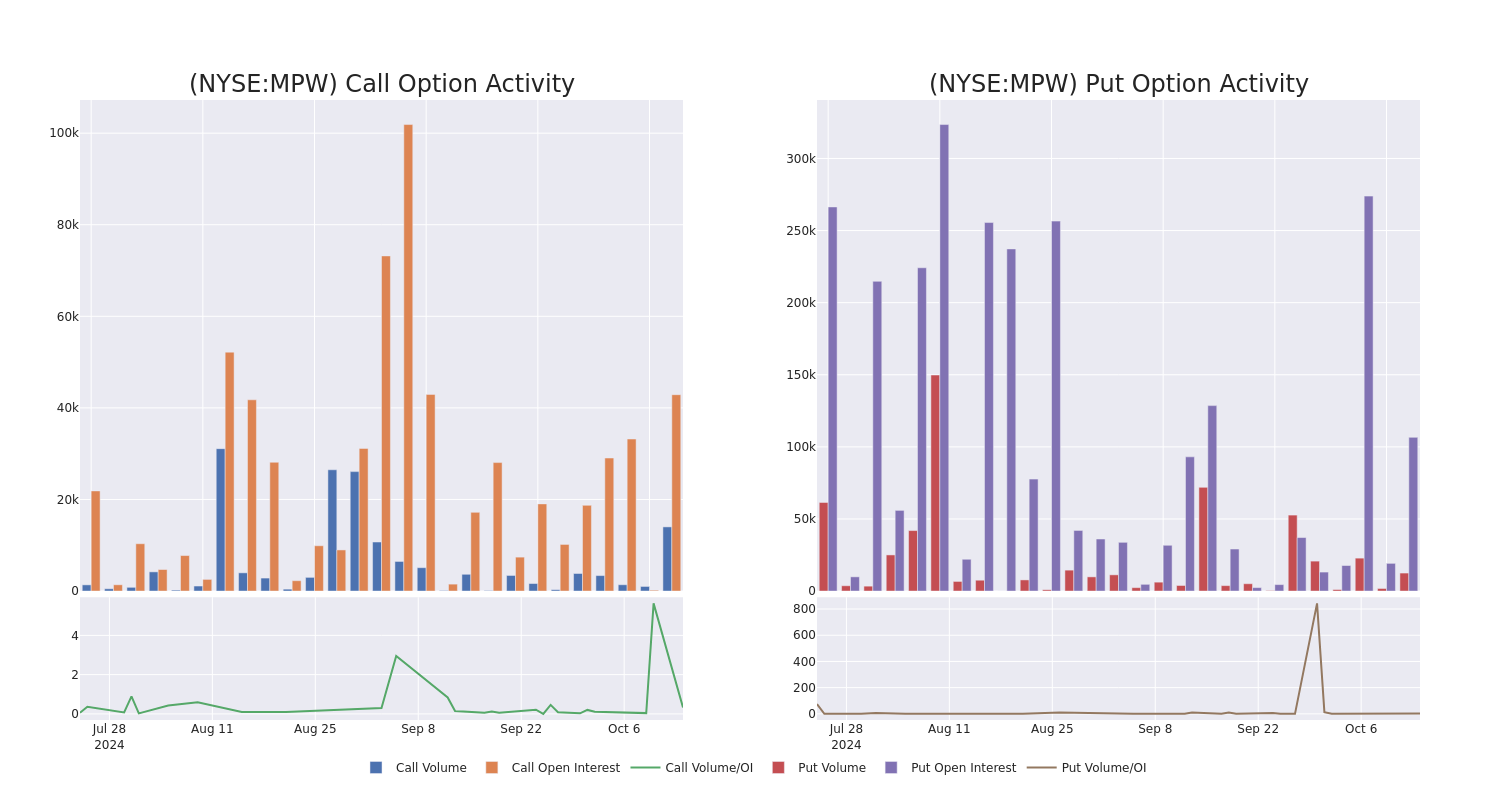

This Is What Whales Are Betting On Medical Properties Trust

Deep-pocketed investors have adopted a bullish approach towards Medical Properties Trust MPW, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in MPW usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 12 extraordinary options activities for Medical Properties Trust. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 58% leaning bullish and 41% bearish. Among these notable options, 4 are puts, totaling $147,973, and 8 are calls, amounting to $557,336.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $2.5 to $10.0 for Medical Properties Trust over the recent three months.

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Medical Properties Trust’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Medical Properties Trust’s whale trades within a strike price range from $2.5 to $10.0 in the last 30 days.

Medical Properties Trust Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MPW | CALL | SWEEP | BEARISH | 01/16/26 | $2.16 | $1.63 | $1.63 | $3.50 | $247.4K | 4.0K | 1.5K |

| MPW | CALL | SWEEP | BULLISH | 10/18/24 | $0.36 | $0.18 | $0.19 | $4.50 | $95.0K | 28.6K | 5.3K |

| MPW | PUT | SWEEP | BEARISH | 11/29/24 | $0.5 | $0.46 | $0.5 | $4.50 | $50.0K | 433 | 1.3K |

| MPW | CALL | SWEEP | BULLISH | 01/15/27 | $0.54 | $0.53 | $0.54 | $10.00 | $45.3K | 1.2K | 1.1K |

| MPW | PUT | SWEEP | BULLISH | 01/17/25 | $0.18 | $0.17 | $0.18 | $3.00 | $40.4K | 61.8K | 2.2K |

About Medical Properties Trust

Medical Properties Trust Inc is a healthcare facility REIT. The company operates one segment, which owns and leases healthcare facilities. The vast majority of Medical’s revenue is generated in the United States, followed by Germany and the United Kingdom. It provides financing for a variety of facilities that require funds for acquisitions, sale-leasebacks, new developments, and expansion projects.

Current Position of Medical Properties Trust

- Currently trading with a volume of 10,357,145, the MPW’s price is down by -5.47%, now at $4.49.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 14 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Medical Properties Trust with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

DJT stock extends massive rally as election odds shift in Donald Trump's favor

Trump Media & Technology Group stock (DJT) extended its massive rally on Monday, jumping as much as 9% as investors bet on former President Donald Trump’s improved odds of winning the November election.

Over the weekend, both domestic and overseas betting markets shifted in favor of a Trump victory, with prediction sites like Polymarket, PredictIt, and Kalshi all showing Trump’s presidential chances ahead of those of Democratic nominee and current Vice President Kamala Harris.

Separately, DJT announced the web launch of its Truth+ TV streaming service on Monday. The app is currently available to access on Android devices and will soon be released as a native Apple iOS app.

DJT shares traded at their lowest level since the company’s debut following the expiration of the company’s highly publicized lockup period last month. The stock has also been under pressure as previous polling saw Harris edging slightly ahead of the former president.

Trump’s recent campaign momentum follows an appearance by Elon Musk at his rally in Butler, Pa., earlier this month. It was the same location where the former president survived an assassination attempt in July.

Tech billionaire Musk, who serves as the CEO of Tesla (TSLA) and SpaceX and also owns social media platform X (formerly Twitter), has been outspoken about his support of Trump ahead of next month’s election. Trump has even said he would consider a Cabinet position for Musk but that the businessman likely would not be able to serve “with all the things he’s got going on.”

At the rally, Musk told the crowd that Trump is the only candidate who can “preserve democracy in America,” adding this will be “the last election” if Trump does not win.

Meanwhile, Harris has recently embarked on a flurry of media appearances in which she was pressed on how she would fund some of her proposals surrounding the economy and immigration.

Trump founded Truth Social after he was kicked off major social media apps like Facebook (META) and Twitter, now X, following the Jan. 6, 2021, Capitol riots. Trump has since been reinstated on those platforms. He officially returned to X in mid-August after about a year’s hiatus.

But as Truth Social attempts to take on the social media incumbents, the fundamentals of the company have long been in question.

In August, DJT reported second quarter results that revealed a net loss of $16.4 million, about half of which was tied to expenses related to the company’s SPAC deal. The company also reported revenue of just under $837,000 for the quarter ending June 30, a 30% year-over-year drop.

Earlier this month, the company revealed that its COO had stepped down in September.

Trump maintains a roughly 60% interest in DJT. At current levels of around $27 a share, Trump Media boasts a market cap of about $5.5 billion, giving the former president a stake worth around $3.3 billion. Right after the company’s public debut, Trump’s stake was worth just over $4.5 billion.

Trump Media went public on the Nasdaq in late March after merging with special purpose acquisition company Digital World Acquisition Corp. But the stock has been on a bumpy ride since, with shares oscillating between highs and lows as the moves have typically been tied to a volatile news cycle.

Over the past six months, the stock has been off around 15% — a massive improvement on the heels of the rally after shares hit their lowest point last month.

Stakeholders, including the former president, were subject to a six-month lockup period before being able to sell or transfer shares. That lockup period expired on Sept. 19, although Trump said at the time that he would not sell his stake.

“I have absolutely no intention of selling,” the former president told reporters at a press conference prior to the lockup period expiration. “I love it. I use it as a method of getting out my word.”

Alexandra Canal is a Senior Reporter at Yahoo Finance. Follow her on X @allie_canal, LinkedIn, and email her at alexandra.canal@yahoofinance.com.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance.

A Look Ahead: FB Financial's Earnings Forecast

FB Financial FBK is set to give its latest quarterly earnings report on Tuesday, 2024-10-15. Here’s what investors need to know before the announcement.

Analysts estimate that FB Financial will report an earnings per share (EPS) of $0.79.

Investors in FB Financial are eagerly awaiting the company’s announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It’s worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

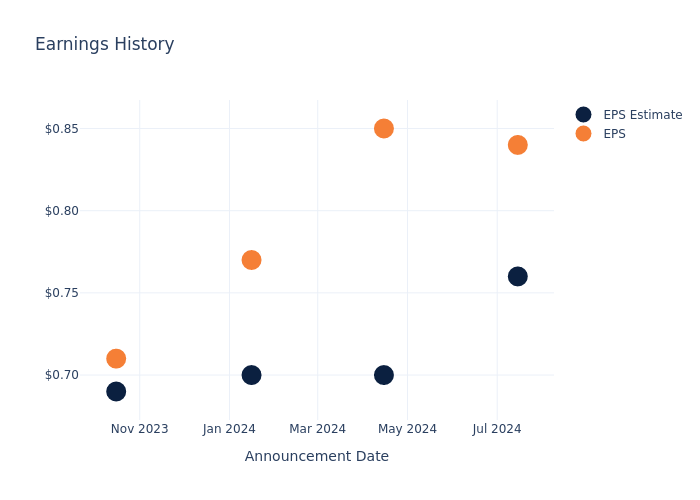

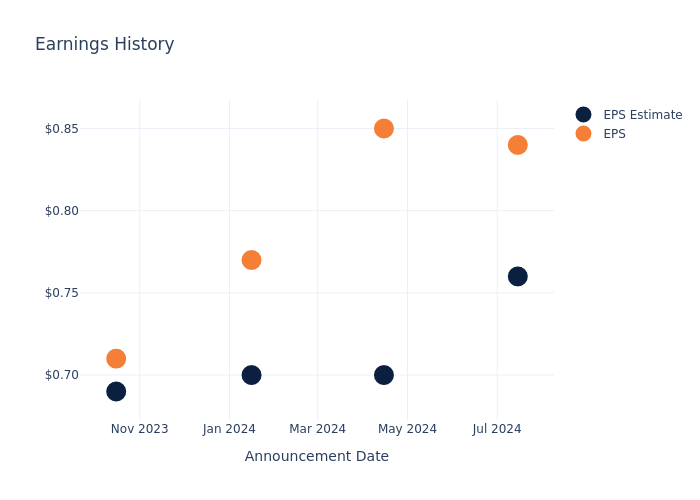

Performance in Previous Earnings

In the previous earnings release, the company beat EPS by $0.08, leading to a 7.99% increase in the share price the following trading session.

Here’s a look at FB Financial’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.76 | 0.70 | 0.70 | 0.69 |

| EPS Actual | 0.84 | 0.85 | 0.77 | 0.71 |

| Price Change % | 8.0% | 4.0% | -4.0% | 2.0% |

Tracking FB Financial’s Stock Performance

Shares of FB Financial were trading at $47.53 as of October 11. Over the last 52-week period, shares are up 66.09%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for FB Financial visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

GSK Says Depemokimab For Chronic Rhinosinusitis Reduces Nasal Polyp Size, Nasal Obstruction Versus Placebo At One Year

On Monday, GSK plc GSK released headline results from the phase 3 trials ANCHOR-1 and ANCHOR-2, which assessed the efficacy and safety of depemokimab versus placebo in adults with chronic rhinosinusitis with nasal polyps (CRSwNP).

Both trials met their co-primary endpoints of a change from baseline in total endoscopic nasal polyp score at 52 weeks and a change from baseline in mean nasal obstruction score from weeks 49 to 52.

The overall incidence and severity of treatment-emergent adverse events across both trials were similar in patients treated with either depemokimab or placebo.

Further analysis of these data is ongoing. The full results of ANCHOR-1 and ANCHOR-2 will be presented at an upcoming scientific congress.

Kaivan Khavandi, SVP, Global Head of Respiratory/Immunology R&D at GSK, said: “Globally millions of people suffer from uncontrolled CRSwNP, the majority of whom will exhibit markers of type 2 inflammation. These patients have high corticosteroid exposure and often experience recurrence of nasal polyps following surgery. We’re very encouraged by the results from the ANCHOR studies, which demonstrate the potential for depemokimab to offer targeted and sustained suppression of a key inflammatory pathway underlying nasal polyp growth and nasal obstruction.”

CRSwNP is a chronic condition that affects up to 4% of the general population, of whom 40% have uncontrolled disease.

It is caused by inflammation of the nasal lining that can lead to soft tissue growth, known as nasal polyps.

People with CRSwNP experience symptoms such as nasal obstruction, loss of smell, facial pressure, sleep disturbance, infections, and nasal discharge.

Data from ANCHOR-1 and ANCHOR-2 and the Phase 3 trials, SWIFT-1 and SWIFT-2, of depemokimab in severe asthma will be used in regulatory filings.

Depemokimab is an ultra-long-acting biologic administered once every six months.

Price Action: GSK stock is up 0.80% at $39.14 during the premarket session at last check Monday.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Hispanic homeowners narrow home value gap to smallest margin on record

SEATTLE, Oct.14 , 2024 /PRNewswire/ — Recent Zillow® research shows Hispanic homeowners making strides in narrowing the home value gap with white homeowners over the past two years, regaining ground lost during the pandemic. The gap is now the narrowest ever observed.

Hispanic-owned homes are currently worth 11.9% less than homes owned by non-Hispanic white households, down from 12.1% last year and a recent high of 12.4% in December 2021. The gap was as wide as 18% in 2012, following the global financial crisis of 2007–2009, when many minority communities were hit especially hard, setting back progress by several years. The slow climb back continued steadily until interrupted in 2021, but the course has now been corrected.

“Homeownership stands as a cornerstone for building wealth, yet systemic barriers have unfairly hindered many people of color from acquiring homes valued comparably to those of their white counterparts,” said Treh Manhertz, Zillow senior economic research scientist. “Efforts to improve access to down payment assistance, credit-building programs, zoning reforms, and affordable housing construction and preservation in desirable areas are key initiatives to help this progress continue.”

More of Hispanic homeowners‘ wealth is typically tied up in their primary residence, relative to homeowners of other races, so home value fluctuations have an outsize effect on them. There is positive movement toward equity at the local level. More than two-thirds of the 100 largest metro areas saw the home value gap decrease for Hispanic homeowners over the past year. For example, significant reductions were observed in several large Florida markets, including Miami, Orlando and Tampa.

Several metros with larger-than-average Hispanic/white home value gaps also saw their gaps narrow. Of the 40 largest metros with gaps larger than the national average, 31 of them reduced their gap by more than the national average. Los Angeles has the largest home value gap, with 32% lower home values for Hispanic residents compared to white residents. The gap in that metro shrunk by 0.75 percentage points in the past year.

However, while gradual progress is being made in closing the gap, the jump into homeownership remains a significant hurdle for Hispanics. According to Zillow’s 2024 Consumer Housing Trends Report, Hispanics represent 18% of prospective buyers, but 13% of successful purchasers. Data from the Homeowners Mortgage Disclosure Act shows that Hispanics face higher fees when purchasing a home, averaging $2,812 compared to the national average of $2,072. Mortgage denial rates are also notably higher for Hispanic borrowers, with 18.8% experiencing denials compared to 10% for non-Hispanic whites, often due to elevated debt-to-income ratios, which account for 38% of denials.

Zillow’s analysis indicates that the home value gap for Black homeowners has slightly narrowed over the past year as well, to 17.7% from 17.9%. However, the gap remains wider compared to mid-2022 (17.2%) and mid-2007, shortly before the housing bust (16.3%).

|

Typical Home Values by Race and Ethnicity (National) |

|||||

|

Race |

Typical Home |

Year-Over-Year |

Home Value Gap, |

One-Year Change |

Five-Year Change in |

|

All |

$362,143 |

2.51 % |

-2.9 % |

0.05pp |

0.27pp |

|

Asian |

$379,919 |

2.65 % |

1.9 % |

0.19pp |

-0.09pp |

|

Black |

$306,928 |

2.69 % |

-17.7 % |

0.19pp |

1.67pp |

|

Hispanic |

$328,283 |

2.62 % |

-11.9 % |

0.14pp |

0.83pp |

|

Pacific Islander |

$350,176 |

2.58 % |

-6.1 % |

.011pp |

0.91pp |

|

White (non-Hispanic) |

$372,835 |

2.46 % |

— |

— |

— |

|

Hispanic Home Value Gaps Relative to White Home Values by Metro |

||||||

|

Region |

Size |

Typical Home Value |

Year-Over-Year |

Home Value Gap, |

One-Year Change in |

Five-Year Change in |

|

United States |

0 |

$328,283 |

2.6 % |

-11.9 % |

0.14 |

0.83 |

|

New York, NY |

1 |

$616,961 |

7.0 % |

-11.8 % |

0.00 |

3.12 |

|

Los Angeles, CA |

2 |

$757,081 |

6.2 % |

-32.0 % |

0.75 |

1.26 |

|

Chicago, IL |

3 |

$277,784 |

5.8 % |

-21.1 % |

0.73 |

2.97 |

|

Dallas, TX |

4 |

$308,407 |

-0.5 % |

-23.8 % |

-0.21 |

0.48 |

|

Houston, TX |

5 |

$262,205 |

0.2 % |

-23.4 % |

-0.37 |

0.93 |

|

Washington, DC |

6 |

$530,240 |

3.2 % |

-9.8 % |

-0.05 |

-0.26 |

|

Philadelphia, PA |

7 |

$306,432 |

5.6 % |

-21.0 % |

0.73 |

2.90 |

|

Miami, FL |

8 |

$481,455 |

4.5 % |

-8.2 % |

1.11 |

0.73 |

|

Atlanta, GA |

9 |

$367,869 |

2.1 % |

-9.8 % |

-0.17 |

1.40 |

|

Boston, MA |

10 |

$612,730 |

6.2 % |

-13.7 % |

0.55 |

1.79 |

|

Phoenix, AZ |

11 |

$382,548 |

1.3 % |

-20.3 % |

0.16 |

1.47 |

|

San Francisco, CA |

12 |

$933,036 |

2.4 % |

-23.1 % |

0.25 |

-0.57 |

|

Riverside, CA |

13 |

$555,505 |

5.0 % |

-6.1 % |

1.07 |

0.78 |

|

Detroit, MI |

14 |

$214,780 |

4.1 % |

-21.1 % |

0.16 |

1.59 |

|

Seattle, WA |

15 |

$672,295 |

3.8 % |

-9.4 % |

-0.25 |

0.21 |

|

Minneapolis, MN |

16 |

$345,525 |

-0.1 % |

-9.0 % |

-0.13 |

-0.75 |

|

San Diego, CA |

17 |

$789,845 |

6.0 % |

-20.8 % |

-0.01 |

-1.37 |

|

Tampa, FL |

18 |

$361,364 |

0.7 % |

-6.0 % |

0.47 |

1.24 |

|

Denver, CO |

19 |

$534,266 |

0.3 % |

-10.2 % |

-0.06 |

0.39 |

|

Baltimore, MD |

20 |

$361,431 |

2.2 % |

-10.0 % |

-0.04 |

0.60 |

|

St. Louis, MO |

21 |

$237,436 |

3.2 % |

-10.0 % |

0.26 |

0.07 |

|

Orlando, FL |

22 |

$382,635 |

1.6 % |

-6.5 % |

0.28 |

0.84 |

|

Charlotte, NC |

23 |

$354,059 |

2.3 % |

-10.6 % |

-0.38 |

1.16 |

|

San Antonio, TX |

24 |

$253,056 |

-3.3 % |

-20.0 % |

-0.58 |

-2.22 |

|

Portland, OR |

25 |

$522,869 |

0.4 % |

-4.8 % |

0.05 |

0.36 |

|

Sacramento, CA |

26 |

$545,042 |

1.9 % |

-6.7 % |

0.07 |

1.07 |

|

Pittsburgh, PA |

27 |

$212,743 |

2.9 % |

-1.8 % |

0.30 |

0.52 |

|

Cincinnati, OH |

28 |

$288,459 |

3.9 % |

-0.4 % |

0.18 |

0.76 |

|

Austin, TX |

29 |

$386,620 |

-4.7 % |

-20.0 % |

-0.12 |

-0.20 |

|

Las Vegas, NV |

30 |

$394,817 |

6.3 % |

-11.8 % |

0.15 |

1.22 |

|

Kansas City, MO |

31 |

$259,774 |

3.1 % |

-16.9 % |

0.56 |

4.92 |

|

Columbus, OH |

32 |

$301,314 |

3.8 % |

-6.1 % |

0.29 |

1.79 |

|

Indianapolis, IN |

34 |

$257,310 |

2.8 % |

-9.3 % |

0.33 |

2.87 |

|

Cleveland, OH |

35 |

$197,351 |

6.3 % |

-19.7 % |

0.60 |

1.82 |

|

San Jose, CA |

36 |

$1,205,284 |

8.3 % |

-29.5 % |

-0.19 |

— |

|

Nashville, TN |

37 |

$410,933 |

1.2 % |

-8.4 % |

-0.08 |

-0.34 |

|

Virginia Beach, VA |

38 |

$340,167 |

4.1 % |

-5.6 % |

-0.02 |

0.41 |

|

Providence, RI |

39 |

$443,424 |

7.7 % |

-10.6 % |

0.61 |

3.17 |

|

Jacksonville, FL |

40 |

$351,709 |

0.0 % |

-5.3 % |

-0.16 |

-0.20 |

|

Milwaukee, WI |

41 |

$302,557 |

6.4 % |

-16.5 % |

1.33 |

3.78 |

|

Oklahoma City, OK |

42 |

$188,978 |

2.9 % |

-22.4 % |

0.92 |

2.31 |

|

Raleigh, NC |

43 |

$399,795 |

0.8 % |

-12.1 % |

-0.55 |

0.20 |

|

Memphis, TN |

44 |

$206,021 |

0.1 % |

-24.5 % |

0.18 |

2.20 |

|

Richmond, VA |

45 |

$354,300 |

3.6 % |

-8.1 % |

-0.95 |

1.93 |

|

Louisville, KY |

46 |

$239,268 |

3.6 % |

-10.2 % |

0.62 |

1.26 |

|

New Orleans, LA |

47 |

$227,884 |

-4.9 % |

-10.5 % |

-0.09 |

-0.38 |

|

Salt Lake City, UT |

48 |

$474,847 |

1.4 % |

-14.3 % |

0.38 |

1.57 |

|

Hartford, CT |

49 |

$320,684 |

8.2 % |

-15.1 % |

0.22 |

2.69 |

|

Buffalo, NY |

50 |

$234,885 |

5.9 % |

-15.5 % |

0.28 |

0.43 |

|

Birmingham, AL |

51 |

$214,607 |

-1.1 % |

-23.6 % |

-0.21 |

0.86 |

|

Rochester, NY |

52 |

$212,113 |

8.5 % |

-20.5 % |

1.19 |

0.88 |

|

Grand Rapids, MI |

53 |

$296,116 |

4.3 % |

-10.1 % |

0.07 |

1.77 |

|

Tucson, AZ |

54 |

$306,415 |

2.4 % |

-17.3 % |

0.29 |

1.48 |

|

Urban Honolulu, HI |

55 |

$837,579 |

0.2 % |

-9.4 % |

0.11 |

1.60 |

|

Tulsa, OK |

56 |

$203,248 |

5.1 % |

-16.6 % |

0.91 |

4.17 |

|

Fresno, CA |

57 |

$361,363 |

3.7 % |

-14.8 % |

0.44 |

1.77 |

|

Worcester, MA |

58 |

$417,878 |

6.7 % |

-9.3 % |

0.20 |

1.97 |

|

Omaha, NE |

59 |

$235,734 |

2.5 % |

-20.6 % |

0.34 |

2.91 |

|

Bridgeport, CT |

60 |

$476,062 |

7.1 % |

-28.9 % |

0.29 |

1.01 |

|

Greenville, SC |

61 |

$282,466 |

2.6 % |

-5.1 % |

0.08 |

0.50 |

|

Albuquerque, NM |

62 |

$317,233 |

3.8 % |

-10.4 % |

0.37 |

2.49 |

|

Bakersfield, CA |

63 |

$341,373 |

5.4 % |

-6.7 % |

0.88 |

3.11 |

|

Albany, NY |

64 |

$326,272 |

6.0 % |

-3.7 % |

0.09 |

0.31 |

|

Knoxville, TN |

65 |

$334,875 |

4.8 % |

-3.6 % |

0.13 |

0.40 |

|

Baton Rouge, LA |

66 |

$237,438 |

1.1 % |

-4.5 % |

-0.03 |

-0.56 |

|

McAllen, TX |

67 |

$185,676 |

4.1 % |

-2.5 % |

0.49 |

1.74 |

|

New Haven, CT |

68 |

$312,071 |

8.8 % |

-20.4 % |

1.07 |

4.72 |

|

El Paso, TX |

69 |

$214,898 |

3.4 % |

-11.0 % |

-0.06 |

-0.12 |

|

Allentown, PA |

70 |

$298,125 |

6.1 % |

-12.6 % |

0.51 |

3.49 |

|

Oxnard, CA |

71 |

$781,421 |

5.2 % |

-13.9 % |

0.64 |

0.78 |

|

Columbia, SC |

72 |

$241,786 |

3.2 % |

-6.6 % |

0.03 |

0.12 |

|

North Port, FL |

73 |

$386,768 |

-3.8 % |

-14.1 % |

0.23 |

0.76 |

|

Dayton, OH |

74 |

— |

||||

|

Charleston, SC |

75 |

$429,839 |

4.0 % |

-6.0 % |

-0.14 |

-0.09 |

|

Greensboro, NC |

76 |

$238,007 |

3.9 % |

-11.1 % |

0.48 |

0.82 |

|

Stockton, CA |

77 |

$493,040 |

2.3 % |

-9.7 % |

0.18 |

1.43 |

|

Cape Coral, FL |

78 |

$343,382 |

-3.3 % |

-13.2 % |

1.59 |

4.27 |

|

Boise City, ID |

79 |

$464,466 |

2.8 % |

-2.8 % |

0.07 |

0.25 |

|

Colorado Springs, CO |

80 |

$409,478 |

0.0 % |

-12.5 % |

-0.32 |

0.32 |

|

Little Rock, AR |

81 |

$185,896 |

4.1 % |

-20.1 % |

0.61 |

-0.95 |

|

Lakeland, FL |

82 |

$315,409 |

-0.8 % |

0.2 % |

-0.45 |

-0.86 |

|

Akron, OH |

83 |

$197,938 |

6.9 % |

-12.2 % |

1.23 |

2.93 |

|

Des Moines, IA |

84 |

$234,000 |

3.8 % |

-18.2 % |

0.92 |

2.30 |

|

Springfield, MA |

85 |

$321,597 |

6.5 % |

-11.5 % |

0.75 |

4.91 |

|

Poughkeepsie, NY |

86 |

— |

||||

|

Ogden, UT |

87 |

$469,761 |

1.3 % |

-5.6 % |

0.03 |

0.28 |

|

Madison, WI |

88 |

$404,765 |

5.4 % |

-2.2 % |

0.15 |

1.05 |

|

Winston, NC |

89 |

$251,975 |

4.7 % |

-8.4 % |

0.43 |

1.60 |

|

Deltona, FL |

90 |

$328,665 |

0.7 % |

-6.2 % |

1.42 |

2.43 |

|

Syracuse, NY |

91 |

$216,714 |

10.6 % |

-11.2 % |

0.47 |

0.70 |

|

Provo, UT |

92 |

$492,017 |

0.2 % |

-7.0 % |

-0.11 |

0.21 |

|

Toledo, OH |

93 |

$172,244 |

5.1 % |

-11.7 % |

0.69 |

2.66 |

|

Wichita, KS |

94 |

$181,120 |

7.0 % |

-18.7 % |

1.02 |

4.03 |

|

Durham, NC |

95 |

$392,000 |

1.9 % |

-6.1 % |

-0.15 |

0.19 |

|

Augusta, GA |

96 |

$229,761 |

2.1 % |

-2.6 % |

-0.41 |

-4.60 |

|

Palm Bay, FL |

97 |

$344,506 |

-1.0 % |

-4.3 % |

-0.03 |

0.35 |

|

Jackson, MS |

98 |

$208,466 |

-0.6 % |

0.2 % |

0.02 |

0.65 |

|

Harrisburg, PA |

99 |

$252,998 |

4.3 % |

-12.1 % |

0.87 |

3.18 |

|

Spokane, WA |

100 |

$390,956 |

0.4 % |

-5.7 % |

0.02 |

0.43 |

Methodology: Zillow’s analysis aggregated small-area home values (ZHVI), weighted by estimated counts of homeowners by race and ethnicity of the household head in the American Community Survey, to estimate relative home values and home value appreciation by race.

About Zillow Group:

Zillow Group, Inc. Z is reimagining real estate to make home a reality for more and more people. As the most visited real estate website in the United States, Zillow and its affiliates help people find and get the home they want by connecting them with digital solutions, dedicated partners and agents, and easier buying, selling, financing and renting experiences.

Zillow Group’s affiliates, subsidiaries and brands include Zillow®, Zillow Premier Agent®, Zillow Home Loans℠, Zillow Rentals®, Trulia®, Out East®, StreetEasy®, HotPads®, ShowingTime+℠, Spruce® and Follow Up Boss®.

All marks herein are owned by MFTB Holdco, Inc., a Zillow affiliate. Zillow Home Loans, LLC is an Equal Housing Lender, NMLS #10287 (www.nmlsconsumeraccess.org). © 2024 MFTB Holdco, Inc., a Zillow affiliate.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/hispanic-homeowners-narrow-home-value-gap-to-smallest-margin-on-record-302274905.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/hispanic-homeowners-narrow-home-value-gap-to-smallest-margin-on-record-302274905.html

SOURCE Zillow

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

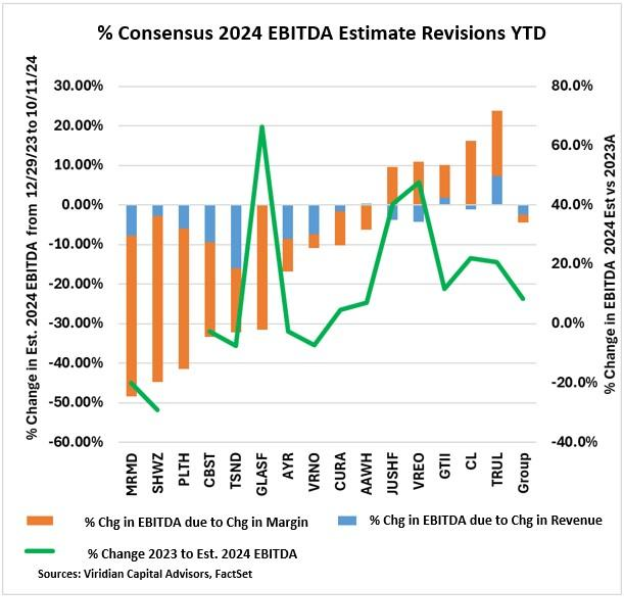

Cannabis Chart Of The Week: Consensus 2024 EBITDA Estimates Are Still Up 8.4% Despite Downward Revisions

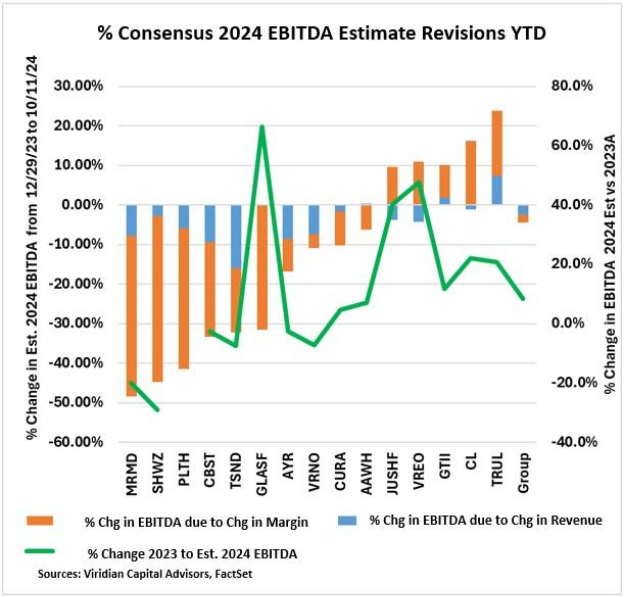

The chart shows the percentage change in consensus 2024 EBITDA estimates between the end of 2023 and now. The orange bars represent the portion of EBITDA % change attributable to changes in EBITDA Margins, while the blue bars depict the part attributable to changes in revenue estimates.

In aggregate, the group 2024 EBITDA estimates have been revised downward by 4.5% YTD, and 2.7% of that has occurred since the end of the second quarter. The range is quite wide, however, from a 48.3% downward revision for MariMed MRMD to an upward revision of 23.9% for Trulieve TCNNF.

We had expected 2024 revisions to be going in the other direction. At the beginning of the year, we believed that as we got closer to S3, stock prices would begin to move upward, allowing for some modest equity issuance, balance sheet repair, and the beginnings of a new round of expansion. Instead, we have seen virtually no rise in equity prices, little new capital coming into the cultivation and retail sector, and mostly debt refinancing. Tight capital has kept capex and M&A constrained.

Lower estimated EBITDA margins primarily drive all of the downward revisions. Rising costs, wholesale price compression, and continued capital scarcity have continued to have a negative impact.

The five companies on the right-hand side of the chart stand out for having significant upward revisions in estimated 2024 EBITDA margins. Interestingly, three of the five have had negative revenue revisions. They are shedding unprofitable business and focusing on margin improvement.

Despite the downward revisions, it is important to realize that current 2024 EBITDA estimates are still 8.4% above 2023 levels. Furthermore, we still believe S3 will lead to stock price increases and the re-equitization of balance sheets, which in turn will allow for additional growth. Will the December 2nd DEA hearing have an impact, or will investors wait until S3 is wholly accomplished? New rumblings regarding the SAFER Act are encouraging, but we are skeptical that anything will happen in an election year.

As always, cannabis investing requires patience. With huge catalysts in view, investors need to avoid credit traps and not be shaken by adverse short-term price action.

The Viridian Capital Chart of the Week highlights key investment, valuation and M&A trends taken from the Viridian Cannabis Deal Tracker.

The Viridian Cannabis Deal Tracker provides the market intelligence that cannabis companies, investors, and acquirers utilize to make informed decisions regarding capital allocation and M&A strategy. The Deal Tracker is a proprietary information service that monitors capital raise and M&A activity in the legal cannabis, CBD, and psychedelics industries. Each week the Tracker aggregates and analyzes all closed deals and segments each according to key metrics:

-

Deals by Industry Sector (To track the flow of capital and M&A Deals by one of 12 Sectors – from Cultivation to Brands to Software)

-

Deal Structure (Equity/Debt for Capital Raises, Cash/Stock/Earnout for M&A) Status of the company announcing the transaction (Public vs. Private)

-

Principals to the Transaction (Issuer/Investor/Lender/Acquirer) Key deal terms (Pricing and Valuation)

-

Key Deal Terms (Deal Size, Valuation, Pricing, Warrants, Cost of Capital)

-

Deals by Location of Issuer/Buyer/Seller (To Track the Flow of Capital and M&A Deals by State and Country)

-

Credit Ratings (Leverage and Liquidity Ratios)

Since its inception in 2015, the Viridian Cannabis Deal Tracker has tracked and analyzed more than 2,500 capital raises and 1,000 M&A transactions totaling over $50 billion in aggregate value.

The preceding article is from one of our external contributors. It does not represent the opinion of Benzinga and has not been edited.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.