Walgreens: A New Risk Just Emerged for the Stock

It’s been a very difficult year for Walgreens Boots Alliance (NASDAQ: WBA), which has seen its stock lose two-thirds of its value this year. The company has fallen victim to consistent drops in drug reimbursement payments from insurance providers over the years, a poor acquisition, and a cost-conscious consumer.

Now a new threat to the company has emerged: Amazon (NASDAQ: AMZN).

The Amazon threat

The pharmacy business has long been considered e-commerce-proof. While there have been mail-order and e-commerce pharmacies for quite some time, catering to people with predictable prescription refills, many patients need their medicine immediately, not in a few days.

However, Amazon is now looking to turn the industry on its head by rapidly expanding its same-day pharmacy services. Amazon began its e-commerce pharmacy service in 2020 and started testing same-day delivery in a few select cities last October. It expanded to the greater Los Angeles area and New York City in March and now has ambitious plans for 2025.

The e-commerce giant now plans to offer same-day pharmacy services in 20 more cities next year, including Boston, Dallas, Minneapolis, Philadelphia, and San Diego, among others. The move is expected to help the company provide same-day pharmacy delivery to nearly half the U.S. by the end of next year.

Amazon said that for orders placed by 4 p.m., customers will be able to get their medications delivered to them by 10 p.m. the same day. In addition, delivery is free for Prime members. Amazon has even been testing delivering medicine by drones in College Station, Texas, which is home to Texas A&M University.

Amazon’s aggressive push into same-day pharmacy delivery comes at a bad time for Walgreens, which recently announced that it could close a quarter of its stores. The move should ultimately be addition by subtraction for Walgreens. As it closes unprofitable stores, the ones that remain open should see a boost as many customers move their scripts to new Walgreens locations. However, with nearby pharmacies closing, the lure of free same-day pharmacy delivery from Amazon could see customers instead opting for the convenience of not having to go to a pharmacy when they are sick.

For its part, Amazon said it was looking to capitalize on the growing number of “pharmacy deserts” that were being created by store closures.

What to do with Walgreens stock?

While Amazon’s same-day pharmacy delivery service is a new emerging threat, the biggest issue Walgreens continues to face is drug reimbursement pressures. Pharmacy benefit managers (PBMs) have created an untenable situation for pharmacies to the point where, in some instances, they lose money by filling certain prescriptions, including popular GLP-1 weight-loss drugs.

For its part, Walgreens is trying to convince PBMs to switch to a new cost-plus model, where pharmacies would be paid for the part they play in helping reduce inflationary pressures on drug prices and the services they provide. However, the company will need to convince the big three PBMs that this model will also benefit them as well.

For its part, the U.S. government has taken notice of what is going on in the PBM market. The Federal Trade Commission (FTC) recently sued the three big PBMs over their practices, which it says have inflated the cost of insulin prices. A verdict in the government’s favor could help the pharmacy industry by leading to improved transparency with PBMs and eliminating the practice of excluding certain drugs from PBM formularies.

At this point, Walgreens stock is trading at a very inexpensive valuation, with a forward price-to-earnings (P/E) of just over 4.5 times earnings based on this fiscal year’s analyst estimates and a similar enterprise value-to-EBITDA (earnings before interest, taxes, depreciation, and amortization) multiple. The latter metric takes into consideration its debt and removes non-cash items.

While the company continues to deal with reimbursement pressure and now has to deal with a new threat from Amazon offering same-day pharmacy services, I think the stock has the potential to rebound. The closing of unprofitable stores should still be a positive, as would disposing of its VillageMD investment, which has also been a drag on the company’s results.

Meanwhile, a favorable ruling by the government against PBMs has the potential to be a catalyst for the stock if they are forced to change their ways. As such, I’d view Walgreens stock as a potential speculative buy, despite the new Amazon threat adding to its list of risks.

Should you invest $1,000 in Walgreens Boots Alliance right now?

Before you buy stock in Walgreens Boots Alliance, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Walgreens Boots Alliance wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,069!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon. The Motley Fool has a disclosure policy.

Walgreens: A New Risk Just Emerged for the Stock was originally published by The Motley Fool

Earnings Outlook For SMART Glb Hldgs

SMART Glb Hldgs SGH is preparing to release its quarterly earnings on Tuesday, 2024-10-15. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect SMART Glb Hldgs to report an earnings per share (EPS) of $0.40.

The announcement from SMART Glb Hldgs is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It’s worth noting for new investors that guidance can be a key determinant of stock price movements.

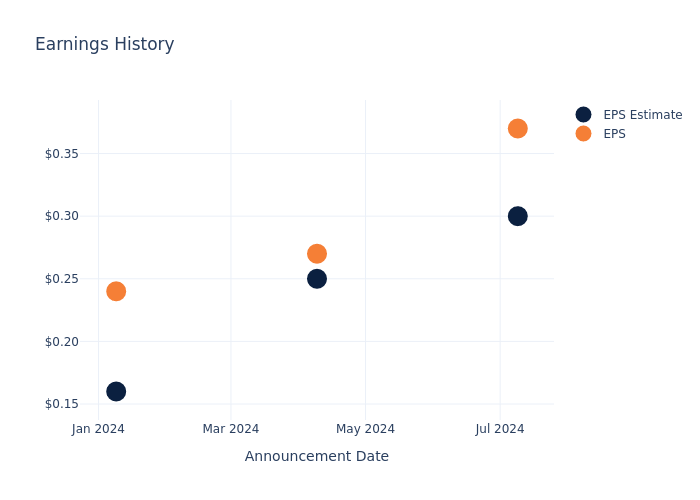

Earnings Track Record

The company’s EPS beat by $0.07 in the last quarter, leading to a 26.27% increase in the share price on the following day.

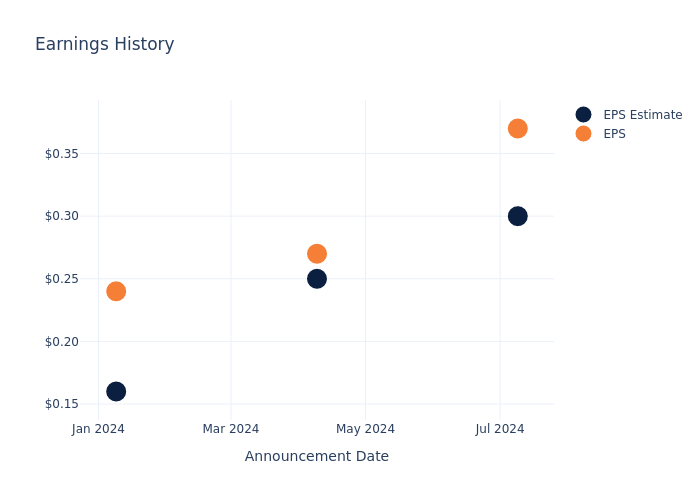

Here’s a look at SMART Glb Hldgs’s past performance and the resulting price change:

| Quarter | Q3 2024 | Q2 2024 | Q1 2024 | Q4 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.30 | 0.25 | 0.16 | 0.45 |

| EPS Actual | 0.37 | 0.27 | 0.24 | 0.35 |

| Price Change % | 26.0% | -24.0% | 10.0% | -44.0% |

Tracking SMART Glb Hldgs’s Stock Performance

Shares of SMART Glb Hldgs were trading at $20.76 as of October 11. Over the last 52-week period, shares are up 41.7%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analysts’ Take on SMART Glb Hldgs

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on SMART Glb Hldgs.

A total of 2 analyst ratings have been received for SMART Glb Hldgs, with the consensus rating being Buy. The average one-year price target stands at $33.5, suggesting a potential 61.37% upside.

Analyzing Analyst Ratings Among Peers

In this comparison, we explore the analyst ratings and average 1-year price targets of and Alpha & Omega, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- As per analysts’ assessments, Alpha & Omega is favoring an Sell trajectory, with an average 1-year price target of $36.0, suggesting a potential 73.41% upside.

Overview of Peer Analysis

The peer analysis summary presents essential metrics for and Alpha & Omega, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| SMART Glb Hldgs | Buy | -12.73% | $88.91M | 1.36% |

| Alpha & Omega | Sell | -0.14% | $41.44M | -0.31% |

Key Takeaway:

SMART Glb Hldgs has a higher consensus rating compared to its peers. It is positioned at the bottom for revenue growth, indicating a decline in revenue. The company also has a higher gross profit than its peers. However, its return on equity is lower than the average of its peers, suggesting lower profitability relative to shareholder equity.

All You Need to Know About SMART Glb Hldgs

SMART Global Holdings Inc is a designer and manufacturer of electronic products focused on memory and computing technology areas. It specializes in application-specific product development and support for customers in the enterprise, government and original equipment manufacturer (OEM) markets. It operates in three segments such as Memory Solutions in which Memory Solutions group, under our SMART Modular brand, provides high performance and reliable memory solutions through the design, development and advanced packaging of leading-edge to extended lifecycle products. Intelligent Platform Solutions in their IPS group, under our Penguin Solutions and newly acquired Stratus Technologies brands, offers specialized platform solutions and services for high-performance computing.

SMART Glb Hldgs’s Economic Impact: An Analysis

Market Capitalization Analysis: Falling below industry benchmarks, the company’s market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Revenue Challenges: SMART Glb Hldgs’s revenue growth over 3 months faced difficulties. As of 31 May, 2024, the company experienced a decline of approximately -12.73%. This indicates a decrease in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: SMART Glb Hldgs’s net margin excels beyond industry benchmarks, reaching 1.87%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): The company’s ROE is a standout performer, exceeding industry averages. With an impressive ROE of 1.36%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): SMART Glb Hldgs’s financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 0.37%, the company showcases efficient use of assets and strong financial health.

Debt Management: SMART Glb Hldgs’s debt-to-equity ratio is notably higher than the industry average. With a ratio of 1.72, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

To track all earnings releases for SMART Glb Hldgs visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Check Out What Whales Are Doing With ADM

Investors with a lot of money to spend have taken a bullish stance on Archer-Daniels Midland ADM.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with ADM, it often means somebody knows something is about to happen.

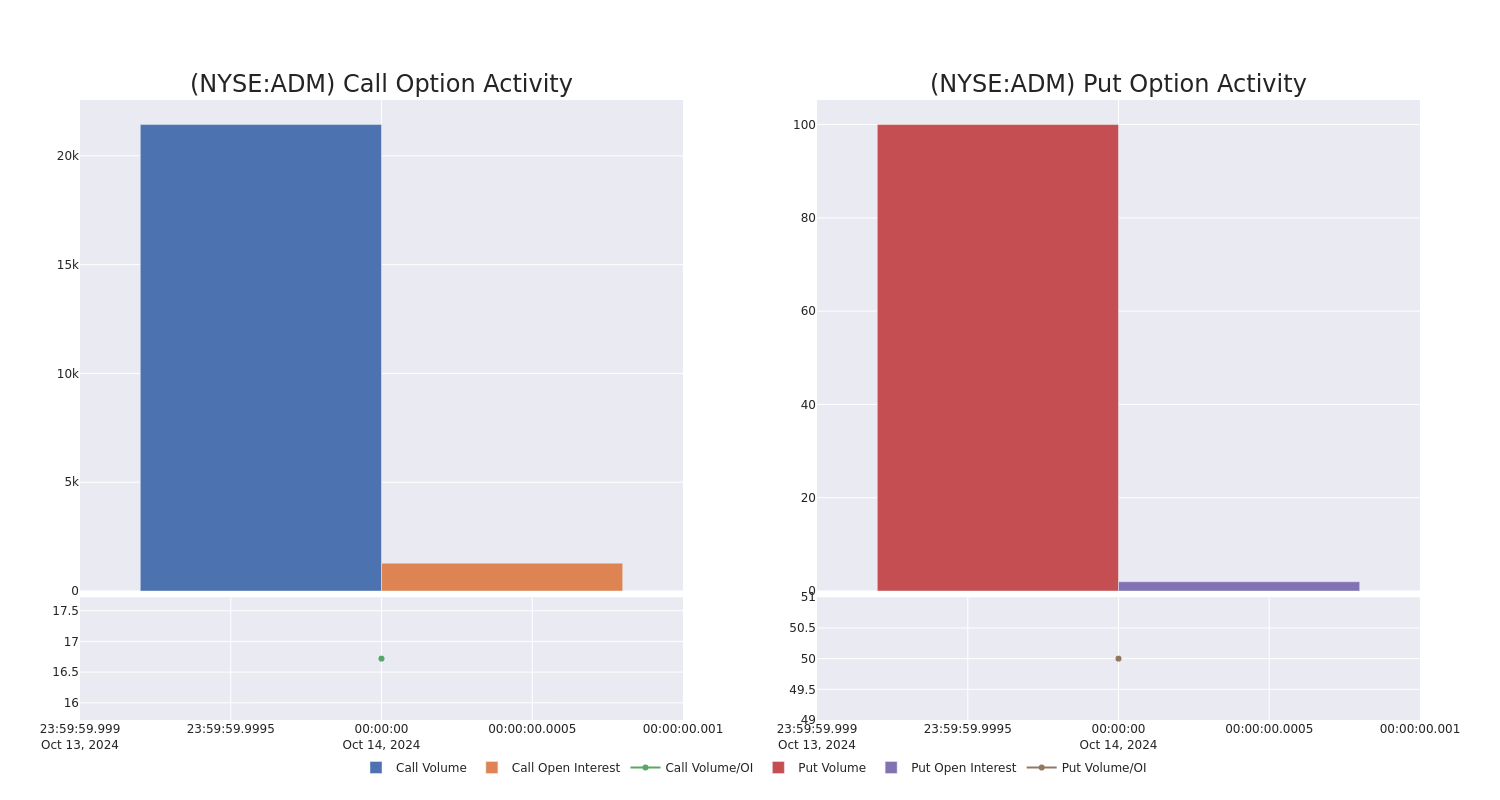

Today, Benzinga’s options scanner spotted 11 options trades for Archer-Daniels Midland.

This isn’t normal.

The overall sentiment of these big-money traders is split between 54% bullish and 45%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $92,800, and 10, calls, for a total amount of $839,557.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $57.5 to $60.0 for Archer-Daniels Midland over the recent three months.

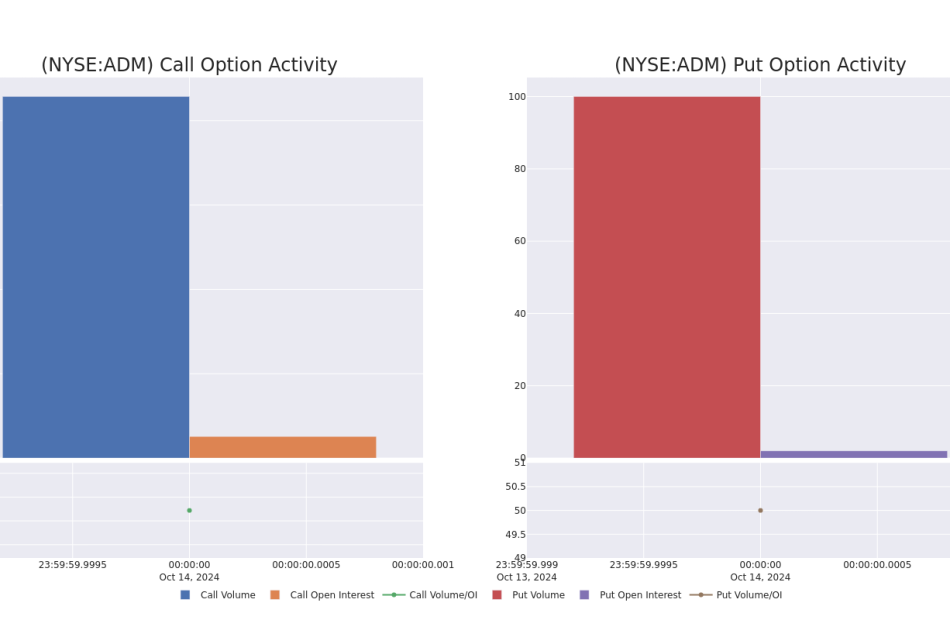

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Archer-Daniels Midland’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Archer-Daniels Midland’s whale trades within a strike price range from $57.5 to $60.0 in the last 30 days.

Archer-Daniels Midland Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ADM | CALL | SWEEP | BEARISH | 11/15/24 | $2.15 | $2.05 | $2.15 | $57.50 | $213.1K | 951 | 2.3K |

| ADM | CALL | SWEEP | BEARISH | 11/15/24 | $2.55 | $2.3 | $2.3 | $57.50 | $183.5K | 951 | 241 |

| ADM | CALL | SWEEP | BEARISH | 11/15/24 | $2.05 | $2.0 | $2.05 | $57.50 | $98.8K | 951 | 2.8K |

| ADM | PUT | TRADE | BULLISH | 01/15/27 | $9.6 | $9.2 | $9.28 | $60.00 | $92.7K | 2 | 100 |

| ADM | CALL | SWEEP | BEARISH | 11/15/24 | $2.3 | $2.2 | $2.3 | $57.50 | $74.9K | 951 | 1.3K |

About Archer-Daniels Midland

Archer-Daniels Midland is a major processor of oilseeds, corn, wheat, and other agricultural commodities. The company is also one of the largest grain merchandisers through its extensive network of logistical assets to store and transport crops around the globe. ADM also runs a nutrition business that focuses on both human and animal ingredients and is a large producer of corn-based sweeteners, starches, and ethanol.

In light of the recent options history for Archer-Daniels Midland, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Archer-Daniels Midland

- With a volume of 424,602, the price of ADM is down -0.26% at $57.82.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 11 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Archer-Daniels Midland with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Omnicom Group Earnings Preview

Omnicom Group OMC is gearing up to announce its quarterly earnings on Tuesday, 2024-10-15. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that Omnicom Group will report an earnings per share (EPS) of $2.02.

The market awaits Omnicom Group’s announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It’s important for new investors to understand that guidance can be a significant driver of stock prices.

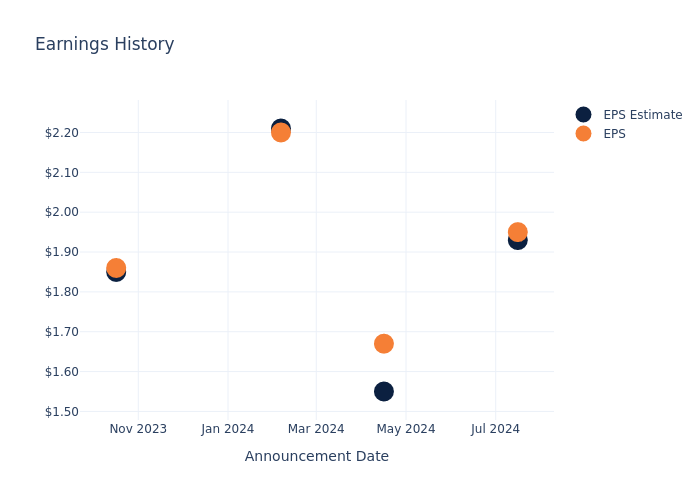

Historical Earnings Performance

The company’s EPS beat by $0.02 in the last quarter, leading to a 4.02% drop in the share price on the following day.

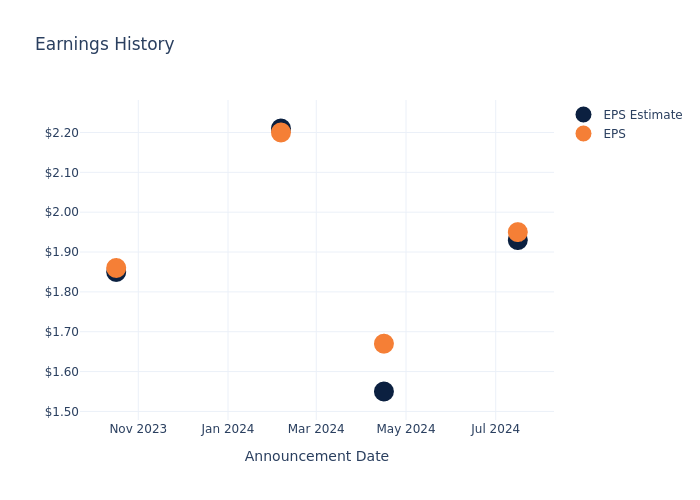

Here’s a look at Omnicom Group’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 1.93 | 1.55 | 2.21 | 1.85 |

| EPS Actual | 1.95 | 1.67 | 2.20 | 1.86 |

| Price Change % | -4.0% | 2.0% | -3.0% | -2.0% |

Market Performance of Omnicom Group’s Stock

Shares of Omnicom Group were trading at $102.86 as of October 11. Over the last 52-week period, shares are up 34.05%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analysts’ Take on Omnicom Group

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Omnicom Group.

With 4 analyst ratings, Omnicom Group has a consensus rating of Outperform. The average one-year price target is $109.25, indicating a potential 6.21% upside.

Analyzing Ratings Among Peers

In this analysis, we delve into the analyst ratings and average 1-year price targets of and Interpublic Gr of Cos, three key industry players, offering insights into their relative performance expectations and market positioning.

- Interpublic Gr of Cos is maintaining an Neutral status according to analysts, with an average 1-year price target of $31.79, indicating a potential 69.09% downside.

Snapshot: Peer Analysis

Within the peer analysis summary, vital metrics for and Interpublic Gr of Cos are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Omnicom Group | Outperform | 6.76% | $681.70M | 9.11% |

| Interpublic Gr of Cos | Neutral | 1.63% | $411.10M | 5.60% |

Key Takeaway:

Omnicom Group outperforms its peers in revenue growth and gross profit. It also has a higher return on equity compared to its peers.

About Omnicom Group

Omnicom is a holding company that owns several advertising agencies and related firms. It provides traditional and digital advertising services that include creative design, market research, data analytics, and ad placement. In addition, Omnicom provides outsourced public relations and other communications services. The firm operates globally, providing services in more than 70 countries; it generates more than one half of its revenue in North America and nearly 30% in Europe.

Omnicom Group: Financial Performance Dissected

Market Capitalization: Positioned above industry average, the company’s market capitalization underscores its superiority in size, indicative of a strong market presence.

Revenue Growth: Omnicom Group displayed positive results in 3 months. As of 30 June, 2024, the company achieved a solid revenue growth rate of approximately 6.76%. This indicates a notable increase in the company’s top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Communication Services sector.

Net Margin: Omnicom Group’s net margin surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 8.51% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Omnicom Group’s ROE surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 9.11% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): The company’s ROA is a standout performer, exceeding industry averages. With an impressive ROA of 1.2%, the company showcases effective utilization of assets.

Debt Management: Omnicom Group’s debt-to-equity ratio stands notably higher than the industry average, reaching 1.94. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

To track all earnings releases for Omnicom Group visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bitcoin Up More Than 6% In 24 hours

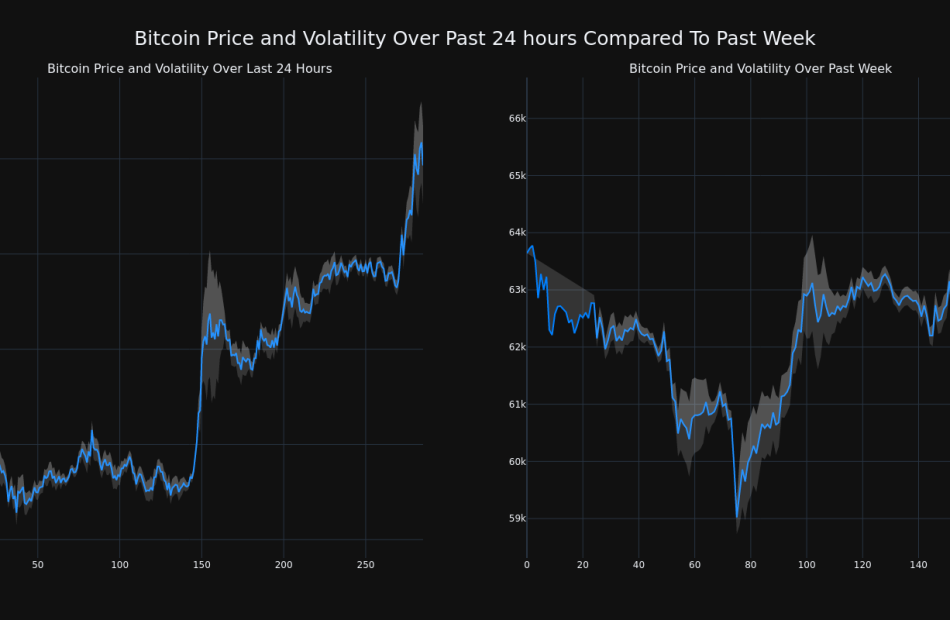

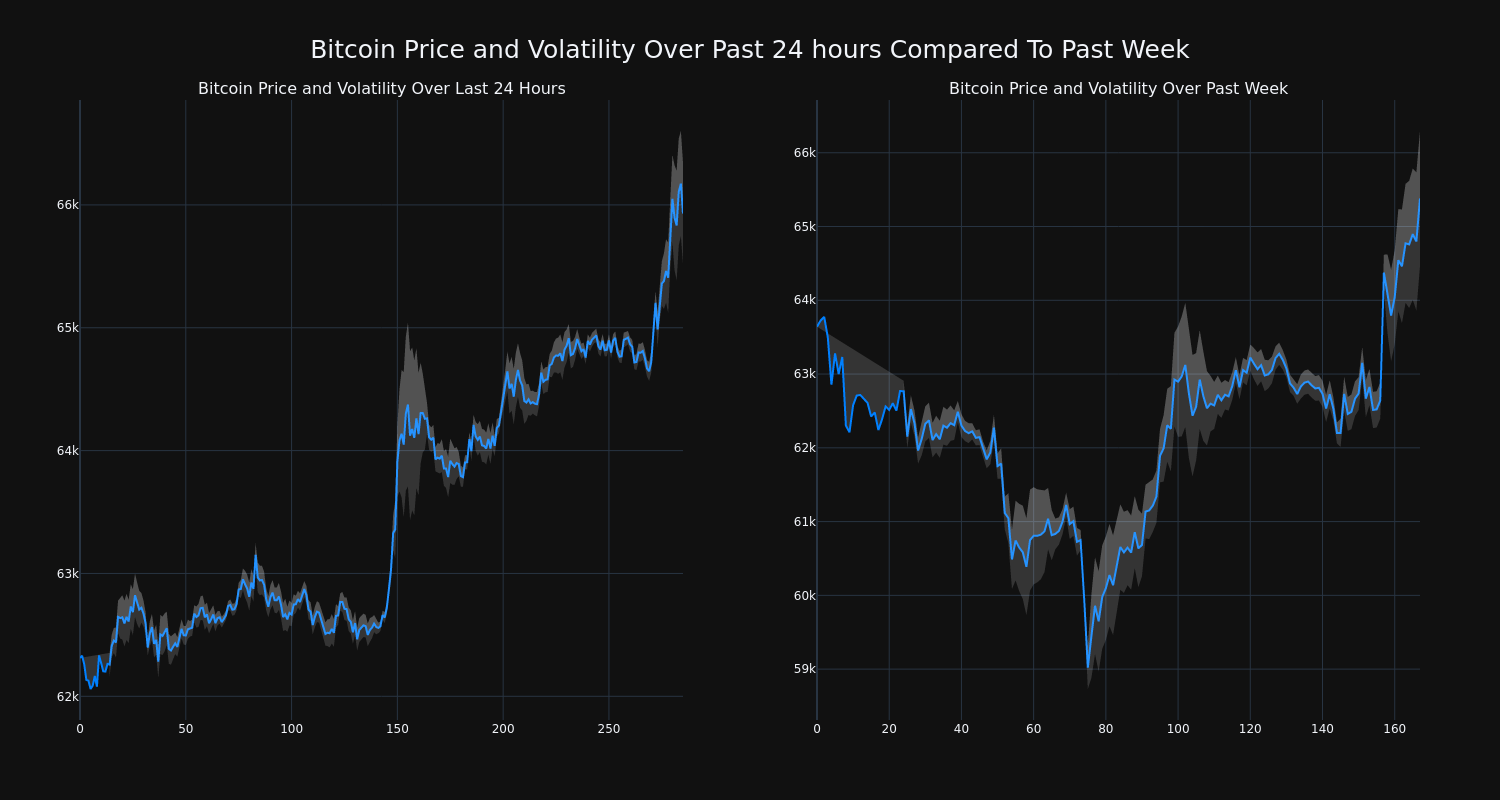

Over the past 24 hours, Bitcoin’s BTC/USD price has risen 6.05% to $65,964.00. This continues its positive trend over the past week where it has experienced a 3.0% gain, moving from $63,642.32 to its current price. As it stands right now, the coin’s all-time high is $73,738.00.

The chart below compares the price movement and volatility for Bitcoin over the past 24 hours (left) to its price movement over the past week (right). The gray bands are Bollinger Bands, measuring the volatility for both the daily and weekly price movements. The wider the bands are, or the larger the gray area is at any given moment, the larger the volatility.

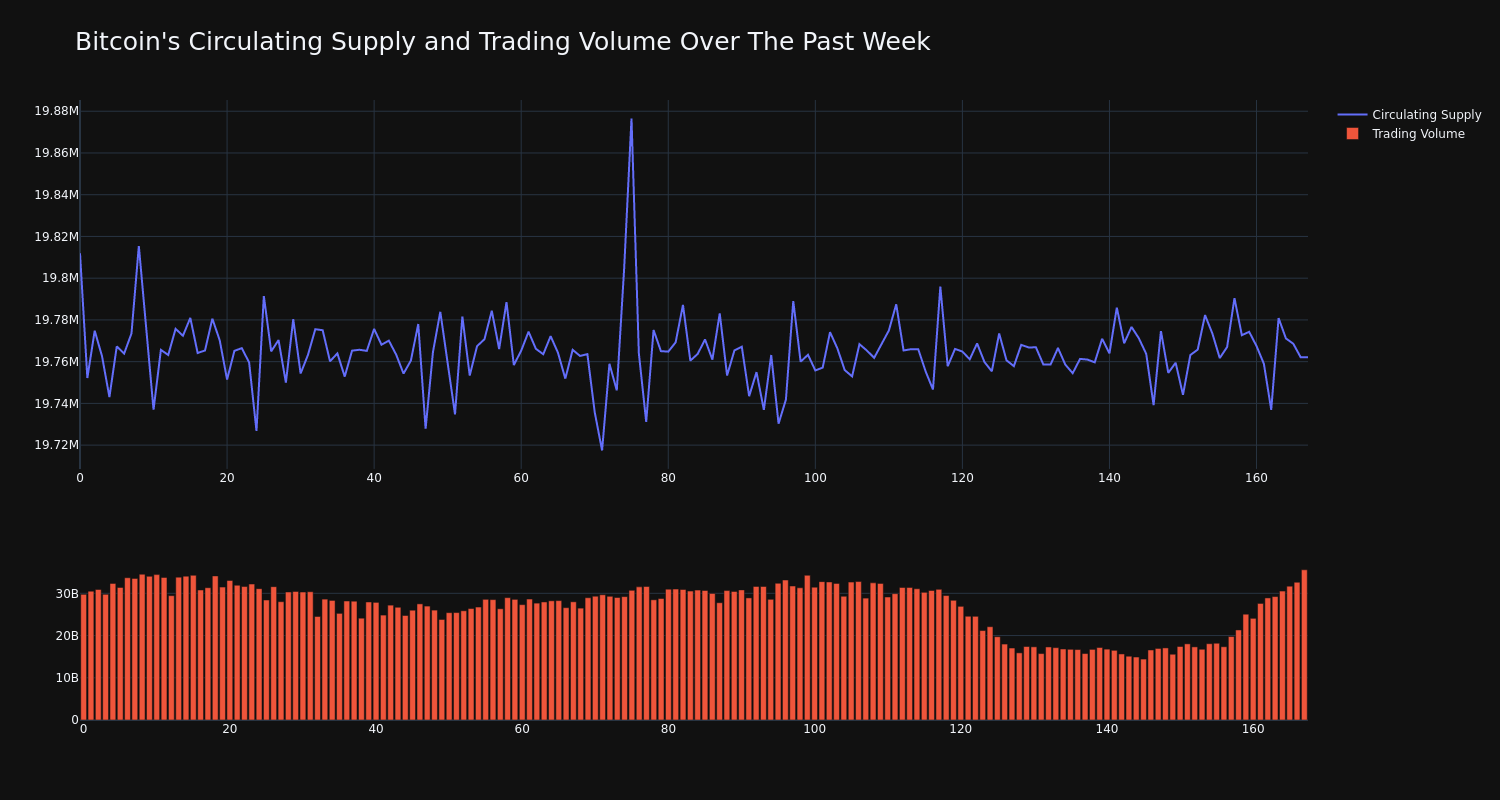

The trading volume for the coin has climbed 20.0% over the past week, moving opposite, directionally, with the overall circulating supply of the coin, which has decreased 0.25%. This brings the circulating supply to 19.77 million, which makes up an estimated 94.13% of its max supply of 21.00 million. According to our data, the current market cap ranking for BTC is #1 at $1.31 trillion.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Veterinary Orthopedic Implant Market is Projected to Reach a Valuation of US$ 14.67 Billion at a CAGR of 17.7% by 2034 | Fact.MR Report

Rockville, MD, Oct. 14, 2024 (GLOBE NEWSWIRE) — A new research report published by Fact.MR states that the global veterinary orthopedic implants market is set to reach a valuation of US$ 2.87 billion in 2024 and further expand at a CAGR of 17.7% from 2024 to 2034.

Orthopedic implants improve mobility, reduce discomfort, and restore joint function. All of these characteristics entice pet owners to choose such implants to help their dogs return to regular life. Cows are an essential part of the agricultural process, and farmers must regularly monitor the health of their animals to keep the process functioning. More farmers understand the importance of orthopedic implants and approach the appropriate hospitals in the event of an emergency to get orthopedic procedures for their cattle.

Factors such as rising awareness of veterinary orthopedic implants are contributing to market expansion. Furthermore, greater consumer knowledge of preventative animal healthcare and ease of access are encouraging the usage of veterinary orthopedic implants. However, technological advancements in veterinary orthopedic implants are projected to create profitable growth prospects in developing countries such as Brazil over the forecast period.

For More Insights into the Market, Request a Sample of this Report:

https://www.factmr.com/connectus/sample?flag=S&rep_id=10150

Key Takeaways from the Market Study:

- The global veterinary orthopedic implant market is forecasted to reach a valuation of US$ 14.67 billion by the end of 2034.

- North America is evaluated to hold a global market share of 17% by the end of 2034.

- The Latin American market is forecasted to expand at a CAGR of 10.3% from 2024 to 2034.

- Canada is analyzed to occupy a market share of 11.8% by 2034 in the North American region, and sales of veterinary orthopedic implants in the country are evaluated to rise at a CAGR of 8% from 2024 to 2034.

- The Latin American market is projected to occupy a share of 6.7% by 2034-end.

- Based on end user, the veterinary clinics segment is estimated to reach a valuation of US$ 1.39 billion in 2024.

“Trend of keeping animal companions is fostering greater empathy toward animal care, thereby driving the growth of the market for veterinary orthopedic implants,” says a Fact.MR analyst.

Leading Players Driving Innovation in the Veterinary Orthopedic Implant Market:

Fusion Implants; Orthomed; KYON Pharma; Biomedtrix; DePuySynthes; Integra Lifesciences; B. Barun Melsungen AG; Veterinary Orthopedic Implants.

3D Printed Implants Attracting More People toward Trying This Technique:

Perhaps one of the most interesting recent breakthroughs is the use of 3D printing and computer-assisted design (CAD) software to create personalized drill guides, cutting guides, and even custom implants. These guides and implants are based on high-resolution 3D CT images. This method has revolutionized the treatment of difficult limb deformities, as well as a range of complex spinal disorders. This implant technique is a key breakthrough and has become popular among veterinary doctors.

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=10150

Veterinary Orthopedic Implant Industry News:

The American medical device manufacturer DePuy Synthes (Johnson & Johnson Services, Inc.) purchased OrthoSpin, an Israeli startup that develops and manufactures computerised strut systems, in December 2021.

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the veterinary orthopedic implant market for 2019 to 2023 and forecast statistics for 2024 to 2034.

The study divulges essential insights into the market based on product type (implants, instruments), application (tibial plateau leveling osteotomy, tibial tuberosity advancement, trauma fixation application, joint replacement, others), and end user (veterinary hospitals, veterinary clinics, others), across seven major regions of the world (North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, and MEA).

Checkout More Related Studies Published by Fact.MR Research:

Veterinary Endoscopy Market: The global veterinary endoscopy market is currently valued at US$ 184 million. Global sales of veterinary endoscopy machines are expected to rise at a CAGR of 5.5% from 2022 to 2027 and will reach US$ 240.4 million by 2027.

Veterinary Surgical Instruments Market: The global veterinary surgical instruments market size was valued at US$ 1.09 Billion in 2023, and is projected to reach US$ 1.86 Billion by 2033, growing at a Compound Annual Growth Rate (CAGR) of 5.5% during the forecast period from 2023 to 2033.

Veterinary Oncology Market: The global veterinary oncology market size stands at a valuation of US$ 260 Million in 2023, and is estimated to reach US$ 800 Million by 2033-end, with a projected compound annual growth rate (CAGR) of 12% during the forecast period from 2023 to 2033.

Animal Healthcare Market: The global animal healthcare market is estimated at US$ 42.87 billion in 2024, as per a new study by Fact.MR. Worldwide demand for animal health products is forecasted to increase at a CAGR of 4.6% and reach a market value of US$ 67.48 billion by the end of 2034.

Veterinary Arthroscopy Device Market: Worldwide sales of veterinary arthroscopy devices are estimated at US$ 401 million in 2024. The global veterinary arthroscopy device market has been forecasted to expand at 6.1% CAGR and reach a value of US$ 721.9 million by the end of 2034.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay ahead in the competitive landscape.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

‘I want the calls and letters to stop’: My mother died owing $17,000 in credit-card debt. The creditors want their money. Will I have to sell her house?

Dear Quentin,

Can you please assist me? I can’t afford a lawyer. My mom passed away in May from Alzheimer’s. I was her primary caretaker. In 2015, my mom created a power of attorney, healthcare directive and a trust. She left me her house in Fresno, Calif., which was not paid off.

She had six credit cards that she was paying off; however, they still owed $17,000 when she died. The creditors are calling, asking if I have a probate court date. I told them no. I don’t even know what that means. Can they make me sell my mom’s house to pay the creditors?

Most Read from MarketWatch

Who initiates the probate court date? Am I responsible for paying her credit cards? I want the calls and letters to stop. I also want to avoid having to go to court. I would appreciate your much needed advice.

The Daughter

Dear Daughter,

Don’t tell your mother’s creditors anything.

It’s unlikely that these credit-card companies will attempt to put a lien on your mother’s house for a few thousand dollars, given that this $17,000 debt is split among several companies. These creditors may be doing their best to overwhelm you with phone calls and letters, hoping that you will pay them what your mother owed them, given your vulnerable state. It’s unclear whether there is even enough money in your mother’s estate to pay them off.

If your mother does have significant assets — that is, money in her bank and retirement accounts etc. — you should be able to pay a lawyer out of the estate. A trusts and estates lawyer will be able to tell you whether you have to file a probate case. In California, you will likely have to file probate if the estate is worth more than $184,500. That includes all assets that are not held in trust or passed directly to you upon your mother’s death.

“A money judgment is no longer enforceable after the death of the debtor except through probate and the creditor’s claim process,” says the Law Offices of Ronald P. Slates. An exception is a judgment lien secured against specific real property, which does not require a creditor’s claim if the creditor waives recourse against all other estate property. In other words? This is pretty much all you’ve got left before that judgment becomes a worthless piece of paper.”

Your mother clearly made preparations for her estate upon her death. She set up a trust; if that trust became irrevocable upon her death, it should be out of reach of the creditors. The same is true for assets — like bank accounts and life-insurance policies that were transferred to you upon her death. If the estate is large enough for probate and there was no will, the court will appoint an administrator if you are unwilling or unable to administer the estate.

The clock is ticking for these creditors, and they know it. “When a delinquent homeowner dies, there is a strict one-year statute of limitations to sue them or to continue a lawsuit against their estate,” according to Tinnelly Law Group in San Juan Capistrano, Calif. “This is true even if the statute of limitations would have been longer had the person survived.” You should focus on wrapping up your mother’s estate, and pay her property taxes and utilities.

The Federal Trade Commission also has strict rules on debt collectors. Among those rules: They can’t contact you before 8 a.m. or after 9 p.m. (unless you agree to it). You can also tell them not to contact you by email or text. “By law, family members usually don’t have to pay the debts of a deceased relative from their own money,” the FTC says. “If there isn’t enough money in the estate to cover the debt, it usually goes unpaid.”

More columns from Quentin Fottrell:

Most Read from MarketWatch

GM Strikes Deal With Barclays To Supercharge Its Rewards Mastercard Program

General Motors Company GM penned a long-term deal with Barclays PLC BCS. Starting next summer, Barclays will become the exclusive issuer of the GM Rewards Mastercard and the GM Business Mastercard in the U.S.

The new partnership with Barclays will offer exclusive benefits and experiences for cardholders.

With the GM Rewards card, members can earn and redeem points on Chevrolet, Cadillac, Buick, and GMC vehicles, including EVs, as well as for services and accessories.

Current My GM Rewards cardmembers can continue using their cards to earn rewards for GM products and services.

Before the transition, they will receive details on activating their new GM card from Barclays.

The new partnership with GM will expand Barclays’ U.S. credit card portfolio, aligning with its growth strategy focused on partnering with top American brands.

Barclays also plans to acquire the GM card program’s receivables from the current issuer next year as part of the agreement.

The GM credit card program will remain exclusively under the Mastercard brand, offering additional cardmember benefits.

Last week, GM Energy launched an energy storage product called the PowerBank to Tesla‘s Powerwall product.

Investors can gain exposure to the stock via First Trust Nasdaq Transportation ETF FTXR and Invesco S&P 500 Pure Value ETF RPV.

Price Action: GM shares are up 0.41% at $48.07 premarket at the last check Monday.

Photo by Jonathan Weiss on Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.