Unpacking the Latest Options Trading Trends in Moderna

Whales with a lot of money to spend have taken a noticeably bearish stance on Moderna.

Looking at options history for Moderna MRNA we detected 37 trades.

If we consider the specifics of each trade, it is accurate to state that 32% of the investors opened trades with bullish expectations and 59% with bearish.

From the overall spotted trades, 19 are puts, for a total amount of $1,152,330 and 18, calls, for a total amount of $1,026,287.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $30.0 to $300.0 for Moderna over the recent three months.

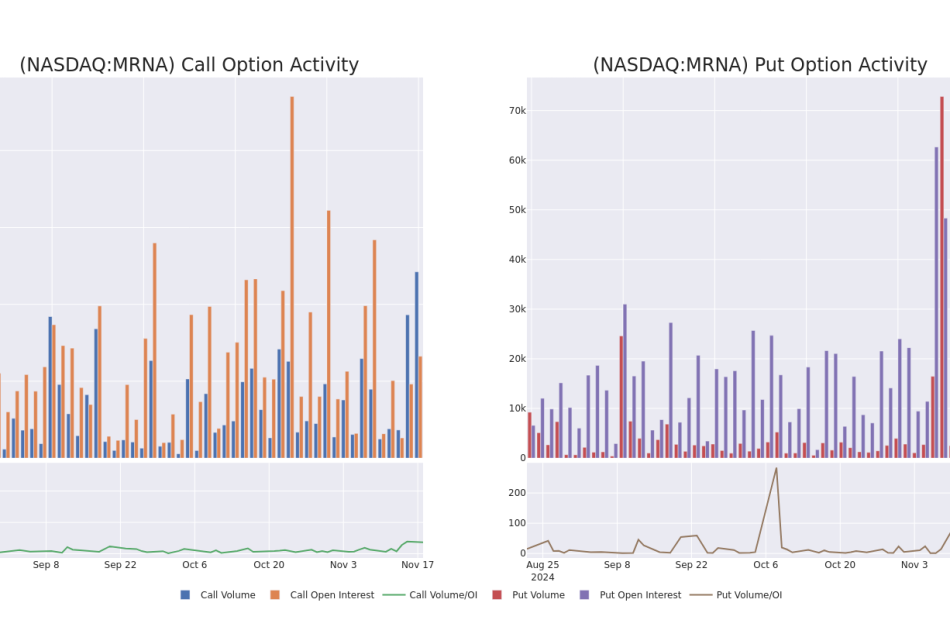

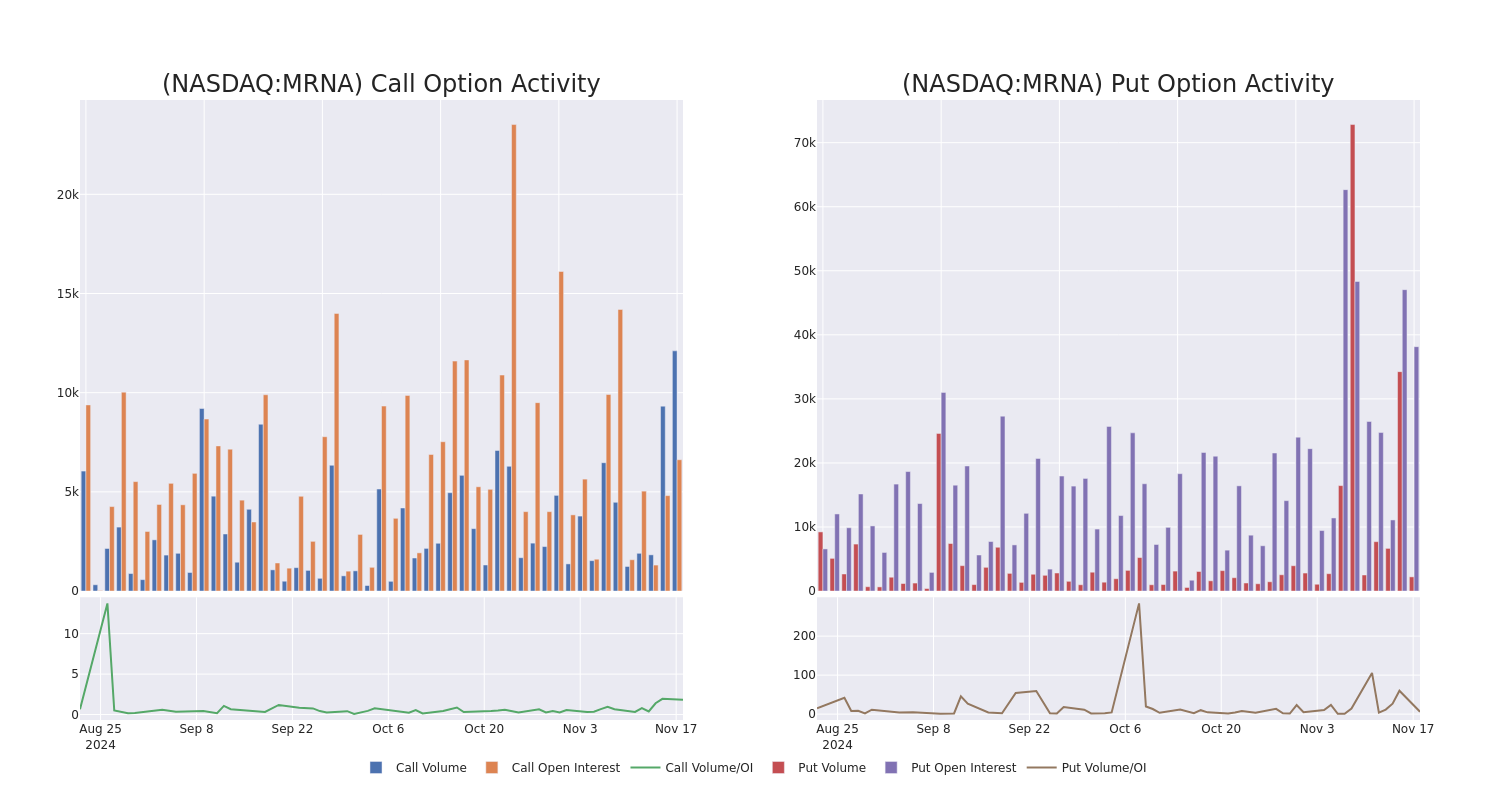

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Moderna’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Moderna’s significant trades, within a strike price range of $30.0 to $300.0, over the past month.

Moderna Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRNA | CALL | SWEEP | BULLISH | 12/20/24 | $3.5 | $3.35 | $3.35 | $40.00 | $169.5K | 1.3K | 1.0K |

| MRNA | PUT | TRADE | BULLISH | 06/20/25 | $34.95 | $33.8 | $33.8 | $70.00 | $168.9K | 1.0K | 50 |

| MRNA | PUT | SWEEP | BULLISH | 04/17/25 | $24.05 | $24.0 | $24.05 | $60.00 | $137.0K | 1.1K | 59 |

| MRNA | CALL | SWEEP | BEARISH | 04/17/25 | $6.3 | $6.2 | $6.21 | $45.00 | $124.0K | 733 | 389 |

| MRNA | CALL | SWEEP | BULLISH | 12/20/24 | $3.35 | $3.3 | $3.3 | $40.00 | $113.1K | 1.3K | 344 |

About Moderna

Moderna is a commercial-stage biotech that was founded in 2010 and had its initial public offering in December 2018. The firm’s mRNA technology was rapidly validated with its covid vaccine, which was authorized in the United States in December 2020. Moderna had 40 mRNA development candidates in clinical development as of September 2024. Programs span a wide range of therapeutic areas, including infectious disease, oncology, cardiovascular disease, and rare genetic diseases.

Having examined the options trading patterns of Moderna, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Moderna

- Trading volume stands at 5,807,278, with MRNA’s price down by -4.83%, positioned at $37.6.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 93 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Moderna, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Surgical Sutures Market Report: Key Insights and Projections | Exactitude Consultancy

Luton, Bedfordshire, United Kingdom, Nov. 19, 2024 (GLOBE NEWSWIRE) — The surgical suture market is experiencing robust growth, driven by multiple factors. Increasing incidences of chronic diseases, coupled with a rise in the global volume of surgical procedures, are key contributors to this market expansion. Furthermore, the growing adoption of minimally invasive surgical techniques is fueling demand for specialized sutures designed to ensure effective healing and reduced recovery times. As a result, there is a rising demand for innovative sutures that can cater to the evolving needs of modern surgical practices.

Access PDF Sample Report (Including Graphs, Charts & Figures) @

https://exactitudeconsultancy.com/reports/2393/surgical-sutures-market/#request-a-sample

Emerging economies, particularly in Asia-Pacific and Latin America, are playing an increasingly significant role in the market’s expansion due to the development of healthcare infrastructure and an increasing focus on quality healthcare services. This is further compounded by the growing awareness among healthcare professionals regarding the importance of using high-quality sutures to prevent post-surgical complications and improve patient outcomes.

Technological advancements in suture materials, such as bioabsorbable sutures, are driving innovation, while demographic trends, including an aging population, are expected to create sustained demand. As healthcare systems in developing regions continue to modernize and adopt higher standards, the surgical suture market is projected to grow at a compound annual growth rate (CAGR) of approximately 6-8% over the next five years.

However, the market also faces certain challenges. Stringent regulatory requirements and the high cost of compliance present barriers to new entrants, particularly in regions with complex regulatory frameworks. Despite these challenges, the overall outlook for the surgical suture market remains positive, with the continued demand for advanced and specialized sutures driving market opportunities.

Overall, advancements in technology, growing healthcare infrastructure in emerging economies, and demographic trends will continue to shape the growth trajectory of the surgical suture market, with expectations for substantial growth over the coming years.

Market Dynamics

Driver: Rising Surgical Procedures and Trauma Cases

The surgical suture market is experiencing substantial growth, largely driven by the increasing prevalence of chronic diseases and the global rise in surgical procedures. With an aging population and a higher incidence of health conditions such as cardiovascular diseases, diabetes, and cancer, the demand for surgical interventions continues to surge. This uptick is driving the need for effective wound closure solutions, with surgical sutures playing a pivotal role in ensuring proper recovery and minimizing complications.

Simultaneously, ongoing advancements in suture technology have revolutionized the field, enabling the development of advanced suture materials that offer enhanced safety, precision, and efficacy. The continuous improvements in suturing techniques, such as bioabsorbable and smart sutures, have expanded the range of available solutions, making them suitable for various surgical specialties. This technological evolution is expected to further propel market growth as healthcare providers increasingly adopt these innovations to improve patient outcomes. Additionally, the global expansion of healthcare infrastructure, particularly in developing regions, has increased access to surgical care, further contributing to the rising demand for sutures.

Restraint: Availability of Alternative Wound Closure Methods

The increasing adoption of alternative wound closure methods poses a challenge to the traditional surgical suture market. Methods such as surgical staples, tissue adhesives, and hemostats have emerged as viable alternatives, each offering specific advantages for particular types of procedures. Surgical staples, known for their quick application and secure closure, are often preferred for abdominal surgeries and skin closures, where speed is essential. Tissue adhesives, which are less invasive and reduce tissue trauma, are increasingly popular in dermatological and cosmetic surgeries, providing aesthetic benefits. Hemostats, used to control bleeding, are becoming more common in delicate surgeries.

The availability of these alternatives means that surgeons have more options to consider when deciding on the most appropriate wound closure technique for their patients. This diversification in wound closure options is reshaping market dynamics, particularly in procedures where traditional sutures were once the primary choice. As a result, the demand for traditional sutures is experiencing downward pressure in specific surgical segments, prompting a reevaluation of their role in modern wound closure practices.

Opportunity: Growth in Low and Middle-Income Countries

A significant growth opportunity exists in low and middle-income countries (LMICs), where the demand for surgical sutures is expanding due to increasing healthcare spending, improving healthcare infrastructure, and the adoption of advanced surgical techniques. As these regions witness a rise in surgical procedures, particularly minimally invasive surgeries (MIS), there is an increasing demand for specialized sutures designed for these procedures.

Furthermore, with growing awareness and access to quality healthcare, there is a noticeable shift towards more affordable and effective wound closure solutions. Technological innovations, such as biodegradable sutures and smart sutures, present further opportunities to address the unique needs of LMICs, where cost-effective solutions are paramount. These regions also face demographic shifts, such as an aging population, which is likely to increase the incidence of surgeries related to age-related conditions, further driving demand for effective wound closure methods.

Challenge: High Market Competition and Pricing Pressures

The surgical suture market is highly competitive, with numerous manufacturers vying for market share. This intense competition has led to pricing pressures, as healthcare providers increasingly seek affordable solutions without compromising on quality. The need to balance product innovation with cost efficiency is a key challenge for companies operating in this space.

Additionally, the presence of alternative wound closure methods has introduced further pricing pressure, forcing traditional suture manufacturers to reevaluate their pricing strategies. Companies are investing in research and development to differentiate their products through innovation, but this comes with its own set of challenges, particularly in terms of maintaining profitability while meeting the demand for cost-effective solutions. This competitive environment compels manufacturers to focus on operational efficiencies, product quality, and customer value to remain competitive and sustain growth in an evolving market landscape.

Report Link Click Here: https://exactitudeconsultancy.com/reports/2393/surgical-sutures-market/

Suture Thread Segment: A Dominant Market Player

The surgical suture thread segment accounted for a significant share of the surgical sutures market in 2022, driven by the essential role these threads play in wound closure. Surgical sutures are indispensable in a variety of procedures, securing incisions and facilitating healing. The increasing adoption of advanced suture materials has further expanded the range of options available to surgeons, allowing for more precise and effective solutions tailored to specific surgical requirements. As a result, suture threads continue to dominate the market, with growing demand attributed to their ability to support wound healing, minimize infection risks, and ensure successful surgical outcomes. By 2028, this segment is expected to maintain a strong position, supported by ongoing innovations in material technology.

Hospitals Segment: Key End-User

Hospitals represented a major share of the surgical sutures market in 2022, reflecting their central role in delivering a wide range of surgical interventions. The high volume of surgeries performed in hospitals, from routine procedures to complex surgeries, drives the demand for surgical sutures. Hospitals are increasingly adopting advanced suture solutions to improve patient outcomes, reduce complications, and optimize recovery times. This trend is further supported by hospitals’ emphasis on using high-quality, specialized sutures that cater to different types of surgical needs. By 2028, the hospitals segment is expected to remain the largest end-user category, driven by the continuous demand for reliable and effective wound closure solutions across various surgical disciplines.

Cardiovascular Surgeries: A Leading Application Area

In 2022, cardiovascular surgeries accounted for the largest share of the surgical sutures market by application, underlining the critical role sutures play in ensuring the success of intricate cardiovascular procedures. These surgeries require sutures with superior tensile strength, minimal tissue reactivity, and the ability to provide secure closure, making them a crucial part of cardiovascular care. The continued advancements in suture technology, including specialized materials designed for cardiovascular use, are anticipated to drive further growth in this segment. As cardiovascular diseases remain a leading cause of mortality worldwide, the demand for surgical sutures in cardiovascular procedures is projected to maintain its prominence through 2028.

North America dominated the Surgical Sutures Industry in 2022.

In 2022, North America led the surgical sutures market, holding a significant share due to its advanced healthcare infrastructure, robust regulatory environment, and growing awareness of the importance of effective wound care. The region’s established healthcare systems, including hospitals and clinics, have been key drivers of this dominance, with a high number of surgical procedures necessitating the use of surgical sutures.

The regulatory landscape in North America has facilitated the growth of the surgical sutures industry by ensuring the availability of high-quality, safe products. Stringent standards for medical devices, including surgical sutures, help maintain the integrity of patient care, fostering trust and widespread adoption of innovative suture technologies. Additionally, the increasing awareness and focus on patient outcomes and recovery are pushing demand for advanced suture solutions.

The region’s medical professionals are also increasingly emphasizing patient-centered care, which has contributed to a greater focus on effective surgical tools, including sutures, that enhance healing and minimize complications. This trend aligns with the growing shift towards personalized medicine, driving the demand for tailored suture solutions.

With North America’s market dominance in 2022, the region is projected to maintain its lead due to continued advancements in healthcare technologies, expanding surgical procedures, and ongoing efforts to improve healthcare access and patient care quality. Furthermore, the focus on minimizing healthcare costs, coupled with the expansion of minimally invasive surgeries, is likely to contribute to sustained growth in the region’s surgical sutures market.

By 2028, North America’s market share is expected to continue its upward trajectory, driven by these factors and an increasing demand for high-quality, specialized surgical suture products.

Key Players:

- Ethicon, Inc.

- Medtronic Plc

- B. Braun SE

- Healthium MedTech Limited

- Peters Surgical

- Corza Medical

- Aqmen Medtech Pvt. Ltd.

- Futura Surgicare Pvt. Ltd.

- DemeTECH Corporation

- Zimmer Biomet Holdings, Inc.

- Stryker Corporation

- Smith & Nephew Plc

- CONMED Corporation

- Anchora Medical Ltd.

- Advanced Medical Solutions Group Plc

- Internacional Farmacéutica S.A. de C.V.

- Lotus Surgicals

- Biosintex

- Meril Life Sciences Pvt. Ltd.

- Boston Scientific Corporation

- Mellon Medical B.V.

- Unisur Lifecare Pvt. Ltd.

- Assut Europe

- KatsanKatgüt Sanayi ve Tic. A.S.

- Sutumed Corp.

Market Segmentation:

By Product

- Suture Thread

- Automated Suturing Devices

By Type

- Monofilament Sutures

- Multifilament Sutures

By Application

- Cardiovascular Surgery

- General Surgery

- Gynecological Surgery

- Orthopedic Surgery

- Ophthalmic Surgery

- Cosmetic & Plastic Surgery

- Other Applications

By End User

- Hospitals

- Ambulatory Surgical Centers

- Clinics & Physicians’ Offices

By Region

- North America

- Europe

- Germany

- UK

- Italy

- Spain

- France

- RoE

- Asia Pacific

- Latin America

- Middle East and Africa

Recent Developments

- January 2024 – Medtronic launched its AI-driven platform for digital surgery, Touch Surgery Live Stream, designed to enhance surgical training and execution with real-time analytics for laparoscopic and robotic-assisted surgeries.

- February 2024 – Ethicon, in collaboration with Google Health, introduced a new initiative focused on using AI to improve surgical precision and suturing techniques, aiming to enhance patient outcomes.

- March 2024 – Surgical Innovations released a new range of sutures designed for minimally invasive surgeries, focusing on reducing patient recovery time and improving surgical efficiency.

- April 2024 – Healthium MedTech expanded into Vietnam and Indonesia through partnerships with local hospitals to distribute advanced surgical sutures and wound care products.

Get a Sample PDF Brochure : https://exactitudeconsultancy.com/reports/2393/surgical-sutures-market/#request-a-sample

Related Reports:

Airway Management Devices Market

https://exactitudeconsultancy.com/reports/1131/airway-management-devices-market/

The Global airway management devices market is expected to grow at more than 7.6% CAGR from 2020 to 2028. It is expected to reach above USD 4.03 billion by 2028 from a little above USD 2.10 billion in 2019.

Ligation Devices Market

https://exactitudeconsultancy.com/reports/1171/ligation-devices-market/

The global ligation devices market was valued at $945.8 million in 2020, and is projected to reach $1,681.2 million by 2028, registering a CAGR of 6.2% from 2021 to 2028.

Pet Insurance Market

https://exactitudeconsultancy.com/reports/796/pet-insurance-market/

The Global Pet Insurance Market size is expected to grow at more than 16% CAGR from 2019 to 2026. It is expected to reach above USD 17 billion by 2026 from a little above USD 6 billion in 2019.

Aspiration & Biopsy Needles Market

https://exactitudeconsultancy.com/reports/1400/aspiration-biopsy-needles-market/

The Global Aspiration & Biopsy Needles Market is expected to grow at more than 6.9% CAGR from 2019 to 2028. It is expected to reach above USD 1,699 million by 2028 from a little above USD 932 million in 2019.

Infection Control Market

https://exactitudeconsultancy.com/reports/1119/infection-control-market/

The Global Infection Control Market size is expected to grow at more than 3.5% CAGR from 2019 to 2028. It is expected to reach above USD 56 billion by 2028 from a little above USD 41.5 billion in 2019.

Breast Imaging Market

https://exactitudeconsultancy.com/reports/1441/breast-imaging-market/

The global market of Breast imaging is expected to grow at more than 8.2% CAGR from 2020 to 2028. It is expected to reach above USD 6.76 billion by 2028 from USD 3.6 billion in 2020.

Metal Implants and Medical Alloys Market

https://exactitudeconsultancy.com/reports/1434/metal-implants-and-medical-alloys-market/

The Global metal implants and medical alloys market is expected to grow at an 8.6% CAGR from 2019 to 2028. It is expected to reach above USD 4.4 billion by 2028 from USD 2.3 billion in 2019.

Rehabilitation Equipment Market

https://exactitudeconsultancy.com/reports/1300/rehabilitation-equipment-market/

The global rehabilitation equipment market is expected to grow at 5.20% CAGR from 2019 to 2028. It is expected to reach above USD 19.3 billion by 2028 from USD 12.2 billion in 2019.

Ashwagandha Extracts Market

https://exactitudeconsultancy.com/reports/926/ashwagandha-extracts-market/

The Global Ashwagandha Extracts Market share is expected to grow at more than 36.8% CAGR from 2019 to 2028. It is expected to reach above USD 3.2 billion by 2028 from a little above USD 128 million in 2019.

Electronic Drug Delivery Systems Market

https://exactitudeconsultancy.com/reports/1262/electronic-drug-delivery-systems-market/

The Global Electronic Drug Delivery Systems Market is expected to grow at 8.1% CAGR from 2019 to 2028. It is expected to reach above USD 14.36 million by 2028 from USD 7.50 million in 2019.

Heart Pump Device Market

https://exactitudeconsultancy.com/reports/1173/heart-pump-device-market/

The Global Heart Pump Device Market is expected to grow at more than 21% CAGR from 2020 to 2028. It is expected to reach above USD 7 billion by 2028 from a little above USD 1.6 billion in 2020.

Dental Imaging Market

https://exactitudeconsultancy.com/reports/764/dental-imaging-market/

The Global Dental Imaging Market size is expected to grow at more than 9.5% CAGR from 2016 to 2028. It is expected to reach above USD 5.9 billion by 2028 from a little above USD 2 billion in 2016.

Irfan Tamboli (Head of Sales) Phone: + 1704 266 3234 Email: sales@exactitudeconsultancy.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Donna Long Exercises Options, Realizes $237K

Disclosed in a recent SEC filing on November 19, Long, SVP at Dorman Prods DORM, made a noteworthy transaction involving the exercise of company stock options.

What Happened: Disclosed in a Form 4 filing on Tuesday with the U.S. Securities and Exchange Commission, Long, SVP at Dorman Prods, executed a strategic derivative sale. This involved exercising stock options for 3,277 shares of DORM, resulting in a transaction value of $237,025.

During Tuesday’s morning session, Dorman Prods shares down by 0.0%, currently priced at $134.01. Considering the current price, Long’s 3,277 shares have a total value of $237,025.

All You Need to Know About Dorman Prods

Dorman Products Inc is a supplier of original equipment parts for automobiles. The company produces automotive and heavy-duty replacement parts, automotive hardware, brake parts, and fasteners for the automotive and heavy-duty aftermarket. The products are sold under the Dorman brand and its sub-brands OE Solutions, Help!, Conduct-Tite, and HD Solutions through aftermarket retailers, regional and local warehouse distributors, specialty markets, and salvage yards. It operates as a single reportable operating segment, namely, the sale of replacement and upgrades parts in the motor vehicle aftermarket industry, serving passenger cars, light-, medium-, and heavy-duty trucks as well as specialty vehicles. The company operates in the United States.

A Deep Dive into Dorman Prods’s Financials

Revenue Growth: Dorman Prods’s revenue growth over a period of 3 months has been noteworthy. As of 30 September, 2024, the company achieved a revenue growth rate of approximately 3.19%. This indicates a substantial increase in the company’s top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Consumer Discretionary sector.

Key Profitability Indicators:

-

Gross Margin: The company sets a benchmark with a high gross margin of 40.46%, reflecting superior cost management and profitability compared to its peers.

-

Earnings per Share (EPS): Dorman Prods’s EPS outshines the industry average, indicating a strong bottom-line trend with a current EPS of 1.81.

Debt Management: Dorman Prods’s debt-to-equity ratio is below the industry average at 0.51, reflecting a lower dependency on debt financing and a more conservative financial approach.

Valuation Metrics:

-

Price to Earnings (P/E) Ratio: The P/E ratio of 22.45 is lower than the industry average, implying a discounted valuation for Dorman Prods’s stock.

-

Price to Sales (P/S) Ratio: With a relatively high Price to Sales ratio of 2.12 as compared to the industry average, the stock might be considered overvalued based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): At 13.65, the company’s EV/EBITDA ratio outperforms industry norms, reflecting positive market perception. This positioning indicates optimistic expectations for the company’s future performance.

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Transactions Are Key in Investment Decisions

Insider transactions shouldn’t be used primarily to make an investing decision, however an insider transaction can be an important factor in the investing decision.

In the realm of legality, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities under Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are required to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Notably, when a company insider makes a new purchase, it is considered an indicator of their positive expectations for the stock.

Conversely, insider sells may not necessarily signal a bearish stance on the stock and can be motivated by various factors.

Breaking Down the Significance of Transaction Codes

Examining transactions, investors often concentrate on those unfolding in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Dorman Prods’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Workhorse Group Reports Third Quarter 2024 Results

CINCINNATI, Nov. 19, 2024 (GLOBE NEWSWIRE) — Workhorse Group Inc. (Nasdaq: WKHS) (“Workhorse” or “the Company”), an American technology company focused on pioneering the transition to zero-emission commercial vehicles, today reported financial results for the third quarter ended September 30, 2024.

Management Commentary

“We continue to make steady progress on several fronts here at Workhorse,” said Company CEO Rick Dauch. “Securing a three-year Master Framework Agreement with FedEx is an extremely important and commercially validating milestone for us as an emerging commercial EV company. We have already built and shipped the first 15 trucks under this agreement and believe we will earn a larger order from FedEx in 2025. We also recently announced several new purchase orders with independent FedEx Ground contractors and are working diligently to convert the positive conversations and vehicle demos we are having with both contractors and other fleets into firm purchase orders.

Mr. Dauch added: “I’m excited to announce that that we have been awarded a General Services Administration (GSA) contract, which further expands our reach by enabling federal government agencies that desire to purchase our vehicles the ability to more easily procure Workhorse vehicles. We continue to see the industry slowly, but steadily, shifting towards zero-emissions, especially in California and other key regions across the country. Workhorse stands ready as a capable and reliable partner to help businesses and government owned fleets execute on their sustainability initiatives.”

Executing Strategic and Financial Actions

- Creating Strong Partnerships with Commercial Last-Mile Delivery Customers: In July, Workhorse and FedEx signed a three-year Master Framework Agreement, and FedEx placed an initial order for 15 W56 step vans, which were delivered for upfit during the third quarter. Following the FedEx Forward Service Provider Summit event in early October, the Company received purchase orders for seven additional W56 electric step vans, which are expected to be delivered in the fourth quarter for completion of third-party upfit. Workhorse continues to experience increased parcel delivery fleet interest, with multiple demos planned in California and additional units in the quoting process.

- Advancing EV Product Roadmap with Extended Product Offerings: The Company’s 208-inch extended wheelbase version of the all-electric W56 step van was certified to meet full FMVSS (Federal Motor Vehicle Safety Standards) and received HVIP (Hybrid and Zero-Emission Truck and Bus Voucher Incentive Project) certification. The 208-inch version extends Workhorse’s product offering to meet larger cargo-volume requirements, while providing the same efficient and robust platform as the 178-inch version. For customers interested in a reduced range option, Workhorse is currently designing and validating a 140-kWh battery option for the W56 chassis which will have a range of 100 miles per charge.

- Establishing Government and Cooperative Purchasing Partnerships: Last week, Workhorse was awarded a General Services Administration (GSA) Multiple Award Schedule (MAS) contract. This milestone allows federal government agencies to streamline procurement of Workhorse vehicles. This award follows a comprehensive review of the Company’s capabilities and inspection of its manufacturing facility, underscoring the quality and reliability of the Company’s processes and products. With the addition of GSA, Workhorse is now an approved supplier under multiple cooperative purchasing agreements, including Sourcewell and the Florida Sheriff’s Association Purchasing Program, which supports police departments, municipalities, and educational institutions across the United States. In addition, the Company’s vehicles are available through OMNIA Partners via its dealer, Doering Fleet Management, and the Company anticipates adding Canoe, Sourcewell’s Canadian counterpart, upon completing pending certifications for Canadian vehicle sales. These partnerships reinforce the Company’s commitment to expanding access to reliable, zero-emission trucks for public sector fleets across North America.

- Conserving Cash and Extending Financial Runway: Workhorse continues to take steps to manage costs across the organization and strengthen its financial position. During the third quarter, the Company began realizing the benefits of cost- and cash-saving measures taken during the first and second quarters to improve its liquidity and working capital requirements. The Company also received additional proceeds in the third quarter from the financing agreement entered into on March 15, 2024.

- Showcasing Reliability, Durability, and Real-World Capabilities on the Road: During a delivery route testing with FedEx Express, the W56 achieved an impressive 31 MPGe (miles per gallon equivalent), compared to the national average fuel economy of 7 MPG for internal combustion engine delivery trucks. The test demonstrated the W56’s significantly lower energy consumption per mile and reduced operating costs for fleet operators, aligning with Workhorse’s own field data. The recent 1,000-mile drive by the W56 to the FedEx Forward event in Orlando, Florida, averaging 27 MPGe in adverse weather conditions showcased the reliability, real-world durability, and performance of the step-van. Based on extensive cost data collected during 12-18 months of daily operations at Stables by Workhorse (the Company’s owned and operated FedEx Ground contractor business), the investment in EV step vans has an expected payback of less than five years, without factoring in any state level incentives.

Third Quarter Financial Results

Sales, net of returns and allowances, for the third quarter of 2024 and 2023 were $2.5 million and $3.0 million, respectively. The decrease in sales was primarily due to the non-recurrence of a $2.3 million sales allowance reversal related to W4 CC vehicle sales recognized in the prior period and an increase in W4 CC and W56 truck sales in the current period of $1.8 million.

Cost of sales was $6.6 million in the third quarter compared to $6.6 million in the same period last year. Cost of sales was primarily flat as increased costs related to direct materials due to higher sales volume were offset by lower inventory reserves of $1.1 million and lower direct and indirect labor costs of $1.0 million primarily due to lower headcount as a result of employee furloughs during the period.

Selling, general, and administrative (“SG&A”) expenses decreased to $7.7 million in the third quarter compared to $11.8 million in the same period last year. The decrease in SG&A expenses was primarily driven by a $1.8 million reduction in employee compensation and related expenses due to lower headcount, a decrease of $1.1 million in consulting expenses, a $0.3 million decrease in legal and professional expenses, and lower corporate insurances of $0.3 million.

Research and development (“R&D”) expenses decreased to $2.3 million in the third quarter compared to $5.8 million in the same period last year. The decrease in R&D expenses was primarily driven by a $2.1 million decrease in employee compensation and related expenses due to lower headcount and a $0.8 million reduction in consulting expenses.

Net interest expense for the third quarter of 2024 was $8.3 million compared to net interest income of $0.4 million for the same period last year. The increase was primarily due to a $5.3 million fair value net loss on note conversions and $2.9 million in financing fees related to funds received.

Net loss was $25.1 million compared to $30.6 million in the same period last year.

As of September 30, 2024, the Company had $3.2 million in cash and cash equivalents, total receivables of $3.7 million, net inventory of $43.2 million, and accounts payable of $10.5 million.

Third Quarter Financial Overview

“We continue to take steps to extend our operational runway and manage our cash flow efficiently through reducing operating costs and improving our liquidity and working capital requirements,” said Workhorse CFO Bob Ginnan. “We are confident in our ability to generate additional purchase orders and revenue from our customers while strengthening our financial position.”

Conference Call

Workhorse management will hold a conference call today, November 14, 2024 at 6:00 p.m. Eastern time (3:00 p.m. Pacific time) to discuss these results and answer related questions.

U.S. dial-in: 877-407-8289

International dial-in: 201-689-8341

Please call the conference telephone number 10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Gateway Group at 949-574-3860.

The conference call will be broadcast live and available for replay here and via the Investor Relations section of Workhorse’s website.

A telephonic replay of the conference call will be available through November 26, 2024.

Toll-free replay number: 877-660-6853

International replay number: 201-612-7415

Replay ID: 13749999

About Workhorse Group Inc.

Workhorse is a technology company focused on providing ground-based electric vehicles to the last-mile delivery sector. As an American original equipment manufacturer, we design and build high performance, battery-electric trucks. Workhorse also develops cloud-based, real-time telematics performance monitoring systems that are fully integrated with our vehicles and enable fleet operators to optimize energy and route efficiency. All Workhorse vehicles are designed to make the movement of people and goods more efficient and less harmful to the environment. For additional information visit workhorse.com.

Forward-Looking Statements

The discussions in this press release contain forward-looking statements reflecting our current expectations that involve risks and uncertainties. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. When used in this presentation, the words “anticipate,” “expect,” “plan,” “believe,” “seek,” “estimate” and similar expressions are intended to identify forward-looking statements. These are statements that relate to future periods and include, but are not limited to, statements about the features, benefits and performance of our products, our ability to introduce new product offerings and increase revenue from existing products, expected expenses including those related to selling and marketing, product development and general and administrative, our beliefs regarding the health and growth of the market for our products, anticipated increase in our customer base, expansion of our products functionalities, expected revenue levels and sources of revenue, expected impact, if any, of legal proceedings, the adequacy of liquidity and capital resources, and expected growth in business. Forward-looking statements are statements that are not historical facts. Such forward-looking statements are subject to risks and uncertainties, which could cause actual results to differ materially from the forward-looking statements contained in this presentation. Factors that could cause actual results to differ materially include, but are not limited to: our ability to develop and manufacture our new product portfolio, including the W4 CC, W750, W56 and WNext platforms; our ability to attract and retain customers for our existing and new products; the possible implementation of changes to the existing tariff regime by the incoming presidential administration; risks associated with obtaining orders and executing upon such orders; supply chain disruptions, including constraints on steel, semiconductors and other material inputs and resulting cost increases impacting our company, our customers, our suppliers or the industry; our ability to capitalize on opportunities to deliver products to meet customer requirements; our limited operations and need to expand and enhance elements of our production process to fulfill product orders; the ability to protect our intellectual property; market acceptance for our products; our ability to control our expenses; potential competition, including without limitation shifts in technology; volatility in and deterioration of national and international capital markets and economic conditions; global and local business conditions; acts of war (including without limitation the conflicts in Ukraine and Israel) and/or terrorism; the prices being charged by our competitors; our inability to retain key members of our management team; our inability to raise additional capital to fund our operations and business plan; our ability to regain compliance with the listing requirements of the Nasdaq Capital Market and otherwise maintain the listing of our securities thereon and the impact of any steps to regain such compliance; our inability to satisfy our customer warranty claims; the outcome of any regulatory or legal proceedings, including with Coulomb Solutions, Inc.; our ability to consummate and realize the benefits of a potential sale and leaseback transaction of our Union City facility; and our liquidity and other risks and uncertainties and other factors discussed from time to time in our filings with the Securities and Exchange Commission (“SEC”), including our annual report on Form 10-K filed with the SEC. Forward-looking statements speak only as of the date hereof. We expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based, except as required by law.

Media Contact:

Aaron Palash / Greg Klassen

Joele Frank, Wilkinson Brimmer Katcher

212-355-4449

Investor Relations Contact:

Tom Colton and Greg Bradbury

Gateway Group

949-574-3860

WKHS@gateway-grp.com

| Workhorse Group Inc. Condensed Consolidated Balance Sheets (Unaudited) |

|||||||

| September 30, 2024 |

December 31, 2023 |

||||||

| Assets | |||||||

| Current assets: | |||||||

| Cash and cash equivalents | $ | 3,244,806 | $ | 25,845,915 | |||

| Restricted cash | — | 10,000,000 | |||||

| Accounts receivable, less allowance for credit losses of $0.2 and $0.2 million as of September 30, 2024 and December 31, 2023, respectively | 682,673 | 2,326,774 | |||||

| Other receivables | 3,002,143 | 2,143,435 | |||||

| Inventory, net | 43,186,462 | 45,408,192 | |||||

| Prepaid expenses and other current assets | 7,357,838 | 8,101,162 | |||||

| Total current assets | 57,473,922 | 93,825,478 | |||||

| Property, plant and equipment, net | 34,825,810 | 37,876,955 | |||||

| Operating lease right-of-use assets, net | 3,465,637 | 4,174,800 | |||||

| Finance lease right-of-use assets, net | 5,470,933 | 5,621,181 | |||||

| Other assets | 176,310 | 176,310 | |||||

| Total Assets | $ | 101,412,612 | $ | 141,674,724 | |||

| Liabilities | |||||||

| Current liabilities: | |||||||

| Accounts payable | $ | 10,572,525 | $ | 12,456,272 | |||

| Accrued and other current liabilities | 8,384,321 | 4,862,740 | |||||

| Deferred revenue | 6,350,581 | 4,714,331 | |||||

| Warranty liability | 776,423 | 1,902,647 | |||||

| Operating lease liabilities, current | 1,001,120 | 1,012,428 | |||||

| Finance lease liabilities, current | 2,100,635 | 2,548,184 | |||||

| Warrant liability | 7,229,919 | 5,605,325 | |||||

| Current portion of convertible notes | 13,182,467 | 20,180,100 | |||||

| Total current liabilities | 49,597,991 | 53,282,027 | |||||

| Operating lease liabilities, long-term | 4,556,738 | 5,280,526 | |||||

| Total Liabilities | 54,154,729 | 58,562,553 | |||||

| Commitments and contingencies | |||||||

| Stockholders’ Equity: | |||||||

| Common stock, par value $0.001 per share, 450,000,000 shares authorized, 31,862,091 shares issued and outstanding as of September 30, 2024 and 14,299,042 shares issued and outstanding as of December 31, 2023 (presented on a reverse stock split-adjusted basis) |

31,862 | 14,299 | |||||

| Additional paid-in capital | 879,405,617 | 834,666,123 | |||||

| Accumulated deficit | (832,179,596 | ) | (751,568,251 | ) | |||

| Total stockholders’ equity | 47,257,883 | 83,112,171 | |||||

| Total Liabilities and Stockholders’ Equity | $ | 101,412,612 | $ | 141,674,724 | |||

| Workhorse Group Inc. Condensed Consolidated Statements of Operations (Unaudited) |

|||||||||||||||

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Sales, net of returns and allowances | $ | 2,509,717 | $ | 3,028,545 | $ | 4,691,451 | $ | 8,688,423 | |||||||

| Cost of sales | 6,642,549 | 6,557,358 | 21,386,676 | 20,312,854 | |||||||||||

| Gross loss | (4,132,832 | ) | (3,528,813 | ) | (16,695,225 | ) | (11,624,431 | ) | |||||||

| Operating expenses | |||||||||||||||

| Selling, general and administrative | 7,722,014 | 11,756,291 | 33,883,845 | 40,448,651 | |||||||||||

| Research and development | 2,313,423 | 5,771,588 | 7,834,113 | 18,056,182 | |||||||||||

| Total operating expenses | 10,035,437 | 17,527,879 | 41,717,958 | 58,504,833 | |||||||||||

| Loss from operations | (14,168,269 | ) | (21,056,692 | ) | (58,413,183 | ) | (70,129,264 | ) | |||||||

| Interest income (expense), net | (8,317,813 | ) | 410,980 | (15,109,136 | ) | 1,466,839 | |||||||||

| Fair value adjustment (loss) on warrants | (2,649,477 | ) | — | (7,089,027 | ) | — | |||||||||

| Other income (loss) | — | (10,000,000 | ) | — | (10,000,000 | ) | |||||||||

| Loss before benefit for income taxes | (25,135,559 | ) | (30,645,712 | ) | (80,611,346 | ) | (78,662,425 | ) | |||||||

| Benefit for income taxes | — | — | — | — | |||||||||||

| Net loss | $ | (25,135,559 | ) | $ | (30,645,712 | ) | $ | (80,611,346 | ) | $ | (78,662,425 | ) | |||

| Net loss per share of common stock | |||||||||||||||

| Basic and Diluted | $ | (0.98 | ) | $ | (2.84 | ) | $ | (4.06 | ) | $ | (8.29 | ) | |||

| Weighted average shares used in computing net loss per share of common stock | |||||||||||||||

| Basic and Diluted | 25,589,725 | 10,793,926 | 19,879,290 | 9,487,842 | |||||||||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Chipotle Mexican Grill's Options: A Look at What the Big Money is Thinking

Deep-pocketed investors have adopted a bullish approach towards Chipotle Mexican Grill CMG, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in CMG usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 13 extraordinary options activities for Chipotle Mexican Grill. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 76% leaning bullish and 15% bearish. Among these notable options, 2 are puts, totaling $346,912, and 11 are calls, amounting to $1,090,010.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $46.0 and $72.0 for Chipotle Mexican Grill, spanning the last three months.

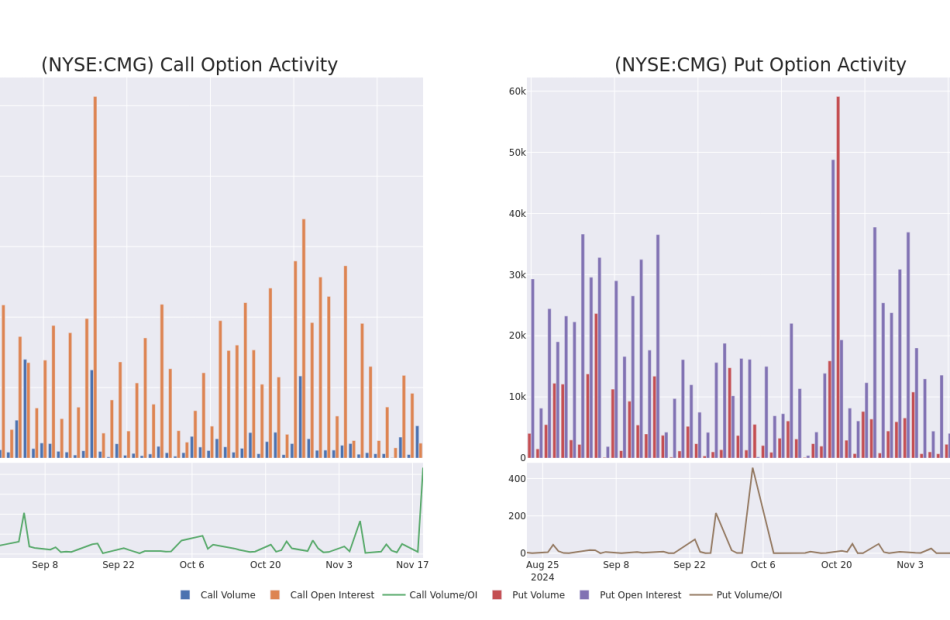

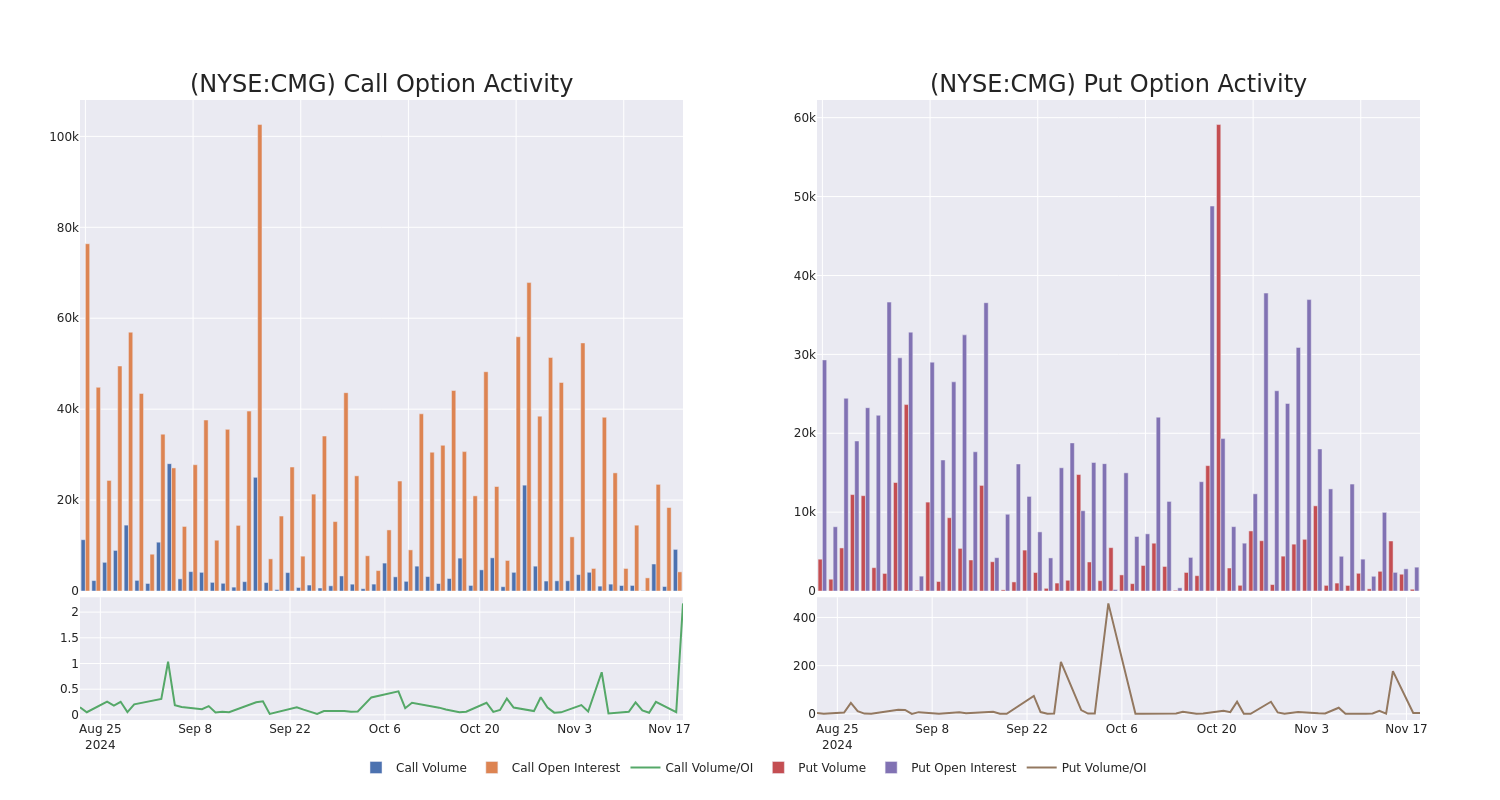

Insights into Volume & Open Interest

In today’s trading context, the average open interest for options of Chipotle Mexican Grill stands at 905.88, with a total volume reaching 9,383.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Chipotle Mexican Grill, situated within the strike price corridor from $46.0 to $72.0, throughout the last 30 days.

Chipotle Mexican Grill Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CMG | CALL | SWEEP | BULLISH | 01/16/26 | $17.4 | $16.7 | $17.4 | $46.00 | $631.6K | 970 | 706 |

| CMG | PUT | SWEEP | BULLISH | 01/16/26 | $14.6 | $14.3 | $14.3 | $72.00 | $318.9K | 57 | 224 |

| CMG | CALL | SWEEP | BULLISH | 01/16/26 | $17.5 | $16.7 | $17.4 | $46.00 | $83.5K | 970 | 772 |

| CMG | CALL | SWEEP | BEARISH | 01/15/27 | $13.3 | $12.8 | $12.8 | $60.00 | $64.0K | 500 | 11 |

| CMG | CALL | TRADE | NEUTRAL | 01/15/27 | $15.6 | $15.2 | $15.42 | $55.00 | $61.6K | 127 | 62 |

About Chipotle Mexican Grill

Chipotle Mexican Grill is the largest fast-casual chain restaurant in the United States, with systemwide sales of $9.9 billion in 2023. The Mexican concept is almost exclusively company-owned, with just two license stores opearted through a master franchise relationship with Alshaya Group in the Middle East. It had a footprint of nearly 3,440 stores at the end of 2023, heavily indexed to the United States, although it maintains a small presence in Canada, the UK, France, and Germany. Chipotle sells burritos, burrito bowls, tacos, quesadillas, and beverages, with a selling proposition built around competitive prices, high-quality food sourcing, speed of service, and convenience. The company generates its revenue entirely from restaurant sales and delivery fees.

Having examined the options trading patterns of Chipotle Mexican Grill, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Chipotle Mexican Grill Standing Right Now?

- With a trading volume of 6,291,565, the price of CMG is down by -0.07%, reaching $58.77.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 77 days from now.

What The Experts Say On Chipotle Mexican Grill

5 market experts have recently issued ratings for this stock, with a consensus target price of $63.6.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from BMO Capital persists with their Market Perform rating on Chipotle Mexican Grill, maintaining a target price of $56.

* An analyst from Stephens & Co. persists with their Equal-Weight rating on Chipotle Mexican Grill, maintaining a target price of $65.

* An analyst from RBC Capital has revised its rating downward to Outperform, adjusting the price target to $70.

* Consistent in their evaluation, an analyst from Wells Fargo keeps a Overweight rating on Chipotle Mexican Grill with a target price of $67.

* Maintaining their stance, an analyst from Barclays continues to hold a Equal-Weight rating for Chipotle Mexican Grill, targeting a price of $60.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Chipotle Mexican Grill options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump Picks Dr. Oz, Who Says Seniors Should Give Medical Marijuana A Try, To Lead Centers For Medicare And Medicaid Services

President-elect Donald J. Trump announced on Tuesday afternoon that he will nominate TV personality Dr. Mehmet Oz to serve as the administrator of the Centers for Medicare and Medicaid Services (CMS). The appointment is among a string of TV hosts — mostly from Fox News — to be chosen to join Trump’s cabinet.

In a statement, Trump said the celebrity TV host will “work closely with Robert F. Kennedy Jr. to take on the illness industrial complex.”

Though a household name due to his long-running “The Dr. Oz Show” (2009-2022), Oz got into politics when he unsuccessfully ran for Senate against now Sen. John Fetterman (D-Penn.) in 2022, during which time the good doctor seemed to forge an alliance with Trump.

At the time, Scientific American wrote Dr. Oz should not be a senator or a doctor, noting that his misinformation had already tarnished medicine and would do much worse in the halls of Congress. “Dr. Oz has long pushed misleading, science-free and unproven alternative therapies such as homeopathy, as well as fad diets, detoxes and cleanses.”

News outlets are quick to point out that Dr. Oz has no experience running a large government body like the CMS but that seems to not matter because, according to the President-elect.

“There may be no Physician more qualified and capable than Dr. Oz to Make America Healthy Again,” Trump said in a statement, referring to the words of Robert Kennedy Jr. who will, if confirmed run the Dept. of Health and Human Services.

Read Also: Trump Wants Matt Gaetz Confirmed ‘100%,’ So Does The Cannabis Industry

The multimillionaire TV host initially called cannabis a “mixed bag for easing pain.” But a recent discussion with Michael Roizen, M.D., of the Wellness Institute at the Cleveland Clinic, Dr. Oz said, “Our advice: If your physician recommends it to manage pain, especially if you’re 65 and older, give it a try.”

While Dr. Oz cautions against cannabis consumption for recreational purposes, he said he believes marijuana for pain represents a “safer solution than, for example, narcotics in many cases.”

During his Senate race, Dr. Oz often criticized Fetterman’s support for cannabis legalization though several years earlier he himself referred to cannabis as “one of the most underused tools in America” and that the U.S. should “completely change our policy on marijuana.”

Now Read:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis is evolving – don’t get left behind!

Curious about what’s next for the industry and how to leverage California’s unique market?

Join top executives, policymakers, and investors at the Benzinga Cannabis Market Spotlight in Anaheim, CA, at the House of Blues on November 12. Dive deep into the latest strategies, investment trends, and brand insights that are shaping the future of cannabis!

Get your tickets now to secure your spot and avoid last-minute price hikes.

MCAN MORTGAGE CORPORATION ANNOUNCES THE DEPARTURE OF ITS PRESIDENT AND CEO AND THE APPOINTMENT OF INTERIM CEO

Stock market symbol

TSX: MKP

TORONTO, Nov. 19, 2024 /CNW/ – MCAN Mortgage Corporation (“MCAN” or the “Company“) announces the departure of Mr. Donald Coulter as President, CEO and director of MCAN. The Board of Directors (the “Board“) would like to express its gratitude to Mr. Coulter for his contribution to MCAN.

The Board is pleased to announce that Mr. Derek Sutherland has been appointed Interim CEO of MCAN until such time as a permanent successor is appointed. Mr. Sutherland is the current Chair of MCAN, has been a director of MCAN since 2017, and has held various positions with MCAN throughout the years including as its Interim CEO in 2023. Ms. Gaelen Morphet has been appointed Lead Director to ensure independent governance at the Board during Mr. Sutherland’s tenure as Interim CEO.

Mr. Sutherland commented, ” I am excited to work along side our talented and dedicated team to ensure continued strong performance and achievement of our objectives, which remains to be a focus on our core mission of providing sustainable growth and returns to our shareholders.”

The Board will be considering options for selecting an individual to permanently fill the CEO role.

MCAN Mortgage Corporation d/b/a MCAN Financial Group (“MCAN” or “we”) is a public company listed on the Toronto Stock Exchange under the symbol MKP and is a reporting issuer in all provinces and territories in Canada. MCAN also qualifies as a mortgage investment corporation (“MIC”) under the Income Tax Act (Canada) (the “Tax Act”).

MCAN’s primary objective is to generate a reliable stream of income by investing in a diversified portfolio of Canadian mortgages, including residential, residential construction, non- residential construction and commercial loans, as well as other types of securities, loans and real estate investments. MCAN employs leverage by issuing term deposits that are eligible for Canada Deposit Insurance Corporation deposit insurance that are sourced through a network of independent financial agents. We manage our capital and asset balances based on the regulations and limits of both the Tax Act and the Office of the Superintendent of Financial Institutions Canada (“OSFI”).

As a MIC, we are entitled to deduct the dividends that we pay to shareholders from our taxable income. Regular dividends are treated as interest income to shareholders for income tax purposes. We are also able to pay capital gains dividends, which would be treated as capital gains to shareholders for income tax purposes. Dividends paid to foreign investors may be subject to withholding taxes. To meet the MIC criteria, 67% of our non-consolidated assets measured on a tax basis are required to be held in cash or cash equivalents and residential mortgages.

MCAN’s wholly owned subsidiary, MCAN Home Mortgage Corporation, is an originator of residential mortgage products across Canada.

A Caution About Forward-looking Information and Statements

This news release contains “forward-looking information” within the meaning of applicable securities laws. Forward-looking information can be identified by words such as: “expect”, “intend,” “plan,” “seek,” “believe,” “estimate,” “future,” “likely,” “may,” “should,” “will” and similar forward-looking language. Future prospects of MCAN constitutes forward-looking information. The forward-looking information contained in this news release is based on a number of assumptions which we believe to be reasonable, including assumptions relating to the investment opportunities that will be available to MCAN in its core business. Forward-looking information entails various risks and uncertainties that could cause actual results to differ materially from those expressed or implied in such forward-looking information. Risks that could cause actual results to differ materially from those expressed or implied in the forward-looking information contained in this press release include, but are not limited to, general risks relating to capital markets, economic conditions, regulatory changes, as well as the operations of our business. These factors may cause actual results to differ materially from those expressed or implied in such forward-looking information. Forward-looking information is not a guarantee of future performance, and management’s assumptions upon which such forward-looking information are based may prove to be incorrect. Investors are cautioned not to place undue reliance on any forward-looking information contained herein. The Company disclaims any obligation to update or revise any forward-looking information contained in this news release, whether as a result of new information, future events or otherwise, except to the extent required by law.

Website: www.mcanfinancial.com

SOURCE MCAN Mortgage Corporation

![]() View original content: http://www.newswire.ca/en/releases/archive/November2024/19/c6571.html

View original content: http://www.newswire.ca/en/releases/archive/November2024/19/c6571.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Activity Update: Manesh Dadlani Executes Options Exercise, Resulting In $409K At Tapestry

Disclosed in a recent SEC filing on November 18, Dadlani, VP at Tapestry TPR, made a noteworthy transaction involving the exercise of company stock options.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Monday showed that Dadlani, VP at Tapestry, a company in the Consumer Discretionary sector, just exercised stock options worth 11,262 shares of TPR stock with an exercise price of $19.03.

The Tuesday morning market activity shows Tapestry shares down by 2.02%, trading at $55.41. This implies a total value of $409,759 for Dadlani’s 11,262 shares.

About Tapestry

Coach, Kate Spade, and Stuart Weitzman are Tapestry’s fashion and accessory brands. The firm’s products are sold through about 1,400 company-operated stores, wholesale channels, and e-commerce in North America (64% of fiscal 2024 sales), Europe, Asia (29% of fiscal 2024 sales), and elsewhere. Coach (76% of fiscal 2024 sales) is best known for affordable luxury leather products. Kate Spade (20% of fiscal 2023 sales) is known for colorful patterns and graphics. Women’s handbags and accessories produced 69% of Tapestry’s sales in fiscal 2024. Stuart Weitzman (4% of sales) generates virtually all its revenue from women’s footwear.

Tapestry: Financial Performance Dissected

Negative Revenue Trend: Examining Tapestry’s financials over 3 months reveals challenges. As of 30 September, 2024, the company experienced a decline of approximately -0.38% in revenue growth, reflecting a decrease in top-line earnings. When compared to others in the Consumer Discretionary sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Profitability Metrics:

-

Gross Margin: Achieving a high gross margin of 75.28%, the company performs well in terms of cost management and profitability within its sector.

-

Earnings per Share (EPS): Tapestry’s EPS lags behind the industry average, indicating concerns and potential challenges with a current EPS of 0.81.

Debt Management: Tapestry’s debt-to-equity ratio is notably higher than the industry average. With a ratio of 2.95, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

Understanding Financial Valuation:

-

Price to Earnings (P/E) Ratio: The P/E ratio of 16.39 is lower than the industry average, implying a discounted valuation for Tapestry’s stock.

-

Price to Sales (P/S) Ratio: With a higher-than-average P/S ratio of 1.99, Tapestry’s stock is perceived as being overvalued in the market, particularly in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an EV/EBITDA ratio lower than industry averages at 10.73, Tapestry could be considered undervalued.

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Unmasking the Significance of Insider Transactions

While insider transactions provide valuable information, they should be part of a broader analysis in making investment decisions.

Within the legal framework, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as per Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

The initiation of a new purchase by a company insider serves as a strong indication that they expect the stock to rise.

However, insider sells may not always signal a bearish view and can be influenced by various factors.

Unlocking the Meaning of Transaction Codes

For investors, a primary focus lies on transactions occurring in the open market, as indicated in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Tapestry’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.