Tesla stock sinks as 'toothless' robotaxi disappoints

Tesla (TSLA) stock sank more than 7% Friday midday as investors signaled disappointment over the EV maker’s robotaxi debut.

Following the event on Thursday night, “We, Robot” — which aimed to cement CEO Elon Musk’s position as an AI leader — investors and analysts came away with more skepticism than excitement over Tesla’s lofty vision for a future of driverless cabs.

Jefferies (JEF) analysts called Tesla’s $30,000 robotaxi, dubbed the Cybercab, a “toothless taxi” in a note to investors Friday morning, adding that Tesla has “ambitious targets” with “little evidence of feasibility.”

“We believe TSLA potentially underappreciates the obstacles to scaling a robotaxi fleet,” they wrote.

Tesla’s new Cybercab has no steering wheel or pedals and is designed to be fully autonomous, Yahoo Finance’s Pras Subramanian reported. The company said it will begin unsupervised full self-driving (FSD) trials with Model 3 and Model Y test vehicles next year in Texas and California. Tesla is aiming to begin Cybercab production “before 2027,” Musk said.

Tesla’s stock drop on Friday extended a two-week decline. TSLA shares fell last week after the company missed Wall Street estimates on its third quarter deliveries, issued a recall, and discontinued a lower-priced model. The stock — which has experienced far more volatility over the past year than its Magnificent Seven peers — is down 17% from last year. Still, TSLA’s Friday price of $220 per share is far higher than lows below $140 this spring. Shares hit a 15-month low in April amid Tesla’s layoffs and price cuts.

Investors and analysts had hoped the company’s long-awaited robotaxi event would live up to the hype but were disappointed by Musk’s lack of clarity over how the company would achieve its ambitious goals.

Raymond James (RJF) analyst Josh Beck called Tesla’s plan to commercialize its Cybercabs “vague” and “underwhelming.” Morgan Stanley (MS) analysts said the event included a “disappointing lack of detail” about updates to Tesla’s FSD technology and market strategy.

RBC Capital analyst Tom Narayan concurred, writing in a note Friday that investors believe Musk’s vision “was light of real numbers and timelines.”

“These typically come at Tesla events,” he added. “This one seemed focused on branding and marketing Tesla’s vision, rather than giving concrete numbers for us to model out.”

Additionally, Tesla did not reveal details about a lower-priced vehicle as some investors had hoped. That vehicle is expected to launch in the first half of 2025, analysts noted.

To be sure, some experts on Wall Street think “We, Robot” was a success. Bank of America analysts said the robotaxi event “lived up to the hype.”

Wedbush analyst and Tesla bull Dan Ives said in a note Friday, “We believe last night was a glimpse of the future of Tesla and next generation transportation for consumers.” He also noted the presence of Tesla’s humanoid robot Optimus, which was “well ahead” of Wedbush expectations.

Musk said Optimus could be “[the] biggest product ever of any kind” in terms of commercial success, Bank of America (BAC) analysts noted. The AI tech underlying the robot is the same as that used in Tesla’s vehicles.

“We think this speaks to the fact that at this point TSLA is more than a traditional automotive company,” Bank of America analysts said.

While noting the lack of details on Tesla’s Cybercab rollout, Wedbush’s Ives said, “[W]e strongly disagree with the notion that last night was a disappointment as we would argue the opposite seeing Cybercab with our own eyes and the massive improvements in Optimus which we interacted with throughout the evening.”

Good news for Uber and Lyft

The overall muted reaction to Tesla’s robotaxi launch is a good sign for ride-hailing companies Uber (UBER) and Lyft (LYFT).

“Clearly building and launching a service is the longer-term direction for Tesla but the vagueness around the service (or clarity in not saying it) may reduce fears that UBER and LYFT would have to start defending share as soon as next — which was our primary fear coming in,” RBC’s Narayan said. Uber and Lyft shares both jumped around 10% Friday.

Wall Street has mixed opinions on Tesla stock. Some 26 of Wall Street analysts tracked by Bloomberg recommend buying it, while 20 have a Hold rating and 15 advise investors to sell it. Overall, analysts see shares falling to $216.59 over the next 12 months, according to Bloomberg consensus data.

Laura Bratton is a reporter for Yahoo Finance. Follow her on X @LauraBratton5.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Elon Musk's X Reaches Agreement With Unilever, Drops It From Ad Boycott Lawsuit: 'First Part Of The Ecosystem-Wide Solution'

Elon Musk’s social media platform, X, formerly Twitter, has dropped Unilever Plc. UL from a lawsuit that accused the company of conspiring to boycott the platform, leading to a loss in revenue.

What Happened: On Friday, X dropped its claims against Unilever in the antitrust lawsuit filed in a federal court in Wichita Falls, Texas, in August.

X confirmed the agreement with Unilever and expressed satisfaction to “continue our partnership with them on the platform.”

However, the social media platform did not disclose the terms of the agreement but said that it is the “first part of the ecosystem-wide solution and we look forward to more resolution across the industry.”

Unilever stated that it had “reached an agreement with X, which has committed to meeting our responsibility standards to ensure the safety and performance of our brands on the platform,” reported Reuters.

Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox.

Why It Matters: The lawsuit accused the World Federation of Advertisers and group members, including Unilever, Mars, and CVS Health, of conspiring to withhold “billions of dollars in advertising revenue” from X.

Following Musk’s acquisition of X in October 2022, the platform experienced a slump in ad revenues for several months. Just last month, the platform faced a major advertiser exodus amid concerns over the platform’s content under Musk’s management.

Previously, billionaire entrepreneur Mark Cuban voiced concerns over advertisers not wanting to be associated with explicit content on X.

“When you talk about free speech, free speech applies to advertisers as well. They get to associate with whoever they want to, no matter what. So there are repercussions,” he stated at the time.

Musk’s platform’s value has also significantly dropped since, with Fidelity valuing the social media network below $10 billion now.

Check out more of Benzinga’s Consumer Tech coverage by following this link.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Boeing Reports Preliminary Third Quarter Results

ARLINGTON, Va., Oct. 11, 2024 /PRNewswire/ — The Boeing Company BA announced today it will recognize impacts to its financial results related to charges for certain programs across the Commercial Airplanes and Defense, Space & Security segments and the IAM work stoppage when it reports third quarter results on October 23. The company expects to report third quarter revenue of $17.8 billion, GAAP loss per share of ($9.97), and operating cash flow of ($1.3) billion. Cash and investments in marketable securities totaled $10.5 billion at the end of the quarter.

“While our business is facing near-term challenges, we are making important strategic decisions for our future and have a clear view on the work we must do to restore our company,” said Kelly Ortberg, Boeing president and chief executive officer. “These decisive actions, along with key structural changes to our business, are necessary to remain competitive over the long term. We are also focusing on areas that are critical to our future and will ensure we have the balance sheet necessary to invest, support our people and deliver for our customers.”

Commercial Airplanes expects to recognize pre-tax earnings charges of $3.0 billion on the 777X and 767 programs. The company now anticipates first delivery of the 777-9 in 2026 and the 777-8 freighter in 2028, resulting in a pre-tax earnings charge of $2.6 billion. This schedule and resulting financial impact are based on an updated assessment of the certification timelines to address the delays in flight testing of the 777-9, as well as anticipated delays associated with the IAM work stoppage. Commercial Airplanes also plans to conclude production of the 767 freighter and recognize a $0.4 billion pre-tax charge on the program, which also reflects impacts from the IAM work stoppage. Beginning in 2027, the company will solely produce 767-2C aircraft in support of the KC-46A Tanker program. Commercial Airplanes expects to report third quarter revenue of $7.4 billion and operating margin of (54.0) percent.

Defense, Space & Security expects to recognize pre-tax earnings charges of $2.0 billion on the T-7A, KC-46A, Commercial Crew, and MQ-25 programs. The T-7A program pre-tax charge of $0.9 billion was driven by higher estimated costs on production contracts in 2026 and beyond. The KC-46A program pre-tax charge of $0.7 billion reflects the decision to conclude production on the 767 freighter and impacts of the IAM work stoppage. Results also include unfavorable performance on other programs. Defense, Space & Security expects to report third quarter revenue $5.5 billion and operating margin of (43.1) percent.

Caution Concerning Forward-Looking Statements

The preliminary estimated financial results for the quarter ended September 30, 2024 included in this press release are preliminary, unaudited and subject to completion, and may change as a result of management’s continued review. Such preliminary results are subject to the finalization of quarter-end financial and accounting procedures. The preliminary financial results represent management estimates that constitute forward-looking statements subject to risks and uncertainties. As a result, the preliminary financial results may materially differ from the actual results when they are completed and publicly disclosed. This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “may,” “should,” “expects,” “intends,” “projects,” “plans,” “believes,” “estimates,” “targets,” “anticipates,” and other similar words or expressions, or the negative thereof, generally can be used to help identify these forward-looking statements. Examples of forward-looking statements include statements relating to our future financial condition and operating results, as well as any other statement that does not directly relate to any historical or current fact. Forward-looking statements are based on expectations and assumptions that we believe to be reasonable when made, but that may not prove to be accurate.

Forward-looking statements are not guarantees and are subject to risks, uncertainties, and changes in circumstances that are difficult to predict. Many factors could cause actual results to differ materially and adversely from these forward-looking statements. Among these factors are risks related to: (1) general conditions in the economy and our industry, including those due to regulatory changes; (2) our reliance on our commercial airline customers; (3) the overall health of our aircraft production system, production quality issues, commercial airplane production rates, our ability to successfully develop and certify new aircraft or new derivative aircraft, and the ability of our aircraft to meet stringent performance and reliability standards; (4) our pending acquisition of Spirit AeroSystems Holdings, Inc. (Spirit), including the satisfaction of closing conditions in the expected timeframe or at all, (5) changing budget and appropriation levels and acquisition priorities of the U.S. government, as well as significant delays in U.S. government appropriations; (6) our dependence on our subcontractors and suppliers, as well as the availability of highly skilled labor and raw materials; (7) work stoppages or other labor disruptions; (8) competition within our markets; (9) our non-U.S. operations and sales to non-U.S. customers; (10) changes in accounting estimates; (11) realizing the anticipated benefits of mergers, acquisitions, joint ventures/strategic alliances or divestitures, including anticipated synergies and quality improvements related to our pending acquisition of Spirit; (12) our dependence on U.S. government contracts; (13) our reliance on fixed-price contracts; (14) our reliance on cost-type contracts; (15) contracts that include in-orbit incentive payments; (16) unauthorized access to our, our customers’ and/or our suppliers’ information and systems; (17) potential business disruptions, including threats to physical security or our information technology systems, extreme weather (including effects of climate change) or other acts of nature, and pandemics or other public health crises; (18) potential adverse developments in new or pending litigation and/or government inquiries or investigations; (19) potential environmental liabilities; (20) effects of climate change and legal, regulatory or market responses to such change; (21) credit rating agency actions and changes in our ability to obtain debt financing on commercially reasonable terms, at competitive rates and in sufficient amounts; (22) substantial pension and other postretirement benefit obligations; (23) the adequacy of our insurance coverage; and (24) customer and aircraft concentration in our customer financing portfolio.

Additional information concerning these and other factors can be found in our filings with the Securities and Exchange Commission, including our most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Any forward-looking statement speaks only as of the date on which it is made, and we assume no obligation to update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except as required by law.

Contact: Investor Relations: BoeingInvestorRelations@boeing.com

Communications: media@boeing.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/boeing-reports-preliminary-third-quarter-results-302274318.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/boeing-reports-preliminary-third-quarter-results-302274318.html

SOURCE Boeing

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What the Options Market Tells Us About Roku

High-rolling investors have positioned themselves bullish on Roku ROKU, and it’s important for retail traders to take note.

This activity came to our attention today through Benzinga’s tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in ROKU often signals that someone has privileged information.

Today, Benzinga’s options scanner spotted 11 options trades for Roku. This is not a typical pattern.

The sentiment among these major traders is split, with 81% bullish and 9% bearish. Among all the options we identified, there was one put, amounting to $42,750, and 10 calls, totaling $426,979.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $50.0 to $110.0 for Roku over the last 3 months.

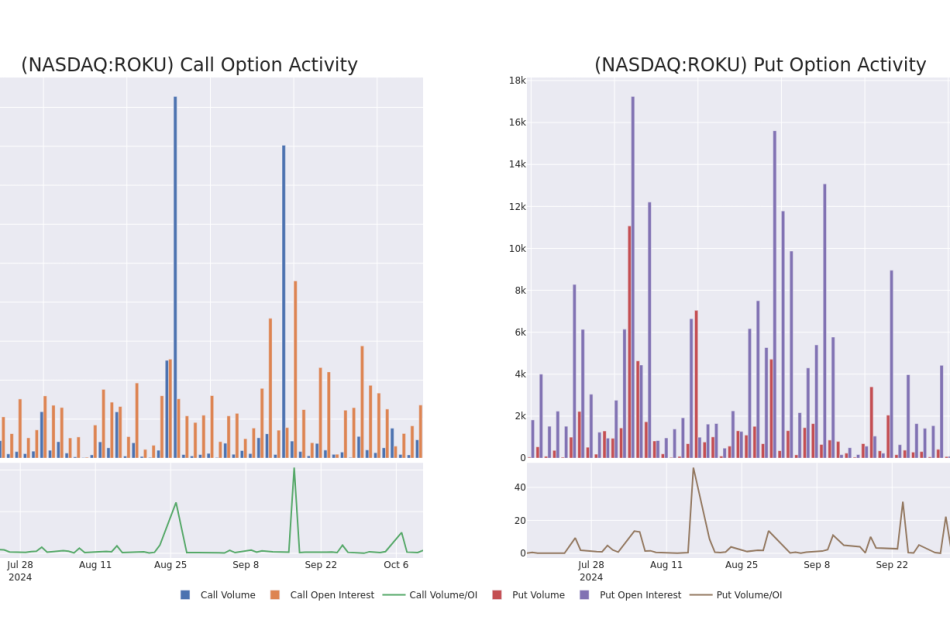

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Roku’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Roku’s whale trades within a strike price range from $50.0 to $110.0 in the last 30 days.

Roku Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ROKU | CALL | SWEEP | BULLISH | 10/25/24 | $2.32 | $2.06 | $2.31 | $80.00 | $70.2K | 513 | 978 |

| ROKU | CALL | SWEEP | BEARISH | 04/17/25 | $3.6 | $3.5 | $3.5 | $110.00 | $69.3K | 6 | 199 |

| ROKU | CALL | TRADE | NEUTRAL | 03/21/25 | $31.35 | $31.0 | $31.2 | $50.00 | $62.4K | 433 | 60 |

| ROKU | CALL | SWEEP | BULLISH | 10/25/24 | $2.28 | $2.2 | $2.21 | $80.00 | $43.5K | 513 | 675 |

| ROKU | CALL | TRADE | BULLISH | 12/20/24 | $9.45 | $9.3 | $9.4 | $75.00 | $43.2K | 1.0K | 83 |

About Roku

Roku enables consumers to stream television programming. It has more than 80 million streaming households and provided well over 100 billion streaming hours in 2023. Roku is the top streaming operating system in the US, reaching more than half of broadband households, according to the company. Roku’s OS is built into streaming devices and televisions that Roku sells and on connected televisions from other manufacturers that license Roku’s name and software. Roku also operates the Roku Channel, a free, ad-supported streaming television platform that offers a mix of on-demand and live television programming. Roku generates revenue primarily from selling devices, licensing, and advertising, and it receives fees from subscription streaming platforms that sell subscriptions through Roku.

Roku’s Current Market Status

- With a trading volume of 2,206,468, the price of ROKU is up by 1.29%, reaching $78.37.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 19 days from now.

What The Experts Say On Roku

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $92.8.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Citigroup continues to hold a Neutral rating for Roku, targeting a price of $77.

* Consistent in their evaluation, an analyst from Macquarie keeps a Outperform rating on Roku with a target price of $90.

* Maintaining their stance, an analyst from JP Morgan continues to hold a Overweight rating for Roku, targeting a price of $92.

* An analyst from Benchmark downgraded its action to Buy with a price target of $105.

* Reflecting concerns, an analyst from Needham lowers its rating to Buy with a new price target of $100.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Roku options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stellantis Unusual Options Activity

Deep-pocketed investors have adopted a bullish approach towards Stellantis STLA, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in STLA usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 9 extraordinary options activities for Stellantis. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 66% leaning bullish and 22% bearish. Among these notable options, 7 are puts, totaling $502,683, and 2 are calls, amounting to $74,300.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $13.0 to $15.0 for Stellantis over the recent three months.

Volume & Open Interest Development

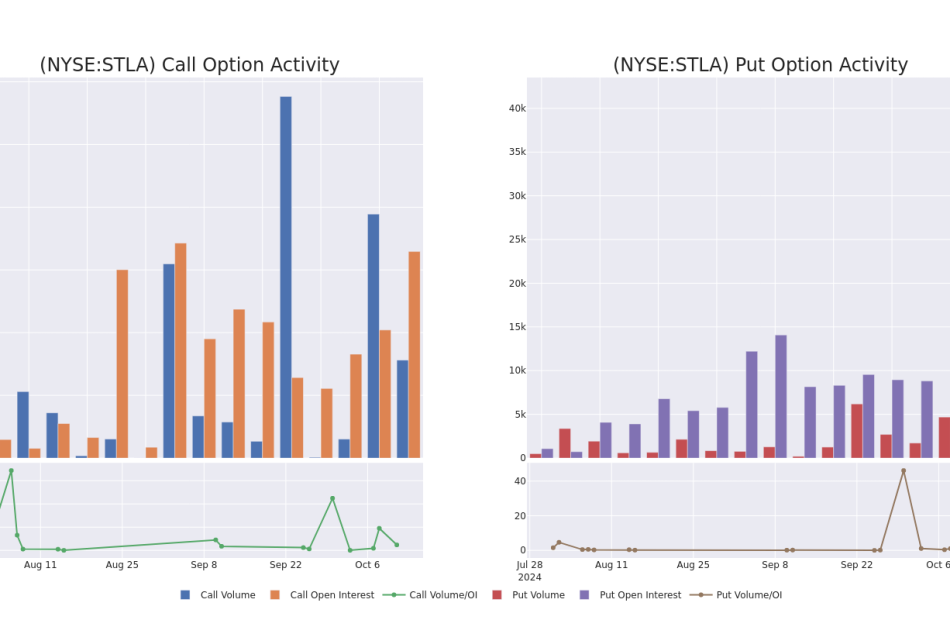

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Stellantis’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Stellantis’s significant trades, within a strike price range of $13.0 to $15.0, over the past month.

Stellantis 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| STLA | PUT | SWEEP | BULLISH | 01/16/26 | $3.0 | $2.85 | $2.9 | $15.00 | $149.6K | 16.1K | 516 |

| STLA | PUT | SWEEP | BULLISH | 01/15/27 | $3.5 | $3.2 | $3.3 | $15.00 | $135.9K | 3.4K | 1.1K |

| STLA | PUT | SWEEP | BEARISH | 06/20/25 | $3.0 | $2.75 | $2.8 | $15.00 | $66.3K | 9.6K | 242 |

| STLA | PUT | SWEEP | NEUTRAL | 01/17/25 | $2.35 | $2.25 | $2.3 | $15.00 | $63.3K | 8.8K | 291 |

| STLA | CALL | SWEEP | BULLISH | 01/17/25 | $0.4 | $0.35 | $0.4 | $15.00 | $40.1K | 2.1K | 1.1K |

About Stellantis

Stellantis was created out of the merger of US-based Fiat Chrysler Automobiles, or FCA, and French-based Peugeot, or PSA, in January 2021, resulting in the fourth-largest automotive original equipment manufacturer, or OEM, by vehicle sales. In 2023 it sold 6.4 million vehicles, 44% and 30% in Europe and North America, respectively. North America is the most profitable region, contributing 53% of operating income. Its brands include Fiat, Jeep, Chrysler, Ram, Peugeot, Citroen, Opel, Alfa Romeo, and Maserati.

After a thorough review of the options trading surrounding Stellantis, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Stellantis

- With a trading volume of 14,626,356, the price of STLA is down by -2.26%, reaching $13.0.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 125 days from now.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Stellantis, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

2 Incredibly Cheap Big Pharma Stocks to Buy Now

If you want to get a good value when you invest in big pharma, it’s necessary to take a look at quality companies that are going through a rough patch. Given the long product development times in the industry, with most drugs taking seven years or more to launch after entering clinical trials, periods of uncertainty can potentially last a good while.

But good things tend to come to those who can wait. With that in mind, let’s examine two pharma stocks that are incredibly cheap and which are worth buying right now, assuming you are willing to patiently let their long-term strategic plans unfold over the coming years.

1. Pfizer

Pfizer (NYSE: PFE) is a pharmaceutical stock that needs no introduction — or perhaps it’s more accurate to say that it needed no introduction during its recent heyday of selling coronavirus vaccines and antivirals, which is over.

In 2022, it brought in more than $100 billion in revenue from sales of those anti-coronavirus medicines. Today, Pfizer looks like it’s struggling, even though its extensive pipeline with 33 late-stage clinical programs, recent major acquisitions, and ambitious plans for expanding through 2030 are potentially powerful drivers of its future growth. Total returns from its stock has fallen 20% over the last three years. Last year, it marked a couple of quarters where it reported operating losses instead of profits, while its trailing-12-month revenue fell to $55 billion.

There are a couple of valuation factors supporting the idea that Pfizer’s stock is undervalued, starting with its price-to-sales (P/S) ratio of 3. Its price-to-free-cash-flow (P/FCF) ratio is 34, which compares favorably to other big pharma players like Novo Nordisk that are starting to look a little bit frothy, with P/FCF multiples near 55.

Brighter days are ahead for Pfizer, which supports the idea of buying its stock at its current valuation.

It’s implementing a manufacturing cost reduction campaign to save as much as $1.5 billion in expenses by the start of 2028, on top of another initiative aiming to reduce expenses by $4 billion by the end of this year. Management is signaling that in the near future, it’ll be hitting the gas on both reinvestment in internal research and development (R&D) activities as well as returning capital to shareholders.

And that’ll likely occur around the same time as its newly acquired oncology drug business is launching and starting to drive growth, which could be a potent cocktail for the value of its stock to say the least.

2. Merck

Much like Pfizer, Merck (NYSE: MRK) has had a couple of unprofitable quarters on an operational basis recently, though it also has more than 30 programs in phase 3 clinical trials, at least some of which will yield it more revenue over the next few years.

More importantly than its recent hiccups, however, is the looming patent expiry of its blockbuster cancer drug, Keytruda, which lapses in 2028. Sales of Keytruda brought in more than $7 billion out of the pharma’s total haul of around $16 billion in the second quarter, so it’s a major pillar supporting the top line. While there are a handful of programs pertaining to expanding the approved indications of the drug, which will likely keep earnings growing for a long time to come, the uncertainty of how Merck will continue to grow rather than merely tread water after generics steal its market share with Keytruda is doubtlessly a factor keeping its valuation down.

Merck’s P/S multiple is roughly 4, and its P/FCF is 21. That makes its valuation a bit pricier than Pfizer’s per dollar of revenue, but significantly cheaper per dollar of free cash flow. In other words, it’s cheap, but not so cheap that you’d find it neglected in the bargain bin.

Investment in R&D continues to be the top priority for the company’s capital allocation, followed by capital expenditure and dividends paid. Share repurchases are the very bottom of the priority list, which could be an ancillary reason why many investors are avoiding the stock despite its low valuation, Still, it doesn’t make sense for investors to bet against the ongoing output of Merck’s pipeline when management is explicitly saying that its dollars are going to keep going toward accelerating its R&D activity rather than curtailing it.

The only reason I think why the market’s been playing safe is because there isn’t yet a clear, long-term revenue stream that will replace Keytruda. However, with a solid investment in R&D, I also think Merck is perfectly capable of eventually bringing multiple drug candidates to the market that can not just replace its existing portfolio of medicines, but will far exceed expectations.

The business is also spending big to acquire promising programs from biotechs. On Oct. 1, it closed a deal worth $750 million to buy an early clinical-stage asset that could treat both relapsed or refractory non-Hodgkin’s lymphoma (NHL), as well as relapsed or refractory B-cell acute lymphocytic leukemia (ALL). And with over $11 billion in cash, equivalents, and short-term investments on hand, it has plenty of dry powder to hunt for promising growth opportunities.

So take advantage of this stock’s pricing while it’s cheap, because it probably won’t be this inexpensive for much longer.

Should you invest $1,000 in Pfizer right now?

Before you buy stock in Pfizer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Pfizer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

Alex Carchidi has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Merck and Pfizer. The Motley Fool recommends Novo Nordisk. The Motley Fool has a disclosure policy.

2 Incredibly Cheap Big Pharma Stocks to Buy Now was originally published by The Motley Fool

Carnival Has Analysts Going Wild: Here's Why

On a day when the benchmark S&P 500 index hit a record high, Carnival Corporation‘s CCL popping 7% to its highest level in more than 2 years says a lot. As one of the hardest hit industries during the COVID pandemic, cruise lines have been closely watched in recent years to see if they can get back to pre-pandemic levels.

So far, though they’ve managed some solid runs, this has proved an elusive goal, but there’s an argument to be made that some cruise stocks, and Carnival in particular, have never looked more likely to do it. Let’s jump in and take a look at some of the reasons behind this.

Strong Fundamental Performance

For starters, there’s the company’s most recent earnings report, which came out just two weeks ago. Off the bat, Carnival absolutely crushed it. The company’s top-line revenue figure was up more than 15% on the year and well ahead of expectations. It was one of their highest quarterly revenue prints ever and keeps the company on track to close out the year with its highest-ever turnover.

Carnival’s bottom line EPS also came in hot and was 10% higher than the consensus, which helped drive operating income to a record $2.2 billion. For context, this was a 34% gain on the same quarter last year, a jump investors would be more used to seeing with some of the big-name tech titans.

But this is exactly what makes the report so impressive and Carnival’s prospects so bullish. As CEO Josh Weinstein summed up, “We are poised to deliver record operating performance for the full year 2024, with adjusted EBITDA now expected to cross $6 billion.” In addition, consistent and impressive demand enabled management to boost their full-year yield guidance for the third time in 2024. Meanwhile, Weinstein remains exceedingly bullish on Carnival’s abilities to drive this momentum through 2025 and, indeed, into 2026.

Bullish Price Action

Carnival shares had rallied close to 40% heading into the report’s release, and the fact they actually sold off a little into the start of October suggests some investors were happy to take some profits off the table. But understandably, given the strength of the report, this lasted only a handful of days before the dip was snapped up, and Carnival shares haven’t looked back since.

The past week alone has seen them jump close to 20%, putting them at their highest level since April 2022 and a full 220% from their post-pandemic lows. And what is the best news for those of our readers considering a position? There are plenty of more gains to come.

This is according to several of the heavyweight analysts, many of whom, in the past week, have been calling for further gains in the region of 40%, from where Carnival shares closed on Wednesday. Take Mizuho, Barclays, or Macquarie, for example. All 3 have reiterated their Buy rating on Carnival shares this month alone and boosted price targets of $26. There are also the updates from the teams at Tigress Financial and Citigroup, who were taking a similar stance earlier this week, although this time with price targets of $28.

Getting Involved

Considering Carnival shares closed out last night’s session around the $20 mark, that’s pointing to a targeted upside of at least 40% from current levels. If Carnival made its way up towards that level in the coming weeks, it would put them within touching distance of their post-pandemic high around the $31 mark.

While it’s true they were turned back from that level quite easily before and didn’t manage to test it again, the stock’s technical structure is, this time, a lot more attractive. Carnival shares have been setting higher lows for the past 2 years and, with this week’s pop, have just broken through what was a major area of resistance at $20. Based on both their fundamental performance and the bullish outlook from the analysts, it’s hard not to see them continue cruising north from here.

The article “Carnival Has Analysts Going Wild: Here’s Why” first appeared on MarketBeat.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Analysis-China's stimulus message leaves investors wanting though hanging onto hope

By Samuel Shen, Ankur Banerjee and Tom Westbrook

SHANGHAI/SINGAPORE (Reuters) – China’s highly anticipated announcement of financial stimulus plans on Saturday was big on intent but low on the measurable details that investors need to ratify their recent return to the world’s second-biggest stock market.

Saturday’s news conference by Finance Minister Lan Foan reiterated Beijing’s broad plans to revive the ailing economy, with promises made on significant increases to government debt and support for consumers and the property sector.

But for investors who were hoping to hear authorities spell out exactly how much the government will throw at the crisis, the briefing was disappointing.

“The strength of the announced fiscal stimulus plan is weaker than expected. There’s no timetable, no amount, no details of how the money will be spent,” said Huang Yan, investment manager at private fund company Shanghai QiuYang Capital Co in Shanghai.

Huang had hoped for more stimulus to boost consumption. Market analysts had been looking for a spending package between 2 trillion yuan to 10 trillion yuan ($283 billion to $1.4 trillion).

Reuters reported last month that China plans to issue special sovereign bonds worth about 2 trillion yuan this year as part of fresh fiscal stimulus. Bloomberg News reported China is considering the injection up to 1 trillion yuan of capital into its biggest state banks. Lan’s press conference did not give any specifics.

In the three weeks since the People’s Bank of China (PBOC) kicked off China’s most aggressive stimulus measures since the pandemic, the CSI300 Index has broken records for daily moves and is up 16% overall. Stocks have grown wobbly in recent sessions, though, as initial enthusiasm gave way to concerns about whether the policy support would be big enough to revive growth.

“If that’s what we have in terms of fiscal policies, the stock market bull run could run out of steam,” Huang said, referring to comments at Saturday’s press conference.

Heading into the briefing, some investors had braced for the finance minister to withhold actual spending details until China’s rubber-stamp parliament meets later this month.

Equally, investors also worried that mere interest rate cuts, which the PBOC has already announced, and a reluctance by the central government to spend will imperil the odds the world’s second-largest economy can hit its 5% growth target.

“Investors will need to be patient,” said HSBC’s chief Asia economist Fred Neumann, noting concrete numbers could come only by the end of this month when the standing committee of the National People’s Congress reviews and votes on specific proposals.

Jason Bedford, former China analyst at Bridgewater and UBS, pointed to Lan’s pledge to recapitalise big state banks as indicating authorities expect to see a revival in demand for credit.

“But the only way the economy needs more credit is if you create credit demand which can only be done if you provide fiscal (support).”

HOW MUCH?

Investors have good reason to be circumspect about how much Beijing will spend. The slump in consumer confidence and the property sector is a by-product of the years-long drive by the Communist Party leadership to reduce debt and root out corruption.

Yet, the hope that authorities are serious to fix those issues has driven foreign investors and domestic retail money into stocks. The PBOC’s 500-billion-yuan swap facility to channel more cash into the stock market has helped.

The Shanghai Composite index is up 12% since the measures were first announced on Sept. 24, but property and tourism stocks are still dragging in a sign of some doubts around the extent of state support.

Global commodity markets from iron ore to other industrial metals and oil have also been volatile on hopes stimulus will stoke its sluggish demand.

“Potentially some event money might be disappointed and remove some bets on the headline numbers not meeting high expectations but the more important capital flows might be encouraged by continuing efforts to stabilise the economy and keep growth at appropriate levels,” said Matthew Haupt, portfolio manager at Wilson Asset Management in Sydney.

According to LSEG Lipper data, overseas China funds received a net $13.91 billion since Sept. 24, pumping up inflows so far in 2024 to $54.34 billion. Much of that money has gone into exchange-traded funds (ETFs), while mutual funds are still reporting net outflows of $11.77 billion for the year.

Bedford is hopeful of a revival in retail interest sustaining the stock market rally.

“We have a perfect storm of four factors at play,” he said, citing pent-up household savings and a lack of attractive alternatives to the stock market, an alignment of corporate and shareholder interests driving up buybacks and dividends, and central bank programmes offering leverage to corporates and institutions to invest in the stock market.

“A sustained rally driven by the China household has the foundations for success … we are early in this process and the risk is the possibility of flawed execution or not communicating things well. The structural story remains compelling though.”

($1 = 7.0666 Chinese yuan renminbi)

(Reporting by Ankur Banerjee, Tom Westbrook in Singapore, Samuel Shen in Shanghai, Gaurav Dogra in Bengaluru; Writing by Vidya Ranganathan; Editing by Kim Coghill)