Should You Follow This Insider's Lead and Sell Palantir Stock?

One of the hottest names in artificial intelligence software is data analytics company Palantir Technologies (NYSE: PLTR). Over the last couple of years, it has swiftly evolved from a government contractor working closely with the U.S. military into a more prolific platform reaching major end markets in the private sector.

The company’s accelerated top- and bottom-line growth isn’t going unnoticed, either. So far in 2024, investors have sent Palantir shares soaring 150% — versus the near-20% returns posted by both the S&P 500 and Nasdaq Composite.

But in the midst of Palantir’s shining moment, the company’s chairman, Peter Thiel, just sold a boatload of stock. Below, I’ll break down the mechanics of insider sales and provide my opinion on whether or not now is a good time to follow Thiel’s move and cash out.

Analyzing insider transactions

When insiders buy or sell stock, it’s natural for outsiders to wonder what factors might have influenced the decision. The Securities and Exchange Commission goes to great lengths to establish rules to mitigate any nefarious insider transactions as much as possible. One such protocol is Rule 10b5-1.

Essentially, 10b5-1 allows insiders to create a planned schedule to buy or sell stock based on certain parameters. The point is to automatically trigger buying or selling once predetermined criteria set by the insider are reached. In other words, Rule 10b5-1 helps dissipate the idea that an insider bought or sold securities based on nonpublic information.

This is exactly the situation with Thiel. Between the final week of September and early days of October, the billionaire venture capitalist sold roughly 28.6 million shares of Palantir for total proceeds of about $1.1 billion.

Remember to think big picture

Thiel is a co-founder of Palantir and has been with the company since 2003. Even though his latest stock sale is large, this is far from the first time he took profits over the last two decades.

In fact, between March and May, Thiel sold about 20 million shares across four separate transactions — accumulating a cool $452 million in the process.

Should you sell Palantir stock?

As I’ve written many times, there is no perfect time to sell a stock. Instead, investors need to ask themselves tough questions around a company’s current level of growth and what the trajectory might look like.

Palantir began the year with a market cap of $35 billion. Not even a full 10 months later, it is now valued 2 1/2 times higher. This is a clear sign of outsize valuation expansion.

While I am bullish on the long-term picture, it’s hard not to take some profits after such an impressive run during an otherwise short time frame. At the end of the day, taking profits really depends on your personal financial situation.

If you need some liquidity or would feel more comfortable stockpiling cash, now could be an appropriate time to sell some shares. The more important idea here is to keep the long-term thesis in focus. If you’re optimistic that better days are ahead for Palantir and you are not in any need of raising funds, then keeping your current allocation is OK, too.

I think the most prudent strategy is a happy medium of trimming your position to recoup your initial investment, while also keeping some exposure to the company.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,266!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,047!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $389,794!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

Adam Spatacco has positions in Palantir Technologies. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool has a disclosure policy.

Should You Follow This Insider’s Lead and Sell Palantir Stock? was originally published by The Motley Fool

Starship To Fly Again On Sunday After SpaceX's Long War Of Words With Regulator Over 'Frivolous' Licensing Delays

Elon Musk‘s SpaceX said on Saturday that its Starship‘s fifth test flight is expected to launch as early as 7 a.m. CT on Sunday, after a long battle of words with regulator Federal Aviation Administration (FAA).

What Happened: SpaceX was planning on launching Starship on Sunday from earlier this week if necessary regulatory approvals are received. The FAA cleared Starship for launch on Saturday.

However, SpaceX also warned that the schedule is likely to change, citing the dynamic schedules associated with all developmental testing activities.

For the upcoming flight, the company’s goal is to catch the two-stage launch vehicle’s booster back at Starbase using the launch tower’s mechanical arms on its return from space, marking a significant demonstration of Starship’s reusability. The Starship spacecraft, meanwhile, will splash down in the Indian Ocean.

SpaceX is looking to ensure full reusability for its Starship rocket. The company believes reusing rockets is integral to bringing down spaceflight costs as the most cost is taken up in building the launch vehicle.

Past Flight Tests: SpaceX has conducted four flight tests with the Starship thus far.

SpaceX last launched Starship in the first half of June. During the test, the two stages of the vehicle – the Starship spacecraft and the Super Heavy booster – separated, and the booster subsequently had a soft splashdown in the Gulf of Mexico. The spacecraft ignited its engines and went into space, made a controlled re-entry to Earth, and had a soft splashdown in the Indian Ocean.

The entire flight lasted one hour and six minutes from launch. The key object of the flight was to re-enter Earth and the mission achieved it while withstanding damage to the vehicle.

The flights before accomplished less. While the spacecraft failed to reach space in the first flight, it reached space and exploded in the second test flight. During the third flight test, the spacecraft broke apart when re-entering Earth’s atmosphere from space.

War Of Words With FAA: In September, SpaceX said that Starship has been ready for its fifth flight test since the first week of August but has been put off owing to “frivolous” and “patently absurd” licensing issues.

“Unfortunately, we continue to be stuck in a reality where it takes longer to do the government paperwork to license a rocket launch than it does to design and build the actual hardware,” SpaceX said.

The company then said that it received a launch license date estimate of late November for the fifth flight from the FAA, marking a two-month delay from the previously communicated date of mid-September.

Why It Matters: Starship is key to NASA’s dreams of taking humans back to the surface of the Moon.

NASA’s Artemis 3 mission slated to launch no earlier than September 2026 is expected to enable humans to land back on the surface of the moon with the help of a lunar lander variant of the Starship spacecraft. The last time humans set foot on the Moon was in 1972 with Apollo 17. Since then, no crew has traveled beyond low-Earth orbit.

Musk, meanwhile, is eyeing taking humans to Earth’s neighboring planet Mars aboard the Starship. Last month, he said that the first Starship launch to Mars is expected in 2026 and that it will not have a crew on board.

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read More:

Photo via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Billionaire Bill Gates Has 81% of His $48 Billion Portfolio in Just 4 Stocks

Most people have probably heard of Bill Gates, best known as the co-founder of Microsoft (NASDAQ: MSFT) and, more recently, his activities as a billionaire philanthropist.

After helming the tech company he founded for more than a quarter of a century, the former CEO left Microsoft to focus on his charitable endeavors. Gates is currently worth $105.8 billion (as of this writing), according to Forbes, making him the 14th richest person in the world today. However, he has vowed to give most of his money to charity so that “the vast majority of my wealth would go toward helping as many people as possible.”

To facilitate that goal, he established the Bill & Melinda Gates Foundation Trust. “Our mission is to create a world where every person has the opportunity to live a healthy, productive life,” according to the Gates Foundation website. Through the end of 2023, the foundation has paid out $77.6 billion since inception, “taking on the toughest, most important problems.”

While the Trust continues to own stakes in two dozen companies, to close out the second quarter, 81% of its holdings comprised just four stocks.

1. Microsoft: 30%

It shouldn’t be a surprise to anyone that the Trust’s largest holding — by a wide margin — is Microsoft, the company Gates founded. The Foundation owns roughly 35 million shares of Microsoft stock, valued at roughly $14.3 billion.

However, this isn’t your grandfather’s Microsoft. Beyond its legacy software, browser, and operating systems, the company is now a major player in a number of emerging industries. It’s the world’s second-largest cloud infrastructure provider, which also gives Microsoft the pole position in marketing artificial intelligence (AI) products and services to its cloud customers.

Management noted that its Azure Cloud growth included “eight points from AI services,” which shows this strategy is driving additional business. These AI-related services, including its AI-powered digital assistant — Copilot — could generate incremental revenue of $143 billion by 2027, according to analysts at Evercore ISS.

There’s also Microsoft’s quarterly dividend, which the company has been paying consistently since 2004 and has raised every year since 2011. The current yield of 0.8% might seem like peanuts, but that’s augmented by stock price gains of 202% over the past five years (as of this writing). Furthermore, its payout ratio of less than 25% illustrates that there’s likely much more potential upside from here.

Given the company’s track record of success, I get why Gates has a soft spot for Microsoft. I believe it will continue to be one of his most profitable investments — that’s why I own shares.

2. Berkshire Hathaway: 23%

Fellow billionaire philanthropist Warren Buffett, CEO of Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B), has joined Gates in his vow to donate the vast majority of his assets to charity. Buffett signed the “Giving Pledge” in 2006 and has thus far donated more than $43 billion to the Trust, including $5.3 billion in Berkshire Hathaway stock earlier this year. As a result, the Gates Foundation currently holds nearly 25 million shares, worth more than $11 billion.

Berkshire Hathaway stock represents instant diversification thanks to the company’s dozens of business interests and stock holdings — so it isn’t surprising it represents such a high percentage of the Trust’s holdings. Furthermore, Berkshire rakes in billions of dollars in dividend income each year and holds a whopping $277 billion in cash.

Given the diversity of its assets, the ongoing windfall of dividend income, and Buffett’s track record — which is without equal — I think it’s a wise choice keeping so much Berkshire Hathaway stock in the Trust’s coffers.

3. Waste Management: 15%

Gates is a fan of companies with strong pricing power and robust recurring revenue, and it would be difficult to find a better example than Waste Management (NYSE: WM). Simply put, society will continue to generate waste for the foreseeable future. The Gates Trust has a stake of more than 35 million shares, worth $7.2 billion.

Waste Management is expanding beyond its trash collection roots, recovering glass, paper, metal, and plastics to redirect to its reclamation stations for recycling. The company also collects landfill gases from its sites to generate electricity, another growing source of income.

In the second quarter, revenue increased by 5.5% year over year, while its adjusted operating EBITDA (earnings before interest, taxes, depreciation, and amortization) increased by 10%, fueled by higher payments for recyclables and overall price increases.

There’s also the dividend to consider. Waste Management has been making consistent payments since 1998 and has increased its dividend for 21 consecutive years. The current payout yields 1.46% and boasts a payout ratio of just 46%, so there’s ample room for future increases.

I don’t own Waste Management stock, but for income investors, I think it’s a savvy pick.

4. Canadian National Railway: 13%

Gates and Buffett also share an affinity for railroads. When Berkshire bought Burlington Northern Santa Fe in 2009, Buffett said railroads transported goods “in a very cost-effective way … they do it in an extraordinarily environmentally friendly way … [releasing] far fewer pollutants into the atmosphere.” Gates obviously agrees, as the Trust owns almost 55 million shares of Canadian National Railway (NYSE: CNI), worth roughly $6.2 billion.

Canadian National is unique in that it’s the only transcontinental railroad in North America, connecting the Atlantic coast, the Pacific coast, and the Gulf of Mexico. To Buffett’s point, railroads are four times more efficient than trucks, making them a more cost-effective option while also reducing greenhouse gas emissions by 75% compared to over-the-road trucks. There’s also a strong economic moat and significant barriers to entry, which makes railroads even more appealing.

Canadian National has a consistent record of dividend payments, with increases every year since its 1995 IPO. The dividend has a current yield of 2.2%, and its payout ratio of 38% suggests there’s plenty of room for additional upside.

I don’t need to be convinced about the value afforded by an investment in Canadian National Railway — I’m already a shareholder.

Should you invest $1,000 in Microsoft right now?

Before you buy stock in Microsoft, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Microsoft wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,069!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

Danny Vena has positions in Canadian National Railway and Microsoft. The Motley Fool has positions in and recommends Berkshire Hathaway and Microsoft. The Motley Fool recommends Canadian National Railway and Waste Management and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Billionaire Bill Gates Has 81% of His $48 Billion Portfolio in Just 4 Stocks was originally published by The Motley Fool

Jamie Dimon Warns Of Global Risks To Economy: 'Treacherous And Getting Worse'

Jamie Dimon, CEO of JPMorgan Chase & Co. JPM, issued a stark warning about challenges that could affect the U.S. economy.

What Happened: In the bank’s third-quarter earnings release, Dimon highlighted several critical global risks that could disrupt both economic and geopolitical stability.

Dimon, who heads the nation’s largest bank, noted concerns around slowing inflation, fiscal deficits, and global trade disruptions, and warned that geopolitical instability could have profound long-term consequences, Fox Business reports. He noted the importance of preparing for unpredictable outcomes.

Dimon also pointed to the need for a robust approach to handling infrastructure needs and warned that remilitarization efforts globally could increase instability.

“We have been closely monitoring the geopolitical situation for some time, and recent events show that conditions are treacherous and getting worse,” Dimon said in the news release.

Also Read: Dimon Calls Out Red Tape – Says It’s ‘Deeply Frustrating’ America Isn’t Solving Its Problems

“There is significant human suffering, and the outcome of these situations could have far-reaching effects on both short-term economic outcomes and more importantly on the course of history,” he added.

While acknowledging the resilience of the U.S. economy, Dimon – who has been floated as a possible future Treasury secretary or Federal Reserve chair – said that the U.S. must get its fiscal house in order.

“Additionally, while inflation is slowing and the U.S. economy remains resilient, several critical issues remain, including large fiscal deficits, infrastructure needs, restructuring of trade and remilitarization of the world,’ Dimon said.

“While we hope for the best, these events and the prevailing uncertainty demonstrate why we must be prepared for any environment,” he added.

Read Next

Jamie Dimon Rejects Trump Endorsement Claim, Casting Doubt On Treasury Rumors

This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Pagani Residences Leverages Blue Square X's Vision X LED Display for Immersive Sales Experience

HOLLYWOOD, Fla., Oct. 11, 2024 /PRNewswire/ — Blue Square X, a leader in cutting-edge display technology, today announced its 216″ Vision X All-In-One 4K LED display played a pivotal role in creating an innovative and immersive sales experience for the ultra-luxury Pagani Residences development in Miami. This collaboration between Blue Square X and Riviera Horizons, the developer behind Pagani Residences, showcases how advanced technology can redefine luxury real estate sales.

Vision X All-In-One 4K LED, celebrated for its exceptional image quality and immersive capabilities, has been seamlessly integrated into the Pagani Residences sales center. This strategic implementation empowers potential buyers to embark on a captivating journey into the heart of this architectural masterpiece. Through the display’s advanced features, clients can now experience:

- Interactive 3D Renderings: Delve into the intricate details of Pagani Residences’ architecture and design through high-fidelity 3D renderings, providing an unparalleled level of visualization.

“The Vision X was a game-changer for our sales center. The quality of the product, installation, and service exceeded our expectations,” said Mikael Hamaoui, founder and CEO of Riviera Horizons.

- Virtual Property Tours: Embark on virtual tours that transcend physical limitations, offering potential buyers the opportunity to experience the flow and ambiance of these exquisite residences firsthand.

- Detailed Floor Plan Exploration: Interact with detailed floor plans, visualizing different layouts and spatial configurations to make informed decisions aligned with their lifestyle preferences.

The Vision X display further elevates the sales process by providing a window into the exclusive lifestyle that awaits at Pagani Residences. Prospective buyers can virtually explore the surrounding neighborhood’s upscale shopping districts, pristine beaches, and vibrant cultural hotspots, all from the comfort of the sales center.

One of the standout features of the Vision X integration is its ability to showcase the bespoke interiors meticulously crafted by Pagani Arte. Potential buyers can explore a wide array of custom finishes, visualize their dream kitchens and bathrooms, and personalize their living spaces with an unparalleled level of detail. This level of customization, made possible by the Vision X’s advanced capabilities, sets a new standard for luxury real estate sales.

The decision to incorporate the Vision X display into the Pagani Residences sales center stems from a shared vision between Blue Square X and Riviera Horizons to create an experience that mirrors the exclusivity and sophistication of the Pagani brand. By seamlessly merging bespoke craftsmanship with cutting-edge digital visualization, Pagani Residences has redefined the luxury buying experience.

This combination of bespoke craftsmanship and advanced digital visualization has been instrumental in driving interest and accelerating sales, particularly for a pre-construction project like Pagani Residences, where prices start at $2.9 million. The Vision X display has become an indispensable tool for showcasing the project’s unique value proposition and captivating discerning buyers seeking the pinnacle of luxury living.

Explore more photos, read the full case study, and watch the video here.

For more information about Blue Square X and its innovative display solutions, please visit Blue Square X.

To learn more about Pagani Residences, visit Pagani Residences.

About Blue Square X

Blue Square X is a digital experience innovation company that transforms imagination into reality by fusing powerful storytelling, art, cutting-edge technology, and architecture. With operations in New York and Miami, they specialize in crafting captivating and immersive visual experiences across a wide range of industries. Blue Square X’s focus on cutting-edge technology and innovation drives business growth and enhances customer experiences.

Media Contact:

Shari Sentlowitz

Blue Square X

201-951-2734

marketing@bluesqx.com

www.bluesqx.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/pagani-residences-leverages-blue-square-xs-vision-x-led-display-for-immersive-sales-experience-302274066.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/pagani-residences-leverages-blue-square-xs-vision-x-led-display-for-immersive-sales-experience-302274066.html

SOURCE Blue Square X

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Are Stock Markets Open on Monday for Columbus Day?

Key Takeaways

-

Next Monday, Oct. 14, is Columbus Day, a federal holiday.

-

Stock and bond markets typically follow the federal holiday schedule, but the New York Stock Exchange and Nasdaq will operate normal hours Monday.

-

However, bond markets will be closed, along with many banks and government operations like the post office.

This year, Oct. 14 is the second Monday of October, the date that Columbus Day is celebrated in the U.S., meaning you may be wondering if stock markets will be open for trading.

Considering the New York Stock Exchange (NYSE) and Nasdaq largely follow the calendar of federal holidays for closures, it may come as a surprise that both will be open and operating normally on Monday.

The two remaining holidays on the exchanges’ respective calendars for 2024 are Thanksgiving and Christmas, with additional shortened hours on the day after Thanksgiving and on Christmas Eve.

However, federal operations like the Federal Reserve and post offices will be closed, as will commercial banks that follow the federal holiday schedule. Bond markets will also be closed.

Read the original article on Investopedia.

1 Dividend Stock Yielding 8% to Buy in Case of a Bear Market

It might not seem like it today with market indexes rocketing to all-time highs, but bear markets do exist. They happen around once a decade and are defined as a period when an index such as the S&P 500 falls 20% or more from all-time highs.

One happened in 2022 (it seems so long ago) as well as briefly in 2020. Before that, there were bear markets in 2009, 2001, and 1990.

When stock prices are soaring, it can feel like the time to put your foot on the gas and get more aggressive with your portfolio. But counterintuitively, it is the best time to get more conservative and mix in some stocks that can weather any recession or bear market. You don’t want your entire portfolio in risky hypergrowth technology stocks that can fall 80% in a market downturn. Many investors made this mistake in 2022.

Dividend stocks with high yields can be great ballast in your portfolio when preparing for an upcoming bear market. One of the top-yielding stocks is Altria Group (NYSE: MO). Here’s why it is an ideal choice to balance out a portfolio of expensive hypergrowth stocks.

Legacy tobacco and pricing power

Altria Group is the corporate owner of Philip Morris USA, which owns brands such as Marlboro and Copenhagen. Cigarettes power the boat for the company, with Marlboro leading the way. However, smoking has been going down in the United States for many years.

Although this is a concern for tobacco companies, Altria has been able to counteract these volume declines with price increases. Revenue is up 13.1% in the last 10 years, while operating income is up 50% cumulatively over that time period.

This is why Altria has been able to consistently raise its dividend per share — most recently by 4.1% to $1.02, its 59th increase in 55 years.

At a current yield of 8%, Altria Group looks like an attractive income stock if it can keep raising prices — and therefore its dividend payout. The big questions are whether this party can continue, and whether management can switch customers over to nicotine alternatives.

Can the company switch customers to other product categories?

Pricing power is great, but it can’t sustain Altria Group indefinitely. Eventually — if the trends of the last few decades persist — cigarettes will be a minuscule part of consumer spending in the United States.

Replacing cigarettes are vaping devices and nicotine pouches. Altria Group has invested in both with its Njoy and on! brands.

Both brands are growing, but still are below direct competitors. On! nicotine pouches have 8.1% market share of the oral tobacco market (including legacy chewy tobacco and new nicotine-pouch brands), while Njoy held just 5.5% of the vaping market in the United States. Combined, the two brands still form just a small portion of Altria’s consolidated revenue.

Over the next five to 10 years, shareholders will need to keep track of the growth of these two brands. They can help replace sales volume lost from people quitting cigarettes.

Buy it for steady returns and low volatility

Altria Group is not a high-growth company. In fact, I wouldn’t expect its revenue to grow much over the next five years. Cigarette volumes will keep declining, which Altria can counteract with price increases and growth from on! and Njoy. But at current prices, I don’t think you need much revenue growth for the stock to do well.

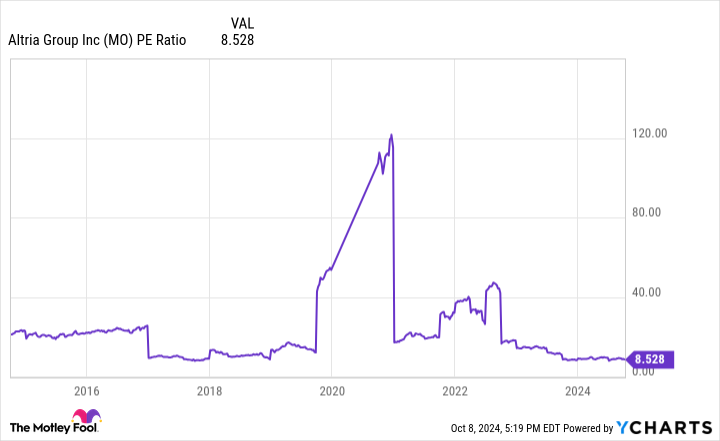

It has a price-to-earnings ratio of just 8.5. The company is repurchasing a ton of its stock, which means it can grow its dividend per share without growing its nominal dividend payout.

The starting yield is around 8% today, and the company has a long history of growing its dividend per share. This means that even if the stock price goes nowhere — or falls in a bear market — investors will be getting a consistent 8% yield.

For all these reasons, I think Altria Group is a cheap stock you would love to own during the next bear market, whenever it arrives.

Should you invest $1,000 in Altria Group right now?

Before you buy stock in Altria Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Altria Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $812,893!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

1 Dividend Stock Yielding 8% to Buy in Case of a Bear Market was originally published by The Motley Fool

The stock market's bull rally is 2 years old. Here's what tends to happen next.

-

The stock market has surged since October 2022, with major indexes posting strong gains.

-

With the bull market in stocks now two years old, investors are wondering how long the rally can last.

-

According to stock market experts, the answer is: a lot longer.

The stock market bottomed on October 12, 2022, marking two years since the start of the ongoing bull rally.

Since then, the Nasdaq 100, S&P 500, and Dow Jones Industrial Average have posted impressive gains of 88%, 62%, and 46%, respectively.

A resilient job market, lower inflation, and continued corporate earnings growth helped push the stock market higher over the past two years.

So, what’s in store for the bull market from here?

Here’s what market experts told Business Insider about what history says about the bull market’s future as it enters its third year.

Freedom Capital Markets, Jay Woods

Chief global strategist Jay Woods of Freedom Capital Markets said what’s most telling about the current bull market is that very few believed in it in the beginning.

“I think it’s important to preface it with when it started, no one believed it. They just thought it was a bear market rally. And then they doubted that it had legs, and then it was just seven stocks,” Woods told Business Insider.

He added: “And now, all of a sudden, it is powerful. And I think the momentum is continuing. You got the rate cycle, you got broadening out, we have wind at our sails, and this bull market should last at least another 12, maybe 18 months.”

Woods said he is encouraged that market leadership is diverse and no longer concentrated in mega-cap technology companies. A recent example is the rotation into utility stocks, which have surged on the AI power demand narrative.

A common Wall Street expression is “rotation is the lifeblood of a bull market,” and that appears to be playing out.

“It’s good to look back and celebrate two years, but it still feels like the party is just beginning,” Woods said.

Carson Group, Ryan Detrick

According to Carson Group chief market strategist Ryan Detrick, the bull market in stocks is still young.

“Although many might think this bull market has gone too far and is getting old, that isn’t the case at all. If you look back at history, bull markets last more than five years on average, making this one at two years actually young,” Detrick told Business Insider.

Detrick said that while he sees more gains ahead, he doesn’t expect another big year for returns like in 2023 and so far in 2024, with the S&P 500 delivering gains of 24% and 22%, respectively.

Instead, Detrick said that the average gain of a bull market in year three is about 8%, which is right around the average annual return for stocks.

“All in all, we expect stocks to be up at least low double digits over the next year,” Detrick said.

Baird, Ross Mayfield

Baird investment strategist Ross Mayfield said the third year of this current bull rally could deliver stronger returns than history suggests because the first two years of the bull delivered underwhelming performance relative to history.

“The first two years of this bull market have been somewhat muted vs. historical standards, so there is ample opportunity for outperformance of the typical year 3 performance,” Mayfield told Business Insider.

Mayfield also echoed Detrick’s sentiment that the average bull market is over five years long, so he thinks “there is plenty of room to run.”

“It would not be surprising if year three of the bull market outperformed the typical year three given the rates backdrop, expected earnings growth, and tepid investor sentiment,” Mayfield said.

US Bank Asset Management, Rob Haworth

Investment strategist Rob Haworth of US Bank Asset Management believes the S&P 500 could surge to 6,480 in its third year of the bull market, representing potential upside of 12%.

Haworth’s bullish view is backed by what really drives stock prices higher: earnings growth.

“The key forward metric for market returns remains the pace of earnings growth,” Haworth told Business Insider. “As we look ahead, we still see a constructive path.”

Haworth expects the S&P 500 to deliver $270 in earnings per share next year, representing about 13% growth from 2024 consensus levels.

“Lower interest rates from the Federal Reserve and soft or no-landing economic scenarios are helping lift growth into next year, supporting further equity market gains,” Haworth said.

Read the original article on Business Insider