Yoshiharu Reports Third Quarter 2024 Financial Results

Third Quarter 2024 Revenues Increase 49% to $3.0 Million

9M 2024 Revenues Increase 36% to $9.2 Million

Strategic Partnerships in Sichuan and Liaoning Provinces in China Anchor International Expansion Plans, Entry into Growing Korean BBQ Segment Expands Presence and Cuisine

BUENA PARK, Calif., Nov. 19, 2024 (GLOBE NEWSWIRE) — Yoshiharu Global Co. YOSH (“Yoshiharu” or the “Company”), a restaurant operator specializing in authentic Japanese ramen & rolls, today reported results for the third quarter ended September 30, 2024.

Third Quarter 2024 and Recent Operational Highlights

- Grand opening of a new restaurant in San Clemente, CA, bringing the number of locations to 15 with 2 additional locations under construction.

- Entered into a non-binding Memorandum of Understanding (“MoU”) with Chengdu Octaday Entertainment Group through a Master License Agreement (“MLA”) for the Sichuan Province in China to introduce Yoshiharu Global’s Expanding Cuisine in Sichuan Province, China, with a rich and diverse culture and home to over 83 million people.

- Entered into a non-binding MoU with Xing Sheng Group through a MLA for the Liaoning Province in China to introduce a new flagship Yoshiharu restaurant in Shenyang, China, home to over 43 million people.

- Announced the planned entry into the lucrative and growing Korean BBQ (“KBBQ”) category, with synergies with existing ramen business expected to drive expanding market opportunity and footprint in high growth category.

- Closed a non-brokered $1.0 million private placement investment from an accredited investor and intends to use these proceeds for the expansion into the KBBQ segment.

- Nine months 2024 revenue increased 36.3% to $9.2 million.

- Restaurant-level contribution increased to $1.0 million for the nine-months ended September 30, 2024 from $543,000 in the same period last year.

Management Commentary

“The third quarter of 2024 was highlighted by strong revenue growth, the grand opening of our 15th location, and new partnerships and initiatives, all positioning us to grow the brand and move us steadily towards profitability,” said James Chae, Yoshiharu’s President, CEO and Chairman of the Board. “In the quarter, revenue growth was driven by our restaurant service across Southern California, Las Vegas and diversified mix of service channels, including takeout and delivery. We have successfully optimized operating expenses while maintaining a strong Average Unit Volume (“AUV”) comparable to previous periods, despite continued headwinds from input costs, consumer price sensitivity, and higher cost of capital.

“We continued to expand our presence and cuisine in both the US and international dining scenes in the third quarter. We celebrated the grand opening of our newest US location in San Clemente, CA, a classic beach town destination known for its beaches, world class surfing and vibrant dining scene. The new location benefits from excellent access and high visibility to I-5, drawing an estimated 8,300 visits a day and over 3 million visits a year, surrounded by an affluent population of more than 69,000 with an average household income of over $145,000 within a 3-mile radius.

“In China, two new strategic non-binding Memorandum of Understandings (“MoU”) through Master License Agreements (“MLA”) will enable us to open locations across China. With Chengdu Octaday Entertainment Group, we are aiming to introduce Yoshiharu Global’s expanding cuisine in Sichuan Province, China, home to over 83 million people. The partnership presents multiple opportunities to open locations within Chengdu Octaday’s 30 corporate owned and managed hotels, theme parks and other destination attractions. We also partnered with Xing Sheng Group to introduce a new flagship Yoshiharu restaurant in Shenyang, China, home to over 43 million people. Xing Sheng Group’s real estate arm specializes in developing tourist attraction centers in Shenyang and is currently constructing China’s largest water park. This partnership offers us a prime opportunity to develop a flagship location within the water park, catering to both local residents and visiting tourists.

“Recently we announced a new initiative to enter the lucrative and growing Korean BBQ (“KBBQ”) category, a highly complementary addition to our ramen business. Demand for KBBQ cuisine in the US has grown along with the popularity of Korean street food and the interest in new international flavors. The communal and interactive nature of KBBQ, with its extensive menus and relatively affordable prices, is a large part of this appeal. Armed with a $1.0 investment for this initiative, we believe we can capitalize on the resource and ingredient synergies between our existing offerings and KBBQ concept to enhance purchasing power, attract a wider audience, and explore cross-promotion opportunities to further solidify and expand the Yoshiharu brand. We also plan to explore further collaborative opportunities with Xing Sheng Group.

“Looking ahead, we are expanding our US geographic footprint with two more locations currently under construction and expected to open in Menifee, CA in December 2024 and Ontario, CA in January 2025. We continue to focus on the bottom-line as we remain keen on reaching profitability in the near future, supported by new initiatives such as adding kiosks across our stores and utilizing cooking robots to reduce labor costs. We are poised for additional growth with two new partnerships in China and expansion into the Korean BBQ segment. Taken together, we believe our multi-dimensional growth strategy will expand the Yoshiharu brand and build long-term shareholder value,” concluded Chae.

Third Quarter 2024 Financial Results

Revenues increased 48.9% to $3.0 million compared to $2.0 million in the prior year period. The increase was primarily driven by the three new Las Vegas restaurants acquired in April 2024.

Total restaurant operating expenses were $3.1 million compared to $2.2 million in the prior year period. The increase was primarily driven by increases in revenues from the three new Las Vegas restaurants acquired.

Operating loss increased to ($1.0) million compared to a loss of ($0.8) million in the prior year period as a result of higher general and administrative driven by the acquisition of Las Vegas entities.

Adjusted EBITDA, a non-GAAP measure defined below, was $(0.7) million compared to $(0.6) million in the prior year period.

Net loss was ($1.2) million compared to a net loss of ($0.9) million in the prior year period primarily due to an increase in expenses following the acquisition of Las Vegas.

Nine Months 2024 Financial Results

Revenues increased 36.3% to $9.2 million compared to $6.7 million in the prior year period. The increase was primarily driven by three new Las Vegas restaurants acquired in April 2024.

Restaurant-level contribution margin was 11.0% compared to 8.1% in the prior period with the increase in revenue from the LV acquisition and the management efforts to control the costs.

Total restaurant operating expenses were $8.7 million compared to $6.6 million in the prior year period. The increase was due to increases in in revenue. As a percentage of the revenue, the operating expenses were 96% compared to 98% in the prior period.

Operating loss improved to ($2.8) million compared to a loss of $(2.9) million in the prior year period.

Adjusted EBITDA, a non-GAAP measure defined below, was $(1.9) million compared to $(2.0) million in the prior year period.

Net loss was $3.2 million compared to a net loss of $3.0 million in the prior year period. The increase was primarily due to an increase in expenses following the acquisition of Las Vegas.

The Company’s cash balance totaled $1.7 million on September 30, 2024, compared to $1.4 million on December 31, 2023.

For more information regarding Yoshiharu’s financial results, including financial tables, please see our Form 10-Q for quarter ended September 30, 2024 filed with the U.S. Securities and Exchange Commission (the “SEC”). The Company’s SEC filings can be found on the SEC’s website at www.sec.gov or the Company’s investor relations site at ir.yoshiharuramen.com.

About Yoshiharu Global Co.

Yoshiharu is a fast-growing restaurant operator and was born out of the idea of introducing the modernized Japanese dining experience to customers all over the world. Specializing in Japanese ramen, Yoshiharu gained recognition as a leading ramen restaurant in Southern California within six months of its 2016 debut and has continued to expand its top-notch restaurant service across Southern California and Las Vegas, currently owning and operating 14 restaurants.

For more information, please visit www.yoshiharuramen.com.

Non-GAAP Financial Measures

EBITDA is defined as net income (loss) before interest, income taxes and depreciation and amortization. Adjusted EBITDA is defined as EBITDA plus stock-based compensation expense, non-cash lease expense and asset disposals, closure costs and restaurant impairments, as well as certain items, such as employee retention credit, litigation accrual, and certain executive transition costs, that we believe are not indicative of our core operating results. Adjusted EBITDA margin is defined as Adjusted EBITDA divided by sales. EBITDA, and Adjusted EBITDA are non-GAAP measures which are intended as supplemental measures of our performance and are neither required by, nor presented in accordance with, GAAP. The Company believes that EBITDA, and Adjusted EBITDA provide useful information to management and investors regarding certain financial and business trends relating to its financial condition and operating results. However, these measures may not provide a complete understanding of the operating results of the Company as a whole and such measures should be reviewed in conjunction with its GAAP financial results.

The Company believes that the use of EBITDA, and Adjusted EBITDA provides an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing its financial measures with those of comparable companies, which may present similar non-GAAP financial measures to investors. However, you should be aware when evaluating EBITDA, and Adjusted EBITDA that in the future the Company may incur expenses similar to those excluded when calculating these measures. In addition, the Company’s presentation of these measures should not be construed as an inference that its future results will be unaffected by unusual or non-recurring items. The Company’s computation of Adjusted EBITDA may not be comparable to other similarly titled measures computed by other companies, because all companies may not calculate Adjusted EBITDA in the same fashion.

Because of these limitations, EBITDA, and Adjusted EBITDA should not be considered in isolation or as a substitute for performance measures calculated in accordance with GAAP. The Company compensates for these limitations by relying primarily on its GAAP results and using EBITDA, and Adjusted EBITDA on a supplemental basis. You should review the reconciliation of net loss to EBITDA, and Adjusted EBITDA in the Company’s SEC filings and not rely on any single financial measure to evaluate its business.

The full reconciliation of net loss to EBITDA and Adjusted EBITDA is set forth in our Form 10-Q for the quarter ended September 30, 2024 which can be found on the SEC ‘s website at www.sec.gov or the Company’s investor relations site at ir.yoshiharuramen.com.

Forward Looking Statements

This press release includes certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including without limitation, statements regarding our position to execute on our growth strategy, and our ability to expand our leadership position. These forward-looking statements include, but are not limited to, the Company’s beliefs, plans, goals, objectives, expectations, assumptions, estimates, intentions, future performance, other statements that are not historical facts and statements identified by words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “seeks”, “estimates” or words of similar meaning. These forward-looking statements reflect our current views about our plans, intentions, expectations, strategies and prospects, which are based on the information currently available to us and on assumptions we have made. Although we believe that our plans, intentions, expectations, strategies and prospects as reflected in, or suggested by, these forward-looking statements are reasonable, we can give no assurance that the plans, intentions, expectations or strategies will be attained or achieved. Forward-looking statements involve inherent risks and uncertainties which could cause actual results to differ materially from those in the forward-looking statements, as a result of various factors including those risks and uncertainties described in the Risk Factors and Management’s Discussion and Analysis of Financial Condition and Results of Operations sections of our filings with the SEC including our Form 10-K for the year ended December 31, 2023, and subsequent reports we file with the SEC from time to time, which can be found on the SEC’s website at www.sec.gov. Such risks, uncertainties, and other factors include, but are not limited to: the risk that our plans to maintain and increase liquidity may not be successful to remediate our past operating losses; the risk that we may not be able to successfully implement our growth strategy if we are unable to identify appropriate sites for restaurant locations, expand in existing and new markets, obtain favorable lease terms, attract guests to our restaurants or hire and retain personnel; that our operating results and growth strategies will be closely tied to the success of our future franchise partners and we will have limited control with respect to their operations; the risk that we may face negative publicity or damage to our reputation, which could arise from concerns regarding food safety and foodborne illness or other matters; the risk that that minimum wage increases and mandated employee benefits could cause a significant increase in our labor costs; and the risk that our marketing programs may not be successful, and our new menu items, advertising campaigns and restaurant designs and remodels may not generate increased sales or profits. We urge you to consider those risks and uncertainties in evaluating our forward-looking statements. We caution readers not to place undue reliance upon any such forward-looking statements, which speak only as of the date made. The Company undertakes no obligation to update these statements for revisions or changes after the date of this release, except as required by law.

Investor Relations Contact:

Larry W Holub

Director

MZ North America

YOSH@mzgroup.us

312-261-6412

| Yoshiharu Global Co. Unaudited Consolidated Balance Sheets |

||||||||

| As of | September 30, 2024 |

December 31, 2023 |

||||||

| ASSETS | ||||||||

| Current Assets: | ||||||||

| Cash | $ | 1,712,064 | $ | 1,462,326 | ||||

| Accounts receivable | 36,397 | – | ||||||

| Inventories | 89,462 | 73,023 | ||||||

| Total current assets | 1,837,923 | 1,535,349 | ||||||

| Non-Current Assets: | ||||||||

| Property and equipment, net | 5,031,361 | 4,092,950 | ||||||

| Operating lease right-of-use asset | 6,846,051 | 5,459,708 | ||||||

| Intangible asset | 504,499 | – | ||||||

| Goodwill | 1,985,645 | – | ||||||

| Other assets | 1,106,597 | 1,931,357 | ||||||

| Total non-current assets | 15,474,153 | 11,484,015 | ||||||

| Total assets | $ | 17,312,076 | $ | 13,019,364 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accounts payable and accrued expenses | $ | 884,857 | $ | 647,811 | ||||

| Line of credit | 1,000,000 | 1,000,000 | ||||||

| Current portion of operating lease liabilities | 908,691 | 572,230 | ||||||

| Current portion of bank notes payables | 169,814 | 414,378 | ||||||

| Current portion of loan payable, EIDL | 2,669 | 10,536 | ||||||

| Loans payable to financial institutions | 119,939 | 534,239 | ||||||

| Due to related party | 1,770,796 | 24,176 | ||||||

| Other payables | 1,078,291 | 65,700 | ||||||

| Total current liabilities | 5,895,057 | 3,269,070 | ||||||

| Operating lease liabilities, less current portion | 6,770,605 | 5,689,535 | ||||||

| Bank notes payables, less current portion | 2,830,798 | 991,951 | ||||||

| Loan payable, EIDL, less current portion | 415,422 | 415,329 | ||||||

| Notes payable to related party | 600,000 | – | ||||||

| Convertible notes to related party | 1,200,000 | – | ||||||

| Total liabilities | 17,711,882 | 10,365,885 | ||||||

| Commitments and Contingencies | ||||||||

| Stockholders’ equity | ||||||||

| Class A Common Stock – $0.0001 par value; 49,000,000 authorized shares; 1,255,197 shares issued and outstanding at September 30, 2024 and 1,230,246 shares issued and outstanding at December 31, 2023 | 125 | 123 | ||||||

| Class B Common Stock – $0.0001 par value; 1,000,000 authorized shares; 100,000 shares issued and outstanding at September 30, 2024 and December 31, 2023 | 10 | 10 | ||||||

| Additional paid-in capital | 12,143,969 | 11,994,119 | ||||||

| Accumulated deficit | (12,543,910 | ) | (9,340,773 | ) | ||||

| Total stockholders’ equity (deficit) | (399,806 | ) | 2,653,479 | |||||

| Total liabilities and stockholders’ equity | $ | 17,312,076 | $ | 13,019,364 | ||||

| Yoshiharu Global Co. Unaudited Consolidated Statements of Operations |

||||||||||||||||

| Nine months Ended September 30, |

Three Months Ended September 30, |

|||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Revenue: | ||||||||||||||||

| Food and beverage | $ | 9,152,530 | $ | 6,714,429 | $ | 3,015,525 | $ | 2,025,386 | ||||||||

| Total revenue | 9,152,530 | 6,714,429 | 3,015,525 | 2,025,386 | ||||||||||||

| Restaurant operating expenses: | ||||||||||||||||

| Food, beverages and supplies | 2,362,515 | 1,787,046 | 853,943 | 557,705 | ||||||||||||

| Labor | 4,125,195 | 3,129,198 | 1,344,534 | 1,125,717 | ||||||||||||

| Rent and utilities | 1,262,963 | 840,389 | 493,667 | 285,013 | ||||||||||||

| Delivery and service fees | 398,986 | 415,139 | 118,070 | 130,189 | ||||||||||||

| Depreciation | 596,701 | 396,388 | 246,374 | 144,701 | ||||||||||||

| Total restaurant operating expenses | 8,746,360 | 6,568,160 | 3,056,588 | 2,243,325 | ||||||||||||

| Net operating restaurant operating income (loss) | 406,170 | 146,269 | (41,063 | ) | (217,939 | ) | ||||||||||

| Operating expenses: | ||||||||||||||||

| General and administrative | 2,953,755 | 2,700,078 | 935,591 | 477,732 | ||||||||||||

| Related party compensation | 139,769 | 216,308 | 50,000 | 92,876 | ||||||||||||

| Advertising and marketing | 80,955 | 86,593 | 22,391 | 34,051 | ||||||||||||

| Total operating expenses | 3,174,479 | 3,002,979 | 1,007,982 | 604,659 | ||||||||||||

| Loss from operations | (2,768,309 | ) | (2,856,710 | ) | (1,049,045 | ) | (822,598 | ) | ||||||||

| Other income (expense): | ||||||||||||||||

| Gain on disposal of fixed asset | – | 8,920 | – | – | ||||||||||||

| Other income | 12,207 | 14,774 | – | 7,784 | ||||||||||||

| Interest | (413,598 | ) | (186,877 | ) | (161,472 | ) | (48,049 | ) | ||||||||

| Total other income (expense), net | (401,391 | ) | (163,183 | ) | (161,472 | ) | (40,265 | ) | ||||||||

| Loss before income taxes | (3,169,700 | ) | (3,019,893 | ) | (1,210,517 | ) | (862,863 | ) | ||||||||

| Income tax provision | 33,437 | 29,068 | 11,599 | 22,080 | ||||||||||||

| Net loss | $ | (3,203,137 | ) | $ | (3,048,961 | ) | $ | (1,222,116 | ) | $ | (884,943 | ) | ||||

| Loss per share: | ||||||||||||||||

| Basic and diluted | $ | (2.39 | ) | (2.29 | ) | (0.91 | ) | (0.67 | ) | |||||||

| Weighted average number of common shares outstanding: | ||||||||||||||||

| Basic and diluted | 1,342,585 | 1,328,847 | 1,343,537 | 1,328,847 | ||||||||||||

| Yoshiharu Global Co. Unaudited Consolidated Statements of Cash Flows |

||||||||

| For the nine months ended September 30, |

||||||||

| 2024 | 2023 | |||||||

| Cash flows from operating activities: | ||||||||

| Net loss | $ | (3,203,137 | ) | $ | (3,048,961 | ) | ||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

| Depreciation | 596,701 | 396,388 | ||||||

| Amortization | 26,552 | – | ||||||

| Gain on disposal of fixed asset | – | (8,920 | ) | |||||

| Changes in assets and liabilities: | ||||||||

| Accounts receivable | (36,397 | ) | – | |||||

| Inventories | (3,654 | ) | 390 | |||||

| Other assets | 825,960 | (564,775 | ) | |||||

| Accounts payable and accrued expenses | 199,483 | (3,118 | ) | |||||

| Due to related party | 1,746,620 | (142,106 | ||||||

| Other payables | 1,012,591 | 59,785 | ||||||

| Net cash provided by (used in) operating activities | 1,164,719 | (3,311,317 | ) | |||||

| Cash flows from investing activities: | ||||||||

| Purchases of property and equipment | (437,042 | ) | (1,339,132 | ) | ||||

| Acquisition of LV entities | (1,800,000 | ) | – | |||||

| Net cash used in investing activities | (2,237,042 | ) | (1,339,132 | ) | ||||

| Cash flows from financing activities: | ||||||||

| Advance from line of credit | – | 500,000 | ||||||

| Proceeds from borrowings for acquisition of LV entities | 900,000 | 812,000 | ||||||

| Proceeds from borrowings | 1,138,164 | – | ||||||

| Repayments on bank notes payables | (451,655 | ) | (645,280 | ) | ||||

| Repayment of loan payable to financial institutions | (414,300 | ) | – | |||||

| Proceeds from sale of common shares | 149,852 | – | ||||||

| Net cash provided by financing activities | 1,322,061 | 666,720 | ||||||

| Net increase (decrease) in cash | 249,738 | (3,983,729 | ) | |||||

| Cash – beginning of period | 1,462,326 | 6,138,786 | ||||||

| Cash – end of period | $ | 1,712,064 | $ | 2,155,057 | ||||

| Supplemental disclosures of non-cash financing activities: | ||||||||

| Note payable to related party | $ | 600,000 | – | |||||

| Convertible notes to related party | $ | 1,200,000 | – | |||||

| Supplemental disclosures of cash flow information | ||||||||

| Cash paid during the periods for: | ||||||||

| Interest | $ | 401,861 | $ | 186,877 | ||||

| Income taxes | $ | 33,437 | $ | 29,068 | ||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Check Out What Whales Are Doing With CCJ

Deep-pocketed investors have adopted a bullish approach towards Cameco CCJ, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in CCJ usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 22 extraordinary options activities for Cameco. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 77% leaning bullish and 18% bearish. Among these notable options, 2 are puts, totaling $529,500, and 20 are calls, amounting to $1,480,442.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $20.0 to $70.0 for Cameco during the past quarter.

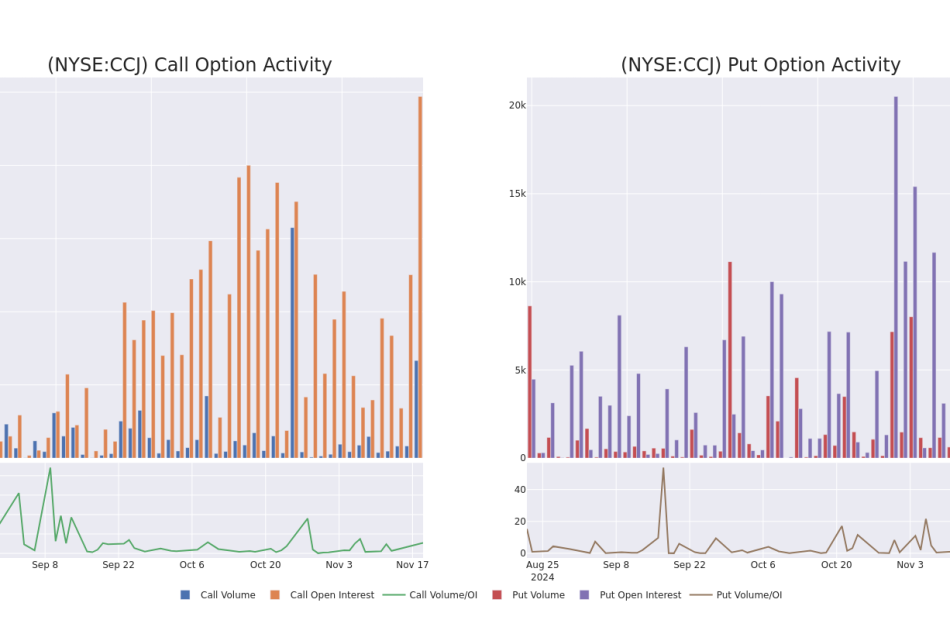

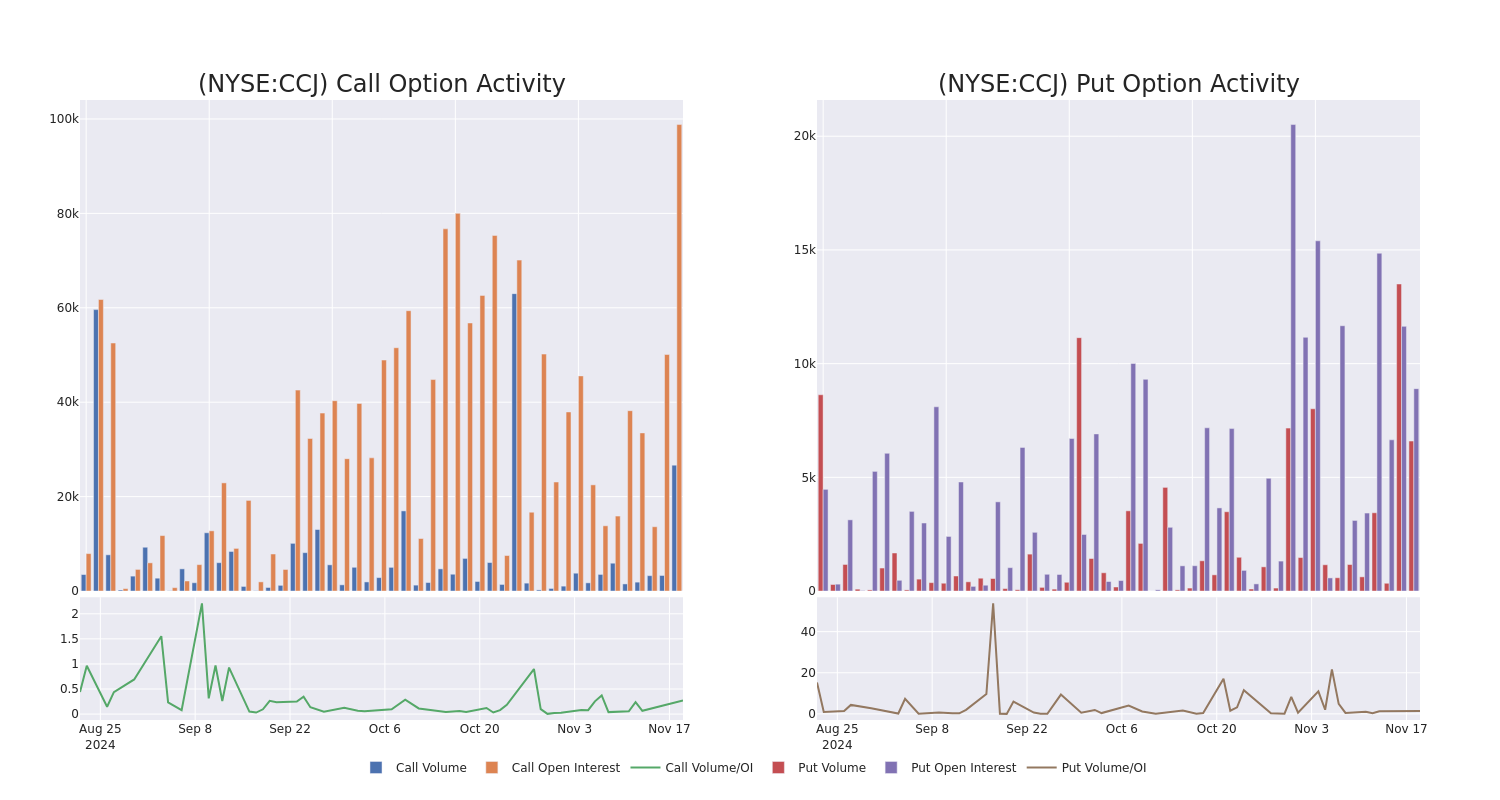

Volume & Open Interest Trends

In today’s trading context, the average open interest for options of Cameco stands at 8976.08, with a total volume reaching 33,251.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Cameco, situated within the strike price corridor from $20.0 to $70.0, throughout the last 30 days.

Cameco Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CCJ | PUT | TRADE | BULLISH | 01/17/25 | $2.76 | $2.72 | $2.73 | $55.00 | $409.5K | 3.4K | 1.5K |

| CCJ | CALL | TRADE | BEARISH | 12/20/24 | $4.7 | $4.6 | $4.63 | $55.00 | $209.7K | 13.0K | 1.4K |

| CCJ | CALL | SWEEP | BEARISH | 12/20/24 | $0.38 | $0.34 | $0.34 | $70.00 | $195.3K | 4.8K | 5.7K |

| CCJ | PUT | TRADE | BEARISH | 11/22/24 | $0.3 | $0.15 | $0.24 | $53.00 | $120.0K | 5.4K | 5.0K |

| CCJ | CALL | SWEEP | BULLISH | 12/20/24 | $2.26 | $2.24 | $2.25 | $60.00 | $109.8K | 38.3K | 4.2K |

About Cameco

Cameco Corp is a provider of uranium needed to generate clean, reliable baseload electricity around the globe. one of those uranium producers. Cameco has three reportable segments, uranium, fuel services and Westinghouse. It derives maximum revenue from Uranium Segment. It has some projects namely; Millennium, Yeelirrie, Kintyre and Exploration. The company operates in Canada, Kazakhstan, Germany, Australia and United States.

Where Is Cameco Standing Right Now?

- Trading volume stands at 3,893,171, with CCJ’s price up by 2.33%, positioned at $57.2.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 79 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Cameco options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Mining Automation Market Share, Growth Drivers, Growth Analysis | Exactitude Consultancy

Luton, Bedfordshire, United Kingdom, Nov. 19, 2024 (GLOBE NEWSWIRE) — The integration of smart connected mines presents considerable opportunities, spurred by the rapid digital transformation sweeping through the global mining industry. Mining automation offers critical advantages, such as enhanced worker safety, increased operational uptime, and significant cost savings. Advanced technologies like remote operation platforms, fleet management software, and data analytics enable supervisors to track, monitor, and analyze vast datasets generated from equipment and workforce operations in real time.

Access PDF Sample Report (Including Graphs, Charts & Figures) @

https://exactitudeconsultancy.com/reports/33351/mining-automation-market/#request-a-sample

These innovations allow companies to optimize their operations, enhance productivity, and achieve cost efficiency. For example, automated mining systems can reduce downtime by approximately 20% while enhancing output quality. Predictive maintenance supported by advanced data analytics has the potential to cut maintenance costs by an estimated 10-20% annually, improving overall resource extraction and processing efficiency.

Moreover, the adoption of connected mining solutions aligns with global sustainability initiatives. Automation and data-driven processes optimize resource utilization and minimize energy consumption, thus reducing the environmental footprint. By incorporating these solutions, companies can better comply with stringent environmental standards and contribute to sustainability goals. The market for smart mining technologies is projected to grow at a compound annual growth rate (CAGR) of roughly 17-20% over the next five years, reflecting strong industry adoption.

As the mining sector increasingly embraces digital technologies, businesses stand to achieve enhanced operational efficiency, reduced safety hazards, and stronger environmental compliance. This digital shift positions forward-thinking companies to secure a competitive edge in an evolving and increasingly regulated industry.

Mining Automation Market Trends

Drivers: Expanding Demand for Fleet Management Systems

The connected mining fleet management market is witnessing significant growth, driven by increased demand for minerals and resources spurred by industrialization and population growth. The expansion of mining operations necessitates advanced fleet management solutions, which reduce costs, improve operational efficiency, and support better decision-making. Technologies like Internet of Things (IoT), machine learning (ML), and automation enable real-time data collection and analytics, enhancing equipment performance and productivity. These advancements result in higher output with minimal resource consumption while prioritizing worker safety. The fleet management system market is expected to grow robustly, with adoption rates projected to rise by 12–15% annually over the next five years as the mining sector continues to embrace digital transformation.

Restraints: Depletion of Natural Resources

The exhaustion of natural resources poses a significant barrier, leading to environmental degradation, habitat destruction, and climate impact through greenhouse gas emissions. Overexploitation has resulted in declining ore grades, forcing mining companies to process larger quantities of material for minimal yields, increasing energy consumption and operational costs. In recent years, the volume of extractable resources has fallen by an estimated 8–10% globally. These issues underscore the pressing need for sustainable mining practices and innovative solutions to balance resource extraction with ecological preservation.

Opportunities: Rising Digitalization in the Mining Sector

The increasing adoption of digital technologies is transforming the mining industry, presenting opportunities to enhance safety and productivity. Digitalization focuses on three main aspects:

- Autonomous Vehicles & Equipment: The deployment of autonomous haul trucks and tunnelling machines minimizes risks for operators in remote mines. Autonomous vehicles are estimated to improve productivity by 15–20% while reducing operational costs by up to 12%.

- Connected Operations: Integrating advanced monitoring and tracking systems enables centralized control of equipment and fosters a digital work environment.

- Actionable Insights via AI: Smart algorithms analyze large datasets generated from connected devices, offering supervisors actionable insights to optimize operations, increase uptime by approximately 10–15%, and improve decision-making. These technologies collectively contribute to a 25–30% increase in operational efficiency.

Report Link Click Here: https://exactitudeconsultancy.com/reports/33351/mining-automation-market/

Challenges: Shortage of Skilled Workforce for Automation

The mining automation sector faces a critical skill gap due to the workforce’s limited expertise in operating and maintaining automated systems. Automation reduces the dependency on manual labor, potentially displacing traditional roles while creating new opportunities requiring advanced technical skills. The sector requires substantial investment in training and upskilling programs, with global initiatives estimated to rise by 8–10% in expenditure to address this gap. Additionally, mining automation demands high initial capital outlay, ongoing maintenance costs, and rigorous operational risk management, presenting a multi-faceted challenge to adoption.

Software Segment Growth in Mining Automation

The software segment within mining automation is poised for substantial growth, with a projected compound annual growth rate (CAGR) of approximately 12–15% over the forecast period. This surge is driven by the increasing complexities of mining operations, including reduced tonnage per shift, escalating operational costs, and the growing inhospitality of mines. These challenges necessitate advanced digital solutions to optimize efficiency, improve safety, and reduce expenses.

Mining firms are adopting a diverse range of software solutions, leveraging technologies such as real-time data tracking, analytics, and automation to streamline operations and enhance decision-making. This segment encompasses several critical areas:

- Fleet Management Systems: Optimize vehicle usage, reduce fuel consumption, and improve operational efficiency.

- Workforce Management: Facilitate the allocation and monitoring of labor resources, boosting productivity by up to 20% in trial deployments.

- Data Management Tools: Enable effective collection, analysis, and utilization of vast data volumes from connected equipment and sensors.

- Environmental Monitoring: Solutions for air quality and temperature monitoring to maintain safety standards in mines.

- Remote Operating & Monitoring Systems: Enhance operational control and oversight from centralized locations.

- Proximity Detection & Collision Avoidance: Prevent accidents and ensure worker safety by leveraging AI and IoT-based sensors.

- Additional Applications: Include payload monitoring and asset tracking, contributing to resource optimization and inventory accuracy.

Asia-Pacific Mining Automation Market Overview

The mining automation market in Asia-Pacific is poised for significant growth, driven by the region’s abundant natural resources and increasing adoption of advanced technologies. Key countries studied in the region include Australia, China, India, and others. Estimates suggest that Asia-Pacific will surpass other regions, becoming the largest market globally for mining automation technologies and equipment by 2030.

This growth is attributed to:

- Adoption by Global Mining Giants: Companies such as Rio Tinto (UK), Fortescue Metals Group (FMG, Australia), and BHP Billiton (Australia) are leveraging automated equipment extensively in their operations.

- Technological Advancements in Australia: Western Australia serves as a global leader, with mining corporations integrating autonomous haul trucks, drilling rigs, and robotic systems into their operations to enhance productivity and safety.

- Rising Investments in Digitization: Across the region, mining corporations are investing heavily in technologies like IoT, AI-driven analytics, and fleet management systems, spurred by increasing economic globalization and the push for sustainable mining practices.

Focus on Australia’s Mining Sector

Australia remains at the forefront of mining automation due to:

- Rich Mineral Resources: The country holds extensive reserves of minerals such as iron ore, coal, and gold.

- Advanced Mining Ecosystem: The sector benefits from state-of-the-art exploration techniques, efficient processing technologies, and well-documented geological data.

- Skilled Workforce & Low Population Density: These factors have enabled scalable and safe mining operations.

- Sustainability Initiatives: Australian mining companies are aligning with global efforts to reduce carbon emissions by adopting energy-efficient machinery and low-impact exploration methods.

Strategic Implications in the Mining Automation Sector

The accelerating adoption of mining automation technologies across Asia-Pacific, particularly in Australia, signifies a transformative regional shift towards smart mining practices. This evolution is driven by increasing demand for critical minerals essential for batteries and renewable energy systems, aligning with the global push for sustainability and clean energy. Partnerships between leading mining firms and technology providers are pivotal, enabling cost reductions, enhanced operational efficiency, and increased productivity.

Governments and corporations are expected to ramp up investments in key areas to support this growth. Infrastructure development, advanced R&D initiatives, and tailored training programs will address emerging challenges, such as skill gaps and the integration of sophisticated technologies. Notably, Australia’s mining ecosystem, benefiting from rich mineral resources and a skilled workforce, is poised to lead this automation boom.

In addition, initiatives promoting sustainability—such as the deployment of zero-emission equipment and digital solutions—will further catalyze the sector’s transformation. The global market for mining automation technologies is anticipated to grow at a CAGR of approximately 17-20% over the next five years, underscoring the strategic importance of this shift for industry stakeholders aiming to remain competitive in a dynamic global market.

Key Players:

- CATERPILLAR

- KOMATSU LTD.

- LIEBHERR-INTERNATIONAL DEUTSCHLAND GMBH

- SANDVIK AB

- ROCKWELL AUTOMATION

- EPIROC AB

- RPMGLOBAL HOLDINGS LIMITED

- SIEMENS

- HITACHI CONSTRUCTION MACHINERY CO., LTD.

- SANY GROUP

- AB VOLVO

- TRIMBLE INC.

- AUTONOMOUS SOLUTIONS, INC.

- HEXAGON AB

Mining Automation Market Segmentations:

By Offering:

- Equipment

- Autonomous Hauling/Mining Trucks

- Autonomous Drilling Rigs

- Underground LHD Loaders

- Tunneling Equipment

- Smart Ventilation Systems

- Pumping Stations

- Software

- Workforce Management Systems

- Proximity Detection and Collision Avoidance Systems

- Air Quality and Temperature Monitoring Systems

- Fleet Management Systems

- Remote Operating and Monitoring Systems

- Data Management Solutions

- Communication Systems

- Wireless Mesh Networks

- Navigation Systems

- Radio-frequency Identification (RFID) Tags

By Workflow:

- Mine development

- Mining process

By Technique:

- Underground Mining

- Surface Mining

By Region:

- North America

- Europe

- Turkey

- Sweden

- Rest of Europe

- Asia Pacific

- Australia

- China

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa

- South Africa

- Rest of Middle East & Africa

Recent Developments in Mining Automation Industry:

- Sandvik’s Underground Equipment Order – November 2023: Sandvik secured a major order from Jimond Mining Management Company (JMMC), a subsidiary of JCHX Mining Management, for underground mining equipment. This equipment will be used at the Kamoa-Kakula copper mine in the Democratic Republic of the Congo.

- Epiroc’s Australian Contract for Minetruck MT65 S Haulers – October 2023: Epiroc AB received an order from Byrnecut, one of the largest underground mining contractors in Australia, for a fleet of Minetruck MT65 S haulers for the Kathleen Valley mine in Western Australia.

- Caterpillar’s New Dozer – May 2023: Caterpillar introduced a new dozer that offers enhanced fuel efficiency, improved productivity, and increased uptime. The updated model boasts up to a 6% efficiency improvement compared to its predecessor, featuring a stator clutch torque converter and load-sensing hydraulics.

- Epiroc’s Fleet Order in South Africa – August 2023: Epiroc won a significant contract to supply electric-powered mining equipment to a major gold mining operator in South Africa. This forms part of the industry’s shift toward reducing carbon emissions.

- Sandvik’s Equipment for Australia’s Evolution Mining – April 2023: Sandvik secured a significant order for underground mining equipment from Evolution Mining, one of Australia’s prominent mining firms. The order includes a variety of mining machines, enhancing operational efficiency and safety at their Australian sites.

Get a Sample PDF Brochure https://exactitudeconsultancy.com/reports/33351/mining-automation-market/#request-a-sample

Related Reports:

Integrated Marine Automation System Market

https://exactitudeconsultancy.com/reports/2212/integrated-marine-automation-system-market/

The global integrated marine automation system market is expected to grow at 10% CAGR from 2019 to 2028. It is expected to reach above USD 10.38 billion by 2028 from USD 4.40 billion in 2019.

Logistics Automation Market

https://exactitudeconsultancy.com/reports/2234/logistics-automation-market/

The global logistics automation market is expected to grow a 10% CAGR from 2019 to 2028. It is expected to reach above USD 103.75 billion by 2028 from USD 44 billion in 2019.

Electric Vehicle Polymers Market

https://exactitudeconsultancy.com/reports/2211/electric-vehicle-polymers-market/

The Electric Vehicle (Car) Polymers Market size is projected to grow from the estimated USD 49.2 billion in 2019 to USD 62.8 billion by 2028, at a compound annual growth rate (CAGR) of 4.2% during the forecast period.

Electric Ships Market

https://exactitudeconsultancy.com/reports/2197/electric-ships-market/

The global Electric Ships Market is expected to grow at more than 13% CAGR from 2019 to 2028. It is expected to reach above USD 15.11 billion by 2028 from a little above USD 3.96 billion in 2019.

Rail Signal Market

https://exactitudeconsultancy.com/reports/1411/rail-signal-market/

The Global Rail Signal Market is expected to grow at more than 8.7% CAGR from 2019 to 2028. It is expected to reach above USD 14.5 billion by 2028 from a little above USD 8.8 billion in 2019.

Automotive Sunroof Market

https://exactitudeconsultancy.com/reports/1043/automotive-sunroof-market/

The Global Automotive Sunroof Market size is expected to grow at more than 6% CAGR from 2019 to 2026. It is expected to reach above USD 19 billion by 2026 from USD 15 billion in 2019.

Aircraft & Marine Turbocharger Market

https://exactitudeconsultancy.com/reports/2050/aircraft-marine-turbocharger-market/

The Global Aircraft & Marine Turbocharger Market is Expected to Grow at more than 3% CAGR from 2019 To 2028. It is Expected to Reach Above USD 288 Million By 2028 From a Little Above USD 275 Million in 2019.

Headlamps Market

https://exactitudeconsultancy.com/reports/965/headlamps-market/

The Global Headlamps Market is expected to grow at more than 3.96% CAGR from 2018 to 2025. It is expected to reach above USD 229 million by 2025 from a little above USD 176 million in 2018.

Automotive Plastics Market

https://exactitudeconsultancy.com/reports/2103/automotive-plastics-market/

The global automotive plastics market is expected to grow at 7.9% CAGR from 2019 to 2028. It is expected to reach above USD 35.93 billion by 2028 from USD 18.12 billion in 2019.

Transportation Telematics Market

https://exactitudeconsultancy.com/reports/3118/transportation-telematics-market/

The global transportation telematics market is expected to grow at 20% CAGR from 2022 to 2029. It is expected to reach above USD 66.04 billion by 2029 from USD 12.79 billion in 2020.

Automotive E-E Architecture Market

https://exactitudeconsultancy.com/reports/987/automotive-e-e-architecture-market/

The Global Automotive E-E Architecture Market is expected to grow at more than 11.44% CAGR from 2019 to 2028. It is expected to reach above USD 184.9 billion by 2028 from a little above USD 84 billion in 2019.

Highway Drive-Assist Market

https://exactitudeconsultancy.com/reports/3227/highway-drive-assist-market/

The global Highway Drive-Assist Market is expected to grow at 24.6% CAGR from 2022 to 2029. It is expected to reach above USD 11.2 billion by 2029 from USD 2.3 Billion in 2020.

Irfan Tamboli (Head of Sales) Phone: + 1704 266 3234 Email: sales@exactitudeconsultancy.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Aeries Technology Reports Results for Second Fiscal Quarter 2025

North America Revenue Up 13.3% Year-Over-Year

Business Re-Focused on Core North American Global Capability Center (GCC) Market

NEW YORK, Nov. 19, 2024 (GLOBE NEWSWIRE) — Aeries Technology AERT, a global professional services and consulting partner for businesses in transformation mode and their stakeholders, today announced financial results for the fiscal quarter ended September 30, 2024.

“We are taking significant steps, including continued alignment of our cost structure, to re-focus on our core business, which consists mostly of US-based, long tenure, high quality private equity backed portfolio companies. These clients have served as a consistent revenue base for Aeries and we believe the North American GCC market will continue to grow with us,” said Sudhir Panikassery, CEO of Aeries Technology. “Our North America revenue was up 13.3% year-over-year, demonstrating the growth potential behind this shift in focus. We’re seeing strong interest from new prospective core clients and have strong visibility into the pipeline that gives us confidence in our new guidance for fiscal 2025.”

Fiscal Quarter Ended September 30, 2024 (Second Fiscal Quarter 2025) Financial Highlights

Revenues: Revenues for the second fiscal quarter 2025 were $16.9 million, down 4% compared to $17.6 million for the second fiscal quarter of 2024.

North America Revenue: North America revenue for the second fiscal quarter 2025 was $15.7 million, up 13% compared to $13.9 million for the second fiscal quarter of 2024.

Income (Loss) from Operations: Income from operations for the second fiscal quarter 2025 was $(4.1) million, down compared to $1.5 million for the second fiscal quarter of 2024.

Net Income (Loss): Net loss for the second fiscal quarter 2025 was $(2.3) million compared to net income of $0.9 million for the second fiscal quarter of 2024.

Adjusted EBITDA: Adjusted EBITDA for the second fiscal quarter 2025 was negative $(2.3) million compared to $3.0 million for the second fiscal quarter of 2024.

Core Adjusted EBITDA: Core Adjusted EBITDA for the second fiscal quarter 2025 was $0.2 million, down 82% compared to $1.0 million for the second fiscal quarter of 2024.

Conference Call Details

The company will host a conference call to discuss their financial results on Wednesday, November 20, 2024 at 8:30 AM ET. The call will be accessible by telephone at 877-407-0792 (domestic) or 1-201-689-8263 (international). The call will also be available live via webcast on the company’s investor relations website at https://ir.aeriestechnology.com or directly here.

A telephone replay of the conference call will be available following its conclusion at 1-844-512-2921 (domestic) or 1-412-317-6671 (international) with access code 13750295 and will be available until 11:59 PM ET, November 27, 2024. An archive of the webcast will also be available on the company’s investor relations website at https://ir.aeriestechnology.com.

About Aeries Technology

Aeries Technology AERT is a global professional services and consulting partner for businesses in transformation mode and their stakeholders, including private equity sponsors and their portfolio companies, with customized engagement models that are designed to provide the right mix of deep vertical specialty, functional expertise, and digital systems and solutions to scale, optimize and transform a client’s business operations. Founded in 2012, Aeries Technology now has over 1,700 professionals specializing in Technology Services and Solutions, Business Process Management, and Digital Transformation initiatives, geared towards providing tailored solutions to drive business success. Aeries Technology’s approach to staffing and developing its workforce has earned it the Great Place to Work Certification.

Non-GAAP Financial Measures

The Company uses non-GAAP financial information and believes it is useful to investors as it provides additional information to facilitate comparisons of historical operating results, identify trends in its underlying operating results and provide additional insight and transparency on how it evaluates the business. The Company uses non-GAAP financial measures to budget, make operating and strategic decisions, and evaluate its performance. The Company has detailed the non-GAAP adjustments that it makes in the non-GAAP definitions below. The adjustments generally fall within the categories of non-cash items. The Company believes the non-GAAP measures presented herein should always be considered along with, and not as a substitute for or superior to, the related GAAP financial measures. In addition, similarly titled items used by other companies may not be comparable due to variations in how they are calculated and how terms are defined. For further information, see “Reconciliation of Non—GAAP Financial Measures” below, including the reconciliations of these non-GAAP measures to their most directly comparable GAAP financial measures.

The Company defines Adjusted EBITDA as net income from operations before interest, income taxes, depreciation and amortization adjusted to exclude stock-based compensation and business combination related costs. The Company defines Core Adjusted EBITDA as Adjusted EBITDA less EBITDA from non-core business. The Company’s core business includes global capability center services provided to private equity-backed companies, primarily in North America, characterized by long-term relationships, recurring contracts, and multi-year revenue streams. In contrast, its non-core business includes consulting services, primarily for customers in the Middle East, which typically involve one-time engagements with extended collection cycles. Moving forward, the Company aims for the majority of its revenue to be generated from its core business, and does not currently plan to enter into new customer contracts outside North America.

Adjusted EBITDA and Core Adjusted EBITDA are key performance indicators the company uses in evaluating our operating performance and in making financial, operating, and planning decisions. The Company believes these measures are useful to investors in the evaluation of Aeries’ operating performance as such information was used by the Company’s management for internal reporting and planning procedures, including aspects of our consolidated operating budget and capital expenditures. Some of the limitations of Adjusted EBITDA and Core Adjusted EBITDA include: each of these measures does not reflect (i) our cash expenditures or future requirements for capital expenditures or contractual commitments or foreign exchange gain/loss; (ii) changes in, or cash requirements for, working capital; (iii) significant interest expense or the cash requirements necessary to service interest or principal payments on our outstanding debt; (iv) payments made or future requirements for income taxes; and (v) cash requirements for future replacement or payment in depreciated or amortized assets; (vi) stock based compensation costs, (vii) Business Combination and transaction related costs, which represent non-recurring legal, professional, personnel and other fees and expenses incurred in connection with potential mergers and acquisitions related activities for the three and six months ended September 30, 2024, and Business Combination related costs for the three and six months related September 30, 2023, (viii) change in fair value of derivative liabilities. Additionally, the Core Adjusted EBITDA does not reflect the provision for expected credit loss / (profit) from non-core business.

Forward-Looking Statements

All statements in this release that are not based on historical fact are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and the provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Words such as “anticipate,” “believe,” “continue,” “could,” “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “should”, “would”, “will”, “understand” and similar words are intended to identify forward looking statements. These forward-looking statements include but are not limited to, statements regarding our future operating results, outlook, guidance and financial position, our business strategy and plans, our objectives for future operations, potential acquisitions and macroeconomic trends. While management has based any forward-looking statements included in this release on its current expectations, the information on which such expectations were based may change. These forward-looking statements rely on a number of assumptions concerning future events and are subject to a number of risks, uncertainties and other factors, many of which are outside of the control of Aeries and its subsidiaries, which could cause actual results to materially differ from such statements. Such risks, uncertainties, and other factors include, but are not limited to, changes in the business, market, financial, political and legal conditions in India, Singapore, the United States, Mexico, the Cayman Islands and other countries, including developments with respect to inflation, interest rates and the global supply chain, including with respect to economic and geopolitical uncertainty in many markets around the world, the potential of decelerating global economic growth and increased volatility in foreign currency exchange rates; the potential for our business development efforts to maximize our potential value; the ability to recognize the anticipated benefits of the business combination with Worldwide Webb Acquisition Corp., which may be affected by, among other things, competition, our ability to grow and manage growth profitably and retain its key employees; the ability to maintain the listing of our Class A ordinary shares and our public warrants on Nasdaq, and the potential liquidity and trading of our securities; changes in applicable laws or regulations and other regulatory developments in the United States, India, Singapore, Mexico, the Cayman Islands and other countries; our ability to develop and maintain effective internal controls, including our ability to remediate the material weakness in our internal controls over financial reporting; our success in retaining or recruiting, or changes required in, our officers, key employees or directors; our financial performance; our ability to continue as a going concern; our ability to make acquisitions, divestments or form joint ventures or otherwise make investments and the ability to successfully complete such transactions and integrate with our business; the period over which we anticipate our existing cash and cash equivalents will be sufficient to fund our operating expenses and capital expenditure requirements; the conflicts between Russia and Ukraine, and Israel and Hamas, and any restrictive actions that have been or may be taken by the U.S. and/or other countries in response thereto, such as sanctions or export controls; risks related to cybersecurity and data privacy; the impact of inflation; the impact of the COVID-19 pandemic and other similar pandemics and disruptions in the future; and the fluctuation of economic conditions, global conflicts, inflation and other global events on Aeries’ results of operations and global supply chain constraints. Further information on risks, uncertainties and other factors that could affect our financial results are included in Aeries’ periodic and current reports filed with the U.S. Securities and Exchange Commission. Furthermore, Aeries operates in a highly competitive and rapidly changing environment where new and unanticipated risks may arise. Accordingly, investors should not place any reliance on forward-looking statements as a prediction of actual results. Aeries disclaims any intention to, and undertakes no obligation to, update or revise forward-looking statements.

Contacts

Ryan Gardella

AeriesIR@icrinc.com

| AERIES TECHNOLOGY, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS As of September 30, 2024 and March 31, 2024 (in thousands of United States dollars, except share and per share amounts) |

||||||||

| SEPTEMBER 30, 2024 |

MARCH 31, 2024 |

|||||||

| (Unaudited) | (Audited) | |||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 3,627 | $ | 2,084 | ||||

| Accounts receivable, net of allowance of $4,844 and $1,263 as of September 30, 2024 and March 31, 2024, respectively | 18,477 | 23,757 | ||||||

| Prepaid expenses and other current assets, net of allowance of $1 and $1, as of September 30, 2024 and March 31, 2024, respectively | 7,343 | 6,995 | ||||||

| Total current assets | $ | 29,447 | $ | 32,836 | ||||

| Property and equipment, net | 3,728 | 3,579 | ||||||

| Operating right-of-use assets | 8,486 | 7,318 | ||||||

| Deferred tax assets | 3,899 | 1,933 | ||||||

| Long-term investments, net of allowance of $117 and $126, as of September 30, 2024 and March 31, 2024, respectively | 1,717 | 1,612 | ||||||

| Other assets, net of allowance of $1 and $1, as of September 30, 2024 and March 31, 2024, respectively | 4,683 | 2,129 | ||||||

| Total assets | $ | 51,960 | $ | 49,407 | ||||

| LIABILITIES, REDEEMABLE NONCONTROLLING INTEREST AND SHAREHOLDERS’ EQUITY (DEFICIT) | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 7,330 | $ | 6,616 | ||||

| Accrued compensation and related benefits, current | 2,603 | 3,119 | ||||||

| Operating lease liabilities, current | 1,654 | 2,080 | ||||||

| Short-term borrowings | 4,482 | 6,778 | ||||||

| Forward purchase agreement put option liability | 9,563 | 10,244 | ||||||

| Other current liabilities | 13,591 | 9,288 | ||||||

| Total current liabilities | $ | 39,223 | $ | 38,125 | ||||

| Long term debt | 1,514 | 1,440 | ||||||

| Operating lease liabilities, noncurrent | 7,209 | 5,615 | ||||||

| Derivative warrant liabilities | 736 | 1,367 | ||||||

| Deferred tax liabilities | 130 | 92 | ||||||

| Other liabilities | 4,462 | 3,948 | ||||||

| Total liabilities | $ | 53,274 | $ | 50,587 | ||||

| Commitments and contingencies (Note 10) | ||||||||

| Redeemable noncontrolling interest | 685 | 734 | ||||||

| Shareholders’ equity (deficit) | ||||||||

| Preference shares, $0.0001 par value; 5,000,000 shares authorized; none issued or outstanding | – | – | ||||||

| Class A ordinary shares, $0.0001 par value; 500,000,000 shares authorized; 44,500,426 shares issued and outstanding as of September 30, 2024; 15,619,004 shares issued and outstanding as of March 31, 2024 | 4 | 2 | ||||||

| Class V ordinary shares, $0.0001 par value; 1 share authorized, issued and outstanding | – | – | ||||||

| Net shareholders’ investment and additional paid-in capital | 27,159 | – | ||||||

| Accumulated other comprehensive loss | (800 | ) | (574 | ) | ||||

| Accumulated deficit | (28,679 | ) | (11,668 | ) | ||||

| Total Aeries Technology, Inc. shareholders’ deficit | $ | (2,316 | ) | $ | (12,240 | ) | ||

| Noncontrolling interest | 317 | 10,326 | ||||||

| Total shareholders’ equity (deficit) | (1,999 | ) | (1,914 | ) | ||||

| Total liabilities, redeemable noncontrolling interest and shareholders’ equity (deficit) | $ | 51,960 | $ | 49,407 | ||||

| AERIES TECHNOLOGY, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS For the three and six months ended September 30, 2024 and 2023 (in thousands of United States dollars, except share and per share amounts) (Unaudited) |

||||||||||||||||

| Three Months Ended September 30, 2024 |

Three Months Ended September 30, 2023 |

Six Months Ended September 30, 2024 |

Six Months Ended September 30, 2023 |

|||||||||||||

| Revenue, net | $ | 16,873 | $ | 17,578 | $ | 33,540 | $ | 33,908 | ||||||||

| Cost of revenue | 13,298 | 12,754 | 25,955 | 24,637 | ||||||||||||

| Gross profit | 3,575 | 4,824 | 7,585 | 9,271 | ||||||||||||

| Operating expenses | ||||||||||||||||

| Selling, general & administrative expenses | 7,670 | 3,338 | 28,100 | 7,008 | ||||||||||||

| Total operating expenses | 7,670 | 3,338 | 28,100 | 7,008 | ||||||||||||

| Income from operations | (4,095 | ) | 1,486 | (20,515 | ) | 2,263 | ||||||||||

| Other income / (expense) | ||||||||||||||||

| Change in fair value forward purchase agreement put option liability | 1,377 | – | 681 | – | ||||||||||||

| Change in fair value of derivative warrant liabilities | (126 | ) | – | 631 | – | |||||||||||

| Interest income | 88 | 70 | 167 | 134 | ||||||||||||

| Interest expense | (135 | ) | (76 | ) | (282 | ) | (199 | ) | ||||||||

| Other income / (expense), net | 59 | 126 | 78 | 120 | ||||||||||||

| Total other income / (expense), net | 1,263 | 120 | 1,275 | 55 | ||||||||||||

| Income / (loss) before income taxes | (2,832 | ) | 1,606 | (19,240 | ) | 2,318 | ||||||||||

| Income tax (expense) / benefit | 526 | (679 | ) | 1,617 | (897 | ) | ||||||||||

| Net income / (loss) | $ | (2,306 | ) | $ | 927 | $ | (17,623 | ) | $ | 1,421 | ||||||

| Less: Net income / (loss) attributable to noncontrolling interests | (90 | ) | 108 | (596 | ) | 181 | ||||||||||

| Net income / (loss) attributable to redeemable noncontrolling interests | $ | (26 | ) | $ | – | $ | (16 | ) | $ | – | ||||||

| Net income / (loss) attributable to shareholders’ of Aeries Technology Inc. | $ | (2,190 | ) | 819 | (17,011 | ) | 1,240 | |||||||||

| Weighted average shares outstanding of Class A ordinary shares, basic and diluted(1) | 44,356,074 | 41,121,826 | ||||||||||||||

| Basic and diluted net loss per Class A ordinary share(1) | $ | (0.05 | ) | $ | (0.42 | ) | ||||||||||

| (1) | Net loss per Class A ordinary share and weighted average Class A ordinary shares outstanding are not presented for the periods prior to the Business Combination, as defined in Note 1. For more information refer to Note 15. | |

| AERIES TECHNOLOGY, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS For the six months ended September 30, 2024, and 2023 (in thousands of United States dollars except share and per share amounts) (Unaudited) |

||||||||

| Six Months Ended September 30, 2024 |

Six Months Ended September 30, 2023 |

|||||||

| Cash flows from operating activities | ||||||||

| Net income / (loss) | $ | (17,623 | ) | $ | 1,421 | |||

| Adjustments to reconcile net income / (loss) to net cash (used in) / provided by operating activities: | ||||||||

| Depreciation and amortization expense | 745 | 661 | ||||||

| Stock-based compensation expense | 12,746 | 1,626 | ||||||

| Deferred tax (benefit) / expense | (1,907 | ) | (81 | ) | ||||

| Accrued income from long-term investments | (106 | ) | (92 | ) | ||||

| Provision for expected credit loss | 3,579 | 15 | ||||||

| Profit on sale of property and equipment | (6 | ) | – | |||||

| Others | (29 | ) | (18 | ) | ||||

| Change in fair value of forward purchase agreement put option liability | (631 | ) | – | |||||

| Change in fair value of derivative warrant liabilities | (681 | ) | – | |||||

| Loss on issuance of shares against accounts payable | 342 | – | ||||||

| Unrealized exchange gain | (40 | ) | (53 | ) | ||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | 1,264 | (1,229 | ) | |||||

| Prepaid expenses and other current assets | (454 | ) | (3,209 | ) | ||||

| Operating right-of-use assets | (2,146 | ) | (631 | ) | ||||

| Other assets | (2,557 | ) | (360 | ) | ||||

| Accounts payable | 863 | (996 | ) | |||||

| Accrued compensation and related benefits, current | (473 | ) | (429 | ) | ||||

| Other current liabilities | 4,552 | 3,377 | ||||||

| Operating lease liabilities | 2,176 | 724 | ||||||

| Other liabilities | 591 | 661 | ||||||

| Net cash provided by operating activities | 205 | 1,387 | ||||||

| Cash flows from investing activities | ||||||||

| Acquisition of property and equipment | (982 | ) | (734 | ) | ||||

| Sale of property and equipment | 7 | – | ||||||

| Issuance of loans to affiliates | (866 | ) | (769 | ) | ||||

| Payments received for loans to affiliates | 853 | 694 | ||||||

| Net cash used in investing activities | (988 | ) | (809 | ) | ||||

| Cash flows from financing activities | ||||||||

| Net proceeds from short term borrowings | (1,855 | ) | 1,270 | |||||

| Payment of insurance financing liability | (440 | ) | – | |||||

| Proceeds from long-term debt | 916 | 575 | ||||||

| Repayment of long-term debt | (820 | ) | (282 | ) | ||||

| Payment of finance lease obligations | (210 | ) | (211 | ) | ||||

| Payment of deferred transaction costs | (20 | ) | (1,147 | ) | ||||

| Net changes in net shareholders’ investment | – | (10 | ) | |||||

| Proceeds from issuance of Class A ordinary shares, net of issuance cost | 4,678 | – | ||||||

| Net cash provided by financing activities | 2,249 | 195 | ||||||

| Effect of exchange rate changes on cash and cash equivalents | 77 | (22 | ) | |||||

| Net increase in cash and cash equivalents | 1,543 | 751 | ||||||

| Cash and cash equivalents at the beginning of the period | 2,084 | 1,131 | ||||||

| Cash and cash equivalents at the end of the period | $ | 3,627 | $ | 1,882 | ||||

| Supplemental cash flow disclosure: | ||||||||

| Cash paid for interest | $ | 321 | $ | 178 | ||||

| Cash paid for income taxes, net of refunds | $ | 556 | $ | 625 | ||||

| Supplemental disclosure of non-cash investing and financing activities: | ||||||||

| Unpaid deferred transaction costs included in accounts payable and other current liabilities | $ | 640 | $ | 1,454 | ||||

| Equipment acquired under finance lease obligations | $ | 38 | $ | 235 | ||||

| Property and equipment purchase included in accounts payable | $ | 1 | $ | 4 | ||||

| Settlement of accounts payable through issuance of Class A ordinary shares to vendors | $ | 342 | $ | – | ||||

| AERIES TECHNOLOGY, INC. AND SUBSIDIARIES RECONCILIATION OF NON-GAAP FINANCIAL MEASURES For the three and six months ended September 30, 2024 and 2023 (in thousands of United States dollars, except percentages) |

||||||||||||||||

| Three Months Ended September 30, |

Six Months Ended September 30, |

|||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Net income | $ | (2,306 | ) | $ | 927 | $ | (17,623 | ) | $ | 1,421 | ||||||

| Income tax expense | (526 | ) | 679 | (1,617 | ) | 897 | ||||||||||

| Interest income | (88 | ) | (70 | ) | (167 | ) | (134 | ) | ||||||||

| Interest expense | 135 | 76 | 282 | 199 | ||||||||||||

| Depreciation and amortization | 371 | 334 | 745 | 661 | ||||||||||||

| EBITDA | $ | (2,414 | ) | $ | 1,946 | $ | (18,380 | ) | $ | 3,044 | ||||||

| Adjustments | ||||||||||||||||

| (+) Stock-based compensation | – | 252 | 12,746 | 1,626 | ||||||||||||

| (+) Business Combination and transaction related costs | 1,370 | 741 | 5,052 | 1,171 | ||||||||||||

| (-) Change in fair value of derivative liabilities | (1,251 | ) | – | (1,312 | ) | – | ||||||||||

| Adjusted EBITDA | $ | (2,295 | ) | $ | 2,939 | $ | (1,894 | ) | $ | 5,841 | ||||||

| (+) Loss / (Profit) from non-core business | 2,478 | (1,929 | ) | 3,513 | (3,184 | ) | ||||||||||

| Core adjusted EBITDA | 183 | 1,010 | 1,619 | 2,657 | ||||||||||||

| Revenue | 16,873 | 17,578 | 33,540 | 33,908 | ||||||||||||

| Adjusted EBITDA margin [Adjusted EBITDA / Revenue] | (13.6 | )% | 16.7 | % | (5.6 | )% | 17.2 | % | ||||||||

| REVENUE BREAKOUT BY GEOGRAPHY For the three and six months ended September 30, 2024 and 2023 (in thousands of United States dollars) |

||||||||||||||||

| Three Months Ended September 30, |

Six Months Ended September 30, |

|||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| North America | $ | 15,728 | $ | 13,879 | $ | 31,235 | $ | 26,366 | ||||||||

| Asia Pacific and Other | 1,145 | 3,699 | 2,305 | 7,542 | ||||||||||||

| Total revenue | $ | 16,873 | $ | 17,578 | $ | 33,540 | $ | 33,908 | ||||||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

DT Midstream Announces Proposed Public Offering of Common Stock

DETROIT, Nov. 19, 2024 (GLOBE NEWSWIRE) — DT Midstream, Inc. DTM announced that it has commenced an underwritten public offering of $300 million of shares of common stock. In connection with this offering, the Company expects to grant the underwriters a 30-day option to purchase up to $45 million of additional shares of common stock at the public offering price, less the underwriting discounts and commissions. The offering is subject to market and other conditions, and there can be no assurances as to whether or when the offering may be completed, or as to the actual size or terms of the offering.

The Company intends to use the net proceeds from this offering, together with proceeds from the expected issuance of up to $650 million aggregate principal amount of new senior secured notes, borrowings under our revolving credit facility and cash on hand, to fund the consideration payable by us in the previously-announced, pending acquisition of all of the equity interests in Guardian Pipeline, L.L.C., Midwestern Gas Transmission Company and Viking Gas Transmission Company from ONEOK Partners Intermediate Limited Partnership and Border Midwestern Company. Barclays Capital Inc. is acting as lead book-running manager. The closing of the offering is not conditioned upon the closing of the pending acquisition.

The shares described above are being offered by the Company pursuant to the Company’s shelf registration statement on Form S-3, including a base prospectus, that was previously filed by the Company with the Securities and Exchange Commission (“SEC”) and that became automatically effective on November 19, 2024. The offering will be made only by means of a preliminary prospectus supplement and the accompanying base prospectus, which are available for free on the SEC’s website located at http://www.sec.gov. A final prospectus relating to the offering will be filed with the SEC and may be obtained, when available, by contacting: Barclays Capital Inc., c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, emailing Barclaysprospectus@broadridge.com or calling (888) 603-5847.

This press release does not constitute an offer to sell or the solicitation of an offer to buy any shares of the Company’s common stock or any other security, nor is there any offer or sale of these securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About DT Midstream

DT Midstream DTM is an owner, operator and developer of natural gas interstate and intrastate pipelines, storage and gathering systems, compression, treatment and surface facilities. The company transports clean natural gas for utilities, power plants, marketers, large industrial customers and energy producers across the Southern, Northeastern and Midwestern United States and Canada. The Detroit-based company offers a comprehensive, wellhead-to-market array of services, including natural gas transportation, storage and gathering. DT Midstream is transitioning towards net zero greenhouse gas emissions by 2050, including a goal of achieving 30% of its carbon emissions reduction by 2030.

Safe Harbor Statement

This press release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, which are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, as amended. Words such as “expects” or “intends” or other similar expressions are intended to identify forward-looking statements. Such statements relate to the proposed public offering and the anticipated use of the net proceeds from the offering. No assurance can be given that the offering discussed above will be completed on the terms described, or at all.

Forward-looking Statements

This release contains statements which, to the extent they are not statements of historical or present fact, constitute “forward-looking statements” under the securities laws. These forward-looking statements are intended to provide management’s current expectations or plans for our future operating and financial performance, business prospects, outcomes of regulatory proceedings, market conditions, and other matters, based on what we believe to be reasonable assumptions and on information currently available to us.

Forward-looking statements can be identified by the use of words such as “believe,” “expect,” “expectations,” “plans,” “strategy,” “prospects,” “estimate,” “project,” “target,” “anticipate,” “will,” “should,” “see,” “guidance,” “outlook,” “confident” and other words of similar meaning. The absence of such words, expressions or statements, however, does not mean that the statements are not forward-looking. In particular, express or implied statements relating to future earnings, cash flow, results of operations, uses of cash, tax rates and other measures of financial performance, future actions, conditions or events, potential future plans, strategies or transactions of DT Midstream, and other statements that are not historical facts, are forward-looking statements.

Forward-looking statements are not guarantees of future results and conditions, but rather are subject to numerous assumptions, risks, and uncertainties that may cause actual future results to be materially different from those contemplated, projected, estimated, or budgeted. Many factors may impact forward-looking statements of DT Midstream including, but not limited to, the following: changes in general economic conditions, including increases in interest rates and associated Federal Reserve policies, a potential economic recession, and the impact of inflation on our business; industry changes, including the impact of consolidations, alternative energy sources, technological advances, infrastructure constraints and changes in competition; global supply chain disruptions; actions taken by third-party operators, processors, transporters and gatherers; changes in expected production from Expand Energy Corporation and other third parties in our areas of operation; demand for natural gas gathering, transmission, storage, transportation and water services; the availability and price of natural gas to the consumer compared to the price of alternative and competing fuels; our ability to successfully and timely implement our business plan; our ability to complete organic growth projects on time and on budget; our ability to finance, complete, or successfully integrate acquisitions; the price and availability of debt and equity financing; our ability to fund and close the pending transaction, the anticipated timing and terms of the pending transaction, our ability to realize the anticipated benefits of the pending transaction, and our ability to manage the risks of the pending transaction; restrictions in our existing and any future credit facilities and indentures; the effectiveness of our information technology and operational technology systems and practices to prevent, detect and defend against evolving cyber attacks on United States critical infrastructure; changing laws regarding cybersecurity and data privacy, and any cybersecurity threat or event; operating hazards, environmental risks, and other risks incidental to gathering, storing and transporting natural gas; geologic and reservoir risks and considerations; natural disasters, adverse weather conditions, casualty losses and other matters beyond our control; the impact of outbreaks of illnesses, epidemics and pandemics, and any related economic effects; the impacts of geopolitical events, including the conflicts in Ukraine and the Middle East; labor relations and markets, including the ability to attract, hire and retain key employee and contract personnel; large customer defaults; changes in tax status, as well as changes in tax rates and regulations; the effects and associated cost of compliance with existing and future laws and governmental regulations, such as the Inflation Reduction Act; changes in environmental laws, regulations or enforcement policies, including laws and regulations relating to climate change and greenhouse gas emissions; ability to develop low carbon business opportunities and deploy greenhouse gas reducing technologies; changes in insurance markets impacting costs and the level and types of coverage available; the timing and extent of changes in commodity prices; the success of our risk management strategies; the suspension, reduction or termination of our customers’ obligations under our commercial agreements; disruptions due to equipment interruption or failure at our facilities, or third-party facilities on which our business is dependent; the effects of future litigation; and the risks described in our Annual Report on Form 10-K for the year ended December 31, 2023 and our reports and registration statements filed from time to time with the SEC.