Max Stock Limited Reports Third Quarter 2024 Financial Results

Third Quarter Revenue Increased 18.6% to ILS 373.1 million; Comparable Store Sales Increased 9.2%; GAAP Net Income (Attributable to Shareholders) Increased 35.3%

First Nine Month Revenue Increased 18.4% to ILS 1.0 billion; Comparable Store Sales Increased 9.0%; GAAP Net Income (Attributable to Shareholders) Increased 37.0%

CAESAREA, Israel, Nov. 20, 2024 /PRNewswire/ — Max Stock Limited MAXO (the “Company”) today reported financial results for the third quarter and nine months ended September 30, 2024.

Third Quarter 2024 Summary

- Revenue increased 18.6% to ILS 373.1 million.

- Comparable store sales increased 9.2%.

- Gross margin was 41.3%.

- GAAP Net income (attributable to shareholders) increased 35.3% to ILS 31.3 million.

- Adjusted Net income1 (attributable to shareholders) increased 34.8% to ILS 31.3 million.

- Adjusted EPS1 (attributable to shareholders) increased 34.7% to ILS 0.22.

- Adjusted EBITDA2 increased 25.0% to ILS 56.5 million.

First Nine Months 2024 Summary

- Revenue increased 18.4% to ILS 1.0 billion.

- Comparable store sales increased 9.0%.

- Gross margin was 41.7%.

- GAAP net income (attributable to shareholders) increased 37.0% to ILS 83.0 million.

- Adjusted Net income1 (attributable to shareholders) increased 38.4% to ILS 83.2 million.

- Adjusted EPS1 (attributable to shareholders) increased 37.5% to ILS 0.59.

- Adjusted EBITDA2 increased 28.7% to ILS 144.3.

Note: Totals may be slightly impacted by minor rounding differences.

1 As used throughout this release, adjusted Net Income (attributable to shareholders) defined as Net Income + Share-based payment, multiplied by the portion attributable to shareholders. Adjusted EPS (attributable to shareholders) is then divided by the number of basic shares.

2 As used throughout this release, adjusted EBITDA Pre IFRS 16 defined as Net Income + Income Tax Expenses + Net Interest Expenses + D&A + Other Expenses – the impact of IFRS 16 + Share-based payment.

“We were pleased to carry our first half momentum into the third quarter, delivering high-teens revenue growth fueled by a high single-digit increase in comparable store sales and successful new store openings over the past 12-months,” said Ori Max, Chief Executive Officer. “This topline performance generated meaningful expense leverage, driving a 25% increase in adjusted EBITDA and a 35% increase in adjusted Net Income. The work we’ve done to simultaneously accelerate sales growth and enhance profitability is underscored by adjusted earnings per share of ILS 0.59 for the first nine months 2024, which eclipsed the ILS 0.58 we reported for the full year 2023. Looking ahead, we remain well-positioned to capitalize on the ongoing consumer shift toward our value-oriented offerings which is adding to our optimism about the growth opportunities that lie ahead for Max Stock.”

Third Quarter Results (2024 compared with 2023)

Revenue increased 18.6% to ILS 373.1 million in the third quarter 2024 as compared with revenue of ILS 314.5 million in the third quarter 2023. The increase over the same period last year was largely attributable to the opening of new branches which added approximately 6,000 net square meters of selling space compared to the year-ago period, combined with a 9.2% increase in comparable store sales largely driven by an increase in store traffic and higher conversion driven by demand for seasonal items, partially offset by a shift in timing of the Jewish New Year holiday into the fourth quarter of 2024, compared to being included in the third quarter of 2023.

Comparable store sales for July – October 2024, which neutralizes the timing of the holidays, was 10.9%. However, October 2023 was impacted by the onset of the Iron Swords war, with negative comparable store sales of ~16%, due to temporary closure of our stores and reduced time schedule throughout the month of October 2023.

Gross profit increased 16.9% to ILS 154.1 million in the third quarter 2024 from ILS 131.8 million in the third quarter 2023. Gross margin was ~41.3% as compared to ~41.9% in the last year period. The 60-basis point decline in gross margin over Q3 2023 was primarily attributable to temporarily higher costs associated with the Company’s distribution facility consolidation.

Selling, general and administrative expenses increased to ILS 99.3 million in the third quarter 2024 from ILS 87.7 million in the third quarter 2023, primarily driven by branch expansion which added incremental expenses related to marketing, salary and the addition of right of use assets. As a percentage of sales, selling, general and administrative expenses decreased approximately 120 basis points to 26.6% in the third quarter 2024, compared with 27.8% in the third quarter 2023, largely due to operating leverage.

GAAP net income (attributable to shareholders) increased 35.3% to ILS 31.3 million.

Adjusted net income attributable to shareholders increased 34.8% to ILS 31.3 million in the third quarter of 2024, as compared with adjusted net income attributable to shareholders of ILS 23.2 million in the third quarter of 2023.

Adjusted EPS attributable to shareholders increased 34.7% to ILS 0.22 per share, in the third quarter of 2024, as compared with adjusted EPS attributable to shareholders of ILS 0.17 per share, in the third quarter of 2023.

Adjusted EBITDA increased 25.0% to ILS 56.5 million in the third quarter of 2024 from ILS 45.2 million in the third quarter of 2023.

First Nine Months 2024 Results

Revenue for the first nine months of 2024 increased 18.4% to ILS 1.0 billion, compared with revenue of ILS 846.9 million in the first nine months of 2023. The increase in revenue was driven by a 9.0% gain in comparable store sales and the sales contribution from new branches. The increase in same stores sales was fueled by an increase in store traffic and higher conversion driven by demand for seasonal items, partially offset by a shift in timing of the Jewish New Year holiday into the fourth quarter of 2024, compared to being included in the third quarter of 2023.

Gross profit increased 19.1% to ILS 418.7 million in the first nine months of 2024 from ILS 351.7 million a year ago. Gross margin was ~41.7% as compared to ~41.5% in the prior year period.

Selling, general and administrative expenses increased to ILS 277.0 million in the first nine months of 2024 from ILS 239.7 million in the first nine months of 2023. The increase in operating expenses was related to branch expansion which added incremental expenses related to marketing, salary and the addition of right of use assets. As a percentage of sales, selling, general and administrative expenses improved 80 basis-points to 27.6% in the first nine months of 2024 compared with 28.4% in the first nine months of 2023.

GAAP net income (attributable to shareholders) increased 37.0% to ILS 83.0 million.

Adjusted net income (attributable to shareholders) increased 38.4% to ILS 83.2 million.

Adjusted EPS1(attributable to shareholders) increased 37.5% to ILS 0.59 in the first nine months of 2024 as compared with adjusted EPS1(attributable to shareholders) of ILS 0.43 per share, in the first nine months of 2023.

Adjusted EBITDA2 increased 28.7% to ILS 144.3 million in the first nine months of 2024 from ILS 112.1 million in 2023.

Balance Sheet and Cash Flow Highlights

The Company’s cash and cash equivalents balance at September 30, 2024 was ILS 87.2 million compared with ILS 128.9 million at December 31, 2023 and ILS 119.9 million at September 30, 2023. The Company ended the third quarter of 2024 with total debt of ILS 14.6 million compared with total debt of ILS 33.0 million at December 31, 2023 and ILS 31.1 million at September 30, 2023.

Inventories at September 30, 2024 were ILS 221.4 million compared with ILS 144.6 million at December 31, 2023 and ILS 148.6 million at September 30, 2023. The increase in inventories is primarily attributable to the building up of inventories for the opening of new branches.

Conference Call Information

The Company will host a conference call on November 20, 2024 at 8:00 a.m. Eastern Standard Time to discuss third quarter 2024 results (link). The conference call will also be accessible at https://ir.maxstock.co.il/en/event-en/.There will be a slide presentation that accompanies the call. The slides will be accessible at https://ir.maxstock.co.il/en/presentation-en/. An archived webcast of the conference call will be available at https://ir.maxstock.co.il/en/presentation-en/.

About Max Stock

Max Stock is Israel’s leading extreme value retailer, currently present in 64 locations throughout Israel and 2 locations in Portugal. We offer a broad assortment of quality products for customers’ everyday needs at affordable prices, helping customers “Dream Big, Pay Small”. For more information, please visit https://ir.maxstock.co.il

Forward-Looking Statements

It should be emphasized that this report includes forward-looking information as defined under the Securities Law, 5728-1968. Forward-looking information is uncertain information regarding the future, including forecasts, projections, estimates or other information which refer to a future event or matter, the eventuation of which is uncertain and/or not within the Company’s control. The forward-looking information included in this report is based on the current information held by the Company or its current assessments, as of the publication date of this report.

Company Contacts:

Talia Sessler,

Chief Corporate Development and IR Officer

talia@maxstock.co.il

![]() View original content:https://www.prnewswire.com/news-releases/max-stock-limited-reports-third-quarter-2024-financial-results-302310967.html

View original content:https://www.prnewswire.com/news-releases/max-stock-limited-reports-third-quarter-2024-financial-results-302310967.html

SOURCE Max Stock Limited

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

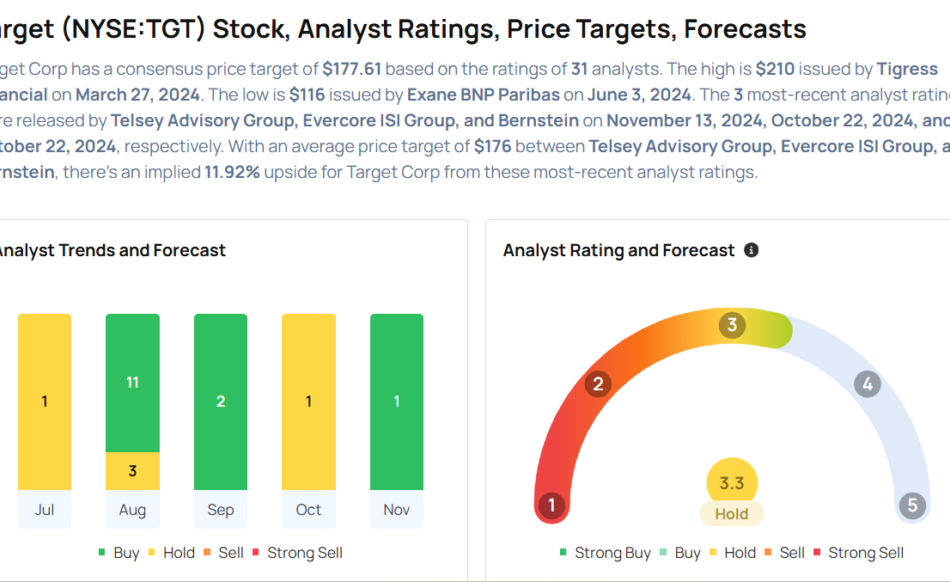

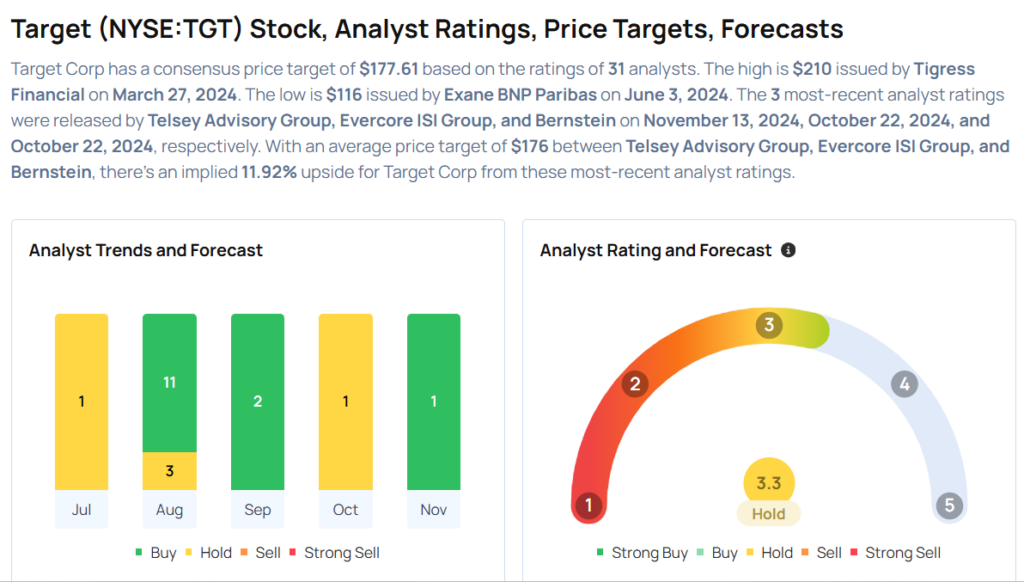

Target Gears Up For Q3 Print; Here Are The Recent Forecast Changes From Wall Street's Most Accurate Analysts

Target Corporation TGT will release earnings results for the third quarter, before the opening bell on Wednesday, Nov. 20.

Analysts expect Target to report quarterly earnings at $2.30 per share. That’s up from $2.10 per share a year ago. The retailer projects to report quarterly revenue of $25.9 billion, compared to $25.4 billion a year earlier, according to data from Benzinga Pro.

On Oct. 22, Target announced plans to slash prices on over 2,000 items for holiday savings, expanding discounts on gifts and essentials.

Target shares fell 0.4% to close at $156.00 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Telsey Advisory Group analyst Joseph Feldman maintained an Outperform rating with a price target of $195 on Nov. 13. This analyst has an accuracy rate of 71%.

- Evercore ISI Group analyst Greg Melich maintained an In-Line rating and cut the price target from $170 to $165 on Oct. 22. This analyst has an accuracy rate of 78%.

- Bernstein analyst Dean Rosenblum initiated coverage on the stock with a Market Perform rating and a price target of $168 on Oct. 22. This analyst has an accuracy rate of 61%.

- JP Morgan analyst Christopher Horvers maintained a Neutral rating and boosted the price target from $153 to $167 on Aug. 29. This analyst has an accuracy rate of 72%.

- Wells Fargo analyst Edward Kelly maintained an Overweight rating and increased the price target from $160 to $180 on Aug. 22. This analyst has an accuracy rate of 63%.

Considering buying TGT stock? Here’s what analysts think:

Read This Next: Wall Street’s Most Accurate Analysts Weigh In On 3 Defensive Stocks With Over 5% Dividend Yields

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

OKX Showcases Commitment to Australian Crypto Community as Gold Sponsor of Australia Crypto Convention, Hosts Ordinals World Tour

SYDNEY, Nov. 20, 2024 (GLOBE NEWSWIRE) — OKX, a leading cryptocurrency exchange and global onchain company, today announced it will serve as Gold Sponsor of Australia Crypto Convention 2024 and host the Australia edition of its Ordinals World Tour. These events, scheduled for 23-24 November, underscore OKX’s continued commitment to strengthening Australia’s digital asset ecosystem.

Since launching its crypto exchange services in Australia in May 2024, OKX has emerged as a key player in the local market, tripling its customer base. OKX has also established itself as a leading exchange in Australia for AUD-crypto trading pairs, while expanding its local team by more than 150% within a span of six months.

Against the backdrop of Bitcoin recently reaching its all-time high, Australia Crypto Convention 2024 will welcome over 10,000 attendees at the International Convention Centre (ICC) in Sydney, where OKX will showcase its extensive suite of crypto trading and onchain products.

The Australia edition of OKX’s Ordinals World Tour, co-hosted in partnership with Ordzaar, takes place on 23 November in Sydney, bringing together pioneers, builders, artists, creators and members of the Australian Ordinals community. This event follows the recent launch of ‘Creators Collective,’ an invite-only community of forward-thinkers in the onchain economy – with an initial focus on Bitcoin innovations like Ordinals.

The success of OKX’s Australian operations was recently recognised at the WeMoney Cryptocurrency Awards in July 2024, where the company secured five prestigious awards, including “Cryptocurrency Exchange of the Year” and “Best for Professional Investors – Cryptocurrency.” In August, OKX further enhanced its local offering with the introduction of dedicated AUD trading order books.

OKX Australia General Manager Jamie Kennedy said: “We plan to increase our investment in Australia throughout 2025 as we develop new products and features which provide a secure and user-friendly trading experience for local customers. The Australian crypto community is in need of an exchange that is accessible, seeks feedback from customers and actively embraces the technological trends that drive the industry forward. We look forward to meeting attendees this weekend and introducing more features tailored specifically for Australian customers very soon.”

Australia Crypto Convention attendees can meet the OKX team at booth 67 to learn more about OKX’s latest products and onchain innovations, including its self-custody wallet and Ordinals Marketplace.

Learn more at okx.com

For further information, please contact:

Media@okx.com

OKX is a technology company with a mission to organize the world’s blockchains and make them more accessible and useful.

We want to create a future that makes our world more efficient, transparent and connected.

OKX began as a crypto exchange giving millions of people access to trading and over time became among the largest platforms in the world. In recent years, we have developed one of the most connected onchain wallets used by millions to access decentralized applications (dApps).

OKX is trusted by hundreds of large institutions seeking access to crypto markets on a reliable platform that seamlessly connects with global banking and payments.

Our most well-known products include: OKX Exchange, OKX Wallet, OKX Explorer, OKX OS, OKX Ventures and OKX Institutional. To learn more about OKX, download our app or visit: okx.com

Disclaimer

Information about: digital currency exchange services is prepared by OKX Australia Pty Ltd (ABN 22 636 269 040); derivatives and margin by OKX Australia Financial Pty Ltd (ABN 14 145 724 509, AFSL 379035) and is only intended for wholesale clients (within the meaning of the Corporations Act 2001 (Cth)); and other products and services by the relevant OKX entities which offer them (see Terms of Service – Australia). Information is general in nature and should not be taken as investment advice, personal recommendation or an offer of (or solicitation to) buy any crypto or related products. You should do your own research and obtain professional advice, including to ensure you understand the risks associated with these products, before you make a decision about them. Past performance is not indicative of future performance – never risk more than you are prepared to lose. Read OKX’s Terms of Service – Australia for more information.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Government of Canada unlocks 12 more federal properties for housing

OTTAWA, ON, Nov. 19, 2024 /CNW/ – Everyone deserves a place to call home. However, for many across the country, home ownership and renting are out of reach due to the housing crisis Canada is facing. We need to build more homes, faster, to get Canadians into homes that meet their needs, at prices they can afford. That’s why in Budget 2024 and Solving the Housing Crisis: Canada’s Housing Plan, the federal government announced the most ambitious housing plan in Canadian history: a plan to build 4 million more homes.

As part of this plan, the Government of Canada is identifying properties within its portfolio that have the potential for housing and is actively adding them to the Canada Public Land Bank. Wherever possible, the government will turn these properties into housing through a long-term lease, to support affordable housing and ensure public land stays public.

Today, the Honourable Jean-Yves Duclos, Minister of Public Services and Procurement, joined by the Honourable Chrystia Freeland, Deputy Prime Minister and Minister of Finance, announced that 12 new properties have been added to the Canada Public Land Bank. These additional properties will create close to 3,900 units of housing for middle-class Canadians.

The 12 new properties included in the Canada Public Land Bank are:

- Calgary, Alberta – Currie – Phase 14, Block 27A, at the corner of Calais Drive and Breskens Street Southwest

- Calgary, Alberta – Currie – Phase 14, Block 31B, at the corner of Bessborough Drive and Breskens Street Southwest

- Calgary, Alberta – Currie – Phase 12C, at the corner of Bessborough Drive and Quesnay Wood Drive

- Edmundston, New Brunswick – 22 Emerson Street

- Grand Falls, New Brunswick – 373-377 Broadway Boulevard

- Dartmouth, Nova Scotia – 15 Iroquois Drive

- Bracebridge, Ontario – 98 Manitoba Street

- London, Ontario – 451 Talbot Street

- Ottawa, Ontario – 529 Richmond Road

- Laval, Quebec – Montée Saint-François – Laval Penitentiary

- Laval, Quebec – Vacant land next to 1575 Chomedey Boulevard

- Whitehorse, Yukon – 419-421 Range Road

A total of 83 federal properties have now been identified as being suitable to support housing. With today’s additions, the Canada Public Land Bank now has properties in 9 provinces and 2 territories. This list will continue to grow in the coming months, with further details on listed properties available soon.

To solve Canada’s housing crisis, the federal government is using every tool at its disposal. The Government of Canada is accelerating its real property disposal process to meet the urgency of getting affordable homes built across Canada.

Quotes

“Safe, accessible and affordable housing options are out of reach for far too many Canadians. Since the launch of the Canada Public Land Bank in August 2024, 83 properties have been identified for potential housing development, paving the way to build affordable housing across the country at a pace and scale not seen in generations.”

The Honourable Jean-Yves Duclos

Minister of Public Services and Procurement and Quebec Lieutenant

“We are delivering on the most ambitious housing plan in Canadian history, to build 4 million homes and make the housing market fairer for first-time buyers and renters alike. Building more student housing will relieve rental demand for students and confronting the financialization of housing will ensure homes are for Canadians, not a speculative asset class for investors. We are taking action on all fronts to build more homes and make housing more affordable for Canadians.”

The Honourable Chrystia Freeland

Deputy Prime Minister and Minister of Finance

“We need to build more homes in Canada, and one of the largest costs in building is land. By building on public lands, we can make it easier to build, and by leasing those same properties, we can make sure the homes built stay affordable for the long term.”

The Honourable Sean Fraser

Minister of Housing, Infrastructure and Communities

Quick facts

- In Budget 2024 and Solving the Housing Crisis: Canada’s Housing Plan, the federal government announced an ambitious whole-of-government approach to addressing the housing crisis by building more homes, making it easier to rent or own a home, and helping Canadians who cannot afford a home.

- A key component of Canada’s Housing Plan is the new Public Lands for Homes Plan. This plan aims to partner with all levels of government, homebuilders and housing providers to build homes, faster, on surplus and underused public lands across the country.

- The Public Lands for Homes Plan supports the government’s goal of unlocking 250,000 new homes by 2031.

- Budget 2024 also provided $500 million, on a cash basis, to launch the new Public Lands Acquisition Fund. This fund will buy land from other orders of government to allow the federal government to acquire more land for housing to help build middle-class homes. Work on the fund is already underway, and more details will be released in the coming weeks.

- In August 2024, a new tool for builders called the Canada Public Land Bank was launched with an initial 56 properties under the Public Lands for Homes Plan.

- As of November 5, 2024, there are 83 properties listed in the Canada Public Land Bank, representing a total of 430 hectares of land, which is the size of approximately 2,700 hockey rinks or almost 525 Canadian Football League football fields.

- So far, Canada Lands Company, in partnership with Canada Mortgage and Housing Corporation, issued a call for proposals for 5 properties located in Edmonton, Calgary, Toronto, Ottawa and Montréal, as well as 2 additional separate opportunities in Ottawa. The initial calls for proposals have closed, and evaluations have begun.

- Building on this momentum, Canada Lands Company has additional opportunities available.

- In addition, a call for proposals was launched for 1 National Capital Commission property located in Gatineau.

- The Government of Canada is processing the feedback received from provinces, territories and municipalities, as well as developers, housing advocates and Indigenous groups. This information will be used to develop and bring more properties to market.

- To provide feedback on the Canada Public Land Bank and its properties, the Government of Canada launched a call for housing solutions for communities, which can be accessed via a secure online platform.

Associated links

Budget 2024

Solving the Housing Crisis: Canada’s Housing Plan

Public lands for homes

Portfolio optimization: Disposal list

Follow us on X (Twitter)

Follow us on Facebook

SOURCE Public Services and Procurement Canada

![]() View original content: http://www.newswire.ca/en/releases/archive/November2024/19/c6879.html

View original content: http://www.newswire.ca/en/releases/archive/November2024/19/c6879.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Microstrategy's Michael Saylor To Advocate For Bitcoin At Microsoft Board Meeting, Offers To Educate Rumble CEO As Well

In a big development, MicroStrategy MSTR Chairman Michael Saylor will present a case for Bitcoin BTC/USD investment to the board of directors at Microsoft Corporation MSFT.

What Happened: During an X space hosted by asset manager VanEck, Saylor said he was contacted by the activist who put up the shareholder proposal to present to the board.

“I agreed to provide a three-minute presentation. That’s all you’re allowed. I’m going to actually post that online and I’m going to present it to the board.”

Saylor said he even proposed meeting with CEO Satya Nadella to discuss the strategy, but the offer was not accepted.

“I think it’s not a bad idea to put it on the agenda of every company. It ought to be put on the agenda of Berkshire Hathaway, Apple, and Google because they all have huge hordes of cash and they’re all burning shareholder value,” Saylor argued.

The MicroStrategy chief said that Microsoft stock would be “much less risky” if half of its enterprise value—which was currently just around 1.5%— is based on tangible assets like Bitcoin.

Meanwhile, Saylor also offered to discuss the implications of adding Bitcoin to the Treasury with Rumble Inc. RUM CEO Chris Pavloski.

https://x.com/saylor/status/1858945523258159169

Why It Matters: Microsoft was set to vote on an assessment of investing in Bitcoin during next month’s shareholders meeting. The shareholders requested the board conduct the assessment, citing Bitcoin’s healthy gains over the last five years.

The proposal explicitly mentioned MicroStrategy, a pioneer in corporate Bitcoin adoption whose shares have outperformed Microsoft in 2024.

Price Action: At the time of writing, Bitcoin was trading at $92,054.06, up 0.86% in the last 24 hours, according to data from Benzinga Pro. Shares of MicroStrategy surged nearly 12% during Tuesday’s regular session, while Microsoft closed 0.49% higher.

Photo: DCStockPhotography/Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Waymo Maybe Too Small For Alphabet Investors To Care About Today, But The Self-Driving Spinoff's Could Be Valued At $850B By 20230, Says Gene Munster

Gene Munster, Managing Partner at Deepwater Asset Management, projects that Alphabet Inc GOOGL GOOGL will spin out its autonomous driving unit Waymo within the next 2-4 years, potentially reaching a valuation between $350 billion and $850 billion by 2030.

What Happened: In a detailed research note, Munster and analyst Brian Baker suggest the spinoff could add 12-28% to Alphabet’s current market capitalization, depending on the parent company’s ownership stake, which they estimate is currently around 70%.

“Today, Waymo alone is too small for Alphabet investors to care about,” Munster wrote. “However, the management team is sharing more about their rapid progress, plans to expand operations, and has raised additional outside capital.”

The analysis comes as Waymo continues to expand its autonomous ride-hailing service, now operating in Phoenix, San Francisco, and Los Angeles, with Austin launching later this year. The company currently provides over 150,000 rides weekly across its 700-vehicle fleet.

Munster’s valuation model hinges on Waymo’s potential market share in the U.S. ride-sharing industry by 2030. In the most optimistic scenario, capturing 70% market share could generate $28 billion in earnings and an $850 billion valuation. A more conservative 30% market share scenario suggests an $11 billion earnings potential and $337 billion valuation.

See Also: ‘Dogecoin Millionaire’ Predicts Ethereum To Hit $15,000 If Bitcoin Cracks $200,000

Why It Matters: The report highlights that despite high upfront vehicle costs of approximately $200,000 per unit, removing human drivers could save about $82,000 annually per vehicle. Munster expects vehicle costs to decrease to around $100,000 to make the long-term economics viable.

Waymo recently raised $5.6 billion in a Series D funding round led by Alphabet, with participation from major investors including Andreessen Horowitz and Fidelity, valuing the company at approximately $45 billion. The funding suggests growing institutional confidence in Waymo’s autonomous driving technology and business model.

Munster predicts the autonomous ride-sharing market will primarily be contested between Waymo and Tesla Inc TSLA, with the first company to achieve widespread autonomy likely to capture the majority share.

Read Next:

Image via Wikimedia Commons

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dogecoin, Bitcoin Left In The Dust By AI Meme Coin GOAT As Nvidia's Q3 Earnings Draw Near

Goatseus Maximus (GOAT), an artificial intelligence (AI)-created meme coin, rallied sharply Tuesday ahead of the third-quarter earnings of Nvidia Corp. NVDA.

What happened: The Solana SOL/USD-based cryptocurrency pumped over 12% in the last 24 hours to a market capitalization of $1.21 billion.

The latest uptick pushed the coin to the top of the daily gainers list, outstripping the returns of blue-chip cryptocurrencies like Bitcoin BTC/USD and Dogecoin DOGE/USD.

GOAT was up more than 42% over the week, and a whopping 1013% since its launch more than a month ago.

Why It Matters: GOAT has caught the cryptocurrency market’s attention, cracking the $1 billion market capitalization club in a quick time. In the process, it also became the first coin launched by Pump.fun, Solana’s token launchpad, to hit the $1 billion milestone.

Launched by AI chatbot Truth Terminal, which has a dedicated X account, the meme coin stands as more of an experiment. Truth Terminal was created by researcher Andy Ayrey, and he controls the cryptocurrency wallet tied to GOAT.

Notable figures in the industry, like Coinbase CEO Brian Armstrong, have taken notice of the project’s rise and even proposed setting up independent wallets to give Truth Terminal more autonomy.

The rally comes ahead of the hotly anticipated earnings report of AI juggernaut Nvidia, an event that has significantly moved the broader financial markets in the past.

Price Action: At the time of writing, GOAT was exchanging hands at $1.16, up 12.91% in the last 24 hours, according to data from Benzinga Pro.

Photo by Igor Faun on Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Satya Nadella Defends Bing's Rise Against Google's Search Dominance — Says OpenAI's Partnership With Apple Is 'Incremental' For Microsoft

Microsoft Corporation MSFT CEO Satya Nadella highlighted Bing’s strong growth countering concerns about its minimal impact on Alphabet Inc.’s GOOG GOOGL Google’s global search dominance.

What Happened: On Tuesday, during a conversation with a CNBC Overtime anchor Jon Fortt, Nadella was asked when AI was integrated into Bing, the hope was to gain more share from Google.

However, one year down the line, Google still has roughly 90% of the global search share. In response, the Microsoft CEO said that Bing search is one of the fastest-growing businesses, showing strong double-digit growth.

When asked about search share, Nadella responded that it’s a game of 100 basis points, and any progress is good.

He then expressed excitement about the success of OpenAI’s ChatGPT and its partnership with Apple Inc. AAPL, which he said is beneficial for Microsoft as it runs on Azure.

“That’s all incremental for even us,” Nadella stated, adding, “We are giving them the Bing index and powering ChatGPT search using our APIs.”

Regarding the relationship with OpenAI, Nadella expressed satisfaction with the partnership’s progress.

“We are thrilled to be an investor. We’re thrilled to be a partner around I.P. They’re one of our biggest customers now. We also compete in some areas. And so the partnership has all of those dimensions to it,” he said.

Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox.

Why It Matters: Microsoft launched Bing in 2009 to compete directly with Google. However, despite its efforts, Google remains the dominant player, with Bing capturing less than 10% of search queries.

Meanwhile, the partnership between Microsoft and OpenAI has been a topic of interest in the tech world, especially since reports started surfacing about OpenAI’s shift from a nonprofit to a for-profit model.

Microsoft has invested nearly $14 billion in OpenAI since 2019, leading to a high-stakes financial and governance tug-of-war. OpenAI’s valuation soared to $157 billion in its latest funding round.

Earlier in May it was reported that OpenAI’s potential agreement with Apple had sparked concerns within Microsoft.

Last month, Microsoft’s first-quarter earnings reported a 16% year-over-year increase in revenue.

Price Action: Microsoft shares rose 0.49% on Tuesday, closing at $417.79, with a slight additional gain of 0.05% in after-hours trading, reaching $418 at the time of writing, according to data from Benzinga Pro.

Check out more of Benzinga’s Consumer Tech coverage by following this link.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.