Anthony Scaramucci Praises Trump For Shifting The Crypto Debate: 'He's Now Forced The Democrats To Come Back Into The Middle'

Anthony Scaramucci, CEO of SkyBridge Capital, applauded former President Donald Trump for shifting the discourse around cryptocurrency.

What Happened: In an interview with cryptocurrency influencer Scott Melker on The Wolf Of All Streets podcast, Scaramucci acknowledged Trump’s political instincts and his ability to force Democrats to reconsider their stance on cryptocurrencies.

“Don’t want [Trump] to be president again but he’s got very good political instincts, and by moving the discourse he’s now forced the Democrats to come back into the middle,” the Democratic-leaning pro-cryptocurrency advocate said. “I think that will bode well for the industry.”

Scaramucci referred to the Stand With Crypto Alliance’s Purple Bus tour in swing states to generate support from single-issue voters and argued that such a campaign would favor Trump.

“I think it’s a mistake that the Democrats haven’t moved and haven’t outwardly moved but I think they will,” the former White House Communications Director hoped.

Why It Matters: Scaramucci’s comments come in the context of a broader discussion on the political landscape of cryptocurrency and Bitcoin BTC/USD.

The ongoing election season has witnessed a considerable increase in emphasis on cryptocurrencies and blockchains, owing largely to Trump’s promise to implement various cryptocurrency-friendly policies if elected.

Although late to the party, Harris also began to pander to the cryptocurrency demographic, vowing active support for emerging technologies like blockchain

As of this writing, the odds of Trump winning the election were 54% on the cryptocurrency-based prediction market Polymarket.

What’s Next: Anthony Scaramucci and other industry experts like Caitlin Long and Jan van Eck will discuss the impact of the incoming administration on digital asset policy at Benzinga’s Future of Digital Assets event on Nov. 19.

Photo by World Economic Forum on Flickr

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fact-Check DeSantis: Why Florida's Weed Legalization Does Not Mean Smoking In Schools

A new campaign ad supporting Florida’s Amendment 3, which aims to legalize recreational marijuana, features Republican Sen. Joe Gruters addressing critics of the measure.

Titled “Blowing Smoke,” the ad counters claims from Governor Ron DeSantis, who opposes the amendment and has sparked further controversy by refusing to extend the Oct. 7 voter registration deadline during Hurricane Milton evacuations.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. You can’t afford to miss out if you’re serious about the business.

Gruters Reassures Voters On Public Marijuana Use

Gruters, who led efforts to ban smoking on public beaches, emphasizes that Amendment 3 won’t allow for uncontrolled public marijuana use. “Florida will do marijuana legalization the right way,” he assures, explaining that public cannabis use will be regulated much like tobacco.

DeSantis Criticized For Hurricane And Voter Registration Response

Governor DeSantis argues that the amendment could lead to unchecked marijuana use in public spaces. At the same time, his refusal to extend the voter registration deadline amid hurricane evacuations has drawn criticism from civil rights groups.

Amy Keith, executive director of Common Cause Florida, pointed out that evacuation orders hindered voter registration efforts. Brad Ashwell from All Voting is Local echoed the concerns, highlighting that many Floridians faced back-to-back hurricanes.

Cannabis Operators Prepare For Hurricane Milton

In addition to the political debate, cannabis companies like Trulieve Cannabis Corp. TCNNF and Cresco Labs Inc. CRLBF have been affected by the storm.

Trulieve shut down 80 stores, while Cresco closed nine dispensaries and a cultivation facility to protect staff and operations ahead of Hurricane Milton.

Read Next: Slipping Weed Sales In Florida’s Market: Is This $100M Bet Really Worth The Hype?

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Click on the image for more info.

Cannabis rescheduling seems to be right around the corner

Want to understand what this means for the future of the industry?

Hear directly for top executives, investors and policymakers at the Benzinga Cannabis Capital Conference, coming to Chicago this Oct. 8-9.

Get your tickets now before prices surge by following this link.

Meet the Stock-Split Stock That Soared 10,720% Over the Past 15 Years. Now, It's Poised to Join Apple, Nvidia, Microsoft, Alphabet, Amazon, and Meta in the $1 Trillion Club

Industrial and oil companies once represented the pinnacle of business valuations, but no more. For instance, in 2004, General Electric and ExxonMobile were the largest companies in the world when measured by market cap, worth $319 billion and $283 billion, respectively.

However, over the past 20 years, there’s been a changing of the guard, and the charts are dominated by the world’s most well-known technology firms. The battle among the top three continues to rage, as Apple, Nvidia, and Microsoft are all worth more than $3 trillion, though the top spot has changed hands several times this year. There are three other tech-centric companies with memberships in the $1 trillion club, namely Alphabet, Amazon, and Meta Platforms, with valuations of $2 trillion, $1.9 trillion, and $1.5 trillion, respectively.

With a market cap of roughly $818 billion (as of this writing), Broadcom (NASDAQ: AVGO) rounds out the top 10 and seems destined to join this exclusive fraternity. The company holds a unique position in the artificial intelligence (AI) infrastructure, and the accelerating adoption of this breakthrough technology could help Broadcom secure its membership in the $1 trillion club sooner than you might think.

A side of chips

Broadcom is responsible for a wide range of semiconductor, software, and security solutions that extend into every aspect of the cable, broadband, mobile, and data center arenas. In fact, management estimates that “99% of all internet traffic crosses through some type of Broadcom technology.” It’s for this reason the company has an important role in the rapid adoption of AI, as its vast collection of technologies forms a foundation necessary for generative AI, which operates primarily in data centers and in the cloud.

There’s also a significant opportunity at hand from Broadcom’s acquisition of VMWare late last year. Management has been working overtime to convert VMWare’s offerings to a subscription licensing model, which will ultimately increase recurring revenue. Broadcom will also benefit from cross-selling these products to its existing customers, a process that’s already on the fast track.

The results show that business is booming. In Broadcom’s fiscal third quarter (ended Aug. 4), revenue jumped 47% year over year to $13.1 billion, while its adjusted earnings per share (EPS) of $1.24 climbed 18%. Management is expecting its robust growth to continue, raising its full-year revenue forecast to $51.5 billion, which would represent growth of 44%.

The company’s consistently strong results and soaring stock price convinced Broadcom’s management to pursue a 10-for-1 stock split, which was completed in mid-July.

The path to $1 trillion

The widespread reach of Broadcom’s chips and accessories — which are key components in the operation of data centers — gives the company a leg-up in the AI revolution.

According to Wall Street estimates, Broadcom is expected to generate revenue of $51.61 billion in 2024, giving it a forward price-to-sales (P/S) ratio of nearly 16. If the stock’s P/S remains constant, Broadcom will need to generate sales of roughly $63 billion annually to support a $1 trillion market cap.

Analysts’ consensus estimates are guiding for revenue growth of 44% in 2024 and 14% in 2025. If the company hits those targets, it could achieve a $1 trillion market cap as early as 2026. Furthermore, the rapid and growing adoption of AI has been increasing growth estimates, so these forecasts could end up being conservative.

The evidence suggests Broadcom could join the ranks of trillionaires sooner than later. Management noted that infrastructure software revenue soared 200% in the third quarter, and the company expects AI-related revenue to grow to over $12 billion this year, which would represent 23% of its forecasted revenue for the fiscal year.

It’s still too early to tell just how big the market for generative AI could become, but the estimates continue to ratchet higher. The economic value of generative AI is expected to be worth between $2.6 trillion and $4.4 trillion annually over the coming decade, according to global management consulting firm McKinsey & Company. That number doubles if it includes the revenue resulting from embedded software.

Broadcom’s strong results and excitement related to the stock split have fueled a surge in the stock price, as well as a commensurate increase in its valuation. The stock is selling for 36 times forward earnings, a premium compared to a multiple of 28 for the S&P 500.

However, Broadcom’s stock has gained 10,720% since 2009, more than 22 times the 471% return for the S&P, which illustrates why the premium is justified.

Should you invest $1,000 in Broadcom right now?

Before you buy stock in Broadcom, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Broadcom wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,069!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Danny Vena has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Meet the Stock-Split Stock That Soared 10,720% Over the Past 15 Years. Now, It’s Poised to Join Apple, Nvidia, Microsoft, Alphabet, Amazon, and Meta in the $1 Trillion Club was originally published by The Motley Fool

NFE INVESTOR ALERT: Bronstein, Gewirtz & Grossman LLC Announces that New Fortress Energy Inc. Investors with Substantial Losses Have Opportunity to Lead Class Action Lawsuit!

NEW YORK, Oct. 13, 2024 (GLOBE NEWSWIRE) — Attorney Advertising — Bronstein, Gewirtz & Grossman, LLC, a nationally recognized law firm, notifies investors that a class action lawsuit has been filed against New Fortress Energy Inc. (“New Fortress” or “the Company”) NFE and certain of its officers.

Class Definition

This lawsuit seeks to recover damages against Defendants for alleged violations of the federal securities laws on behalf of all persons and entities that purchased or otherwise acquired New Fortress securities between February 29, 2024, and August 8, 2024, inclusive (the “Class Period”). Such investors are encouraged to join this case by visiting the firm’s site: bgandg.com/NFE.

Case Details

The Complaint alleges that throughout the Class Period, Defendants made false and/or misleading statements and/or failed to disclose that: (1) defendants created the false impression that they possessed reliable information pertaining to New Fortress’ projected revenue outlook and anticipated growth while also minimizing risk regarding New Fortress’ plan to have its Fast LNG (“FLNG”) projects fully operational and increase business growth globally; and (2) New Fortress’ FLNG projects failed to meet New Fortress’ publicly stated progress, specifically that its FLNG 1 project would be in service by March 2024.

The Complaint further alleges that on August 9, 2024, New Fortress announced second quarter 2024 financial results, revealing adjusted EBITDA of $120 million, which was well below New Fortress’ expectation of $275 million. According to the complaint, New Fortress attributed disappointing results and lowered guidance to delays placing New Fortress’ FLNG 1 project into service, which cost New Fortress $150 million per quarter in lost operating margin. The New Fortress class action lawsuit alleges that on this news, the price of New Fortress stock fell more than 23%.

What’s Next?

A class action lawsuit has already been filed. If you wish to review a copy of the Complaint, you can visit the firm’s site: bgandg.com/NFE or you may contact Peretz Bronstein, Esq. or his Client Relations Manager, Nathan Miller, of Bronstein, Gewirtz & Grossman, LLC at 332-239-2660. If you suffered a loss in New Fortress you have until November 18, 2024, to request that the Court appoint you as lead plaintiff. Your ability to share in any recovery doesn’t require that you serve as lead plaintiff.

There is No Cost to You

We represent investors in class actions on a contingency fee basis. That means we will ask the court to reimburse us for out-of-pocket expenses and attorneys’ fees, usually a percentage of the total recovery, only if we are successful.

Why Bronstein, Gewirtz & Grossman

Bronstein, Gewirtz & Grossman, LLC is a nationally recognized firm that represents investors in securities fraud class actions and shareholder derivative suits. Our firm has recovered hundreds of millions of dollars for investors nationwide.

Attorney advertising. Prior results do not guarantee similar outcomes.

Contact

Bronstein, Gewirtz & Grossman, LLC

Peretz Bronstein or Nathan Miller

332-239-2660 | info@bgandg.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Premier Cannabis Dispensary Gotham Debuts A Third Location at The Refinery at Domino

Gotham’s First Brooklyn Outpost Joins Locations in Manhattan and Upstate New York, Driving the Culture of Cannabis Forward

NEW YORK, Oct. 11, 2024 /PRNewswire/ — Gotham, the world’s first cannabis concept store, announces the grand opening of their new Brooklyn location. The expansive 4,000 square foot storefront is located in the heart of Williamsburg on Kent Avenue and South 2nd Street in The Refinery at Domino. Brooklyn-based, family-owned real estate development firm Two Trees Management specifically selected Gotham to occupy the space, reflecting the shared commitment of both brands to thoughtfully merge lifestyle, community, and culture. Gotham will be the first retailer to operate at The Refinery and will officially open to the public on Friday, October 11, just one month after Gotham debuted their latest venture, Gotham Hudson located on the famous Warren Street in Hudson, New York.

Building on a successful launch year in 2023, where Gotham pioneered innovative partnerships, impactful campaigns, and meaningful community engagement in New York’s legal cannabis market, the company is now set to grow its reach even further with the debut of this new outpost, reaffirming that Gotham truly is where culture meets cannabis.

“Driving the democratization of cannabis consumption, through a specifically cultural lens, sits at the very center of Gotham’s DNA,” says Joanne Wilson, founder of Gotham. “We are honored at the opportunity to continue making a palpable influence on the industry in New York, and to cement our commitment to being an integral part of the city’s cultural fabric.”

“Gotham IS New York, and we are thrilled to have this world-class concept open at The Refinery,” said Bonnie Campbell, Principal of Two Trees Management. “The Williamsburg community has championed our local retailers since the opening of Domino Park, and this latest addition brings culture and connectivity to this already thriving district. We love what they are about, fusing culture and entertainment with luxury cannabis lifestyle products, and we know they’ll bring a high-end experience and premium products to locals and our tenants.”

Adjacent to bustling Domino Park and newly opened Domino Square, Gotham Domino is perfectly situated for city residents on the move and those taking a moment of leisure at the vibrant waterfront. The inviting arched windows draw patrons in for an unforgettable retail experience, which is anchored around a breathtaking, custom tree installation designed by interdisciplinary artist Molly Lowe, long-time collaborator and friend of the brand who has constructed distinctive trees for the interiors of each Gotham storefront. A wide array of materials in dazzling shades of green cascade down from the branches on the ceiling, emulating a willow tree.

Beneath the tree’s canopy sits Gotham’s carefully curated cannabis selection featuring the finest in premium flower, pre-rolls, edibles, vape pens, and live resin. Expert sales associates are at the ready to assist and educate clientele to provide the best experience for each individual.

Open shelving on the perimeter of the store displays the brand’s highly-curated selection of lifestyle, beauty, and fashion products — including home decor, glassware, fragrances, skincare, accessories and more, all hand selected by Gotham’s Vice President of Creative and Merchandising, Rachel Berks. Featured brands include Eckhaus Latta, Collina Strada, Carne Bollente, Porter Yoshida, Jungles Jungles, Extra Vitamins and more, available alongside Gotham’s own line of products which include candles, topicals, wearable merchandise and more.

To celebrate the Williamsburg launch, Gotham will be debuting ‘Sugarhigh,’ a limited-edition, white sugar cube edible inspired by the iconic Domino Sugar Factory. Created with New York-based brand Off Hours, ‘Sugar High’ is available only at Gotham locations.

Gotham’s Williamsburg location opens for full service to the public on October 11th,, and will be open every day from 12:00PM – 11:00PM. The store will offer in-person shopping and in-store pick-up and expand the brand’s delivery radius to a new borough. To stay updated on the latest news about the opening, follow Gotham on Instagram @gotham.ny and online at gotham.nyc.

About Gotham

Gotham, the world’s first cannabis concept store, is a female-founded, mission driven, arts-and culture-forward legal cannabis dispensary in New York City.. The brand – where culture and cannabis meet – offers expertly curated cannabis alongside elevated apparel, home, and lifestyle goods for a discerning consumer. Gotham’s flagship, located on Bowery and 3rd St. in the East Village, debuted in 2023, fusing art, design, fashion, and culture alongside the state’s best cannabis. In 2024, Gotham began to expand its community across New York to offer bespoke experiences state-wide, opening their second location in upstate New York in the creative community of Hudson, NY at 260 Warren Street. With their third location in Williamsburg, at The Refinery at Domino, Gotham proves that they are a pioneer in the industry with one of the first retail operations in the state-of-the art and historic facility. Working to revolutionize the narrative around cannabis consumption, Gotham creates a sense of welcome to their local communities and has solidified their place within the cultural zeitgeist of New York with in-store activations, collaborations with creative leaders and tastemakers, and elevated events. Visit Gotham online at www.gotham.nyc | Instagram: @gotham.ny

About Two Trees Management

Two Trees Management Company is a family-owned, Brooklyn-based real estate development firm best known for its singular role in transforming DUMBO from a neglected industrial waterfront into a vibrant mixed-use community, as well as the on-going creation of the Domino campus on the Williamsburg waterfront. Two Trees owns and manages a real estate portfolio worth more than $4 billion, including more than 4,000 market and affordable-rate apartments and over 3 million square feet of office and retail space in New York City. Since its founding in 1968, Two Trees has operated under the fundamental belief that successful neighborhoods offer a wide variety of uses and attract diverse groups of people, and that developers must play a fundamental role in cultivating livable streetscapes – because people prosper when neighborhoods bloom. In addition to the residential and commercial buildings across DUMBO, Williamsburg, Fort Greene, Brooklyn Heights, Hell’s Kitchen and Flatiron neighborhoods, other notable projects include Domino Park, The Plaza at 300 Ashland, The Refinery at Domino, River Ring, The Wythe Hotel and Jane’s Carousel.

Media Contact: Ally Berkowitz | ally.berkowitz@purplepr.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/premier-cannabis-dispensary-gotham-debuts-a-third-location-at-the-refinery-at-domino-302273472.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/premier-cannabis-dispensary-gotham-debuts-a-third-location-at-the-refinery-at-domino-302273472.html

SOURCE Gotham

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

2 Top Electric Vehicle (EV) Stocks to Buy in October

Want to add massive long-term growth potential to your portfolio? Check out electric car stocks.

Many EV makers have seen their sales skyrocket in recent years. Yet their stock prices haven’t always followed suit, creating several compelling buying opportunities over the years. This month looks like an especially great time to jump in.

If you want to buy into the world’s adoption of EVs — a story that is truly a multi-decade growth opportunity — then these two stocks are for you. One you’ve likely heard of. But the other is a diamond in the rough.

Don’t be shy about buying shares in Tesla

Perhaps the most popular EV maker in the world is Tesla (NASDAQ: TSLA). Its boisterous CEO, Elon Musk, is constantly making the news. And with nearly $100 billion in sales, Tesla dominates the EV industry of several major markets, the U.S. included.

You’re likely already familiar with the company’s lineup. Tesla offers premium models like the Roadster, Model X, Cybertruck, and the Model S. But it also offers a few mass-market vehicles. These are typically vehicles under the $50,000 price mark, a common benchmark for gleaning whether a car or truck will be accessible to the masses.

While Tesla does have exposure to other markets like energy generation and storage, more than 90% of its revenue is still tied to its EV business. And while its luxury models helped put it on the map, it really was its two mass-market models — the Model Y and Model 3 — that helped Tesla’s sales grow by more than 1,000% over the past decade. After all, the volumes that can be achieved through a $50,000 car are perhaps an order of magnitude higher than what can be achieved with a $100,000 car.

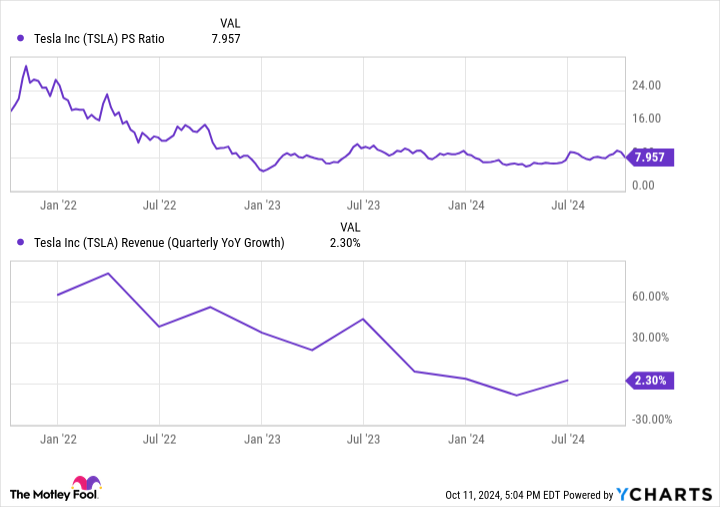

Due to weaker-than-expected sales growth this year for the EV industry, the stocks of most EV producers have suffered. Tesla hasn’t been immune to these pressures, but its valuation still doesn’t look like an obvious bargain. Shares currently trade at 7.9 times sales — roughly what they traded for nearly two years ago, when quarterly sales growth was around 30%.

But a bet on Tesla today isn’t about the near term — it’s about the multidecade growth trajectory for EVs in general. The IEA forecasts EV demand to grow by double digits for decades to come. And Tesla has what most EV start-ups only dream of: access to capital.

So while the stock isn’t as big of a bargain as the next stock on this list, Tesla is still a reasonable investment for those looking to bet on EV companies with the best chance of riding the long-term EV adoption wave.

This EV stock looks like a hidden gem

Want to invest in the next Tesla? Look no further than Rivian (NASDAQ: RIVN). The EV maker might not have the brand-name recognition of Tesla right now, but in the coming years, that could change quickly.

The company expects to release its first mass-market vehicles — the R2, R3, and R3X — beginning in 2026. And if Tesla is any indication, sales could quickly rise by 1,000% more in the years that follow.

Despite this impending sales ramp, Rivian shares trade at a steep discount to Tesla on a price-to-sales basis. What’s going on?

As a smaller competitor with a sales base of just $5 billion, the market is understandably skeptical that Rivian can execute on its sales ramp. While Tesla is a success story, there have been many more bankruptcies in the EV space than successes. Rivian not only needs to raise billions in additional capital to support its launch plans, but also to scale up manufacturing capabilities greater than any other time in its history. And then, of course, it needs to produce cars that people love at a price point they can afford.

Due to these concerns, Rivian shares have fallen by roughly 55% in 2024, versus a much lesser 12% decline for Tesla shares. This has created a great buying opportunity this month for investors willing to take on extra risk in exchange for the high potential returns involved in identifying the next big EV brand.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,266!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,047!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $389,794!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

2 Top Electric Vehicle (EV) Stocks to Buy in October was originally published by The Motley Fool

Tesla stock selloff after robotaxi event could be just the beginning, pros warn

Fundamentals over hype.

Indeed that’s the lesson for Tesla (TSLA) investors after the EV maker’s disappointing robotaxi event exposed a disconnect between the stock’s lofty valuation and reality.

A lack of details surrounding the rollout plan and regulatory approval, plus no mention of a more affordable regular EV left Wall Street wanting more.

CFRA analyst Garrett Nelson likened the event to “watching a movie with a lot of plot twists and special effects, and at the end, you’re walking out scratching your head.”

Safe to say analysts “scratching their heads” was probably not the reaction Musk was hoping for when showing off the Cybercab and Robovan concepts. Now, the big issue for investors is reevaluating Tesla’s stock price.

On Friday, more than $60 billion was wiped off of Tesla’s valuation in a selloff, a sharp reversal from the stock’s recent momentum. Shares had soared over 70% since Musk started touting AI in April. The rally brought Tesla’s market value to over $760 billion ahead of the robotaxi announcement— more than 14 times GM’s (GM) market cap and nearly 18 times Ford’s (F).

Nelson, who had been a longtime bull on Tesla, warned Friday’s drop “could be” just the beginning as Wall Street reassesses.

“There is an increasing disconnect between the stock’s lofty valuation and the reality that Tesla’s earnings growth has hit a wall,” he tells me, noting that intermediate-term growth drivers are “unclear.”

In a note to clients, Bernstein’s Toni Sacconaghi reiterated his belief that Tesla’s valuation is disconnected from fundamentals, writing the robotaxi event was “short on immediate deliverables or incremental revenue drivers.”

Sacconaghi estimated that Tesla’s automotive business is worth around $200 billion, suggesting that nearly $600 billion of its valuation hinges on its less proven ventures, including Full Self Driving (FSD), robotaxis, and humanoid robots.

As my colleague Akiko Fujita wrote, robotaxis are a costly venture, and may be years away from becoming profitable.

The absence of near-term catalysts comes at an already challenging time for Tesla. Lackluster demand and increased EV competition from the likes of GM have pressured sales and margins in recent quarters, and it’s a trend that pros warn is unlikely to change anytime soon.

In Q2, the company reported operating margins of 6.3%, compared to 14.6% just two years earlier.

Guggenheim’s Ron Jewsikow, who sees fair value around $153 per share, told me that post-robotaxi event, investors will “return to focusing on the fundamentals of the business,” which he characterized as “quite poor.”

“A business trading at 100 times next year’s earnings, with little to no free cash flow, is really difficult to underwrite,” he added.

With its shares falling 9% on Friday and down over 17% in the past year, it’s safe to say Tesla has a lot to prove when it comes to the fundamentals. Its next big test will be its third-quarter earnings, scheduled for after the bell on October 23.

Will it be more hype than fundamentals? Buckle up!

Seana Smith is an anchor at Yahoo Finance. Follow Smith on Twitter @SeanaNSmith. Tips on deals, mergers, activist situations, or anything else? Email seanasmith@yahooinc.com.

Click here for the latest technology news that will impact the stock market

Read the latest financial and business news from Yahoo Finance

3 Reliable Dividend Stocks With Yields Above 5% That You Can Buy With Less Than $100 Right Now

There’s no wrong way to put your money to work on Wall Street, but some methods produce more reliable gains than others. If you’re looking for a relatively safe and easy way to grow the stream of income you’ll have to work with during your retirement years, buying dividend-paying stocks and holding them for long periods is a terrific option.

During the 50-year period that ended in 2023, dividend-paying stocks in the S&P 500 index returned 9.17% annually on average. That’s more than double the return produced by their non-dividend-paying cousins. During the same period, the average dividend non-payers in the benchmark index returned just 4.27% annually, according to Ned Davis Research and Hartford funds.

You don’t need to be rich to put your money to work for you. At the moment, shares of AT&T (NYSE: T), Hercules Capital (NYSE: HTGC), and Pfizer (NYSE: PFE) offer dividend yields of 5% or better, and you can buy a share of all three with less than $100. Adding them to a portfolio now gives you a good chance to outperform the market while they beef up your passive-income stream.

1. AT&T

AT&T lowered its dividend payout in 2022 to adjust for the sale of its unpredictable media assets. Now that it’s strictly a telecommunications business, the cash flows it uses to make dividend payments should be extra reliable. At recent prices, the stock offers a 5.2% dividend yield.

Traditional-wireline subscriptions are still shrinking, but this headwind is easily overcome by demand for services that run on its 5G network and a growing web of fiber-optic cables. In the second quarter, mobility-service revenue rose 3.4% year over year, and this isn’t the only operation driving growth.

The three-month period ended June 30 was the 18th consecutive quarter in which AT&T added over 200,000 new fiber-internet subscribers. Late last year, the company also launched a fixed-wireless service for folks who aren’t located next to fiber optic cables. As a result, Q2 consumer-broadband sales rose 7% year over year.

At $2.7 billion in Q2, consumer broadband is responsible for less than 10% of total revenue. AT&T is one of just three telecom companies with a nationwide 5G network, so investors can reasonably rely on its consumer-broadband business to drive growth for many years to come.

2. Hercules Capital

Hercules Capital is a business development company (BDC), which means it can avoid income taxes by giving nearly all of its earnings to shareholders as a dividend payment. At recent prices, the stock’s regular distribution offers a big 8% yield.

Hercules also offers a supplemental dividend that it set at $0.32 per share this year. If next year’s supplemental dividend remains unchanged, investors who buy this stock at recent prices will receive a 9.7% yield.

Most BDCs originate relatively high-interest loans to established mid-sized businesses that already earn money. Hercules Capital takes a riskier approach to financing by engaging start-ups in the life science and technology industries before they have any recurring revenues to report.

In isolation, the bets Hercules makes are extremely risky. The potential payoffs are so large, though, that the company can report strong-earnings growth if just a fraction of its investments succeed.

Hercules has raised or maintained its regular distribution since 2010, and continued movement in the right direction seems likely. In the first half of 2024, the BDC reported $1.07 billion in total-gross funding, which was 28% more than the previous-year period.

3. Pfizer

Sales of Pfizer’s COVID-19 vaccine and antiviral treatment broke records regarding its rate of growth and decline. Sales of Comirnaty and Paxlovid shot up to a combined $56.7 billion in 2022. Less than a year and a half later, sales of the same two drugs collapsed to an annualized $1.8 billion.

Don’t let its recent ups and downs confuse you. Pfizer is a reliable dividend payer that has raised its payout every year since 2009. At recent prices, it offers a 5.7% yield that will be easier to predict now that sinking sales of its COVID-19 products are responsible for less than 3% of total revenue.

Pfizer’s dividend payout is supported by one of the largest catalogs of drugs with patent-protected market exclusivity. In the first half of 2024, a dozen of its products grew sales by a double-digit percentage compared to the previous year period.

One of the investments Pfizer made with its pandemic-related earnings haul was the $43 billion acquisition of cancer drug developer Seagen. The purchase gave Pfizer access to four commercial-stage treatments, including Padcev. In late 2023, Padcev became a chemotherapy-free option for newly diagnosed bladder cancer patients. As such, sales are expected to reach $8 billion annually by 2030.

Padcev is one of several blockbuster drugs that could help Pfizer continue its dividend-raising streak. Adding some shares to a diverse portfolio now seems like the right move.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,022!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,329!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $393,839!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

Cory Renauer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Pfizer. The Motley Fool has a disclosure policy.

3 Reliable Dividend Stocks With Yields Above 5% That You Can Buy With Less Than $100 Right Now was originally published by The Motley Fool