DT Midstream Announces Proposed Public Offering of Common Stock

DETROIT, Nov. 19, 2024 (GLOBE NEWSWIRE) — DT Midstream, Inc. DTM announced that it has commenced an underwritten public offering of $300 million of shares of common stock. In connection with this offering, the Company expects to grant the underwriters a 30-day option to purchase up to $45 million of additional shares of common stock at the public offering price, less the underwriting discounts and commissions. The offering is subject to market and other conditions, and there can be no assurances as to whether or when the offering may be completed, or as to the actual size or terms of the offering.

The Company intends to use the net proceeds from this offering, together with proceeds from the expected issuance of up to $650 million aggregate principal amount of new senior secured notes, borrowings under our revolving credit facility and cash on hand, to fund the consideration payable by us in the previously-announced, pending acquisition of all of the equity interests in Guardian Pipeline, L.L.C., Midwestern Gas Transmission Company and Viking Gas Transmission Company from ONEOK Partners Intermediate Limited Partnership and Border Midwestern Company. Barclays Capital Inc. is acting as lead book-running manager. The closing of the offering is not conditioned upon the closing of the pending acquisition.

The shares described above are being offered by the Company pursuant to the Company’s shelf registration statement on Form S-3, including a base prospectus, that was previously filed by the Company with the Securities and Exchange Commission (“SEC”) and that became automatically effective on November 19, 2024. The offering will be made only by means of a preliminary prospectus supplement and the accompanying base prospectus, which are available for free on the SEC’s website located at http://www.sec.gov. A final prospectus relating to the offering will be filed with the SEC and may be obtained, when available, by contacting: Barclays Capital Inc., c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, emailing Barclaysprospectus@broadridge.com or calling (888) 603-5847.

This press release does not constitute an offer to sell or the solicitation of an offer to buy any shares of the Company’s common stock or any other security, nor is there any offer or sale of these securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About DT Midstream

DT Midstream DTM is an owner, operator and developer of natural gas interstate and intrastate pipelines, storage and gathering systems, compression, treatment and surface facilities. The company transports clean natural gas for utilities, power plants, marketers, large industrial customers and energy producers across the Southern, Northeastern and Midwestern United States and Canada. The Detroit-based company offers a comprehensive, wellhead-to-market array of services, including natural gas transportation, storage and gathering. DT Midstream is transitioning towards net zero greenhouse gas emissions by 2050, including a goal of achieving 30% of its carbon emissions reduction by 2030.

Safe Harbor Statement

This press release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, which are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, as amended. Words such as “expects” or “intends” or other similar expressions are intended to identify forward-looking statements. Such statements relate to the proposed public offering and the anticipated use of the net proceeds from the offering. No assurance can be given that the offering discussed above will be completed on the terms described, or at all.

Forward-looking Statements

This release contains statements which, to the extent they are not statements of historical or present fact, constitute “forward-looking statements” under the securities laws. These forward-looking statements are intended to provide management’s current expectations or plans for our future operating and financial performance, business prospects, outcomes of regulatory proceedings, market conditions, and other matters, based on what we believe to be reasonable assumptions and on information currently available to us.

Forward-looking statements can be identified by the use of words such as “believe,” “expect,” “expectations,” “plans,” “strategy,” “prospects,” “estimate,” “project,” “target,” “anticipate,” “will,” “should,” “see,” “guidance,” “outlook,” “confident” and other words of similar meaning. The absence of such words, expressions or statements, however, does not mean that the statements are not forward-looking. In particular, express or implied statements relating to future earnings, cash flow, results of operations, uses of cash, tax rates and other measures of financial performance, future actions, conditions or events, potential future plans, strategies or transactions of DT Midstream, and other statements that are not historical facts, are forward-looking statements.

Forward-looking statements are not guarantees of future results and conditions, but rather are subject to numerous assumptions, risks, and uncertainties that may cause actual future results to be materially different from those contemplated, projected, estimated, or budgeted. Many factors may impact forward-looking statements of DT Midstream including, but not limited to, the following: changes in general economic conditions, including increases in interest rates and associated Federal Reserve policies, a potential economic recession, and the impact of inflation on our business; industry changes, including the impact of consolidations, alternative energy sources, technological advances, infrastructure constraints and changes in competition; global supply chain disruptions; actions taken by third-party operators, processors, transporters and gatherers; changes in expected production from Expand Energy Corporation and other third parties in our areas of operation; demand for natural gas gathering, transmission, storage, transportation and water services; the availability and price of natural gas to the consumer compared to the price of alternative and competing fuels; our ability to successfully and timely implement our business plan; our ability to complete organic growth projects on time and on budget; our ability to finance, complete, or successfully integrate acquisitions; the price and availability of debt and equity financing; our ability to fund and close the pending transaction, the anticipated timing and terms of the pending transaction, our ability to realize the anticipated benefits of the pending transaction, and our ability to manage the risks of the pending transaction; restrictions in our existing and any future credit facilities and indentures; the effectiveness of our information technology and operational technology systems and practices to prevent, detect and defend against evolving cyber attacks on United States critical infrastructure; changing laws regarding cybersecurity and data privacy, and any cybersecurity threat or event; operating hazards, environmental risks, and other risks incidental to gathering, storing and transporting natural gas; geologic and reservoir risks and considerations; natural disasters, adverse weather conditions, casualty losses and other matters beyond our control; the impact of outbreaks of illnesses, epidemics and pandemics, and any related economic effects; the impacts of geopolitical events, including the conflicts in Ukraine and the Middle East; labor relations and markets, including the ability to attract, hire and retain key employee and contract personnel; large customer defaults; changes in tax status, as well as changes in tax rates and regulations; the effects and associated cost of compliance with existing and future laws and governmental regulations, such as the Inflation Reduction Act; changes in environmental laws, regulations or enforcement policies, including laws and regulations relating to climate change and greenhouse gas emissions; ability to develop low carbon business opportunities and deploy greenhouse gas reducing technologies; changes in insurance markets impacting costs and the level and types of coverage available; the timing and extent of changes in commodity prices; the success of our risk management strategies; the suspension, reduction or termination of our customers’ obligations under our commercial agreements; disruptions due to equipment interruption or failure at our facilities, or third-party facilities on which our business is dependent; the effects of future litigation; and the risks described in our Annual Report on Form 10-K for the year ended December 31, 2023 and our reports and registration statements filed from time to time with the SEC.

The above list of factors is not exhaustive. New factors emerge from time to time. We cannot predict what factors may arise or how such factors may cause actual results to vary materially from those stated in forward-looking statements, see the discussion under the section entitled “Risk Factors” in our Annual Report for the year ended December 31, 2023, filed with the SEC on Form 10-K and any other reports filed with the SEC. Given the uncertainties and risk factors that could cause our actual results to differ materially from those contained in any forward-looking statement, you should not put undue reliance on any forward-looking statements.

Any forward-looking statements speak only as of the date on which such statements are made. We are under no obligation to, and expressly disclaim any obligation to, update or alter our forward-looking statements, whether as a result of new information, subsequent events or otherwise.

Investor Relations Todd Lohrmann, DT Midstream, 313.774.2424 investor_relations@dtmidstream.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Abivax Establishes an At-the-Market (ATM) Program on Nasdaq

Abivax Establishes an At-the-Market (ATM) Program on Nasdaq

PARIS, France, November 19, 2024 – 10:30PM CET – Abivax SA FR (“Abivax” or the “Company“), a clinical-stage biotechnology company focused on developing therapeutics that harness the body’s natural regulatory mechanisms to modulate the inflammatory response in patients with chronic inflammatory diseases, today announced the implementation of an At-The-Market program (“ATM Program“) allowing the Company to issue and sell, including with unsolicited investors who have expressed an interest, ordinary shares in the form of American Depositary Shares (“ADS“), each ADS representing one ordinary share, nominal value €0.01 per share, of the Company, with aggregate gross sales proceeds of up to $150,000,000 (subject to French regulatory limits and within the limits of the investors’ requests expressed in the context of the program), from time to time, pursuant to the terms of an equity distribution agreement with Piper Sandler & Co. (“Piper Sandler“), acting as sales agent. The timing of any issuances in the form of ADSs will depend on a variety of factors. The ATM Program will be effective for a 3-year period, i.e. until November 19, 2027, unless terminated prior to such date in accordance with the equity distribution agreement or if ADSs representing the maximum gross sales proceeds have been sold thereunder.

A shelf registration statement on Form F-3, including a base prospectus relating to Abivax’s securities and an equity distribution agreement prospectus relating to the ATM Program, was filed with the U.S. Securities and Exchange Commission (“SEC“), but has not yet become effective. The base prospectus provides for the potential sale of ADSs of the Company (including outside of the ATM Program) with aggregate gross sales proceeds of up to $350,000,000 to grant additional flexibility to the Company in connection with its financing strategy. The securities referred to in the registration statement may not be sold, nor may offers to buy them be accepted, prior to the time the registration statement becomes effective.

To the extent that ADSs are sold pursuant to the ATM Program, Abivax currently intends to use the net proceeds (after deduction of fees and expenses), if any, of sales of ADSs issued under the ATM Program primarily for the launch and continuation of clinical programs on obefazimod, and working capital and general corporate purposes, at its discretion.

Piper Sandler, as sales agent, will use commercially reasonable efforts to arrange on the Company’s behalf the sale of ADSs to eligible investors requesting it, consistent with Piper Sandler’s normal sales and trading practices. Sales prices may vary based on market prices and other factors. Only eligible investors (as described in greater detail below) may purchase ADSs under the ATM Program. In any case, the corresponding sales price of the new ordinary shares underlying the ADSs will not be less than the volume weighted-average of the trading prices of the Company’s ordinary shares on the regulated market of Euronext in Paris (“Euronext Paris“) over a period chosen of between three and ninety consecutive trading days prior to the relevant pricing date, subject to a maximum discount to such volume weighted-average price of 10%.

The ADSs and the underlying ordinary shares will be issued through one or more share capital increases without shareholders’ preferential subscription rights under the provisions of Article L. 225-138 of the French Commercial Code (Code de commerce) and pursuant to and within the limits set forth in the 20th and 28th resolutions adopted by the combined shareholders’ general meeting dated May 30, 2024 (or any substitute resolutions, adopted from time to time), i.e., a maximum number of 25,000,000 ordinary shares, representing a maximum potential dilution of approximately 39.5% based on the existing share capital of the Company as of October 31, 2024. The number of underlying ordinary shares to be admitted on Euronext Paris shall represent, over a period of 12 months, less than 20% of the ordinary shares already admitted to trading on said market without a French listing prospectus (such limit being increased to 30% upon entry into force of the Listing Act Regulation1 on December 4, 2024).

The new ordinary shares to be sold in the form of ADSs would be issued in one or more offerings at the market price of the ADSs at the time of pricing of the considered capital increases.

ADSs under the ATM Program may only be issued to the categories of investors defined in the 20th resolution adopted by the General meeting of May 30, 2024 (or any similar resolutions that may be substituted for it in the future), comprising (i) French or foreign individuals or legal entities, including companies, trusts or investment funds or other investment vehicles of any kind, investing on a regular basis, or having invested more than one million euros during the 24 months preceding the considered capital increase, (a) in the pharmaceutical sector; and/or (b) in growth stocks listed on a regulated market or a multilateral negotiation system (type Euronext Growth) considered as “micro, small and medium-sized enterprises” in the meaning of annex I to the Regulation (CE) no. 651/2014 of the European Commission of June 17, 2014; and/or (ii) one or more strategic partners of the Company, located in France or abroad, who has (have) entered into or will enter into one or more partnership agreements (such as development, co-development, distribution, and manufacturing agreements) or commercial agreements with the Company (or a subsidiary) and/or companies they control, that control them or are controlled by the same person(s), directly or indirectly, within the meaning of Article L. 233-3 of the French Commercial Code. The new ordinary shares will be admitted to trading on Euronext Paris and the issued ADSs will trade on the Nasdaq Global Market (“Nasdaq“).

On an illustrative basis, assuming the issuance of the full amount of $150 million (all exchange rate translations in this press release are for convenience and based on an exchange rate of €1.00 = $1.0583, the exchange rate reported by the European Central Bank on November 15, 2024) of ADSs under the ATM Program at an assumed offering price of $9.50 per ADS (or €8.87 per ordinary share), the last reported price of the ADSs on Nasdaq on November 15, 2024, a holder of 1.0% of the Company’s outstanding share capital as of the date of this press releases, would hold 0.80% of the Company’s outstanding share capital after the completion of the transaction (calculated on the basis of the number of outstanding shares on the date of publication of this press release).

During the term of the ATM Program, the Company intends to include information in the publication of its half-year and full-year financial reports about its use of the ATM Program during the preceding period and intends to also provide an update after each capital increase under its ATM Program on a dedicated location on its corporate website in order to inform investors about the main features of each issue that may be completed under the ATM Program from time to time.

The shelf registration statement on Form F-3 (including a prospectus) relating to Abivax’s ADSs was filed with the SEC on November 19, 2024. Before purchasing ADSs in the offering, prospective investors should read the prospectus supplement and the accompanying prospectus, together with the documents incorporated by reference therein. Prospective investors may obtain these documents for free by visiting EDGAR on the SEC’s website at www.sec.gov. Alternatively, a copy of the prospectus supplement (and accompanying prospectus) relating to the offering may be obtained from Piper Sandler, 800 Nicollet Mall, J12S03, Minneapolis, MN 55402, Attention: Prospectus Department, by telephone at +1 (800) 747-3924, or by email at prospectus@psc.com. No prospectus will be filed with the French Autorité des Marchés Financiers (“AMF“) pursuant to Regulation (EU) 2017/1129 of the European Parliament and of the Council dated June 14, 2017, as amended (the “Prospectus Regulation“), since the contemplated share capital increase(s) (for the issuance of the ordinary shares underlying the ADSs) would be offered to qualified investors (as such term is defined in Article 2(e) of the Prospectus Regulation) and fall under the exemption provided for in Article 1(5)(a) of the Prospectus Regulation, which states that the obligation to publish a prospectus shall not apply to admission to trading on a regulated market of securities fungible with securities already admitted to trading on the same regulated market, provided that they represent, over a period of 12 months, less than 20% of the number of securities already admitted to trading on the same regulated market (such limit being increased to 30% upon entry into force of the Listing Act Regulation2).

This press release shall not constitute an offer to sell or the solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. In particular, no public offering of the ADSs will be made in Europe.

*****

About Abivax

Abivax is a clinical-stage biotechnology company focused on developing therapeutics that harness the body’s natural regulatory mechanisms to stabilize the immune response in patients with chronic inflammatory diseases. Based in France and the United States, Abivax’s lead drug candidate, obefazimod (ABX464), is in Phase 3 clinical trials for the treatment of moderately to severely active ulcerative colitis.

Contact:

Patrick Malloy

SVP, Investor Relations

Abivax SA

patrick.malloy@abivax.com

+1 847 987 4878

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements, forecasts and estimates, including those relating to the Company’s business and financial objectives. Words such as “intend,” “may,” “would,” “will” and variations of such words and similar expressions are intended to identify forward-looking statements. These forward-looking statements include statements concerning the Company’s proposed securities offering and its intended use of proceeds. Although Abivax’s management believes that the expectations reflected in such forward-looking statements are reasonable, investors are cautioned that forward-looking information and statements are subject to various risks, contingencies and uncertainties, many of which are difficult to predict and generally beyond the control of Abivax, that could cause actual results and developments to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. A description of these risks, contingencies and uncertainties can be found in the documents filed by the Company with the French Autorité des Marchés Financiers pursuant to its legal obligations including its universal registration document (Document d’Enregistrement Universel) and in its Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission on April 5, 2024 under the caption “Risk Factors.” These risks, contingencies and uncertainties include, among other things, the uncertainties inherent in research and development, future clinical data and analysis, decisions by regulatory authorities, such as the FDA or the EMA, regarding whether and when to approve any drug candidate, as well as their decisions regarding labelling and other matters that could affect the availability or commercial potential of such product candidates, and the availability of funding sufficient for the Company’s foreseeable and unforeseeable operating expenses and capital expenditure requirements. Special consideration should be given to the potential hurdles of clinical and pharmaceutical development, including further assessment by the Company and regulatory agencies and IRBs/ethics committees following the assessment of preclinical, pharmacokinetic, carcinogenicity, toxicity, CMC and clinical data. Furthermore, these forward-looking statements, forecasts and estimates are made only as of the date of this press release. Readers are cautioned not to place undue reliance on these forward-looking statements. Abivax disclaims any obligation to update these forward-looking statements, forecasts or estimates to reflect any subsequent changes that the Company becomes aware of, except as required by law. Information about pharmaceutical products (including products currently in development) that is included in this press release is not intended to constitute an advertisement. This press release is for information purposes only, and the information contained herein does not constitute either an offer to sell or the solicitation of an offer to purchase or subscribe for securities of the Company in any jurisdiction. Similarly, it does not give and should not be treated as giving investment advice. It has no connection with the investment objectives, financial situation or specific needs of any recipient. It should not be regarded by recipients as a substitute for exercise of their own judgment. All opinions expressed herein are subject to change without notice. The distribution of this document may be restricted by law in certain jurisdictions. Persons into whose possession this document comes are required to inform themselves about and to observe any such restrictions.

Disclaimer

This press release does not, and shall not, in any circumstances constitute a public offering nor an invitation to solicit the interest of the public in France, the United States, or in any other jurisdiction, in connection with any offer.

The distribution of this document may, in certain jurisdictions, be restricted by local legislations. Persons into whose possession this document comes are required to inform themselves about and to observe any such potential local restrictions.

This press release is not an advertisement and not a prospectus within the meaning of Regulation (EU) 2017/1129 (the “EU Prospectus Regulation”). This document does not constitute an offer to the public in France (except for public offerings defined in Article L.411-2 1° of the French Monetary and Financial Code) and the securities referred to in this document can only be offered or sold in France pursuant to article L. 411-2, 1° of the French Monetary and Financial Code to (i) qualified investors (investisseurs qualifiés) as defined in Article 2(e) of the EU Prospectus Regulation and/or (ii) a limited group of investors (cercle restreint d’investisseurs) acting for their own account, all as defined in and in accordance with articles L. 411-1, L. 411-2 and D. 411-2 to D. 411-4 of the French Monetary and Financial Code.

With respect to the Member States of the European Economic Area, no action has been undertaken or will be undertaken to make an offer to the public of the securities referred to herein requiring a publication of a prospectus in any relevant Member State. As a result, the securities may not and will not be offered in any relevant Member State except in accordance with the exemptions set forth in Article 1(4) of the EU Prospectus Regulation or under any other circumstances which do not require the publication by the Company of a prospectus pursuant to Article 3 of the EU Prospectus Regulation and/or to applicable regulations of that relevant Member State.

MIFID II product governance / Retail investors, professional investors and ECPs only target market – Solely for the purposes of each manufacturer’s product approval process, the target market assessment in respect of the new shares has led to the conclusion that: (i) the target market for the new shares is retail investors, eligible counterparties and professional clients, each as defined in MiFID II; and (ii) all channels for distribution of the new shares to retail investors, eligible counterparties and professional clients are appropriate. Any person subsequently offering, selling or recommending the new shares (a “distributor”) should take into consideration the manufacturers’ target market assessment; however, a distributor subject to MiFID II is responsible for undertaking its own target market assessment in respect of the new shares (by either adopting or refining the manufacturers’ target market assessment) and determining appropriate distribution channels. For the avoidance of doubt, even if the target market includes retail investors, the manufacturers have decided that the new shares will be offered, as part of the ATM Program, only to eligible counterparties and professional clients.

1 Regulation (EU) 2024/2809 of the European Parliament and of the Council of 23 October 2024 amending Regulations (EU) 2017/1129, (EU) No 596/2014 and (EU) No 600/2014 to make public capital markets in the Union more attractive for companies and to facilitate access to capital for small and medium-sized enterprises

2 Regulation (EU) 2024/2809 of the European Parliament and of the Council of 23 October 2024 amending Regulations (EU) 2017/1129, (EU) No 596/2014 and (EU) No 600/2014 to make public capital markets in the Union more attractive for companies and to facilitate access to capital for small and medium-sized enterprises

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dolby Laboratories Reports Q4 Earnings, Provides Strong Forecast For 2025, Shares Surge

Dolby Laboratories DLB reported financial results for the fourth quarter of fiscal 2024 after the bell on Tuesday. Here’s a look at the key metrics from the quarter.

- Q4 Revenue: $304.81 million, versus estimates of $307.94 million

- Q4 Adjusted EPS: 81 cents, versus estimates of 70 cents

Dolby said it repurchased approximately 251,000 shares during the quarter. The company had approximately $402 million remaining under its stock repurchase authorization at the quarter’s end. The company also declared a cash dividend of 33 cents per share payable on Dec. 10 to shareholders of record as of Dec. 3.

“As we enter fiscal 2025, we have strong momentum with Dolby Atmos and Dolby Vision, our imaging patent portfolio has gotten stronger with the GE Licensing acquisition, and we are excited about our opportunity with Dolby.io, which is well positioned to provide real-time interactive experiences for sports and entertainment,” said Kevin Yeaman, president and CEO of Dolby.

Don’t Miss: Target Q3 Earnings Preview: Analysts Expect Revenue, EPS Growth As Attention Turns To Holiday Quarter

Outlook: Dolby expects first-quarter revenue to be in the range of $330 million to $360 million versus estimates of $307.94 million. The company anticipates first-quarter earnings of 96 cents to $1.11 per share versus estimates of 70 cents per share.

Dolby sees full-year 2025 revenue in the range of $1.33 billion to $1.39 billion versus estimates of $1.28 billion. The company expects full-year earnings to be between $3.99 and $4.14 per share versus estimates of $3.70 per share.

Dolby’s strong forecast appears to be helping push shares higher after hours. The company’s management team will further discuss the quarter on a call with analysts and investors at 5 p.m. ET.

DLB Price Action: Dolby shares were up 11.06% in after hours, trading at $78.75 at the time of publication Tuesday, according to Benzinga Pro.

Photo: Pixabay.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nano Labs Regains Compliance with Nasdaq Minimum Bid Price Requirement

HANGZHOU, China, Nov. 19, 2024 (GLOBE NEWSWIRE) — Nano Labs Ltd NA (“we,” the “Company” or “Nano Labs”), a leading fabless integrated circuit design company and product solution provider in China, today announced that it received a notification letter (the “Notification Letter on Compliance”) from the Listing Qualifications Department of The Nasdaq Stock Market Inc. (“Nasdaq”) on November 18, 2024, indicating that the Company has regained compliance with the minimum bid price requirement set forth in Rule 5450(a)(1) of the Nasdaq Listing Rules.

As previously announced, on May 23, 2024, the Nasdaq notified the Company of its non-compliance with the Nasdaq’s minimum bid price requirement due to its failure to maintain a minimum bid price of US$1 per share. According to the Notification Letter on Compliance, the staff of Nasdaq has determined that for the last 10 consecutive business days, from November 4 through November 15, 2024, the closing bid price of the Company’s Class A ordinary shares had been at $1.00 per share or greater, and the Company has regained compliance with Rule 5450(a)(1) of the Nasdaq Listing Rules.

About Nano Labs Ltd

Nano Labs Ltd is a leading fabless integrated circuit (“IC”) design company and product solution provider in China. Nano Labs is committed to the development of high throughput computing (“HTC”) chips, high performance computing (“HPC”) chips, distributed computing and storage solutions, smart network interface cards (“NICs”) vision computing chips and distributed rendering. Nano Labs has built a comprehensive flow processing unit (“FPU”) architecture which offers solution that integrates the features of both HTC and HPC. Nano Lab’s Cuckoo series are one of the first near-memory HTC chips available in the market*. For more information, please visit the Company’s website at: ir.nano.cn.

| * | According to an industry report prepared by Frost & Sullivan. |

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and as defined in the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements include, without limitation, the Company’s plan to appeal the Staff’s determination, which can be identified by terminology such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “potential,” “continue,” “is/are likely to” or other similar expressions. Such statements are based upon management’s current expectations and current market and operating conditions, and relate to events that involve known or unknown risks, uncertainties and other factors, all of which are difficult to predict and many of which are beyond the Company’s control, which may cause the Company’s actual results, performance or achievements to differ materially from those in the forward-looking statements. Further information regarding these and other risks, uncertainties or factors is included in the Company’s filings with the Securities and Exchange Commission. The Company does not undertake any obligation to update any forward-looking statement as a result of new information, future events or otherwise, except as required under law.

For investor inquiries, please contact:

Nano Labs Ltd

ir@nano.cn

Ascent Investor Relations LLC

Tina Xiao

Phone: +1-646-932-7242

Email: investors@ascent-ir.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Patrick Industries, Inc. Announces Three-for-Two Common Stock Split

ELKHART, Ind., Nov. 19, 2024 /PRNewswire/ — Patrick Industries, Inc. PATK (“Patrick” or the “Company”) announced today that on November 18, 2024, the Company’s Board of Directors approved a three-for-two stock split of the Company’s common stock, to be effected in the form of a stock dividend, payable as one additional share of common stock for every two shares of common stock held. Shareholders will receive cash in lieu of any fractional share of common stock that they otherwise would have been entitled to receive in connection with the split.

The stock dividend is effective for shareholders of record as of the close of business on November 29, 2024 and will be payable on December 13, 2024. The Company’s stock will begin trading on a post-split basis on December 16, 2024. The split will increase the number of outstanding shares of the Company’s common stock from approximately 22.4 million to 33.6 million.

As previously reported, the Company announced an increase in its quarterly cash dividend on a pre-split basis to $0.60 per share payable on December 9, 2024 to shareholders of record at the close of business on November 25, 2024.

“In tandem with our recently announced increase in our quarterly cash dividend and upsize in our share repurchase authorization, the stock split is a reflection of Management’s and our Board of Directors’ confidence in the long-term growth prospects of the Company and is in alignment with driving strong liquidity for our shares in the marketplace,” said Andy Nemeth, Chief Executive Officer. “We remain focused on maximizing shareholder value through the successful execution of our strategic growth initiatives across our end markets.”

About Patrick Industries, Inc.

Patrick PATK is a leading component solutions provider serving the RV, Marine, Powersports and Housing markets. Since 1959, Patrick has empowered manufacturers and outdoor enthusiasts to achieve next-level recreation experiences. Our customer-focused approach brings together design, manufacturing, distribution, and transportation in a full solutions model that defines us as a trusted partner. Patrick is home to more than 85 leading brands, all united by a commitment to quality, customer service, and innovation. Headquartered in Elkhart, IN, Patrick employs approximately 10,000 skilled team members throughout the United States. For more information on Patrick, our brands, and products, please visit www.patrickind.com.

Forward-Looking Statements

This press release contains certain statements related to future results, our intentions, beliefs and expectations or predictions for the future, which are forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. Any projections of financial performance or statements concerning expectations as to future developments should not be construed in any manner as a guarantee that such results or developments will, in fact, occur. There can be no assurance that any forward-looking statement will be realized or that actual results will not be significantly different from that set forth in such forward-looking statement. Information about certain risks that could affect our business and cause actual results to differ from those expressed or implied in the forward-looking statements are contained in the section entitled “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, and in the Company’s Forms 10-Q for subsequent quarterly periods, which are filed with the Securities and Exchange Commission (“SEC”) and are available on the SEC’s website at www.sec.gov. Each forward-looking statement speaks only as of the date of this press release, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances occurring after the date on which it is made.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/patrick-industries-inc-announces-three-for-two-common-stock-split-302310572.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/patrick-industries-inc-announces-three-for-two-common-stock-split-302310572.html

SOURCE Patrick Industries, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Methanex Announces Upsize and Pricing of Senior Unsecured Notes

VANCOUVER, British Columbia, Nov. 19, 2024 (GLOBE NEWSWIRE) — Methanex Corporation MX MEOH (“Methanex”) announced today that its wholly-owned subsidiary, Methanex US Operations Inc., has priced an offering of US$600 million aggregate principal amount of 6.250% senior unsecured notes due 2032 (the “notes”) in a private offering (the “Offering”) exempt from the registration requirements of the United States Securities Act of 1933, as amended (the “Securities Act”). The size of the Offering was increased to US$600 million from the previously announced Offering size of US$500 million in aggregate principal amount of notes. The notes will be issued at a price of 99.289% of the aggregate principal amount, with an effective yield to maturity of 6.375%, and will be guaranteed on a senior basis by Methanex. The Offering is expected to close on or about November 22, 2024, subject to the satisfaction of customary closing conditions.

Methanex intends to use the net proceeds from the Offering to fund a portion of the cash purchase price of its previously announced agreement to acquire OCI Global’s international methanol business (the “OCI Acquisition”) and for general corporate purposes.

The notes will be subject to a special mandatory redemption if either (1) the OCI Acquisition is not completed within the time period required by the related acquisition agreement, as it may be extended (but in no event later than May 31, 2026) or (2) Methanex publicly announces that it will not proceed with the OCI Acquisition for any reason, as further described in the terms of the notes.

The notes have not been and will not be registered under the Securities Act, or the securities laws of any other jurisdiction and may not be offered or sold in the United States or to or for the account or benefit of any U.S. persons absent registration under the Securities Act or an applicable exemption from the registration requirements thereof. The notes are being offered and sold only to qualified institutional buyers in the United States in accordance with Rule 144A under the Securities Act and outside of the United States to non-U.S. persons in reliance on Regulation S under the Securities Act. The notes will be offered and sold in Canada on a private placement basis pursuant to certain exemptions from the prospectus requirements of applicable Canadian securities laws.

This news release is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, the notes in the United States, in any province of Canada or any other jurisdiction, nor shall there be any sale of the notes in any province or jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such province or jurisdiction or an exemption therefrom.

About Methanex

Methanex is a Vancouver-based, publicly traded company and is the world’s largest supplier of methanol to major international markets. Methanex shares are listed for trading on the Toronto Stock Exchange in Canada under the trading symbol “MX” and on the NASDAQ Global Select Market in the United States under the trading symbol “MEOH”.

Forward-Looking Statements

This news release contains certain forward-looking statements, or forward-looking information, with respect to us and our industry. These statements relate to future events or our future performance. All statements other than statements of historical fact are forward-looking statements. Statements that include the word “intend”, “expect”, “will” or other comparable terminology and similar statements of a future or forward-looking nature identify forward-looking statements. More particularly and without limitation, the following are forward-looking statements: the completion of the Offering and the timing thereof; Methanex’s intended use of proceeds to fund a portion of the cash purchase price for the OCI Acquisition; the completion of the OCI Acquisition; and the contingencies surrounding the special mandatory redemption.

Forward-looking statements, by their nature, involve risks and uncertainties that could cause actual results to differ materially from those contemplated by the forward-looking statements. Factors that may cause actual results to vary include, but are not limited to, risks relating to conditions in the financial markets and other risk factors as detailed from time to time in Methanex’s reports filed with Canadian securities administrators and the U.S. Securities and Exchange Commission. Certain of these risks are described in more detail in our 2023 Annual Management’s Discussion and Analysis, Third Quarter 2024 Management’s Discussion and Analysis and in our public filings with Canadian securities administrators and the U.S. Securities and Exchange Commission.

Readers are cautioned not to place undue reliance on forward-looking statements. They are not a substitute for the exercise of one’s own due diligence and judgment. The outcomes implied by forward-looking statements may not occur and we do not undertake to update forward-looking statements except as required by applicable securities laws.

Contact

Sarah Herriott

Director, Investor Relations

Methanex Corporation

604 661 2600 or Toll Free: 1 800 661 8851

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

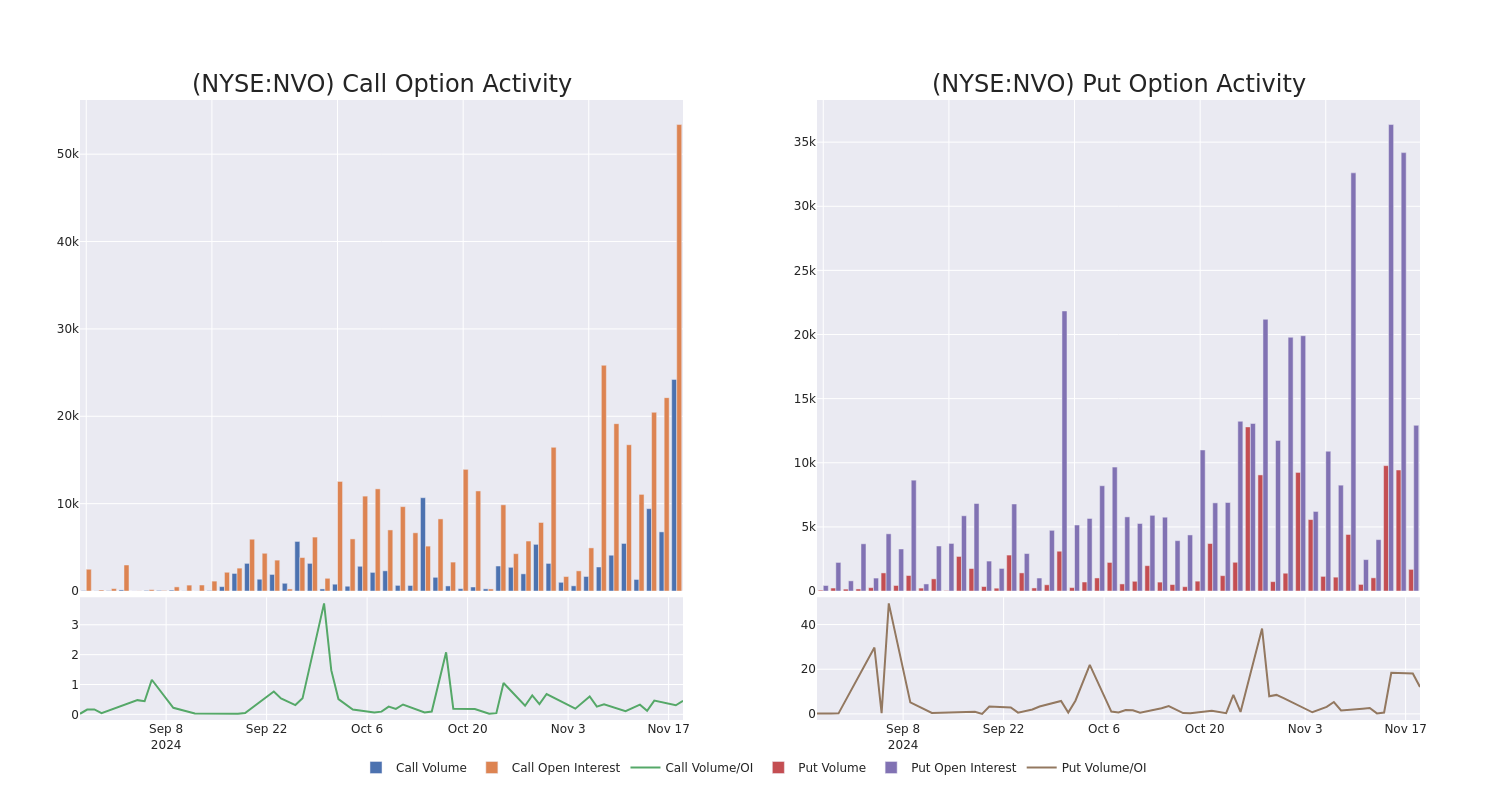

Novo Nordisk Unusual Options Activity For November 19

Whales with a lot of money to spend have taken a noticeably bullish stance on Novo Nordisk.

Looking at options history for Novo Nordisk NVO we detected 45 trades.

If we consider the specifics of each trade, it is accurate to state that 57% of the investors opened trades with bullish expectations and 40% with bearish.

From the overall spotted trades, 11 are puts, for a total amount of $549,674 and 34, calls, for a total amount of $2,045,493.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $70.0 to $130.0 for Novo Nordisk during the past quarter.

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Novo Nordisk’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Novo Nordisk’s whale trades within a strike price range from $70.0 to $130.0 in the last 30 days.

Novo Nordisk Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NVO | CALL | TRADE | BEARISH | 12/20/24 | $2.34 | $2.22 | $2.23 | $115.00 | $289.9K | 11.2K | 3.4K |

| NVO | CALL | SWEEP | BULLISH | 12/20/24 | $5.7 | $5.6 | $5.66 | $105.00 | $190.8K | 2.1K | 557 |

| NVO | CALL | SWEEP | BULLISH | 12/20/24 | $5.7 | $5.6 | $5.7 | $105.00 | $152.7K | 2.1K | 994 |

| NVO | PUT | TRADE | BULLISH | 01/17/25 | $19.05 | $18.8 | $18.8 | $120.00 | $112.8K | 1.9K | 71 |

| NVO | PUT | SWEEP | BEARISH | 01/17/25 | $5.0 | $4.95 | $4.95 | $97.50 | $99.5K | 2.4K | 224 |

About Novo Nordisk

With roughly one third of the global branded diabetes treatment market, Novo Nordisk is the leading provider of diabetes-care products in the world. Based in Denmark, the company manufactures and markets a variety of human and modern insulins, injectable diabetes treatments such as GLP-1 therapy, oral antidiabetic agents, and obesity treatments. Novo also has a biopharmaceutical segment (constituting roughly 10% of revenue) that specializes in protein therapies for hemophilia and other disorders.

Having examined the options trading patterns of Novo Nordisk, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Novo Nordisk’s Current Market Status

- With a trading volume of 4,369,108, the price of NVO is up by 2.64%, reaching $102.44.

- Current RSI values indicate that the stock is may be oversold.

- Next earnings report is scheduled for 71 days from now.

Expert Opinions on Novo Nordisk

In the last month, 1 experts released ratings on this stock with an average target price of $160.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $160.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Novo Nordisk, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

J Street Property Services Expands with Strategic Acquisition of Hudson Peters' Property Management Division

ADDISON, Texas, Nov. 19, 2024 /PRNewswire/ — J Street Property Services, a rapidly growing leader in third-party property management known for its client-centered and community-focused approach, proudly announces its acquisition of the property management division of Hudson Peters Commercial. This strategic expansion brings over one million square feet of office, multifamily, retail, and industrial space under J Street’s management, further strengthening its footprint in the Dallas/Fort Worth area and bolstering its dedication to a culture-first approach in property management.

This acquisition aligns with J Street’s mission to deliver high-quality management services that meet the unique needs of property owners and tenants. By integrating a talented team from Hudson Peters Commercial who share J Street’s values and service philosophy, the acquisition ensures a seamless transition that benefits clients and employees alike.

“Our decision to acquire this portfolio is a commitment to grow with integrity, honoring our client relationships and core values,” said Shea Byers, CEO & Principal of J Street Property Services. “We are thrilled to welcome new clients and employees who share our vision for property management, service, and community impact.”

With this acquisition, J Street welcomes six seasoned property management professionals from Hudson Peters Commercial. Known for their collaborative and client-focused expertise, these new team members will enhance J Street’s reputation for integrity, accountability, and tenant and resident satisfaction.

Hudson Peters Commercial’s clients will enjoy J Street’s advanced technological resources while continuing to receive the high level of service they have come to expect. This acquisition allows J Street to leverage synergies across both portfolios, ultimately delivering increased efficiency, innovation, and value.

“This acquisition represents an important milestone for J Street as we grow with intention, focusing on properties and clients that align with our commitment to service excellence,” added Tommy Wells, COO & Principal at J Street Property Services. “We look forward to working closely with our new clients and ensuring a smooth transition.”

For more information about J Street or partnership opportunities, please contact

Clint Williamson VP of Partnerships at CWilliamson@JStreetPS.com

Media Contact:

Chrissie Rivers

crivers@jstreetps.com

Photos:

https://www.prlog.org/13047082

Press release distributed by PRLog

![]() View original content:https://www.prnewswire.com/news-releases/j-street-property-services-expands-with-strategic-acquisition-of-hudson-peters-property-management-division-302310362.html

View original content:https://www.prnewswire.com/news-releases/j-street-property-services-expands-with-strategic-acquisition-of-hudson-peters-property-management-division-302310362.html

SOURCE J Street Property Services

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.