Jim Cramer Says 'I'm Worried' About Boeing After Plane Maker Lays Off 17,000 Employees Amid Safety And Financial Woes: 'A Very Jarring Series Of News Tonight'

Jim Cramer expressed his concerns regarding Boeing Co.’s BA financial health after the plane maker announced plans to lay off 17,000 employees in the wake of ongoing safety issues and worker strikes.

What Happened: Cramer, in CNBC‘s Lightning Round on Saturday, voiced his worries about Boeing’s financial situation, stating, “I’m worried…The balance sheet’s not great, and they should have raised capital when they had a chance to.”

“This was a very jarring series of news tonight, and I don’t have any conviction whatsoever that they are getting this right,” he added.

See Also: Tesla Stock Falls Nearly 3% In Overnight Trading On Robinhood After Self-Driving Cybercab Unveil

Boeing’s CEO, Kelly Ortberg, disclosed the impending job cuts in an email to staff. The layoffs, which will affect a range of employees including executives and managers, represent about 10% of the company’s workforce and will be implemented over the coming months.

Why It Matters: The aerospace giant has been grappling with a series of challenges this year. In January, its 737 Max planes were grounded following a mid-flight incident. In July, Boeing admitted guilt in crashes involving the 737 Max in 2018 and 2019, which resulted in over 300 fatalities.

Further complications arose with Boeing’s Starliner spacecraft, which returned from the International Space Station in September without astronauts due to technical issues. Additionally, nearly 33,000 Boeing factory workers have been on strike since mid-September, further complicating the company’s situation.

Ortberg stressed the need for the layoffs to align with Boeing’s financial reality and future recovery plans. The delivery of the first 777X airplane has now been postponed to 2026, as stated in Ortberg’s memo.

Image Credit: Shutterstock

This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Columbus Day trading, Netflix and bank earnings, and economic data: What to watch in the markets this week

After a hectic week filled with major earnings reports, an AI summit, robotaxis, and key inflation data, this coming week will be shorter but still significant.

Here’s what’s on the agenda for the week ahead.

Is the stock market closed on Columbus Day?

No, the New York Stock Exchange (ICE) and the Nasdaq (NDAQ) will remain open Monday during Columbus Day, also known as Indigenous Peoples’ Day.

But bond markets will be closed.

Big bank earnings

Several major banks and financial institutions are set to release their quarterly earnings, offering valuable insights into their performance and broader economic trends. Goldman Sachs (GS), Bank of America (BAC), and Citigroup (C) will kick off the week with their earnings reports Tuesday, shedding light on how well these financial giants have navigated recent market volatility.

Discover Financial Services (DFS) and Citizens Financial Group (CFG) will reveal their financial health Wednesday, providing a closer look at consumer credit trends and regional banking performance. On Thursday, earnings from Morgan Stanley (MS), Blackstone (BX), and M&T Bank Corporation (MTB) will follow, giving insight into investment banking, private equity, and regional banking sectors. Finally, the week closes Friday with American Express (AXP) reporting its earnings.

Netflix and other important earnings

On Tuesday, Johnson & Johnson (JNJ), UnitedHealth Group (UNH), and Walgreens (WBA) will release their earnings reports before the opening bell, offering a glimpse into the healthcare and insurance sectors. On Thursday, the spotlight shifts to technology and travel, as Taiwan Semiconductor Manufacturing Company (TSM), Netflix (NFLX), American Airlines (AAL), and Alaska Airlines (ALK) will release their financial report cards.

Macroeconomic data to watch

While this week won’t bring any blockbuster macroeconomic reports, several key indicators will still provide valuable insights into the health of the U.S. economy. On Wednesday, the Import Price Index for September will be released, offering a glimpse into inflationary pressures from imported goods.

On Thursday, initial jobless claims will provide an updated snapshot of the U.S. labor market. The release of U.S. retail sales data will shed light on consumer spending patterns, a key driver of economic growth. Industrial production data will offer insights into manufacturing output and factory activity nationwide. Additionally, homebuilder confidence for October will gauge the housing market’s health, providing an outlook on construction activity and the broader real estate sector.

Kremlin Critic Warns Russia Could Grow Stronger If Trump Wins White House: 'Will Basically Be Handing Some Type Of Military Victory'

American financier and Kremlin critic Bill Browder on Saturday warned of the potential global ramifications of a second term for former President Donald Trump, citing the possibility of a weakened NATO and increased Russian aggression.

What Happened: Browder, during an interview on MSNBC, expressed concerns about the potential consequences of a Trump re-election. He highlighted the possibility of Trump cutting off military aid to Ukraine, which could potentially hand Russia a military victory.

“This is a terrifying moment for the whole world really in the sense that if Donald Trump becomes the next president, he will cut off military aid for Ukraine,” Browder said.

“Ukraine is totally dependent on U.S. military aid and that will basically be handing some type of military victory to Russia and to Putin.”

Browder also pointed to Trump’s previous discussions with Russian President Vladimir Putin during significant global events, such as the COVID-19 pandemic and Russia’s invasion of Ukraine. He suggested that Putin’s aggression could escalate under a second Trump presidency.

“Putin has designs on other parts of Europe. He’s looking at Estonia, Latvia and Lithuania who are NATO members,” Browder said. “If he gets involved with those countries in a military way then we have a treaty to defend those countries.”

See Also: Kamala Harris Advises On Howard Stern Show: Don’t Get Stoned Before Visiting The Sphere In Las Vegas

“And then the question is would Donald Trump honor that treaty obligation. And he’s made all sorts of noises in his previous presidency about not liking to be a part of NATO,” Browder added.

“This is a scary moment because we could be in a sort of World War II situation if Putin can run roughshod over Europe because he no longer has to worry about American aid for Ukraine,” Browder said.

Why It Matters: Browder’s concerns about Trump’s relationship with Putin are not unfounded. An upcoming book by journalist Bob Woodward alleges that Trump and Putin have maintained secret communication since 2021, with as many as seven conversations. This suggests a continued rapport between the two leaders, despite Trump’s departure from office.

Former White House Russia expert Fiona Hill has also suggested earlier that Putin views Trump as an asset and has been strategically manipulating him for some time. This perception of Trump’s potential return to power as a valuable card in international affairs could further embolden Putin’s actions, as Browder has warned.

Moreover, Trump has previously received praise from Putin for his Ukraine peace plan, which could further complicate the situation in Eastern Europe if Trump were to return to the White House.

This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Image via Wikimedia Commons

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Don't Give Up on Dividends: 3 Dividend Stocks That Reward You Through Thick and Thin

This year, some notable companies have cut or eliminated their dividends. For example, former stalwarts Walgreens and 3M ended decades-long streaks of dividend growth with deep cuts to their payouts. It’s a situation that can make some investors want to give up altogether on income investing.

However, while some formerly reliable companies have disappointed investors on the dividend front in recent years, others have continued to make their payments no matter what. Enterprise Products Partners (NYSE: EPD), Oneok (NYSE: OKE), and NextEra Energy (NYSE: NEE) stand out to a few Fool.com contributors for their dividend stability. Here’s why you should consider adding them to your portfolio.

Enterprise Products Partners is built to pay you well

Reuben Gregg Brewer (Enterprise Products Partners): For 26 consecutive years, midstream energy giant Enterprise Products Partners has increased its distributions. That’s a huge commitment to its unitholders, but there’s more for income investors to like here than just the distribution history. It all starts with its master limited partnership structure, which is designed to pass income on to investors in a tax-advantaged manner. (A portion of the distribution is usually return of capital.) So down to its foundation, Enterprise is about paying its investors well.

Then, factor in its business model. Enterprise owns energy infrastructure like pipelines, storage, refining, and transportation assets that are vital to the energy sector’s operation. However, unlike other segments of the industry, the midstream segment is largely fee driven. Enterprise generates reliable cash flows based on the use of its assets, so the often-volatile prices of oil and natural gas don’t really have that big an impact on its financial results. Demand for energy, which is usually strong even when oil prices are weak, is the key determinant of Enterprise’s success.

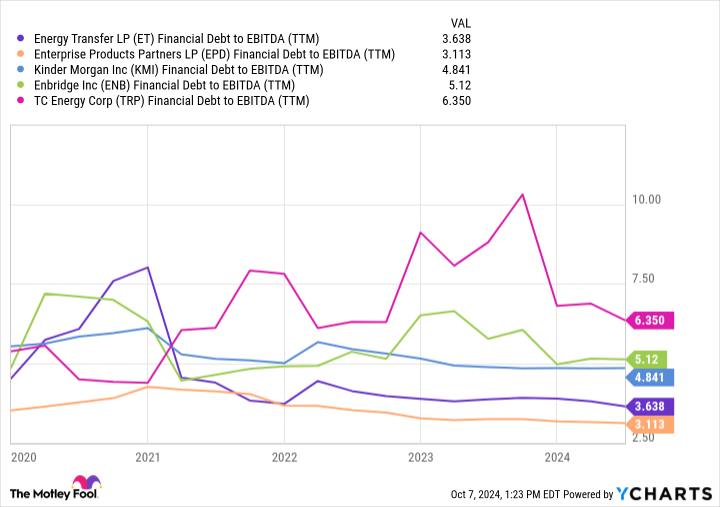

Then there’s the fact that Enterprise has an investment-grade rated balance sheet. Moreover, its leverage is normally toward the low end of its peer group, so it is conservative on both an absolute and relative basis. Lastly, the partnership’s distributable cash flow covers its distribution 1.7 times over.

All in all, a lot would have to go wrong before Enterprise Products Partners would need to cut its distribution. It is far more likely that it will continue to grow those disbursements, albeit slowly, as its capital investment plans pan out. But slow and steady distribution growth combined with a huge 7% yield will probably sound like music to most dividend investors’ ears.

Over a quarter century of growth and stability (and more growth coming down the pipeline)

Matt DiLallo (Oneok): Pipeline giant Oneok has proven its dividend durability over the decades. It has achieved more than a quarter century of dividend stability. While it hasn’t increased its payment every year during that period, it has a strong track record on payout hikes. Since 2013, Oneok has produced peer-leading total dividend growth of more than 150%. That’s impressive, considering that the world experienced two notable periods of oil price volatility during that period.

Oneoke has delivered sustainable earnings growth over the years. Its portfolio of pipelines and related midstream infrastructure generates predictable fees backed by long-term contracts and government-regulated rate structures. Its earnings grow as the volumes flowing through that infrastructure increase due to production growth, organic expansion projects, and acquisitions.

The company has been on an acquisition-fueled expansion binge in recent years. Last year, it bought Magellan Midstream Partners in a transformational $18.8 billion deal that increased its diversification and cash flow. The highly accretive deal will add an average of more than 20% to its free cash flow per share through 2027. That supports management’s view that Oneok will be able to grow its dividend by 3% to 4% annually during that period while also repurchasing shares and reducing its leverage ratio.

Oneok followed that up with a $5.9 billion deal to buy Medallion Midstream and a meaningful interest in EnLink Midstream this August. The transaction will be immediately accretive to its free cash flow and capital allocation strategy. After closing that deal, Oneok plans to buy the rest of EnLink, further boosting its cash flow per share. The company also expects to complete additional organic expansion projects, further enhancing its growth rate.

The midstream giant’s investments will help fuel its dividend growth for the next several years, even if there’s another market downturn. Those features make Oneok a great stock to buy for those seeking reliable dividends.

A steady dividend grower

Neha Chamaria (NextEra Energy): NextEra Energy, which has a yield of 2.6% at its current stock price, has rewarded its shareholders through thick and thin, and management is determined to continue doing so. The utility and clean energy giant has paid regular dividends for decades, but more importantly, increased them steadily over time. Between 2003 and 2023, the compound annual growth rate (CAGR) of NextEra Energy’s dividend was nearly 10%, backed by a 9% CAGR in its adjusted earnings per share (EPS) and an 8% CAGR in operating cash flow during the period.

NextEra Energy operates two businesses — Florida Power & Light Company (the largest electric utility in Florida) and clean energy company NextEra Energy Resources (the world’s largest generator of wind and solar energy). So while its regulated utility business generates stable cash flows, clean energy is where its growth largely comes from.

NextEra Energy expects its adjusted EPS to grow at an annualized rate of 6% to 8% through 2027, and expects annual dividend hikes of around 10% through 2026 as it pumps billions of dollars into both businesses.

More specifically, NextEra Energy plans to spend over $34 billion on Florida Power & Light between 2024 and 2027 and more than $65 billion on renewable energy over the next four years. That’s massive, and if done right, should steadily boost NextEra Energy’s earnings and cash flows to support bigger dividends for years, regardless of how the economy fares.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,022!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,329!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $393,839!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

Matt DiLallo has positions in 3M, Enterprise Products Partners, and NextEra Energy. Neha Chamaria has no position in any of the stocks mentioned. Reuben Gregg Brewer has positions in 3M. The Motley Fool has positions in and recommends NextEra Energy. The Motley Fool recommends 3M, Enterprise Products Partners, and Oneok. The Motley Fool has a disclosure policy.

Don’t Give Up on Dividends: 3 Dividend Stocks That Reward You Through Thick and Thin was originally published by The Motley Fool

Former Tesla Enthusiast Embraces Rivian After R1T Survives Hurricane

Former Tesla aficionado Michael Cusick has shifted his loyalty to Rivian Automotive RIVN following the survival of his Rivian R1T electric truck in Hurricane Helene.

What Happened: Cusick, a resident of Asheville, North Carolina, was a staunch supporter of Tesla Inc TSLA having owned and extensively driven a Model 3. However, his experience with the Rivian R1T during Hurricane Helene, which wreaked havoc in the southeast, including Asheville, has led him to switch his allegiance to Rivian.

According to the report by Business Insider, after weighing several options including the Tesla Cybertruck and the Chevy Silverado EV, Cusick purchased a Rivian R1T in June 2024.

He was attracted to the Rivian R1T due to its midsize truck capabilities, its ability to traverse narrower trails, and its air suspension that provides about 2 feet of ground clearance.

During the onslaught of Hurricane Helene, Cusick’s Rivian was swallowed by floodwaters. However, once the waters subsided, he discovered his vehicle was unscathed and fully functional.

In the hurricane’s aftermath, Cusick’s Rivian R1T even functioned as a generator, powering a food truck and a chainsaw for clearing roads.

Subsequent to the incident, Rivian contacted Cusick and provided him with a loaner vehicle while his truck is inspected and potentially repaired. This experience has cemented Cusick’s commitment to Rivian. “I’m all-in on Rivian now, without a doubt,” Cusick told the outlet.

Why It Matters: This incident underscores the durability and resilience of Rivian’s electric vehicles, which could potentially boost consumer confidence in the brand.

The company’s swift response in providing a loaner vehicle also highlights their commitment to customer service. This could further enhance Rivian’s reputation and market position in the competitive electric vehicle industry.

Read Next

Mark Zuckerberg Flaunts Watches Valued at a Cybertruck’s Price

This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The Newest Artificial Intelligence Stock Has Arrived — and It Claims to Make Chips That Are 20x Faster Than Nvidia

The artificial intelligence chipmaker Nvidia (NASDAQ: NVDA) has amassed close to a $3.2 trillion market cap, making it one of the world’s largest chipmakers. It now consumes more than 6% of the broader benchmark S&P 500 index. Over the last five years, Nvidia has grown annual revenue by 458% and the stock is up an incredible 2,009%. Given the potential for AI to disrupt life as we know it, it’s understandable that investors are so excited about the stock.

But the lure of these kinds of gains is naturally going to attract competition. Now, one of Nvidia’s competitors is planning an initial public offering (IPO) and claiming to manufacture chips that can vastly outperform Nvidia at a fraction of the price. Let’s take a look.

20x better than Nvidia?

Last week, the AI chipmaker Cerebras filed its registration statement with the Securities and Exchange Commission (SEC) with the intent to go public. In a press release from 2021, Cerebras said it had a valuation of $4 billion after a $250 million series F financing round. The company is targeting a $1 billion IPO at a $7 billion to $8 billion valuation.

In its registration statement, Cerebras cites Nvidia as a competitor, as well as other large AI companies such as Advanced Micro Devices, Intel, Microsoft, and Alphabet. Here is a description of what Cerebras does:

We design processors for AI training and inference. We build AI systems to power, cool, and feed the processors data. We develop software to link these systems together into industry-leading supercomputers that are simple to use, even for the most complicated AI work, using familiar ML frameworks like PyTorch. Customers use our supercomputers to train industry-leading models. We use these supercomputers to run inference at speeds unobtainable on alternative commercial technologies.

Cerebras’ pitch is that bigger is better. That’s because the company has designed a chip that is the size of a full silicon wafer, and the largest ever sold. The company believes that the size advantage leads to less time moving data. Furthermore, Cerebras has a flexible business model in which clients can buy Cerebras products to have at their facilities or through a consumption-based subscription through the company’s cloud infrastructure.

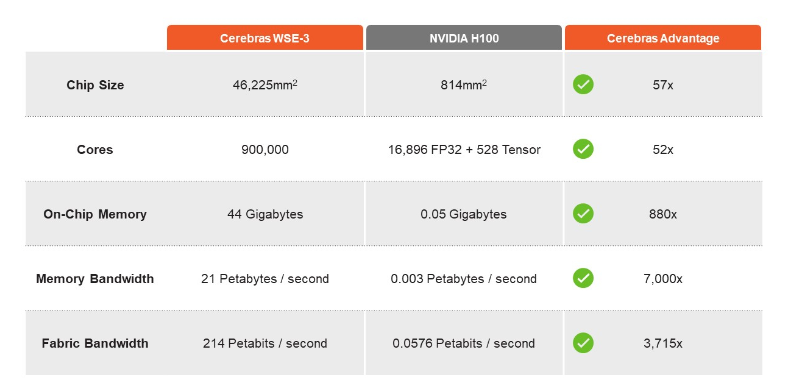

Cerebras clearly wants investors to compare, or at least associate, the company with Nvidia. Nvidia is mentioned 12 times in the registration statement. Cerebras also provides a side-by-side comparison of its Wafer-Scale Engine-3 chip versus Nvidia’s H100 graphics processing unit (GPU), which is considered the most powerful GPU on the market.

Cerebras CEO Andrew Feldman publicly said the company’s inference offering is 20 times faster than Nvidia’s at a fraction of the price. In 2023, Cerebras generated about $78.7 million of revenue, up 220% year over year. Through the first half of 2024, Cerebras has grown revenue to $136.4 million. The company still hasn’t earned a profit, having reported a nearly $67 million loss through the first half of 2024. These numbers also pale in comparison to Nvidia, which recently reported second-quarter revenue of $30 billion and a profit of roughly $16.6 billion.

Will Cerebras make a splash?

With big publicity from news publications and claims of being 20 times faster than Nvidia, I think it’s safe to say that Cerebras already has and will continue to make a splash.

Depending on the excitement investment bankers can drum up during the company’s road show and market conditions, I wouldn’t be surprised to see Cerebras go public at a higher valuation than expected. AI has been all the buzz and the IPO market has been flat for a few years now, so there could be pent-up demand on Wall Street.

Will Cerebras overtake Nvidia? Only time will tell. Its product offerings are impressive, but it still has a ways to go to get its financial profile in line with Nvidia. Furthermore, there may be some advantages to Nvidia having smaller chips and it remains to be seen whether Cerebras can compete with Nvidia’s software language CUDA — although the company does say that its software program “eliminates the need for low-level programming in CUDA.”

While everything sounds great, there is likely still a “show me” component to this story. After all, the bulk of Cerebras’ revenue comes from one customer. Nvidia also has a leading market share in the AI chip space and relationships with many large clients. Who’s to say Nvidia couldn’t use its size — and likely resource — advantage to develop a similar large wafer chip? There’s a lot left to play out, but this could be one of the more interesting developments for market watchers to pay attention to.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,266!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,047!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $389,794!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Bram Berkowitz has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

The Newest Artificial Intelligence Stock Has Arrived — and It Claims to Make Chips That Are 20x Faster Than Nvidia was originally published by The Motley Fool

Mary Trump: 'Because Donald Is A World-Class Hypocrite, It Turns Out His Interviews Have Been Edited'

On Friday former President Donald Trump called for the revocation of the broadcasting license of CBS, alleging widespread corruption and disinformation among media outlets.

What Happened: Trump declined to partake in a customary pre-election interview on CBS’ 60 Minutes due to the network’s commitment to fact-checking his statements.

He has since called for CBS to be stripped of its broadcasting license and proposed that all other broadcast licenses should be auctioned to the highest bidder. The former president’s ire was ignited by the airing of two different versions of a response given by Vice President Kamala Harris on a question about Israel.

Trump accused 60 Minutes and CBS of perpetrating fraud by editing the interview for clarity, which he branded as “the Single Biggest scandal in Broadcast History.”

During an event in Detroit, Trump informed the audience that all networks are “crooked as hell” and should be deprived of their licenses, a comment that was greeted with applause.

Talking about Trump’s stance on the media outlet, his niece Mary Trump said in a Substack post that “because Donald is a world-class hypocrite, it turns out his interviews have been edited in order to make him look better.”

“For years, Donald has railed against the press, calling them the “the enemy of the people.” He singles out individual reporters, especially women, by name and calls them stupid when they ask probing questions, or don’t flatter him enough,” she said in the post.

“There is plenty of evidence, from misleading New York Times headlines that whitewash his authoritarianism, racism, and criminality, to the abysmal performances by moderators at both the CNN and CBS debates, that Donald’s working the refs has succeeded,” Mary Trump continued.

She also said that “too many reporters and news organizations fear Donald and have decided that the best way to protect themselves is to appease him.”

“Unfortunately, doing so makes it impossible for them to do their jobs—which, at this critical time in American history, is to educate the American people about, and alert them to, the unique danger a second Trump administration poses,” Mary Trump said.

Also Read: Mary Trump: ‘Donald’s Narcissistic Injury Is So Great That He Has Essentially Stopped Campaigning’

Why It Matters: This is not the first time that Trump has been at odds with the media. Throughout his presidency, he has been known for his contentious relationship with the press, often accusing them of spreading “fake news”.

His recent call for CBS and other networks to lose their broadcasting licenses signifies an escalation in this ongoing conflict.

The implications of such a move could be far-reaching, potentially affecting the freedom of the press and the public’s access to information.

Read Next:

This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fulcrum Therapeutics Reports Inducement Grants Under Nasdaq Listing Rule 5635(c)(4)

CAMBRIDGE, Mass., Oct. 11, 2024 (GLOBE NEWSWIRE) — Fulcrum Therapeutics, Inc.® FULC, a clinical-stage biopharmaceutical company focused on developing small molecules to improve the lives of patients with genetically defined rare diseases, today announced that the company granted non-statutory stock options to two new employees. Fulcrum granted stock options to purchase shares of the company’s common stock pursuant to the company’s 2022 Inducement Stock Incentive Plan, as amended, or the plan, as an inducement material to the new employees entering into employment with Fulcrum in accordance with Nasdaq Listing Rule 5635(c)(4).

Fulcrum granted the new employees an aggregate of 90,000 options to purchase shares of the company’s common stock at an exercise price of $3.57 per share, the closing price per share of Fulcrum’s common stock as reported on the grant effective date, October 7, 2024. Each option has a ten-year term and vests over four years, with 25% of the original number of shares vesting on the first anniversary of the applicable employee’s start date and an additional 6.25% of the shares vesting in equal quarterly installments over the twelve successive quarters following the first anniversary, subject to the applicable employee’s continued service with the company through the applicable vesting dates.

About Fulcrum Therapeutics

Fulcrum Therapeutics is a clinical-stage biopharmaceutical company focused on developing small molecules to improve the lives of patients with genetically defined rare diseases in areas of high unmet medical need. Fulcrum’s lead program in clinical development is pociredir, a small molecule designed to increase expression of fetal hemoglobin and in development for the treatment of sickle cell disease (SCD). Fulcrum uses proprietary technology to identify drug targets that can modulate gene expression to treat the known root cause of gene mis-expression. For more information, visit www.fulcrumtx.com and follow us on Twitter/X (@FulcrumTx) and LinkedIn.

Contact:

Chris Calabrese

LifeSci Advisors, LLC

ccalabrese@lifesciadvisors.com

917-680-5608

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.