Nokia's US shares rise after T-Mobile says no plans to stop partnership

(Reuters) – U.S.-listed shares of Nokia jumped around 5% in extended trading on Tuesday after T-Mobile said it has no plans to stop working with the Finnish company in a response to an analyst report claiming such a possibility.

Nokia shares closed down around 7% after Earl Lum of EJL Wireless Research said in a LinkedIn post there is a chance that Nokia could be dropped by T-Mobile in favor of Swedish firm Ericsson.

“We have made no decision to end our working relationship with Nokia, and any reports in the media implying this are untrue,” T-Mobile said in a statement.

Lum pointed in the post to Nokia’s inability to deliver on T-Mobile’s networking needs and the superiority of Ericsson’s products.

“T-Mobile works with both Nokia and Ericsson on our RAN, who have helped us over the years build the largest and fastest 5G network in the nation,” T-Mobile said.

Last year, telecom rival AT&T chose Ericsson to build a telecom network, which will cover 70% of its wireless traffic in the U.S. by late 2026, eroding the presence of Nokia in the North American market.

(Reporting by Zaheer Kachwala in Bengaluru)

Qifu Technology Announces Third Quarter 2024 Unaudited Financial Results and Launches A New US$450 Million Share Repurchase Plan for 2025

SHANGHAI, China, Nov. 19, 2024 (GLOBE NEWSWIRE) — Qifu Technology, Inc. QFIN HKEx: 3660)) (“Qifu Technology” or the “Company”), a leading Credit-Tech platform in China, today announced its unaudited financial results for the third quarter ended September 30, 2024 and launched a new US$450 million share repurchase plan for 2025.

Third Quarter 2024 Business Highlights

- As of September 30, 2024, our platform has connected 162 financial institutional partners and 254.3 million consumers*1 with potential credit needs, cumulatively, an increase of 11.6% from 227.9 million a year ago.

- Cumulative users with approved credit lines*2 were 55.2 million as of September 30, 2024, an increase of 12.2% from 49.2 million as of September 30, 2023.

- Cumulative borrowers with successful drawdown, including repeat borrowers was 33.1 million as of September 30, 2024, an increase of 12.6% from 29.4 million as of September 30, 2023.

- In the third quarter of 2024, financial institutional partners originated 23,042,303 loans*3 through our platform.

- Total facilitation and origination loan volume*4 of ongoing services reached RMB82,436 million, a decrease of 14.9% from RMB96,923 million in the same period of 2023 and an increase of 13.1% from RMB72,864 million in the prior quarter. RMB45,396 million of such loan volume was under capital-light model, Intelligence Credit Engine (“ICE”) and total technology solutions*5, representing 55.1% of the total, an increase of 4.7% from RMB43,353 million in the same period of 2023 and an increase of 15.4% from RMB39,344 million in the prior quarter.

- Loan facilitation volume of intended discontinued service*6 reached RMB17,145 million, a decrease of 34.6% from RMB26,226 million in the same period of 2023 and a decrease of 24.0% from RMB22,561 million in the prior quarter.

- Total outstanding loan balance*7 of ongoing services was RMB127,727 million as of September 30, 2024, a decrease of 13.3% from RMB147,237 million as of September 30, 2023 and an increase of 3.4% from RMB123,551 million as of June 30, 2024. RMB74,078 million of such loan balance was under capital-light model, “ICE” and total technology solutions*8, a decrease of 0.5% from RMB74,421 million as of September 30, 2023 and an increase of 6.4% from RMB69,589 million as of June 30, 2024.

- Outstanding loan balance of intended discontinued service*6 was RMB31,901 million as of September 30, 2024, a decrease of 23.8% from RMB41,863 million as of September 30, 2023 and a decrease of 6.8% from RMB34,227 million as of June 30, 2024.

- The weighted average contractual tenor of loans originated by financial institutions across our platform in the third quarter of 2024 was approximately 10.12 months, compared with 11.23 months in the same period of 2023.

- 90 day+ delinquency rate*9 of loans originated by financial institutions across our platform was 2.72% as of September 30, 2024.

- Repeat borrower contribution*10 of loans originated by financial institutions across our platform for the third quarter of 2024 was 93.8%.

1 Refers to cumulative registered users across our platform.

2 “Cumulative users with approved credit lines” refers to the total number of users who had submitted their credit applications and were approved with a credit line at the end of each period.

3 Including 3,298,567 loans across “V-pocket”, and 19,743,736 loans across other products.

4 Refers to the total principal amount of loans facilitated and originated during the given period.

5 “ICE” is an open platform primarily on our “Qifu Jietiao” APP (previously known as “360 Jietiao”), we match borrowers and financial institutions through big data and cloud computing technology on “ICE”, and provide pre-loan investigation report of borrowers. For loans facilitated through “ICE”, the Company does not bear principal risk. Loan facilitation volume through “ICE” was RMB 29,635 million in the third quarter of 2024.

Under total technology solutions, we have been offering end-to-end technology solutions to financial institutions based on on-premise deployment, SaaS or hybrid model since 2023. Loan facilitation volume through total technology solutions was RMB761 million in the third quarter of 2024.

6 In 2021, we started to offer financial institutions on-premise deployed, modular risk management SaaS, which helps financial institution partners improve credit assessment results. We further began to offer end-to-end technology solutions to financial institutions based on on-premise deployment, SaaS or hybrid model in 2023, which we refer to as total technology solutions. These foregoing services combined were previously referred to as other technology solutions. However, as the risk management SaaS service only generated marginal returns and had little potential for up selling, we intend to gradually discontinue it by the end of 2024. The gradual discontinuation of the service is not expected to have a material impact on our overall business, financial condition, and results of operations.

7 “Total outstanding loan balance” refers to the total amount of principal outstanding for loans facilitated and originated at the end of each period, excluding loans delinquent for more than 180 days.

8 As of September 30, 2024, outstanding loan balance was RMB42,898 million for “ICE” and RMB1,544 million for total technology solutions.

9 “90 day+ delinquency rate” refers to the outstanding principal balance of on- and off-balance sheet loans that were 91 to 180 calendar days past due as a percentage of the total outstanding principal balance of on- and off-balance sheet loans across our platform as of a specific date. Loans that are charged-off and loans under “ICE” and total technology solutions are not included in the delinquency rate calculation.

10 “Repeat borrower contribution” for a given period refers to (i) the principal amount of loans borrowed during that period by borrowers who had historically made at least one successful drawdown, divided by (ii) the total loan facilitation and origination volume through our platform during that period.

Third Quarter 2024 Financial Highlights

- Total net revenue was RMB4,370.2 million (US$622.7 million), compared to RMB 4,281.0 million in the same period of 2023.

- Income from operations was RMB2,289.2 million (US$326.2 million), compared to RMB 1,388.9 million in the same period of 2023.

- Non-GAAP*11 income from operations was RMB2,315.5 million (US$330.0 million), compared to RMB 1,432.2 million in the same period of 2023.

- Operating margin was 52.4%. Non-GAAP operating margin was 53.0%.

- Net income was RMB1,798.8 million (US$256.3 million), compared to RMB 1,137.7 million in the same period of 2023.

- Non-GAAP net income was RMB1,825.1 million (US$260.1 million), compared to RMB 1,181.0 million in the same period of 2023.

- Net income margin was 41.2%. Non-GAAP net income margin was 41.8%.

- Net income per fully diluted American depositary share (“ADS”) was RMB12.18 (US$1.74), compared to RMB6.94 in the same period of 2023.

- Non-GAAP net income per fully diluted ADS was RMB12.35 (US$1.76), compared to RMB7.20 in the same period of 2023.

11 Non-GAAP income from operations, Non-GAAP net income, Non-GAAP operating margin, Non-GAAP net income margin and Non-GAAP net income per fully diluted ADS are Non-GAAP financial measures. For more information on these Non-GAAP financial measures, please see the section of “Use of Non-GAAP Financial Measures Statement” and the table captioned “Unaudited Reconciliations of GAAP and Non-GAAP Results” set forth at the end of this press release.

Mr. Haisheng Wu, Chief Executive Officer and Director of Qifu Technology, commented, “We are very pleased to deliver a strong quarter of financial results in a still challenging macro environment with some tentative sign of increasing users’ activities late in the quarter. We continued to make noticeable progress in key areas of our operations and achieved better efficiency and enhanced returns.

During the quarter, we saw continued improvement in net take rates with the help of improving risks and lowering funding costs. Non-credit risk bearing loans for ongoing services accounted for nearly 55% of total volume. In the third quarter, we further reduced unit costs for user acquisition through more efficient and diversified user acquisition channels. Meanwhile, in an overall easing funding environment, we continued to strengthen our relationship with financial institution partners and further reduced overall funding costs to another historic low.

While we are encouraged by recent release of stimulus economic policies, it may still take a while to see the actual impact to the overall consumer demand and consumption behavior. Looking ahead, we intend to continue to take a disciplined risk management approach despite improved asset quality and tentatively uptick in user activities. With our consistent execution, we believe we are well positioned to capture long-term opportunities by building a comprehensive credit-tech platform that offers differentiate products and services to users and financial institution partners based on their respective credit profiles and risk preferences.”

“We are excited to report a set of strong financial results in the quarter. Total net revenue was RMB4.37 billion and Non-GAAP net income was RMB1.83 billion for the third quarter,” Mr. Alex Xu, Chief Financial Officer, commented. “At the end of the third quarter, our total cash and cash equivalent*12 was approximately RMB9.77 billion, and we generated approximately RMB2.37 billion cash from operations. During the quarter, we continued to execute the US$350 million share repurchase program with meaningful progress. The newly approved US$450 million share repurchase program for 2025 further demonstrates our strong commitment to sustainable shareholder returns through dividend and share repurchases.”

Mr. Yan Zheng, Chief Risk Officer, added, “We experienced further improvement in overall risk metrics of our loan book in the third quarter as we continued to take a prudent approach in managing risks. Among key leading indicators, Day-1 delinquency rate*13 was 4.6%, and 30-day collection rate*14 was approximately 87.4%. The 30-day collection rates reached its best levels in the past three years. As we remain vigilant in risk management under current macro environment, we expect to see relatively stable overall risk performance in the coming quarters.”

12 Including “Cash and cash equivalents”, “Restricted cash”, “Security deposit prepaid to third-party guarantee companies” and “Short-term investments”.

13 “Day-1 delinquency rate” is defined as (i) the total amount of principal that became overdue as of a specified date, divided by (ii) the total amount of principal that was due for repayment as of such specified date.

14 “30-day collection rate” is defined as (i) the amount of principal that was repaid in one month among the total amount of principal that became overdue as of a specified date, divided by (ii) the total amount of principal that became overdue as of such specified date.

Third Quarter 2024 Financial Results

Total net revenue was RMB4,370.2 million (US$622.7 million), compared to RMB4,281.0 million in the same period of 2023, and RMB4,160.1 million in the prior quarter.

Net revenue from Credit Driven Services was RMB 2,901.0 million (US$413.4 million), compared to RMB3,071.0 million in the same period of 2023, and RMB2,912.2 million in the prior quarter.

Loan facilitation and servicing fees-capital heavy were RMB258.7 million (US$36.9 million), compared to RMB479.2 million in the same period of 2023 and RMB151.1 million in the prior quarter. The year-over-year decrease was primarily due to the decline in capital-heavy loan facilitation volume, and the sequential increase mainly due to increasing capital-heavy loan facilitation volume and lower funding cost for capital-heavy loan facilitation.

Financing income*15 was RMB1,744.1 million (US$248.5 million), compared to RMB1,369.9 million in the same period of 2023 and RMB1,690.1 million in the prior quarter. The year-over-year increase was primarily due to the growth in outstanding balance of the on-balance-sheet loans.

Revenue from releasing of guarantee liabilities was RMB794.6 million (US$113.2 million), compared to RMB1,165.7 million in the same period of 2023, and RMB972.6 million in the prior quarter. The year-over-year and sequential decreases were mainly due to decreases in the average outstanding balance of off-balance-sheet capital-heavy loans during the period.

Other services fees were RMB103.7 million (US$14.8 million), compared to RMB56.1 million in the same period of 2023, and RMB98.4 million in the prior quarter. The year-over-year and sequential increases were mainly due to the increases in late payment fees under the capital-heavy model.

Net revenue from Platform Services was RMB1,469.1 million (US$209.3 million), compared to RMB1,210.1 million in the same period of 2023 and RMB1,247.9 million in the prior quarter.

Loan facilitation and servicing fees-capital light were RMB574.6 million (US$81.9 million), compared to RMB863.9 million in the same period of 2023 and RMB524.4 million in the prior quarter. The year-over-year decrease was mainly due to a lower capital-light loan facilitation volume.

Referral services fees were RMB763.1 million (US$108.7 million), compared to RMB234.2 million in the same period of 2023 and RMB623.5 million in the prior quarter. The year-over-year and sequential increases were mainly due to the increases in the loan facilitation volume through ICE.

Other services fees were RMB131.4 million (US$18.7 million), compared to RMB112.0 million in the same period of 2023 and RMB100.0 million in the prior quarter.

Total operating costs and expenses were RMB2,081.0 million (US$296.5 million), compared to RMB2,892.2 million in the same period of 2023 and RMB2,175.1 million in the prior quarter.

Facilitation, origination and servicing expenses were RMB707.9 million (US$100.9 million), compared to RMB639.8 million in the same period of 2023 and RMB722.2 million in the prior quarter. The year-over-year increase was primarily due to higher collection fees.

Funding costs were RMB146.8 million (US$20.9 million), compared to RMB160.2 million in the same period of 2023 and RMB161.3 million in the prior quarter. The year-over-year decrease was mainly due to the lower average cost of ABS and trusts. The sequential decrease was mainly due to the decline in funding from ABS and trusts and lower average costs.

Sales and marketing expenses were RMB419.9 million (US$59.8 million), compared to RMB529.6 million in the same period of 2023 and RMB366.4 million in the prior quarter. The year-over-year decrease was mainly due to a more prudent customer acquisition approach. The sequential increase was primarily due to an increased number of customers acquired, offset by a lower unit customer acquisition cost.

General and administrative expenses were RMB92.0 million (US$13.1 million), compared to RMB95.4 million in the same period of 2023 and RMB95.1 million in the prior quarter.

Provision for loans receivable was RMB477.5 million (US$68.0 million), compared to RMB509.0 million in the same period of 2023 and RMB849.5 million in the prior quarter. The year-over-year decrease mainly reflected the Company’s consistent approach in assessing provisions commensurate with its underlying loan profile. The sequential decrease was mainly due to the decrease in loan origination volume of on-balance-sheet loans and a larger reversal of prior quarters’ provision because of improving asset quality.

Provision for financial assets receivable was RMB64.4 million (US$9.2 million), compared to RMB86.9 million in the same period of 2023 and RMB70.2 million in the prior quarter. The year-over-year and sequential decreases mainly reflected the Company’s consistent approach in assessing provisions commensurate with its underlying loan profile. In addition, the year-over-year decrease was due to the decline in loan facilitation volume of off-balance-sheet loans.

Provision for accounts receivable and contract assets was RMB108.8 million (US$15.5 million), compared to RMB39.7 million in the same period of 2023 and RMB123.8 million in the prior quarter. The year-over-year and sequential changes reflected the Company’s consistent approach in assessing provisions commensurate with its underlying loan profile.

Provision for contingent liability was RMB63.6 million (US$9.1 million), compared to RMB831.6 million in the same period of 2023 and RMB-213.3 million in the prior quarter. The year-over-year and sequential changes reflected the Company’s consistent approach in assessing provisions commensurate with its underlying loan profile as well as the change in capital-heavy loan facilitation volume.

Income from operations was RMB2,289.2 million (US$326.2 million), compared to RMB1,388.9 million in the same period of 2023 and RMB1,985.0 million in the prior quarter.

Non-GAAP income from operations was RMB2,315.5 million (US$330.0 million), compared to RMB1,432.2 million in the same period of 2023 and RMB2,021.9 million in the prior quarter.

Operating margin was 52.4%. Non-GAAP operating margin was 53.0%.

Income before income tax expense was RMB2,356.9 million (US$335.9 million), compared to RMB1,478.1 million in the same period of 2023 and RMB2,076.6 million in the prior quarter.

Net income was RMB1,798.8 million (US$256.3 million), compared to RMB1,137.7 million in the same period of 2023 and RMB1,376.5 million in the prior quarter.

Non-GAAP net income was RMB1,825.1 million (US$260.1 million), compared to RMB1,181.0 million in the same period of 2023 and RMB1,413.4 million in the prior quarter.

Net income margin was 41.2%. Non-GAAP net income margin was 41.8%.

Net income attributed to the Company was RMB1,802.9 million (US$256.9 million), compared to RMB1,142.0 million in the same period of 2023 and RMB1,380.5 million in the prior quarter.

Non-GAAP net income attributed to the Company was RMB1,829.2 million (US$260.7 million), compared to RMB1,185.3 million in the same period of 2023 and RMB1,417.4 million in the prior quarter.

Net income per fully diluted ADS was RMB12.18 (US$1.74).

Non-GAAP net income per fully diluted ADS was RMB12.35 (US$1.76).

Weighted average basic ADS used in calculating GAAP net income per ADS was 145.30 million.

Weighted average diluted ADS used in calculating GAAP and non-GAAP net income per ADS was 148.10 million.

15 “Financing income” is generated from loans facilitated through the Company’s platform funded by the consolidated trusts and Fuzhou Microcredit, which charge fees and interests from borrowers.

30 Day+ Delinquency Rate by Vintage and 180 Day+ Delinquency Rate by Vintage

The following charts and tables display the historical cumulative 30 day+ delinquency rates by loan facilitation and origination vintage and 180 day+ delinquency rates by loan facilitation and origination vintage for all loans facilitated and originated through the Company’s platform. Loans under “ICE” and total technology solutions are not included in the 30 day+ charts and the 180 day+ charts:

http://ml.globenewswire.com/Resource/Download/34f83b73-48a7-41be-a668-6e743c1d297c

http://ml.globenewswire.com/Resource/Download/1360a84d-f015-42f7-8863-25fc8d82115e

Update on Share Repurchase Plan of 2024

On March 12, 2024, the Company’s board of directors approved a share repurchase plan whereby the Company is authorized to repurchase its ADSs or Class A ordinary shares with an aggregate value of up to US$350 million during the 12-month period from April 1, 2024.

As of November 19, 2024, the Company had in aggregate purchased approximately 13.7 million ADSs in the open market for a total amount of approximately US$298 million (inclusive of commissions) at an average price of US$21.7 per ADS pursuant to the share repurchase plan.

New US$450 Million Share Repurchase Plan of 2025

On November 19, 2024, the Company’s board of directors approved a new share repurchase plan whereby the Company is authorized to repurchase up to US$450 million worth of its ADSs or Class A ordinary shares over the next 12 months starting from January 1, 2025. The share repurchases may be effected from time to time on the open market at prevailing market prices, in privately negotiated transactions, in block trades and/or through other legally permissible means, depending on market conditions and will be implemented in accordance with applicable rules and regulations.

Business Outlook

As macro-economic uncertainties persist, the Company intends to maintain a prudent approach in its business planning. Management will continue to focus on enhancing efficiency of the Company’s operations. As such, for the fourth quarter of 2024, the Company expects to generate a net income between RMB1.75 billion and RMB1.85 billion and a non-GAAP net income*16 between RMB1.80 billion and RMB1.90 billion, representing a year-on-year growth between 57% and 65%. This outlook reflects the Company’s current and preliminary views, which is subject to material changes.

16 Non-GAAP net income represents net income excluding share-based compensation expenses.

Conference Call Preregistration

Qifu Technology’s management team will host an earnings conference call at 7:30 PM U.S. Eastern Time on Tuesday, November 19, 2024 (8:30 AM Beijing Time on Wednesday, November 20, 2024).

All participants wishing to join the conference call must pre-register online using the link provided below.

Registration Link: https://register.vevent.com/register/BI019bc78618c84e7184e794d691cfdb5b

Upon registration, each participant will receive details for the conference call, including dial-in numbers and a unique access PIN. Please dial in 10 minutes before the call is scheduled to begin.

Additionally, a live and archived webcast of the conference call will be available on the Investor Relations section of the Company’s website at http://ir.qifu.tech.

About Qifu Technology

Qifu Technology is a leading Credit-Tech platform in China that provides a comprehensive suite of technology services to assist financial institutions and consumers and SMEs in the loan lifecycle, ranging from borrower acquisition, preliminary credit assessment, fund matching and post-facilitation services. The Company is dedicated to making credit services more accessible and personalized to consumers and SMEs through Credit-Tech services to financial institutions.

For more information, please visit: https://ir.qifu.tech.

Use of Non-GAAP Financial Measures Statement

To supplement our financial results presented in accordance with U.S. GAAP, we use Non-GAAP financial measure, which is adjusted from results based on U.S. GAAP to exclude share-based compensation expenses. Reconciliations of our Non-GAAP financial measures to our U.S. GAAP financial measures are set forth in tables at the end of this earnings release, which provide more details on the Non-GAAP financial measures.

We use Non-GAAP income from operation, Non-GAAP operating margin, Non-GAAP net income, Non-GAAP net income margin, Non-GAAP net income attributed to the Company and Non-GAAP net income per fully diluted ADS in evaluating our operating results and for financial and operational decision-making purposes. Non-GAAP income from operation represents income from operation excluding share-based compensation expenses. Non-GAAP operating margin is equal to Non-GAAP income from operation divided by total net revenue. Non-GAAP net income represents net income excluding share-based compensation expenses. Non-GAAP net income margin is equal to Non-GAAP net income divided by total net revenue. Non-GAAP net income attributed to the Company represents net income attributed to the Company excluding share-based compensation expenses. Non-GAAP net income per fully diluted ADS represents net income excluding share-based compensation expenses per fully diluted ADS. Such adjustments have no impact on income tax. We believe that Non-GAAP income from operation, Non-GAAP operating margin, Non-GAAP net income, Non-GAAP net income margin, Non-GAAP net income attributed to the Company and Non-GAAP net income per fully diluted ADS help identify underlying trends in our business that could otherwise be distorted by the effect of certain expenses that we include in results based on U.S. GAAP. We believe that Non-GAAP income from operation and Non-GAAP net income provide useful information about our operating results, enhance the overall understanding of our past performance and future prospects and allow for greater visibility with respect to key metrics used by our management in its financial and operational decision-making. Our Non-GAAP financial information should be considered in addition to results prepared in accordance with U.S. GAAP, but should not be considered a substitute for or superior to U.S. GAAP results. In addition, our calculation of Non-GAAP financial information may be different from the calculation used by other companies, and therefore comparability may be limited.

Exchange Rate Information

This announcement contains translations of certain RMB amounts into U.S. dollars at specified rates solely for the convenience of the reader. Unless otherwise noted, all translations from RMB to U.S. dollars are made at a rate of RMB 7.0176 to US$1.00, the exchange rate set forth in the H.10 statistical release of the Board of Governors of the Federal Reserve System as of September 30, 2024.

Safe Harbor Statement

Any forward-looking statements contained in this announcement are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates” and similar statements. Among other things, the business outlook and quotations from management in this announcement, as well as the Company’s strategic and operational plans, contain forward-looking statements. Qifu Technology may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission (“SEC”), in announcements made on the website of The Stock Exchange of Hong Kong Limited (the “Hong Kong Stock Exchange”), in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including the Company’s business outlook, beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, which factors include but not limited to the following: the Company’s growth strategies, the Company’s cooperation with 360 Group, changes in laws, rules and regulatory environments, the recognition of the Company’s brand, market acceptance of the Company’s products and services, trends and developments in the credit-tech industry, governmental policies relating to the credit-tech industry, general economic conditions in China and around the globe, and assumptions underlying or related to any of the foregoing. Further information regarding these and other risks and uncertainties is included in Qifu Technology’s filings with the SEC and announcements on the website of the Hong Kong Stock Exchange. All information provided in this press release is as of the date of this press release, and Qifu Technology does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

For more information, please contact:

Qifu Technology

E-mail: ir@360shuke.com

| Unaudited Condensed Consolidated Balance Sheets (Amounts in thousands of Renminbi (“RMB”) and U.S. dollars (“USD”) except for number of shares and per share data, or otherwise noted) |

|||

| December 31, | September 30, | September 30, | |

| 2023 | 2024 | 2024 | |

| RMB | RMB | USD | |

| ASSETS | |||

| Current assets: | |||

| Cash and cash equivalents | 4,177,890 | 4,288,460 | 611,101 |

| Restricted cash | 3,381,107 | 2,253,397 | 321,107 |

| Short term investments | 15,000 | 3,120,158 | 444,619 |

| Security deposit prepaid to third-party guarantee companies | 207,071 | 108,670 | 15,485 |

| Funds receivable from third party payment service providers | 1,603,419 | 771,847 | 109,987 |

| Accounts receivable and contract assets, net | 2,909,245 | 2,183,030 | 311,079 |

| Financial assets receivable, net | 2,522,543 | 1,410,934 | 201,056 |

| Amounts due from related parties | 45,346 | 17,124 | 2,440 |

| Loans receivable, net | 24,604,487 | 26,317,013 | 3,750,144 |

| Prepaid expenses and other assets | 329,920 | 1,188,059 | 169,297 |

| Total current assets | 39,796,028 | 41,658,692 | 5,936,315 |

| Non-current assets: | |||

| Accounts receivable and contract assets, net-noncurrent | 146,995 | 34,954 | 4,981 |

| Financial assets receivable, net-noncurrent | 596,330 | 193,252 | 27,538 |

| Amounts due from related parties | 4,240 | 106 | 15 |

| Loans receivable, net-noncurrent | 2,898,005 | 2,743,839 | 390,994 |

| Property and equipment, net | 231,221 | 331,200 | 47,196 |

| Land use rights, net | 977,461 | 961,919 | 137,072 |

| Intangible assets | 13,443 | 11,828 | 1,685 |

| Goodwill | 41,210 | 42,368 | 6,037 |

| Deferred tax assets | 1,067,738 | 964,505 | 137,441 |

| Other non-current assets | 45,901 | 45,852 | 6,534 |

| Total non-current assets | 6,022,544 | 5,329,823 | 759,493 |

| TOTAL ASSETS | 45,818,572 | 46,988,515 | 6,695,808 |

| LIABILITIES AND EQUITY | |||

| Current liabilities: | |||

| Payable to investors of the consolidated trusts-current | 8,942,291 | 7,643,597 | 1,089,204 |

| Accrued expenses and other current liabilities | 2,016,039 | 2,678,610 | 381,699 |

| Amounts due to related parties | 80,376 | 38,780 | 5,526 |

| Short term loans | 798,586 | 1,043,404 | 148,684 |

| Guarantee liabilities-stand ready | 3,949,601 | 2,266,859 | 323,025 |

| Guarantee liabilities-contingent | 3,207,264 | 1,654,924 | 235,825 |

| Income tax payable | 742,210 | 839,403 | 119,614 |

| Other tax payable | 163,252 | 93,753 | 13,360 |

| Total current liabilities | 19,899,619 | 16,259,330 | 2,316,937 |

| Non-current liabilities: | |||

| Deferred tax liabilities | 224,823 | 503,675 | 71,773 |

| Payable to investors of the consolidated trusts-noncurrent | 3,581,800 | 7,093,800 | 1,010,858 |

| Other long-term liabilities | 102,473 | 232,290 | 33,101 |

| Total non-current liabilities | 3,909,096 | 7,829,765 | 1,115,732 |

| TOTAL LIABILITIES | 23,808,715 | 24,089,095 | 3,432,669 |

| TOTAL QIFU TECHNOLOGY INC EQUITY | 21,937,483 | 22,839,274 | 3,254,568 |

| Noncontrolling interests | 72,374 | 60,146 | 8,571 |

| TOTAL EQUITY | 22,009,857 | 22,899,420 | 3,263,139 |

| TOTAL LIABILITIES AND EQUITY | 45,818,572 | 46,988,515 | 6,695,808 |

| Unaudited Condensed Consolidated Statements of Operations (Amounts in thousands of Renminbi (“RMB”) and U.S. dollars (“USD”) except for number of shares and per share data, or otherwise noted) |

|||||||||||||

| Three months ended September 30, | Nine months ended September 30, | ||||||||||||

| 2023 | 2024 | 2024 | 2023 | 2024 | 2024 | ||||||||

| RMB | RMB | USD | RMB | RMB | USD | ||||||||

| Credit driven services | 3,070,969 | 2,901,040 | 413,396 | 8,490,297 | 8,829,527 | 1,258,197 | |||||||

| Loan facilitation and servicing fees-capital heavy | 479,248 | 258,717 | 36,867 | 1,185,924 | 653,556 | 93,131 | |||||||

| Financing income | 1,369,855 | 1,744,075 | 248,529 | 3,624,475 | 4,969,171 | 708,101 | |||||||

| Revenue from releasing of guarantee liabilities | 1,165,737 | 794,586 | 113,228 | 3,534,111 | 2,933,190 | 417,976 | |||||||

| Other services fees | 56,129 | 103,662 | 14,772 | 145,787 | 273,610 | 38,989 | |||||||

| Platform services | 1,210,057 | 1,469,118 | 209,348 | 3,304,227 | 3,853,877 | 549,173 | |||||||

| Loan facilitation and servicing fees-capital light | 863,860 | 574,615 | 81,882 | 2,516,970 | 1,601,735 | 228,245 | |||||||

| Referral services fees | 234,190 | 763,115 | 108,743 | 503,530 | 1,935,430 | 275,797 | |||||||

| Other services fees | 112,007 | 131,388 | 18,723 | 283,727 | 316,712 | 45,131 | |||||||

| Total net revenue | 4,281,026 | 4,370,158 | 622,744 | 11,794,524 | 12,683,404 | 1,807,370 | |||||||

| Facilitation, origination and servicing | 639,795 | 707,859 | 100,869 | 1,928,125 | 2,166,045 | 308,659 | |||||||

| Funding costs | 160,181 | 146,829 | 20,923 | 484,429 | 464,094 | 66,133 | |||||||

| Sales and marketing | 529,632 | 419,936 | 59,840 | 1,388,295 | 1,201,941 | 171,275 | |||||||

| General and administrative | 95,393 | 91,975 | 13,106 | 313,039 | 293,444 | 41,815 | |||||||

| Provision for loans receivable | 508,990 | 477,541 | 68,049 | 1,511,160 | 2,174,970 | 309,931 | |||||||

| Provision for financial assets receivable | 86,875 | 64,437 | 9,182 | 237,892 | 233,606 | 33,289 | |||||||

| Provision for accounts receivable and contract assets | 39,724 | 108,792 | 15,503 | 84,694 | 344,031 | 49,024 | |||||||

| Provision for contingent liabilities | 831,563 | 63,635 | 9,068 | 2,269,487 | 167,032 | 23,802 | |||||||

| Total operating costs and expenses | 2,892,153 | 2,081,004 | 296,540 | 8,217,121 | 7,045,163 | 1,003,928 | |||||||

| Income from operations | 1,388,873 | 2,289,154 | 326,204 | 3,577,403 | 5,638,241 | 803,442 | |||||||

| Interest income, net | 49,713 | 66,019 | 9,408 | 170,337 | 162,064 | 23,094 | |||||||

| Foreign exchange (loss) gain | (659 | ) | (1,410 | ) | (201 | ) | 3,171 | (1,168 | ) | (166 | ) | ||

| Other income, net | 40,175 | 3,178 | 453 | 225,727 | 160,576 | 22,882 | |||||||

| Investment loss | – | – | – | (30,112 | ) | – | – | ||||||

| Income before income tax expense | 1,478,102 | 2,356,941 | 335,864 | 3,946,526 | 5,959,713 | 849,252 | |||||||

| Income taxes expense | (340,412 | ) | (558,144 | ) | (79,535 | ) | (785,637 | ) | (1,624,264 | ) | (231,456 | ) | |

| Net income | 1,137,690 | 1,798,797 | 256,329 | 3,160,889 | 4,335,449 | 617,796 | |||||||

| Net loss attributable to noncontrolling interests | 4,357 | 4,065 | 579 | 12,707 | 12,228 | 1,742 | |||||||

| Net income attributable to ordinary shareholders of the Company | 1,142,047 | 1,802,862 | 256,908 | 3,173,596 | 4,347,677 | 619,538 | |||||||

| Net income per ordinary share attributable to ordinary shareholders of Qifu Technology, Inc. | |||||||||||||

| Basic | 3.56 | 6.20 | 0.88 | 9.85 | 14.39 | 2.05 | |||||||

| Diluted | 3.47 | 6.09 | 0.87 | 9.61 | 14.11 | 2.01 | |||||||

| Net income per ADS attributable to ordinary shareholders of Qifu Technology, Inc. | |||||||||||||

| Basic | 7.12 | 12.40 | 1.76 | 19.70 | 28.78 | 4.10 | |||||||

| Diluted | 6.94 | 12.18 | 1.74 | 19.22 | 28.22 | 4.02 | |||||||

| Weighted average shares used in calculating net income per ordinary share | |||||||||||||

| Basic | 320,789,494 | 290,601,938 | 290,601,938 | 322,240,695 | 302,088,098 | 302,088,098 | |||||||

| Diluted | 329,220,827 | 296,205,651 | 296,205,651 | 330,391,888 | 308,157,887 | 308,157,887 | |||||||

| Unaudited Condensed Consolidated Statements of Cash Flows (Amounts in thousands of Renminbi (“RMB”) and U.S. dollars (“USD”) except for number of shares and per share data, or otherwise noted) |

|||||||||||||

| Three months ended September 30, | Nine months ended September 30, | ||||||||||||

| 2023 | 2024 | 2024 | 2023 | 2024 | 2024 | ||||||||

| RMB | RMB | USD | RMB | RMB | USD | ||||||||

| Net cash provided by operating activities | 1,243,893 | 2,371,822 | 337,982 | 4,766,559 | 6,291,705 | 896,561 | |||||||

| Net cash used in investing activities | (2,260,922 | ) | (2,929,892 | ) | (417,506 | ) | (9,262,095 | ) | (7,048,470 | ) | (1,004,399 | ) | |

| Net cash provided by (used in) financing activities | 702,952 | (1,248,749 | ) | (177,945 | ) | 1,978,079 | (240,947 | ) | (34,335 | ) | |||

| Effect of foreign exchange rate changes | 4,934 | (23,638 | ) | (3,368 | ) | 10,492 | (19,428 | ) | (2,767 | ) | |||

| Net decrease in cash and cash equivalents | (309,143 | ) | (1,830,457 | ) | (260,837 | ) | (2,506,965 | ) | (1,017,140 | ) | (144,940 | ) | |

| Cash, cash equivalents, and restricted cash, beginning of period | 8,314,541 | 8,372,314 | 1,193,045 | 10,512,363 | 7,558,997 | 1,077,148 | |||||||

| Cash, cash equivalents, and restricted cash, end of period | 8,005,398 | 6,541,857 | 932,208 | 8,005,398 | 6,541,857 | 932,208 | |||||||

| Unaudited Condensed Consolidated Statements of Comprehensive (Loss)/Income (Amounts in thousands of Renminbi (“RMB”) and U.S. dollars (“USD”) except for number of shares and per share data, or otherwise noted) |

|||||

| Three months ended September 30, | |||||

| 2023 | 2024 | 2024 | |||

| RMB | RMB | USD | |||

| Net income | 1,137,690 | 1,798,797 | 256,329 | ||

| Other comprehensive income, net of tax of nil: | |||||

| Foreign currency translation adjustment | 4,051 | (102,976 | ) | (14,674 | ) |

| Other comprehensive income (loss) | 4,051 | (102,976 | ) | (14,674 | ) |

| Total comprehensive income | 1,141,741 | 1,695,821 | 241,655 | ||

| Comprehensive loss attributable to noncontrolling interests | 4,357 | 4,065 | 579 | ||

| Comprehensive income attributable to ordinary shareholders | 1,146,098 | 1,699,886 | 242,234 | ||

| Nine months ended September 30, | |||||

| 2023 | 2024 | 2024 | |||

| RMB | RMB | USD | |||

| Net income | 3,160,889 | 4,335,449 | 617,796 | ||

| Other comprehensive income, net of tax of nil: | |||||

| Foreign currency translation adjustment | 20,724 | (99,076 | ) | (14,118 | ) |

| Other comprehensive income (loss) | 20,724 | (99,076 | ) | (14,118 | ) |

| Total comprehensive income | 3,181,613 | 4,236,373 | 603,678 | ||

| Comprehensive loss attributable to noncontrolling interests | 12,707 | 12,228 | 1,742 | ||

| Comprehensive income attributable to ordinary shareholders | 3,194,320 | 4,248,601 | 605,420 | ||

| Unaudited Reconciliations of GAAP and Non-GAAP Results (Amounts in thousands of Renminbi (“RMB”) and U.S. dollars (“USD”) except for number of shares and per share data, or otherwise noted) |

|||||

| Three months ended September 30, | |||||

| 2023 | 2024 | 2024 | |||

| RMB | RMB | USD | |||

| Reconciliation of Non-GAAP Net Income to Net Income | |||||

| Net income | 1,137,690 | 1,798,797 | 256,329 | ||

| Add: Share-based compensation expenses | 43,289 | 26,339 | 3,753 | ||

| Non-GAAP net income | 1,180,979 | 1,825,136 | 260,082 | ||

| GAAP net income margin | 26.6 | % | 41.2 | % | |

| Non-GAAP net income margin | 27.6 | % | 41.8 | % | |

| Net income attributable to shareholders of Qifu Technology, Inc. | 1,142,047 | 1,802,862 | 256,908 | ||

| Add: Share-based compensation expenses | 43,289 | 26,339 | 3,753 | ||

| Non-GAAP net income attributable to shareholders of Qifu Technology, Inc. | 1,185,336 | 1,829,201 | 260,661 | ||

| Weighted average ADS used in calculating net income per ordinary share for both GAAP and non-GAAP EPS – diluted | 164,610,414 | 148,102,826 | 148,102,826 | ||

| Net income per ADS attributable to ordinary shareholders of Qifu Technology, Inc. – diluted | 6.94 | 12.18 | 1.74 | ||

| Non-GAAP net income per ADS attributable to ordinary shareholders of Qifu Technology, Inc. – diluted | 7.20 | 12.35 | 1.76 | ||

| Reconciliation of Non-GAAP Income from operations to Income from operations | |||||

| Income from operations | 1,388,873 | 2,289,154 | 326,204 | ||

| Add: Share-based compensation expenses | 43,289 | 26,339 | 3,753 | ||

| Non-GAAP Income from operations | 1,432,162 | 2,315,493 | 329,957 | ||

| GAAP operating margin | 32.4 | % | 52.4 | % | |

| Non-GAAP operating margin | 33.5 | % | 53.0 | % | |

| Nine months ended September 30, | |||||

| 2023 | 2024 | 2024 | |||

| RMB | RMB | USD | |||

| Reconciliation of Non-GAAP Net Income to Net Income | |||||

| Net income | 3,160,889 | 4,335,449 | 617,796 | ||

| Add: Share-based compensation expenses | 143,032 | 107,893 | 15,375 | ||

| Non-GAAP net income | 3,303,921 | 4,443,342 | 633,171 | ||

| GAAP net income margin | 26.8 | % | 34.2 | % | |

| Non-GAAP net income margin | 28.0 | % | 35.0 | % | |

| Net income attributable to shareholders of Qifu Technology, Inc. | 3,173,596 | 4,347,677 | 619,538 | ||

| Add: Share-based compensation expenses | 143,032 | 107,893 | 15,375 | ||

| Non-GAAP net income attributable to shareholders of Qifu Technology, Inc. | 3,316,628 | 4,455,570 | 634,913 | ||

| Weighted average ADS used in calculating net income per ordinary share for both GAAP and non-GAAP EPS – diluted | 165,195,944 | 154,078,944 | 154,078,944 | ||

| Net income per ADS attributable to ordinary shareholders of Qifu Technology, Inc. – diluted | 19.22 | 28.22 | 4.02 | ||

| Non-GAAP net income per ADS attributable to ordinary shareholders of Qifu Technology, Inc. – diluted | 20.08 | 28.92 | 4.12 | ||

| Reconciliation of Non-GAAP Income from operations to Income from operations | |||||

| Income from operations | 3,577,403 | 5,638,241 | 803,442 | ||

| Add: Share-based compensation expenses | 143,032 | 107,893 | 15,375 | ||

| Non-GAAP Income from operations | 3,720,435 | 5,746,134 | 818,817 | ||

| GAAP operating margin | 30.3 | % | 44.5 | % | |

| Non-GAAP operating margin | 31.5 | % | 45.3 | % | |

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Duos Technologies Group Reports Improved Third Quarter 2024 Results

JACKSONVILLE, Fla., Nov. 19, 2024 (GLOBE NEWSWIRE) — Duos Technologies Group, Inc. (“Duos” or the “Company”) DUOT, reported financial results for the third quarter (“Q3 2024”) ended September 30, 2024.

Third Quarter 2024 and Recent Operational Highlights

- Delivered and installed Edge Data Center for Amtrak at the Secaucus location. Construction work continues at the site. Received more than $1.4 million in contract modifications at Amtrak including renewal of the subscription utilizing three portals for long-distance passenger trains. Initial discussions for future sites in progress.

- Expanded investment in new subsidiary, “Duos Edge AI” with the addition of three new EDCs for a total of six units. Expecting continuous delivery to field in Q4 and Q1 and with initial customer indications of approximately $3.3 million in annual recurring revenue for 2025.

- New subsidiary, “Duos Energy Corporation“, secured initial revenues during the quarter of approximately $500,000 for consulting services to a large private equity group related to the evaluation of power generation assets with additional services expected in Q4. Using our existing in-house expertise to support the massive demand for AI, Edge computing, and 5G rollout this new subsidiary is aligned with our strategy to be an important part of the growth in data centers.

- Over 2.3 million comprehensive railcar scans were performed in the third quarter across 13 portals, with more than 379,000 unique railcars scanned. This metric encompasses all railcars scanned at locations across the U.S., Canada, and Mexico, representing approximately 24% of the total freight car population in North America.

- As of the end of the third quarter, the Company now has $18.8 million of revenue in backlog including near-term extensions. In addition, the Company received a cash exercise of approximately $900,000 for all remaining warrants and the Company now has no warrants outstanding.

Third Quarter 2024 Financial Results

It should be noted that the following Financial Results represent the consolidation of the Company with its subsidiaries Duos Technologies, Inc., Duos Edge AI, Inc., and Duos Energy Corporation.

Total revenues for Q3 2024 increased 112% to $3.24 million compared to $1.53 million in the third quarter of 2023 (“Q3 2023”). Total revenue for Q3 2024 represents an aggregate of approximately $1,685,000 of technology systems revenue and approximately $1,550,000 in recurring services and consulting revenue. The increase in overall revenues is primarily attributed to a $1.4 million contract modification associated with our two high-speed Railcar Inspection Portals project, which was awarded and largely recognized as revenue during Q3 2024. There was an 88% increase in recurring services and consulting revenue for the same comparison period as a result of new AI and subscription customers that were not present in the same quarter last year as well as increases in service contract revenue due to higher service contract prices. The Company also generated $505,982 in services and consulting revenue from power consulting work, which was new to this quarter.

Cost of revenues for Q3 2024 increased 78% to $2.32 million compared to $1.30 million for Q3 2023. The increase in cost of revenues was driven by $473,069 in amortization expenses recorded in 2024 to offset site revenue related to a nonmonetary transaction for the new services and data agreement signed during the second quarter of 2024. The Company also generated $505,982 in services and consulting revenue from power consulting work, which was provided at cost, further increasing the cost of revenue for services and consulting, which was also not present in the corresponding period of 2023.

Gross margin for Q3 2024 increased 306% to $919,000 compared to $226,000 for Q3 2023. The increase in margin was primarily due to the awarded change order, associated with our two high-speed, transit-focused Railcar Inspection Portals, that was awarded and substantially recognized in Q3 2024. This was offset by $505,982 in services and consulting revenue from power consulting work, which was largely provided at cost, which had a onetime dilutive effect on gross margin. These same project revenues and subsequent margin impacts were absent during the third quarter of 2023.

Operating expenses for Q3 2024 decreased 11% to $2.84 million compared to $3.20 million for Q3 2023. The decrease in expenses is attributed to reductions in development and administrative costs due to the completion of certain activities and the impact of previously implemented cost reductions. Stable operating expenses are expected for the remainder of 2024 while we continue to focus on further efficiencies to support anticipated revenue growth. The decrease in operating expenses is slightly offset by additional investments in sales resources for expansion of the commercial team that was made in the latter half of 2023. The Company implemented a 5% reduction in staff in early Q3 2024. Beginning in late Q3 2024, the Company allocated personnel costs, typically recorded under operating expenses, to costs of revenue associated with power consulting efforts, allowing the Company to recover costs that it would not have otherwise.

Net operating loss for Q3 2024 totaled $1.92 million compared to net operating loss of $2.97 million for Q3 2023. Operating losses were lower than the comparative quarter of a year ago. The decrease in loss from operations was primarily the result of higher revenues recorded in the quarter related to the two high-speed RIPs for a passenger transit client accompanied by a planned reduction in expenses which resulted in an overall decrease in operating loss compared to the same quarter in 2023.

Net loss for Q3 2024 totaled $1.40 million compared to net loss of $2.95 million for Q3 2023. The 53% decrease in net loss was mostly attributed to the increase in revenues as described above as well remaining successful in driving down operating costs, a trend which is expected to continue.

Cash and cash equivalents at September 30, 2024 totaled $0.65 million compared to $2.44 million at December 31, 2023. In addition, the Company had over $2.21 million in receivables and contract assets for a total of approximately $2.86 million in cash and expected short-term liquidity.

Nine Month 2024 Financial Results

Total revenue decreased 2% to $5.82 million from $5.95 million in the same period last year. Total revenue for the first nine months of 2024 represents an aggregate of approximately $2.22 million of technology systems revenue and approximately $3.60 million in recurring services and consulting revenue. An increase in recurring revenues by 42% was offset by the decrease in technology systems revenue. The decrease in technology systems revenue is primarily attributed to delays outside of the Company’s control with deployment of our two high-speed Railcar Inspection Portals. The Company was able to contract a change order related to our two high-speed Railcar Inspection Portals project in the third quarter of 2024. This adjustment added more than $1.4 million to the contract’s total value, with a substantial portion recognized in Q3 of 2024. The increase in the services portion of our revenues stems from the addition of new AI and subscription customers that were not present in the same quarter. Last year as well as increases in service contract revenue due to higher service contract prices. We also generated $505,982 in services and consulting revenue from power consulting work, which was new to this quarter.

Cost of revenues increased 2% to $5.02 million from $4.94 million in the same period last year. The increase in cost of revenues was driven by $1,021,190 in amortization expenses recorded in 2024 to offset site revenue related to a nonmonetary transaction for the new services and data agreement signed during the second quarter of 2024. The Company also generated $505,982 in services and consulting revenue from power consulting work, which was provided at cost, further increasing the cost of revenue for services and consulting, which was also not present in the corresponding period of 2023.

Gross margin decreased 21% to $799,000 from $1,005,000 in the same period last year. The decrease in gross margin was a direct result of the timing of business activity related to the manufacturing of two high-speed, transit-focused Railcar Inspection Portals. The revenues from the aforementioned project and subsequent margin impacts were not present during the first and second quarters of 2024. The Company also generated $505,982 in services and consulting revenue from power consulting work, which was provided largely at cost, having a dilutive effect on the overall gross margin. These same project revenues and subsequent margin contributions were absent during the third quarter of 2023.

Operating expenses decreased 6% to $8.70 million from $9.27 million in the same period last year. The Company experienced a slight decrease in overall operating expenses due to reductions in development costs and a decrease in administrative costs, primarily from a reduction in workforce which began in Q3. However, this was partially offset by an increase in sales and marketing expenses, driven by the continued expansion of our commercial team for the new subsidiaries which began in the latter half of 2023 as we prepare to enter new markets. Beginning in late Q3 2024, the Company allocated personnel costs, typically recorded under operating expenses, to costs of revenue associated with power consulting efforts, allowing the Company to recover costs that it would not have otherwise offsetting the impact of certain low margin revenues.

Net operating loss totaled $7.90 million compared to net operating loss of $8.27 million in the same period last year. The decrease in loss from operations was primarily the result of planned decreases in operating expenses, which offset the impact of lower revenues recorded in the period as a consequence of delays in going to field for the two high-speed RIPs for a passenger transit client.

Net loss totaled $7.36 million compared to a net loss of $8.08 million in the same period last year. The decrease in net loss was mostly attributable to the slight decrease in revenues as previously noted above, partially offset by the increase in services and consulting revenue and decrease in operating expenses.

Financial Outlook

At the end of the third quarter, the Company’s contracts in backlog and near-term renewals and extensions are now more than $18.8 million in revenue, of which approximately at least $1.6 million is expected to be recognized during the remainder of 2024. The balance of contract backlog is comprised of multi-year service and software agreements as well as project revenues. It should be noted that $10.0 million of the revenue in backlog is for data access to support the new subscription business and is accounted for as a “non-monetary exchange” that resulted from an amendment to a Master Material and Service Purchase Agreement with a Class 1 railroad. Any new subscription business going forward will be offset by royalty payments by Duos.

The agreement gives Duos the rights to use and resell all data acquired by seven portals owned by the Class I railroad. The initial decrease in cash receivables is expected to be offset from revenues for data subscriptions to owners and lessors of railcar assets for the provision of mechanical and safety data and longer-term provide an expected growing, high-margin, revenue stream from subscribers.

Duos anticipates an improvement in operating results to be reflected over the next 12 months as a result of the new initiatives described in this release and the Company will provide further updates as they become available.

Management Commentary

“The Company has made significant progress this year particularly in the establishment of new businesses and related market opportunities,” said Chuck Ferry, Duos CEO. “I will be discussing more on these expansions in our upcoming earnings call but while the improved results this quarter are encouraging. I am particularly pleased with the progress of our Duos Edge AI subsidiary which continues to make inroads to that market. I expect that Duos will be delivering much higher growth, particularly in 2025 and beyond.”

Conference Call

The Company’s management will host a conference call tomorrow, November 20, 2024, at 4:00 p.m. Eastern time (1:00 p.m. Pacific time) to discuss these results, followed by a question-and-answer period.

Date: Wednesday, November 20, 2024

Time: 4:00 p.m. Eastern time (1:00 p.m. Pacific time)

U.S. dial-in: 877-407-3088

International dial-in: 201-389-0927

Confirmation: 13749773

Please call the conference telephone number 5-10 minutes prior to the start time of the conference call. An operator will register your name and organization.

If you have any difficulty connecting with the conference call, please contact DUOT@duostech.com.

The conference call will be broadcast live via telephone and available for online replay via the investor section of the Company’s website here.

About Duos Technologies Group, Inc.

Duos Technologies Group, Inc. DUOT, based in Jacksonville, Florida, through its wholly owned subsidiaries, Duos Technologies, Inc., Duos Edge AI, Inc., and Duos Energy Corporation, designs, develops, deploys and operates intelligent technology solutions for Machine Vision and Artificial Intelligence (“AI”) applications including real-time analysis of fast-moving vehicles, Edge Data Centers and power consulting. For more information, visit www.duostech.com , www.duosedge.ai and www.duosenergycorp.com.

Forward- Looking Statements

This news release includes forward-looking statements regarding the Company’s financial results and estimates and business prospects that involve substantial risks and uncertainties that could cause actual results to differ materially. Forward-looking statements relate to future events and typically address the Company’s expected future business and financial performance. The forward-looking statements in this news release relate to, among other things, information regarding anticipated timing for the installation, development and delivery dates of our systems; anticipated entry into additional contracts; anticipated effects of macro-economic factors (including effects relating to supply chain disruptions and inflation); timing with respect to revenue recognition; trends in the rate at which our costs increase relative to increases in our revenue; anticipated reductions in costs due to changes in the Company’s organizational structure; potential increases in revenue, including increases in recurring revenue; potential changes in gross margin (including the timing thereof); statements regarding our backlog and potential revenues deriving therefrom; and statements about future profitability and potential growth of the Company. Words such as “believe,” “expect,” “anticipate,” “should,” “plan,” “aim,” “will,” “may,” “should,” “could,” “intend,” “estimate,” “project,” “forecast,” “target,” “potential” and other words and terms of similar meaning, typically identify such forward-looking statements. Forward-looking statements involve risks and uncertainties and there are important factors that could cause actual results to differ materially from those expressed or implied by these forward-looking statements. These factors include, but are not limited to, the Company’s ability to continue as a going concern, the Company’s ability to generate sufficient cash to continue and expand operations, the competitive environment generally and in the Company’s specific market areas, changes in technology, the availability of and the terms of financing, changes in costs and availability of goods and services, economic conditions in general and in the Company’s specific market areas, changes in federal, state and/or local government laws and regulations potentially affecting the use of the Company’s technology, changes in operating strategy or development plans and the ability to attract and retain qualified personnel. The Company cautions that the foregoing list of risks, uncertainties and factors is not exclusive. Additional information concerning these and other risk factors is contained in the Company’s most recently filed Annual Reports on Form 10-K, subsequent Quarterly Reports on Form 10-Q, recent Current Reports on Form 8-K, and other filings filed by the Company with the U.S. Securities and Exchange Commission (the “SEC”), which are available at the SEC’s website, http://www.sec.gov. The Company believes its plans, intentions and expectations reflected in or suggested by these forward-looking statements are based on reasonable assumptions. No assurance, however, can be given that the Company will achieve or realize these plans, intentions or expectations. Indeed, it is likely that some of the Company’s assumptions may prove to be incorrect. The Company’s actual results and financial position may vary from those projected or implied in the forward-looking statements and the variances may be material. Each forward-looking statement speaks only as of the date of the particular statement. We do not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in our expectations or any change in events, conditions or circumstances on which any forward-looking statement is based, except as required by law. All subsequent written and oral forward-looking statements concerning the Company or other matters attributable to the Company or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above.

| DUOS TECHNOLOGIES GROUP, INC. AND SUBSIDIARIES | ||||||||||||||||

| CONSOLIDATED STATEMENTS OF OPERATIONS | ||||||||||||||||

| For the Three Months Ended | For the Three Months Ended | For the Nine Months Ended | For the Nine Months Ended | |||||||||||||

| September 30, | September 30, | September 30, | September 30, | |||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| REVENUES: | ||||||||||||||||

| Technology systems | $ | 1,686,456 | $ | 705,849 | $ | 2,221,310 | $ | 3,404,107 | ||||||||

| Services and consulting | 1,552,454 | 825,074 | 3,598,776 | 2,541,163 | ||||||||||||

| Total Revenues | 3,238,910 | 1,530,923 | 5,820,086 | 5,945,270 | ||||||||||||

| COST OF REVENUES: | ||||||||||||||||

| Technology systems | 947,563 | 883,836 | 2,311,912 | 3,723,151 | ||||||||||||

| Services and consulting | 1,372,248 | 420,499 | 2,709,007 | 1,217,022 | ||||||||||||

| Total Cost of Revenues | 2,319,811 | 1,304,335 | 5,020,919 | 4,940,173 | ||||||||||||

| GROSS MARGIN | 919,099 | 226,588 | 799,167 | 1,005,097 | ||||||||||||

| OPERATING EXPENSES: | ||||||||||||||||

| Sales and marketing | 471,411 | 353,386 | 1,737,353 | 962,040 | ||||||||||||

| Research and development | 396,610 | 450,006 | 1,168,752 | 1,392,692 | ||||||||||||

| General and administration | 1,971,358 | 2,394,173 | 5,790,804 | 6,916,390 | ||||||||||||

| Total Operating Expenses | 2,839,379 | 3,197,565 | 8,696,909 | 9,271,122 | ||||||||||||

| LOSS FROM OPERATIONS | (1,920,280 | ) | (2,970,977 | ) | (7,897,742 | ) | (8,266,025 | ) | ||||||||

| OTHER INCOME (EXPENSES): | ||||||||||||||||

| Interest expense | (116,396 | ) | (1,406 | ) | (117,991 | ) | (5,816 | ) | ||||||||

| Change in fair value of warrant liabilities | 245,980 | – | 245,980 | – | ||||||||||||

| Gain on extinguishment of warrant liabilities | 379,626 | – | 379,626 | – | ||||||||||||

| Other income, net | 9,407 | 24,647 | 31,984 | 191,022 | ||||||||||||

| Total Other Income (Expenses), net | 518,617 | 23,241 | 539,599 | 185,206 | ||||||||||||

| NET LOSS | $ | (1,401,663 | ) | $ | (2,947,736 | ) | $ | (7,358,143 | ) | $ | (8,080,819 | ) | ||||

| Basic and Diluted Net Loss Per Share | $ | (0.18 | ) | $ | (0.41 | ) | $ | (0.98 | ) | $ | (1.12 | ) | ||||

| DUOS TECHNOLOGIES GROUP, INC. AND SUBSIDIARIES | |||||||||

| CONSOLIDATED BALANCE SHEETS | |||||||||

| September 30, | December 31, | ||||||||

| 2024 | 2023 | ||||||||

| (Unaudited) | |||||||||

| ASSETS | |||||||||

| CURRENT ASSETS: | |||||||||

| Cash | $ | 613,594 | $ | 2,441,842 | |||||

| Restricted cash | 32,519 | – | |||||||

| Accounts receivable, net | 1,601,152 | 1,462,463 | |||||||

| Contract assets | 609,008 | 641,947 | |||||||

| Inventory | 1,028,387 | 1,526,165 | |||||||

| Prepaid expenses and other current assets | 310,869 | 184,478 | |||||||

| Note Receivable, net | 159,375 | – | |||||||

| Total Current Assets | 4,354,904 | 6,256,895 | |||||||

| Property and equipment, net | 2,318,233 | 726,507 | |||||||

| Operating lease right of use asset | 4,117,471 | 4,373,155 | |||||||

| Security deposit | 500,000 | 550,000 | |||||||

| OTHER ASSETS: | |||||||||

| Intangible Asset, net | 10,140,238 | – | |||||||

| Note Receivable, net | – | 153,750 | |||||||

| Patents and trademarks, net | 128,793 | 129,140 | |||||||

| Software development costs, net | 465,228 | 652,838 | |||||||

| Total Other Assets | 10,734,259 | 935,728 | |||||||

| Total Assets | $ | 22,024,867 | $ | 12,842,285 | |||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||||

| CURRENT LIABILITIES: | |||||||||

| Accounts payable | $ | 1,727,190 | $ | 595,634 | |||||

| Notes payable – financing agreements | 128,404 | 41,976 | |||||||

| Accrued expenses | 323,593 | 164,113 | |||||||

| Operating lease obligations-current portion | 793,658 | 779,087 | |||||||

| Contract liabilities, current | 2,982,213 | 1,666,243 | |||||||

| Total Current Liabilities | 5,955,058 | 3,247,053 | |||||||

| Contract liabilities, less current portion | 7,947,755 | – | |||||||

| Notes payable | 1,647,995 | – | |||||||

| Operating lease obligations, less current portion | 3,961,590 | 4,228,718 | |||||||

| Total Liabilities | 19,512,398 | 7,475,771 | |||||||

| Commitments and Contingencies (Note 5) | |||||||||

| STOCKHOLDERS’ EQUITY: | |||||||||

| Preferred stock: $0.001 par value, 10,000,000 authorized, 9,441,000 shares available to be designated | |||||||||

| Series A redeemable convertible preferred stock, $10 stated value per share, | – | – | |||||||

| 500,000 shares designated; 0 and 0 issued and outstanding at September 30, 2024 and December 31, 2023, respectively, | |||||||||

| convertible into common stock at $6.30 per share | |||||||||

| Series B convertible preferred stock, $1,000 stated value per share, | – | – | |||||||

| 15,000 shares designated; 0 and 0 issued and outstanding at September 30, 2024 | |||||||||

| and December 31, 2023, respectively, convertible into common stock at $7 per share | |||||||||

| Series C convertible preferred stock, $1,000 stated value per share, | – | – | |||||||

| 5,000 shares designated; 0 and 0 issued | |||||||||

| and outstanding at September 30, 2024 and December 31, 2023, respectively, | |||||||||

| convertible into common stock at $5.50 per share | |||||||||

| Series D convertible preferred stock, $1,000 stated value per share, | 1 | 1 | |||||||

| 4,000 shares designated; 1,399 and 1,299 issued | |||||||||

| and outstanding at September30, 2024 and December 31, 2023, respectively, | |||||||||

| convertible into common stock at $3.00 per share | |||||||||

| Series E convertible preferred stock, $1,000 stated value per share, | |||||||||

| 30,000 shares designated; 13,625 and 11,500 issued | |||||||||

| and outstanding at September 30, 2024 and December 31, 2023, respectively, | 14 | 12 | |||||||

| convertible into common stock at $2.61 and $3.00 per share, respectively | |||||||||

| Series F convertible preferred stock, $1,000 stated value per share, | |||||||||

| 5,000 shares designated; 0 and 0 issued | |||||||||

| and outstanding at September 30, 2024 and December 31, 2023, respectively, | – | – | |||||||

| convertible into common stock at $6.20 per share | |||||||||

| Common stock: $0.001 par value; 500,000,000 shares authorized, | |||||||||

| 8,051,189 and 7,306,663 shares issued, 8,049,865 and 7,305,339 | 8,049 | 7,306 | |||||||

| shares outstanding at September 30, 2024 and December 31, 2023, respectively | |||||||||

| Additional paid-in-capital | 73,623,552 | 69,120,199 | |||||||

| Accumulated deficit | (70,961,695 | ) | (63,603,552 | ) | |||||

| Sub-total | 2,669,921 | 5,523,966 | |||||||

| Less: Treasury stock (1,324 shares of common stock | |||||||||

| at September 30, 2024 and December 31, 2023) | (157,452 | ) | (157,452 | ) | |||||

| Total Stockholders’ Equity | 2,512,469 | 5,366,514 | |||||||

| Total Liabilities and Stockholders’ Equity | $ | 22,024,867 | $ | 12,842,285 | |||||

| DUOS TECHNOLOGIES GROUP, INC. AND SUBSIDIARIES | |||||||

| CONSOLIDATED STATEMENTS OF CASH FLOWS | |||||||

| (Unaudited) | |||||||

| For the Nine Months Ended | |||||||

| September 30, | |||||||

| 2024 | 2023 | ||||||

| Cash from operating activities: | |||||||

| Net loss | $ | (7,358,143 | ) | $ | (8,080,819 | ) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | |||||||

| Depreciation and amortization | 1,472,965 | 393,057 | |||||

| Stock based compensation | 281,405 | 499,590 | |||||

| Stock issued for services | 122,500 | 105,565 | |||||

| Amortization of debt discount related to warrant liability | 73,601 | – | |||||

| Fair value of warrant liabilities | (245,980 | ) | – | ||||

| Gain on settlement of warrant liabilities | (379,626 | ) | – | ||||

| Amortization of operating lease right of use asset | 255,684 | 235,217 | |||||

| Changes in assets and liabilities: | |||||||

| Accounts receivable | (138,689 | ) | 3,159,389 | ||||

| Note receivable | (5,625 | ) | (151,875 | ) | |||

| Contract assets | 32,939 | (921,009 | ) | ||||

| Inventory | 197,777 | (97,552 | ) | ||||

| Security deposit | 50,000 | 50,000 | |||||

| Prepaid expenses and other current assets | 300,271 | 543,793 | |||||

| Accounts payable | 1,131,552 | (1,670,625 | ) | ||||

| Accrued expenses | 159,482 | (178,081 | ) | ||||

| Operating lease obligation | (252,557 | ) | (154,653 | ) | |||

| Contract liabilities | (1,897,703 | ) | 630,931 | ||||

| Net cash used in operating activities | (6,200,147 | ) | (5,637,072 | ) | |||

| Cash flows from investing activities: | |||||||

| Purchase of patents/trademarks | (8,105 | ) | (58,208 | ) | |||

| Purchase of software development | – | (640,609 | ) | ||||

| Purchase of fixed assets | (1,547,439 | ) | (199,618 | ) | |||

| Net cash used in investing activities | (1,555,544 | ) | (898,435 | ) | |||

| Cash flows from financing activities: | |||||||

| Repayments on financing agreements | (340,232 | ) | (395,221 | ) | |||

| Repayment of finance lease | – | (22,851 | ) | ||||

| Proceeds from notes payable | 2,200,000 | – | |||||

| Proceeds from warrant exercises | 899,521 | – | |||||

| Proceeds from common stock issued | 197,011 | – | |||||

| Stock issuance cost | (78,688 | ) | (17,645 | ) | |||

| Proceeds from shares issued under Employee Stock Purchase Plan | 87,348 | 117,048 | |||||

| Proceeds from preferred stock issued | 2,995,002 | 9,000,000 | |||||

| Net cash provided by financing activities | 5,959,962 | 8,681,331 | |||||

| Net increase (decrease) in cash | (1,795,729 | ) | 2,145,824 | ||||

| Cash, beginning of period | 2,441,842 | 1,121,092 | |||||

| Cash, end of period | $ | 646,113 | $ | 3,266,916 | |||

| Supplemental Disclosure of Cash Flow Information: | |||||||

| Interest paid | $ | 1,596 | $ | 5,816 | |||

| Taxes paid | $ | 5,432 | $ | – | |||

| Supplemental Non-Cash Investing and Financing Activities: | |||||||

| Debt discount for warrant liability | $ | 625,606 | $ | – | |||

| Notes issued for financing of insurance premiums | $ | 426,661 | $ | 458,452 | |||

| Transfer of inventory to fixed assets | $ | 300,000 | $ | – | |||

| Intangible asset acquired with contract liability | $ | 11,161,428 | $ | – | |||

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/1cb594bc-763f-4fc8-9a8c-03313c278d6a

This press release was published by a CLEAR® Verified individual.

Contacts

Corporate

Fei Kwong, Director, Corporate Communications

Duos Technologies Group, Inc. DUOT

904-652-1625

fk@duostech.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Unpacking the Latest Options Trading Trends in Moderna

Whales with a lot of money to spend have taken a noticeably bearish stance on Moderna.

Looking at options history for Moderna MRNA we detected 37 trades.

If we consider the specifics of each trade, it is accurate to state that 32% of the investors opened trades with bullish expectations and 59% with bearish.

From the overall spotted trades, 19 are puts, for a total amount of $1,152,330 and 18, calls, for a total amount of $1,026,287.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $30.0 to $300.0 for Moderna over the recent three months.

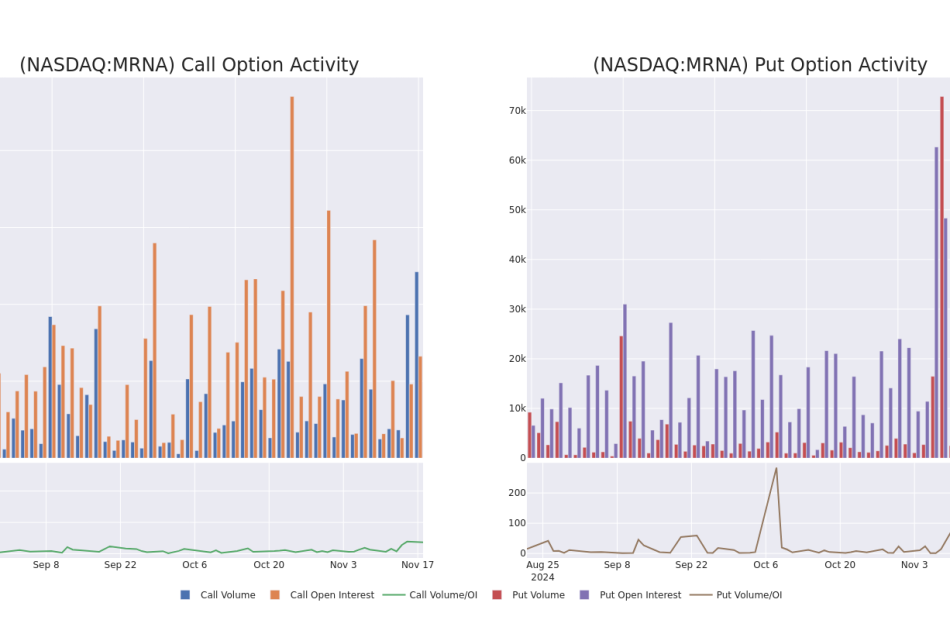

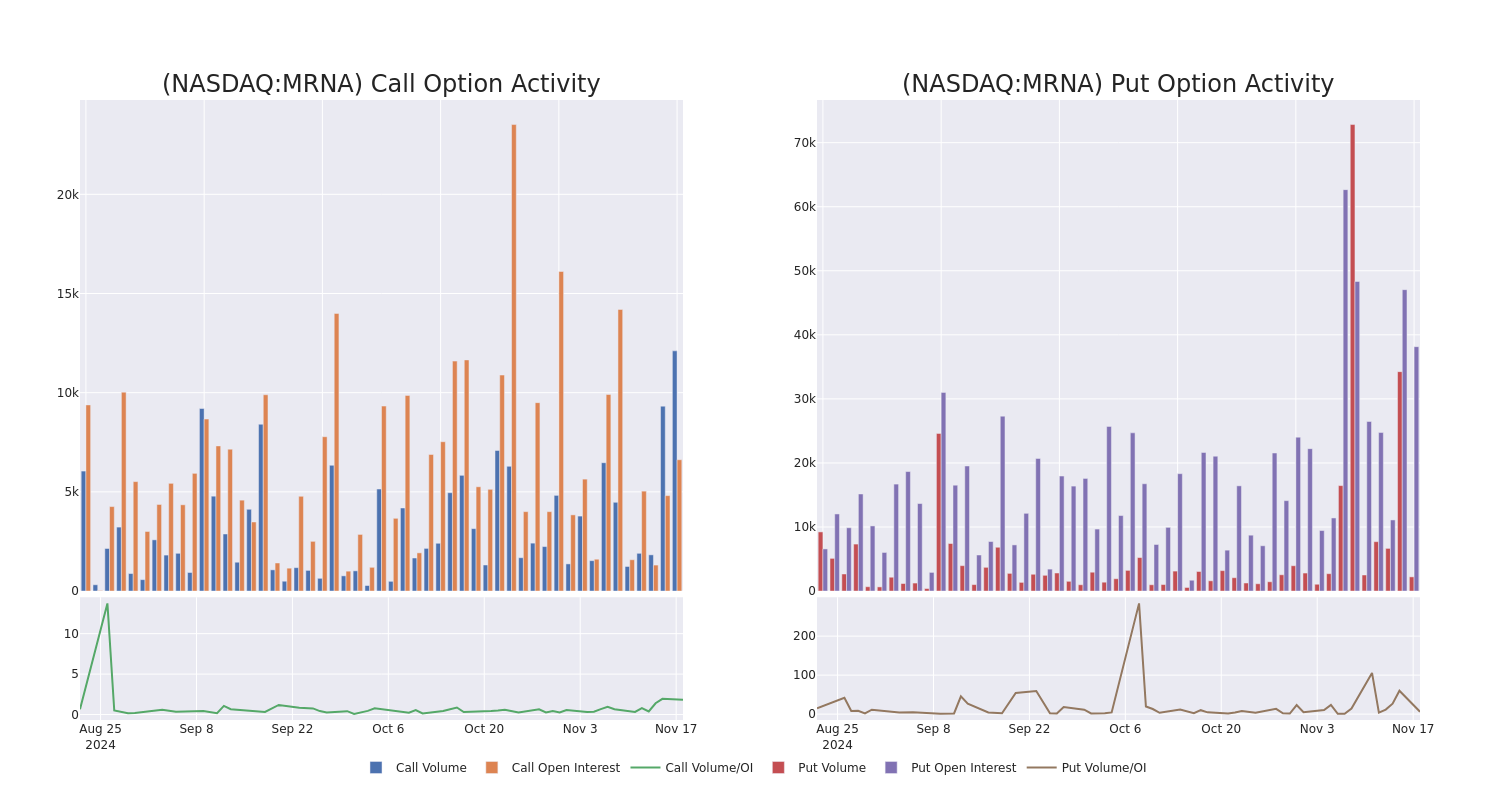

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Moderna’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Moderna’s significant trades, within a strike price range of $30.0 to $300.0, over the past month.

Moderna Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRNA | CALL | SWEEP | BULLISH | 12/20/24 | $3.5 | $3.35 | $3.35 | $40.00 | $169.5K | 1.3K | 1.0K |

| MRNA | PUT | TRADE | BULLISH | 06/20/25 | $34.95 | $33.8 | $33.8 | $70.00 | $168.9K | 1.0K | 50 |

| MRNA | PUT | SWEEP | BULLISH | 04/17/25 | $24.05 | $24.0 | $24.05 | $60.00 | $137.0K | 1.1K | 59 |

| MRNA | CALL | SWEEP | BEARISH | 04/17/25 | $6.3 | $6.2 | $6.21 | $45.00 | $124.0K | 733 | 389 |

| MRNA | CALL | SWEEP | BULLISH | 12/20/24 | $3.35 | $3.3 | $3.3 | $40.00 | $113.1K | 1.3K | 344 |

About Moderna

Moderna is a commercial-stage biotech that was founded in 2010 and had its initial public offering in December 2018. The firm’s mRNA technology was rapidly validated with its covid vaccine, which was authorized in the United States in December 2020. Moderna had 40 mRNA development candidates in clinical development as of September 2024. Programs span a wide range of therapeutic areas, including infectious disease, oncology, cardiovascular disease, and rare genetic diseases.

Having examined the options trading patterns of Moderna, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Moderna

- Trading volume stands at 5,807,278, with MRNA’s price down by -4.83%, positioned at $37.6.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 93 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Moderna, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Surgical Sutures Market Report: Key Insights and Projections | Exactitude Consultancy

Luton, Bedfordshire, United Kingdom, Nov. 19, 2024 (GLOBE NEWSWIRE) — The surgical suture market is experiencing robust growth, driven by multiple factors. Increasing incidences of chronic diseases, coupled with a rise in the global volume of surgical procedures, are key contributors to this market expansion. Furthermore, the growing adoption of minimally invasive surgical techniques is fueling demand for specialized sutures designed to ensure effective healing and reduced recovery times. As a result, there is a rising demand for innovative sutures that can cater to the evolving needs of modern surgical practices.

Access PDF Sample Report (Including Graphs, Charts & Figures) @

https://exactitudeconsultancy.com/reports/2393/surgical-sutures-market/#request-a-sample

Emerging economies, particularly in Asia-Pacific and Latin America, are playing an increasingly significant role in the market’s expansion due to the development of healthcare infrastructure and an increasing focus on quality healthcare services. This is further compounded by the growing awareness among healthcare professionals regarding the importance of using high-quality sutures to prevent post-surgical complications and improve patient outcomes.

Technological advancements in suture materials, such as bioabsorbable sutures, are driving innovation, while demographic trends, including an aging population, are expected to create sustained demand. As healthcare systems in developing regions continue to modernize and adopt higher standards, the surgical suture market is projected to grow at a compound annual growth rate (CAGR) of approximately 6-8% over the next five years.