Insiders Hold Tight as Helen of Troy Prepares for a Major Rebound

There is a significant shift in institutional activity for Helen of Troy HELE shares. The institutions shifted from selling to buying in Q3, creating a solid tailwind due to the high interest. Institutions own nearly 99% of this stock, leaving less than 1.5% for insiders, retail investors, and short-sellers. Coincidentally, the short interest is also high, over 10% in the last report and nearly 10% in mid-September, providing ample fuel for a short-covering rally.

The takeaway for investors is that consumer products maker Helen of Troy has hit its market bottom and is now set to rebound. The rebound will likely take time to develop but will deliver sufficient upside to make this investment more than interesting. Trading near a decade low, technical targets for the stock price suggest a nearly 50% upside with a chance for a full reversal. In that scenario, the stock could gain another 50% to 100% over the next few years.

Insider activity is also noteworthy—not because of its volume but because of its lack thereof. Data from Insidertrades.com shows that insiders haven’t sold or purchased this stock since 2023, the last being CFO Brian L. Grass’s purchase. The lack of sales is a sign of insider confidence; investors should not be surprised if insiders start buying shares at such low levels.

Helen of Troy Outperforms in FQ2: Shares Surge

Helen of Troy continues to face challenges, including macroeconomic headwinds and efforts to improve efficiency. However, the Q2 results reflect a positive impact of the company’s global restructuring effort named Project Pegasus. The Q2 revenue is down compared to last year but 330 basis points better than expected, with greater strength on the bottom line. The revenue decline is due to weakness in the Beauty and Wellness segments, offset by Home and Outdoors growth. Home and Outdoors sales grew nearly 1.0% despite negative product mix shifts, while Beauty and Wellness contracted by 7.7%.

Margin news is equally good. The company’s margin contracted at the gross and operational levels in the GAAP and adjusted comparisons but was less than expected. The gross margin fell by 110 bps and the adjusted operating margin by 260, leaving the operating margin at 9.8%. The salient detail is that the 9.8% adjusted margin left the earnings down by double-digits, but the $1.21 in adjusted EPS is 1500 basis points ahead of the consensus estimate, providing sufficient cash flow to sustain operations, reinvestment, and capital return.

Guidance is mixed but indicates a turning point for the business. The company reaffirmed its full-year targets for revenue and earnings, which puts revenue in alignment with the consensus estimate and the EPS midpoint above it. The negative detail is that the free cash flow and debt reduction targets were eased but there is a mitigating factor. Operational challenges at the Tennessee distribution facility impact the cash flow. The automation effort hit snags in Q1, but remediation efforts have been largely completed. The impact on cash flow will end before the fiscal year-end, and automation is expected to drive additional efficiency in calendar 2025.

Helen of Troy Has a Fortress Balance Sheet

Helen of Troy has hurdles to cross but is in a position to do so. The balance sheet highlights include steady assets, declining debt, low leverage, and improving shareholder equity despite debt reduction and capital return. The capital return, in the form of share buybacks, ramped in Q2 compared to last year, reducing the average count by 5%.

The pace of buybacks is expected to continue in F2025 because of the recently announced increase in authorization. The new total is $500 million, which is a tailwind for the market because it is worth 35% of the market cap with shares at a ten-year low. Regarding leverage, total liability, including long-term debt, is about 1x equity.

Following the report, Helen of Troy shares surged nearly 20% in premarket trading. The move suggests that short-covering has begun and a bottom is in play. The critical resistance target is near $75 and the 150-day EMA; a sustained rally may soon form if the market moves above it. If not, the market may become range-bound at current levels until more news is available.

The article “Insiders Hold Tight as Helen of Troy Prepares for a Major Rebound” first appeared on MarketBeat.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insights into Pinnacle Finl Partners's Upcoming Earnings

Pinnacle Finl Partners PNFP will release its quarterly earnings report on Tuesday, 2024-10-15. Here’s a brief overview for investors ahead of the announcement.

Analysts anticipate Pinnacle Finl Partners to report an earnings per share (EPS) of $1.78.

Anticipation surrounds Pinnacle Finl Partners’s announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

Earnings Track Record

In the previous earnings release, the company beat EPS by $0.02, leading to a 2.98% increase in the share price the following trading session.

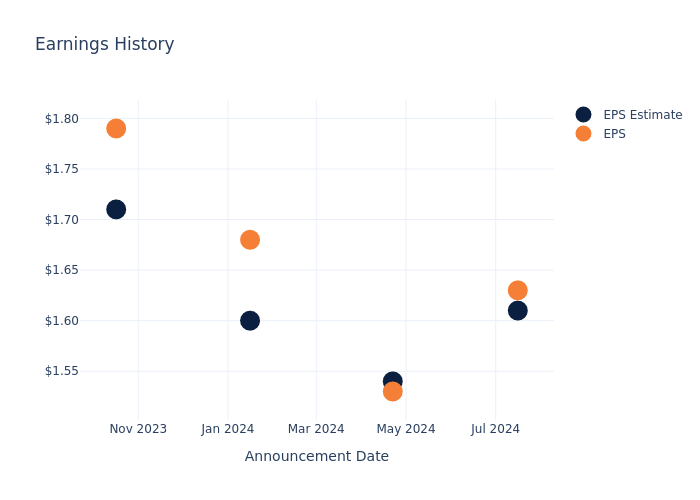

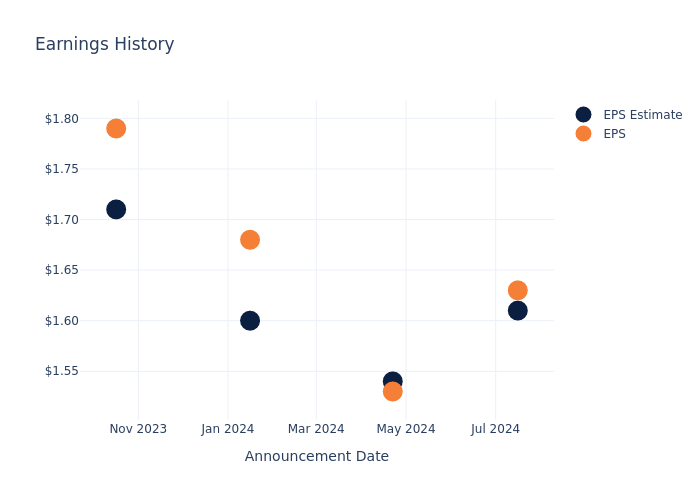

Here’s a look at Pinnacle Finl Partners’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 1.61 | 1.54 | 1.60 | 1.71 |

| EPS Actual | 1.63 | 1.53 | 1.68 | 1.79 |

| Price Change % | 3.0% | -0.0% | 1.0% | -6.0% |

Tracking Pinnacle Finl Partners’s Stock Performance

Shares of Pinnacle Finl Partners were trading at $98.69 as of October 11. Over the last 52-week period, shares are up 43.26%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for Pinnacle Finl Partners visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cryptocurrency Pepe's Price Increased More Than 11% Within 24 hours

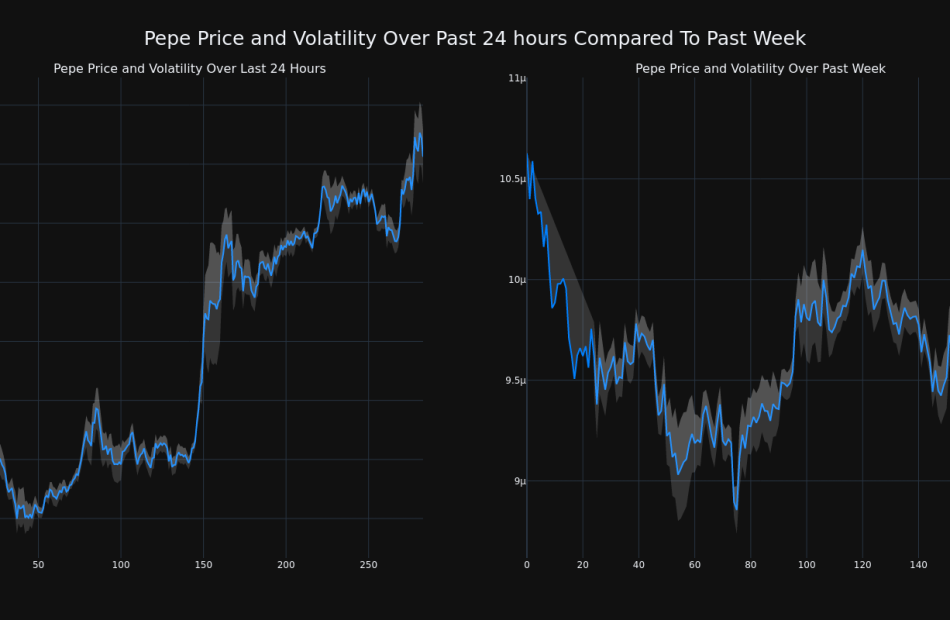

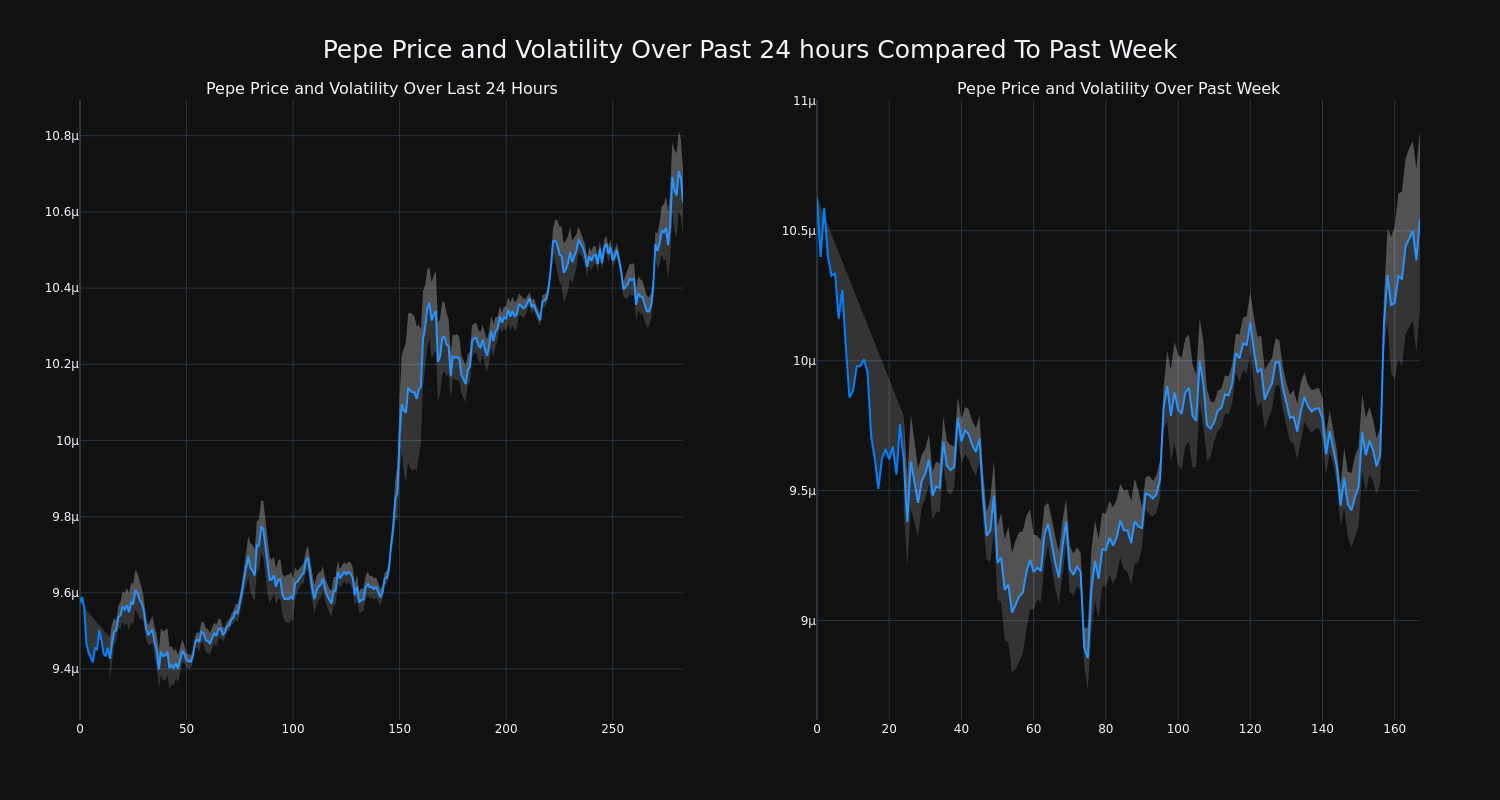

Pepe’s PEPE/USD price has increased 11.24% over the past 24 hours to $0.000011, which is in the opposite direction of its trend over the past week, where it has experienced a 1.0% loss, moving from $0.000011 to its current price.

The chart below compares the price movement and volatility for Pepe over the past 24 hours (left) to its price movement over the past week (right). The gray bands are Bollinger Bands, measuring the volatility for both the daily and weekly price movements. The wider the bands are, or the larger the gray area is at any given moment, the larger the volatility.

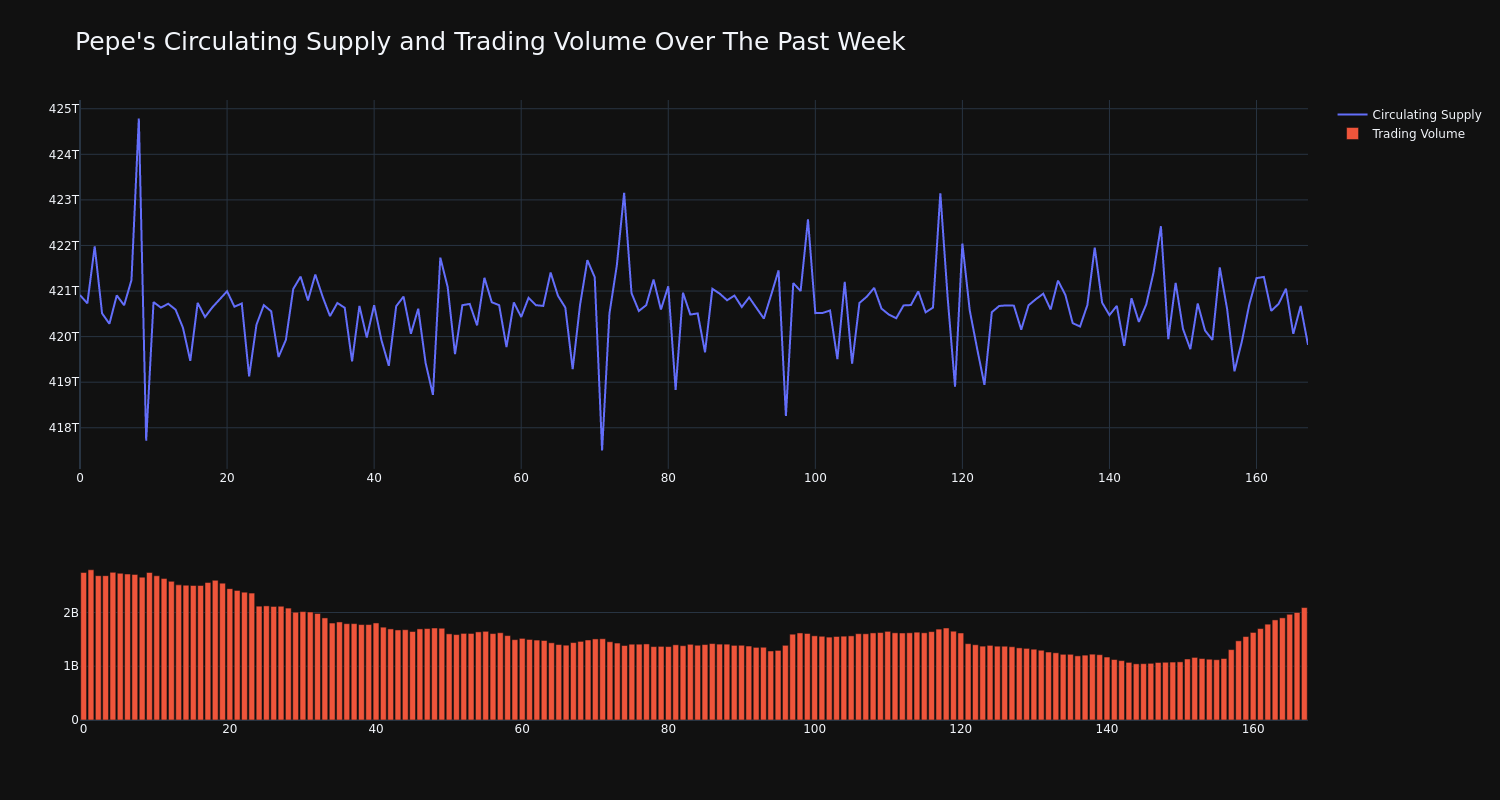

The trading volume for the coin has tumbled 24.0% over the past week along with the circulating supply of the coin, which has fallen 0.26%. This brings the circulating supply to 420.69 trillion, which makes up an estimated 100.0% of its max supply of 420.69 trillion. According to our data, the current market cap ranking for PEPE is #29 at $4.47 billion.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What's Next: Charles Schwab's Earnings Preview

Charles Schwab SCHW will release its quarterly earnings report on Tuesday, 2024-10-15. Here’s a brief overview for investors ahead of the announcement.

Analysts anticipate Charles Schwab to report an earnings per share (EPS) of $0.75.

Charles Schwab bulls will hope to hear the company announce they’ve not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

Earnings Track Record

In the previous earnings release, the company beat EPS by $0.01, leading to a 5.38% drop in the share price the following trading session.

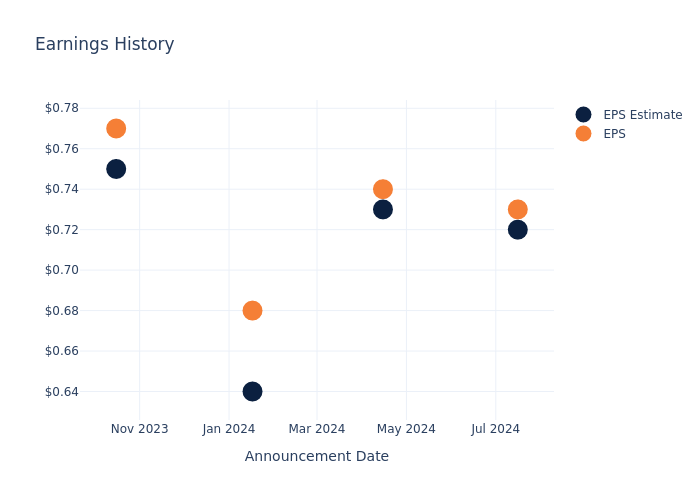

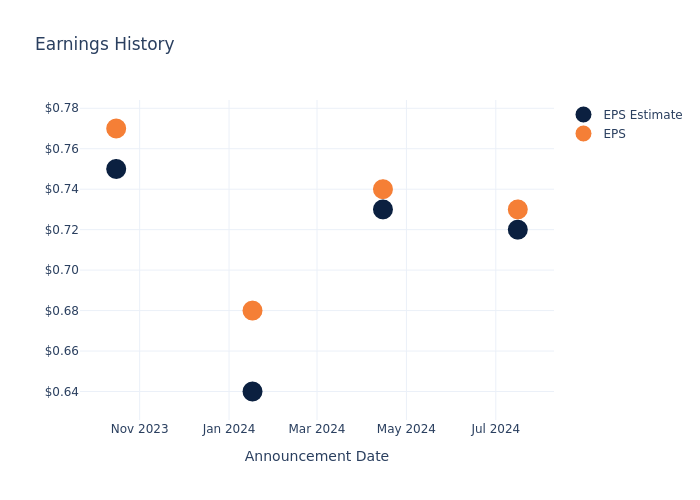

Here’s a look at Charles Schwab’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.72 | 0.73 | 0.64 | 0.75 |

| EPS Actual | 0.73 | 0.74 | 0.68 | 0.77 |

| Price Change % | -5.0% | 3.0% | -1.0% | -0.0% |

Charles Schwab Share Price Analysis

Shares of Charles Schwab were trading at $67.68 as of October 11. Over the last 52-week period, shares are up 26.72%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for Charles Schwab visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

WETH's Price Increased More Than 7% Within 24 hours

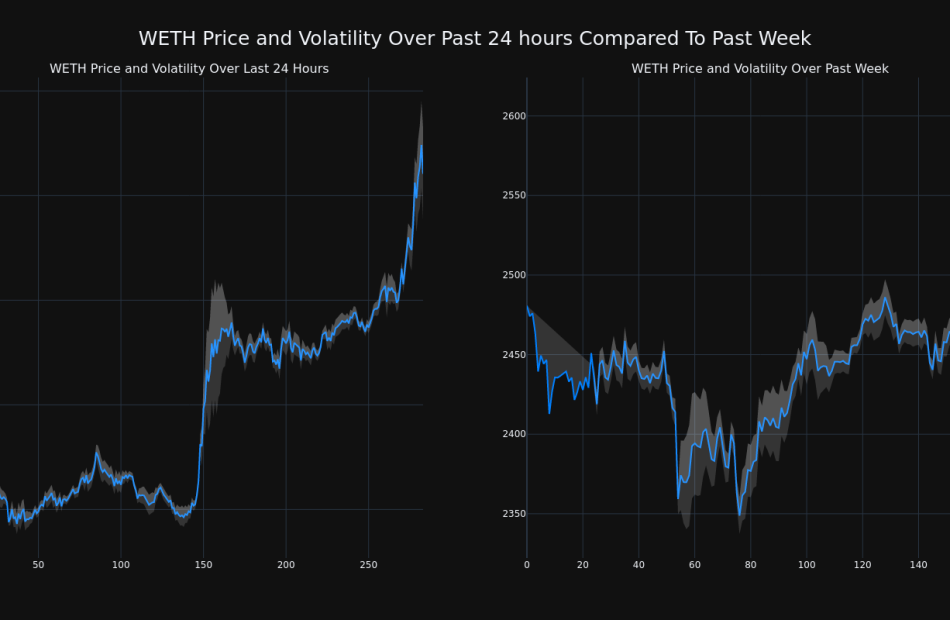

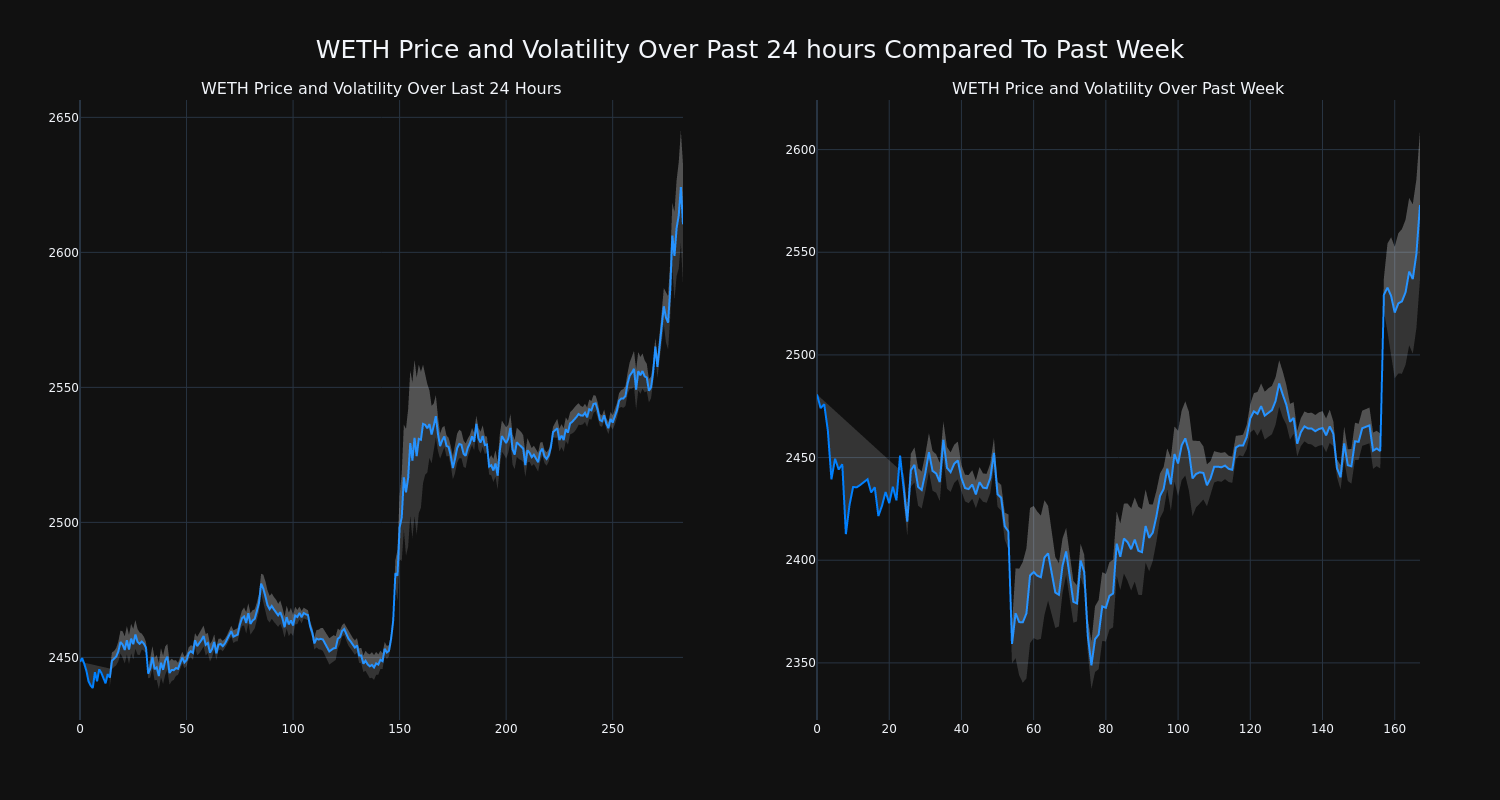

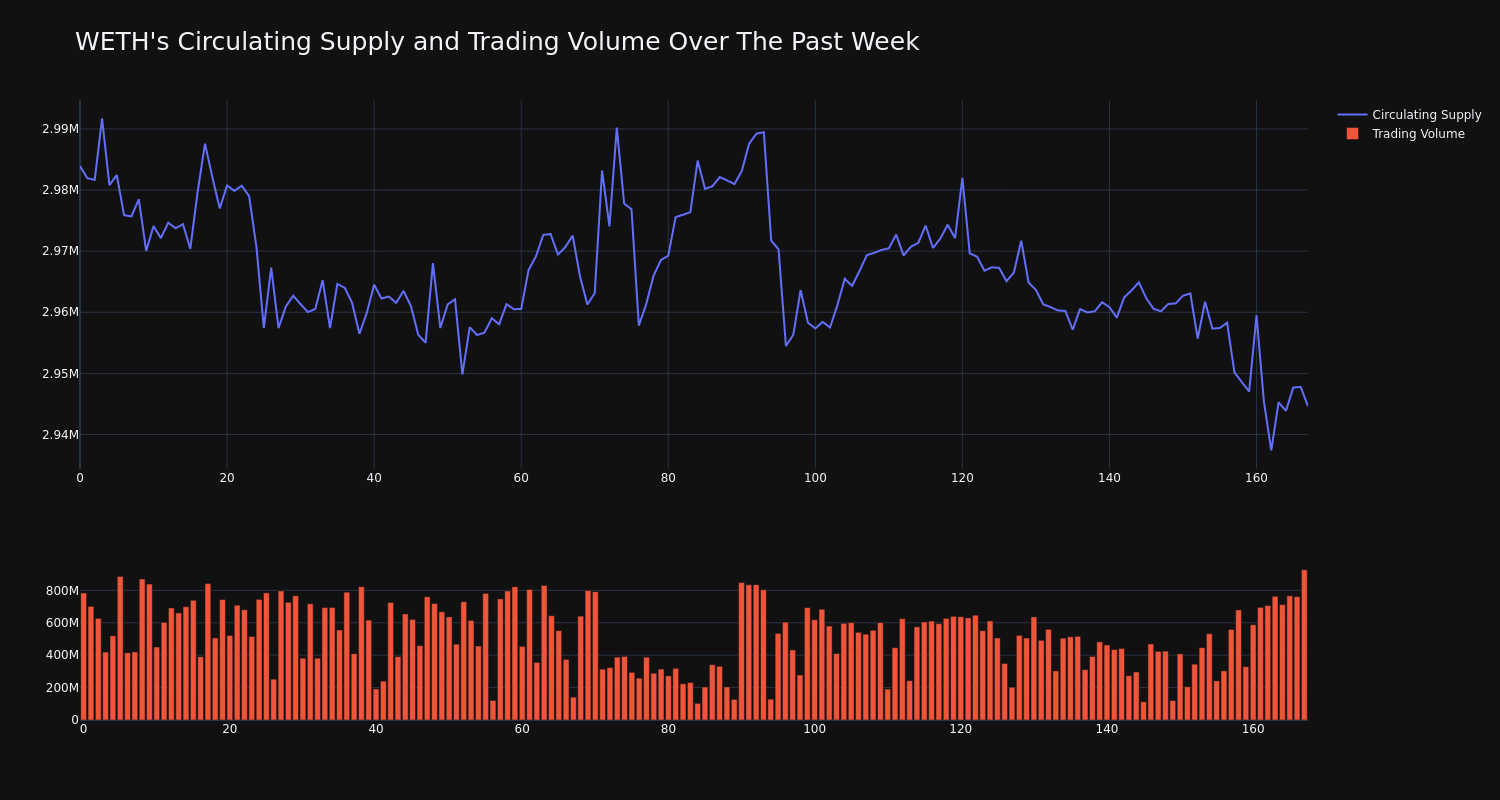

Over the past 24 hours, WETH’s WETH/USD price rose 7.08% to $2,617.98. This continues its positive trend over the past week where it has experienced a 4.0% gain, moving from $2,480.74 to its current price. As it stands right now, the coin’s all-time high is $4,799.89.

The chart below compares the price movement and volatility for WETH over the past 24 hours (left) to its price movement over the past week (right). The gray bands are Bollinger Bands, measuring the volatility for both the daily and weekly price movements. The wider the bands are, or the larger the gray area is at any given moment, the larger the volatility.

The trading volume for the coin has climbed 18.0% over the past week, moving opposite, directionally, with the overall circulating supply of the coin, which has decreased 1.32%. This brings the circulating supply to 2.94 million. According to our data, the current market cap ranking for WETH is #17 at $7.68 billion.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Where Will Palantir Stock Be In 1 Year?

At this time last year, the stock price for Palantir Technologies (NYSE: PLTR) was under $15 per share. As of mid-morning on Oct. 9, shares of Palantir were hovering around $43 — nearly triple where they were just one year ago.

Over the last year, Palantir’s software suite has garnered much attention as sophisticated data analytics platforms become a critical part of artificial intelligence (AI) roadmaps. But with shares of Palantir continuing to rise, investors need to start wondering how much longer the music is going to be playing.

Below, I’ll cover a number of catalysts that could spur even further growth for Palantir while also calling out some risks the company faces.

What could cause Palantir stock to run higher?

I see three key factors that could ignite further buying of Palantir stock over the next year.

1. Institutional Coverage and Ownership: Back in September, Palantir reached a critical milestone as it was inducted into the S&P 500. Now that Palantir is part of the exclusive index, I would not be surprised to see the company receive more attention from large financial institutions.

For example, high-profile investment banks such as JP Morgan or Wells Fargo could begin covering the stock from an equity research perspective. If more analysts from Wall Street’s largest banks begin to regularly report on Palantir and its prospects, the company has a good chance to land on more investors’ radar. This could be a positive catalyst for the stock as it broadens Palantir’s reach to a bigger pool of investors.

Moreover, I also think that more hedge funds may begin taking positions in Palantir. Steadily rising institutional ownership in Palantir could also be a catalyst that charges more gains for the stock.

2. More Partnerships: Earlier this year, Palantir signed two notable strategic partnerships. The deal with Microsoft revolves around increasing AI investments in the defense sector, while the relationship with Oracle is going to integrate cloud-based workflows into Palantir’s data analytics platform, Foundry.

I think the deals with Microsoft and Oracle bode well for Palantir’s chances to continue partnering with the tech sector’s largest businesses. Such relationships can help strengthen Palantir’s deal flow pipeline and provide many cross-selling opportunities, ultimately serving as lucrative catalysts for the company and the stock.

3. AI in the defense sector: One area of the AI realm that I think is misunderstood is how the technology can be leveraged in military operations. Defense tech is becoming more of a priority, and it’s taking many different forms. In cybersecurity, logistics, and even simulated combat operations, AI stands to be an important piece of technology for the military.

Keep in mind that nearly half of Palantir’s revenue stems from government contracts with the U.S. military and its Western allies. In just the last few months, Palantir has won a number of important AI-focused deals with the Department of Defense (DOD). I suspect that as AI investments become a more mainstream feature in defense budgets, Palantir will continue to benefit from these initiatives, given the company’s existing strong relationships with government agencies.

What could cause Palantir stock to sell off?

The chart below illustrates Palantir’s revenue and net income trajectory over the last several years. Investors can see that the company’s top line is accelerating while the business has finally reached consistent profitability.

Candidly, I am a little wary that the AI narrative itself is not going to be enough to keep investors interested in Palantir. While the company’s growth is undoubtedly impressive, there are other data analytics platforms for large enterprises on the market.

The company has a unique ability to reinvest its excess profits into areas including research and development (R&D), hiring efforts, marketing, or acquisitions.

I think Palantir is going to need to introduce additional products and services sooner rather than later; otherwise, the company’s future earnings reports may run the risk of being viewed as satisfactory, but not great. In turn, investors could quickly sour on Palantir and dump the stock in exchange for something more appealing.

Palantir’s valuation story tells itself

As of the time of this article, Palantir has a market capitalization of $96 billion. As much as I am a Palantir bull, I have to concede that this valuation is pricey for a company that’s only done $2.5 billion in sales over the last 12 months.

At some point, I think some investors are going to begin taking profits in Palantir and I would not be surprised if such an action takes place in the near-term. While I think Palantir has numerous catalysts, all of the ideas explored above are longer-term tailwinds. For this reason, I would not be surprised to see Palantir stock witness a sell-off over the next year as the company’s longer-term priorities continue to develop and take shape.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,069!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Wells Fargo is an advertising partner of The Ascent, a Motley Fool company. Adam Spatacco has positions in Palantir Technologies. The Motley Fool has positions in and recommends JPMorgan Chase, Oracle, and Palantir Technologies. The Motley Fool has a disclosure policy.

Where Will Palantir Stock Be In 1 Year? was originally published by The Motley Fool

‘It’s so unfair!’ I’m miserable in my job. I’m 58 and have $1 million in a 401(k) and Roth IRA. Can I afford to quit?

Dear Quentin,

I’ve spent six years at a mostly miserable job where I have dealt with poor management and with a slacker, lying co-worker being promoted even after egregious behavior. All of this has led me to want to quit! It’s obviously a bit more complicated, but there’s too much to go into now.

I just turned 58. I have $1 million in a 401(k) and Roth IRA, but I feel like it’s not enough to retire, as I’ll need healthcare and I can’t collect Social Security until I’m at least 62, but I would prefer to wait until I’m 67.

Most Read from MarketWatch

Please be kind in your response. The work situation has become unbearable and is especially sad because I love my work. It’s so unfair! I’ve been looking for a new job! But I am fed up and want to quit my current job.

Currently, I live comfortably on $5,000 a month, but I could probably live on $3,500 a month. I’m including expenses, rent and $800 a month that I’ll need to pay for my healthcare. Can I quit and be free? Or would it be a foolish move?

Halfway out the Door

Dear Halfway,

Quitting won’t bring you freedom — not financial freedom, at least.

Your original letter contained many words in all-caps and lots of exclamation points. That suggests to me that you are allowing your emotions to rule your world. It’s much easier to feel hard done by and frustrated with your current job and triggered by unfairness wherever you look when you have a monthly salary than when you no longer have one. If you pull the plug on your job, you will have disempowered yourself.

You could possibly retire on $1 million, but there’s no guarantee that it will last you for the rest of your life. Using the 4% rule — withdrawing 4% of your nest egg every year — you would take out $40,000, but you would still have to pay income tax on your 401(k) withdrawals, given that those contributions were made with pretax dollars. Contributions made to a Roth IRA, as you are no doubt aware, are after-tax.

Expectations are relative, but U.S. adults, on average, say they’ll need $1.46 million to retire comfortably, up 15% over the $1.27 million reported last year, according to a recent study by Northwestern Mutual. That increase far outpaces the current inflation rate of between 2% and 3%. People’s “magic number” for retirement savings has risen 53% from the $951,000 target Americans reported in 2020.

I’m telling you this as a reality check. You need to give yourself some breathing room. Hopefully, thinking about something other than who was given a promotion, why your job stinks and who does or doesn’t appreciate you will help you to put things in perspective. It’s a job. It’s also a golden ticket, even if it’s one that might stink from time to time, to get you where you want to go: the Retirement Land of the Financially Free.

Your life as an umbrella

Visualize your job as the handle of an umbrella and your life as the canopy. The handle is the stable part that holds all of that up. Your resentments about unfair management practices may be valid, but if you can exercise control over your feelings, they can change. The pandemic has wreaked havoc on our emotional relationship to work and made millions of people question how they spend their time.

The words of a boss often carry a power greater than those of most other people in our lives. Indeed, the quality of workplace leadership has a real impact on people’s mental health, according to a study released last year by the Workforce Institute at UKG, which provides research and education on workplace issues. The researchers interviewed 2,200 employees in 10 countries, in addition to 600 C-suite leaders and 600 human-resources executives in the U.S.

The day-to-day stress associated with office politics should be given the same attention as workplace burnout. Some 69% of workers said that the words and actions of their manager affected their mental health — the same percentage who said the same thing about their spouse or partner, and an even higher percentage than those who said their doctors (51%) or their therapists (41%) had an effect on their mental health.

The strong labor market is not rolling out the red carpet for everyone, particularly people over 50. Age discrimination is alive and well. And while the Labor Department recently reported an increase of 254,000 jobs in September, don’t expect that to last. MarketWatch reporter Jeffry Bartash wrote that the U.S. has produced an average of 169,000 jobs a month. Going forward, he wrote, “that’s probably closer to the mark.”

Your work situation may feel untenable, but unemployment could feel a heck of a lot worse.

More columns from Quentin Fottrell:

Most Read from MarketWatch

Struggling Retailers Brace For Halloween Consumer Spending Slump

The U.S. retail industry is set to face another blow with a predicted drop in Halloween spending, adding to the woes of debt-laden retailers grappling with increased overheads and a consumer shift towards cheaper products.

What Happened: As per a recent report by Bloomberg, the National Retail Federation anticipates a 5% decrease in US Halloween expenditure, amounting to $11.6 billion this year.

The most significant decline is expected in the sales of greeting cards and costumes, which could hit merchants relying on seasonal spending in an already tough year for the retail sector.

Higher unemployment rates and persistent inflation have particularly impacted lower-income households. During a recent earnings call, Michaels Cos. MIK pointed out that households with earnings below $100,000 are tightening their belts, resulting in smaller shopping baskets.

Also Read: Impending Recession? US Consumer Spending Shows Worrying Signs

Several struggling companies, including Michaels and At Home Group Inc. HOME, are under the ownership of private equity managers. These firms are facing difficulties due to poorly timed buyouts during the pandemic, which coincided with surging interest rates and inflation that strained household budgets.

Despite the hurdles, both Michaels and At Home remain hopeful about securing a larger portion of holiday spending. However, the overall spending cutback is posing challenges for the wider industry, leading to a series of high-profile bankruptcies this year.

Why It Matters: The predicted decrease in Halloween spending is a reflection of the ongoing economic challenges faced by US households.

The retail sector, already hit hard by the pandemic, is now grappling with reduced consumer spending due to inflation and high unemployment rates. This scenario is particularly concerning for firms owned by private equity managers, who are already struggling with the repercussions of ill-timed buyouts during the pandemic.

The situation underscores the need for strategic planning and innovative solutions to navigate the current economic landscape.

Read Next

Brighter Outlook: Goldman Sachs Optimistic On U.S. Economy, Cuts Recession Risk Down To 20%

This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.