Engaging In Options Activity, John W Casella Exercises Options Valued At $2.67M In Casella Waste Sys

Disclosed in a recent SEC filing on November 18, Casella, Chief Executive Officer at Casella Waste Sys CWST, made a noteworthy transaction involving the exercise of company stock options.

What Happened: Casella, Chief Executive Officer at Casella Waste Sys, exercised stock options for 27,940 shares of CWST stock. This information was disclosed in a Form 4 filing with the U.S. Securities and Exchange Commission on Monday. The exercise price of the options was $12.48 per share.

The latest update on Tuesday morning shows Casella Waste Sys shares down by 0.0%, trading at $108.01. At this price, Casella’s 27,940 shares are worth $2,669,108.

Delving into Casella Waste Sys’s Background

Casella Waste Systems Inc is a solid waste removal company, providing resource management services to residential, commercial, municipal, and industrial customers. The company’s reportable segments on Geographical basis include Eastern, Western and Mid-Atlantic regions through the Resource solution segment. It generates maximum revenue from the Western region segment. The company services include Recycling, Collection, Organics, Energy, Landfills, Special Waste as well as Professional Services.

Casella Waste Sys: A Financial Overview

Revenue Growth: Casella Waste Sys displayed positive results in 3 months. As of 30 September, 2024, the company achieved a solid revenue growth rate of approximately 16.7%. This indicates a notable increase in the company’s top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Industrials sector.

Profitability Metrics: Unlocking Value

-

Gross Margin: The company faces challenges with a low gross margin of 35.11%, suggesting potential difficulties in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): Casella Waste Sys’s EPS is below the industry average. The company faced challenges with a current EPS of 0.1. This suggests a potential decline in earnings.

Debt Management: Casella Waste Sys’s debt-to-equity ratio is below the industry average. With a ratio of 0.76, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Assessing Valuation Metrics:

-

Price to Earnings (P/E) Ratio: The current Price to Earnings ratio of 981.91 is higher than the industry average, indicating the stock is priced at a premium level according to the market sentiment.

-

Price to Sales (P/S) Ratio: A higher-than-average P/S ratio of 4.23 suggests overvaluation in the eyes of investors, considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an impressive EV/EBITDA ratio of 24.75, Casella Waste Sys demonstrates exemplary market valuation, surpassing industry averages.

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Understanding the Significance of Insider Transactions

Emphasizing the importance of a comprehensive approach, considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

Breaking Down the Significance of Transaction Codes

In the domain of transactions, investors frequently turn their focus to those taking place in the open market, as meticulously outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Casella Waste Sys’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Keysight Technologies Stock Jumps On Q4 Earnings: Revenue Beat, EPS Beat, 'Confidence In Our Ability To Outperform'

Keysight Technologies Inc KEYS reported fiscal fourth-quarter financial results after the market close on Tuesday. Here’s a rundown of the report.

- Q4 Revenue: $1.29 billion, versus estimates of $1.26 billion

- Q4 Adjusted EPS: $1.65, versus estimates of $1.57

Cash flow from operations was $359 million in the quarter, versus $378 million in the prior year’s quarter. The company generated $328 million in free cash flow in the fourth quarter, down from $340 million year-over-year.

The company had $1.8 billion in cash and cash equivalents as of Oct. 31.

“Keysight executed well and delivered fourth-quarter revenue and earnings per share above the high end of guidance under market conditions which remained consistent with our expectations,” said Satish Dhanasekaran, president and CEO of Keysight.

“As we look ahead, the strength of our differentiated portfolio, deep engagement with customers and the accelerating pace of technology innovation give us confidence in our ability to outperform as markets recover.”

Q1 Outlook: Keysight expects first-quarter revenue to be in the range of $1.265 billion to $1.285 billion. The company expects first-quarter adjusted earnings to be between $1.65 and $1.71 per share.

Management will hold a conference call at 4:30 p.m. ET to further discuss the quarter with analysts and investors.

KEYS Price Action: Keysight shares were up 10.42% in after-hours, trading at $167.98 at the time of publication Tuesday, per Benzinga Pro.

Read Next:

Photo: Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Decision: LEROY BALL Exercises Options At Koppers Hldgs For $234K

A substantial insider activity was disclosed on November 18, as BALL, CEO at Koppers Hldgs KOP, reported the exercise of a large sell of company stock options.

What Happened: A notable Form 4 filing on Monday with the U.S. Securities and Exchange Commission revealed that BALL, CEO at Koppers Hldgs, exercised stock options for 11,103 shares of KOP, resulting in a transaction value of $234,717.

Currently, Koppers Hldgs shares are trading down 0.0%, priced at $38.71 during Tuesday’s morning. This values BALL’s 11,103 shares at $234,717.

About Koppers Hldgs

Koppers Holdings Inc through its subsidiaries, manufactures and sells wood products, wood treatment chemicals, and carbon compounds used in markets such as railroad, aluminum and steel, agriculture, utilities, and residential lumber. The company is organized into three business segments: railroad and utility products and services, performance chemicals, and carbon materials and chemicals. Its product portfolio includes treated and untreated wood products like crossties used in railroads, wood preservation chemicals, and carbon compounds such as creosote used in the treatment of wood crossties, among others. The majority of its revenue comes from the company’s railroad and utility products and services segment, and more than half of the company’s revenue is earned in the United States.

Financial Insights: Koppers Hldgs

Positive Revenue Trend: Examining Koppers Hldgs’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 0.71% as of 30 September, 2024, showcasing a substantial increase in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Materials sector.

Holistic Profitability Examination:

-

Gross Margin: The company excels with a remarkable gross margin of 21.87%, indicating superior cost efficiency and profitability compared to its industry peers.

-

Earnings per Share (EPS): Koppers Hldgs’s EPS outshines the industry average, indicating a strong bottom-line trend with a current EPS of 1.12.

Debt Management: Koppers Hldgs’s debt-to-equity ratio surpasses industry norms, standing at 2.02. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

Insights into Valuation Metrics:

-

Price to Earnings (P/E) Ratio: Koppers Hldgs’s P/E ratio of 11.0 is below the industry average, suggesting the stock may be undervalued.

-

Price to Sales (P/S) Ratio: The Price to Sales ratio is 0.39, which is lower than the industry average. This suggests a possible undervaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Koppers Hldgs’s EV/EBITDA ratio at 7.37 suggests potential undervaluation, falling below industry averages.

Market Capitalization Analysis: Falling below industry benchmarks, the company’s market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Navigating the Impact of Insider Transactions on Investments

Insider transactions serve as a piece of the puzzle in investment decisions, rather than the entire picture.

Within the legal framework, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as per Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

The initiation of a new purchase by a company insider serves as a strong indication that they expect the stock to rise.

However, insider sells may not always signal a bearish view and can be influenced by various factors.

A Deep Dive into Insider Transaction Codes

Delving into transactions, investors typically prioritize those unfolding in the open market, as precisely outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Koppers Hldgs’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Roblox Unusual Options Activity For November 19

Investors with a lot of money to spend have taken a bullish stance on Roblox RBLX.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with RBLX, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 15 uncommon options trades for Roblox.

This isn’t normal.

The overall sentiment of these big-money traders is split between 60% bullish and 33%, bearish.

Out of all of the special options we uncovered, 5 are puts, for a total amount of $259,440, and 10 are calls, for a total amount of $562,301.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $40.0 to $80.0 for Roblox during the past quarter.

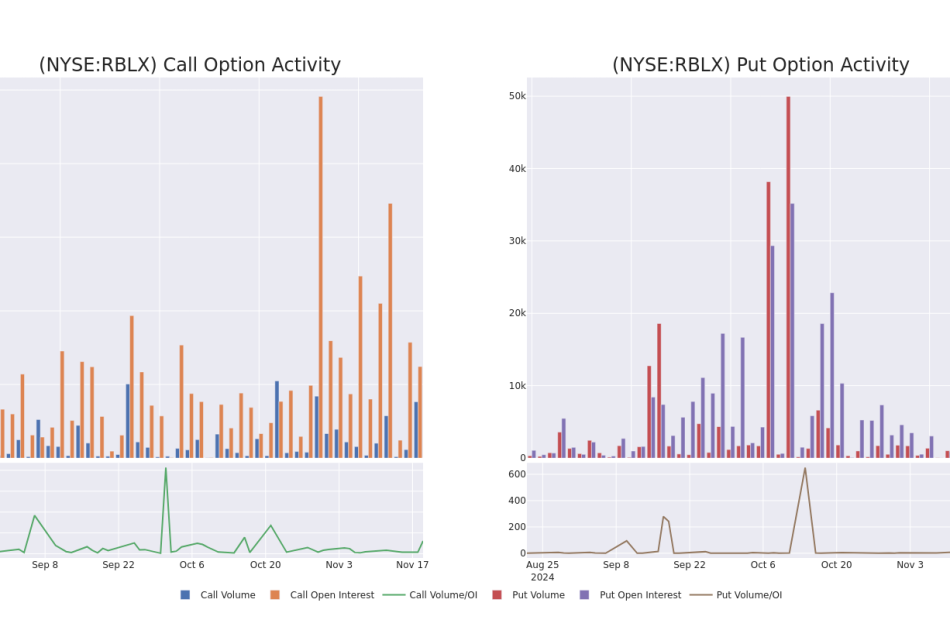

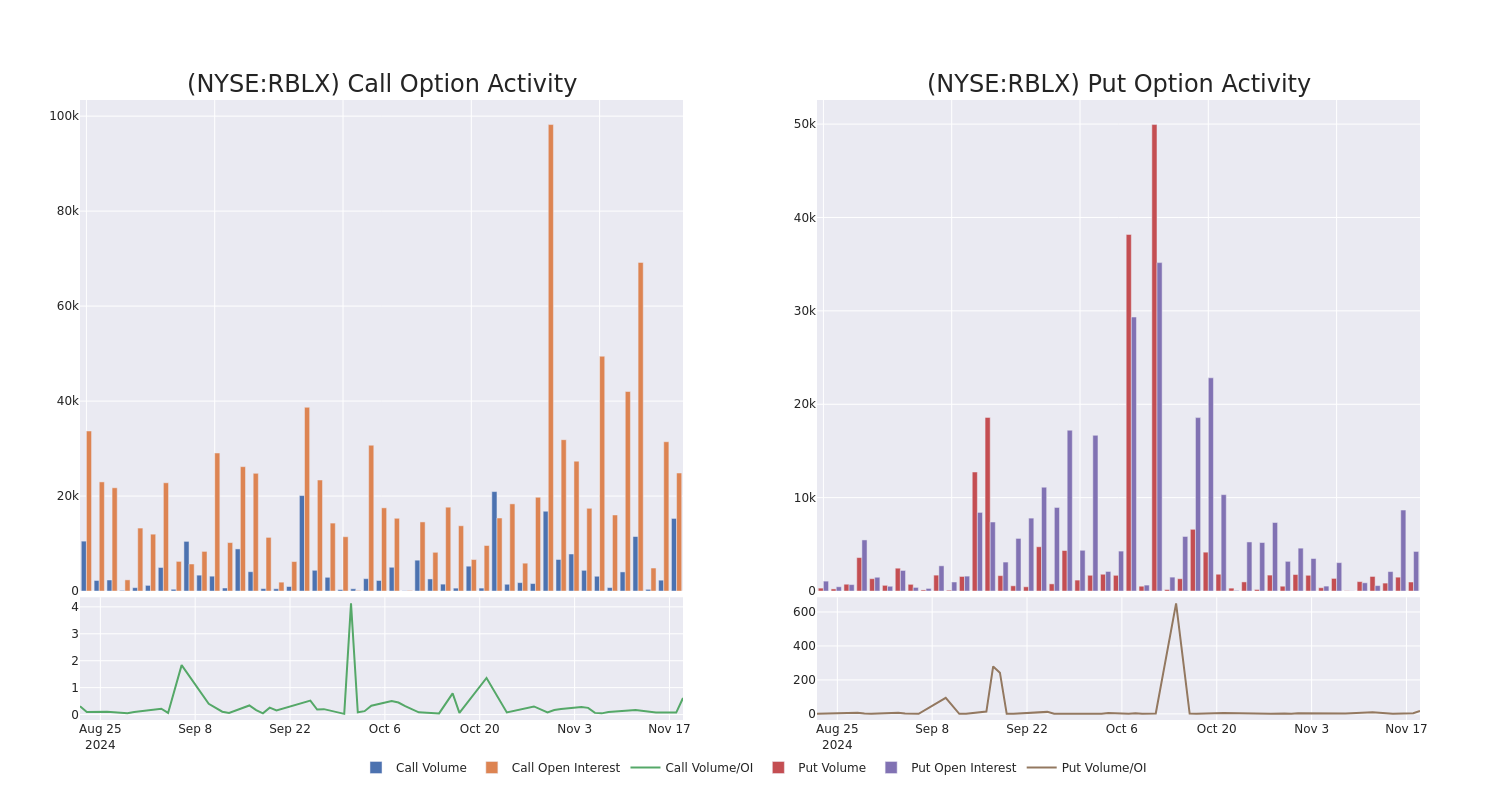

Volume & Open Interest Trends

In today’s trading context, the average open interest for options of Roblox stands at 3636.38, with a total volume reaching 16,256.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Roblox, situated within the strike price corridor from $40.0 to $80.0, throughout the last 30 days.

Roblox Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RBLX | CALL | SWEEP | BEARISH | 11/29/24 | $4.65 | $4.6 | $4.6 | $48.00 | $111.3K | 12.4K | 2.6K |

| RBLX | CALL | SWEEP | NEUTRAL | 11/29/24 | $4.25 | $4.25 | $4.25 | $48.00 | $79.0K | 12.4K | 1.9K |

| RBLX | CALL | SWEEP | BEARISH | 11/29/24 | $4.65 | $4.6 | $4.6 | $48.00 | $73.1K | 12.4K | 2.2K |

| RBLX | CALL | SWEEP | BULLISH | 11/29/24 | $4.15 | $4.15 | $4.15 | $48.00 | $63.5K | 12.4K | 1.0K |

| RBLX | PUT | SWEEP | BULLISH | 02/21/25 | $3.7 | $3.65 | $3.65 | $50.00 | $62.7K | 11 | 172 |

About Roblox

Roblox operates an online video game platform with 80 million daily active users that lets young gamers create, develop, and monetize games (or “experiences”) for other players. The firm offers its developers a hybrid of a game engine, publishing platform, online hosting and services, marketplace with payment processing, and social network. The platform is a closed garden that Roblox controls, earning $3.5 billion in bookings in 2023 through in-game purchases and advertising while benefiting from outsourced game development. Unlike traditional video game publishers, Roblox is more focused on the creation of new tools and monetization techniques for its developers than creating new games or franchises.

In light of the recent options history for Roblox, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Roblox

- With a volume of 4,103,597, the price of RBLX is up 2.78% at $52.45.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 78 days.

Expert Opinions on Roblox

In the last month, 5 experts released ratings on this stock with an average target price of $56.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Goldman Sachs persists with their Neutral rating on Roblox, maintaining a target price of $55.

* An analyst from Wells Fargo persists with their Overweight rating on Roblox, maintaining a target price of $58.

* Consistent in their evaluation, an analyst from Benchmark keeps a Buy rating on Roblox with a target price of $60.

* An analyst from Macquarie persists with their Outperform rating on Roblox, maintaining a target price of $58.

* In a cautious move, an analyst from Wedbush downgraded its rating to Outperform, setting a price target of $49.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Roblox, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Atico Reports Consolidated Financial Results for Third Quarter of 2024

VANCOUVER, British Columbia, Nov. 19, 2024 (GLOBE NEWSWIRE) — Atico Mining Corporation (the “Company” or “Atico”) ((TSX.V: ATY, OTC:ATCMF) today announced its financial results for the three months ended September 30, 2024, posting income from mining operations of $5.8 million and net income of $1.2 million for the quarter. Production for the quarter at Atico’s El Roble mine totaled 2.9 million pounds (“lbs”) of copper and 2,072 ounces (“oz”) of gold in concentrate at a cash cost(1) of $2.44 per payable pound of copper(2).

Fernando E. Ganoza, CEO and Director, commented, “During this period, the mine’s operational metrics aligned with our expectations, despite being lower compared to both the previous quarter and the same period last year. Nonetheless, we still delivered strong financial results, as we recognized revenue from the planned concentrate shipment, in addition to a portion of the shipment that was scheduled for the prior quarter.” Mr. Ganoza continued, “For the remainder of the year, our focus will be on meeting production targets and enhancing cost efficiencies at El Roble. We will also continue to advance the engineering and permitting of the La Plata project, while executing the near-mine drilling program at El Roble, which aims to replace resources and extend the life of mine.”

Third Quarter Financial Highlights

- Net income for the quarter amounted to $1.2 million, compared with $1.1 million net loss for the comparative quarter of last year. Income for the period was primarily due to higher sales.

- Sales for the quarter increased 61% to $24.6 million when compared with $15.3 million in Q3-2023. Copper (“Cu”) and gold (“Au”) accounted for 78% and 22% of the 11,936 (Q3-2023 – 8,325) dry metric tonnes (“DMT”) sold during Q3-2024.

- The average realized price per metal was $4.30 (Q3-2023 – $3.87) per pound of copper and $2,574 (Q3-2023 – $1,936) per ounce of gold.

- Ending working capital was $6.9 million (December 31, 2023 – $2.1 million deficit), while the Company had $14.1 million (December 31, 2023 – $6.0 million) in long-term loans payable.

- Cash costs(1) were $145.34 per tonne of processed ore and $2.44 per pound of payable copper produced, which was an increase of 10% and 24% over Q3-2023, respectively. The increase in cash costs per pound of payable copper produced is due to lower copper output due to lower grade and lower gold (by-product) credits due to lower gold grade.

- Cash margin was $1.86 per pound of payable copper produced(1), which was a decrease of 2% over Q3-2023 due to the higher cash cost per pound (above), partially offset by an increase in realized copper and gold price.

- All-in sustaining cash cost per payable pound of copper produced(1) was $3.60 (Q3-2023 – $2.64) which is primarily due to the increase in cash cost per pound (above) and higher commercial and government royalties from increased sales, as well as a decrease in total payable copper produced.

- In August 2024, the Company entered into an amendment and restatement agreement with Trafigura PTE. LTD. (the “Lender”) to amend the US$ 10 million credit agreement it had entered into with the Lender in February 2022, by extending the maturity date of the credit facility from August 8, 2024, to July 31, 2026.

Third Quarter Summary of Financial Results

| Q3 2024 |

Q3 2023 |

% Change |

|||||||

| Revenue | $ | 24,599,601 | $ | 15,279,950 | 61 | % | |||

| Cost of sales | (18,835,153 | ) | (13,225,475 | ) | 42 | % | |||

| Income from mining operations | 5,764,448 | 2,054,475 | 181 | % | |||||

| As a % of revenue | 23 | % | 13 | % | |||||

| General and administrative expenses and share-based payments | (1,569,840 | ) | (1,586,297 | ) | (1 | %) | |||

| Income from operations | 4,194,08 | 468,178 | 796 | % | |||||

| As a % of revenue | 17 | % | 3 | % | |||||

| Income before income taxes | 3,842,615 | 332,420 | 1,056 | % | |||||

| Net income (loss) | 1,156,185 | (1,063,401 | ) | (209 | %) | ||||

| As a % of revenue | 5 | % | (7 | %) | |||||

| Operating cash flow before changes in non-cash operating working capital items(1) | 8,113,422 | 2,655,490 | 206 | % | |||||

Third Quarter Consolidated Operational Details

In Q3-2024, the Company produced 2.9 million lbs of copper, 2,072 oz of gold, and 8,239 oz of silver. When compared to the same period in 2023, production decreased by 23% for copper and 23% for gold, which was due to average copper head-grades decreasing by 14% and average gold head-grades decreasing by 17%, and tonnes of processed ore also decreasing by 10% compared to Q3-2023.

| Q3 2024 |

Q3 2023 |

% Change |

|||

| Production (Contained metals)(3) | |||||

| Copper (000s lbs) | 2,912 | 3,762 | (23 | %) | |

| Gold (oz) | 2,072 | 2,705 | (23 | %) | |

| Silver (oz) | 8,239 | 9,979 | (17 | %) | |

| Mine | |||||

| Tonnes of material mined | 67,869 | 77,947 | (13 | %) | |

| Mill | |||||

| Tonnes processed | 67,354 | 74,580 | (10 | %) | |

| Tonnes processed per day | 856 | 888 | (4 | %) | |

| Copper grade (%) | 2.13 | 2.46 | (14 | %) | |

| Gold grade (g/t) | 1.52 | 1.83 | (17 | %) | |

| Silver grade (g/t) | 8.70 | 10.13 | (14 | %) | |

| Recoveries | |||||

| Copper (%) | 92.2 | 93.0 | (1 | %) | |

| Gold (%) | 62.9 | 61.9 | 2 | % | |

| Silver (%) | 44.4 | 41.0 | 8 | % | |

| Concentrates | |||||

| Copper Concentrates (DMT) | 7,248 | 9,336 | (22 | %) | |

| Copper (%) | 18.2 | 18.3 | (0 | %) | |

| Gold (g/t) | 8.9 | 9.0 | (1 | %) | |

| Silver (g/t) | 35.4 | 33.2 | 6 | % | |

| Payable copper produced (000s lbs) | 2,737 | 3,536 | (23 | %) | |

| Cash cost per pound of payable copper ($/lbs)(1)(2) | 2.44 | 1.97 | 24 | % | |

The financial statements and MD&A are available on SEDAR+ and have also been posted on the company’s website at http://www.aticomining.com/s/FinancialStatements.asp

El Roble Third Quarter Updates

The ongoing Arbitration at the Center for Arbitration and Conciliation of the Bogota Chamber of Commerce to resolve the El Roble royalty dispute with the National Mining Agency is progressing with the first procedural hearing of the arbitration held on July 2, 2024, during which the arbitrators declared themselves competent and allowed for the arbitration process to continue. The evidentiary hearings were completed, and witnesses’ testimonies from both the National Mining Agency and the Company were heard by the Tribunal. The proceedings are ongoing according to schedule, with the final hearing scheduled for December 10, 2024, in which the investigation phase of the process will conclude, and the closing arguments of the parties will be heard by the Tribunal. The tribunal’s final decision is due by January 15, 2025, with an allowable six-month extension as per the arbitration rules. If the Tribunal’s final decision favors the Company, the Payment Plan will cease, and any amounts paid under the Payment Plan with the National Mining Agency will need to be reimbursed to the Company or offset against future royalty obligations.

The Payment Plan is payable in biannual instalments for a total principal amount of COP$101,217,832,270 (approximately $24.3 million) plus interest at a 6% annual rate. As at September 30, 2024, the Company has paid to the National Mining Agency a total principal amount of COP$30,598,648,182 (approximately $7.4 million) plus interest. As of September 30, 2024, all of the dry metric tonnes of metals concentrate in inventories were pledged as security for the principal amount of the Payment Plan that remains outstanding. While this pledged inventory is recorded at cost on the balance sheet, its fair market value at the end of Q3-2024 is sufficient to pay the vast majority of the outstanding balance of the Payment Plan.

La Plata Third Quarter Updates

In May 2022 the Company received the technical approval of its Environmental and Social Impact Assessment (“ESIA”) study for the La Plata project and the Ministry of Environment, Waters and Ecological Transition (MAATE) initiated the socialization of the ESIA, through an environmental public consultation process, as an important step for the issuance of the environmental license for the La Plata project. However, on July 31, 2023, the Constitutional Court in Ecuador, admitted for processing a claim of the Confederation of Indigenous Nationalities of Ecuador (CONAIE) and other complainants, provisionally suspending Executive Decree No 754 signed on May 31, 2023, that regulates environmental consultations for all public and private industries and sectors in Ecuador – not limited to extractive industries.

The La Plata environmental consultation process was, as result put on pause until a ruling was made from the Constitutional Court in Ecuador. On November 17, 2023, the Ecuadorian Constitutional Court ruled the Executive Decree 754 was unconstitutional, but decided to maintain the decree in force until the Ecuadorian National Assembly enacts this procedure into Organic Law. Until the Assembly passes the necessary organic law, the temporary suspension of the Decree was revoked by the Constitutional Court and the Decree remains in effect. This allows many projects across all industries and sectors, including La Plata, to resume their respective consultation process, which MAATE reinitiated for La Plata during Q1-2024.

On March 22, 2024, the mayor of the Canton of Sigchos, CONAIE and other complainants (the “Claimants”) filed a constitutional protective action against MAATE and other governmental entities, challenging the environmental consultation process that was being conducted by MAATE which is an important step for the issuance of the La Plata environmental license. The protective action was accepted by the Court on March 25, 2024, and the Court proceeding was carried out in the Judicial Unit of the Canton of Sigchos, in the province of Cotopaxi, Ecuador, between May 20, 2024, and July 9, 2024. On August 2, 2024, the Court issued a binding oral ruling, rejecting the Protective Action filed by the Claimants. The Court concluded that the consultation process conducted by MAATE complied with applicable legal requirements, did not constitute rights violations, and removed the cautionary measures previously applied. The court issued the ruling in writing on August 5, 2024. After the Court’s ruling, the Claimants advised the Court of their intention to appeal the Court’s decision. The appeal will be heard by the Provincial Court of Justice of Cotopaxi in due course. No date for the appeal has been set.

On July 2, 2024, the Company reported results of the La Plata Feasibility Study prepared in accordance with National Instrument 43-101 and the Technical Report was filed on SEDAR+ on August 14, 2024.

- Initial Probable Mineral Reserves for the La Plata project 2.51 Mt with an average grade of 1.59% Cu, 2.28 g/t Au, 30.41 g/t Ag, and 2.18% Zn.

- Updated Indicated Resources of 2.345 Mt with an average grade of 2.13% Cu, 2.98 g/t Au, 40 g/t Ag, 3.05% Zn and Inferred Resources of 380 Kt at average grade of 0.96% Cu, 1.75 g/t Au, 38 g/t Ag, 2.29% Zn.

- Average annual production of 9.71 Mlbs Cu, 15,929 oz Au, 226,299 oz Ag, and 13.25 Mlbs Zn in concentrates over 8.1 years Life of Mine (“LOM”)

- Initial Capex of US$91 Million, including a 9.8% contingency

- Average AIC(1) of US$2.70 per payable lb of Cu equivalent produced over LOM

- After Tax NPV of US$93M at a 5% discount rate and an IRR of 25.1%

The Company continues to work on obtaining the necessary permits and the environmental license to begin construction of the La Plata project.

Qualified Person

Mr. Thomas Kelly (SME Registered Member 1696580), advisor to the Company and a qualified person under National Instrument 43-101 standards, is responsible for ensuring that the technical information contained in this news release is an accurate summary of the original reports and data provided to or developed by Atico.

About Atico Mining Corporation

Atico is a growth-oriented Company, focused on exploring, developing and mining copper and gold projects in Latin America. The Company generates significant cash flow through the operation of the El Roble mine and is developing it’s high-grade La Plata VMS project in Ecuador. The Company is also pursuing additional acquisition of advanced stage opportunities. For more information, please visit www.aticomining.com.

ON BEHALF OF THE BOARD

Fernando E. Ganoza

CEO

Atico Mining Corporation

Trading symbols: TSX.V: ATY | OTC: ATCMF

Investor Relations

Igor Dutina

Tel: +1.604.633.9022

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

No securities regulatory authority has either approved or disapproved of the contents of this news release. The securities being offered have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the ‘‘U.S. Securities Act”), or any state securities laws, and may not be offered or sold in the United States, or to, or for the account or benefit of, a “U.S. person” (as defined in Regulation S of the U.S. Securities Act) unless pursuant to an exemption therefrom. This press release is for information purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities of the Company in any jurisdiction.

Cautionary Note Regarding Forward Looking Statements

This announcement includes certain “forward-looking statements” within the meaning of Canadian securities legislation. All statements, other than statements of historical fact, included herein, without limitation the use of net proceeds, are forward-looking statements. Forward-looking statements involve various risks and uncertainties and are based on certain factors and assumptions. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company’s expectations include uncertainties as to the timing and process for renewal of title to the El Roble claims; uncertainties as to the outcome of the Arbitration process with the National Mining Agency in Colombia for the royalties’ dispute, as to the timing of the Tribunal’s decision, and if a favorable Tribunal Decision, as to the timing for the reimbursement of the payments made under the Payment Plan to the National Mining Agency; uncertainties relating to interpretation of drill results and the geology, continuity and grade of mineral deposits; uncertainty of estimates of capital and operating costs of the Company’s projects; the need to obtain additional financing to maintain its interest in and/or explore and develop the Company’s mineral projects; uncertainty of meeting anticipated program milestones for the Company’s mineral projects; and other risks and uncertainties disclosed under the heading “Risk Factors” in the Company’s Management’s Discussion and Analysis for the year ended December 31, 2023 and in the Company’s Annual Information Form (“AIF”) dated September 4, 2024, filed with the Canadian securities regulatory authorities on the SEDAR+ website at www.sedarplus.com and as available on the Company’s website for further details.

Non-GAAP Financial Measures

The items marked with a “(1)” are alternative performance measures and readers should refer to Non-GAAP Financial Measures in the Company’s Management’s Discussion and Analysis for the three and nine months ended September 30, 2024, as filed on SEDAR+ and as available on the Company’s website for further details.

(1) Alternative performance measures; please refer to “Non-GAAP Financial Measures” at the end of this release.

(2) Net of by-product credits

(3) Subject to adjustments on final settlement

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

A Closer Look at Arista Networks's Options Market Dynamics

Investors with a lot of money to spend have taken a bullish stance on Arista Networks ANET.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with ANET, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 30 uncommon options trades for Arista Networks.

This isn’t normal.

The overall sentiment of these big-money traders is split between 33% bullish and 30%, bearish.

Out of all of the special options we uncovered, 9 are puts, for a total amount of $342,871, and 21 are calls, for a total amount of $1,005,778.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $260.0 to $460.0 for Arista Networks over the recent three months.

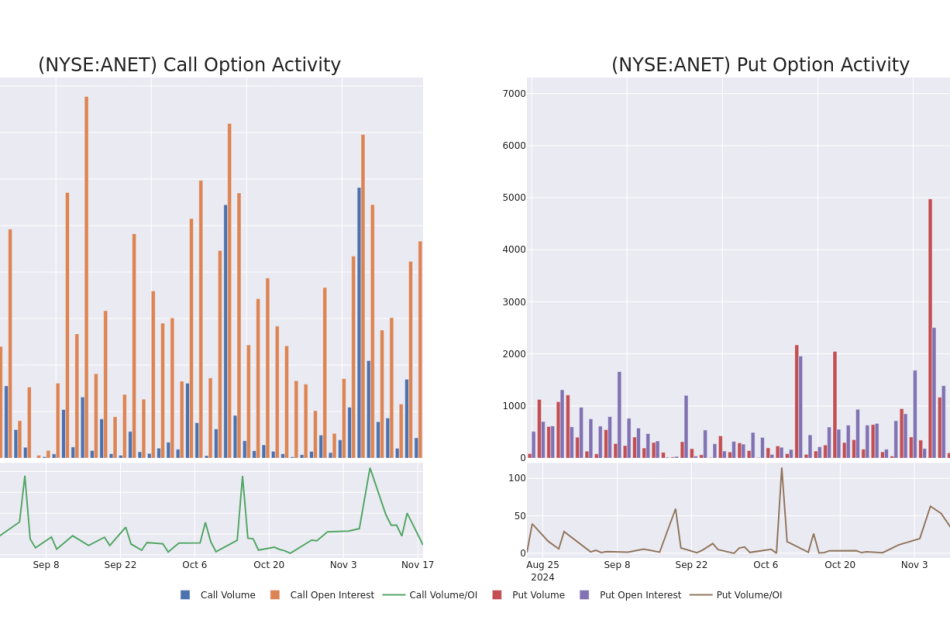

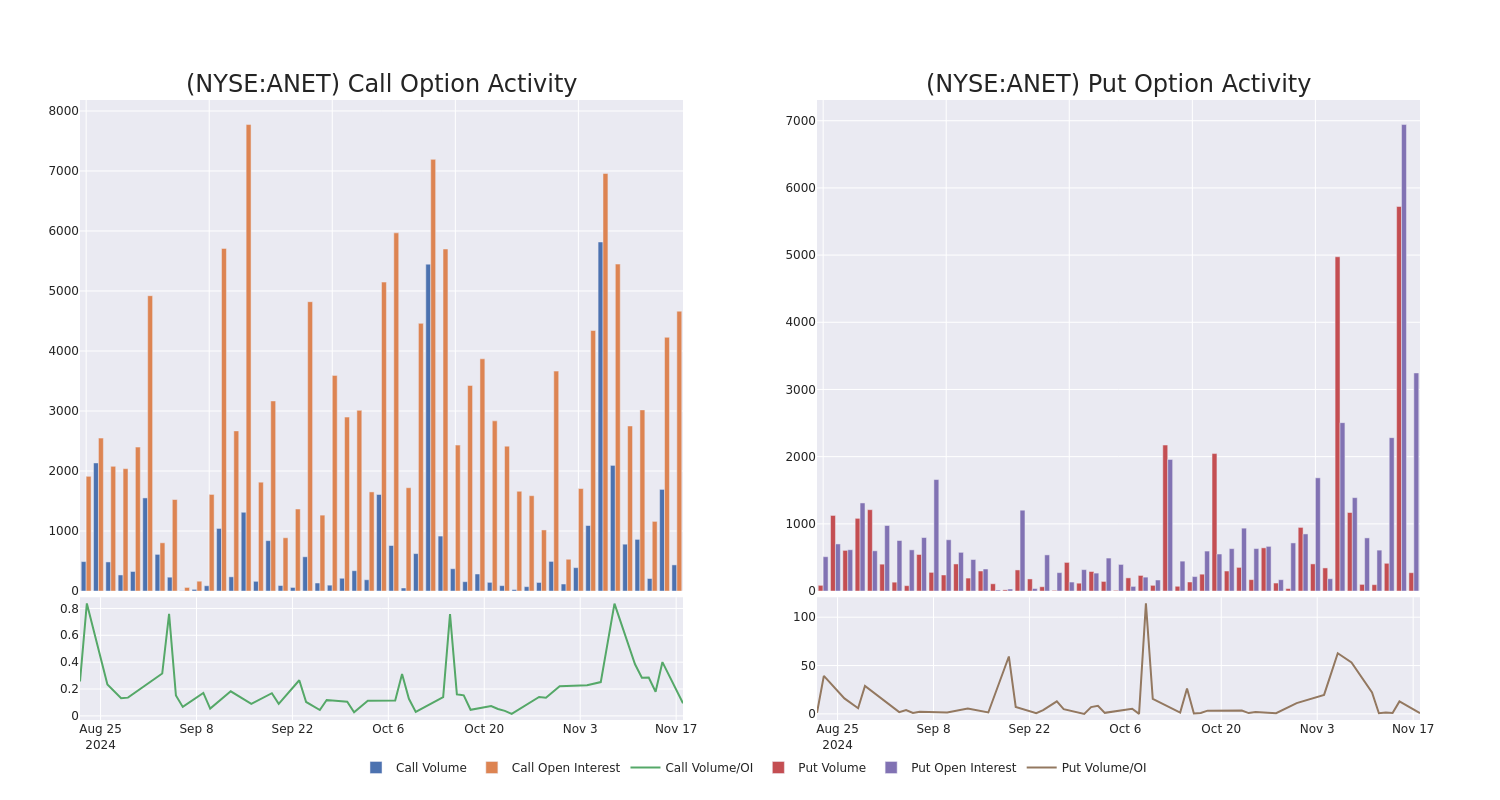

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Arista Networks’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Arista Networks’s whale trades within a strike price range from $260.0 to $460.0 in the last 30 days.

Arista Networks Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ANET | CALL | TRADE | NEUTRAL | 06/20/25 | $49.1 | $47.5 | $48.4 | $380.00 | $91.9K | 110 | 21 |

| ANET | CALL | TRADE | BEARISH | 02/21/25 | $15.3 | $14.6 | $14.7 | $430.00 | $80.8K | 171 | 114 |

| ANET | CALL | SWEEP | BEARISH | 02/21/25 | $18.0 | $17.4 | $17.43 | $420.00 | $80.3K | 309 | 52 |

| ANET | CALL | TRADE | NEUTRAL | 01/17/25 | $2.7 | $2.1 | $2.45 | $460.00 | $73.5K | 502 | 311 |

| ANET | CALL | TRADE | BEARISH | 02/21/25 | $13.3 | $12.6 | $12.6 | $430.00 | $69.3K | 171 | 0 |

About Arista Networks

Arista Networks is a networking equipment provider that primarily sells Ethernet switches and software to data centers. Its marquee product is its extensible operating system, or EOS, that runs a single image across every single one of its devices. The firm operates as one reportable segment. It has steadily gained market share since its founding in 2004, with a focus on high-speed applications. Arista counts Microsoft and Meta Platforms as its largest customers and derives roughly three quarters of its sales from North America.

In light of the recent options history for Arista Networks, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Arista Networks’s Current Market Status

- With a volume of 2,357,777, the price of ANET is up 1.84% at $377.3.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 83 days.

Professional Analyst Ratings for Arista Networks

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $424.2.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on Arista Networks with a target price of $495.

* An analyst from Wells Fargo persists with their Overweight rating on Arista Networks, maintaining a target price of $460.

* An analyst from UBS persists with their Neutral rating on Arista Networks, maintaining a target price of $425.

* An analyst from Piper Sandler has revised its rating downward to Neutral, adjusting the price target to $421.

* Maintaining their stance, an analyst from Rosenblatt continues to hold a Sell rating for Arista Networks, targeting a price of $320.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Arista Networks, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insights Ahead: Intchains Gr's Quarterly Earnings

Intchains Gr ICG is preparing to release its quarterly earnings on Wednesday, 2024-11-20. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect Intchains Gr to report an earnings per share (EPS) of $0.05.

Investors in Intchains Gr are eagerly awaiting the company’s announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It’s worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

Earnings Track Record

During the last quarter, the company reported an EPS beat by $0.08, leading to a 4.53% increase in the share price on the subsequent day.

Stock Performance

Shares of Intchains Gr were trading at $4.1 as of November 18. Over the last 52-week period, shares are down 50.91%. Given that these returns are generally negative, long-term shareholders are likely a little upset going into this earnings release.

To track all earnings releases for Intchains Gr visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why Supermicro Stock Is Up 30% Today

David Paul Morris / Bloomberg / Getty Images

Super Micro Computer CEO Charles Liang

-

Supermicro’s shares were up more than 30% in recent trading, extending a wild year that has seen both dramatic highs and steep declines.

-

The company late yesterday issued a much-awaited announcement, naming a new auditor and filing a plan to avoid delisting by the Nasdaq.

-

Despite today’s jump, the stock is down 75% from its all-time highs in March.

Shares of Super Micro Computer are flying today, though nowhere near their highs.

The server maker’s shares were recently up more than 30% in Tuesday trading, extending a wild year that has seen both dramatic highs and steep declines.

What’s behind the move? Supermicro (SMCI) late yesterday issued a much-awaited announcement, naming a new auditor and filing a plan to avoid delisting by the Nasdaq—which was itself necessitated by the company’s failure to file its annual report on time. (The plan still requires approval from the Nasdaq, Mizuho analysts noted Tuesday.)

Today’s jump is the latest swing for a stock that has seen a whipsaw 2024. Aided by AI-fueled enthusiasm, the stock—which finished last year just below $29—jumped above $120 in March; earlier this month, amid ongoing concerns about issues related to the filing, its accounting and related matters, it traded below $18.

Along the way, the company was named to the benchmark S&P 500 index and split its shares 10-for-1. At recent prices, it’s roughly in the neighborhood of break-even for the year so far.

TradingView