Stocks Move Higher, Walmart Hits Record High, Natural Gas Reaches 5-Month Peak: What's Driving Markets Tuesday?

Wall Street managed to recover from a red start caused by heightened geopolitical tensions stemming from the ongoing Russia-Ukraine conflict.

Ukraine launched its first U.S.-made missile strike on a Russian city, while Russian President Vladimir Putin adjusted the nation’s nuclear doctrine to broaden scenarios for a potential response. Yet, Russian Foreign Minister Sergei Lavrov sought to assuage fears of a nuclear escalation, stating that a nuclear war is not something Russia is considering.

Amid the geopolitical noise, investors remained focused on corporate earnings. Walmart Inc. WMT, often regarded as a bellwether of consumer health, surpassed expectations for the recent quarter. The retailer’s stock surged 4%, hitting fresh all-time highs and boosting market sentiment.

At midday, both the S&P 500 and Nasdaq 100 posted marginal gains, while blue-chip stocks showed a slight deceleration and small caps held steady.

In fixed income, longer-dated bond yields dipped, with the iShares 20+ Year Treasury Bond ETF TLT climbing 0.5%. The U.S. dollar gained 0.1%, attempting to rebound after two consecutive sessions of losses.

Geopolitical risks lifted demand for commodities, with gold and oil rebounding 0.8% and 0.5%, respectively. Natural gas prices – as closely tracked by the United States Natural Gas Fund LP UNG – extended the rally, adding 2.6% after a 5.3% jump on Monday and hitting the highest levels since June.

Meanwhile, Bitcoin BTC/USD continued to display extraordinary strength, with the cryptocurrency breaking to a new all-time high of $93,931, underscoring robust market interest despite broader macro uncertainties.

Tuesday’s Performance In Major US Indices, ETFs

| Major Indices | Price | 1-day %chg |

| Nasdaq 100 | 20,610.47 | 0.3% |

| S&P 500 | 5,907.68 | 0.2% |

| Russell 2000 | 2,309.75 | 0.1% |

| Dow Jones | 43,316.79 | -0.2% |

According to Benzinga Pro data:

- The SPDR S&P 500 ETF Trust SPY rose 0.2% to $589.41.

- The SPDR Dow Jones Industrial Average DIA fell 0.3% to $433.10.

- The tech-heavy Invesco QQQ Trust Series QQQ edged 0.4% higher to $502.08.

- The iShares Russell 2000 ETF IWM fell 0.3% to $229.50.

- The Technology Select Sector SPDR Fund XLK outperformed, rising 0.5%. The Energy Select Sector SPDR Fund XLE lagged, down 0.7%.

Tuesday’s Stock Movers

- Super Micro Computer Inc. SMCI surged 22% after appointing BDO US as its auditor and submitting a compliance plan to Nasdaq, signaling a proactive effort to address delisting concerns. The news bolstered investor confidence in the company’s governance and market stability.

- United Airlines Holdings Inc. UAL climbed 3.5%, reaching its highest level since December 2019, following a bullish call from TD Owen, which raised the stock’s price target from $100 to $110.

- Incyte Corp. INCY plummeted over 14% after announcing that data from its Phase 2 clinical study failed to support further development, disappointing investors hoping for progress in its pipeline.

- Valvoline Inc. VVV dropped 8% in reaction to a weaker-than-expected earnings report, as the market digested concerns over the company’s growth trajectory and profitability.

- Vertive Holdings Inc. VRT rallied 11.7% in reaction to price target raises from investment banks such as Deustsce Bank and Oppenheimer.

Read Next:

Image created using artificial intelligence via Midjourney.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Here's How Much $100 In Bitcoin Could Be Worth In 2030 If Cathie Wood's Price Target Is Reached

Ark Invest CEO Cathie Wood has been a vocal bull for the cryptocurrency sector for years, specifically for leading cryptocurrency Bitcoin (CRYPTO: BTC), which she recently said could be helped by the incoming White House administration.

Wood has shared price targets for Bitcoin over the years, including a high of $3.8 million for BTC by the year 2030. Here’s a look at how much a small investment in Bitcoin today could increase over time if Wood’s various price targets are reached in the future.

Don’t Miss:

Following Wood Into Bitcoin: With Bitcoin hitting all-time highs after the 2024 presidential election, big questions remain about how high the leading cryptocurrency can go and how long it will take to reach various milestones like $100,000.

Earlier this year, Wood laid out her price targets for Bitcoin based on a bear case, base case and bull case for the year 2030. Wood also added a new bull case that includes the potential highest price Bitcoin could reach by 2030 if companies allocated 5% to Bitcoin.

Trending: ‘Scrolling to UBI’: Deloitte’s #1 fastest-growing software company allows users to earn money on their phones – invest today with $1,000 for just $0.25/share

With Bitcoin trading at $89,384.76 at the time of writing, an investor could buy 0.00112 BTC today with $100. Here is a look at how much that $100 would be worth in the future under Wood’s various price targets.

-

Bear Case, $258,500: $100 today would be worth $289.52, up 189.5%

-

Base Case, $682,000: $100 today would be worth $763.84, up 663.8%

-

Bull Case, $1,480,000: $100 today would be worth $1,657.60, up 1,557.6%

-

Bullish Case, $3,800,000: $100 today would be worth $4,256.00, up 4,156.0%

As you can see, a small investment would turn into a sizable return if Wood’s base or bullish predictions come true. Even the bearish price target hitting would more than double the investment from today.

While there’s no guarantee that any of the price targets will hit, the exercise shows how a small investment in cryptocurrency could add up over time.

Trending: With over 7.8K investors including Meta, Google, And Amazon Execs — this AI Startup’s valuation has skyrocketed from $5 million to $85 million in just three years. Be an early investor with just $1,000 for only $0.50/share today before the offer closes in the next few days!

What’s Next: Wood recently reiterated her price targets in a CNBC interview while highlighting how Ark Invest was early to investing in Bitcoin.

Vertiv's Earnings Estimates Raised By Analyst Amid Improved Margin Outlook

BofA Securities analyst Andrew Obin reiterated the Buy rating on Vertiv Holdings VRT, with a price forecast of $150.

Obin writes that, management has revised its organic revenue growth forecast to a 12%-14% CAGR from 2024 to 2029, up from a previous range of 8%-11%.

This compares to BofA and consensus estimates of a 14% CAGR from 2024-2027.

The analyst attributes the revision to potential industry-wide constraints, such as electricity availability and skilled labor shortages.

Vertiv’s capital expenditure is projected to increase, with capex rising to approximately 3.0% of revenue in 2025, up from 2.6% in 2024, indicating a continued acceleration of capacity expansions.

Also Read: Grant Cardone Calls Himself A ‘Coward Investor,’ Puts His Money In ‘Real Assets’

As of 3Q24, Vertiv’s gross equipment assets grew by 25% year-over-year, the analyst writes.

Management also guided for an adjusted operating margin of 25+% by 2029 (or sooner), an improvement from the previous target of 20+% by 2028.

This enhanced margin outlook is despite an increase in R&D and capacity investment, which is now expected to reach $150-200 million per year, up from the previous $75-125 million range, Obin adds.

The analyst raised the 2025 adj. EPS estimate by $0.10 to $3.60 (+33% year over year), driven largely by faster revenue growth.

Obin raised the 2026 adj. EPS estimate by $0.15 to $4.40 (+22% year over year).

The analyst also raised the dividend forecast to reflect the 50% increase to $0.15/share annualized rate in conjunction with the Investor Day.

Price Action: VRT shares are trading higher by 10.9% to $136.49 at last check Tuesday.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Medtronic Q2 Earnings: Diabetes And Neuroscience Revenue Boost Growth, Raises Annual Outlook

Tuesday, Medtronic Plc MDT reported second-quarter 2025 sales of $8.40 billion, beating the consensus of $8.27 billion. The medical device maker reported adjusted EPS of $1.26, beating the consensus of $1.25.

Revenue increased 5.3% year over year, as reported, and 5% on an organic basis.

Also Read: Medtronic Recalls MiniMed Pump Due To Battery Life Concerns

Cardiovascular segment revenue reached $3.102 billion, up 6.1% year over year as reported, and increased 5.6% organically, with a high-single-digit increase in Structural Heart & Aortic and mid-single-digit increases in Cardiac Rhythm & Heart Failure and Coronary & Peripheral Vascular, all on an organic basis.

Neuroscience revenues of $2.45 billion increased 7.1% as reported and 6.7% organically, with a low-double-digit increase in Neuromodulation and mid-single-digit increases in Cranial & Spinal Technologies and Specialty Therapies, all on an organic basis.

Medical Surgical revenue of $2.13 billion increased by 1.2% as reported and increased by 0.7% organically, with a low-single-digit organic increase in Acute Care & Monitoring and flat organic result in Surgical & Endoscopy.

Surgical & Endoscopy year-over-year results were affected by a difficult comparison from the prior year supply recovery in Surgical and increased high-single digits sequentially.

Diabetes revenue of $686 million increased by 12.4%, as reported, and by 11% organic.

“Our momentum is building as we keep executing on our commitments, delivering yet another consecutive quarter of strong results that came in ahead of expectations,” said Geoff Martha, Medtronic chairman and chief executive officer.

Guidance: Medtronic raised its fiscal year 2025 organic revenue growth guidance to 4.75%-5%, up from the prior 4.5%-5%.

If recent foreign currency exchange rates hold, 2025 revenue growth on an adjusted basis would be 3.4%-3.9%.

Medtronic expects 2025 adjusted EPS guidance to be $5.44-$5.50 versus previous guidance of $5.42-$5.50 and consensus of $5.45.

Price Action: MDT stock is down 3.52% at $84.53 at the last check on Tuesday.

Read Next:

Photo by Tony Webster via Wikimedia Commons

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Gold Moves Higher; Medtronic Posts Upbeat Results

U.S. stocks traded mixed toward the end of trading, with the Nasdaq Composite gaining by around 1% on Tuesday.

The Dow traded down 0.03% to 43,374.79 while the NASDAQ rose 1.03% to 18,985.21. The S&P 500 also rose, gaining, 0.49% to 5,922.41.

Check This Out: This Apollo Global Management Analyst Begins Coverage On A Bullish Note; Here Are Top 5 Initiations For Tuesday

Leading and Lagging Sectors

Information technology shares rose by 0.6% on Tuesday.

In trading on Tuesday, materials shares fell by 0.6%.

Top Headline

Medtronic Plc MDT reported better-than-expected results for its second quarter and raise its outlook.

The company posted second-quarter 2025 sales of $8.40 billion, beating the consensus of $8.27 billion. The medical device maker reported adjusted EPS of $1.26, beating the consensus of $1.25.

Medtronic raised its fiscal year 2025 organic revenue growth guidance to 4.75%-5%, up from the prior 4.5%-5%. If recent foreign currency exchange rates hold, 2025 revenue growth on an adjusted basis would be 3.4%-3.9%. Medtronic expects 2025 adjusted EPS guidance to be $5.44-$5.50 versus previous guidance of $5.42-$5.50 and consensus of $5.45.

Equities Trading UP

- Super Micro Computer, Inc. SMCI shares shot up 29% to $27.84 after the company announced the appointment of BDO USA as its independent auditor and the filing of a compliance plan with Nasdaq.

- Shares of PainReform Ltd. PRFX got a boost, surging 172% to $1.4600. The company announced a 1-for-4 reverse stock split.

- Interactive Strength Inc. TRNR shares were also up, gaining 30% to $3.30. The company, which makes specialty fitness equipment under the CLMBR and FORME brands, disclosed that Armah Sports Group‘s B_FIT is installing CLMBRs in three of its nine locations in Saudi Arabia.

Equities Trading DOWN

- NWTN Inc. NWTN shares dropped 12% to $1.06. NWTN received Nasdaq staff delisting determination for non-compliance with Listing Rule 5250(c)(1).

- Shares of Incyte Corporation INCY were down 13% to $66.74 after the company announced that data from its Phase 2 study evaluating MRGPRX4 (INCB000547) in cholestatic pruritus does not support further development.

- Codere Online Luxembourg, S.A. CDRO was down, falling 11% to $6.77 after the company received a Nasdaq delisting notice due to its public reports rule.

Commodities

In commodity news, oil traded down 0.1% to $69.12 while gold traded up 0.7% at $2,632.40.

Silver traded up 0.3% to $31.305 on Tuesday, while copper rose 0.6% to $4.1435.

Euro zone

European shares closed lower today. The eurozone’s STOXX 600 fell 0.45%, Germany’s DAX fell 0.67% and France’s CAC 40 fell 0.67%. Spain’s IBEX 35 Index fell 0.74%, while London’s FTSE 100 fell 0.13%.

Hourly labor costs in the Eurozone rose by 4.6% year-over-year in the third quarter compared to a revised 5% gain in the prior quarter. Annual inflation in the Eurozone rose to 2% in October from 1.7% in September.

Asia Pacific Markets

Asian markets closed higher on Tuesday, with Japan’s Nikkei 225 gaining 0.51%, Hong Kong’s Hang Seng Index gaining 0.44%, China’s Shanghai Composite Index gaining 0.67% and India’s BSE Sensex gaining 0.31%.

Malaysia’s trade surplus narrowed to MYR 12.0 billion in October from MYR 13.0 billion in the year-ago month.

Economics

- Housing starts in the U.S. declined by 3.1% to 1.311 million in October versus a revised 1.353 million in the previous month.

- U.S. building permits declined by 0.6% to an annual rate of 1.416 million in October.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Decision: Mark Silver Offloads $221K Worth Of Ryerson Holding Stock

Mark Silver, EVP at Ryerson Holding RYI, reported an insider sell on November 18, according to a new SEC filing.

What Happened: A Form 4 filing with the U.S. Securities and Exchange Commission on Monday outlined that Silver executed a sale of 9,000 shares of Ryerson Holding with a total value of $221,040.

Tracking the Tuesday’s morning session, Ryerson Holding shares are trading at $24.78, showing a down of 0.0%.

About Ryerson Holding

Ryerson Holding Corp provides a metals service center, and value-added processor and is a distributor of industrial metals with operations in the United States, Canada, and Mexico. In addition to its North American operations, it conducts processing and distribution operations in China. Its customers range from local, independently owned fabricators and machine shops to large, international original equipment manufacturers. It carries a full line of products in stainless steel, aluminum, carbon steel, and alloy steels and a limited line of nickel and red metals in various shapes and forms. The company generates substantially all of its revenue from sales of metal products. Geographically, the majority is from the United States.

Ryerson Holding: Financial Performance Dissected

Revenue Growth: Ryerson Holding’s revenue growth over a period of 3 months has faced challenges. As of 30 September, 2024, the company experienced a revenue decline of approximately -9.63%. This indicates a decrease in the company’s top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Materials sector.

Insights into Profitability:

-

Gross Margin: The company excels with a remarkable gross margin of 17.93%, indicating superior cost efficiency and profitability compared to its industry peers.

-

Earnings per Share (EPS): With an EPS below industry norms, Ryerson Holding exhibits below-average bottom-line performance with a current EPS of -0.2.

Debt Management: With a high debt-to-equity ratio of 1.07, Ryerson Holding faces challenges in effectively managing its debt levels, indicating potential financial strain.

Evaluating Valuation:

-

Price to Earnings (P/E) Ratio: A higher-than-average P/E ratio of 39.33 suggests caution, as the stock may be overvalued in the eyes of investors.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 0.18 is below industry norms, suggesting potential undervaluation and presenting an investment opportunity for those considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Ryerson Holding’s EV/EBITDA ratio, surpassing industry averages at 11.1, positions it with an above-average valuation in the market.

Market Capitalization Perspectives: The company’s market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Illuminating the Importance of Insider Transactions

In the complex landscape of investment decisions, investors should approach insider transactions as part of a comprehensive analysis, considering various elements.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

A Closer Look at Important Transaction Codes

Examining transactions, investors often concentrate on those unfolding in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Ryerson Holding’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Jacobs Solutions Q4: Revenue Beats, EPS Misses, Muted FY25 Outlook & More

Jacobs Solutions Inc. J shares are trading lower after the company reported mixed fourth-quarter results.

The company reported fourth-quarter revenue growth of 4.4% year-over-year to $2.96 billion, beating the consensus of $2.368 billion. Adjusted revenue rose 4.3% YoY to $2.118 billion.

Adjusted EPS was $1.37, up from $1.07 a year ago, below the consensus of $1.54.

Gross margin was flat at 24.8% YoY and rose 4.2% to $735.21 million. Operating margin expanded 70 bps to 6.6% YoY, and operating profit rose 16.5% to $195.21 million.

Jacobs Recorded $187 million in mark-to-market gains on investment in AMTM, increasing GAAP net income.

The quarterly backlog reached $21.8 billion, marking a 22.5% year-over-year increase. The Q4 book-to-bill ratio was 1.67x (1.35x on a trailing twelve-month basis).

Operating cash flow for the quarter totaled $196.53 million, down from $219.36 million a year ago.

“Our GAAP net income margin and adjusted EBITDA margin showed strong sequential growth in Q4, and we plan to build on this strong performance in FY25. Furthermore, our balance sheet remains in excellent condition following the separation transaction. This financial strength positions us well to continue investing in organic growth while repurchasing shares and growing our dividend over the long-term,” commented CFO Venk Nathamuni.

Jacobs’ Chair and CEO Bob Pragada highlighted the company’s progress in its strategic shift toward a streamlined, higher-value portfolio, marked by the completion of the separation transaction for its Critical Mission Solutions and Cyber & Intelligence businesses. He noted strong demand in key end markets and continued momentum driving higher gross profit.

Looking ahead to FY25, Pragada expressed confidence in positive trends across Water and Environmental, Critical Infrastructure, and Life Sciences and Advanced Manufacturing, supported by a simplified structure, global delivery model, and operational efficiencies.

2025 Outlook: Jacobs Solutions projects Adjusted EPS in the range of $5.80 to $6.20. Adjusted net revenue is expected to grow at a mid-to-high single-digit rate.

The company anticipates an Adjusted EBITDA margin of 13.8% to 14.0% and forecasts reported free cash flow (FCF) conversion to exceed 100% of net income.

Price Action: J shares are trading lower by 1.83% at $137.79 at the last check Tuesday.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

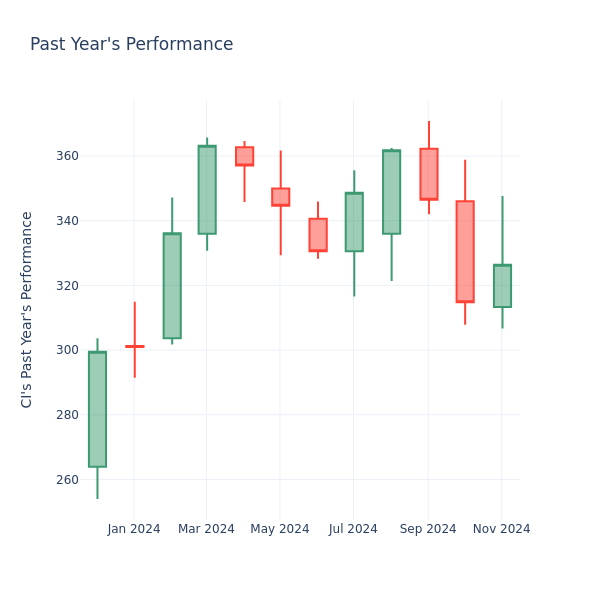

Price Over Earnings Overview: Cigna

In the current session, the stock is trading at $326.05, after a 1.12% increase. Over the past month, Cigna Inc. CI stock increased by 2.82%, and in the past year, by 13.21%. With performance like this, long-term shareholders are optimistic but others are more likely to look into the price-to-earnings ratio to see if the stock might be overvalued.

Evaluating Cigna P/E in Comparison to Its Peers

The P/E ratio is used by long-term shareholders to assess the company’s market performance against aggregate market data, historical earnings, and the industry at large. A lower P/E could indicate that shareholders do not expect the stock to perform better in the future or it could mean that the company is undervalued.

Compared to the aggregate P/E ratio of the 42.22 in the Health Care Providers & Services industry, Cigna Inc. has a lower P/E ratio of 30.56. Shareholders might be inclined to think that the stock might perform worse than it’s industry peers. It’s also possible that the stock is undervalued.

In summary, while the price-to-earnings ratio is a valuable tool for investors to evaluate a company’s market performance, it should be used with caution. A low P/E ratio can be an indication of undervaluation, but it can also suggest weak growth prospects or financial instability. Moreover, the P/E ratio is just one of many metrics that investors should consider when making investment decisions, and it should be evaluated alongside other financial ratios, industry trends, and qualitative factors. By taking a comprehensive approach to analyzing a company’s financial health, investors can make well-informed decisions that are more likely to lead to successful outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.