A Look at Interactive Brokers Gr's Upcoming Earnings Report

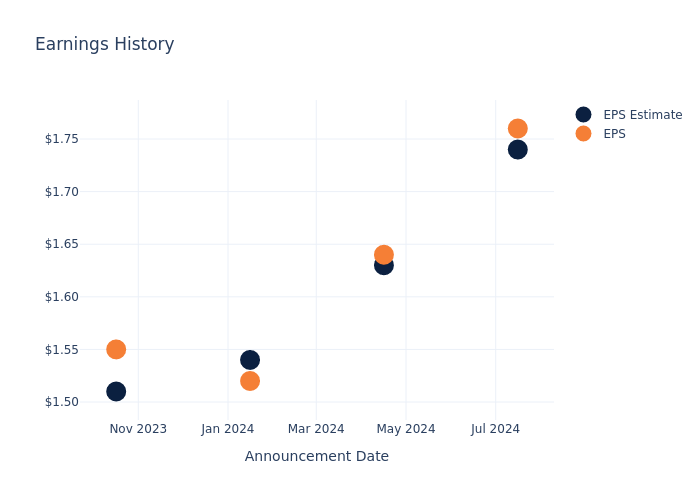

Interactive Brokers Gr IBKR is gearing up to announce its quarterly earnings on Tuesday, 2024-10-15. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that Interactive Brokers Gr will report an earnings per share (EPS) of $1.76.

Interactive Brokers Gr bulls will hope to hear the company announce they’ve not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

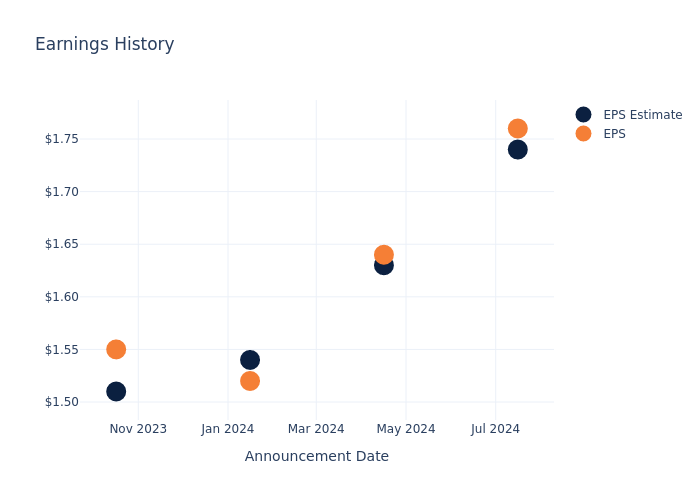

Historical Earnings Performance

During the last quarter, the company reported an EPS beat by $0.02, leading to a 0.23% drop in the share price on the subsequent day.

Here’s a look at Interactive Brokers Gr’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 1.74 | 1.63 | 1.54 | 1.51 |

| EPS Actual | 1.76 | 1.64 | 1.52 | 1.55 |

| Price Change % | -0.0% | 2.0% | 2.0% | -4.0% |

Tracking Interactive Brokers Gr’s Stock Performance

Shares of Interactive Brokers Gr were trading at $151.14 as of October 11. Over the last 52-week period, shares are up 75.03%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for Interactive Brokers Gr visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Where Will Artificial Intelligence (AI) Leader Nvidia Be in 5 Years?

Chip and data center specialist Nvidia (NASDAQ: NVDA) has emerged as the king of the artificial intelligence (AI) realm. Quarter after quarter, the company continues to defy expectations, set revenue and profit records, and provide investors with a laundry list of such good news that it’s hard to keep track of it all.

If you’ve held Nvidia stock at any point during the last two years, congratulations. You’ve probably made a lot of money.

But as I often express in my pieces, investors need to think long term. Can Nvidia’s rocket ship keep climbing higher?

Below, I’ll outline catalysts and risk factors facing Nvidia. Moreover, I’ll detail how I think these points can impact the stock and assess how Nvidia shares may hold up over the next five years.

The next couple of years look great, but…

One of Nvidia’s best-selling products at the moment is its H100 graphics processing unit (GPU). Meta Platforms CEO Mark Zuckerberg and Tesla CEO Elon Musk have both specifically referenced the importance of the H100 technology for their respective businesses’ generative AI development.

Yet, despite the unrelenting demand for the H100, Nvidia is already on the brink of a successor chipset. The company’s new Blackwell GPUs are set to launch later this year, and both Wall Street and Nvidia’s own management are forecasting billions of additional dollars in sales by the end of the year.

Furthermore, continued heavy spending on capital expenditures (capex) from the likes of Meta, Tesla, Microsoft, Amazon, and Alphabet should serve as a nice tailwind for Nvidia’s compute and networking business.

With all that in mind, Nvidia stock could be poised to see further gains over the next couple of years once Blackwell really hits its stride.

The longer-term picture is cloudy

One important detail to call out regarding more capex spending from big tech is that not all of this will be allocated toward Nvidia’s products. Rather, each of the “Magnificent Seven” members highlighted above is working on their own in-house custom chip designs. In other words, Nvidia’s own customers are looking to compete with the company and move away from a sweeping overreliance on its IT infrastructure.

Such a dynamic will likely be a headwind for Nvidia in terms of its pricing power. I suspect lower prices for Nvidia’s GPUs will begin eating away at its revenue growth and gross profit margins. As revenue growth begins to normalize and margins start to shrink, Nvidia’s profitability profile will tighten.

As a result, rising competition could be the catalyst that ultimately leads to a plateau across Nvidia’s entire business. For these reasons, I think the stock has a good chance of selling off in the long run.

The bottom line

I’d like to make one thing abundantly clear: Nvidia stock likely has a solid runway ahead. However, as I’ve expressed before, I think timing will become a more important factor when assessing whether or not to buy or sell Nvidia shares.

In other words, I do not think Nvidia stock will gain another 2,800% over the next five years. While the stock will go up at times, it’s highly unlikely that shares will soar upwards in a straight line and experience minimal sell-offs.

Candidly, I think these dynamics have been at the center of Nvidia’s selling activity from several high-profile billionaires lately.

Will Blackwell and whatever else Nvidia releases over the next five years be successful products? Probably. But will they be so successful that Nvidia will remain the king of the AI realm, with the rest of the tech world lucky just to get their hands on the company’s products? In my opinion, I don’t think that will be the case.

For these reasons, I think Nvidia’s valuation will normalize over the next five years, and the stock may very well underperform its peers and the technology sector at large. I think there are more compelling opportunities in the chip industry and AI space more broadly. I would think long and hard before doubling down on a position in Nvidia over the next several years.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,266!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,047!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $389,794!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Where Will Artificial Intelligence (AI) Leader Nvidia Be in 5 Years? was originally published by The Motley Fool

Waste to Energy Market Predicted to Grow at a CAGR of 7.5% by 2031, Report by SkyQuest Technology

Westford, USA, Oct. 14, 2024 (GLOBE NEWSWIRE) — SkyQuest projects that the Global Waste to Energy Market will reach a value of USD 73.83 Billion by 2031, with a CAGR of 7.5% during the forecast period (2024-2031). The rising energy requirements from the end-use sector, on the other hand, combined with favorable regulatory policies that support effective waste management and power production, is predicted to be the biggest driver of market growth in the next available years. As conventional energy resources are being depleted at a rather alarming rate, governments are shifting their priorities toward commercializing alternative sources of energy, including Waste-to-Energy (WTE) technologies. Moreover, this industry is undergoing growth spurts due to the introduction of environmental regulations related to reduction of carbon emissions through the use of fossil fuels.

Request Sample of the Report – https://www.skyquestt.com/sample-request/waste-to-energy-market

Browse in-depth TOC on the “Waste to Energy Market Report”, Pages – 182, Tables – 63, Figures – 75

Waste to Energy Market Overview:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 41.40 Billion |

| Estimated Value by 2031 | USD 73.83 Billion |

| Growth Rate | Poised to grow at a CAGR of 7.5 % |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Technology, Waste Type, Region |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa |

| Report Highlights | Innovations in Waste to Energy Market |

| Key Market Opportunities | Funding and Incentives |

| Key Market Drivers | Rising Waste Generation |

Thermal Conversion Simplifying Waste Management for Modern Cities

In the waste-to-energy, the thermal category has the highest share of sales. The mode of incineration is one of the thermal techniques that has seen a huge rise in overall market revenues and is largely responsible for this domination. For waste-to-energy projects, they are very attractive because thermal conversion methods are very simple and easy to apply. Thermal treatment also provides contemporary cities with an environmentally friendly response. This does it because it significantly reduces the volume of trash, lowers the amount of greenhouse gases emitted, and totally burns the gases emitted by garbage.

Agricultural Waste Fueling Future of Waste-to-Energy

Agricultural waste accounts for the greatest market share in the waste to energy market because huge gasification and pyrolysis processes are used. Global agricultural output is predicted to increase in the market because of increased crop residues, manure, and silt waste. These processes eliminate problems concerning waste management, as it makes organic waste turn into energy. This could be further complemented with agricultural by-products containing pesticides and herbicides to enhance this potential as a reliable feedstock in the WtE landscape.

Get Customized Reports with your Requirements, Free – https://www.skyquestt.com/speak-with-analyst/waste-to-energy-market

Government Initiatives Propel Waste to Energy Growth in Asia-Pacific

Due to rising economic activities and subsequent waste generation, Asia Pacific has become the largest market leader. Furthermore, numerous governments are encouraging the construction of WtE plants, and thus, Asia-Pacific is expected to capture the largest share during the forecast period. For instance, Japan has been one of the leading countries in the Asia-Pacific market along with others. Japan’s success in converting waste to energy is driven by its highly efficient solid waste management system. Additionally, strong financial support from both national and local governments fuels projects ranging from small to large scale. Also, the nation aims at putting up the latest technologies to recycle all types of waste or garbage to turn them properly into resources while protecting the environment.

Waste to Energy Market Insights

Drivers

- Rising Waste Generation

- Sustainability Goals

- Growing Energy Demand

Restraints

- High Initial Capital Costs

- Competition from Other Energy Sources

- Technical Limitations

Key Players Operating in the Waste to Energy Market

- A2A S.p.A.

- Fortum Corporation

- HZI

- KBR, Inc.

- Nippon Steel Engineering Co., Ltd.

- RWE AG

- E.ON SE

- Hitachi Zosen Inova

- TOMRA Systems ASA

- Waste Management, Inc.

Is this report aligned with your requirements? Interested in making a Purchase – https://www.skyquestt.com/buy-now/waste-to-energy-market

Key Questions Covered in the Waste to Energy Market Report

- What are the factors driving the growth of the global market?

- Which is the dominant region within the market?

- What are the major players operating within the market?

This report provides the following insights:

- Analysis of key drivers (rising waste generation, increasing energy demand), restraints (high initial capital costs, competition with other energy sources), opportunities (innovative business models, technical innovations), and challenges (infrastructure need, waste composition variability) influencing the growth of the waste to energy market.

- Market Penetration: Comprehensive information on the product portfolios offered by the top players in the market.

- Product Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and product launches in the waste to energy market.

- Market Development: Comprehensive information on lucrative emerging regions.

- Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the market.

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and products of the leading market players.

Related Reports:

Gas Turbine Market : Global Opportunity Analysis and Forecast, 2024-2031

Diesel Generator Market : Global Opportunity Analysis and Forecast, 2024-2031

LNG Bunkering Market : Global Opportunity Analysis and Forecast, 2024-2031

Power Rental Market: Global Opportunity Analysis and Forecast, 2024-2031

Natural Gas Storage Market: Global Opportunity Analysis and Forecast, 2024-2031

About Us:

SkyQuest is an IP focused Research and Investment Bank and Accelerator of Technology and assets. We provide access to technologies, markets and finance across sectors viz. Life Sciences, CleanTech, AgriTech, NanoTech and Information & Communication Technology.

We work closely with innovators, inventors, innovation seekers, entrepreneurs, companies and investors alike in leveraging external sources of R&D. Moreover, we help them in optimizing the economic potential of their intellectual assets. Our experiences with innovation management and commercialization have expanded our reach across North America, Europe, ASEAN and Asia Pacific.

Contact:

Mr. Jagraj Singh

SkyQuest Technology

1 Apache Way,

Westford,

Massachusetts 01886

USA (+1) 351-333-4748

Email: sales@skyquestt.com

Visit Our Website: https://www.skyquestt.com/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

2 Best Artificial Intelligence Stocks to Buy in October

The artificial intelligence (AI) market has created some monster growth stocks already, but companies involved in enabling this technological revolution are still seeing growing opportunities. Here are two AI leaders that could be profitable investments over the next year and beyond.

1. C3.ai

C3.ai‘s (NYSE: AI) recent growth has been overshadowed by the stellar performance at Palantir Technologies, but investors shouldn’t overlook C3. It recently reported accelerating revenue increases for the sixth consecutive quarter, which could set the stage for excellent returns over the next year.

C3.ai continues to expand its sales in North America and Europe. In the latest fiscal quarter, it closed 71 agreements. New deals were forged with several clients, including GSK (formerly GlaxoSmithKline), Dolce & Gabbana, and the U.S. Department of Defense.

It’s also expanding its footprint across state and local governments, with 25 agreements across several states, including Texas, California, and Florida.

All these deals are clear signs that C3.ai’s momentum is real. Customers are seeing cost savings using generative AI, and its customer service could solidify long-term relationships with these clients.

Despite the momentum, the stock has drifted down for most of the year. One factor hurting it is C3.ai’s weak profitability. Management’s guidance calls for a full-year adjusted loss from operations between $95 million and $125 million, which is a lot compared to its revenue guidance of $370 million to $395 million.

Still, the stock appears poised to rebound. The company’s net loss is improving year over year, and it’s reasonable to expect a profit down the road as the business continues to grow. If investors give the company credit for strong revenue growth, as they did for Palantir over a year ago, C3.ai’s share price could rocket higher over the next year.

2. Nvidia

Nvidia (NASDAQ: NVDA) has been one of the best ways to invest in the AI boom in recent years. It is a pure-play on the growing demand for AI-optimized computing hardware. With data centers still in the early stages of upgrading components for AI workloads, Nvidia is still a solid buy.

Thomas Siebel, the CEO of C3.ai, made a comment on his company’s last earnings call that speaks to the opportunity for Nvidia. Siebel said that it is very difficult to model the demand trends happening in the AI market right now. He said his company is seeing interest in enterprise AI from organizations it didn’t anticipate, including law firms and medical diagnostic companies.

Nvidia is seeing similar trends. While cloud service providers generated nearly half of its $26 billion in data center revenue last quarter, it is also experiencing strong demand from AI start-ups building generative AI applications for consumers, healthcare, education, and advertising.

AI developers want to use Nvidia because it is the largest supplier of graphics processing units (GPUs), and its chips are used to power every cloud service. There are 4.7 million developers using Nvidia’s CUDA computing platform, which provides access to software development kits and other tools designed to work with its GPUs.

The stock is trading at an attractive forward price-to-earnings ratio of 34 based next year’s consensus earnings estimate. That is a steal for a company expected to grow earnings by 36% on an annualized basis.

One factor holding down the valuation of the stock is that semiconductor companies can experience pauses in demand, which happened to Nvidia in 2018 and 2022. But investors who buy its stock with the intention of holding for the long term should see market-beating returns.

The demand for AI technology in data centers will continue to grow over the next decade. This should benefit Nvidia, since it controls over 70% of the AI chip market, and it has expanding revenue opportunities in data-center networking hardware and software.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,266!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,047!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $389,794!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

John Ballard has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia and Palantir Technologies. The Motley Fool recommends C3.ai and GSK. The Motley Fool has a disclosure policy.

2 Best Artificial Intelligence Stocks to Buy in October was originally published by The Motley Fool

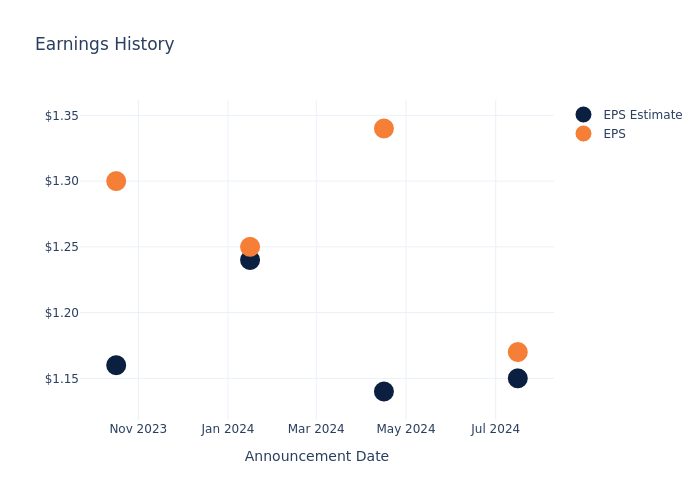

A Look Ahead: Mercantile Bank's Earnings Forecast

Mercantile Bank MBWM is gearing up to announce its quarterly earnings on Tuesday, 2024-10-15. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that Mercantile Bank will report an earnings per share (EPS) of $1.17.

Anticipation surrounds Mercantile Bank’s announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

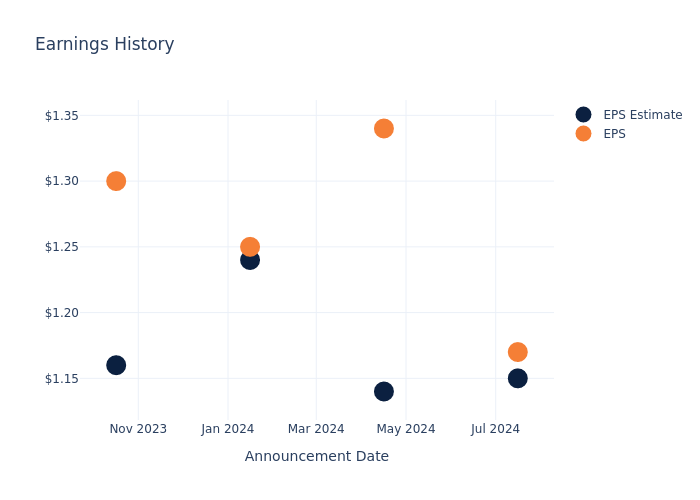

Earnings Track Record

In the previous earnings release, the company beat EPS by $0.02, leading to a 0.16% increase in the share price the following trading session.

Here’s a look at Mercantile Bank’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 1.15 | 1.14 | 1.24 | 1.16 |

| EPS Actual | 1.17 | 1.34 | 1.25 | 1.30 |

| Price Change % | 0.0% | -2.0% | 2.0% | -2.0% |

Tracking Mercantile Bank’s Stock Performance

Shares of Mercantile Bank were trading at $43.91 as of October 11. Over the last 52-week period, shares are up 31.24%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for Mercantile Bank visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

How Germany's Cannabis Market Is Dominating Europe And Unlocking New Profit Opportunities

In a global cannabis market brimming with potential, where should businesses focus their attention? Experts from the Benzinga Cannabis Capital Conference examined the profitability and growth prospects across Europe, Australia, Southeast Asia, and Canada, with Germany standing out as the market leader.

Europe: A Booming Market Led By Germany

The panel, moderated by Jamie Pearson, President of New Holland Group BHNGF, featured William Muecke, co-Founder of Artemis Growth Partners, Michael DeGiglio, CEO of Village Farms International Inc VFF, Beena Goldenberg, CEO of Organigram Holdings Inc OGI, and Finn Age Hänsel, Founder of Sanity Group.

The panelists agreed that Germany is the leading force in the global cannabis market. “Germany is the poster child for what we think the rest of Europe could look like,” Muecke said. Since April 1, Germany enacted CanG, decriminalizing cannabis sales, which led to a surge in demand. He added that the patient base grew from 250,000 to 600,000 in under a year, with more growth on the horizon.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. You can’t afford to miss out if you’re serious about the business.

A $4 Billion Market In The Making

“The European cannabis market is currently valued at around $1 billion, and we expect it to grow to $4 billion within three years,” Muecke said. By contrast, while the U.S. market stands at $45 billion today, it is expected to grow to $60 billion over the same period. With Germany’s population of 85 million, the country is a significant driver of this expansion.

Hänsel added that Germany has enormous potential, noting, “Right now, only 0.2% of the population are medical cannabis patients. Compare that to 3% in Australia or 4% in Florida, and you see how much room there is for growth.”

Read Also: 25 German Cities Join Cannabis Pilot Trials In 2024 Under New Legalization Law

Supply Challenges And Opportunities

One of Germany‘s biggest hurdles will be meeting the increasing demand for cannabis. Hänsel shared that Sanity Group’s sales rose from 150 kilograms in January to a projected 700 kilograms by October, illustrating the rapid scaling needed.

Goldenberg added that sourcing high-quality products domestically in Germany remains challenging, and the country may need to import from markets like Canada.

Canada: High Taxes, Low Profits

Canada, once considered a leader in cannabis legalization, is struggling with profitability. “It’s tough to make money in Canada,” said DeGiglio. Village Farms paid $100 million in excise taxes this year, representing nearly 50% of their revenue. This tax burden has pushed Canadian companies to explore international markets for higher profitability.

Goldenberg echoed this sentiment, explaining, “We don’t pay excise taxes on our international sales,” making markets like Germany and Australia much more appealing.

Australia: A Rising Star

Australia is emerging as a promising market, particularly for non-combustible products. Goldenberg highlighted Australia’s focus on ingestibles, saying, “It’s not just about flowers anymore. Australia is interested in gummies and vapes, and we think that trend will grow.” The export opportunities in this market could provide a much-needed revenue boost for companies diversifying beyond flower sales.

The Importance Of EU GMP Certification

A recurring theme throughout the panel was the necessity of EU GMP (Good Manufacturing Practice) certification. Both Village Farms and Organigram have secured EU GMP certification, which allows them to export cannabis to international markets. “There are only about 50 licensed EU GMP operators worldwide,” DeGiglio noted. “This certification opens a lot of doors, especially in Europe.”

Goldenberg added that obtaining this certification is a serious commitment, requiring significant investment in facilities and compliance. “It’s no joke,” she said. “This is what sets us apart and allows us to ship quality products globally.”

Photo by Wendy Davis.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

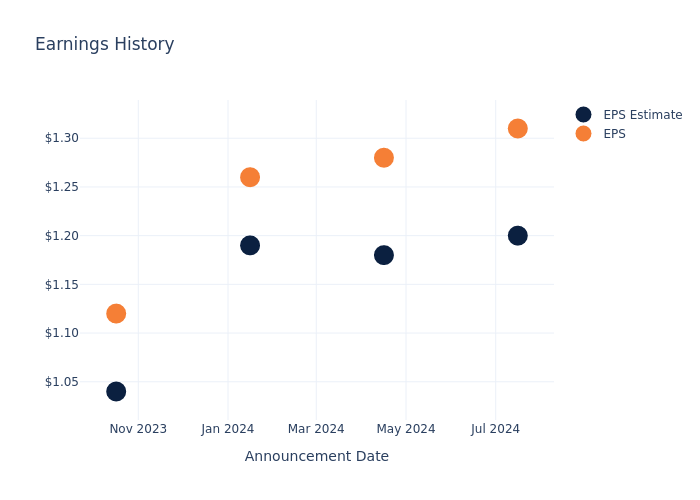

A Glimpse of Hancock Whitney's Earnings Potential

Hancock Whitney HWC is preparing to release its quarterly earnings on Tuesday, 2024-10-15. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect Hancock Whitney to report an earnings per share (EPS) of $1.29.

The announcement from Hancock Whitney is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It’s worth noting for new investors that guidance can be a key determinant of stock price movements.

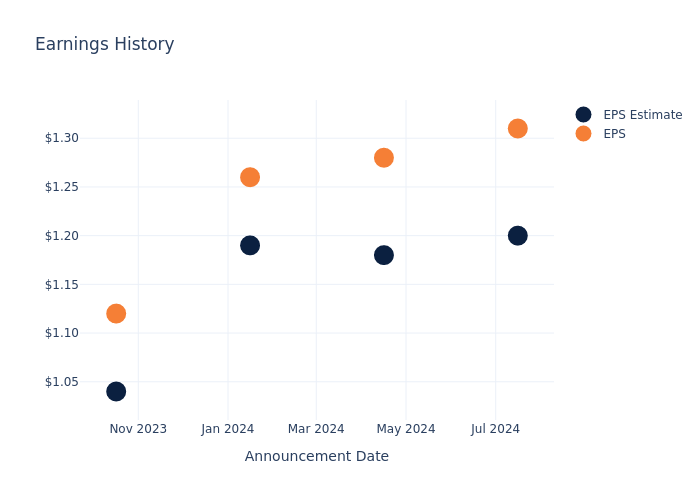

Overview of Past Earnings

Last quarter the company beat EPS by $0.11, which was followed by a 1.58% increase in the share price the next day.

Here’s a look at Hancock Whitney’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 1.20 | 1.18 | 1.19 | 1.04 |

| EPS Actual | 1.31 | 1.28 | 1.26 | 1.12 |

| Price Change % | 2.0% | 2.0% | 0.0% | -4.0% |

Hancock Whitney Share Price Analysis

Shares of Hancock Whitney were trading at $52.5 as of October 11. Over the last 52-week period, shares are up 44.14%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for Hancock Whitney visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

A Closer Look at Pan American Silver's Options Market Dynamics

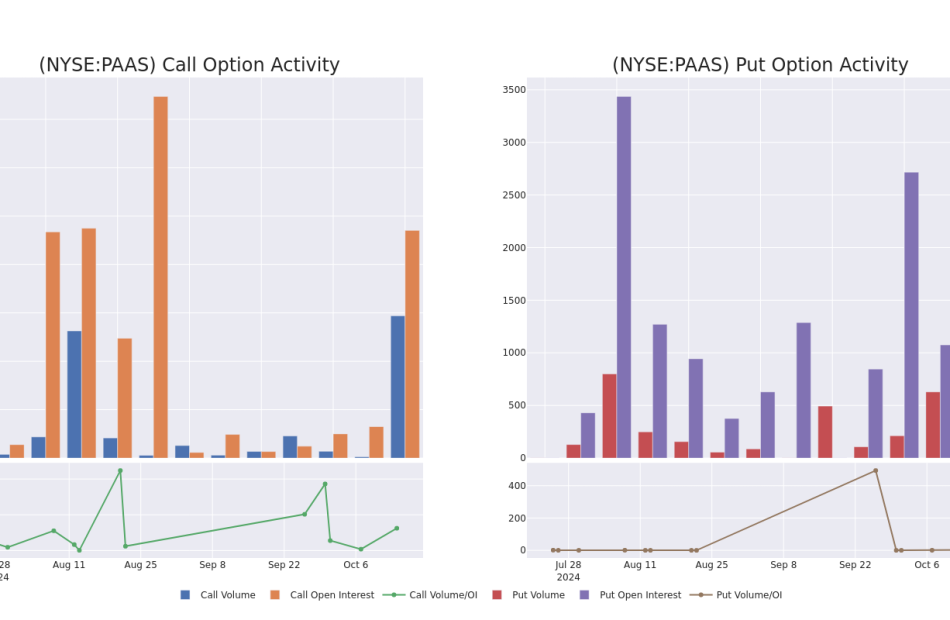

Investors with a lot of money to spend have taken a bearish stance on Pan American Silver PAAS.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with PAAS, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 9 options trades for Pan American Silver.

This isn’t normal.

The overall sentiment of these big-money traders is split between 0% bullish and 100%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $25,417, and 8, calls, for a total amount of $255,059.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $18.0 to $25.0 for Pan American Silver over the recent three months.

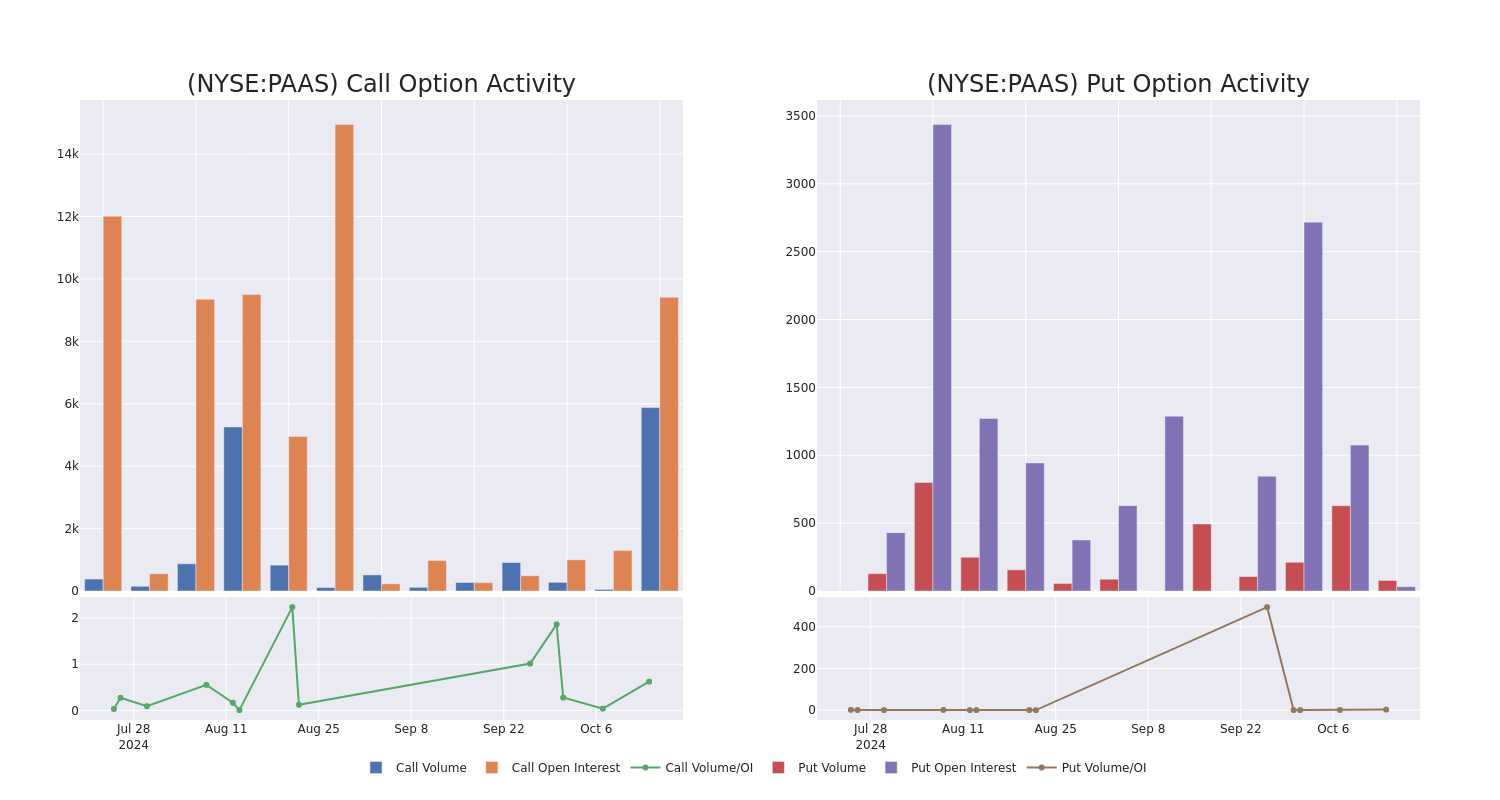

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Pan American Silver’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Pan American Silver’s whale trades within a strike price range from $18.0 to $25.0 in the last 30 days.

Pan American Silver Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PAAS | CALL | SWEEP | BEARISH | 10/18/24 | $2.15 | $2.1 | $2.1 | $20.00 | $42.0K | 4.7K | 350 |

| PAAS | CALL | SWEEP | BEARISH | 10/18/24 | $4.2 | $4.1 | $4.1 | $18.00 | $40.9K | 1.0K | 100 |

| PAAS | CALL | SWEEP | BEARISH | 10/18/24 | $2.15 | $2.1 | $2.1 | $20.00 | $31.5K | 4.7K | 150 |

| PAAS | CALL | SWEEP | BEARISH | 01/17/25 | $1.35 | $1.25 | $1.26 | $24.00 | $31.3K | 3.6K | 1.3K |

| PAAS | CALL | SWEEP | BEARISH | 01/17/25 | $1.35 | $1.25 | $1.25 | $24.00 | $31.2K | 3.6K | 1.5K |

About Pan American Silver

Pan American Silver Corp is a mining company principally engaged in the operation and development of, and exploration for, silver and gold-producing properties and assets. The company’s principal products are silver and gold, although it also produces and sells zinc, lead, and copper. Its operating mines comprise La Colorada, Dolores, Huaron, Morococha, Shahuindo, La Arena, Timmins West, Bell Creek, Manantial Espejo, and San Vicente mines.

In light of the recent options history for Pan American Silver, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Pan American Silver

- Currently trading with a volume of 501,207, the PAAS’s price is down by -2.02%, now at $21.81.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 22 days.

Professional Analyst Ratings for Pan American Silver

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $23.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from Jefferies keeps a Hold rating on Pan American Silver with a target price of $23.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Pan American Silver, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.