Kingsoft Cloud Q3 Earnings: Revenue Surges 16%, AI Growth Fuels Profits, CEO Shares Optimistic Outlook

Kingsoft Cloud Holdings KC reported a fiscal third-quarter 2024 revenue of 1.89 billion Chinese yuan ($268.7 million), up by 16.0% year-on-year, beating the analyst consensus estimate of $247.46 million.

The accelerated growth of high-quality businesses, such as AI, has offset the decline in the low-margin CDN business due to strategic proactive adjustments.

Kingsoft clocked an adjusted loss per ADS of 14 cents, which aligns with the analyst estimate. The stock price climbed after the print.

Revenues from public cloud services increased by 15.6% year over year to $167.5 million, mainly due to the growth of AI demands. Revenues from enterprise cloud services were $101.2 million, an increase of 16.7% Y/Y.

The adjusted gross profit was 307.6 million Chinese yuan ($43.8 million) versus 196.3 million Chinese yuan Y/Y.

The margin expanded by 420 bps to 16.3% due to strategic revenue mix adjustment, optimized enterprise cloud project selection, and efficient cost control measures.

Kingsoft held $230.6 million in cash and equivalents as of September end.

Kingsoft Cloud’s CEO, Tao Zou, emphasized the company’s commitment to its “High-quality and Sustainable Development Strategy,” which drove 16% topline growth in third-quarter of 2024. The AI business expanded to 362 million Chinese yuan, representing 31% of public cloud revenue. Revenues from the Xiaomi and Kingsoft Ecosystem surged by 36% year-over-year, capitalizing on opportunities in sectors like EVs, LLM, and WPS AI, reinforcing confidence in the company’s strategic direction.

CFO Henry He highlighted the company’s strong quarterly performance, marked by double-digit revenue growth to 1.89 billion Chinese yuan and significant profitability improvements. Gross profit and EBITDA profit growth outpaced industry averages. The adjusted EBITDA margin saw a remarkable turnaround, reflecting the success of the company’s revenue structure adjustment and AI-focused transformation.

Outlook: The company anticipates robust growth in the fourth quarter of 2024, driven by stable performance in public and enterprise cloud segments. It expects an accelerated revenue growth rate during the quarter and continued improvements in profitability. Operating profit and adjusted operating profit will likely show significant progress.

Kingsoft Cloud Holdings stock surged over 21% year-to-date.

Price Action: KC stock is up 3.48% at $4.49 at the last check on Tuesday.

Also Read:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Suze Orman Warns $3 Million Isn't Enough For Retirement, Even At A Mere 3% Withdrawal Rate – She Says You Need $10 Million Or More

Think $3 million is a solid retirement fund? Suze Orman has a reality check for you.

Speaking on the “Afford Anything” podcast, she explained why even this seemingly hefty amount might leave you struggling in retirement – especially if life throws a few curveballs your way.

Don’t Miss:

Orman was asked whether $3 million, paired with a conservative 3% withdrawal rate, could fund a secure early retirement. Her response? A flat-out no. She didn’t even hesitate to poke holes in the idea, calling $3 million “far from enough” for the unexpected costs life can throw at you.

The host, Paula Pant, asked Orman, “What would be a safe amount at which a person can say, ‘All right, at this point, given the size of my portfolio, I’m comfortable enough that if I did get hit by a bus, I would be fine.’?”

Orman answered, “It would have to be in the millions.” Pant, wanting a clearer answer, pressed further: “How many million?” That’s when Orman started doing the math – it wasn’t pretty.

“It depends where you live, what your expenses are,” Orman said. “Do you own your home outright? So, what are your expenses? But just think about it logically.”

And then she did exactly that: broke it down, line by line.

Trending: Deloitte’s fastest-growing software company partners with Amazon, Walmart & Target – You can still get 4,000 of its pre-IPO shares for with $1,000 for just $0.25/share

“Let’s say you need help. Remember, I took care of my mother and it cost me, like I said, $30,000 a month. $30,000 a month,” Orman emphasized. “So, you’re talking about, very possibly, for full-time help and everything – because good luck getting insurance and things to pay for it now – you’re talking about maybe $300,000, $400,000 a year.”

If that wasn’t sobering enough, she added: “Now you have other expenses – food and everything. Let’s just say you need another $100,000 a year to live. So now you’re at $350,000 a year after taxes.”

Trending: Can you guess how many retire with a $5,000,000 nest egg? The percentage may shock you.

To generate $350,000 annually after taxes without touching your principal, Orman said you’d need a portfolio yielding at least 5%. That means a whopping $10 million in assets, if not more.

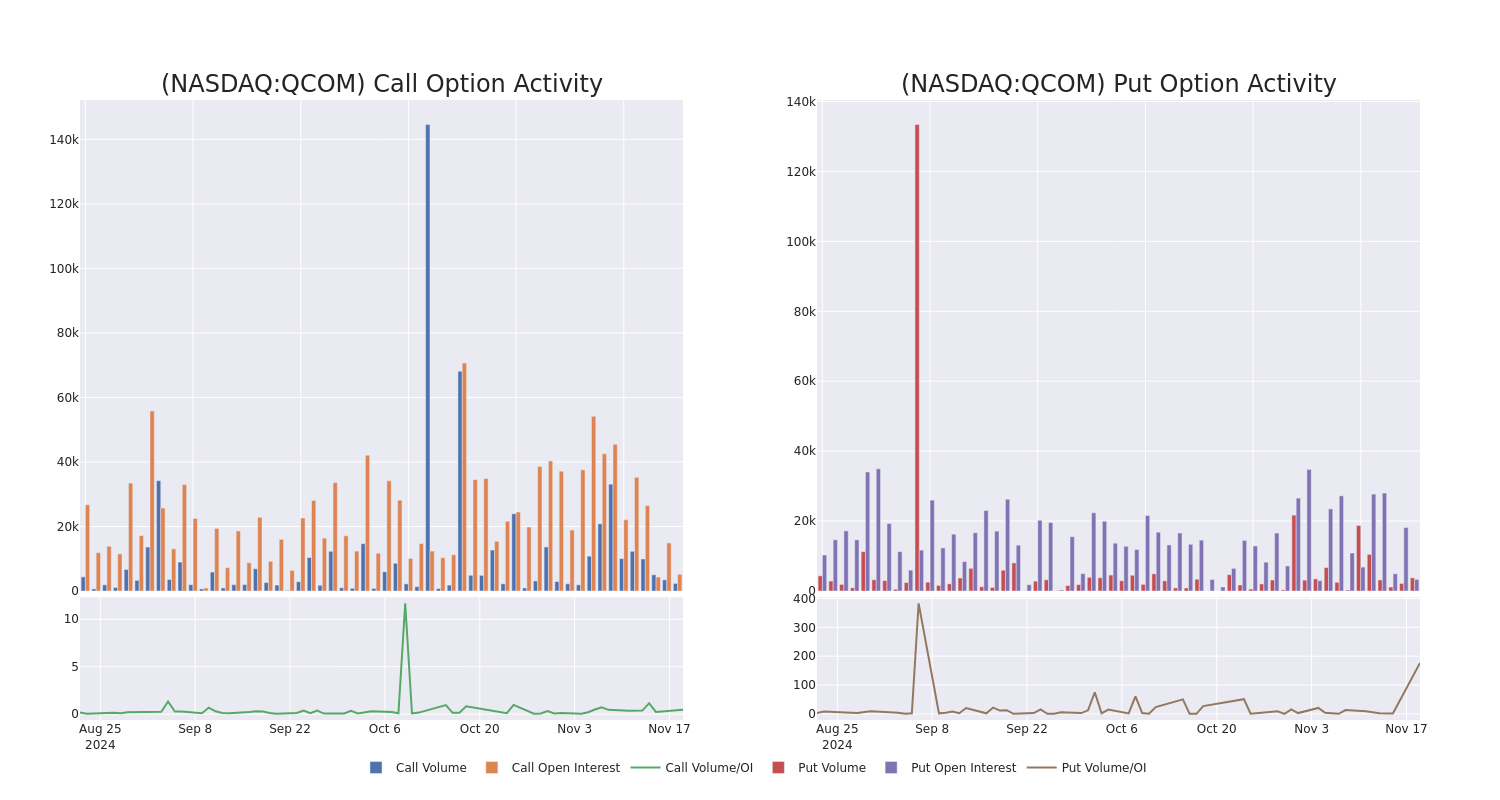

Qualcomm Unusual Options Activity

Whales with a lot of money to spend have taken a noticeably bearish stance on Qualcomm.

Looking at options history for Qualcomm QCOM we detected 13 trades.

If we consider the specifics of each trade, it is accurate to state that 38% of the investors opened trades with bullish expectations and 46% with bearish.

From the overall spotted trades, 7 are puts, for a total amount of $2,092,331 and 6, calls, for a total amount of $217,041.

What’s The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $150.0 to $230.0 for Qualcomm over the last 3 months.

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Qualcomm’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Qualcomm’s substantial trades, within a strike price spectrum from $150.0 to $230.0 over the preceding 30 days.

Qualcomm Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| QCOM | PUT | SWEEP | BEARISH | 04/17/25 | $14.6 | $14.5 | $14.54 | $165.00 | $758.5K | 119 | 1.0K |

| QCOM | PUT | SWEEP | BEARISH | 04/17/25 | $14.55 | $14.45 | $14.55 | $165.00 | $699.9K | 119 | 1.0K |

| QCOM | PUT | TRADE | BULLISH | 07/18/25 | $11.15 | $10.8 | $10.8 | $150.00 | $324.0K | 2 | 300 |

| QCOM | PUT | SWEEP | BULLISH | 04/17/25 | $17.35 | $17.3 | $17.3 | $170.00 | $197.2K | 1.8K | 114 |

| QCOM | CALL | SWEEP | BULLISH | 11/22/24 | $2.38 | $2.3 | $2.42 | $165.00 | $55.9K | 2.6K | 659 |

About Qualcomm

Qualcomm develops and licenses wireless technology and designs chips for smartphones. The company’s key patents revolve around CDMA and OFDMA technologies, which are standards in wireless communications that are the backbone of all 3G, 4G, and 5G networks. Qualcomm’s IP is licensed by virtually all wireless device makers. The firm is also the world’s largest wireless chip vendor, supplying nearly every premier handset maker with leading-edge processors. Qualcomm also sells RF-front end modules into smartphones, as well as chips into automotive and Internet of Things markets.

Qualcomm’s Current Market Status

- With a trading volume of 2,592,300, the price of QCOM is down by -0.28%, reaching $164.04.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 71 days from now.

What The Experts Say On Qualcomm

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $196.8.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* In a cautious move, an analyst from Loop Capital downgraded its rating to Hold, setting a price target of $180.

* An analyst from UBS has decided to maintain their Neutral rating on Qualcomm, which currently sits at a price target of $190.

* An analyst from Evercore ISI Group has decided to maintain their In-Line rating on Qualcomm, which currently sits at a price target of $199.

* Consistent in their evaluation, an analyst from Bernstein keeps a Outperform rating on Qualcomm with a target price of $215.

* Consistent in their evaluation, an analyst from JP Morgan keeps a Overweight rating on Qualcomm with a target price of $200.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Qualcomm, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Keysight Earnings Are Imminent; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

Keysight Technologies, Inc. KEYS will release earnings results for its fourth quarter, after the closing bell on Tuesday, Nov. 19.

Analysts expect the Santa Rosa, California-based bank to report quarterly earnings at $1.57 per share, down from $1.99 per share in the year-ago period. Keysight projects to report revenue of $1.26 billion for the recent quarter, compared to $1.31 billion a year earlier, according to data from Benzinga Pro.

On Oct. 28, Keysight and Analog Devices, Inc. ADI collaborated to create a comprehensive test solution for Gigabit Multimedia Serial Link (GMSL2TM) devices.

Keysight shares gained 1.4% to close at $151.42 on Monday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Barclays analyst Tim Long upgraded the stock from Equal-Weight to Overweight and raised the price target from $158 to $180 on Nov. 5. This analyst has an accuracy rate of 76%.

- Deutsche Bank analyst Matthew Niknam maintained a Buy rating and raised the price target from $163 to $175 on Aug. 26. This analyst has an accuracy rate of 61%.

- Baird analyst Richard Eastman maintained an Outperform rating and increased the price target from $160 to $163 on Aug. 22. This analyst has an accuracy rate of 79%.

- B of A Securities analyst David Ridley-Lane maintained an Underperform rating and raised the price target from $135 to $150 on Aug. 21. This analyst has an accuracy rate of 65%.

- JP Morgan analyst Samik Chatterjee maintained a Neutral rating and increased the price target from $155 to $165 on Aug. 21. This analyst has an accuracy rate of 73%.

Considering buying KEYS stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

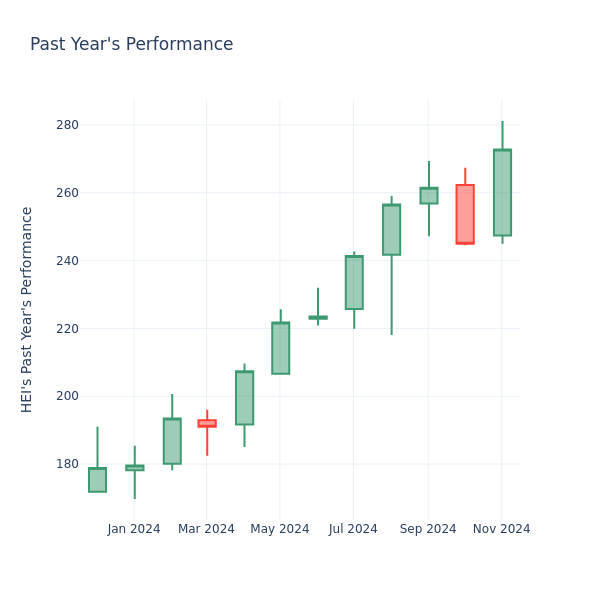

A Look Into Heico Inc's Price Over Earnings

In the current session, the stock is trading at $272.56, after a 1.08% increase. Over the past month, Heico Inc. HEI stock increased by 6.76%, and in the past year, by 57.14%. With performance like this, long-term shareholders are optimistic but others are more likely to look into the price-to-earnings ratio to see if the stock might be overvalued.

How Does Heico P/E Compare to Other Companies?

The P/E ratio measures the current share price to the company’s EPS. It is used by long-term investors to analyze the company’s current performance against it’s past earnings, historical data and aggregate market data for the industry or the indices, such as S&P 500. A higher P/E indicates that investors expect the company to perform better in the future, and the stock is probably overvalued, but not necessarily. It also could indicate that investors are willing to pay a higher share price currently, because they expect the company to perform better in the upcoming quarters. This leads investors to also remain optimistic about rising dividends in the future.

Heico has a better P/E ratio of 79.08 than the aggregate P/E ratio of 70.63 of the Aerospace & Defense industry. Ideally, one might believe that Heico Inc. might perform better in the future than it’s industry group, but it’s probable that the stock is overvalued.

In summary, while the price-to-earnings ratio is a valuable tool for investors to evaluate a company’s market performance, it should be used with caution. A low P/E ratio can be an indication of undervaluation, but it can also suggest weak growth prospects or financial instability. Moreover, the P/E ratio is just one of many metrics that investors should consider when making investment decisions, and it should be evaluated alongside other financial ratios, industry trends, and qualitative factors. By taking a comprehensive approach to analyzing a company’s financial health, investors can make well-informed decisions that are more likely to lead to successful outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

JLL and Slate Asset Management announce technology joint venture to tackle data challenges for real estate investors

JLL Asset Beacon integrates data across the commercial real estate asset management lifecycle, paving the way for AI-generated insights

CHICAGO, Nov. 19, 2024 /PRNewswire/ — JLL and Slate Asset Management (Slate) today announced a joint venture to commercialize Slate’s best-in-class technology platform for commercial real estate (CRE) professionals. The result is JLL Asset Beacon, a software-as-a-service (SaaS) technology platform that integrates data across asset management functions to create a real-time, end-to-end view of performance—whether it’s a single asset, fund, or the entire portfolio.

JLL Asset Beacon provides CRE professionals with accurate, integrated data to make informed decisions faster, optimize portfolio performance, mitigate risks, and identify opportunities for value creation. This private and secure hub captures all financial, operational, and leasing data and documents to provide a single source of truth with robust and customizable data visualization and reporting capabilities.

JLL’s generative AI capabilities, powered by the recently launched JLL Falcon platform, such as lease abstraction, entity resolution, and natural language query functionality will be integrated into JLL Asset Beacon, allowing users to unlock the potential of AI to organize and derive insights from their proprietary data.

“Our software gives real estate professionals a powerful competitive edge by providing better data insights and transparency that, in turn, enable faster and more informed decision making and ultimately drive value creation,” said Blair Welch, founding partner of Slate. “We have been developing, refining, and evolving this platform since Slate’s inception, and it has been a key to our strategic growth. Together with JLL, we can take this platform to the next level and make it available to a broader group of users, including investment managers, allocators, asset managers and limited partners.”

According to JLL Research, CRE portfolio diversification has grown over the past decade, making active asset management even more challenging. Advanced SaaS platforms such as JLL Asset Beacon validate, consolidate, and reconcile large amounts of data—helping investors maximize value through dynamic decision making.

“Active asset management is the driving force behind unlocking and enhancing value in real estate investments,” said Richard Bloxam, CEO of Capital Markets at JLL. “As the market recovers, capital deployment will focus on strategies offering returns that are competitive against the higher cost of capital. By leveraging data-driven insights, JLL Asset Beacon will help clients optimize their investments throughout the asset management lifecycle, across geographies and asset classes, to enable better decisions that deliver superior returns.”

Amit Koren, CEO of Leasing and Capital Markets Technology Group at JLL, added: “Slate’s powerful asset management hub, combined with JLL’s domain expertise and advanced AI capabilities, sets a new standard for data-driven, proactive asset management for our clients. JLL Asset Beacon will empower asset and portfolio managers with unparalleled insights, agility and efficiency for more precise decision-making about investment strategies in an increasingly complex market landscape.”

JLL’s Amir Leitersdorf and Iri Amirav will serve as co-CEOs of the joint venture. Both are seasoned technology entrepreneurs who joined JLL in 2021 when their company, Skyline AI, was acquired by JLL as a strategic addition to JLL’s technology portfolio.

About JLL

For over 200 years, JLL JLL, a leading global commercial real estate and investment management company, has helped clients buy, build, occupy, manage and invest in a variety of commercial, industrial, hotel, residential and retail properties. A Fortune 500® company with annual revenue of $20.8 billion and operations in over 80 countries around the world, our more than 111,000 employees bring the power of a global platform combined with local expertise. Driven by our purpose to shape the future of real estate for a better world, we help our clients, people and communities SEE A BRIGHTER WAYSM. JLL is the brand name, and a registered trademark, of Jones Lang LaSalle Incorporated. For further information, visit jll.com.

About Slate Asset Management

Slate Asset Management is a global alternative investment platform. We focus on fundamentals with the objective of creating long-term value for our investors and partners. Slate’s platform focuses on four areas of real assets, including real estate equity, real estate credit, real estate securities, and infrastructure. We are supported by exceptional people and flexible capital, which enable us to originate and execute on a wide range of compelling investment opportunities. Visit slateam.com to learn more, and follow Slate Asset Management on LinkedIn, X (Twitter), and Instagram.

Contact: Jesse Tron

Phone: + 1 914 424 0299

Email: jesse.tron@jll.com

Contact: Karolina Kmiecik, Head of Communications

Phone: +1 224 848 0662

Email: karolina@slateam.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/jll-and-slate-asset-management-announce-technology-joint-venture-to-tackle-data-challenges-for-real-estate-investors-302310111.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/jll-and-slate-asset-management-announce-technology-joint-venture-to-tackle-data-challenges-for-real-estate-investors-302310111.html

SOURCE JLL-IR

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Erik Ragatz Boosts Confidence With $2.01M Purchase Of Grocery Outlet Holding Stock

A significant insider buy by Erik Ragatz, Director at Grocery Outlet Holding GO, was executed on November 18, and reported in the recent SEC filing.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Monday showed that Ragatz purchased 110,000 shares of Grocery Outlet Holding. The total transaction amounted to $2,007,500.

At Tuesday morning, Grocery Outlet Holding shares are up by 4.42%, trading at $18.65.

All You Need to Know About Grocery Outlet Holding

Grocery Outlet Holding Corp is a grocery store operator in the United States. Its flexible buying model allows them to offer quality, name-brand opportunistic products at prices generally 40% to 70% below those of conventional retailers. The stores are run by Entrepreneurial independent operators which create a neighborhood feel through personalized customer service and a localized product offering.

Grocery Outlet Holding: Financial Performance Dissected

Positive Revenue Trend: Examining Grocery Outlet Holding’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 10.39% as of 30 September, 2024, showcasing a substantial increase in top-line earnings. When compared to others in the Consumer Staples sector, the company excelled with a growth rate higher than the average among peers.

Exploring Profitability:

-

Gross Margin: The company issues a cost efficiency warning with a low gross margin of 31.12%, indicating potential difficulties in maintaining profitability compared to its peers.

-

Earnings per Share (EPS): Grocery Outlet Holding’s EPS lags behind the industry average, indicating concerns and potential challenges with a current EPS of 0.25.

Debt Management: With a high debt-to-equity ratio of 1.29, Grocery Outlet Holding faces challenges in effectively managing its debt levels, indicating potential financial strain.

Financial Valuation Breakdown:

-

Price to Earnings (P/E) Ratio: Grocery Outlet Holding’s stock is currently priced at a premium level, as reflected in the higher-than-average P/E ratio of 35.02.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 0.42 is below industry norms, suggesting potential undervaluation and presenting an investment opportunity for those considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio 16.53 is above the industry average, suggesting that the market values the company more highly for each unit of EBITDA. This could be attributed to factors such as strong growth prospects or superior operational efficiency.

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Impact of Insider Transactions on Investments

Insider transactions, although significant, should be considered within the larger context of market analysis and trends.

In the context of legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as outlined by Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are obligated to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Despite insider sells not always signaling a bearish sentiment, they can be driven by various factors.

Understanding Crucial Transaction Codes

Surveying the realm of stock transactions, investors often give prominence to those unfolding in the open market, systematically detailed in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Grocery Outlet Holding’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Confidence On Display: CARL ICAHN Acquires $1.01M In CVR Partners Stock

It was revealed in a recent SEC filing that CARL ICAHN, 10% Owner at CVR Partners UAN made a noteworthy insider purchase on November 18,.

What Happened: In a Form 4 filing on Monday with the U.S. Securities and Exchange Commission, it was disclosed that ICAHN bought 13,971 shares of CVR Partners, amounting to a total of $1,010,026.

CVR Partners shares are trading down 0.31% at $71.47 at the time of this writing on Tuesday morning.

About CVR Partners

CVR Partners LP is a manufacturer and supplier of nitrogen fertilizer products. Its principal products include Urea Ammonium Nitrate (UAN) and ammonia. The company market ammonia products to industrial and agricultural customers and UAN products to agricultural customers. The primary geographic markets for its fertilizer products are Kansas, Missouri, Nebraska, Iowa, Illinois, Colorado, and Texas. The company’s product sales are heavily weighted toward UAN.

Key Indicators: CVR Partners’s Financial Health

Decline in Revenue: Over the 3 months period, CVR Partners faced challenges, resulting in a decline of approximately -4.13% in revenue growth as of 30 September, 2024. This signifies a reduction in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Materials sector.

Key Profitability Indicators:

-

Gross Margin: The company issues a cost efficiency warning with a low gross margin of 14.73%, indicating potential difficulties in maintaining profitability compared to its peers.

-

Earnings per Share (EPS): CVR Partners’s EPS is significantly higher than the industry average. The company demonstrates a robust bottom-line performance with a current EPS of 0.36.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 1.92, caution is advised due to increased financial risk.

Valuation Metrics: A Closer Look

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 14.42 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 1.44 is below industry norms, suggesting potential undervaluation and presenting an investment opportunity for those considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With a lower-than-industry-average EV/EBITDA ratio of 7.18, CVR Partners presents a potential value opportunity, as investors are paying less for each unit of EBITDA.

Market Capitalization: Indicating a reduced size compared to industry averages, the company’s market capitalization poses unique challenges.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Importance of Insider Transactions

In the complex landscape of investment decisions, investors should approach insider transactions as part of a comprehensive analysis, considering various elements.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Exploring Key Transaction Codes

In the domain of transactions, investors frequently turn their focus to those taking place in the open market, as meticulously outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of CVR Partners’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.