AFCEA International's Cyber Committee Proposes National Innovation Strategy

Fairfax, VA, Nov. 19, 2024 (GLOBE NEWSWIRE) — In an effort to reach U.S. entities and the highest levels of government with recommendations for making the United States a top competitor in global innovation, AFCEA International’s Cyber Committee developed and published its National Innovation Strategy (NIS) proposal on November 19.

The NIS addresses challenges and amplifies emerging opportunities for fostering a more robust innovation ecosystem in the United States. The proposal emphasizes the crucial role of innovation in strengthening national security, economic prosperity and societal well-being.

“America’s ability to gain and retain a future competitive edge relies on the nation’s ability to out-innovate all others,” said Lt. Gen. Susan S. Lawrence, AFCEA president and CEO. “The committee’s NIS provides a thought-through, comprehensive and balanced roadmap to strengthen the nation’s ability to innovate and secure a prosperous and secure future for our nation.”

“With the last national innovation strategy proposed in 2015, the Cyber Committee sought to provide impetus and an updated approach to fostering innovation. Among other recommendations, the strategy calls for a significant increase in collaboration between government, industry, research and academic leaders to improve the United States’ competitiveness in fostering innovation,” said John Gilligan, the committee’s co-chair. “The NIS also analyzes the international innovation landscape with several country examples and outlines steps the United States can take to rise above competitors within the innovation ecosystem.”

Over the next five years of NIS implementation, the goals are for the United States to rank first in the Global Innovation Index, protect and secure the nation’s critical infrastructure, increase innovation-driven economic growth and job creation, and balance technological advancements with ethical considerations.

“As we enter a new chapter of leadership, it’s imperative the next administration prioritizes results-driven innovation to address our most pressing challenges and capitalize on emerging opportunities,” said James P. Craft, committee member and co-chair of the National Innovation Strategy subcommittee. “Innovation is not just a tool for progress; it’s the foundation of our national security, economic prosperity, and global competitiveness. By fostering a culture of collaboration across government, industry, and academia, we can drive efficiencies, reduce costs, and maintain our edge on the world stage.”

The NIS is a proposal for the incoming U.S. administration, but it is also a call to action. Some of the recommended actions include increasing research and development funding, creating a National Innovation Council and developing agile regulatory frameworks for innovative technologies.

“Leadership that drives transformative change and positions innovation is the cornerstone for the future,” offer Henry J. Costa, PhD, committee member and co-chair of the National Innovation Strategy subcommittee.

AFCEA has a variety of committees that support the member-based association’s mission to foster collaboration and innovation between government, industry and academia. They include the Cyber Committee, Homeland Security Committee, Intelligence Committee, Emerging Professionals in the Intelligence Community Committee (EPIC), Small Business Committee, Technology Committee and the Membership Committee.

###

AFCEA International is a 501(c)(6) nonprofit international professional association that connects people, ideas and solutions globally. Established in 1946, the membership association serves the military, government, industry and academia by developing networking and educational opportunities and providing an ethical forum. This enables military, government, industry and academia to align technology and strategy to meet the needs of those who serve. AFCEA operates under the guidance of a board of directors, international staff and committees. A large network of chapters is managed by a group of regional vice presidents. Join online.

Howard Wahlberg AFCEA International 703-631-6199 hwahlberg@afcea.org

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

A Preview Of Jack In The Box's Earnings

Jack In The Box JACK is preparing to release its quarterly earnings on Wednesday, 2024-11-20. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect Jack In The Box to report an earnings per share (EPS) of $1.09.

Investors in Jack In The Box are eagerly awaiting the company’s announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It’s worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

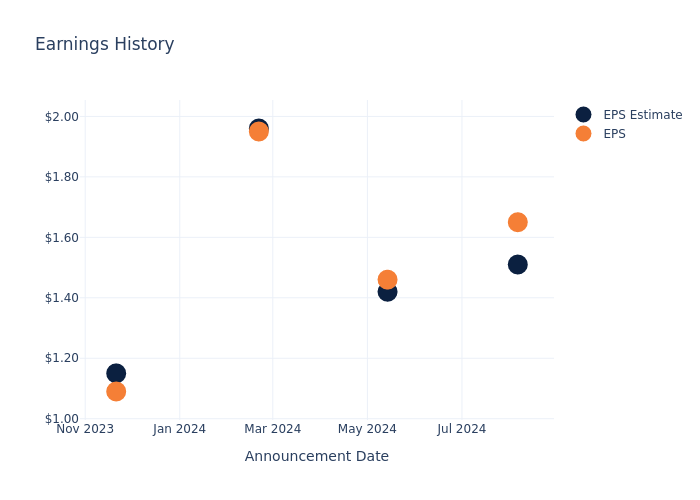

Historical Earnings Performance

In the previous earnings release, the company beat EPS by $0.14, leading to a 3.11% drop in the share price the following trading session.

Here’s a look at Jack In The Box’s past performance and the resulting price change:

| Quarter | Q3 2024 | Q2 2024 | Q1 2024 | Q4 2023 |

|---|---|---|---|---|

| EPS Estimate | 1.51 | 1.42 | 1.96 | 1.15 |

| EPS Actual | 1.65 | 1.46 | 1.95 | 1.09 |

| Price Change % | -3.0% | 1.0% | -5.0% | 2.0% |

Market Performance of Jack In The Box’s Stock

Shares of Jack In The Box were trading at $46.61 as of November 18. Over the last 52-week period, shares are down 34.64%. Given that these returns are generally negative, long-term shareholders are likely upset going into this earnings release.

To track all earnings releases for Jack In The Box visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Super Micro Computer Is Skyrocketing Today — Is It Time to Buy the AI Stock?

Super Micro Computer (NASDAQ: SMCI) stock is seeing explosive gains in Tuesday’s trading. The company’s share price was up 30.7% as of 1:45 a.m. ET.

Supermicro stock is roaring higher today following news that the company has hired BDO as its new financial auditor and submitted a financial-results filing plan to Nasdaq. The auditor hiring and submission of the filing plan prevented the stock from being delisted from the Nasdaq exchange yesterday, removing a major short-term risk factor that had been worrying investors. But some big questions remain.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Supermicro hiring BDO as its independent auditor is a significant positive development. BDO is the fifth-largest public accounting firm in the world and has a solid reputation in its industry. On the heels of recent controversies that have surrounded Supermicro and its accounting practices, bringing on a well-regarded auditor is good news.

In August, short-seller Hindenburg Research published a scathing bearish report on Supermicro that alleged repeated accounting violations. The next day, Supermicro announced that it was delaying the filing of its annual 10-K report.

In October, Ernst & Young (EY) resigned as the server specialist’s financial results auditor. EY stated that it had stepped back from the role because it no longer believed that it could rely on statements made by Supermicro’s management team and auditing committee. With BDO now on board, Supermicro can presumably move forward with the filing of its delayed 10-K reports. The move has also allowed Supermicro to submit a crucial financial filing plan.

If the filing plan had not been submitted, Supermicro’s stock would have been delisted from the Nasdaq exchange yesterday. In turn, the company’s shares would have started trading over the counter — which means less trading volume and less visibility for investors. Delisting would also mean that that the stock would be removed from major exchange traded funds (ETFs). But while immediate removal from the Nasdaq exchange has been averted, a potential delisting at a later date could still be on the table.

Additionally, an investigation into Supermicro by the Department of Justice is reportedly underway. Most coverage points to the reported investigation being tied to financial reporting issues, although some have speculated that the DoJ could also be looking into whether Supermicro violated export bans preventing the sale of advanced artificial intelligence (AI) processors to China. With so much uncertainty still surrounding the company, only investors with very high levels of risk tolerance should be considering the stock right now.

Methanex Corporation – Notice of Cash Dividend

VANCOUVER, British Columbia, Nov. 19, 2024 (GLOBE NEWSWIRE) — Methanex Corporation (the “Company” or “Methanex”) MX MEOH announced today that its Board of Directors has declared a quarterly dividend of US$0.185 per share. The dividend will be payable on December 31, 2024, to holders of common shares of record on December 17, 2024.

About Methanex

Methanex is a Vancouver-based, publicly traded company and is one of the world’s largest producers and suppliers of methanol to major international markets. Methanex shares are listed for trading on the Toronto Stock Exchange in Canada under the trading symbol “MX” and on the NASDAQ Global Select Market in the United States under the trading symbol “MEOH”. Methanex can be visited online at www.methanex.com.

Inquiries:

Sarah Herriott

Director, Investor Relations

Methanex Corporation

604-661-2600 or Toll Free: 1-800-661-8851

www.methanex.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Frontenac Mortgage Investment Corporation Announcement of October Dividend of $0.0574222 Per Share

SHARBOT LAKE, ON, Nov. 19, 2024 /CNW/ –

Dividends Update

FMIC is also pleased to confirm that its Board has approved and declared a dividend of $0.0574222 per share, payable on November 19, 2024 to shareholders of record as of October 31, 2024. The dividend represents FMIC’s approximate net income calculated for October 2024. The dividend reinvestment program will not be available for this dividend so all shareholders will receive this dividend in cash.

More information about FMIC is available under FMIC’s profile on SEDAR+ at www.sedarplus.ca.

Forward-Looking Statements

This press release contains certain forward-looking statements and forward-looking information (collectively referred to herein as “forward-looking statements“) within the meaning of applicable Canadian securities laws, which may include, but are not limited to, information and statements regarding or inferring the future business, operations, financial performance, prospects, and other plans, intentions, expectations, estimates, and beliefs of the Corporation. All statements other than statements of present or historical fact are forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as “anticipate”, “achieve”, “could”, “believe”, “plan”, “intend”, “objective”, “continuous”, “ongoing”, “estimate”, “outlook”, “expect”, “may”, “will”, “project”, “should” or similar words, including negatives thereof, suggesting future outcomes.

Forward-looking statements involve and are subject to assumptions and known and unknown risks, uncertainties, and other factors beyond FMIC’s ability to predict or control which may cause actual events, results, performance, or achievements of FMIC to be materially different from future events, results, performance, and achievements expressed or implied by forward-looking statements herein. Forward-looking statements are not a guarantee of future performance. Although FMIC believes that any forward-looking statements herein are reasonable, in light of the use of assumptions and the significant risks and uncertainties inherent in such statements, there can be no assurance that any such forward-looking statements will prove to be accurate. Actual results may vary, and vary materially, from those expressed or implied by the forward-looking statements herein. Accordingly readers are advised to rely on their own evaluation of the risks and uncertainties inherent in forward-looking statements herein and should not place undue reliance upon such forward-looking statements. All forward-looking statements herein are qualified by this cautionary statement. Any forward-looking statements herein are made only as of the date hereof, and except as required by applicable laws, FMIC assumes no obligation and disclaims any intention to update or revise any forward-looking statements herein or to update the reasons that actual events or results could or do differ from those projected in any forward-looking statements herein, whether as a result of new information, future events or results, or otherwise.

SOURCE Frontenac Mortgage Investment Corporation

![]() View original content: http://www.newswire.ca/en/releases/archive/November2024/19/c4307.html

View original content: http://www.newswire.ca/en/releases/archive/November2024/19/c4307.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bitdeer Technologies' Strong Growth Potential Highlighted By Analysts Amid Bitcoin Bull Market

Bitdeer Technologies Group BTDR shares are trading lower on Tuesday.

Yesterday, the company reported third-quarter results, where total revenue was $62.0 million, compared to $87.3 million in the year-ago period. Gross profit was $2.8 million, compared to $21.1 million in the year-ago period.

Here are the analyst’s takes on the earnings performance:

Needham analyst John Todaro reiterated the Buy rating on the stock, with a price forecast of $14.

The analyst praised the increased transparency with the full management team on the earnings call, but Todaro expressed disappointment over the lack of concrete details on potential HPC sites.

Todaro remains bullish on the stock due to the bitcoin bull market, maintaining a Buy rating.

The analyst notes that Bitdeer ranks mid-to-lower among public bitcoin miners in production costs, offering strong gross margins with bitcoin above $50-60k. The stock is expected to re-rate in 2025, driven by hash rate expansion, new generation mining machines sourced at production cost, and a growing presence in U.S. capital markets.

Benchmark analyst Mark Palmer reiterated the Buy rating on the company, with a price forecast of $16.

The analyst highlights that Bitdeer has started mass production of its SEALMINER A2 rigs, targeting 18 EH/s, with deliveries expected in 1Q25. Additionally, BTDR’s SEAL03 chip, designed for improved efficiency at 10 J/TH, will enter testing with samples expected by 2Q25, enabling the SEALMINER A3 rig to achieve 11-12 J/TH efficiency in 2Q25, Palmer adds.

HC Wainwright analyst Mike Colonnese reiterated the Buy rating on Bitdeer, raising the price forecast to $18 from $17. The analyst estimates Bitdeer could nearly triple its self-mining capacity to ~23 EH/s by 2025, up from 8.4 EH/s in October, though management withheld official guidance.

The 2024 revenue estimate was lowered to $342.9 million from $381.2 million, driven by lower hosting revenues, partially offset by higher self-mining revenues. The revised estimate includes $157.6 million in self-mining revenues (up from $153.6 million) and reduced hosting revenues of $129.3 million (down from $171.6 million).

Price Action: BTDR shares are trading lower by 3.25% to $11.47 at last check Tuesday.

Image via Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

PLTR, MNDY, or SOFI: Which Growth Stock Is the Most Attractive Pick?

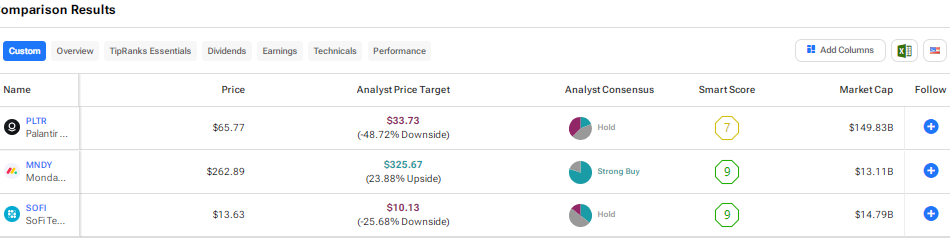

Several growth stocks announced better-than-expected third-quarter results recently, displaying their ability to navigate an uncertain macro backdrop. The Federal Reserve’s interest rate cuts are expected to provide relief to growth stocks and boost their prospects. Bearing that in mind, we used TipRanks’ Stock Comparison Tool to place Palantir Technologies (PLTR), Monday.com (MNDY), and SoFi Technologies (SOFI) against each other to find the most attractive growth stock, according to analysts.

Data analytics company Palantir Technologies impressed investors with its beat-and-raise Q3 results recently. The company’s third-quarter revenue grew 30% to $725.5 million, driven by artificial intelligence (AI)-led demand.

It is worth noting that the revenue growth of Palantir’s U.S. government business accelerated to 40% in Q3 from 24% in Q2, while the U.S. commercial business delivered top-line growth of 54%. In fact, the company highlighted that customer count in the U.S. commercial business jumped 77% compared to the 37% growth in Q3 2023.

PLTR shares have rallied 283% so far this year, as investors welcomed the stock’s inclusion in the S&P 500 (SPX) and are optimistic about the company’s AI tailwinds. Further, on November 15, PLTR stock surged 11% after the company announced its plan to shift its listing to Nasdaq from the NYSE. In contrast to the upbeat investor views, Wall Street is sidelined on PLTR stock.

Following the Q3 results, Monness analyst Brian White reiterated a Sell rating on PLTR stock with a price target of $18. The analyst noted that Palantir’s enterprise value to revenue multiple of 26x is way higher than the 6.1x average of the stocks in his software group. He added that PLTR trades at a 39% premium to semiconductor giant Nvidia’s (NVDA) EV/revenue multiple.

While White believes that Palantir is well positioned to benefit from AI and capitalize on volatile geopolitics in the long run, he contends that the stock’s valuation is lofty, revenue recognition from government-related contracts has been uneven, and execution has been “spotty.”

Overall, Wall Street has a Hold consensus rating on Palantir Technologies stock based on three Buys, seven Holds, and six Sell recommendations. At $33.73, the average PLTR stock price target implies about 49% upside potential.

Trulieve Cannabis Execs Buy 26K Company Shares: What Does This Mean For Investors?

Trulieve Cannabis Corp. TCNNFTRUL executives recently purchased 26,000 shares, signaling potential confidence in the company’s future. Between November 8 and 13, COO Marie Zhang, CPO Kyle Landrum, and CLO Eric Powers increased their holdings, according to a report by Beacon Securities.

Zhang made the largest move, acquiring 21,300 shares at an average price of $7.19, adding $153,147 of an estimated total of around $186.000. What does this mean for investors? Is the stock undervalued?

Stock Decline

Trulieve’s stock has dropped sharply in recent weeks, trading at around $6.34 after peaking at $14 in mid-October. The decline follows two major setbacks: the failure of Florida’s cannabis legalization ballot and heightened political uncertainty tied to Donald Trump’s election victory.

These setbacks created an election gapt hat the stock has yet to close.

There’s a reason why those events had a significant impact on the company. Florida is the company’s largest market, and the ballot’s failure denied an opportunity to double the size of the state’s legal cannabis market. A Trump presidency also raises concerns about the future of federal cannabis reform, further complicating Trulieve’s growth outlook.

The ballot’s defeat was particularly damaging. If approved, it would have allowed Trulieve to expand its 156 Florida stores into the recreational market, dramatically boosting revenue potential.

Adding to these challenges, Trulieve’s third-quarter 2024 earnings showed mixed results. The company reported $284 million in revenue, a modest 3% increase from the previous year, with a strong gross margin of 61% and adjusted EBITDA of $96 million (up 24% year-over-year). However, a $60 million net loss, significantly higher than the $25.4 million loss in Q3 2023 highlighted the financial strain of $48 million in non-recurring expenses tied to the Florida ballot campaign.

Read Also: Can Trump’s Return Save The Cannabis Sector? Debt Mounts As Giants Face Post-Election Reckoning

Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

Is Trulieve Undervalued?

Insider stock purchases often indicate that management views the stock as undervalued. These moves could also be intended to restore investor confidence after a significant drop. However, determining undervaluation is complex and subjective, often requiring a mix of financial analyses and market sentiment.

From a technical perspective, Trulieve appears oversold, with an RSI of 31.94, suggesting the possibility of a rebound. Key resistance levels are $9.58 (SMA) and $14 (the October high), while support hovers at $6.00, with a critical floor near $3.71 (lower Bollinger Band). Recent high volumes during the selloff suggest heavy selling pressure, but the current lower volumes indicate stabilization.

Chart created using Benzinga Pro

At a glance, it seems the market has not bought yet on the promising future this cannabis company has to offer, with or without legal recreational cannabis in Florida. But, with small-cap cannabis stocks prone to volatility, this is a situation investors should monitor closely.

Cover: AI generated image

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.