Wall Street Analysts Think IonQ Is a Good Investment: Is It?

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock’s price, do they really matter?

Let’s take a look at what these Wall Street heavyweights have to say about IonQ, Inc. IONQ before we discuss the reliability of brokerage recommendations and how to use them to your advantage.

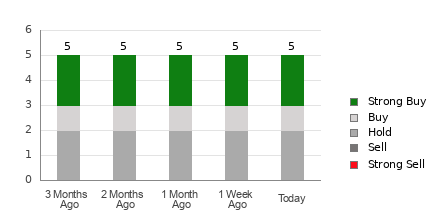

IonQ currently has an average brokerage recommendation of 2.00, on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell, etc.) made by five brokerage firms. An ABR of 2.00 indicates Buy.

Of the five recommendations that derive the current ABR, two are Strong Buy and one is Buy. Strong Buy and Buy respectively account for 40% and 20% of all recommendations.

Brokerage Recommendation Trends for IONQ

The ABR suggests buying IonQ, but making an investment decision solely on the basis of this information might not be a good idea. According to several studies, brokerage recommendations have little to no success guiding investors to choose stocks with the most potential for price appreciation.

Are you wondering why? The vested interest of brokerage firms in a stock they cover often results in a strong positive bias of their analysts in rating it. Our research shows that for every “Strong Sell” recommendation, brokerage firms assign five “Strong Buy” recommendations.

In other words, their interests aren’t always aligned with retail investors, rarely indicating where the price of a stock could actually be heading. Therefore, the best use of this information could be validating your own research or an indicator that has proven to be highly successful in predicting a stock’s price movement.

Zacks Rank, our proprietary stock rating tool with an impressive externally audited track record, categorizes stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), and is an effective indicator of a stock’s price performance in the near future. Therefore, using the ABR to validate the Zacks Rank could be an efficient way of making a profitable investment decision.

Zacks Rank Should Not Be Confused With ABR

Although both Zacks Rank and ABR are displayed in a range of 1-5, they are different measures altogether.

Broker recommendations are the sole basis for calculating the ABR, which is typically displayed in decimals (such as 1.28). The Zacks Rank, on the other hand, is a quantitative model designed to harness the power of earnings estimate revisions. It is displayed in whole numbers — 1 to 5.

Analysts employed by brokerage firms have been and continue to be overly optimistic with their recommendations. Since the ratings issued by these analysts are more favorable than their research would support because of the vested interest of their employers, they mislead investors far more often than they guide.

In contrast, the Zacks Rank is driven by earnings estimate revisions. And near-term stock price movements are strongly correlated with trends in earnings estimate revisions, according to empirical research.

In addition, the different Zacks Rank grades are applied proportionately to all stocks for which brokerage analysts provide current-year earnings estimates. In other words, this tool always maintains a balance among its five ranks.

There is also a key difference between the ABR and Zacks Rank when it comes to freshness. When you look at the ABR, it may not be up-to-date. Nonetheless, since brokerage analysts constantly revise their earnings estimates to reflect changing business trends, and their actions get reflected in the Zacks Rank quickly enough, it is always timely in predicting future stock prices.

Should You Invest in IONQ?

Looking at the earnings estimate revisions for IonQ, the Zacks Consensus Estimate for the current year has remained unchanged over the past month at -$0.84.

Analysts’ steady views regarding the company’s earnings prospects, as indicated by an unchanged consensus estimate, could be a legitimate reason for the stock to perform in line with the broader market in the near term.

The size of the recent change in the consensus estimate, along with three other factors related to earnings estimates, has resulted in a Zacks Rank #3 (Hold) for IonQ.

It may therefore be prudent to be a little cautious with the Buy-equivalent ABR for IonQ.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

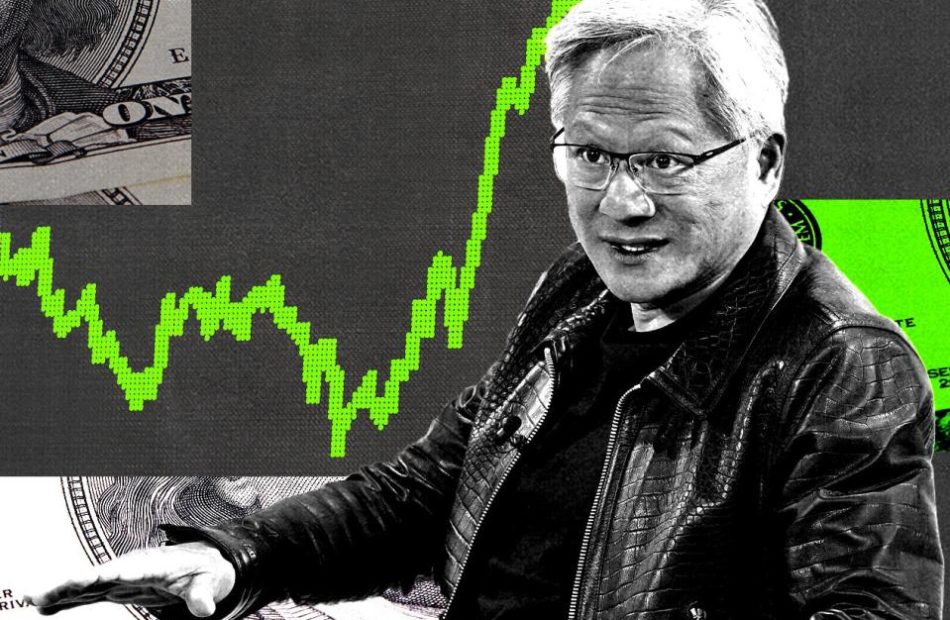

Morgan Stanley recently met with Nvidia's management team. Here are the biggest takeaways as the bank eyes another 12% upside for the stock.

-

Nvidia stock is set for more gains as demand for its GPU chips surges, Morgan Stanley says.

-

Nvidia’s Blackwell GPU is on schedule and is sold out for the next 12 months, the company said.

-

Inference computing growth boosts the long-term demand potential for Nvidia’s AI GPU chips.

Nvidia stock is poised for more gains as its GPU chip business continues to see surging demand.

That’s according to Morgan Stanley, which hosted meetings with Nvidia CEO Jensen Huang, CFO Colette Kress, and other members of the chip maker’s management team for three days in New York City this week.

The key takeaway is that “every indication from management is that we are still early in a long term AI investment cycle,” Morgan Stanley analyst Joseph Moore said.

The bank reiterated its “Overweight” and “Top Pick” ratings and $150 price target, representing potential upside of 12% from current levels.

Moore said Nvidia’s production ramp of its next-generation Blackwell GPU chip is “progressing on schedule,” adding that the product is sold out for the next 12 months.

“Any new Blackwell orders now that aren’t already in queue will be shipped late next year, as they are booked out 12 months, which continues to drive strong short term demand for Hopper which will still be a major factor through the year,” Moore explained.

Hopper is Nvidia’s previous generation of AI-enabled GPU chips, which are being sold in clusters to cloud “hyperscalers” like Amazon, Microsoft, and Meta Platforms.

And Nvidia has a new “element” to its story, according to Moore, which is the view that inference computing “is starting to solve much more complex problems which will require a much richer mix of hardware.”

That should be a boon for Nvidia’s GPU chip product set, according to the note.

“The longer term vision is that deep thinking will allow every company in the world to hire large numbers of “digital AI employees” that can execute challenging tasks,” Moore said.

He added: “The notion that a more thoughtful, task oriented inference would cause an exponential jump in inference complexity strikes us an important new avenue for growth, and another clear area where NVIDIA’s full stack approach to solving these problems adds to the company’s considerable lead.”

Nvidia CEO Jensen Huang made it clear to Morgan Stanley that the company expects to see meaningful growth in 2025 that spills over into 2026, “though he did not quantify,” Moore said.

Nvidia’s shares have increased since the start of October, rising about 10%. Nvidia stock is up 172% since the start of this year.

Read the original article on Business Insider

Why Chinese stocks will climb another 50% from current levels, research CEO says

-

Chinese stocks are poised for a huge run-up in the next year, according to Renaissance Macro’s Jeff deGraaf.

-

The research firm CEO said perfect conditions are aligning for additional gains exceeding 50%.

-

Other notable investors have been looking to buy the dip in Chinese stocks amid continued stimulus efforts.

China’s stock rally isn’t over — and the nation could have the perfect cocktail of ingredients to stage a monster run-up over the next year, according to one Wall Street forecaster.

Jeff deGraaf, the CEO of Renaissance Macro Research, says he sees China’s benchmark stock index climbing to 6,000 over the next year. That implies a 54% increase from the CSI 300’s current levels, thanks to the right mix of conditions in Beijing that should power equities higher, he told Bloomberg on Friday.

“Skepticism, valuation, stimulus, momentum and a trend change,” deGraaf said of China’s investing environment, adding that it was “one of the best set-ups” he’s seen over his 35-year career.

Chinese stocks have been on a roller coaster in recent weeks after Beijing announced its latest monetary stimulus package, which included lowering interest rates and pumping the stock market with $114 billion. The package sparked the steepest rally in Chinese stocks since 2008 before it quickly fizzled, a sign investors were disappointed Beijing didn’t announce more stimulus measures.

Markets, though, are expecting the nation to announce a fresh fiscal stimulus package at a briefing on Saturday, potentially reviving the bull case for stocks. Most investors expect China to add 2 trillion yuan, or $283 billion, in fiscal stimulus through 2025, according to a Bloomberg poll of market participants.

“We see the policy response as self-preservation, a reaction to the weakness and a potential Mario Draghi-esque ‘Do what it takes’ moment for China,” deGraaf said, later urging investors to “keep stops in place” when betting on Chinese stocks.

Other traders on Wall Street have shown interest in buying the dip in Chinese equities, despite fear that Beijing’s economic slowdown could stick around.

Investors poured a record $39.1 billion into Chinese stock funds in the week ending October 9, according to EPFR Global data cited by Bank of America in a note.

“We buy any China dips,” BofA strategist Michael Hartnett wrote in a note. Stimulus efforts will continue to “be used aggressively to boost domestic animal spirits and demand,” he added.

Additionally, the Shenzhen Huaan Hexin Private Investment Fund Management Co., a Chinese hedge fund up 800% since 2017, also says it’s buying the dip in technology stocks listed in Hong Kong. The Hang Seng Index has dropped 3% over the last five trading days, but is still up 27% from levels at the start of the year.

“Such a correction is more like a buying opportunity,” Yuan Wei, the fund’s founder, said in an interview with Bloomberg this week. “If you compare to their fundamentals, the stocks remain very cheap.”

China’s onshore market has a 50% chance of starting a new bull run, as opposed to a short-term bounce, and the bear market in equities should be over by now, Yuan said.

“The market is just rebounding from an extremely bearish level to a level that’s still undervalued,” he later added.

Other strategists on Wall Street have made bullish calls on Chinese equities in recent weeks, with eyes on continued stimulus measures in Beijing. Goldman Sachs predicted China’s stock market could rally another 20%, thanks to “more substantial policy measures” and Chinese stocks being oversold, strategists said in a note.

Read the original article on Business Insider

WM Technology, Inc. Announcement: If You Have Suffered Losses in WM Technology, Inc. (NASDAQ: MAPS), You Are Encouraged to Contact The Rosen Law Firm About Your Rights

NEW YORK, Oct. 11, 2024 (GLOBE NEWSWIRE) —

Why: Rosen Law Firm, a global investor rights law firm, continues to investigate potential securities claims on behalf of shareholders of WM Technology, Inc. MAPS resulting from allegations that WM Technology may have issued materially misleading business information to the investing public.

So What: If you purchased WM Technology securities you may be entitled to compensation without payment of any out of pocket fees or costs through a contingency fee arrangement. The Rosen Law Firm is preparing a class action seeking recovery of investor losses.

What to do next: To join the prospective class action, go to https://rosenlegal.com/submit-form/?case_id=29177 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action.

What is this about: On September 25, 2024, the U.S. Securities and Exchange Commission (the “SEC”) issued a litigation release in which it announced it had “charged public company WM Technology, Inc. MAPS, its former CEO, Christopher Beals, and its former CFO, Arden Lee, for making negligent misrepresentations in WM Technology’s public reporting of a self-described key operating metric, the “monthly active users,” or “MAU,” for WM Technology’s online cannabis marketplace.” The same announcement noted the SEC had “also instituted a related settled administrative proceeding against WM Technology” and “WM Technology also agreed to pay a civil penalty of $1,500,000.”

On this news, WM Technology’s stock fell 1.9% on September 25, 2024.

Why Rosen Law: We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience, resources, or any meaningful peer recognition. Many of these firms do not actually litigate securities class actions. Be wise in selecting counsel. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm has achieved the largest ever securities class action settlement against a Chinese Company. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 4 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020, founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

Follow us for updates on LinkedIn: https://www.linkedin.com/company/the-rosen-law-firm, on Twitter: https://twitter.com/rosen_firm or on Facebook: https://www.facebook.com/rosenlawfirm/.

Attorney Advertising. Prior results do not guarantee a similar outcome.

Contact Information:

Laurence Rosen, Esq.

Phillip Kim, Esq.

The Rosen Law Firm, P.A.

275 Madison Avenue, 40th Floor

New York, NY 10016

Tel: (212) 686-1060

Toll Free: (866) 767-3653

Fax: (212) 202-3827

case@rosenlegal.com

www.rosenlegal.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

CBH Homes Promotes Women in Construction at the House that She Built Event.

Boise, Idaho, Oct. 11, 2024 (GLOBE NEWSWIRE) — CBH Homes, Idaho’s leading home builder, is thrilled to announce the return of “The House That She Built” event and in 2024 is launching a new addition to make it even better. Last year, CBH Homes hosted 300 Girl Scouts and quickly realized the need to open it to the entire community was apparent.

“We were awestruck last year. The turnout of Girl Scouts blew us away and inspired us to open it up to all girls in the community,” said Ronda Conger, Vice President of CBH Homes. “We’re passionate about showing girls that construction is a rewarding and promising career.”

Inspired by the children’s book “The House That She Built” by Mollie Elkman, this interactive event empowers young girls to explore the exciting world of construction. The book, based on a true story of an all-women built house in Utah, highlights the diverse skills and people involved in building a home.

This year’s main event, open for all girls, will be held on Thursday, October 12th, from 2:00 PM to 4:00 PM at CBH Homes’ newest community, Spring Shores in Nampa, Idaho.

With a workforce comprised of 70% women, CBH Homes is committed to fostering a more inclusive construction industry. “The House That She Built” event provides a unique platform for girls to:

- Engage in hands-on activities: Girls will participate in a mini construction project, providing a tangible experience of the building process.

- Connect with industry role models: Meet and learn from successful women in various construction roles, gaining valuable insights and inspiration.

- Tour a CBH Home community: Explore a real-world construction site and witness different stages of the home building process.

- Enjoy fun giveaways: Receive exciting takeaways, making the experience even more memorable.

Event Details:

The House That She Built With CBH Homes

Date: Saturday, October 12th, 2024

Time: 2:00 PM – 4:00 PM

Location: Spring Shores by CBH Homes Community – 7514 E Shields Dr, Nampa, ID

Price: FREE

Spaces are limited! Sign up for this exciting event by clicking here.

About The House That She Built: A children’s book inspired by a true story written by Mollie Elkman. The mission of The House That She Built is to support workforce development initiatives in the construction industry by generating awareness of the skilled trades to the largest underrepresented community. The movement has grown to Girl Scout Patch Program, Events, and now a non-profit organization shebuilt.org.

About CBH Homes: CBH Homes has been building new homes for sale in Idaho for over 32 years, and for 19 of those, CBH Homes has been Idaho’s #1 Builder, a Best Places to Work in Idaho, ranked #42 in the nation, and proudly working with over 26,000 happy homeowners. Start shopping today, click here! Cbhhomes.com RCE-923

CeCe Cheney CBH Homes 208.288.5560 cecec@cbhhomes.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Jefferies Financial Gr President Trades $12.62M In Company Stock

Revealing a significant insider sell on October 11, BRIAN FRIEDMAN, President at Jefferies Financial Gr JEF, as per the latest SEC filing.

What Happened: FRIEDMAN’s recent Form 4 filing with the U.S. Securities and Exchange Commission on Friday unveiled the sale of 200,000 shares of Jefferies Financial Gr. The total transaction value is $12,618,060.

As of Friday morning, Jefferies Financial Gr shares are up by 0.1%, currently priced at $63.16.

About Jefferies Financial Gr

Jefferies Financial Group Inc is a diversified financial services company. It has two reportable segments; Investment Banking and Capital Markets which is also the majority revenue generating segment, includes securities, commodities, corporate lending, futures and foreign exchange capital markets activities and its investment banking business, which provides underwriting and financial advisory services to clients across different sectors. The Asset Management reportable business segment provides alternative investment management services to investors in the U.S. and overseas and generates investment income from capital invested in and managed by it or its affiliated asset managers.

Financial Milestones: Jefferies Financial Gr’s Journey

Revenue Growth: Jefferies Financial Gr displayed positive results in 3 months. As of 31 August, 2024, the company achieved a solid revenue growth rate of approximately 27.18%. This indicates a notable increase in the company’s top-line earnings. When compared to others in the Financials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Profitability Metrics:

-

Gross Margin: The company maintains a high gross margin of 60.41%, indicating strong cost management and profitability compared to its peers.

-

Earnings per Share (EPS): With an EPS below industry norms, Jefferies Financial Gr exhibits below-average bottom-line performance with a current EPS of 0.78.

Debt Management: Jefferies Financial Gr’s debt-to-equity ratio is below the industry average at 2.14, reflecting a lower dependency on debt financing and a more conservative financial approach.

Valuation Metrics:

-

Price to Earnings (P/E) Ratio: Jefferies Financial Gr’s P/E ratio of 26.97 is below the industry average, suggesting the stock may be undervalued.

-

Price to Sales (P/S) Ratio: With a P/S ratio of 1.47 below industry standards, the stock shows potential undervaluation, making it an appealing investment option for those focusing on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an EV/EBITDA ratio lower than industry averages at 5.53, Jefferies Financial Gr could be considered undervalued.

Market Capitalization Analysis: Above industry benchmarks, the company’s market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Navigating the Impact of Insider Transactions on Investments

Insider transactions, although significant, should be considered within the larger context of market analysis and trends.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Transaction Codes To Focus On

Surveying the realm of stock transactions, investors often give prominence to those unfolding in the open market, systematically detailed in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Jefferies Financial Gr’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Christ Revocable Trust Implements A Sell Strategy: Offloads $4.78M In Altair Engineering Stock

Revealing a significant insider sell on October 10, Christ Revocable Trust, 10% Owner at Altair Engineering ALTR, as per the latest SEC filing.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Thursday showed that Trust sold 49,952 shares of Altair Engineering. The total transaction amounted to $4,781,645.

In the Friday’s morning session, Altair Engineering‘s shares are currently trading at $96.0, experiencing a up of 1.06%.

All You Need to Know About Altair Engineering

Altair Engineering Inc is a provider of enterprise-class engineering software enabling origination of the entire product lifecycle from concept design to in-service operation. The integrated suite of software provided by the company optimizes design performance across multiple disciplines encompassing structures, motion, fluids, thermal management, system modeling, and embedded systems. It operates through two segments: Software which includes the portfolio of software products such as solvers and optimization technology products, modeling and visualization tools, industrial and concept design tools, and others; and Client Engineering Services which provides client engineering services to support customers. Majority of its revenue comes from the software segment.

Altair Engineering’s Economic Impact: An Analysis

Positive Revenue Trend: Examining Altair Engineering’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 5.41% as of 30 June, 2024, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Information Technology sector.

Key Profitability Indicators:

-

Gross Margin: The company sets a benchmark with a high gross margin of 79.49%, reflecting superior cost management and profitability compared to its peers.

-

Earnings per Share (EPS): Altair Engineering’s EPS lags behind the industry average, indicating concerns and potential challenges with a current EPS of -0.06.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.33.

Exploring Valuation Metrics Landscape:

-

Price to Earnings (P/E) Ratio: With a higher-than-average P/E ratio of 296.97, Altair Engineering’s stock is perceived as being overvalued in the market.

-

Price to Sales (P/S) Ratio: With a relatively high Price to Sales ratio of 12.76 as compared to the industry average, the stock might be considered overvalued based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): At 95.42, the company’s EV/EBITDA ratio outperforms industry norms, reflecting positive market perception. This positioning indicates optimistic expectations for the company’s future performance.

Market Capitalization Perspectives: The company’s market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Illuminating the Importance of Insider Transactions

Insider transactions contribute to decision-making but should be supplemented by a comprehensive investment analysis.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Important Transaction Codes

Surveying the realm of stock transactions, investors often give prominence to those unfolding in the open market, systematically detailed in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Altair Engineering’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Warren Buffett and Cathie Wood Agree: This Growth Stock Is a Buy

Warren Buffett and Cathie Wood typically don’t agree on much when it comes to assembling a portfolio. Only rarely have they owned the same company.

But there’s one growth stock that both of these investors love — Latin American fintech Nu Holdings (NYSE: NU) — so much so that they have invested nearly $1.5 billion combined into the business. And yet many investors have never heard of this company.

You can use this ignorance to your advantage by snapping up shares at an incredible discount.

This growth stock is a proven winner

It’s not often that you can buy a proven growth stock at a reasonable valuation, nonetheless a discounted valuation. That’s because once a growth trajectory has begun, the market rushes to price that proven potential into the stock.

This is, in part, what makes growth investing so challenging. You can buy and hold a stock that grows revenue by 500% over your holding period. But if the market had been pricing in 600% growth, you could still end up underperforming the market.

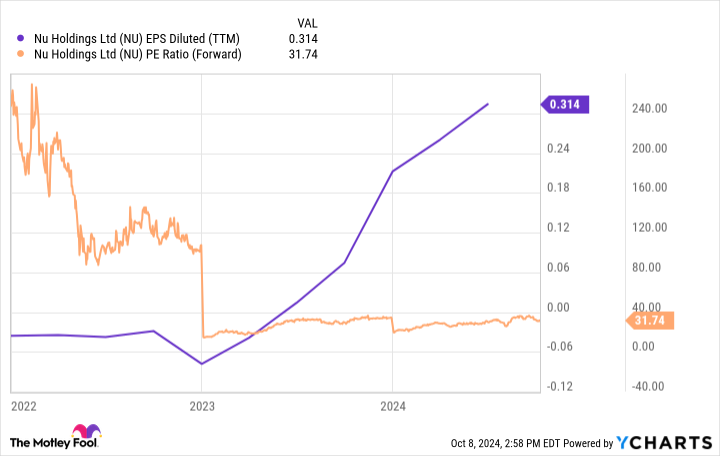

How do you get a discount on a proven growth stock? Just look at one that the market is ignoring — like Nu Holdings. And that might be the reason shares trade at just 32 times forward earnings, even though its bottom line has skyrocketed in recent years.

The issue for Nu isn’t a lack of famous investors. Buffett owns a bit more than $1.4 billion in shares through his holding company, Berkshire Hathaway — a position it has held since Nu’s initial public offering (IPO) in 2021. And through her company ARK Invest, Cathie Wood owns around 1.5 million shares of Nu, worth roughly $20 million.

The issue isn’t scale, either. Right now, Nu has more than 100 million customers. The issue is simply that Nu operates in just three countries: Brazil, Mexico, and Colombia. Unless you live in one of these nations, you likely have never heard of Nu — and certainly have never used its services.

What exactly is Nu’s business? It’s a fintech that offers a suite of financial services directly to customers through their smartphones. This might not sound so innovative today, but it was in Latin America in 2013.

Back then, a few stodgy incumbents controlled most of Latin America’s banking industry. Nu took the market by storm, offering more advanced services at a lower cost, available to anyone instantly through the device in their pocket.

There was clearly a lot of pent-up demand. Nu’s customer base went from essentially zero to more than 100 million over its first decade in business. And new product lines like its crypto trading platform surpassed 1 million users in its first month of operation.

Suffice it to say that the financials look great for Nu. Two years ago, its sales base had just surpassed $2 billion. Today, it’s approaching $8 billion. Meanwhile, earnings have flipped positive — a trajectory that is likely to be sustained for years to come. Over the next five years, for example, analysts expect earnings to grow at an average of 54% annually.

Should you follow Wood and Buffett into Nu stock?

Nu has an incredible story, a proven track record, and a reputable platform to build on. And its valuation — just 32 times forward earnings — is almost too good to pass up.

Just don’t think this will be a smooth ride. After its IPO, Nu shares actually lost 70% of their value over the first year of trading. Shares have completely rebounded since, but it’s a good reminder than rapid-growth stocks are often at the mercy of market volatility. The multiples assigned to these companies can vary widely based on market sentiment.

Like Buffett and Wood, I’m a big fan of Nu Holdings as an investment. But as with most stocks, it will be patience that ultimately generates the biggest returns. Don’t buy unless you’re willing to hold through the downward swings.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,022!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,329!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $393,839!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool recommends Nu Holdings. The Motley Fool has a disclosure policy.

Warren Buffett and Cathie Wood Agree: This Growth Stock Is a Buy was originally published by The Motley Fool