Where Will Nvidia Stock Be in 2025?

The red-hot rally that started in shares of Nvidia (NASDAQ: NVDA) toward the end of 2022 is now almost two years old, and the chip giant has delivered 11x gains during this two-year period.

So, an investment of just $100 made in Nvidia stock a couple of years ago is now worth more than $1,100. More importantly, it appears that the company’s phenomenal run could be sustainable in 2025 as well, thanks to the developments in the artificial intelligence (AI) chip market.

Here, we will take a closer look at the reasons why Nvidia’s stunning run may continue next year.

Strong Blackwell demand and improving supply will be tailwinds for Nvidia next year

Consensus estimates forecast Nvidia to end the ongoing fiscal year 2025 with $125.5 billion in revenue, which would be a 125% increase from the previous year. However, analysts at KeyBanc are forecasting the company’s revenue to come in at $130.6 billion in the current fiscal year (which will end in January 2025).

KeyBanc points out that Nvidia is on track to deliver stronger growth this year thanks to the sales ramp of its new Blackwell AI processors. That’s not surprising, as Nvidia management pointed out on the recent earnings conference call that it expects “to get several billion dollars in Blackwell revenue” in the fourth quarter of fiscal 2025.

At the same time, Nvidia believes that the sales of its current-generation Hopper chips, the H100 and H200 processors, are on track to increase in the second half of fiscal 2025 on the back of strong demand and improved supply. KeyBanc analysts also point out that the demand for these Hopper chips is extremely strong.

Even better, Nvidia’s suppliers are taking steps to ensure that the chip giant is able to fulfill more orders. For instance, contract electronics manufacturer Foxconn has announced that it is building the world’s largest production facility for Nvidia’s GB200 Grace Blackwell Superchip. This particular chip consists of two of Nvidia’s B200 Tensor Core GPUs (graphics processing units) that are connected to its Grace CPU (central processing unit).

Each Nvidia GB200 Superchip is expected to be priced between $60,000 to $70,000. More importantly, the server systems manufactured using multiple GB200 Superchips are in robust demand. Nvidia reportedly increased its orders for the Blackwell GPUs by 25% in July this year, and Foxconn’s announcement suggests that demand remains robust.

Market research firm TrendForce estimates that Nvidia could ship 60,000 units of GB200 NVL36 servers next year, and this particular configuration reportedly commands an average selling price of $1.8 million. What that means is that Nvidia may be able to sell $108 billion worth of its GB200 NVL36 servers next year.

Meanwhile, Japanese investment bank Mizuho is forecasting sales of 6.5 million to 7 million units of Nvidia’s AI graphics cards next year, suggesting that the company could pull in close to $200 billion in data center revenue in calendar 2025 (which will coincide with the majority of its fiscal 2026). If that indeed happens, Nvidia could be well on its way to smashing analysts’ revenue expectations for the next fiscal year.

The stock seems built for more upside in 2025

As the chart shows us, analysts are expecting Nvidia to clock $177 billion in revenue in fiscal 2026.

The estimate has moved substantially higher as the year has progressed. So, there is a good chance that it could indeed breach the $200 billion mark going forward, considering the potential revenue that Nvidia is expected to generate from sales of its data center chips alone. That healthy jump in Nvidia’s revenue is set to translate into impressive earnings growth as well.

Analysts are expecting Nvidia to post $4.02 in earnings in fiscal 2026, up 41% from this year’s projected earnings of $2.84 per share. However, next year’s earnings estimate has moved up significantly in the past 90 days. Three months ago, consensus estimates were projecting $3.69 per share in earnings from Nvidia for the next fiscal year.

In all, Nvidia seems well placed to sustain its healthy growth next year as well. The stock has a median 12-month price target of $150, per 65 analysts covering it, pointing toward a 13% upside from current levels. However, the Street-high 12-month price target of $203 would translate into 53% gains from where this AI stock is right now, and it won’t be surprising to see Nvidia approaching that mark in 2025 thanks to the points discussed.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,069!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Where Will Nvidia Stock Be in 2025? was originally published by The Motley Fool

1 Stock to Buy, 1 Stock to Sell This Week: Netflix, Walgreens

-

Retail sales, Fed speakers, Q3 earnings will be in focus this week.

-

Netflix is a buy with upbeat profit and subscriber growth expected.

-

Walgreens Boots Alliance is a sell with disappointing earnings, guidance on deck.

-

Looking for more actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro for less than $8 a month!

U.S. stocks ended higher on Friday to cap off their fifth winning week in a row, as investors digested the first batch of third-quarter earnings and continued to assess the Federal Reserve’s rate plans for the months ahead.

For the week, the benchmark S&P 500 and the blue-chip Dow Jones Industrial Average climbed 1.1% and 1.2%, respectively. Both averages hit fresh all-time highs and closed at records. The tech-heavy Nasdaq Composite added 1.1%.

Source: Investing.com

The holiday-shortened week ahead – which will see the U.S. stock market closed on Monday in observance of Colombus Day – is expected to be another busy one as investors assess the outlook for the economy, interest rates and corporate earnings.

Most important on the economic calendar will be Thursday’s U.S. retail sales report for September, with economists estimating a headline increase of 0.3% after sales rose 0.1% during the prior month.

Source: Investing.com

That will be accompanied by a heavy slate of Fed speakers, with the likes of district governors Neel Kashkari, Christopher Waller, Mary Daly, and Adriana Kugler all set to make public appearances.

As of Sunday morning, investors see an 86% chance of the Fed cutting rates by 25 basis points at its November 7 policy meeting, and a 14% chance of no action, according to Investing.com’s Fed Monitor Tool.

Meanwhile, third-quarter earnings season shifts into high gear, with Netflix (NASDAQ:NFLX) leading the charge. Other high-profile companies reporting include Bank of America (NYSE:BAC), Citigroup (NYSE:C), Goldman Sachs (NYSE:GS), Morgan Stanley (NYSE:MS), American Express (NYSE:AXP), Johnson & Johnson (NYSE:JNJ), UnitedHealth (NYSE:UNH), Procter & Gamble (NYSE:PG), Walgreens Boots Alliance (NASDAQ:WBA), United Airlines (NASDAQ:UAL), ASML (AS:ASML), and Taiwan Semiconductor (NYSE:TSM).

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see fresh downside. Remember though, my timeframe is just for the week ahead, Monday, October 14 – Friday, October 18.

Stock To Buy: Netflix

I foresee another strong performance for Netflix’s stock this week, as the streaming giant’s third quarter earnings report will easily beat estimates thanks to favorable consumer demand trends and an improving fundamental outlook.

The Los Gatos, California-based Internet television network is scheduled to release its Q3 update after the U.S. market closes on Thursday at 4:00PM ET. A call with co-CEO’s Ted Sarandos and Greg Peters is set for 5:00PM ET.

Market participants expect a sizable swing in NFLX stock after the print drops, according to the options market, with a possible implied move of 7.9% in either direction.

Profit estimates have been revised upward 29 times in the last 90 days, reflecting growing confidence among analysts. Only two downward revisions have been noted, underscoring Wall Street’s bullish sentiment toward Netflix.

The company’s recent cost-cutting measures, along with its ability to drive subscriber growth, have positioned it as a dominant player in the streaming space.

Source: InvestingPro

Netflix is seen earning $4.53 per share, jumping 37% from EPS of $3.11 in the year-ago period. Meanwhile, revenue is forecast to increase 14.3% year-over-year to $9.76 billion.

If confirmed, this would represent the highest quarterly sales in Netflix’s 27-year history, driven by strong demand for its lower-cost, ad-supported tier and the company’s ongoing crackdown on password sharing, a move that has pushed more users to sign up for their own accounts.

As such, I reckon Netflix will maintain its solid pace of net streaming subscriber additions and easily top Wall Street estimates of about 4.2 million new global subscribers added during the third quarter.

NFLX stock hit a new all-time high of $736 on Friday before ending at $722.79. At current levels, Netflix has a market cap of $310.2 billion.

Source: Investing.com

Shares are up 48.4% in the year to date.

InvestingPro highlights Netflix’s promising outlook, emphasizing its favorable positioning in the streaming industry, which has allowed it to leverage a resilient business model and strong profit growth.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Subscribe now with an exclusive 10% discount and position your portfolio one step ahead of everyone else!

Stock to Sell: Walgreens Boots Alliance

In contrast, Walgreens Boots Alliance is set to deliver a disappointing earnings report when it updates investors on its fiscal fourth quarter before the market opens on Tuesday at 7:00AM ET.

The retail pharmacy giant has been struggling to navigate a challenging macroeconomic environment, and the outlook for the stock remains bleak.

According to the options market, traders are pricing in a swing of about 7.5% in either direction for Walgreens stock following the print.

Earnings have been catalysts for outsized swings in shares this year, as per data from InvestingPro, with WBA gapping down a massive 22.7% when the company last reported quarterly numbers in late June.

Analysts expect a sharp decline in earnings, with forecasts calling for a drop of roughly 53% compared to initial estimates from 90 days ago. This significant downward revision reflects the numerous challenges facing Walgreens, including weaker consumer demand, rising labor costs, and persistent inflationary pressures.

Source: InvestingPro

Wall Street sees Walgreens earning $0.36 per share, compared to EPS of $0.67 in the year-ago period, amid higher cost pressures and declining operating margins.

Meanwhile, revenue is forecast to inch up 0.4% year-over-year to $35.55 billion, as it deals with low consumer spending due to the challenging retail environment.

Adding to its woes, Walgreens is expected to provide soft guidance for the upcoming fiscal year as it struggles to adapt to the rise in popularity of online pharmacy and direct to consumer platforms, which are both seen as posing a threat to Walgreens’ business.

WBA stock ended at $9.21 on Friday, not far from a recent low of $8.22, which was the weakest level since September 1996. At its current valuation, the Deerfield, Illinois-based retail drugstore chain operator and pharmacy services provider has a market cap of $7.9 billion.

Source: Investing.com

Shares – which were removed from the Dow Jones Industrial Average earlier this year – are down 64.7% in 2024.

Not surprisingly, Walgreens has a below-average InvestingPro ‘Financial Health’ score of 1.8 out of 5.0 due to worries over its weak profitability outlook and significant debt load.

Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now to get an additional 10% off the final price and instantly unlock access to several market-beating features, including:

-

AI ProPicks: AI-selected stock winners with proven track record.

-

InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

-

Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

-

Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF, and the Invesco QQQ Trust ETF. I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.

Related Articles

1 Stock to Buy, 1 Stock to Sell This Week: Netflix, Walgreens

Doom Prophets Are Like Broken Clocks – Occasionally Correct but Mostly Useless

Dominoâs Pizza Stock Delivers: A Hot Buy for Growth Investors

Retail sales, big banks' results, and Netflix earnings: What to know this week

Stocks closed another week at record highs as investors began to digest quarterly earnings releases and debate intensified over what the Federal Reserve will do at its November meeting.

For the week, the Nasdaq (^IXIC), the S&P 500 (^GSPC), and the Dow Jones Industrial Average (^DJI) all rose more than 1%, with both the Dow and S&P 500 closing at all-time highs Friday.

In the week ahead, a monthly report on retail sales will lead the economic calendar as investors assess whether or not the economy is reaccelerating following a surprisingly strong September jobs report.

In corporate news, the results from Bank of America (BAC), Goldman Sachs (GS), and Morgan Stanley (MS) will round out earnings from big banks, while reports from United Airlines (UAL) and Netflix (NFLX) will also highlight the week.

A building case for no-cut November

In the past week, speculation that the Federal Reserve will not cut interest rates further at its November meeting has been growing. The September jobs report, which included another decline in the unemployment rate and one of the highest monthly payroll addition numbers of the year, helped ease fears that the labor market was rapidly deteriorating.

On Thursday, the latest Consumer Price Index (CPI) report showed core prices increased more than expected. On Friday, the latest Producer Price Index (PPI) told a similar story, with core prices increasing 2.8%, compared to Wall Street’s expectations for a 2.6% increase.

Some have argued that given this data — as well as recent minutes from the Fed’s September meeting revealing “some” officials would’ve supported a smaller interest rate cut — the central bank is likely to hold rates steady in November.

“As long as inflation isn’t getting towards 2% so dramatically and there’s no crisis that unfolds in the labor market, which I don’t foresee, I don’t think there’s anything that gives the Fed reason to cut further this year,” Yardeni Research chief markets strategist Eric Wallerstein told Yahoo Finance.

As of Friday, markets were pricing a roughly 18% chance the Fed doesn’t cut in November, up from a 3% chance seen a week prior, per the CME FedWatch Tool.

Retail reading

Stronger-than-expected economic data has helped drive the “no cut” discussion. Investors will have another update in that department this week with the release of the September retail sales report on Thursday.

Economists expect that retail sales increased 0.2% in September from the prior month. In August, retail sales rose 0.1%, defying the decline economists had projected.

“Retail sales, in particular, could be a significant market mover as variance in the series has increased, and scrutiny over the health of the consumer has intensified,” Jefferies’ economics team led by Thomas Simons wrote in a note to clients on Friday. “We would warn that one should not read too deeply into a miss against consensus (upside or downside) because retail sales measures spending with a very heavy weighting towards goods rather than services, and it is measured in nominal terms. Weakness may just be due to continued disinflation or deflation in goods.”

Netflix takes the big screen

Big banks largely passed Wall Street’s test to open earnings season. Investor focus will remain on financials early in the week with reports from Morgan Stanley, Goldman Sachs, and Bank of America before shifting to Netflix results on Thursday after the bell.

The streaming giant’s stock is up about 50% this year and trading near an all-time high. Wall Street expects Netflix to report earnings per share of $5.16 on revenue of $9.77 billion. This would represent nearly 40% earnings growth compared to the year prior.

But Wall Street is heavily debating whether or not the stock can sustain its massive run. In the near term, Citi analyst Jason Bazinet believes Netflix announcing further price hikes in the US could be a catalyst for the stock.

“We expect Netflix’s stock to trade higher on a US price hike announcement, but we would expect shares to eventually trade lower as investor’s hopes for $25 in 2025 earnings per share are dashed,” Bazinet wrote.

Yields on the rise

The 10-year Treasury (^TNX) is hovering near 4.1% for the first time since late July.

The 10-year has now added roughly 30 basis points over the past week as investors have scaled back their expectations for interest rate cuts amid signs that inflation may be stickier than initially thought while economic growth data holds steady.

For much of the past few years, higher yields have been a headwind for stocks. But Piper Sandler chief investment strategist Michael Kantrowitz told Yahoo Finance on Thursday yields likely have not risen enough to be too much of a headwind just yet.

“I don’t think this backup in interest rates is all that worrisome for equities in aggregate,” Kantrowitz said. “But where it does show up is in leadership.”

Kantrowitz pointed out that areas like Real Estate (XLRE) and the small-cap Russell 2000 Index (^RUT), which had benefited from investors anticipating lower rates, have lagged amid the 10-year yield’s recent rise.

For now, Kantrowitz added, rising rates are determining market leadership more than they are weighing on the S&P 500 index.

“If rates keep going higher, I don’t think it’s a massive issue for equities unless it persists for, I’d say, a few months,” he said.

Monday

Economic data: NY Fed 1-year inflation expectations, September (3% prior)

Earnings: No notable earnings.

Tuesday:

Economic data: Empire Manufacturing, October (0.5 expected, 11.5 prior)

Earnings: Bank of America (BAC), Charles Schwab (SCHW), Citi (C), Goldman Sachs (GS), J.B. Hunt (JBHT), Johnson & Johnson (JNJ), Progressive (PGR), State Street (STT), United Airlines (UAL), UnitedHealth Group (UNH), Walgreens Boots Alliance (WBA)

Wednesday

Economic data: MBA Mortgage Applications, week ending Oct. 11 (-5.1% previously); Import price index month-over-month, September (-0.3% expected, -0.3% prior); Export price index month-over-month, September (-0.3% expected, -0.7% prior)

Earnings: Abbott (ABT), Alcoa (AA), ASML (ASML), Citizens (CIA), Discover Financial Services (DFS), Morgan Stanley (MS)

Thursday

Economic data: Initial jobless claims, week ending Oct. 12 (258,000 previously); Retail sales month-over-month, September (0.2% expected, 0.1% prior); Retail sales excluding auto and gas, September (0.3% expected, 0.2% prior); Philadelphia Fed Business Outlook, October (2.9 expected, 1.7 previously); Industrial production, month-over-month, September (0% expected, 0.8% prior); NAHB housing market index, October (42 expected, 41 prior); Leading Index, March (-0.1% expected, +0.1% previously); Existing home sales, month-over-month, March (-5.1% expected, 9.5% previously)

Earnings: Netflix (NFLX), Blackstone (BX), Travelers (TRV), First National Bank (FBAK), Western Alliance (WAL), WD-40 (WDFC)

Friday

Economic data: Housing starts month-over-month, September (-0.9% expected, 9.6% prior); Building permits month-over-month, September (-0.3% expected, 4.9% prior)

Earnings: Ally Financial (ALLY), American Express (AXP), Comerica (CMA), Procter & Gamble (PG)

Josh Schafer is a reporter for Yahoo Finance. Follow him on X @_joshschafer.

Click here for in-depth analysis of the latest stock market news and events moving stock prices

Read the latest financial and business news from Yahoo Finance

This Market Pro Says Kamala Harris' Unrealized Capital Gains Tax 'Makes No Sense' And Will 'Suck Money Out Of The Market'

Vice President Kamala Harris has endorsed a tax proposal that is lighting up debates everywhere. The 25% minimum tax on total income, including unrealized capital gains, targets the ultrawealthy, particularly those with over $100 million fortunes. While some see this as a bold move toward fairness, many financial experts and political voices are raising alarm bells.

Don’t Miss:

Jason Katz, managing director and senior portfolio manager at UBS, is among the most outspoken critics. In an interview with Fox Business, Katz didn’t mince words, calling the proposal “an unmitigated disaster.”

According to him, taxing unrealized gains – that is, gains on assets that haven’t been sold yet – would create an “accounting nightmare.” He painted a grim picture of taxpayers facing massive bills for gains that could easily disappear the following year.

Trending: Studies show 50% of consumers think Financial Advisors cost much more than they do — to debunk this, this company provides matching for free and a complimentary first call with the matched advisor.

Katz illustrated his point with a hypothetical scenario, asking, “If you have an ultra high net worth person who bought, say, $100 million worth of Amazon and it goes to $150 million and the government taxes 23% on that $50 million in year one, if in year two, that $150 – because Amazon drops – goes back to $100 million, is the government going to rebate the tax from the previous year?”

“It would be an accounting nightmare, not to mention the fact it would suck money out of the capital markets,” he said. He added that it ‘made no sense’ applying the tax to other asset classes like real estate, where investors also see unrealized gains.

Trending: The global games market is projected to generate $272B by the end of the year — for $0.55/share, this VC-backed startup with a 7M+ userbase gives investors easy access to this asset market.

While Katz and other critics warn of potential market disruptions, the Biden administration defends the proposal as a necessary step to close loopholes that allow the wealthiest Americans to avoid paying their fair share.

An entrepreneur and “Shark Tank” investor, Mark Cuban offered a somewhat different perspective. According to CNBC’s Squawk Box, the billionaire entrepreneur and “Shark Tank” star claims to have spoken with Harris’ team directly.

Trending: ‘Scrolling to UBI’: Deloitte’s #1 fastest-growing software company allows users to earn money on their phones – invest today with $1,000 for just $0.25/share

He said Harris’ aide told him that unrealized capital gains wouldn’t be taxed, which contradicts what has been circulating about the proposal. Even within Harris’ camp, there’s a bit of a disconnect on what the plan entails.

However, tax proponents, such as Democratic Sen. Elizabeth Warren, argue that taxing unrealized capital gains could help close the wealth gap by ensuring that the ultrawealthy pay their fair share. According to a report from The New York Times, wealth inequality in the U.S. has reached levels not seen since the 1920s.

Trending: This Adobe-backed AI marketing startup went from a $5 to $85 million valuation working with brands like L’Oréal, Hasbro, and Sweetgreen in just three years – here’s how there’s an opportunity to invest at $1,000 for only $0.50/share today.

From an economic perspective, critics, including former CKE Restaurants CEO Andy Puzder, have called the proposal “voodoo economics.” Speaking on Fox Business’s ‘Evening Edit,’ he said, “The idea that we’re going to tax unrealized capital gains, that’s just absurd. This is voodoo economics … it’s absolutely ridiculous.”.

There are also logistical hurdles to consider. Analysts have pointed out that taxing unrealized gains would likely require new reporting systems and create huge compliance headaches for taxpayers and the IRS.

Read Next:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article This Market Pro Says Kamala Harris’ Unrealized Capital Gains Tax ‘Makes No Sense’ And Will ‘Suck Money Out Of The Market’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

LLAP INVESTOR ALERT: Bronstein, Gewirtz & Grossman LLC Announces that Terran Orbital Corporation Investors with Substantial Losses Have Opportunity to Lead Class Action Lawsuit

NEW YORK, Oct. 13, 2024 (GLOBE NEWSWIRE) — Attorney Advertising–Bronstein, Gewirtz & Grossman, LLC, a nationally recognized law firm, notifies investors that a class action lawsuit has been filed against Terran Orbital Corporation (“Terran” or “the Company”) LLAP and certain of its officers.

Class Definition

This lawsuit seeks to recover damages against Defendants for alleged violations of the federal securities laws on behalf of all persons and entities that purchased or otherwise acquired Terran securities between August 15, 2023, and August 14, 2024, inclusive (the “Class Period”). Such investors are encouraged to join this case by visiting the firm’s site: bgandg.com/LLAP.

Case Details

The Complaint alleges that, throughout the Class Period, Defendants made materially false and misleading statements regarding the Company’s business, operations, and prospects. Specifically, the Complaint alleges that Defendants made false and/or misleading statements and/or failed to disclose that: (1) it would take much longer than Defendants had represented to investors and analysts for Terran to convert its contracts with its customers (collectively, “Customer Contracts”) into revenue and free cash flow; (2) Terran did not have adequate liquidity to operate its business while waiting for the Customer Contracts to generate revenue and free cash flow; (3) Terran had concealed the true scope and severity of its dire financial situation; and (4) as a result of the foregoing, Terran’s public statements were materially false and misleading at all relevant times.

What’s Next?

A class action lawsuit has already been filed. If you wish to review a copy of the Complaint, you can visit the firm’s site: bgandg.com/LLAP or you may contact Peretz Bronstein, Esq. or his Client Relations Manager, Nathan Miller, of Bronstein, Gewirtz & Grossman, LLC at 332-239-2660. If you suffered a loss in Terran you have until November 26, 2024, to request that the Court appoint you as lead plaintiff. Your ability to share in any recovery doesn’t require that you serve as lead plaintiff.

There is No Cost to You

We represent investors in class actions on a contingency fee basis. That means we will ask the court to reimburse us for out-of-pocket expenses and attorneys’ fees, usually a percentage of the total recovery, only if we are successful.

Why Bronstein, Gewirtz & Grossman

Bronstein, Gewirtz & Grossman, LLC is a nationally recognized firm that represents investors in securities fraud class actions and shareholder derivative suits. Our firm has recovered hundreds of millions of dollars for investors nationwide.

Attorney advertising. Prior results do not guarantee similar outcomes.

Contact

Bronstein, Gewirtz & Grossman, LLC

Peretz Bronstein or Nathan Miller

332-239-2660 | info@bgandg.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

How Saudi Arabia could create a crisis for Russia's economy

-

Saudi Arabia could flood the market with oil to regain control of prices.

-

This would create a difficult situation for Russia, which is reliant on higher crude prices.

-

One analyst suggests the market could see a repeat of the 2020 oil price war.

Russia’s wartime economy could face a tougher time securing needed oil revenue if Saudi Arabia tanks global crude prices.

The kingdom has reportedly signaled that crude could drop as low as $50 a barrel if the Organization of Petroleum Exporting Countries does not commit to reducing oil output.

In other words, Riyadh is hinting that it could flood the market with oil supply, analysts say. The move would slash prices and penalize OPEC members who have not cooperated in reducing oil flows — including Russia.

“With Russia already selling its oil at discounted rates and with higher production costs, a low-price environment in oil markets may impact its ability to finance its aggression in Ukraine,” Luke Cooper, a research fellow at the London School of Economics, wrote for the IPS Journal.

Saudi Arabia, the de facto leader of OPEC, has been trying to keep oil above $100 per barrel by pushing for member states to cut production.

But with international crude hovering below the $80 mark, this hasn’t worked. To shift strategy sources told the Financial Times that Riyadh now plans to turn on its taps by December.

“Saudi Arabia is fed up,” Simon Henderson, director of the Bernstein Program on Gulf and Energy Policy at The Washington Institute, told Business Insider. “Leadership of OPEC is a multifaceted responsibility. It can work well, but it’s also like herding cats — pretty damn impossible, at least some of the time.”

S&P Global Ratings data counts Russia among the overproducers in OPEC+. According to its last available data, Moscow produced 122,000 barrels above its daily quota in July. Iran and Kazakhstan also breached agreed-upon thresholds.

The Kremlin’s dilemma

Henderson suggested that some coalition members might be doing this to maximize profits.

In Russia’s case, Moscow is facing pressure to rake in as much as it can, as its war in Ukraine has ballooned defense and security spending in three years of war. These sectors will collectively account for 40% of all federal expenditures in Russia next year.

Russia’s finances, meanwhile, are heavily dependent on oil revenue. A few years ago, gas and oil production made up 35%-40% of the nation’s budget revenue, the country’s finance minister said this week.

It’s for this reason that the West has been so focused on curbing Russian oil profits. Consider the Group of Seven’s $60 price cap on Moscow’s crude: though the two-year initiative has not panned out as hoped, it was considered to be a key to keeping oil supply stable while denying the Kremlin much needed revenue.

Russia has been able to circumvent these caps using unregistered “shadow” tankers, but Riyadh’s $50 per barrel threat might be harder to overcome.

Things could turn sour if Saudia Arabia’s supply dump reignites an oil price war between Russia and the kingdom. Henderson suggested this could happen, referring to a similar event that occurred in 2020.

That year, production cut disagreements prompted both nations to unleash supply, testing who could survive this low-price environment longer.

In these situations, foreign exchange reserves become essential, which is problematic for Russia.

Since invading Ukraine, the country’s insurance against low oil prices has dissipated. Russia’s National Wealth fund was nearly halved at the start of this year, and it is no longer able to source Western currencies to diversify its foreign exchange reserves.

It remains to be seen whether President Vladimir Putin will want to engage in a price war with Riyadh, given his other, more immediate priorities, Henderson said.

Predicting the Kremlin’s moves is hard, he said, given many unknowns tied to Russia’s oil sales.

However, some kind of confrontation with Saudi Arabia may be stirring. This week, Russia’s deputy prime minister Alexander Novak said it’s unclear whether OPEC should increase oil output at its December meeting, as signaled by Saudi Arabia.

If things do take a turn for the worst, Cooper sees a potential price war as bad news for Russia.

“Unlike Saudi Arabia, its oil is not cheap to extract, making it poorly equipped to deal with low-price conditions. This drives a short-term escalatory logic for Russia’s war on Ukraine, requiring rapid battlefield successes prior to the emergence of low-price oil market conditions.”

Read the original article on Business Insider

Platinum Hits Costco Shelves: Why The Retail Giant Is Selling $1,089 Bars To Its Members

Costco is again venturing into the precious metals market, expanding its offerings beyond the gold and silver bars it sold to great success. The retail giant now offers 1-ounce platinum bars for $1,089.99 exclusively to members via its website. This move is part of Costco’s broader strategy to diversify its product lineup and capitalize on the growing demand for collectible precious metals.

Don’t Miss:

A Continuation of Costco’s Precious Metals Success

Costco entered the precious metals market in 2023, introducing gold bars. The retailer sold more than $100 million of these bars in just the first quarter of that year. More recently, it added silver coins, which sold for $675. Now, platinum joins the lineup with its Swiss-made bars engraved with an image of Lady Fortuna, the Roman goddess of fortune and prosperity.

While the price of platinum has seen modest increases year to date – up 15% from 2023 – the allure of precious metals remains strong for collectors and investors. Gold has recently hit record highs and remains the more popular investment due to its higher appreciation rate.

However, CNN reports that Costco’s decision to sell platinum bars is less about competing with gold and more about continuing its “treasure hunt” retail strategy.

“We try to create an attitude that, if you see it, you ought to buy it because chances are it ain’t going to be there next time,” Costco’s founder once said to the Wall Street Journal. “That’s the treasure-hunt aspect. We constantly buy that stuff and intentionally run out of it from time to time.”

Trending: Are you rich? Here’s what Americans think you need to be considered wealthy.

Why Platinum?

Platinum may not be as sought after as gold, but it uniquely appeals. It’s a rarer metal used in industrial applications and as a form of wealth preservation. Costco’s platinum bars are made of 999.5 pure platinum, which collectors and investors might find appealing as a diversification opportunity.

Kelly Bania, a senior research analyst at BMO Capital Markets, told ABC News that Costco’s move to introduce platinum bars is consistent with its strategy of offering high-margin products. Platinum’s market value fluctuates around $1,008 per ounce, so Costco’s $1,089.99 price tag reflects a small markup. However, buyers are willing to pay a premium for the convenience of purchasing precious metals from a trusted retailer.

Trending: The global games market is projected to generate $272B by the end of the year — for $0.55/share, this VC-backed startup with a 7M+ userbase gives investors easy access to this asset market.

Should You Invest?

Investing in precious metals like platinum carries potential risks. Unlike stocks or bonds, precious metals don’t generate income and are subject to price volatility. Additionally, selling these metals can involve fees, making them a more complex investment for the average buyer.

Those considering platinum as an investment should do thorough research and possibly consult a financial advisor to ensure it fits their long-term goals.

Ultimately, Costco’s venture into platinum sales may be more about marketing than moving large quantities of the metal. But for shoppers who enjoy the thrill of snagging exclusive items, platinum bars are another example of the unique finds that make Costco a popular destination.

Read Next:

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article Platinum Hits Costco Shelves: Why The Retail Giant Is Selling $1,089 Bars To Its Members originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Super Micro Computer: Is This Stock-Split a Buying Opportunity or a Trap?

Super Micro Computer (NASDAQ: SMCI) is a pretty complicated investment right now. On one hand, it makes server components and entire servers that are in massive demand thanks to artificial intelligence (AI). On the other hand, there are accounting malpractice accusations and a Department of Justice (DOJ) probe that is investigating those concerns.

Right now, the bear case outweighs the bull one, which is why shares of Supermicro (as the company is known) are down 60% from their all-time high set in March. Furthermore, the company has recently undergone a 10-for-one stock split, a catalyst that usually causes a stock price to rise, not fall.

So, is this a stock to stay away from? Or is it a chance to own an undervalued and potentially massive winner?

Supermicro’s product is at risk of being commoditized

Let’s start with the business itself — and there may be other concerns to consider here, too. The space for Supermicro’s products is rather saturated today as a result of many competitors.

However, Supermicro has one key advantage: It has the most energy-efficient technology available. With energy being a significant operating cost for these servers, companies are considering the total cost of operation for them. This is pushing a massive amount of demand Supermicro’s way.

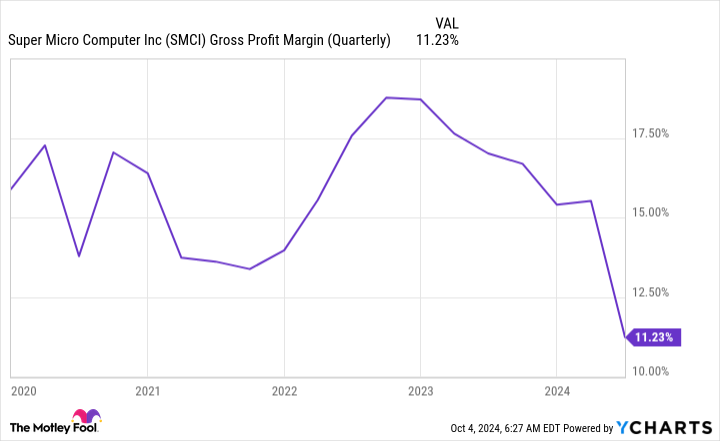

However, this isn’t without its own problems. Supermicro’s gross margin has collapsed due to its new liquid-cooled technology, as its supply chain has been bottlenecked for key components in these new systems. Management expects its gross margins to increase throughout fiscal 2025 (ending June 30, 2025), driven by its customer mix and manufacturing efficiencies as it scales up manufacturing in Malaysia and Taiwan, which should alleviate the bottlenecks it’s currently experiencing.

While this may be true, something else could be happening here. When a product becomes commoditized, companies that make it have to start cutting margins to compete. This could be happening with Supermicro’s business, which wouldn’t bode well for the company, even if it has best-in-class products.

This will be an important trend to watch over the next year as a low gross margin could break the Supermicro investment thesis.

Accounting malpractice allegations have triggered a government probe

Then there are the allegations and government probe. Well-known short seller Hindenburg Research released a report in late August alleging account malpractice at Supermicro, something the Securities and Exchange Commission already fined Supermicro $17.5 million for in 2020. While Supermicro’s management has denied these allegations, it didn’t do itself any favors when it announced it was delaying filing its end-of-year form 10-K with the SEC the day after Hindenburg’s report was published due to assessing “internal controls over financial reporting.”

It’s worth remembering that Hindenburg is a short seller, and so it benefits when the stock price falls. However, these allegations were serious enough that the DOJ initiated a probe into Supermicro to determine whether they had merit. It will be some time before we know the results of this investigation, so investors have a tough choice to make.

I wouldn’t blame anyone for throwing Supermicro into the “too hard to understand” pile. There’s no shame in this conclusion. One of the greatest investors of all time, Warren Buffett, often does this with businesses he doesn’t understand. With shrinking gross margins and an ongoing DOJ probe, there are certainly a lot of negatives surrounding Supermicro.

But there are some positives too. In fiscal 2025 (ending June 30, 2025), Supermicro expects its revenue to grow between 74% and 101% year over year. That’s massive growth, yet the stock is priced at a dirt cheap level.

At just 14.2 times forward earnings, Supermicro may be one of the cheapest companies you’ll ever find that’s posting growth rates like that. So, if Supermicro’s management is right and it improves its gross margin and delivers strong growth throughout FY 2025, the stock has massive upside, as it’s far below where the S&P 500 trades (at 23.7 times forward earnings).

I think there’s enough of a compelling investment thesis here that I bought the dip on the stock. However, I only let it take up around 1% of my portfolio, as there’s a lot of risk involved. Supermicro is all about risk tolerance and management. If you’re not OK with this stock losing money on the potential for strong gains, there are still plenty of other AI stocks that are great picks.

But there’s a strong chance this stock could double — if it works out some of its flaws.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,069!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

Keithen Drury has positions in Super Micro Computer. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Super Micro Computer: Is This Stock-Split a Buying Opportunity or a Trap? was originally published by The Motley Fool