This Market Pro Says Kamala Harris' Unrealized Capital Gains Tax 'Makes No Sense' And Will 'Suck Money Out Of The Market'

Vice President Kamala Harris has endorsed a tax proposal that is lighting up debates everywhere. The 25% minimum tax on total income, including unrealized capital gains, targets the ultrawealthy, particularly those with over $100 million fortunes. While some see this as a bold move toward fairness, many financial experts and political voices are raising alarm bells.

Don’t Miss:

Jason Katz, managing director and senior portfolio manager at UBS, is among the most outspoken critics. In an interview with Fox Business, Katz didn’t mince words, calling the proposal “an unmitigated disaster.”

According to him, taxing unrealized gains – that is, gains on assets that haven’t been sold yet – would create an “accounting nightmare.” He painted a grim picture of taxpayers facing massive bills for gains that could easily disappear the following year.

Trending: Studies show 50% of consumers think Financial Advisors cost much more than they do — to debunk this, this company provides matching for free and a complimentary first call with the matched advisor.

Katz illustrated his point with a hypothetical scenario, asking, “If you have an ultra high net worth person who bought, say, $100 million worth of Amazon and it goes to $150 million and the government taxes 23% on that $50 million in year one, if in year two, that $150 – because Amazon drops – goes back to $100 million, is the government going to rebate the tax from the previous year?”

“It would be an accounting nightmare, not to mention the fact it would suck money out of the capital markets,” he said. He added that it ‘made no sense’ applying the tax to other asset classes like real estate, where investors also see unrealized gains.

Trending: The global games market is projected to generate $272B by the end of the year — for $0.55/share, this VC-backed startup with a 7M+ userbase gives investors easy access to this asset market.

While Katz and other critics warn of potential market disruptions, the Biden administration defends the proposal as a necessary step to close loopholes that allow the wealthiest Americans to avoid paying their fair share.

An entrepreneur and “Shark Tank” investor, Mark Cuban offered a somewhat different perspective. According to CNBC’s Squawk Box, the billionaire entrepreneur and “Shark Tank” star claims to have spoken with Harris’ team directly.

Trending: ‘Scrolling to UBI’: Deloitte’s #1 fastest-growing software company allows users to earn money on their phones – invest today with $1,000 for just $0.25/share

He said Harris’ aide told him that unrealized capital gains wouldn’t be taxed, which contradicts what has been circulating about the proposal. Even within Harris’ camp, there’s a bit of a disconnect on what the plan entails.

However, tax proponents, such as Democratic Sen. Elizabeth Warren, argue that taxing unrealized capital gains could help close the wealth gap by ensuring that the ultrawealthy pay their fair share. According to a report from The New York Times, wealth inequality in the U.S. has reached levels not seen since the 1920s.

Trending: This Adobe-backed AI marketing startup went from a $5 to $85 million valuation working with brands like L’Oréal, Hasbro, and Sweetgreen in just three years – here’s how there’s an opportunity to invest at $1,000 for only $0.50/share today.

From an economic perspective, critics, including former CKE Restaurants CEO Andy Puzder, have called the proposal “voodoo economics.” Speaking on Fox Business’s ‘Evening Edit,’ he said, “The idea that we’re going to tax unrealized capital gains, that’s just absurd. This is voodoo economics … it’s absolutely ridiculous.”.

There are also logistical hurdles to consider. Analysts have pointed out that taxing unrealized gains would likely require new reporting systems and create huge compliance headaches for taxpayers and the IRS.

Read Next:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article This Market Pro Says Kamala Harris’ Unrealized Capital Gains Tax ‘Makes No Sense’ And Will ‘Suck Money Out Of The Market’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

LLAP INVESTOR ALERT: Bronstein, Gewirtz & Grossman LLC Announces that Terran Orbital Corporation Investors with Substantial Losses Have Opportunity to Lead Class Action Lawsuit

NEW YORK, Oct. 13, 2024 (GLOBE NEWSWIRE) — Attorney Advertising–Bronstein, Gewirtz & Grossman, LLC, a nationally recognized law firm, notifies investors that a class action lawsuit has been filed against Terran Orbital Corporation (“Terran” or “the Company”) LLAP and certain of its officers.

Class Definition

This lawsuit seeks to recover damages against Defendants for alleged violations of the federal securities laws on behalf of all persons and entities that purchased or otherwise acquired Terran securities between August 15, 2023, and August 14, 2024, inclusive (the “Class Period”). Such investors are encouraged to join this case by visiting the firm’s site: bgandg.com/LLAP.

Case Details

The Complaint alleges that, throughout the Class Period, Defendants made materially false and misleading statements regarding the Company’s business, operations, and prospects. Specifically, the Complaint alleges that Defendants made false and/or misleading statements and/or failed to disclose that: (1) it would take much longer than Defendants had represented to investors and analysts for Terran to convert its contracts with its customers (collectively, “Customer Contracts”) into revenue and free cash flow; (2) Terran did not have adequate liquidity to operate its business while waiting for the Customer Contracts to generate revenue and free cash flow; (3) Terran had concealed the true scope and severity of its dire financial situation; and (4) as a result of the foregoing, Terran’s public statements were materially false and misleading at all relevant times.

What’s Next?

A class action lawsuit has already been filed. If you wish to review a copy of the Complaint, you can visit the firm’s site: bgandg.com/LLAP or you may contact Peretz Bronstein, Esq. or his Client Relations Manager, Nathan Miller, of Bronstein, Gewirtz & Grossman, LLC at 332-239-2660. If you suffered a loss in Terran you have until November 26, 2024, to request that the Court appoint you as lead plaintiff. Your ability to share in any recovery doesn’t require that you serve as lead plaintiff.

There is No Cost to You

We represent investors in class actions on a contingency fee basis. That means we will ask the court to reimburse us for out-of-pocket expenses and attorneys’ fees, usually a percentage of the total recovery, only if we are successful.

Why Bronstein, Gewirtz & Grossman

Bronstein, Gewirtz & Grossman, LLC is a nationally recognized firm that represents investors in securities fraud class actions and shareholder derivative suits. Our firm has recovered hundreds of millions of dollars for investors nationwide.

Attorney advertising. Prior results do not guarantee similar outcomes.

Contact

Bronstein, Gewirtz & Grossman, LLC

Peretz Bronstein or Nathan Miller

332-239-2660 | info@bgandg.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

How Saudi Arabia could create a crisis for Russia's economy

-

Saudi Arabia could flood the market with oil to regain control of prices.

-

This would create a difficult situation for Russia, which is reliant on higher crude prices.

-

One analyst suggests the market could see a repeat of the 2020 oil price war.

Russia’s wartime economy could face a tougher time securing needed oil revenue if Saudi Arabia tanks global crude prices.

The kingdom has reportedly signaled that crude could drop as low as $50 a barrel if the Organization of Petroleum Exporting Countries does not commit to reducing oil output.

In other words, Riyadh is hinting that it could flood the market with oil supply, analysts say. The move would slash prices and penalize OPEC members who have not cooperated in reducing oil flows — including Russia.

“With Russia already selling its oil at discounted rates and with higher production costs, a low-price environment in oil markets may impact its ability to finance its aggression in Ukraine,” Luke Cooper, a research fellow at the London School of Economics, wrote for the IPS Journal.

Saudi Arabia, the de facto leader of OPEC, has been trying to keep oil above $100 per barrel by pushing for member states to cut production.

But with international crude hovering below the $80 mark, this hasn’t worked. To shift strategy sources told the Financial Times that Riyadh now plans to turn on its taps by December.

“Saudi Arabia is fed up,” Simon Henderson, director of the Bernstein Program on Gulf and Energy Policy at The Washington Institute, told Business Insider. “Leadership of OPEC is a multifaceted responsibility. It can work well, but it’s also like herding cats — pretty damn impossible, at least some of the time.”

S&P Global Ratings data counts Russia among the overproducers in OPEC+. According to its last available data, Moscow produced 122,000 barrels above its daily quota in July. Iran and Kazakhstan also breached agreed-upon thresholds.

The Kremlin’s dilemma

Henderson suggested that some coalition members might be doing this to maximize profits.

In Russia’s case, Moscow is facing pressure to rake in as much as it can, as its war in Ukraine has ballooned defense and security spending in three years of war. These sectors will collectively account for 40% of all federal expenditures in Russia next year.

Russia’s finances, meanwhile, are heavily dependent on oil revenue. A few years ago, gas and oil production made up 35%-40% of the nation’s budget revenue, the country’s finance minister said this week.

It’s for this reason that the West has been so focused on curbing Russian oil profits. Consider the Group of Seven’s $60 price cap on Moscow’s crude: though the two-year initiative has not panned out as hoped, it was considered to be a key to keeping oil supply stable while denying the Kremlin much needed revenue.

Russia has been able to circumvent these caps using unregistered “shadow” tankers, but Riyadh’s $50 per barrel threat might be harder to overcome.

Things could turn sour if Saudia Arabia’s supply dump reignites an oil price war between Russia and the kingdom. Henderson suggested this could happen, referring to a similar event that occurred in 2020.

That year, production cut disagreements prompted both nations to unleash supply, testing who could survive this low-price environment longer.

In these situations, foreign exchange reserves become essential, which is problematic for Russia.

Since invading Ukraine, the country’s insurance against low oil prices has dissipated. Russia’s National Wealth fund was nearly halved at the start of this year, and it is no longer able to source Western currencies to diversify its foreign exchange reserves.

It remains to be seen whether President Vladimir Putin will want to engage in a price war with Riyadh, given his other, more immediate priorities, Henderson said.

Predicting the Kremlin’s moves is hard, he said, given many unknowns tied to Russia’s oil sales.

However, some kind of confrontation with Saudi Arabia may be stirring. This week, Russia’s deputy prime minister Alexander Novak said it’s unclear whether OPEC should increase oil output at its December meeting, as signaled by Saudi Arabia.

If things do take a turn for the worst, Cooper sees a potential price war as bad news for Russia.

“Unlike Saudi Arabia, its oil is not cheap to extract, making it poorly equipped to deal with low-price conditions. This drives a short-term escalatory logic for Russia’s war on Ukraine, requiring rapid battlefield successes prior to the emergence of low-price oil market conditions.”

Read the original article on Business Insider

Platinum Hits Costco Shelves: Why The Retail Giant Is Selling $1,089 Bars To Its Members

Costco is again venturing into the precious metals market, expanding its offerings beyond the gold and silver bars it sold to great success. The retail giant now offers 1-ounce platinum bars for $1,089.99 exclusively to members via its website. This move is part of Costco’s broader strategy to diversify its product lineup and capitalize on the growing demand for collectible precious metals.

Don’t Miss:

A Continuation of Costco’s Precious Metals Success

Costco entered the precious metals market in 2023, introducing gold bars. The retailer sold more than $100 million of these bars in just the first quarter of that year. More recently, it added silver coins, which sold for $675. Now, platinum joins the lineup with its Swiss-made bars engraved with an image of Lady Fortuna, the Roman goddess of fortune and prosperity.

While the price of platinum has seen modest increases year to date – up 15% from 2023 – the allure of precious metals remains strong for collectors and investors. Gold has recently hit record highs and remains the more popular investment due to its higher appreciation rate.

However, CNN reports that Costco’s decision to sell platinum bars is less about competing with gold and more about continuing its “treasure hunt” retail strategy.

“We try to create an attitude that, if you see it, you ought to buy it because chances are it ain’t going to be there next time,” Costco’s founder once said to the Wall Street Journal. “That’s the treasure-hunt aspect. We constantly buy that stuff and intentionally run out of it from time to time.”

Trending: Are you rich? Here’s what Americans think you need to be considered wealthy.

Why Platinum?

Platinum may not be as sought after as gold, but it uniquely appeals. It’s a rarer metal used in industrial applications and as a form of wealth preservation. Costco’s platinum bars are made of 999.5 pure platinum, which collectors and investors might find appealing as a diversification opportunity.

Kelly Bania, a senior research analyst at BMO Capital Markets, told ABC News that Costco’s move to introduce platinum bars is consistent with its strategy of offering high-margin products. Platinum’s market value fluctuates around $1,008 per ounce, so Costco’s $1,089.99 price tag reflects a small markup. However, buyers are willing to pay a premium for the convenience of purchasing precious metals from a trusted retailer.

Trending: The global games market is projected to generate $272B by the end of the year — for $0.55/share, this VC-backed startup with a 7M+ userbase gives investors easy access to this asset market.

Should You Invest?

Investing in precious metals like platinum carries potential risks. Unlike stocks or bonds, precious metals don’t generate income and are subject to price volatility. Additionally, selling these metals can involve fees, making them a more complex investment for the average buyer.

Those considering platinum as an investment should do thorough research and possibly consult a financial advisor to ensure it fits their long-term goals.

Ultimately, Costco’s venture into platinum sales may be more about marketing than moving large quantities of the metal. But for shoppers who enjoy the thrill of snagging exclusive items, platinum bars are another example of the unique finds that make Costco a popular destination.

Read Next:

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article Platinum Hits Costco Shelves: Why The Retail Giant Is Selling $1,089 Bars To Its Members originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Super Micro Computer: Is This Stock-Split a Buying Opportunity or a Trap?

Super Micro Computer (NASDAQ: SMCI) is a pretty complicated investment right now. On one hand, it makes server components and entire servers that are in massive demand thanks to artificial intelligence (AI). On the other hand, there are accounting malpractice accusations and a Department of Justice (DOJ) probe that is investigating those concerns.

Right now, the bear case outweighs the bull one, which is why shares of Supermicro (as the company is known) are down 60% from their all-time high set in March. Furthermore, the company has recently undergone a 10-for-one stock split, a catalyst that usually causes a stock price to rise, not fall.

So, is this a stock to stay away from? Or is it a chance to own an undervalued and potentially massive winner?

Supermicro’s product is at risk of being commoditized

Let’s start with the business itself — and there may be other concerns to consider here, too. The space for Supermicro’s products is rather saturated today as a result of many competitors.

However, Supermicro has one key advantage: It has the most energy-efficient technology available. With energy being a significant operating cost for these servers, companies are considering the total cost of operation for them. This is pushing a massive amount of demand Supermicro’s way.

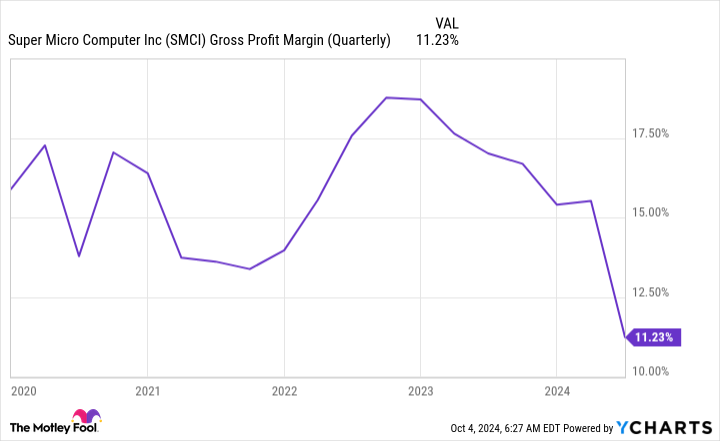

However, this isn’t without its own problems. Supermicro’s gross margin has collapsed due to its new liquid-cooled technology, as its supply chain has been bottlenecked for key components in these new systems. Management expects its gross margins to increase throughout fiscal 2025 (ending June 30, 2025), driven by its customer mix and manufacturing efficiencies as it scales up manufacturing in Malaysia and Taiwan, which should alleviate the bottlenecks it’s currently experiencing.

While this may be true, something else could be happening here. When a product becomes commoditized, companies that make it have to start cutting margins to compete. This could be happening with Supermicro’s business, which wouldn’t bode well for the company, even if it has best-in-class products.

This will be an important trend to watch over the next year as a low gross margin could break the Supermicro investment thesis.

Accounting malpractice allegations have triggered a government probe

Then there are the allegations and government probe. Well-known short seller Hindenburg Research released a report in late August alleging account malpractice at Supermicro, something the Securities and Exchange Commission already fined Supermicro $17.5 million for in 2020. While Supermicro’s management has denied these allegations, it didn’t do itself any favors when it announced it was delaying filing its end-of-year form 10-K with the SEC the day after Hindenburg’s report was published due to assessing “internal controls over financial reporting.”

It’s worth remembering that Hindenburg is a short seller, and so it benefits when the stock price falls. However, these allegations were serious enough that the DOJ initiated a probe into Supermicro to determine whether they had merit. It will be some time before we know the results of this investigation, so investors have a tough choice to make.

I wouldn’t blame anyone for throwing Supermicro into the “too hard to understand” pile. There’s no shame in this conclusion. One of the greatest investors of all time, Warren Buffett, often does this with businesses he doesn’t understand. With shrinking gross margins and an ongoing DOJ probe, there are certainly a lot of negatives surrounding Supermicro.

But there are some positives too. In fiscal 2025 (ending June 30, 2025), Supermicro expects its revenue to grow between 74% and 101% year over year. That’s massive growth, yet the stock is priced at a dirt cheap level.

At just 14.2 times forward earnings, Supermicro may be one of the cheapest companies you’ll ever find that’s posting growth rates like that. So, if Supermicro’s management is right and it improves its gross margin and delivers strong growth throughout FY 2025, the stock has massive upside, as it’s far below where the S&P 500 trades (at 23.7 times forward earnings).

I think there’s enough of a compelling investment thesis here that I bought the dip on the stock. However, I only let it take up around 1% of my portfolio, as there’s a lot of risk involved. Supermicro is all about risk tolerance and management. If you’re not OK with this stock losing money on the potential for strong gains, there are still plenty of other AI stocks that are great picks.

But there’s a strong chance this stock could double — if it works out some of its flaws.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,069!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

Keithen Drury has positions in Super Micro Computer. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Super Micro Computer: Is This Stock-Split a Buying Opportunity or a Trap? was originally published by The Motley Fool

Two big homebuilders missed Wall Street estimates on a key metric — here's why

Housing demand has been hard to forecast even as mortgage rates have declined. Just take a look at homebuilders’ quarterly results so far this earnings season.

Two of America’s largest homebuilders, Lennar (LEN) and KB Home (KBH), reported third quarter net new home orders that have fallen short of Wall Street expectations.

Net new orders represent the number of new sales contracts that have been finalized and signed by buyers minus customer home order cancellations booked for the period. Investors and analysts pay close attention to this figure because its a leading indicator for homebuilders on housing activity.

Lennar, the nation’s second-largest homebuilder, said last month that its net new orders for the quarterly period ending Aug. 31 rose 4.7% from the prior year to 20,587. That fell short of analysts’ forecasts of 20,827 orders, per Bloomberg data.

Homebuilder KB Home also reported in September that net orders for the period ending Aug. 31 were a disappointment. The builder said orders fell 0.4% from the prior year to 3,085, lower than analysts’ estimates of 3,345 orders.

Part of the reason for the misses is that it’s been hard to determine how much recent mortgage rate movements would affect buyer demand. Mortgage rates have stayed stuck between 6% and 7% this year. And in June, rates were toggling just above or below 7%.

Read more: When will mortgage rates go down? A look at 2024 and 2025.

“Maybe shame on us for not modeling it more clearly, but June and July were clearly challenging months,” John Lovallo, senior equity research analyst at UBS, told Yahoo Finance in an interview.

From a buyer’s perspective, “there was uncertainty about where rates were going. There was uncertainty about where the economy and the Fed were going, and there was growing uncertainty about the election,” Lovallo added.

The uncertainty doesn’t appear to be going away despite the Federal Reserve’s jumbo interest rate cut in September. Mortgage rates had already been on the decline as investors had bet on a rate reduction ahead.

It’s unclear how much they’ll fall. Data from Freddie Mac shows the average 30-year fixed mortgage rate jumped by 20 basis points to 6.32% last week. This marks the biggest week-over-week increase since April.

Read more: Is this a good time to buy a house?

Goldman Sachs revised its year-end forecasts in early October for 30-year conforming mortgage rates, lowering them to 6% for this year and 6.05% for 2025, down from the previous estimates of 6.5% and 6.1%.

The firm’s strategists said in the note that there’s “limited room” for major declines. They think “the decline in mortgage rates has largely run its course.”

Lovallo warned that it’s highly likely that the other homebuilders will report misses on Q3 net orders due to rate volatility this summer. More builders are gearing up to report quarterly earnings in the next few weeks with PulteGroup (PHM) and NVR (NVR) reporting on Oct. 22 and DR Horton (DHI) on Oct. 29.

Dani Romero is a reporter for Yahoo Finance. Follow her on X @daniromerotv.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Integris Composites Displays New Military Armor at AUSA 2024

Driving solutions in a period of unprecedented change in today’s combat zones

Meet Our Global Team at Booth 2407

TYSONS CORNER, Va., Oct. 13, 2024 /PRNewswire/ — One year after relocating its headquarters from Europe to the Washington D.C. area and changing its name to Integris Composites, the business founded 30 years ago returns tomorrow to AUSA 2024 with a global team of experts and product innovations to help protect warfighters in a period of unprecedented change and complexity.

Founded in 1994 as ARES, and later established as TenCate Advanced Armor until the name was changed last year, Integris Composites is exhibiting at AUSA, Oct. 14-16, in Booth 2407.

“We are displaying an expanding portfolio of ballistic, blast and spall limiting technology for land, sea and air operations. We’re also inviting visitors to discuss emerging challenges with our experts from around the world,” said David Cordova, chief commercial officer, Integris Composites, Inc. Engineers and armor designers from the global organization will be on hand to speak with guests.

Global Challenges & Multinational Resources

“In addition to personal protection and tactical vehicles, our team can share solutions being developed for watercraft and aircraft globally. We can also discuss the rapidly changing threats in combat,” Cordova said.

“For example, we are all aware that militias spawned by terrorists are fielding low-cost explosives and drones that are creating unique challenges for Western allies,” Cordova added.

“At Integris, we are exploring innovative defenses against advanced threats, including top-attack weapons, kamikaze drones, loitering munitions, and smart submunitions. These are just some of the factors affecting the armor and survivability sector being reshaped by advancements in design, technology, changing military needs, and international security challenges,” Cordova added.

A Parade of Solutions

During AUSA, Integris is showcasing a parade of composite armor kits and personal protection plates designed, engineered and manufactured for multiple contracts with Defense Department and OEM suppliers. They include:

- ESAPI & XSBI Plates

- Aircraft armor

- Add-on armor – Stanag level III to VI

- Maritime armor

- Mine/blast – ABDS

- Low-profile armor systems

An Enduring Mission & New Wins

“We are proud of our accomplishments in the recent year,” said Andrew Bonham, president of Integris Composites, Inc.

He said Integris has been selected as the sole supplier of armor systems by Bell Textron Inc. for the V280 Valor, the Army’s platform for its Future Long-Range Assault Aircraft (FLRAA). It will replace the aging UH-60 Black Hawk helicopters, providing increased speed, range and payloads.

In addition, new MH-139A Grey Wolf helicopters that will replace the UH-1N Huey for the Air Force incorporate armor designed and manufactured by Integris. Boeing delivered the first production aircraft in August, Bonham added.

“In the recent past, Integris armor kits were selected by Mack Defense for the M917 Heavy Dump Truck, and we are supplying armor kits for the C-130 J tactical airlifter.” Integris continues to be a major provider of personal protection ballistic plates for multiple military and tactical law enforcement units, and we are especially proud of being named the leading supplier of the X-Side Ballistic Insert (XSBI) plates. Known for their lightweight design, they offer additional protection along the side of the torso, explained Bonham.

“Despite changes, our commitment to saving lives remains unchanged,” said Bonham. Integris is an engineering company and the manufacturer of composite armor for land vehicles, aircraft, naval craft, protection housing for optronics and other sensitive technology and personal protection gear.

The company’s scope includes the design, development, production, sales, and services of composite armor solutions worldwide. Integris’ product portfolio consists of panels or ready-to-install kits made from high-strength materials like UHMWPE, aramids, ceramics and metal.

Photo:

New MH-139A Grey Wolf helicopters incorporate armor designed and manufactured by Integris. DoD Photo by Samuel King, Jr. Does not imply or constitute DoD endorsement.

Integris has been selected as the sole supplier of armor systems by Bell Textron Inc. for the V280 Valor, the Army’s platform for its Future Long-Range Assault Aircraft (FLRAA)V-280 in flight. Photo by Danazar – Creative Commons

Contact:

David Cordova

Chief Commercial Officer

+1 704 458 7796

David.Cordova@IntegrisCompositesUS.com

Photos:

https://www.prlog.org/13043015

Press release distributed by PRLog

![]() View original content:https://www.prnewswire.com/news-releases/integris-composites-displays-new-military-armor-at-ausa-2024-302274642.html

View original content:https://www.prnewswire.com/news-releases/integris-composites-displays-new-military-armor-at-ausa-2024-302274642.html

SOURCE Integris Composites, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

CHASE PROPERTIES EXPANDS PORTFOLIO WITH CREEKSIDE PLAZA IN ITHACA, NY, AND WAYNESBORO TOWN CENTER IN WAYNESBORO, VA

BEACHWOOD, Ohio, Oct. 11, 2024 /PRNewswire/ — Chase Properties is pleased to announce two significant retail acquisitions: Creekside Plaza in Ithaca, New York, and Waynesboro Town Center in Waynesboro, Virginia. These additions align with Chase Properties’ strategy of investing in dominant retail centers in secondary and tertiary markets with limited competition.

Creekside Plaza – Ithaca, NY

Built in 2001, the 180,000-square-foot shopping center is currently 95% leased and boasts anchor tenants such as Dick’s Sporting Goods, HomeGoods, Barnes & Noble, and O’Reilly Auto Parts. The property also benefits from the adjacent Wegmans Food Market, which generates strong and consistent customer traffic.

Waynesboro Town Center – Waynesboro, VA

Waynesboro Town Center is a 170,810-square-foot retail hub, strategically located along the I-81 corridor in Virginia’s Shenandoah Valley. Built in 2007, the center is currently 98% leased and shadow-anchored by Target and Kohl’s. Its tenant mix includes Ross Dress for Less, PetSmart, Burlington, and Michaels.

Andrew Kline, Co-CEO of Chase Properties, highlighted these acquisitions’ significance within the company’s broader investment strategy:

“We are thrilled to acquire two dominant shopping centers which perfectly align with our strategy of owning and managing well located properties in secondary and tertiary markets. Creekside Plaza and Waynesboro Town Center have strong tenant rosters with a proven history of robust sales performance. Their positions as the primary retail destinations in their areas, coupled with best-in-class shadow anchors and access to large trade areas, ensure their continued appeal and growth, making them valuable additions to our retail portfolio.”

With these acquisitions, Chase Properties continues to focus on investing in well-positioned, high-quality retail assets in smaller markets, ensuring long-term growth and value for its investors.

About Chase Properties

Chase Properties is a full-service real estate investment firm specializing in the ownership and management of retail properties. With over five decades of experience, Chase Properties is committed to creating value through strategic investments and superior property management.

Contact:

Chase Properties

Andy Kline – 216.464.6626

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/chase-properties-expands-portfolio-with-creekside-plaza-in-ithaca-ny-and-waynesboro-town-center-in-waynesboro-va-302273370.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/chase-properties-expands-portfolio-with-creekside-plaza-in-ithaca-ny-and-waynesboro-town-center-in-waynesboro-va-302273370.html

SOURCE Chase Properties Ltd

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.