Ask an Advisor: How Can I Make the Most of $1 Million for Passive Income and Tax Savings?

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

I have a million dollars and I want to put it to work for me. Where can I put it to make the most amount of passive income from it? Also, how can I minimize taxes on that to be able to keep more of that money?

– Andrea

While today’s high-interest rate environment has been challenging in many respects, the silver lining is that investors seeking to earn passive income can do so more easily than they could at any point since the global financial crisis of 2007-2009.

Before laying out some options to capitalize on prevailing yields and considering the associated tax consequences, it’s helpful to evaluate your existing financial picture and ask yourself some important questions that will impact where you put the money. (A financial advisor can help you do both and this tool can help you match with one.)

Evaluate Your Financial Situation

Investing your $1 million dollars with an eye toward generating passive income may very well be the best option for this money. However, rather than viewing your decision in a vacuum, I would recommend looking at the money in the context of your broader financial situation and longer-term goals. In particular, it might be helpful to consider the following questions:

-

Your total assets: Do you already have a portfolio of investments? Where are those assets located and what are their tax implications (e.g., IRA, Roth IRA, 401(k), brokerage account)?

-

Your work status: How many more years will you have an income to add to your assets?

-

Other income: Do you have any other sources of income (Social Security, pension, etc.)?

-

Purpose for generating passive income: Are you retired and seeking to fund your ongoing expenses? Or is it to provide supplementary income while the rest of your portfolio continues to grow?

-

Growth vs. income: Are you willing and/or able to sacrifice growth and preservation of purchasing power for the sake of income? If income is the only goal or need, then expectations for growth and your ability to maintain the purchasing power of the assets should remain low.

It is possible that after thinking through these questions you might pursue a different goal for the money. (And if you need more help assessing your financial situation, consider speaking with a financial advisor.)

Options for Generating Passive Income

Given the rise in interest rates since March 2022, income-oriented assets have become more attractive for those looking to earn a reasonable yield from their investments. Building a portfolio that includes a variety of assets capable of generating an aggregate yield is often a sound approach, as opposed to investing in a single product or security. While a financial advisor can help you build a robust portfolio, here are a few options to consider:

Money Market Funds

While generally considered an alternative to holding cash in a savings account, money market funds have become a popular topic among investors amid rate increases. Prior to the Federal Reserve’s recent series of rate hikes, money market yields were close to 0%, meaning you effectively earned no interest on your investment. Today, however, yields are closer to 5%, making this a much more compelling option for generating low-risk income.

Municipal Bonds

Municipal bonds are another solid option for income-focused investors. As with any investment, you’ll want to consider your goals before investing in municipal bonds since the risk profile and income potential will vary across securities. Evaluating credit ratings and maturities in relation to the yield you expect to earn in exchange for taking on credit and duration risk is a necessary step to take. Because they are typically not subject to federal taxes (or state taxes in the state where they are issued), municipal bonds tend to be a tax-efficient investment.

Certificates of Deposit

Like money market funds, certificates of deposit (CDs) have gained popularity as rates have increased. CDs can be particularly attractive if you do not need to liquidate the investment over its intended time horizon since you generally will pay a penalty for early withdrawals. It is therefore important to align a CD’s maturity date with the date at which you expect to need the money back.

Dividend Stocks

If you will need some growth to accompany the passive income your money generates, you may want to consider investing in dividend stocks. The S&P 500 High Dividend Index was paying a dividend yield in excess of 5% as of the end of September, making it competitive with other options listed. Unlike fixed-income products, dividend stocks will typically provide more opportunity for appreciation, which may help you maintain purchasing power over time if that’s a concern.

Other Options

Of course, there are additional options for generating passive income. These include Treasuries, high-yield bonds, master limited partnerships (MLPs), real estate investment trusts (REITs) and many others. Before committing to each, consider the level of risk you are able and willing to take, the amount of income you will need, and whether some element of growth is necessary. Also, evaluate the tax implications of the investments you choose. (And if you need more help evaluating and selecting investments, consider matching with a financial advisor.)

Mitigate the Impact of Taxes

Each of the options cited above is treated differently for tax purposes. The interest earned by fixed-income securities is taxed at ordinary income tax rates. Taxes on dividends from equity securities depend on how long you own the asset – qualified dividends are taxed at long-term capital gains rates while ordinary dividends are taxed at ordinary income rates. Appreciation from equity securities is taxed at capital gains rates.

It’s important to understand the tax treatment of individual assets since that will play a role in determining the type of account that holds these assets. Generally speaking, owning individual stocks and bonds, as well as their passively managed index alternatives, is more tax-efficient than actively managed mutual funds. Therefore, it’s typically advisable to own individual stocks, bonds and index funds in taxable brokerage accounts. Tax-advantaged accounts like IRAs and 401(k)s, and after-tax Roth IRAs, are generally more suitable for your actively managed funds and less tax-efficient securities like high-yield bonds.

Thinking holistically about the assets you own and where to allocate them will ultimately help you mitigate taxes. Of course, it can be helpful to speak with your tax advisor to better understand the impact on your individual situation, given your specific tax brackets. (Consider matching with a financial advisor with tax expertise.)

Bottom Line

Positioning your assets for passive income generation is a sound strategy, but only if it aligns with your long-term financial needs and goals. Before committing to this approach, critically assess your personal situation and the rationale behind seeking passive income. From there, you may consider various fixed-income products like bonds and CDs, as well as equity securities like dividend-paying stocks. Each option has its own tax consequences, and the type of account the securities are held in will also have an impact on taxes.

Tips for Generating Passive Income

-

A CD ladder is one way to capitalize on today’s high-interest rate environment while also generating income. The strategy calls for opening multiple CD accounts, each with varying maturity dates. The idea is that you’ll always have a CD reaching its maturity date and paying out interest. Here’s a look at today’s CD rates.

-

A financial advisor can help you decide which investments are most aligned with your financial goals. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Jeremy Suschak, CFP®, is a SmartAsset financial planning columnist who answers reader questions on personal finance topics. Got a question you’d like answered? Email AskAnAdvisor@smartasset.com and your question may be answered in a future column.

Jeremy is a financial advisor and head of business development at DBR & CO. He has been compensated for this article. Additional resources from the author can be found at dbroot.com.

Please note that Jeremy is not a participant in the SmartAsset AMP platform, nor is he an employee of SmartAsset, and he has been compensated for this article. Some reader-submitted questions are edited for clarity or brevity.

Photo credit: ©iStock.com/Viorel Kurnosov, ©iStock.com/Sam Edwards

The post Ask an Advisor: I Have $1 Million and Want It to Work for Me. How Do I Maximize Passive Income and Minimize Taxes? appeared first on SmartReads by SmartAsset.

‘She can’t even buy groceries or put gas in her car’: My friend’s husband died, leaving her with three young children, no job and $15,000 in credit-card debt

Dear Quentin,

I have a friend who lives in Virginia and has been a stay-at-home mom to three kids for the last nine years. Her husband passed away unexpectedly last month. He didn’t have any life insurance or savings. The mortgage was in his name only, but my friend is also on the deed of the house. Likewise, he had credit cards in his name only but had listed her as an authorized user on the accounts — and then cut up her cards. He left a balance of about $15,000.

She currently has no income and three kids between 5 and 10 years of age. They live in a rural area with no family or support system close by, so finding a job will be difficult, but she will be filing for Social Security benefits soon, so that’s something. She can’t pay the mortgage. She is planning to sell the house and should net between $75,000 and $100,000 on the sale of the property.

Most Read from MarketWatch

Will she be responsible for repaying her husband’s credit-card debt? Given that she hasn’t worked for the last decade and has no income, even finding an apartment to rent will be difficult unless she pays the entire lease amount up front with the proceeds from the sale of the house. Do you have any advice to help get my friend and her children on their feet? Right now, she can’t even buy groceries or put gas in her car.

Trying to Help

Dear Trying,

Selling her house should be a last resort. Without it, she will be dealing with landlords and housing insecurity for years to come and will still have to qualify for tenancy, which will require references, a regular income and good credit score. Her mortgage may feel like a burden now, but it will be far worse if she ends up moving from apartment to apartment with her children. Generally, people should hold off on making any drastic changes after a loved one dies.

She is likely not liable for her husband’s credit-card debt, even as an authorized user on his accounts. Becoming an authorized user allows a person to build a credit score without having their own credit card. “Authorized users have no legal duty to pay for charges to the credit account,” according to Equifax, one of the big three credit bureaus, along with TransUnion and Experian. “The primary cardholder is the one ultimately responsible for making payments.”

However, her husband’s credit-card company could, in theory, claim the $15,000 debt from her husband’s estate. So if she did sell her house, those proceeds could be vulnerable to the reclaiming of that debt. It all depends on the company and its procedures. Your friend should consult with an attorney as she starts the probate process.

Make sure she applies for Social Security survivor benefits. She may be eligible regardless of her age, given that her husband left three minor children. The children may also be eligible for benefits, according to the Social Security Administration, if they’re 17 or younger; if they are age 18-19 and attending school (not college) full time; or if they are any age and developed a disability at age 21 or younger.

Healthcare and food assistance

Temporary Assistance for Needy Families also provides help paying for food, housing, home energy, child care and job training. She can find her local TANF office through the U.S. Department of Health and Human Services. Your friend should contact the mortgage company as soon as possible, and provide them with her husband’s death certificate, to explain what happened; her husband may have had life insurance on the mortgage, or the company may give her a grace period on her payments.

She can also apply for Obamacare, the healthcare program signed into law by President Barack Obama in 2010. “Under the Affordable Care Act, Medicaid coverage is extended to nearly all nonelderly adults with incomes at or below 138% of the federal poverty level (about $23,556 for a family of three in 2022) in the 42 states (including D.C.) that opted to expand as of March 2023,” according to the nonprofit KFF, formerly the Kaiser Family Foundation.

“Under rules in place before the ACA, all states extend public coverage to poor and low-income children, with a median income eligibility level of 255% of poverty in 2022,” KFF says. “The ACA also established health insurance marketplaces where individuals can purchase insurance and allowed for federal tax credits for such coverage for people with incomes from 100% to 400% [of the federal poverty level] (about $23,030 to $92,120 for a family of three in 2022).”

She should also look into the Family Access to Medical Insurance Security Plan, which is Virginia’s health-insurance program for children. “There are no monthly premiums, co-payments, deductibles or other costs for covered services to children enrolled in the FAMIS program,” according to Virginia’s Department of Medical Assistance Services. The program covers dental care, doctor visits, emergency care, prescription medicine, X-rays and vaccinations.

In the meantime, your friend could contact Viriginia Legal Aid, a free service, to get the ball rolling. It’s not going to be easy: Remote jobs are hard to find, particularly for someone who does not have any tech training — as the best paid work-from-home jobs involve some kind of STEM skill. There is a lot she can do to stay afloat financially, hopefully without giving up her only asset — her home.

More columns from Quentin Fottrell:

Most Read from MarketWatch

A Preview Of State Street's Earnings

State Street STT is set to give its latest quarterly earnings report on Tuesday, 2024-10-15. Here’s what investors need to know before the announcement.

Analysts estimate that State Street will report an earnings per share (EPS) of $2.13.

The announcement from State Street is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It’s worth noting for new investors that guidance can be a key determinant of stock price movements.

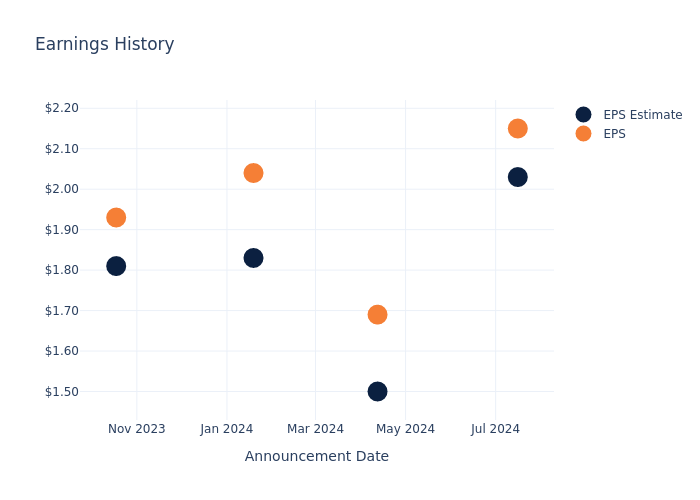

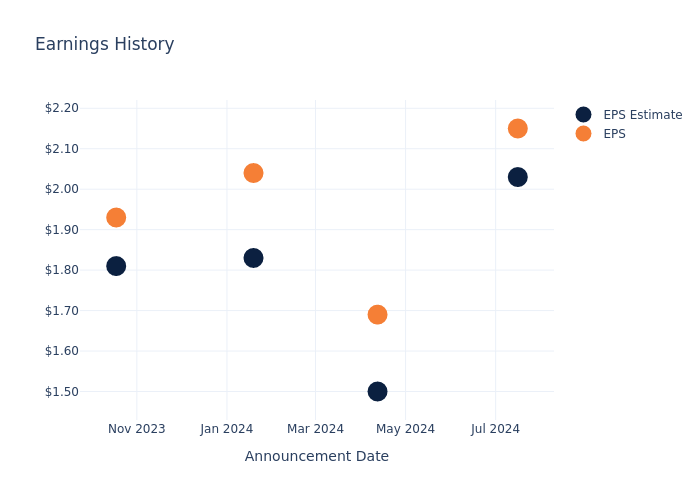

Past Earnings Performance

During the last quarter, the company reported an EPS beat by $0.12, leading to a 0.61% increase in the share price on the subsequent day.

Here’s a look at State Street’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 2.03 | 1.50 | 1.83 | 1.81 |

| EPS Actual | 2.15 | 1.69 | 2.04 | 1.93 |

| Price Change % | 1.0% | 3.0% | 2.0% | -3.0% |

State Street Share Price Analysis

Shares of State Street were trading at $89.83 as of October 11. Over the last 52-week period, shares are up 34.0%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analysts’ Perspectives on State Street

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on State Street.

Analysts have given State Street a total of 13 ratings, with the consensus rating being Neutral. The average one-year price target is $92.77, indicating a potential 3.27% upside.

Understanding Analyst Ratings Among Peers

The analysis below examines the analyst ratings and average 1-year price targets of Ares Management, Blue Owl Cap and Franklin Resources, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- The prevailing sentiment among analysts is an Neutral trajectory for Ares Management, with an average 1-year price target of $158.5, implying a potential 76.44% upside.

- Analysts currently favor an Outperform trajectory for Blue Owl Cap, with an average 1-year price target of $21.5, suggesting a potential 76.07% downside.

- For Franklin Resources, analysts project an Neutral trajectory, with an average 1-year price target of $21.66, indicating a potential 75.89% downside.

Comprehensive Peer Analysis Summary

Within the peer analysis summary, vital metrics for Ares Management, Blue Owl Cap and Franklin Resources are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| T. Rowe Price Gr | Neutral | 7.65% | $911.50M | 4.77% |

| Ares Management | Neutral | -20.67% | $718.06M | 5.04% |

| Blue Owl Cap | Outperform | 31.88% | $322.75M | 2.00% |

| Franklin Resources | Neutral | 7.82% | $1.70B | 1.29% |

Key Takeaway:

State Street ranks in the middle for consensus rating among its peers. It ranks at the bottom for revenue growth. It ranks at the top for gross profit. It ranks in the middle for return on equity.

Get to Know State Street Better

State Street is a leading provider of financial services, including investment servicing, investment management, and investment research and trading. With approximately $42 trillion in assets under custody and administration and $4.1 trillion assets under management as of Dec. 31, 2023, State Street operates globally in more than 100 geographic markets and employs more than 46,000 worldwide.

State Street’s Economic Impact: An Analysis

Market Capitalization Analysis: Reflecting a smaller scale, the company’s market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Over the 3 months period, State Street showcased positive performance, achieving a revenue growth rate of 2.6% as of 30 June, 2024. This reflects a substantial increase in the company’s top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Financials sector.

Net Margin: State Street’s net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of 20.53%, the company may face hurdles in effective cost management.

Return on Equity (ROE): State Street’s ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 2.96%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): State Street’s ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 0.2%, the company may face hurdles in achieving optimal financial performance.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 1.49, caution is advised due to increased financial risk.

To track all earnings releases for State Street visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

I Want to Move $720k to a Roth IRA – Are There Ways to Cut Conversion Taxes?

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

Taxes are a valid concern if you want to roll over $720,000 from your retirement fund into a Roth IRA. While you won’t pay any taxes if the assets you’re rolling over are held in another Roth account, there’s typically no way to completely avoid paying taxes when rolling pre-tax money into a Roth IRA. However, with a few strategic moves, you can potentially limit today’s tax pain while still reaping the rewards of tomorrow’s tax-free benefits. To determine if a Roth rollover aligns with your overall savings and tax strategy, consider running the numbers with a financial advisor who’s attuned to your financial situation and retirement vision.

Roth Rollover Rules

A Roth IRA is a retirement account that allows people to contribute after-tax dollars. Unlike a traditional IRA, you don’t get a tax break on Roth contributions. However, qualified Roth withdrawals in retirement can be made tax-free. This differs from traditional IRAs, whose contributions are often tax-deductible but withdrawals are taxed as ordinary income.

In general, you can roll over funds from another retirement account such as a traditional IRA or 401(k) into a Roth IRA. This is called a Roth conversion or Roth rollover. When you convert funds, you owe income taxes on the amount that’s rolled over for that year. So if you roll over $50,000 from a traditional IRA to a Roth IRA, the $50,000 is added to your taxable income for the year.

It’s important to understand that Roth rollovers are not the same as Roth contributions. Higher-income taxpayers may not qualify to make direct Roth contributions. However, there are no income limits on doing Roth conversions from other accounts.

You can roll over funds from 401(k)s, 403(b)s, 457 plans, traditional IRAs, SEP IRAs and Simple IRAs. To start the process, contact the institution that holds the account you want to roll over and convert. They can help facilitate the transfer. You typically have 60 days to complete the conversion, otherwise, the IRS will treat the transfer as a distribution and you could be hit with a 10% early withdrawal penalty. But if you need additional help determining how much to roll over and convert, consider speaking with a financial advisor.

Why Roth Rollovers Matter

There are a few key reasons why an individual might choose to do a Roth conversion:

-

Tax-free growth: Money that’s converted into a Roth IRA grows tax-free. This differs from traditional IRAs whose investment earnings are tax-deferred but eventually get taxed when they’re withdrawn. Roth withdrawals will be 100% tax-free, provided you satisfy the five-year rule and are 59.5 years old.

-

Avoid RMDs: Traditional IRAs are subject to required minimum distributions (RMDs) – mandatory withdrawals that start at age 73. For those who don’t need these distributions, RMDs can create excess taxable income. However, Roth conversions eliminate future RMDs since Roth accounts are not subject to these rules.

-

Tax savings: Paying conversion taxes now can make sense if you expect to be in a higher tax bracket in retirement. Roth conversions lock in today’s rates. They also reduce future RMD amounts that could push you into a higher bracket.

-

Inheritance planning: Heirs who inherit Roth IRAs can potentially stretch out tax-free distributions over their life expectancy, depending on their relation to the person who died. However, some beneficiaries will be required to empty the account within 10 years.

As you can see, there are some good reasons to convert an IRA or 401(k) into a Roth IRA, but a financial advisor can help you explore how such a transaction may impact your finances and tax liability.

Roth Rollover Strategies

When doing a Roth conversion, the main drawback is the tax obligation. There are some strategic moves to potentially reduce taxes, though:

-

Partial conversions: One method is to do partial Roth conversions over multiple years instead of converting your entire balance at once. The idea is to convert just enough each year to “fill up” your current bracket with income while also avoiding a higher bracket.

-

Low-tax years: In low-income years it may make sense to convert larger sums. This could be early in retirement before RMDs or Social Security begins. Again, the goal is to add just enough extra income to fill up your current tax bracket without pushing you into the next tax bracket.

-

Use non-retirement assets: Many experts suggest paying conversion taxes with non-retirement funds instead of IRA assets. This allows your entire IRA balance to transfer to the Roth account and keep growing tax-free.

If you need help determining which strategy is best for you, consider using this free matching tool to connect with a fiduciary financial advisor.

Rollover Strategies in Action

As an example, let’s consider a single filing taxpayer who wants to roll over $720,000 from an old 401(k) to a Roth IRA. Here are a few scenarios to think about:

Lump Sum Conversion

Converting the entire $720,000 would potentially generate a tax bill of nearly $220,000 at today’s top marginal rate of 37% (assuming you take the standard deduction of $14,600). That whole sum has to be paid for the year in which the conversion is completed.

Partial Conversions Spread Over 10 Years

Completing a series of conversions each year for 10 years controls tax bracket jumps and spreads the tax hit over a decade. A $72,000 annual conversion would put you in the 22% bracket if you have little or no additional income. That translates to a tax bill of approximately $7,700 per year or $77,000 over 10 years – less than half of what you’d pay on a lump sum conversion. Keep in mind that your balance will potentially continue to grow during these 10 years, requiring additional conversions and more taxes to pay.

Low-Income Year

By maximizing conversions during years in which your income dips, you can take advantage of being in a lower tax bracket. For example, say you earn $60,000 in taxable income in a typical year, placing you in the 22% bracket and resulting in a tax liability of approximately $5,200 after taking the standard deduction. If you also convert $72,000, you’ll move up into the 24% bracket with $132,000 in total taxable income. You’d see your tax liability climb to around $21,000. Do this two years in a row and your combined tax bill will be approximately $42,000.

But say you will only receive $30,000 one year because you are taking a six-month sabbatical. You could skip conversions in the previous year and convert two years’ worth, or $144,000, in the sabbatical year. That year, you’ll have an income of $174,000, including $144,000 in conversions and $30,000 from salary. This would put you in the 24% bracket and generate a tax bill of approximately $31,000. Add the $5,200 tax bill from the previous year and your two-year tax bill could end up being around $36,200. A financial advisor can help you assess whether this strategy may be an option for you.

Non-Retirement Assets

Using non-IRA funds to pay your tax bill on a conversion allows the full amount of the rollover to go into the Roth account. If you use taxable funds rather than IRA funds to pay all taxes due on a lump sum conversion of $720,000, that’s $227,000 more you’ll have growing tax-free in your Roth.

Bottom Line

Roth rollovers can reduce future taxes and eliminate RMDs in retirement, at the cost of having to pay more in taxes today. Strategic partial conversions completed over several years, conversions timed with low-income years can potentially limit the tax pain, as well as using non-retirement assets to pay conversion taxes. Consult with financial and tax professionals to map out a tax-savvy approach.

Retirement Planning Tips

-

With a major retirement move like a Roth conversion, it helps to sit down with a financial advisor who can analyze your full financial picture. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

It’s important to have a sense of the progress you’re making as you plan and save for retirement. SmartAsset’s free retirement calculator can help you estimate how much money you may need to save to retire and whether you’re on track to hit that target.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Photo credit: ©iStock.com/izusek, ©iStock.com/designer491, ©iStock.com/Chainarong Prasertthai

The post I Want to Roll Over $720k to a Roth IRA. How Do I Avoid Paying Taxes? appeared first on SmartReads by SmartAsset.

Warren Buffett Is Generating an Annual Yield of 33% to 60% From 3 Magnificent Stocks — Here's His Simple Secret to Outsize Yields

For almost 60 years, Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett has been delivering outsize returns. Based on the closing price of Berkshire’s Class A shares (BRK.A) on Oct. 10, he’s overseen a nearly 5,500,000% aggregate return and watched his company (briefly) hit the trillion-dollar mark, which is something only eight publicly traded companies have accomplished.

The Oracle of Omaha’s secrets to success really aren’t secrets at all. Whether it’s through his annual letter to shareholders, shareholder meetings, or rare interviews with financial media, Buffett willingly discusses the traits he looks for when putting his company’s capital to work.

But among the various characteristics that have powered Berkshire’s phenomenal returns is his penchant for investing in dividend stocks. Companies that pay a dividend are almost always profitable on a recurring basis, time-tested, and capable of providing transparent growth outlooks.

More importantly, dividend stocks have absolutely crushed non-payers in the return column over the last half-century. According to The Power of Dividends: Past, Present, and Future, which was released last year by the investment advisors at Hartford Funds, dividend stocks have averaged a 9.17% annualized return over the previous 50 years (1973-2023), while non-payers have produced a more modest 4.27% average annual return over the same timeline.

Over the next 12 months, Warren Buffett is set to oversee the collection of roughly $5 billion in dividend income for Berkshire Hathaway.

However, three of Buffett’s core holdings are generating truly outsize yields that range from 33% to 60% on an annual basis. His secret to netting these supercharged yields is really simple: patience.

Coca-Cola: 60% annual yield to cost

Out of the 43 stocks and two index funds held in Berkshire Hathaway’s $313 billion portfolio, none has been a fixture longer than beverage behemoth Coca-Cola (NYSE: KO).

Buffett’s company has been a shareholder of Coca-Cola since 1988, with Berkshire boasting an enviable cost basis in the company of $3.2475 per share. Given that Coca-Cola has raised its dividend for 62 consecutive years and is currently doling out $1.94 annually, Berkshire is netting a whopping 60% annual yield on this position, relative to its cost basis. Berkshire’s brightest investment minds simply sitting on their hands will lead to $776 million in annual income over the next 12 months.

One of the clearest reasons Coke has been such a steady outperformer for decades is because it’s a consumer staples stock. This is to say that it sells products (beverages) that are in demand regardless of how well or poorly the U.S. and global economy are performing. Selling basic need goods ensures cash flow consistency year after year.

The company also has virtually unrivaled geographic diversity in its corner. Sans North Korea, Cuba, and Russia, it has operations in every other country. This means it generates highly predictable operating cash flow in developed markets, but is also moving the organic growth needle in emerging markets.

Further, Coca-Cola was named the most-chosen brand by Kantar’s “Brand Footprint” report for the 12th consecutive year in 2024. Well-known, time-tested, consumer staples stocks tend to outperform over long periods, and Coca-Cola is no exception.

American Express: 33% annual yield to cost

A second longtime holding in Berkshire Hathaway’s portfolio that’s responsible for an outsize yield is credit-services provider American Express (NYSE: AXP), which is better known as “AmEx.”

AmEx has been a continuous holding for Buffett’s company since 1991, with Berkshire sporting a cost basis in the company of about $8.49 per share. Although AmEx doesn’t increase its dividend on an annual basis like Coca-Cola, it has boosted its payout notably over time. The $2.80 per share that’s being paid out annually ($0.70 per quarter) equates to a 33% yield relative to cost for Buffett’s company.

Warren Buffett is a huge fan of financial stocks because they’re cyclical. Even though recessions are a normal part of the economic cycle, they resolve quickly. Financial stocks like AmEx are usually able to take advantage of economic expansions lasting disproportionately longer than downturns.

What’s arguably even more important for American Express is being able to take advantage of both sides of a transaction. It serves as the third-largest payment processor in the U.S. by credit card network purchase volume, which allows it to collect fees from merchants. Additionally, it generates annual fees and interest income by acting as a lender via its credit cards.

Lastly, AmEx has historically done a phenomenal job of attracting high-earning cardholders. The well-to-do are less likely to alter their spending habits, regardless of what the U.S. or global economy throw their way.

Moody’s: 34% annual yield to cost

The third high-octane stock that Warren Buffett is generating a jaw-dropping yield to cost on is ratings agency Moody’s (NYSE: MCO).

Patience is the theme of this list. Moody’s has been a pillar in Berkshire’s portfolio since being spun off from Dun & Bradstreet in 2000. Over that time, Moody’s base annual payout has grown to $3.40 per share. With Berkshire’s cost basis in Moody’s a minuscule $10.05 per share, it means Buffett’s company is netting a cool 34% yield, relative to cost.

For more than a decade, Moody’s Investors Services benefited immensely from historically low interest rates. Businesses and governments were eager to raise capital at attractive rates, which kept Moody’s ratings agency busy.

But with interest rates climbing at a rapid clip since March 2022, it’s the company’s Analytics segment that’s now driving its growth. This is the segment responsible for assessing risk management and offering compliance solutions to its customers. With a couple of predictive indicators suggesting trouble is on the horizon, such as the first meaningful decline in M2 money supply since the Great Depression and the longest yield-curve inversion in history, risk management solutions should remain a hot commodity.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,266!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,047!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $389,794!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

American Express is an advertising partner of The Ascent, a Motley Fool company. Sean Williams has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway and Moody’s. The Motley Fool has a disclosure policy.

Warren Buffett Is Generating an Annual Yield of 33% to 60% From 3 Magnificent Stocks — Here’s His Simple Secret to Outsize Yields was originally published by The Motley Fool

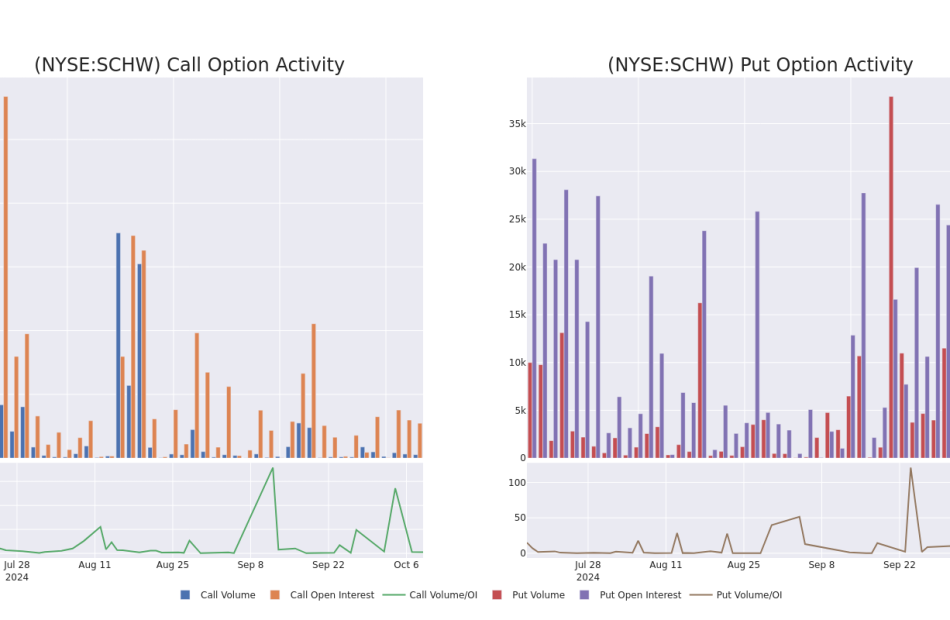

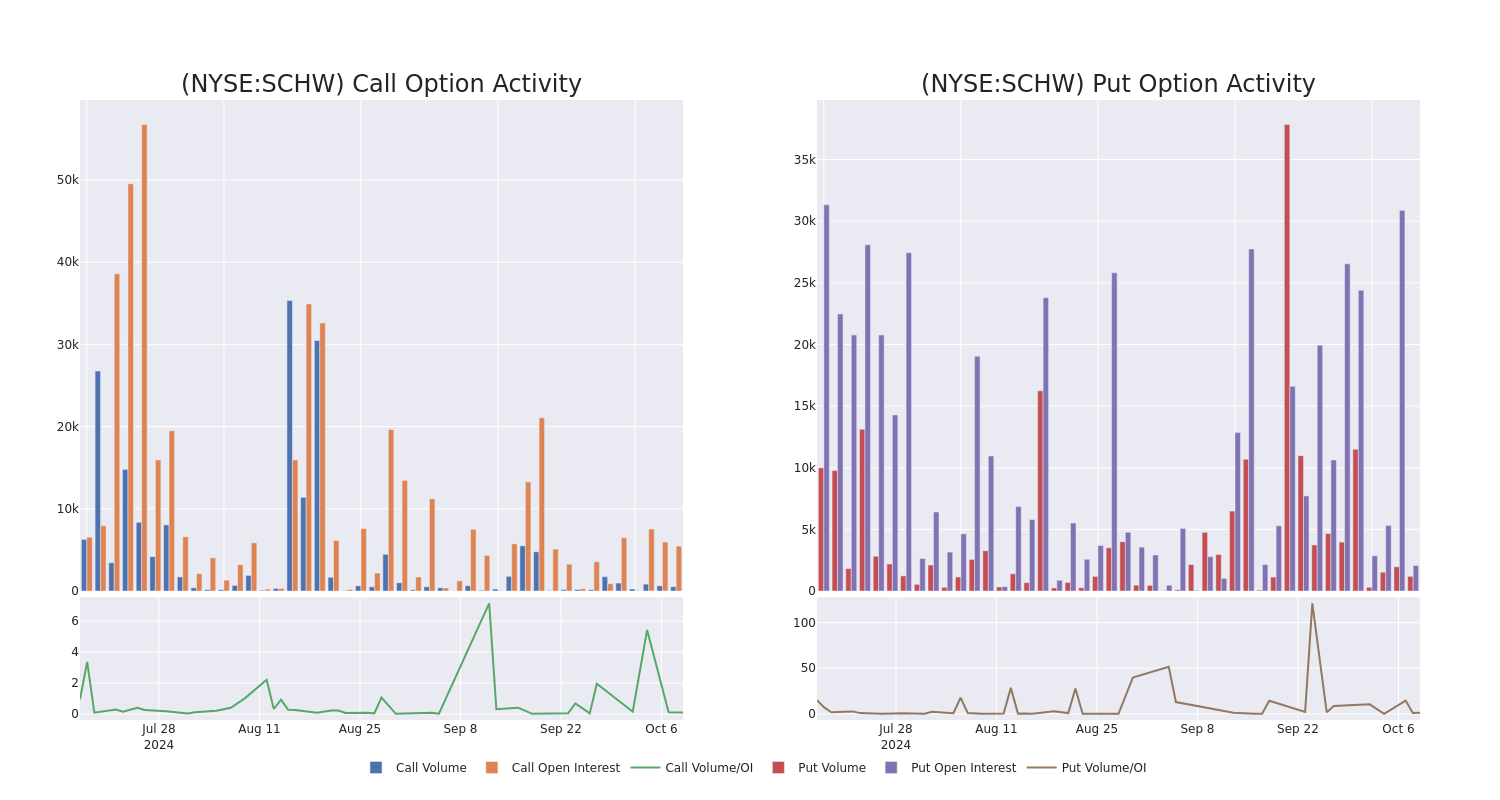

Unpacking the Latest Options Trading Trends in Charles Schwab

Investors with a lot of money to spend have taken a bullish stance on Charles Schwab SCHW.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with SCHW, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 8 uncommon options trades for Charles Schwab.

This isn’t normal.

The overall sentiment of these big-money traders is split between 62% bullish and 25%, bearish.

Out of all of the special options we uncovered, 6 are puts, for a total amount of $650,057, and 2 are calls, for a total amount of $55,036.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $50.0 to $67.5 for Charles Schwab during the past quarter.

Analyzing Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Charles Schwab’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Charles Schwab’s whale activity within a strike price range from $50.0 to $67.5 in the last 30 days.

Charles Schwab 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SCHW | PUT | SWEEP | BULLISH | 01/15/27 | $9.5 | $9.45 | $9.45 | $67.50 | $273.1K | 0 | 908 |

| SCHW | PUT | SWEEP | NEUTRAL | 01/15/27 | $9.9 | $9.55 | $9.51 | $67.50 | $141.3K | 0 | 202 |

| SCHW | PUT | SWEEP | BULLISH | 01/15/27 | $9.6 | $9.55 | $9.51 | $67.50 | $101.0K | 0 | 319 |

| SCHW | PUT | SWEEP | BULLISH | 01/15/27 | $9.6 | $9.55 | $9.55 | $67.50 | $51.5K | 0 | 373 |

| SCHW | PUT | SWEEP | BULLISH | 01/15/27 | $9.5 | $9.4 | $9.45 | $67.50 | $43.4K | 0 | 618 |

About Charles Schwab

Charles Schwab operates in brokerage, wealth management, banking, and asset management. It runs a large network of brick-and-mortar brokerage branch offices and a well-established online investing website, and it has mobile trading capabilities. It also operates a bank and a proprietary asset-management business and offers services to independent investment advisors. Schwab is among the largest firms in the investment business, with over $8 trillion of client assets at the end of December 2023. Nearly all of its revenue is from the United States.

Charles Schwab’s Current Market Status

- Trading volume stands at 2,022,582, with SCHW’s price up by 0.53%, positioned at $68.04.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 1 days.

Professional Analyst Ratings for Charles Schwab

Over the past month, 4 industry analysts have shared their insights on this stock, proposing an average target price of $70.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Morgan Stanley continues to hold a Equal-Weight rating for Charles Schwab, targeting a price of $68.

* An analyst from Jefferies has decided to maintain their Buy rating on Charles Schwab, which currently sits at a price target of $73.

* Consistent in their evaluation, an analyst from Citigroup keeps a Neutral rating on Charles Schwab with a target price of $72.

* Maintaining their stance, an analyst from Goldman Sachs continues to hold a Neutral rating for Charles Schwab, targeting a price of $67.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Charles Schwab, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Expert Finds Trump's Tax Proposal Drains Money From 95% Of Households And Funnels It To The Top 5%, Widening Wealth Gap

Former President Donald Trump’s proposed tax plan has stirred up fresh controversy. A new analysis shows that it could provide substantial tax cuts for the nation’s wealthiest while burdening the rest with tax increases by 2026.

According to a recent Institute on Taxation and Economic Policy (ITEP) report, the top 1% of earners could enjoy an average tax cut of over $36,300. In comparison, the next 4% would see cuts averaging $7,200. Meanwhile, 95% of Americans could face tax hikes ranging from $600 to $1,800, depending on their income bracket.

Don’t Miss:

Trump, who often touts his tax plan as a boon for everyday Americans, would instead disproportionately benefit the wealthiest, the ITEP analysis suggests. Steve Wamhoff, ITEP’s federal policy director and lead researcher, put it bluntly in an interview with Salon: “It does seem like there’s a whole bunch of complicated proposals here to just make the rich a little bit richer and then make everyone else worse off.”

See Also: A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

The middle 20% of American households, earning between $55,100 and $94,100, would be hit with an average tax increase of $1,530 – about 2.1% of their income, per the ITEP findings. The poorest 20% of households, those earning under $28,600, would face an average tax hike of $800, accounting for 4.8% of their income. Essentially, as family income decreases, the burden of these tax hikes increases.

Other experts, like Erica York, senior economist at the Tax Foundation, have offered a more nuanced take. She noted that Trump’s proposals often combine regressive taxes, like tariffs, with more progressively distributed income tax cuts.

Trending: Studies show 50% of consumers think Financial Advisors cost much more than they do — to debunk this, this company provides matching for free and a complimentary first call with the matched advisor.

“How each income group fares will depend on which combinations of tax and tariff ideas Trump ultimately pursues,” York told Salon in an email. She added that higher tariffs could “outweigh the benefits of the reduced taxes for lower and middle-income groups.”

Key to Trump’s tax strategy is his plan to extend most of the provisions from his 2017 tax law, which expires at the end of 2025. His new proposals include reducing the corporate tax rate from 21% to 20% or even 15% for certain U.S.-made products and eliminating overtime pay and tips taxes. Additionally, Trump has suggested a sweeping 20% tariff on all imported goods and a steeper 60% tariff on goods from China.

See Also: These five entrepreneurs are worth $223 billion – they all believe in one platform that offers a 7-9% target yield with monthly dividends

Proponents argue that Trump’s plan would boost U.S. jobs and support working-class families. “President Donald Trump passed the largest tax CUTS for working families in history,” his campaign said in a statement to Salon. However, critics warn that the tariffs would function as a federal consumption tax, disproportionately affecting low-income and middle-class families.

Read Next:

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article Expert Finds Trump’s Tax Proposal Drains Money From 95% Of Households And Funnels It To The Top 5%, Widening Wealth Gap originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

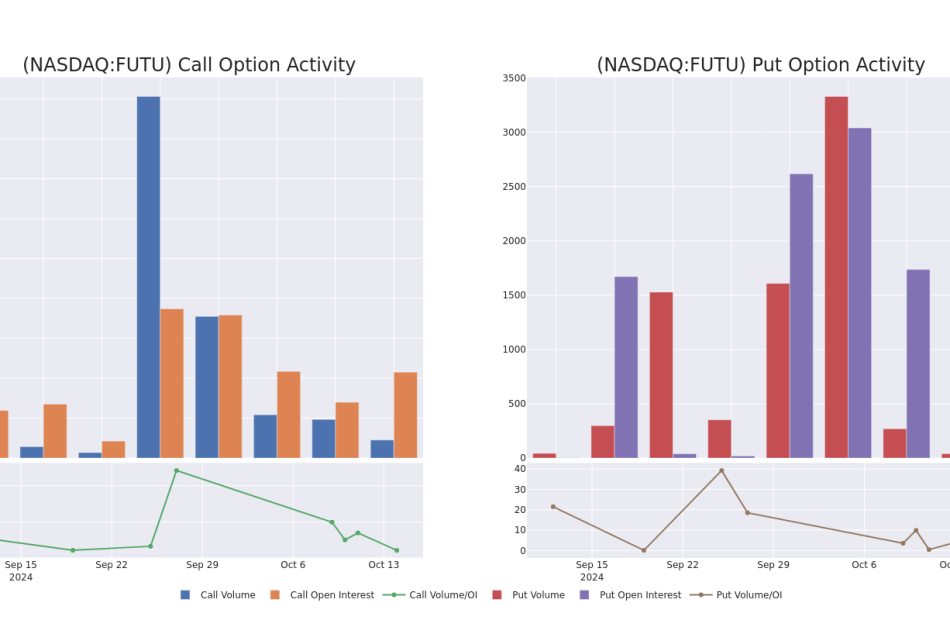

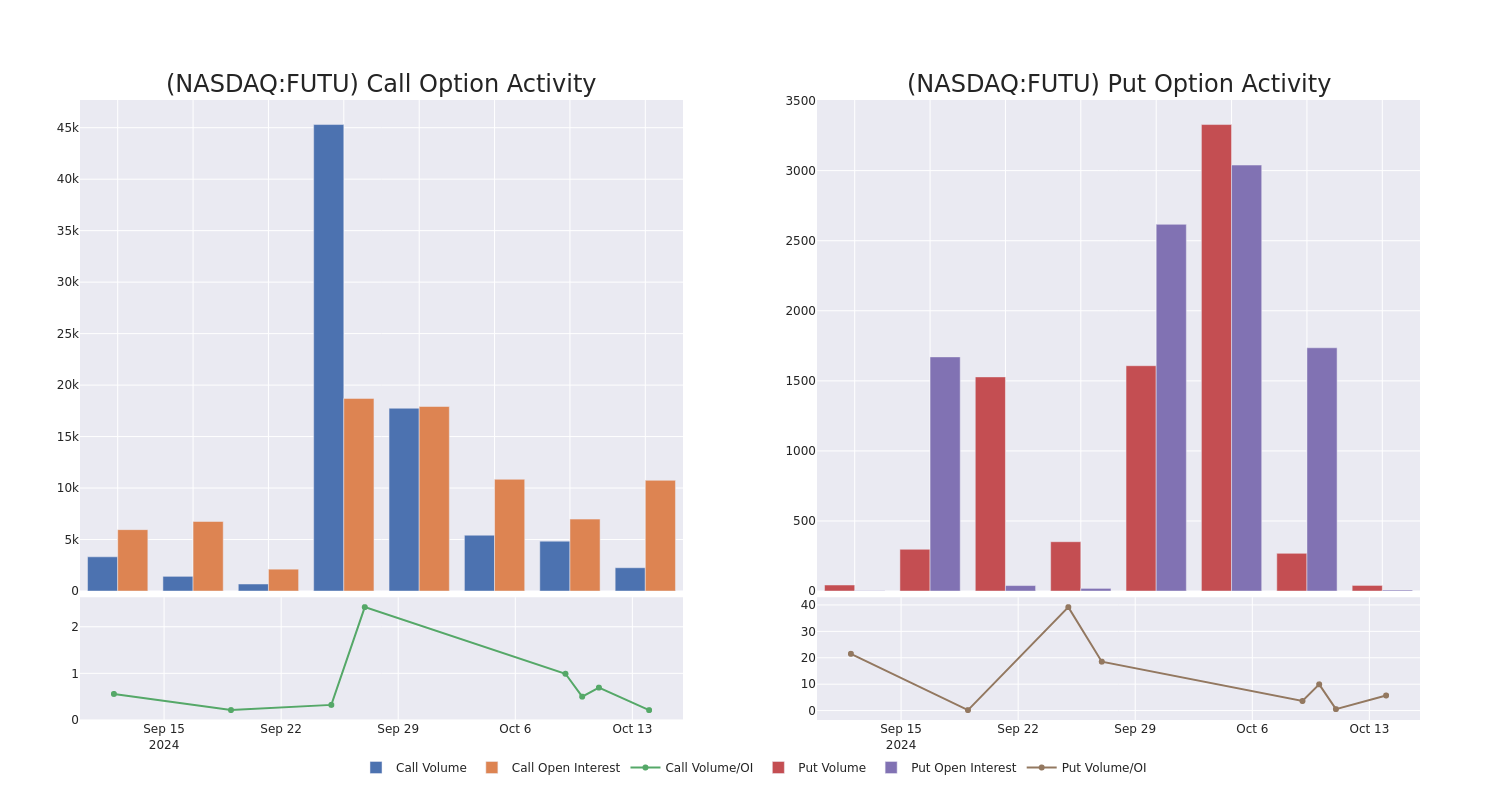

Decoding Futu Hldgs's Options Activity: What's the Big Picture?

High-rolling investors have positioned themselves bearish on Futu Hldgs FUTU, and it’s important for retail traders to take note.

This activity came to our attention today through Benzinga’s tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in FUTU often signals that someone has privileged information.

Today, Benzinga’s options scanner spotted 16 options trades for Futu Hldgs. This is not a typical pattern.

The sentiment among these major traders is split, with 43% bullish and 50% bearish. Among all the options we identified, there was one put, amounting to $41,700, and 15 calls, totaling $1,030,484.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $70.0 and $190.0 for Futu Hldgs, spanning the last three months.

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Futu Hldgs options trades today is 896.83 with a total volume of 2,304.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Futu Hldgs’s big money trades within a strike price range of $70.0 to $190.0 over the last 30 days.

Futu Hldgs Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FUTU | CALL | TRADE | BEARISH | 11/15/24 | $14.95 | $13.95 | $14.0 | $100.00 | $151.2K | 787 | 295 |

| FUTU | CALL | TRADE | BULLISH | 12/20/24 | $9.3 | $8.95 | $9.31 | $120.00 | $93.1K | 1.3K | 148 |

| FUTU | CALL | SWEEP | BULLISH | 12/20/24 | $18.0 | $17.0 | $18.0 | $100.00 | $90.0K | 1.0K | 50 |

| FUTU | CALL | TRADE | BEARISH | 01/16/26 | $31.5 | $29.4 | $29.85 | $115.00 | $89.5K | 105 | 30 |

| FUTU | CALL | SWEEP | BULLISH | 01/17/25 | $42.4 | $39.75 | $42.45 | $70.00 | $84.8K | 1.2K | 0 |

About Futu Hldgs

Futu Holdings Ltd is an online broker providing one-stop online investing services. The company provides its services through its digital platform Futu NiuNiu, which includes market data, trading service, and news feed of Hong Kong, Mainland China, Singapore, and United States equity markets. It generates its revenue in the form of brokerage commission and handling charge services.

Having examined the options trading patterns of Futu Hldgs, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Futu Hldgs

- With a trading volume of 2,438,259, the price of FUTU is down by -2.95%, reaching $107.74.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 38 days from now.

Expert Opinions on Futu Hldgs

1 market experts have recently issued ratings for this stock, with a consensus target price of $90.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from B of A Securities continues to hold a Buy rating for Futu Hldgs, targeting a price of $90.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Futu Hldgs, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.