Busbar Trunking System Market is Projected to Reach a Valuation of US$ 11,787.3 Million at a CAGR of 6.1% by 2034 | Fact.MR Report

Rockville, MD , Oct. 14, 2024 (GLOBE NEWSWIRE) — The global Busbar Tunking System Market is estimated to be US$ 6,520.2 million in 2024. The market is projected to expand at a 6.1% CAGR through 2034. The market is projected to surpass US$ 11,787.3 million by 2034.

The increased demand for dependable and efficient power distribution systems across various industries. Busbar trunking systems have been praised for their high capacity, minimal maintenance requirements, and ease of installation, making them an excellent choice for power distribution in industrial and commercial environments.

The growing use of renewable energy sources and the demand for smart grid infrastructure have all contributed to market expansion. Furthermore, the development of advanced technologies such as intelligent monitoring systems and the incorporation of IoT into busbar trunking systems has accelerated the growth of this industry. Another factor fueling the industry’s growth is an increasing focus on energy efficiency and sustainability.

The high initial cost of installing busbar trunking systems is one of the primary limitations limiting industry expansion. These systems necessitate a considerable initial investment for purchase and installation, which is predicted to be difficult for many companies and organizations, particularly those with limited resources.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=9697

Key Takeaways from the Market Study:

- North America’s busbar trunking system market is expected to grow at a CAGR of 6.3% from 2024 to 2034.

- The market is projected to register a CAGR of 6.1% in the United States over the forecast period.

- China’s busbar trunking system market is anticipated to rise at a CAGR of 6.8% through 2034.

- Based on application type, the diesel engine segment leads the market, with an expected market share of 75.7% in 2024.

“The busbar trunking system manufacturers offer a highly efficient and dependable solution to satisfy the rising demand, making it a popular option for businesses to strengthen their power infrastructure. Furthermore, the system’s ease of installation, versatility, and low maintenance requirements have boosted its popularity.” says a Fact.MR analyst.

Leading Players Driving Innovation in the Busbar Trunking System Market:

General Electric Company, Legrand, Schneider Electric SE, Rittal GmbH and Co. KG, Sati Italia S.p.A., ARJ Group, C and S Electric Limited, EAE Inc., Eaton Corporation, Siemens AG

These players are well-known for their high-quality products and exceptional customer service, which has helped them maintain a dominant market position. However, several smaller companies are gaining traction by providing more economical solutions to customers.

Busbar Trunking System Industry News:

- ABB completed the acquisition of GE Industrial Solutions in 2018. It is anticipated that this move will strengthen the company’s electrification business segment, boosting revenue in the power distribution sector and strengthening ABB’s standing in the electrification market.

- In 2021, ABB completed its acquisition of GE Industrial Solutions. This advancement is expected to strengthen the company’s electrification business segment, increasing ABB’s revenue in the power distribution industry and thereby improving the company’s position in the electrification market.

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=9697

Segmentation of Busbar Trunking System Market Research:

- By Product Type:

- Low Voltage Rated Busbar Trunking Systems (Up to 1.1kV)

- Medium Voltage Rated Busbar Trunking Systems (3kV – 40 kV)

- By Application:

- Gasoline Engines

- Diesel Engines

Checkout More Related Studies Published by Fact.MR Research:

Fire Protection System Market: The global fire protection system market is estimated to achieve a size of US$ 70.48 billion in 2024, according to a revised research report published by Fact.MR. Demand is projected to expand at a notable CAGR of 9.1% to touch a valuation of US$ 168.4 billion by 2034-end.

Land Survey Equipment System Market: The global land survey equipment system market is expected to reach a valuation of US$ 8,523.2 million in 2024 and is projected to climb to US$ 13,363.4 million by 2034, expanding at a CAGR of 4.6% during the forecast period of 2024 to 2034.

Acoustic Emission-based NDT Market: The global acoustic emission-based NDT market is estimated to generate revenue worth US$ 307.5 million in 2024 and thereafter forecasted to a reach value of US$ 477.6 million by the end of 2034. The market has been projected to rise at a 4.5% CAGR between 2024 and 2034.

Bandsaw Machine Market: Revenue from the global bandsaw machine market is projected to reach US$ 3.48 billion in 2024. The market has been forecasted to increase to a size of US$ 4.96 billion by the end of 2034, expanding at a CAGR of 3.6% over the next ten years.

Construction Equipment Rental Market: Revenue from the global construction equipment rental market is estimated to reach US$ 131.2 billion in 2024. The market has been projected to climb to a value of US$ 201.81 billion by the end of 2034, expanding at a CAGR of 4.4% between 2024 and 2034.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay ahead in the competitive landscape.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Johnson & Johnson Preps For Q3 Earnings As MedTech Expands, But Stock Sends Mixed Signals

Johnson & Johnson JNJ is set to announce its third quarter earnings on Oct. 15 before the market opens. Wall Street is expecting the pharmaceutical and healthcare giant to post earnings per share (EPS) of $2.21 and revenue of $22.16 billion.

But while J&J’s numbers are in focus, recent headlines about its MedTech acquisitions and drug trial halts are stealing the spotlight.

MedTech Grows, Drug Trials Stumble

Johnson & Johnson recently completed its acquisition of V-Wave, adding a minimally invasive cardiovascular treatment to its MedTech portfolio. The Ventura Interatrial Shunt is expected to strengthen J&J’s position in tackling heart failure, but the acquisition comes with a short-term cost. The company has warned that this move will dilute adjusted EPS by around 24 cents in 2024 and 6 cents in 2025, an update they’ll likely address in Tuesday’s earnings report.

On the flip side, the company had to discontinue its Phase 3 SunRISe-2 trial, which was investigating a treatment for muscle-invasive bladder cancer. The trial didn’t show superiority over chemoradiation, leading to its early termination, though J&J remains optimistic about the future of its TARIS platform, forecasting a $5 billion potential.

The Charts Are Sending Mixed Signals

Despite some positive news in the MedTech arena, Johnson & Johnson’s stock has had a relatively stagnant year, up just 0.93% year-to-date and only 2.49% over the past year. But in the past six months, the stock has seen a 9.40% rise, reflecting a slow but steady recovery.

Chart created using Benzinga Pro

At its current price of $161.46, JNJ stock is just above its eight-day simple moving average of $160.48, a positive sign. However, the stock is lagging behind its 20-day and 50-day simple moving averages, sitting at $162.32 and $162.53, respectively. This signals some underlying selling pressure that may persist in the near term.

Read Also: What Analysts Are Saying About Johnson & Johnson Stock

Chart created using Benzinga Pro

The Moving Average Convergence/Divergence (MACD) indicator at a negative 0.72 leans toward bearishness, hinting at continued downward pressure. Meanwhile, JNJ stock’s Relative Strength Index (RSI) of 47.83 suggests the stock is in neutral territory.

The Bollinger Bands show a range between $157.98 and $168.05, with JNJ stock nestled in the lower bearish band. This positioning could suggest that the stock is poised for a bounce, but given the selling pressure, caution is warranted.

Can Q3 Earnings Change The Tune?

All eyes will be on J&J’s third-quarter earnings report. Investors are particularly interested in any updates to the company’s guidance following the V-Wave acquisition and the ongoing performance of its MedTech and Innovative Medicine segments.

Johnson & Johnson’s charts may not be flashing strong bullish signals, but its strategic moves in MedTech and future product pipeline could offer long-term growth potential.

Investors will have to weigh the upcoming earnings report to see if J&J stock can shake off recent pressures and revitalize its performance.

Read Next:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 No-Brainer Stocks to Buy If Kamala Harris and Democrats Sweep in November

Vice President Kamala Harris has a slight edge in becoming the next president, according to Decision Desk HQ’s model. The Democratic Party could have a tougher time gaining control of Congress, though. Decision Desk HQ estimates that the GOP has a 54% probability of holding onto its majority in the House and a 71% chance of recapturing a majority in the Senate.

Still, it’s possible that momentum could swing toward the Democrats in the final weeks of the campaign. How might investors take advantage of such a scenario? Here are three no-brainer stocks to buy if Harris and Democrats sweep in November.

1. D.R. Horton

D.R. Horton (NYSE: DHI) would likely be among the biggest winners if Harris wins and Democrats control Congress in the upcoming elections. The company has been the largest U.S. homebuilder by volume since 2002. It operates in 121 markets across 33 states.

Harris has proposed a plan that she says will promote the construction of 3 million new homes over the next four years. She wants to give $25,000 to first-time homebuyers to help them with down payments. The Democratic presidential nominee also seeks to provide a tax incentive for homebuilders who sell homes to first-time homebuyers. Both proposals would almost certainly boost D.R. Horton’s revenue.

Another key reason many D.R. Horton shareholders might cheer a Democratic sweep is inflation. A survey of nearly 40 top U.S. economists by the Financial Times and the University of Chicago found that 70% believed Harris’ policies would lead to lower inflation than those proposed by former President Donald Trump. Lower inflation translates to lower interest rates — an important ingredient to D.R. Horton’s success.

Regardless of which party is in control after the elections, though, D.R. Horton should be in great shape over the long run. The U.S. continues to face a housing shortage. And there’s only one practical solution to the problem: Building more homes.

2. Brookfield Renewable

Democrats have been vocal supporters of renewable energy for years. Harris is no exception. She promises to “invest in building the energy industries of the future.” The Vice President also wants to cut red tape to allow clean energy projects to be completed quickly. Brookfield Renewable (NYSE: BEP) (NYSE: BEPC) could be a beneficiary of these policies.

Harris seeks to protect the energy security of the U.S. and keep the country from having to rely on foreign oil. While domestic production of oil and natural gas will be needed to achieve this goal, renewable power will be increasingly important.

Brookfield Renewable is one of the largest producers of clean energy with hydroelectric, wind, and solar facilities across the world. The company currently has an operating capacity of around 37 gigawatts, twice as much as it had in 2020. Its development capacity is roughly 200 gigawatts.

Two other factors should help Brookfield Renewable even if Democrats don’t win across the board in November. First, renewable power is already the lowest-cost energy alternative. Second, the demand for electricity is growing rapidly, especially with the surging number of data centers.

3. UnitedHealth Group

Harris has committed to making permanent the tax credits available to working and middle-class families purchasing health insurance on the Affordable Care Act (ACA) marketplace if elected president. She wants to accelerate the speed of Medicare drug price negotiations.

Both proposals should help companies that offer health plans on the marketplace and Medicare Part D prescription drug plans. UnitedHealth Group (NYSE: UNH) is the biggest health insurer in the group.

UnitedHealth Group offers individual and family health plans on ACA health insurance marketplaces in 26 states. Last year, the company enrolled 10.2 million people in Medicare Part D plans, including stand-alone plans and Medicare Advantage plans.

There’s a bigger tailwind, though, that should be more important to UnitedHealth Group over the long term than which party is in power in Washington, D.C.: an aging population. The number of Medicare enrollees is projected to soar by 2030 as baby boomers retire. Look for Medicare Advantage to become an even more important part of UnitedHealth’s business in the coming years.

Should you invest $1,000 in UnitedHealth Group right now?

Before you buy stock in UnitedHealth Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and UnitedHealth Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,069!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

Keith Speights has positions in Brookfield Renewable and Brookfield Renewable Partners. The Motley Fool has positions in and recommends Brookfield Renewable and D.R. Horton. The Motley Fool recommends Brookfield Renewable Partners and UnitedHealth Group. The Motley Fool has a disclosure policy.

3 No-Brainer Stocks to Buy If Kamala Harris and Democrats Sweep in November was originally published by The Motley Fool

IBM Investigates Allegations of Executive Misconduct in China

(Bloomberg) — International Business Machines Corp. is looking into allegations against its China head after a letter circulating online accused the executive of misconduct, including accepting gifts from business partners, the latest upheaval in the US firm’s operations in the Asian country.

Most Read from Bloomberg

A former employee said in a letter to the US company that Chairman Chen Xudong of IBM’s Greater China Group received gift vouchers and cash equivalents from external partners, leaked classified company information to others and violated the company’s expense policies by taking his staff to karaoke bars, several Chinese outlets including the influential business publication Jiemian reported on Monday.

A IBM spokesperson confirmed the existence of the letter and said the company is looking into it.

“IBM takes seriously and thoroughly investigates any alleged behavior that might have violated our business conduct guidelines. We do not discuss individual employee circumstances and remain focused on serving our clients across greater China,” the spokesperson said.

When contacted by a Bloomberg News reporter via WeChat, China’s equivalent of Whatsapp, Chen declined to comment and referred questions to IBM’s communications team.

In August, Bloomberg News reported that IBM was shutting down a hardware research team in China in part due to geopolitical tensions between Washington and Beijing.

–With assistance from Jessica Sui.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Nasdaq, S&P 500 Futures Rise Solidly Ahead Of Q3 Earnings Season, Boeing Drags Dow: This Strategist Sees 'A Lot Of Firepower' Supporting Market After Election

U.S. stocks could get off to a mixed start on Monday after the averages posted weekly gains for a fifth straight week. The bond market is closed on account of Columbus Day, which is a federal holiday, but the stock market will trade during usual hours. The majority opinion among strategists hints at a potential pause in stock rally over the next couple of weeks before resuming in the final two months of the year.

That said, earning news flow will pick up momentum in the coming days, potentially cushioning any downside. Cumulative earnings of S&P 500 companies are set to rise for a fifth straight quarter, FactSet said. This, though, would mark a slowdown from the 11.2% growth reported for the second quarter.

On Monday, traders could focus on a couple of Fed speeches and a consumer inflation expectations survey as well as the bond yield even as they look ahead to some key earnings reports over the week.

| Futures | Performance (+/-) |

| Nasdaq 100 | +0.35% |

| S&P 500 | +0.23% |

| Dow | -0.06% |

| R2K | +0.36% |

In premarket trading on Monday, the SPDR S&P 500 ETF Trust SPY added 0.19% to $580.68 and the Invesco QQQ ETF QQQ moved up 0.33% to $495.07, according to Benzinga Pro data.

Cues From Last Week:

Despite the consumer price inflation data throwing investors off guard, the market had enough momentum to keep the rally going in the week ended Oct. 11. A rise in bond yields following some recent strong data and the Hurricane Milton threat also exerted downward pressure on the market, but a benign producer price inflation report and a good start to big bank earnings provided the offsetting impact.

The Dow Jones Industrial Average and the S&P 500 Index ended at fresh intraday and closing highs, while the Nasdaq Composite slowly progressed toward its previous closing high of 18,509.34 hit on July 16.

| Index | Week’s Performance (+/) |

Value |

| Nasdaq Composite | +1.13% | 18,342.94 |

| S&P 500 Index | +1.11% | 5,815.03 |

| Dow Industrials | +1.21% | 42,863.86 |

| Russell 2000 | +0.98% | 2,188.42 |

Insights From Analysts:

Yardeni Research reiterated its call for the S&P 500 to hit 8,000 by 2030 under its “Roaring 2020s” scenario. The index will be supported on its way higher by earnings rather than rising valuation multiples, the firm said. The comments came in the aftermath of the second anniversary of the bull market that began on Oct. 12, 2022.

The period was marked by widespread fears of a recession due to monetary policy tightening, the firm said. “Those fears lingered through October 4 of this year, when a stronger-than-expected employment report once again confirmed that the young bull correctly discounted that inflation would fall while the economy remained resilient,” it said.

Since Oct. 12, 2022, all the major stock market indices are up at least 20%, with the S&P 500 up 62.6%, Yardeni Research said. The S&P 500’s performance is par for the course compared to the previous eight bull markets, it added.

As the momentum remains firmly to the upside, Fund Strat Head of Research Tom Lee said his firm has advised clients to remain cautious but at the same time buy the dips. In an interview with CNBC on Friday, the strategist said investors want to see who ends up president. “We are in a period where the market is sitting on the sidelines,” he said.

At the same time, 2024 has been such a strong year, he said, adding that the last two weeks have proved that macro is taking a step back now, and liquidity and cash on the sidelines are becoming the dominant factor, Lee said. “There is a lot of firepower supporting stocks post election,” he said.

The Fed is dovish, the economy looks healthy, and therefore the three- and six-month outlook is very strong for stocks, he added.

See Also: How To Trade Futures

Upcoming Economic Data

This week’s economic calendar is dominated by Fed speeches, the September retail sales report and a few manufacturing and housing market data. The New York and Philadelphia Feds will release the results of their respective October manufacturing surveys and the Fed is due to announce its September industrial production data. Among the housing data due this week are the National Association of Home Builders housing market index for October and the Commerce Department’s housing starts report for September.

- On Monday, Minneapolis Fed President Neel Kashkari will make public appearances at 9 am EDT and 5 pm EDT.

- The New York Fed is due to release the results of its survey of consumer expectations for September at 11 a.m. EDT. In August, the one- and five-year ahead inflation expectations remained unchanged at 3% and 2.8%, respectively.

- Federal Reserve Governor Christopher Waller is scheduled to speak at 3 p.m.

Stocks In Focus:

- Tesla, Inc. TSLA climbed 1.80% in premarket trading after Friday’s nearly 9% slump.

- Sirius XM Holdings Inc. SIRI climbed nearly 6% after Berkshire Hathaway, Inc. (NYSE; BRK-A) BRK boosted its stake in the company.

- Boeing Co. BA fell over 1.70% after the company announced the elimination of 10% of its workforce.

- Bitcoin’s BTC/USD rally past $64K sent crypto-linked stocks such as MicroStrategy, Inc. MSTR and Coinbase Global, Inc. COIN higher.

Commodities, Bonds And Global Equity Markets:

Crude oil futures tumbled in the early New York session, losing nearly 2.75% as traders turned jittery after the release of weak China data. Gold futures were little changed.

The 10-year Treasury note yield rose marginally to 4.096%.

Most major Asian markets ended higher on Monday, led by the Chinese market. The New Zealand and Hong Kong markets pulled back while the Japanese market was closed for a public holiday.

European stocks showed tentativeness and were mostly lower in early trading.

Read Next:

Image Via Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

EXCLUSIVE: How To Raise Capital In Cannabis – A Guide To Debt And Equity For Avoiding Pitfalls That Sink Most Startups

When your cannabis business needs cash, where do you turn? Should you give up some control for investors or borrow money and risk debt? At the Benzinga Cannabis Capital Conference in Chicago, experts tackled these tough decisions. The panel, “Cannabis Financing 101,” offered practical advice for businesses at every stage.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. You can’t afford to miss out if you’re serious about the business.

Sources Of Funding For Cannabis Startups

Moderated by Marc Claybon, principal-tax at Crowe, the session featured Tayyaba Khan, partner at Cassels; Adam Stettner, CEO of FundCanna; Anthony Coniglio. CEO of NewLake Capital Partners NLCP and Charles Alovisetti, partner at Vicente LLP. They shared essential tips on navigating debt, equity and liquidity in today’s cannabis market.

“For newer companies, friends and family funding is often the only option,” Alovisetti said, pointing out that more established businesses can tap into broader sources such as state grants, social equity programs, or hard money lenders. However, he added, “Not every business is a good candidate for debt. You have to consider cash flow and collateral.”

While startups may struggle to secure traditional financing, larger, more established cannabis operators may have access to sale-leaseback agreements or other forms of asset-backed lending.

Equity Vs. Debt: What Works For Your Business?

Khan detailed the pros and cons of equity versus debt financing. Equity financing offers flexibility, as businesses do not have to repay funds immediately, but it comes at the cost of ownership. “You’re giving up a piece of your company, and investors will likely want a say in decision-making,” she explained.

Debt, on the other hand, allows companies to retain ownership but comes with repayment obligations. “Debt is cheaper capital than equity,” Khan said but warned that companies need to carefully manage their cash flow to meet repayment schedules. Interest payments may offer tax deductions, but missing debt payments can lead to default or loss of assets.

Read Also: Budtenders Letting You Down? Meet The Weed Bot That Actually Knows What You Want

Debt Can’t Wait: Tackling The AR Dilemma

A recurring challenge in the cannabis industry is the management of accounts receivable (AR). Stettner highlighted this issue. “The one thing that we’re universally dealing with is delinquent AR. It doesn’t matter where you are in the supply chain—it’s an issue.”

The mismatch between payment terms and revenue cycles exacerbates the problem. “It’s very hard as a purchaser to make payment on goods when you don’t have revenue from the goods you’ve purchased,” Stettner said. He urged businesses to ensure that their debt repayment schedules align with revenue cycles. “Debt is not a four-letter word,” he joked, noting that even companies like Apple and Google use leverage for growth. “It’s about doing it right.”

Real Estate: Lease, Own Or Sale-Leaseback?

Real estate is a critical issue for cannabis businesses and the complexities are magnified by the disconnect between federal and state laws. Coniglio pointed out that most landlords with federally-backed mortgages are prohibited from leasing to cannabis companies, creating a significant barrier. “This forces many operators to buy properties outright, tying up capital that could be used elsewhere,” he said.

Cannabis businesses have several options when dealing with real estate challenges.

Some choose to buy and then finance their property through banks, though this often comes at a “haircut to the non-cannabis value,” as Coniglio described it. Others turn to specialized lending or sale-leaseback agreements.

In a sale-leaseback, companies sell their property to a real estate investment trust (REIT) or another buyer, then lease it back under a long-term agreement. This allows them to unlock the capital tied up in real estate while continuing operations.

Coniglio explained that each option has its pros and cons, and businesses need to assess their long-term strategies. “Real estate is a core part of any cannabis business, and companies need to explore all their options carefully,” he concluded.

Read Also: It’s Your Constitutional Right: How You Can Break The Senate’s Block On Cannabis Legalization

Cash Flow: The Lifeblood of Cannabis Finance

Throughout the discussion, the panelists repeatedly stressed the importance of cash flow. “Cash flow is the most critical part of this whole conversation,” Coniglio said. Whether pursuing debt or equity financing, investors will always examine a company’s cash flow to determine its ability to repay loans or generate returns.

Stettner agreed, warning that businesses must focus on realistic cash flow projections. “Nobody is going to lend you money if they don’t see how you’ll pay it back,” he said.

Read Next: EXCLUSIVE: Inside The Amazon Of Weed, Helping 400 Cannabis Brands Save And Grow In Regulatory Maze

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

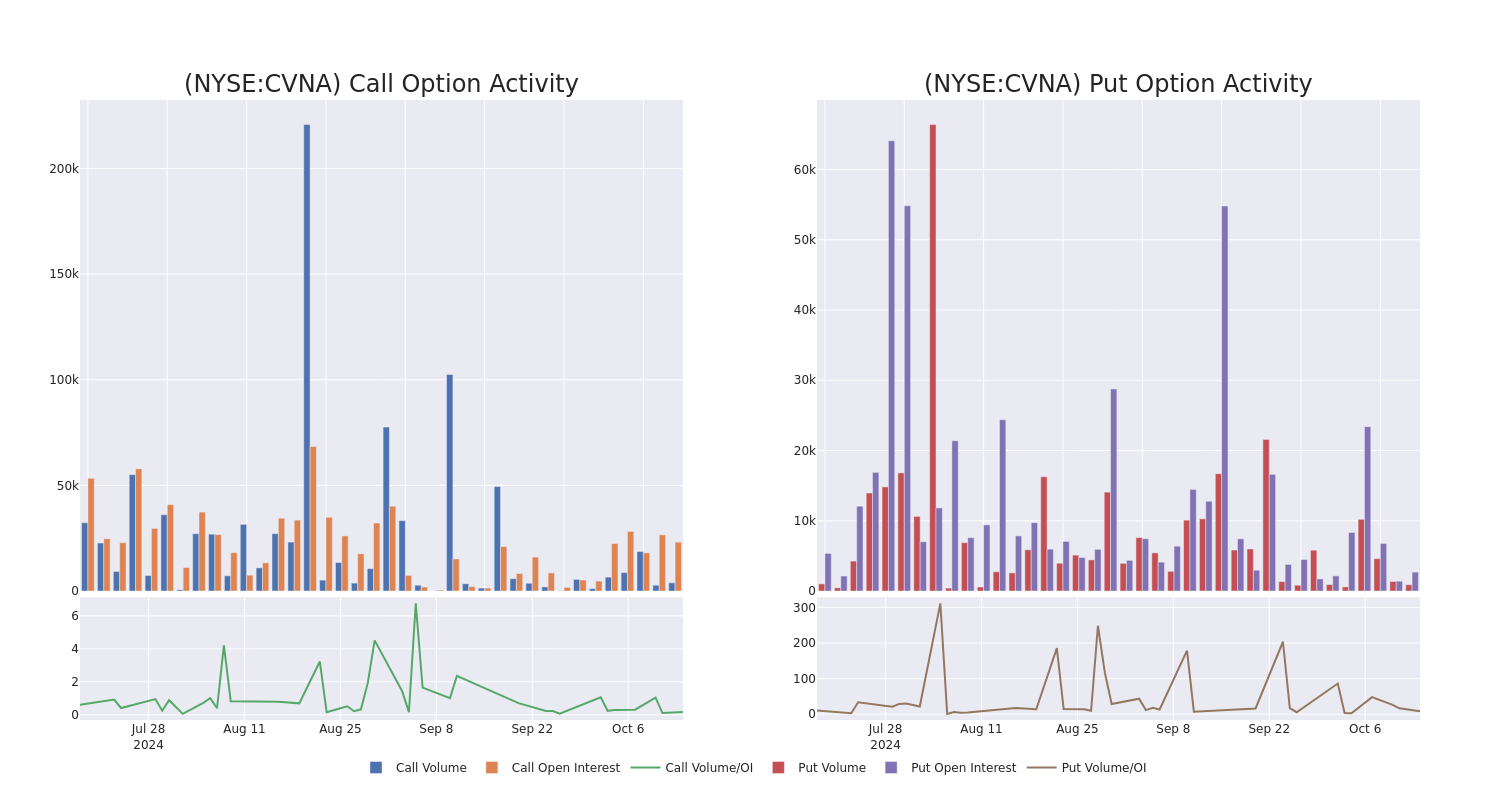

Carvana Unusual Options Activity

Investors with a lot of money to spend have taken a bearish stance on Carvana CVNA.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with CVNA, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 34 uncommon options trades for Carvana.

This isn’t normal.

The overall sentiment of these big-money traders is split between 35% bullish and 55%, bearish.

Out of all of the special options we uncovered, 15 are puts, for a total amount of $1,078,765, and 19 are calls, for a total amount of $3,704,445.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $50.0 and $270.0 for Carvana, spanning the last three months.

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Carvana’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Carvana’s substantial trades, within a strike price spectrum from $50.0 to $270.0 over the preceding 30 days.

Carvana 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CVNA | CALL | TRADE | BULLISH | 01/17/25 | $47.85 | $47.35 | $47.85 | $155.00 | $952.2K | 11.6K | 400 |

| CVNA | CALL | SWEEP | BEARISH | 01/17/25 | $48.05 | $47.05 | $47.05 | $155.00 | $941.0K | 11.6K | 800 |

| CVNA | CALL | TRADE | BULLISH | 01/17/25 | $44.25 | $43.75 | $44.25 | $160.00 | $854.0K | 5.3K | 400 |

| CVNA | PUT | SWEEP | BEARISH | 11/15/24 | $11.55 | $11.35 | $11.55 | $180.00 | $205.5K | 329 | 199 |

| CVNA | CALL | SWEEP | BULLISH | 01/17/25 | $46.6 | $46.05 | $46.6 | $155.00 | $163.1K | 11.6K | 1.2K |

About Carvana

Carvana Co is an e-commerce platform for buying and selling used cars. The company derives revenue from used vehicle sales, wholesale vehicle sales and other sales and revenues. The other sales and revenues include sales of loans originated and sold in securitization transactions or to financing partners, commissions received on VSCs and sales of GAP waiver coverage. The foundation of the business is retail vehicle unit sales. This drives the majority of the revenue and allows the company to capture additional revenue streams associated with financing, VSCs, auto insurance and GAP waiver coverage, as well as trade-in vehicles.

In light of the recent options history for Carvana, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Carvana

- With a volume of 802,040, the price of CVNA is up 0.18% at $192.59.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 16 days.

Professional Analyst Ratings for Carvana

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $191.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from B of A Securities downgraded its action to Buy with a price target of $185.

* Consistent in their evaluation, an analyst from JP Morgan keeps a Overweight rating on Carvana with a target price of $230.

* An analyst from Wedbush has decided to maintain their Neutral rating on Carvana, which currently sits at a price target of $175.

* An analyst from B of A Securities persists with their Buy rating on Carvana, maintaining a target price of $210.

* Maintaining their stance, an analyst from Evercore ISI Group continues to hold a In-Line rating for Carvana, targeting a price of $157.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Carvana options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.