Sonor Investments Limited Reports Third Quarter Financial Results

TORONTO, Nov. 19, 2024 (GLOBE NEWSWIRE) — Sonor Investments Limited today reported its financial results for the nine months ended September 30, 2024.

| 9 months ended September 30 | 3 months ended September 30 | ||||||||||||||

| 2024 $000 |

2023 $000 |

2024 $000 |

2023 $000 |

||||||||||||

| Revenue | 2,039 | 809 | 1,370 | (149 | ) | ||||||||||

| Income (loss) before taxes | 1,558 | 365 | 1,236 | (335 | ) | ||||||||||

Michael Gardiner, Chair and CEO, stated that as at September 30, 2024, the Company’s assets totaled $63.8 million. These assets included $15.8 million of marketable securities, $35.6 million in private investment and $12.4 million of cash, cash equivalents and short-term investments.

During the nine months ended September 30, 2024, the Company realized $260,000 of net capital gains on the sale of investments. In the comparable period for 2023, the Company realized a net capital loss of $26,000 on the sale of investments. During the three month period ended September 30, 2024, the Company realized $7,000 of net capital gains on sale of investments. During the three month period ended September 30, 2023, the Company realized $16,000 of net capital loss on the sale of investments.

During the period under review, the Company has maintained net assets and qualified investments in excess of the amounts prescribed under the share conditions pertaining to the First Preference Shares in its capital stock.

Sonor Investments Limited is an investment company located in Toronto, Canada. The First Preference Shares of Sonor trade on The TSX Venture Exchange under the symbol SNI.PR.A.

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

Company Contacts:

| Mr. Michael Gardiner Chair and CEO (416) 369-1499 |

Ms. Fanny Grenier Treasurer and CFO (416) 369-1499 |

|

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What's Going On With Marvell Technology (MRVL) Stock?

As NVIDIA Corp prepares to unveil its earnings Wednesday evening, the results could have significant consequences for Marvell Technology Inc MRVL, a key player in the semiconductor space with a growing focus on AI infrastructure.

Nvidia’s earnings are a bellwether for the AI-driven technology trade, and Marvell’s exposure to similar market trends makes its stock particularly sensitive to Nvidia’s performance. Marvell meanwhile reports third-quarter financial results Tuesday, December 3rd.

What To Know: Marvell has positioned itself as a vital supplier of semiconductor solutions tailored to data centers, 5G infrastructure and AI applications. These areas overlap significantly with Nvidia’s core markets, particularly in powering the next generation of AI workloads.

A strong earnings report from Nvidia could reaffirm optimism around AI infrastructure investments, potentially boosting demand expectations for Marvell’s high-speed networking and storage products.

Conversely, if Nvidia’s results or guidance fall short of lofty expectations, it may signal a broader slowdown in AI-related spending, putting pressure on Marvell’s growth story. Investors may scrutinize Nvidia’s commentary on supply-chain dynamics and demand trends for insights into potential ripple effects on Marvell’s upcoming earnings.

Marvell’s stock has already been volatile this year, reflecting fluctuating investor sentiment on the AI boom. With Nvidia options pricing in a massive 12.5% one-day move, market expectations are high, and Marvell could see collateral volatility as investors reassess AI’s near-term trajectory.

Investors can gain exposure to MRVL by investing in the VanEck Semiconductor ETF SMH and the Invesco QQQ Trust, Series 1 QQQ.

How To Buy MRVL Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Marvell Tech’s case, it is in the Information Technology sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

According to data from Benzinga Pro, MRVL has a 52-week high of $95.09 and a 52-week low of $50.35.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

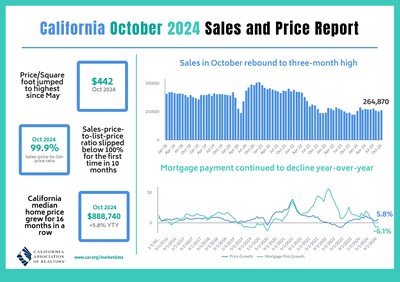

California housing market bounces back in October as both home sales and median price post increases from previous month and year, C.A.R. reports

- Existing, single-family home sales totaled 264,870 in October on a seasonally adjusted annualized rate, up 4.7 percent from 253,010 in September and up 9.5 percent from 241,910 in October 2023.

- October’s statewide median home price was $888,740, up 2.4 percent from September and up 5.8 percent from $839,990 in October 2023.

- Year-to-date statewide home sales edged up 1.7 percent.

LOS ANGELES, Nov. 19, 2024 /PRNewswire/ — California home sales rebounded in October, reversing two straight months of sales declines and registering the fastest year-over-year sales pace in 40 months, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.

Infographic: https://www.car.org/Global/Infographics/2024-10-Sales-and-Price

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 264,870 in October, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2024 if sales maintained the October pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

October’s sales pace climbed 4.7 percent from the 253,010 homes sold in September and was up 9.5 percent from a year ago, when a revised 241,910 homes were sold on an annualized basis. The year-over-year sales pace reached its highest level in 40 months, partly because of a low sales base in 2023, when sales dropped nearly 12 percent compared to the previous year.

“Rising rates in the past few weeks have created a less favorable lending environment for the housing market, but many of the homes that went pending in August and September finally closed,” said 2025 C.A.R. President Heather Ozur, a Palm Springs REALTOR®. “While market conditions are improving at a slower-than-expected pace, October’s bounce back in home sales suggests that there’s still solid interest from motivated buyers.”

The statewide median price climbed in October from both the previous month and year. The October median price rose 2.4 percent from $868,150 in September to $888,740 in October and 5.8 percent from a revised $839,990 in October 2023. The September-to-October price gain was the largest in 45 years, while the year-over-year price gain was the biggest pace recorded in the past three months, marking the 16th consecutive month of annual price increases. Home prices could soften further in the coming months as the market enters the traditional off-season but should continue to register year-over-year growth for the remainder of the year.

Sales in higher-priced market segments continued to have an effect on the mix of sales, but the impact on the statewide median price growth has tapered in recent months. While the sales pace for the $1 million-and-higher price segment remained moderately low in October at 3.9 percent, sales in the sub-$500,000 market continued to underperform, dropping 8.6 percent from a year ago. Moderation in the median price growth could be observed in the coming months if the share of homes priced at or above $1 million continues to shrink in the fall.

“With the elections behind us and the Federal Reserve cutting rates again earlier this month, some buyers will take advantage of the seasonal lull and purchase before the end of the year,” said C.A.R. Senior Vice President and Chief Economist Jordan Levine. “However, rates are also expected to decline only gradually, creating headwinds for consumers. Fortunately, pending sales rose by double digits in October, which bodes well for closed sales next month.”

Other key points from C.A.R.’s October 2024 resale housing report include:

- At the regional level, home sales in all major regions, except one, bettered their year-ago levels in October. Four out of five regions in the state experienced an annual increase, with the San Francisco Bay Area (16.2 percent) increasing the most, followed by the Central Valley (13.7 percent), Central Coast (13.0 percent) and Southern California (11.9 percent). The only region where sales fell behind last year’s level was the Far North (-6.7 percent).

- Thirty-eight of the 53 counties tracked by C.A.R. experienced an increase in sales from a year ago, with sales in 30 counties jumping more than 10 percent year over year. Del Norte (80.0 percent) posted the largest yearly sales gain, followed by Madera (41.2 percent) and Mendocino (35.9 percent). Twelve counties registered sales decreases, with sales in nine counties falling more than 10 percent, five counties dropping more than 20 percent and three counties dropping more than 30 percent. Trinity (-66.7 percent) posted the biggest annual sales decline, followed by Lassen (-45.5 percent) and Kings (-38.6 percent).

- All major regions except one increased recorded median price gains from a year ago in October. The Central Valley registered the biggest jump on a year-over-year basis, increasing 5.7 percent from a year ago. Southern California (5.5 percent) was a close second, followed by the Far North (3.7 percent) and the San Francisco Bay Area (3.6 percent). The only region with an annual price decline in October was the Central Coast, with a 5.7 percent drop. The price drop in that region was due primarily to lower median prices in Monterey and Santa Barbara counties, which likely resulted from a change in the mix of sales.

- Home prices continued to grow on a year-over-year basis throughout the state, with median sales prices in 33 counties rising from a year ago in October. Del Norte (29.9 percent) recorded the biggest price increase, followed by Mendocino (20.0 percent) and Lassen (14.1 percent). Nineteen counties experienced a median price decline from last year, with Trinity dropping the most at 35.9 percent, followed by Santa Barbara (-23.5 percent) and Monterey (-18.1 percent).

- The statewide Unsold Inventory Index (UII), which measures the number of months needed to sell the supply of homes on the market at the current sales rate, decreased month-over-month but increased from a year ago. The index was 3.1 months in October, down from 3.6 months in September but up from 2.7 months in October 2023. Total active listings at the state level rose 31.5 percent on a year-over-year basis, the slowest growth rate since April of this year. Nevertheless, it was the ninth consecutive annual sales gain and the eighth straight double-digit increase. With the market entering the holiday season and home sales likely to be negatively impacted in the next couple months by the surge in mortgage rates in recent weeks, housing inventory could continue building up as we move further into the fall and winter.

- At the county level, the number of properties on the market increased from a year ago in all but four counties in October. Calaveras (76.8 percent) had the biggest year-over-year jump in supply, followed by Contra Costa (63.7 percent) and San Joaquin (54.3 percent). Of the four counties that did not record an increase in total active listings on a year-over-year basis, San Benito was the only county that remained unchanged. Housing inventory dipped from a year ago in the remaining three counties, with San Francisco (-18.4 percent) dropping the most, followed by San Mateo (-12.2 percent) and Madera (-3.5 percent).

- New active listings at the state level improved from a year ago for the 10th straight month in October. The pace of new listings was not only the highest since July of this year, but it was the ninth time in the last 10 months that new listings increased by double-digits. Consistent growth in active listings continues to be an encouraging sign for the supply side. Forty-two of the 52 counties tracked by C.A.R. experienced an annual increase in new active listings. Sutter increased the most on a year-over-year basis with a 57.8 percent increase, followed closely by Yuba (57.6 percent) and Calaveras (54.2 percent). Two counties were unchanged, and eight counties saw a decline in new active listings from a year ago. Trinity (-28.6 percent) had the biggest drop, followed by Plumas (-21.4 percent) and Lassen (-13.0 percent).

- The median number of days it took to sell a California single-family home was 25 days in October, up from 20 days in October 2023.

- C.A.R.’s statewide sales-price-to-list-price ratio* was 99.9 percent in October 2024 and 100.0 percent in October 2023.

- The statewide median price per square foot** for an existing single-family home was $442, up from $419 in October a year ago.

- The 30-year, fixed-mortgage interest rate averaged 6.43 percent in October, down from 7.62 percent in October 2023, according to C.A.R.’s calculations based on Freddie Mac’s weekly mortgage survey data.

Note: The County MLS median price and sales data in the tables are generated from a survey of more than 90 associations of REALTORS® throughout the state and represent statistics of existing single-family detached homes only. County sales data is not adjusted to account for seasonal factors that can influence home sales. Movements in sales prices should not be interpreted as changes in the cost of a standard home. The median price is where half sold for more and half sold for less; medians are more typical than average prices, which are skewed by a relatively small share of transactions at either the lower end or the upper end. Median prices can be influenced by changes in cost, as well as changes in the characteristics and the size of homes sold. The change in median prices should not be construed as actual price changes in specific homes.

*Sales-to-list-price ratio is an indicator that reflects the negotiation power of home buyers and home sellers under current market conditions. The ratio is calculated by dividing the final sales price of a property by its original list price and is expressed as a percentage. A sales-to-list ratio with 100 percent or above suggests that the property sold for more than the list price, and a ratio below 100 percent indicates that the price sold below the asking price.

**Price per square foot is a measure commonly used by real estate agents and brokers to determine how much a square foot of space a buyer will pay for a property. It is calculated as the sale price of the home divided by the number of finished square feet. C.A.R. currently tracks price-per-square foot statistics for 53 counties.

Leading the way…® in California real estate for nearly 120 years, the CALIFORNIA ASSOCIATION OF REALTORS® (www.car.org) is one of the largest state trade organizations in the United States with more than 200,000 members dedicated to the advancement of professionalism in real estate. C.A.R. is headquartered in Los Angeles.

October 2024 County Sales and Price Activity

(Regional and condo sales data not seasonally adjusted)

|

October 2024 |

Median Sold Price of Existing Single-Family Homes |

Sales |

|||||||

|

State/Region/County |

Oct. 2024 |

Sept. 2024 |

Oct. 2023 |

Price MTM% Chg |

Price YTY% Chg |

Sales MTM% Chg |

Sales YTY% Chg |

||

|

Calif. Single-family home |

$888,740 |

$868,150 |

$839,990 |

r |

2.4 % |

5.8 % |

4.7 % |

9.5 % |

|

|

Calif. Condo/Townhome |

$670,000 |

$660,000 |

$660,000 |

1.5 % |

1.5 % |

11.9 % |

13.8 % |

||

|

Los Angeles Metro Area |

$835,720 |

$810,000 |

$785,000 |

3.2 % |

6.5 % |

15.3 % |

11.4 % |

||

|

Central Coast |

$990,000 |

$993,250 |

$1,050,000 |

-0.3 % |

-5.7 % |

15.2 % |

13.0 % |

||

|

Central Valley |

$500,000 |

$500,000 |

$473,000 |

0.0 % |

5.7 % |

11.1 % |

13.7 % |

||

|

Far North |

$390,000 |

$379,500 |

$376,000 |

2.8 % |

3.7 % |

-3.0 % |

-6.7 % |

||

|

Inland Empire |

$599,000 |

$579,990 |

$561,410 |

3.3 % |

6.7 % |

7.1 % |

8.1 % |

||

|

San Francisco Bay Area |

$1,315,000 |

$1,266,250 |

$1,268,940 |

3.8 % |

3.6 % |

20.3 % |

16.2 % |

||

|

Southern California |

$865,000 |

$850,000 |

$820,000 |

1.8 % |

5.5 % |

14.2 % |

11.9 % |

||

|

San Francisco Bay Area |

|||||||||

|

Alameda |

$1,266,000 |

$1,267,500 |

$1,240,000 |

-0.1 % |

2.1 % |

22.3 % |

23.1 % |

||

|

Contra Costa |

$869,500 |

$863,750 |

$824,950 |

0.7 % |

5.4 % |

20.8 % |

10.8 % |

||

|

Marin |

$1,700,000 |

$1,750,000 |

$1,712,500 |

-2.9 % |

-0.7 % |

45.8 % |

25.7 % |

||

|

Napa |

$910,000 |

$882,500 |

$1,027,500 |

3.1 % |

-11.4 % |

1.4 % |

-13.4 % |

||

|

San Francisco |

$1,750,000 |

$1,625,000 |

$1,650,000 |

7.7 % |

6.1 % |

64.9 % |

23.2 % |

||

|

San Mateo |

$2,000,000 |

$2,100,000 |

$2,100,000 |

-4.8 % |

-4.8 % |

6.7 % |

15.6 % |

||

|

Santa Clara |

$1,990,000 |

$1,927,500 |

$1,805,000 |

3.2 % |

10.2 % |

21.2 % |

15.6 % |

||

|

Solano |

$603,000 |

$611,000 |

$620,000 |

-1.3 % |

-2.7 % |

1.4 % |

10.2 % |

||

|

Sonoma |

$826,710 |

$830,000 |

$857,500 |

-0.4 % |

-3.6 % |

16.6 % |

18.9 % |

||

|

Southern California |

|||||||||

|

Imperial |

$389,990 |

$397,500 |

$380,000 |

-1.9 % |

2.6 % |

-5.8 % |

6.5 % |

||

|

Los Angeles |

$956,210 |

$960,370 |

$893,650 |

r |

-0.4 % |

7.0 % |

23.1 % |

10.9 % |

|

|

Orange |

$1,350,000 |

$1,397,450 |

$1,275,000 |

-3.4 % |

5.9 % |

12.3 % |

14.8 % |

||

|

Riverside |

$635,000 |

$605,000 |

r |

$610,000 |

r |

5.0 % |

4.1 % |

8.2 % |

10.4 % |

|

San Bernardino |

$499,000 |

$485,000 |

r |

$475,000 |

r |

2.9 % |

5.1 % |

5.3 % |

0.8 % |

|

San Diego |

$1,010,000 |

$1,000,000 |

$936,250 |

1.0 % |

7.9 % |

10.5 % |

14.3 % |

||

|

Ventura |

$940,000 |

$900,000 |

$899,000 |

4.4 % |

4.6 % |

20.4 % |

25.1 % |

||

|

Central Coast |

|||||||||

|

Monterey |

$919,840 |

$1,000,000 |

$1,122,500 |

-8.0 % |

-18.1 % |

-5.3 % |

-1.4 % |

||

|

San Luis Obispo |

$943,000 |

$895,000 |

$887,620 |

5.4 % |

6.2 % |

21.3 % |

24.1 % |

||

|

Santa Barbara |

$1,047,500 |

$1,098,000 |

$1,370,000 |

-4.6 % |

-23.5 % |

12.3 % |

8.1 % |

||

|

Santa Cruz |

$1,325,000 |

$1,300,000 |

$1,229,000 |

1.9 % |

7.8 % |

41.1 % |

21.8 % |

||

|

Central Valley |

|||||||||

|

Fresno |

$410,500 |

$430,000 |

$410,000 |

-4.5 % |

0.1 % |

1.3 % |

5.5 % |

||

|

Glenn |

$353,500 |

$348,000 |

$363,000 |

1.6 % |

-2.6 % |

55.6 % |

0.0 % |

||

|

Kern |

$399,500 |

$400,500 |

$395,000 |

-0.2 % |

1.1 % |

13.8 % |

-1.9 % |

||

|

Kings |

$340,000 |

$379,000 |

$360,000 |

-10.3 % |

-5.6 % |

-23.9 % |

-38.6 % |

||

|

Madera |

$438,000 |

$424,120 |

$435,000 |

3.3 % |

0.7 % |

5.4 % |

41.2 % |

||

|

Merced |

$412,000 |

$399,500 |

$392,750 |

3.1 % |

4.9 % |

19.7 % |

3.9 % |

||

|

Placer |

$649,200 |

$660,000 |

$685,000 |

-1.6 % |

-5.2 % |

24.1 % |

27.6 % |

||

|

Sacramento |

$550,000 |

$560,000 |

$550,000 |

-1.8 % |

0.0 % |

11.4 % |

21.5 % |

||

|

San Benito |

$820,000 |

$856,130 |

$780,000 |

-4.2 % |

5.1 % |

-17.4 % |

22.6 % |

||

|

San Joaquin |

$553,950 |

$583,550 |

$550,000 |

-5.1 % |

0.7 % |

18.1 % |

13.0 % |

||

|

Stanislaus |

$485,000 |

$480,000 |

$460,000 |

1.0 % |

5.4 % |

10.7 % |

11.9 % |

||

|

Tulare |

$391,750 |

$376,070 |

$358,500 |

4.2 % |

9.3 % |

12.2 % |

24.1 % |

||

|

Far North |

|||||||||

|

Butte |

$464,000 |

$465,580 |

$421,400 |

-0.3 % |

10.1 % |

7.6 % |

0.0 % |

||

|

Lassen |

$282,500 |

$265,000 |

$247,500 |

6.6 % |

14.1 % |

-52.0 % |

-45.5 % |

||

|

Plumas |

$377,500 |

$455,000 |

$385,250 |

-17.0 % |

-2.0 % |

-18.9 % |

-28.6 % |

||

|

Shasta |

$379,000 |

$374,500 |

$389,500 |

1.2 % |

-2.7 % |

1.7 % |

5.4 % |

||

|

Siskiyou |

$301,250 |

$290,000 |

$295,000 |

3.9 % |

2.1 % |

14.3 % |

-11.1 % |

||

|

Tehama |

$345,000 |

$320,000 |

$370,000 |

7.8 % |

-6.8 % |

-13.8 % |

19.0 % |

||

|

Trinity |

$205,000 |

$247,500 |

$320,000 |

-17.2 % |

-35.9 % |

-30.0 % |

-66.7 % |

||

|

Other Calif. Counties |

|||||||||

|

Amador |

$440,000 |

$432,500 |

$410,000 |

1.7 % |

7.3 % |

16.7 % |

-7.5 % |

||

|

Calaveras |

$434,500 |

$522,000 |

$405,500 |

-16.8 % |

7.2 % |

52.0 % |

26.7 % |

||

|

Del Norte |

$399,500 |

$370,000 |

$307,500 |

8.0 % |

29.9 % |

-5.3 % |

80.0 % |

||

|

El Dorado |

$664,000 |

$689,000 |

$660,000 |

-3.6 % |

0.6 % |

22.2 % |

24.9 % |

||

|

Humboldt |

$435,000 |

$425,000 |

$432,500 |

2.4 % |

0.6 % |

-8.2 % |

3.5 % |

||

|

Lake |

$340,000 |

$335,000 |

$365,000 |

1.5 % |

-6.8 % |

17.0 % |

-12.7 % |

||

|

Mariposa |

$465,000 |

$322,500 |

$485,000 |

44.2 % |

-4.1 % |

25.0 % |

15.4 % |

||

|

Mendocino |

$516,000 |

$525,000 |

$430,000 |

-1.7 % |

20.0 % |

23.3 % |

35.9 % |

||

|

Mono |

$970,000 |

$815,000 |

$1,050,000 |

19.0 % |

-7.6 % |

22.2 % |

-15.4 % |

||

|

Nevada |

$527,500 |

$570,000 |

$538,000 |

-7.5 % |

-2.0 % |

16.5 % |

14.0 % |

||

|

Sutter |

$439,000 |

$451,500 |

$425,750 |

-2.8 % |

3.1 % |

-6.3 % |

7.1 % |

||

|

Tuolumne |

$425,000 |

$357,500 |

$410,000 |

18.9 % |

3.7 % |

-4.7 % |

-20.8 % |

||

|

Yolo |

$612,500 |

$610,000 |

$629,900 |

0.4 % |

-2.8 % |

0.0 % |

11.6 % |

||

|

Yuba |

$435,620 |

$440,000 |

$424,900 |

-1.0 % |

2.5 % |

4.5 % |

0.0 % |

||

|

r = revised |

|||||||||

October 2024 County Unsold Inventory and Days on Market

(Regional and condo sales data not seasonally adjusted)

|

October 2024 |

Unsold Inventory Index |

Median Time on Market |

||||||||

|

State/Region/County |

Oct. 2024 |

Sept. 2024 |

Oct. 2023 |

Oct. 2024 |

Sept. 2024 |

Oct. 2023 |

||||

|

Calif. Single-family home |

3.1 |

3.6 |

2.7 |

25.0 |

24.0 |

20.0 |

||||

|

Calif. Condo/Townhome |

3.5 |

4.0 |

2.8 |

28.0 |

26.0 |

20.0 |

||||

|

Los Angeles Metro Area |

3.4 |

3.7 |

2.9 |

28.0 |

26.0 |

23.0 |

||||

|

Central Coast |

3.2 |

3.9 |

2.9 |

22.0 |

21.0 |

15.0 |

||||

|

Central Valley |

3.1 |

3.4 |

2.8 |

24.0 |

22.0 |

17.0 |

||||

|

Far North |

5.0 |

4.9 |

4.0 |

28.0 |

38.5 |

38.0 |

||||

|

Inland Empire |

4.1 |

4.2 |

3.5 |

33.0 |

31.0 |

26.0 |

||||

|

San Francisco Bay Area |

2.1 |

2.8 |

2.0 |

18.0 |

20.0 |

16.0 |

||||

|

Southern California |

3.3 |

3.6 |

2.8 |

27.0 |

24.0 |

21.0 |

||||

|

San Francisco Bay Area |

||||||||||

|

Alameda |

1.9 |

2.7 |

1.6 |

14.0 |

14.0 |

13.0 |

||||

|

Contra Costa |

2.1 |

2.9 |

1.5 |

15.0 |

19.0 |

14.0 |

||||

|

Marin |

2.0 |

3.6 |

2.2 |

53.0 |

46.0 |

43.5 |

||||

|

Napa |

6.0 |

6.4 |

4.0 |

72.0 |

71.5 |

50.0 |

||||

|

San Francisco |

1.7 |

3.3 |

2.5 |

36.0 |

29.5 |

36.5 |

||||

|

San Mateo |

1.8 |

2.2 |

2.3 |

12.0 |

12.0 |

12.0 |

||||

|

Santa Clara |

1.5 |

2.1 |

1.5 |

9.0 |

10.0 |

8.0 |

||||

|

Solano |

2.9 |

3.0 |

2.5 |

45.0 |

45.5 |

41.0 |

||||

|

Sonoma |

2.8 |

3.7 |

2.9 |

59.0 |

58.0 |

59.0 |

||||

|

Southern California |

||||||||||

|

Imperial |

2.1 |

1.9 |

NA |

15.0 |

16.0 |

15.5 |

||||

|

Los Angeles |

3.3 |

3.6 |

2.8 |

25.0 |

24.0 |

21.0 |

||||

|

Orange |

2.6 |

3.1 |

2.3 |

27.0 |

22.0 |

21.5 |

||||

|

Riverside |

4.1 |

4.1 |

3.5 |

34.0 |

33.0 |

27.5 |

||||

|

San Bernardino |

4.4 |

4.6 |

3.6 |

33.0 |

29.0 |

24.0 |

||||

|

San Diego |

2.8 |

3.2 |

2.3 |

20.0 |

18.0 |

14.0 |

||||

|

Ventura |

2.6 |

3.4 |

2.6 |

33.0 |

35.0 |

32.0 |

||||

|

Central Coast |

||||||||||

|

Monterey |

4.0 |

3.9 |

2.8 |

19.0 |

17.5 |

14.5 |

||||

|

San Luis Obispo |

3.0 |

3.8 |

3.0 |

24.0 |

23.5 |

17.5 |

||||

|

Santa Barbara |

3.1 |

3.7 |

2.7 |

22.0 |

23.0 |

16.0 |

||||

|

Santa Cruz |

3.1 |

4.7 |

3.0 |

19.5 |

21.0 |

13.5 |

||||

|

Central Valley |

||||||||||

|

Fresno |

3.6 |

3.4 |

3.1 |

19.0 |

21.0 |

14.0 |

||||

|

Glenn |

3.6 |

5.2 |

3.4 |

15.0 |

84.0 |

75.0 |

||||

|

Kern |

3.1 |

3.5 |

2.3 |

23.0 |

20.0 |

13.0 |

||||

|

Kings |

3.4 |

2.2 |

1.9 |

24.0 |

28.0 |

12.0 |

||||

|

Madera |

4.7 |

4.7 |

6.6 |

38.0 |

33.0 |

30.5 |

||||

|

Merced |

3.4 |

4.3 |

2.7 |

19.0 |

22.5 |

17.0 |

||||

|

Placer |

3.0 |

3.8 |

2.8 |

29.0 |

28.0 |

25.0 |

||||

|

Sacramento |

2.5 |

2.8 |

2.2 |

23.0 |

20.0 |

16.0 |

||||

|

San Benito |

3.6 |

3.1 |

4.5 |

32.0 |

36.0 |

23.0 |

||||

|

San Joaquin |

3.4 |

3.8 |

2.6 |

25.0 |

22.0 |

18.0 |

||||

|

Stanislaus |

2.9 |

3.3 |

2.5 |

27.0 |

25.0 |

20.0 |

||||

|

Tulare |

3.2 |

3.7 |

3.7 |

20.0 |

18.0 |

15.0 |

||||

|

Far North |

||||||||||

|

Butte |

3.4 |

3.8 |

2.9 |

21.0 |

28.5 |

20.0 |

||||

|

Lassen |

8.6 |

4.6 |

5.0 |

54.5 |

55.0 |

46.5 |

||||

|

Plumas |

5.8 |

5.5 |

3.7 |

45.5 |

51.0 |

49.5 |

||||

|

Shasta |

4.6 |

4.6 |

4.1 |

27.0 |

24.5 |

37.5 |

||||

|

Siskiyou |

6.2 |

7.3 |

4.6 |

47.0 |

67.0 |

41.0 |

||||

|

Tehama |

5.9 |

5.1 |

6.3 |

42.0 |

84.0 |

58.0 |

||||

|

Trinity |

14.4 |

10.2 |

4.6 |

33.0 |

73.5 |

91.0 |

||||

|

Other Calif. Counties |

||||||||||

|

Amador |

5.4 |

6.9 |

4.7 |

44.0 |

41.5 |

33.0 |

||||

|

Calaveras |

5.1 |

8.0 |

3.9 |

59.0 |

39.0 |

17.0 |

||||

|

Del Norte |

5.2 |

6.3 |

8.7 |

58.5 |

58.0 |

13.0 |

||||

|

El Dorado |

4.1 |

5.5 |

4.1 |

41.5 |

41.5 |

33.0 |

||||

|

Humboldt |

6.4 |

6.1 |

5.6 |

39.0 |

43.0 |

28.5 |

||||

|

Lake |

7.9 |

9.8 |

6.4 |

39.0 |

42.0 |

36.0 |

||||

|

Mariposa |

7.9 |

10.5 |

7.9 |

41.0 |

67.0 |

80.0 |

||||

|

Mendocino |

6.6 |

9.0 |

8.4 |

77.0 |

77.0 |

66.0 |

||||

|

Mono |

2.5 |

3.8 |

2.0 |

40.0 |

18.0 |

36.0 |

||||

|

Nevada |

4.4 |

5.5 |

4.3 |

45.5 |

36.0 |

38.0 |

||||

|

Sutter |

4.0 |

3.6 |

2.9 |

29.0 |

24.5 |

29.5 |

||||

|

Tuolumne |

6.6 |

6.5 |

4.3 |

43.0 |

28.0 |

30.0 |

||||

|

Yolo |

2.9 |

3.0 |

2.5 |

19.0 |

23.0 |

18.0 |

||||

|

Yuba |

4.8 |

4.7 |

3.3 |

43.0 |

28.5 |

21.0 |

||||

|

r = revised |

||||||||||

|

NA = not available |

||||||||||

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/california-housing-market-bounces-back-in-october-as-both-home-sales-and-median-price-post-increases-from-previous-month-and-year-car-reports-302310286.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/california-housing-market-bounces-back-in-october-as-both-home-sales-and-median-price-post-increases-from-previous-month-and-year-car-reports-302310286.html

SOURCE CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.)

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stryker Recent Insider Activity

Spencer S Stiles, Group President at Stryker SYK, executed a substantial insider sell on November 18, according to an SEC filing.

What Happened: Stiles’s recent Form 4 filing with the U.S. Securities and Exchange Commission on Monday unveiled the sale of 514 shares of Stryker. The total transaction value is $201,056.

Stryker shares are trading up 0.07% at $389.67 at the time of this writing on Tuesday morning.

Delving into Stryker’s Background

Stryker designs, manufactures, and markets an array of medical equipment, instruments, consumable supplies, and implantable devices. The product portfolio includes hip and knee replacements, extremities, endoscopy systems, operating room equipment, embolic coils, hospital beds and gurneys, and orthopedic robotics. Stryker remains one of the three largest competitors in reconstructive orthopedic implants and holds the leadership position in operating room equipment. Just over one fourth of Stryker’s total revenue currently comes from outside the United States.

A Deep Dive into Stryker’s Financials

Revenue Growth: Over the 3 months period, Stryker showcased positive performance, achieving a revenue growth rate of 11.92% as of 30 September, 2024. This reflects a substantial increase in the company’s top-line earnings. When compared to others in the Health Care sector, the company excelled with a growth rate higher than the average among peers.

Profitability Metrics: Unlocking Value

-

Gross Margin: Achieving a high gross margin of 64.02%, the company performs well in terms of cost management and profitability within its sector.

-

Earnings per Share (EPS): Stryker’s EPS is significantly higher than the industry average. The company demonstrates a robust bottom-line performance with a current EPS of 2.18.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 0.77, caution is advised due to increased financial risk.

Navigating Market Valuation:

-

Price to Earnings (P/E) Ratio: The current P/E ratio of 41.74 is below industry norms, indicating potential undervaluation and presenting an investment opportunity.

-

Price to Sales (P/S) Ratio: A higher-than-average P/S ratio of 6.82 suggests overvaluation in the eyes of investors, considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Indicated by a lower-than-industry-average EV/EBITDA ratio of 29.39, the company suggests a potential undervaluation, which might be advantageous for value-focused investors.

Market Capitalization Analysis: The company’s market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Transactions Are Key in Investment Decisions

It’s important to note that insider transactions alone should not dictate investment decisions, but they can provide valuable insights.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

Deciphering Transaction Codes in Insider Filings

In the domain of transactions, investors frequently turn their focus to those taking place in the open market, as meticulously outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Stryker’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

AEO Unveils New Survey Data to Amplify the Voices of Underserved Entrepreneurs

Washington, D.C., Nov. 19, 2024 (GLOBE NEWSWIRE) — The Association for Enterprise Opportunity (AEO) is excited to announce the introduction of new microbusiness owner survey items in the 2024 Entrepreneurship in the Population (EPOP) Survey (EPOP:2024), one of the most important and systematic surveys of entrepreneurship that has been conducted since 2022 by NORC at the University of Chicago. In collaboration with NORC, AEO seeks to deepen our understanding of the experiences of underserved entrepreneurs across the U.S.

As part of AEO’s commitment to empowering the nation’s microbusinesses—those with fewer than 10 employees, which make up 96% of all U.S. businesses—AEO introduced new survey items in the EPOP:2024 Survey to explore critical areas such as access to business support services, financing needs beyond startup, and the adoption of cutting-edge technologies like generative AI. These additions aim to uncover the unique barriers and opportunities that microbusiness entrepreneurs face and identify the resources that could drive their success.

“While EPOP data includes insight into businesses of all sizes, small businesses are so critical to the health and growth of the U.S. economy. We were pleased to partner with AEO to capture a better understanding of microbusiness owners,” said Karen Gregorian, Vice President and Project Director at NORC.

By collaborating with NORC, AEO has enriched the data collected from over 2,000 microbusiness owners. This rich dataset will be instrumental in shaping policies and initiatives that promote a more inclusive entrepreneurial ecosystem. The EPOP Survey is a five-year project led by NORC and funded by the Ewing Marion Kauffman Foundation, designed to track and analyze business formation and ownership trends across the United States.

“Our mission is to illuminate the specific hurdles that underserved entrepreneurs encounter and transform that knowledge into tangible, impactful solutions,” said Natalie Madeira Cofield, CEO of AEO. “This survey is a powerful tool that will guide us in reshaping the support landscape, ensuring every entrepreneur has the resources they need to thrive.”

The EPOP:2024 public use data set with the microbusiness survey items is now available for download here. In the coming months, AEO will release new reports that draw from the survey to shed light on key findings and their implications for policymakers and the small business support ecosystem.

“This survey captures the evolving experiences of microbusiness in the U.S.,” added Dr. Lori Smith, Senior Research Advisor at AEO. “By delving deeper into how entrepreneurs are accessing support, contributing to their communities, and embracing new technologies, we can strategically address their most critical needs and drive meaningful change.”

About the Association for Enterprise Opportunity (AEO):

The Association for Enterprise Opportunity (AEO) is the leading voice of innovation in microbusiness and microfinance in the United States. AEO and its more than 1,700 member organizations are dedicated to empowering underserved entrepreneurs and enhancing economic opportunity for all. Since its founding, AEO has worked to create a robust ecosystem of support for micro-businesses, driving economic growth and equity across the nation. Click here for more information.

About NORC at the University of Chicago

NORC at the University of Chicago conducts research and analysis that decision-makers trust. As a nonpartisan research organization and a pioneer in measuring and understanding the world, we have studied almost every aspect of the human experience and every major news event for more than eight decades. Today, we partner with government, corporate, and nonprofit clients around the world to provide the objectivity and expertise necessary to inform the critical decisions facing society.

About EPOP:

Starting in 2022, NORC is conducting a five-year project to study business ownership in the population through the Entrepreneurship in the Population (EPOP) Survey Project. Funded by a grant from the Ewing Marion Kauffman Foundation, the EPOP Survey uses a nationally representative sample to measure current and former business ownership. In addition to providing a characteristic profile of the individuals involved in entrepreneurial activities across the U.S., the survey serves as a resource for understanding the motivations, actions, and challenges faced by individuals during the entrepreneurial process and the resources available to them.

AEO Communications Association for Enterprise Opportunity (AEO) 202.650.5580 communications@aeoworks.org

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

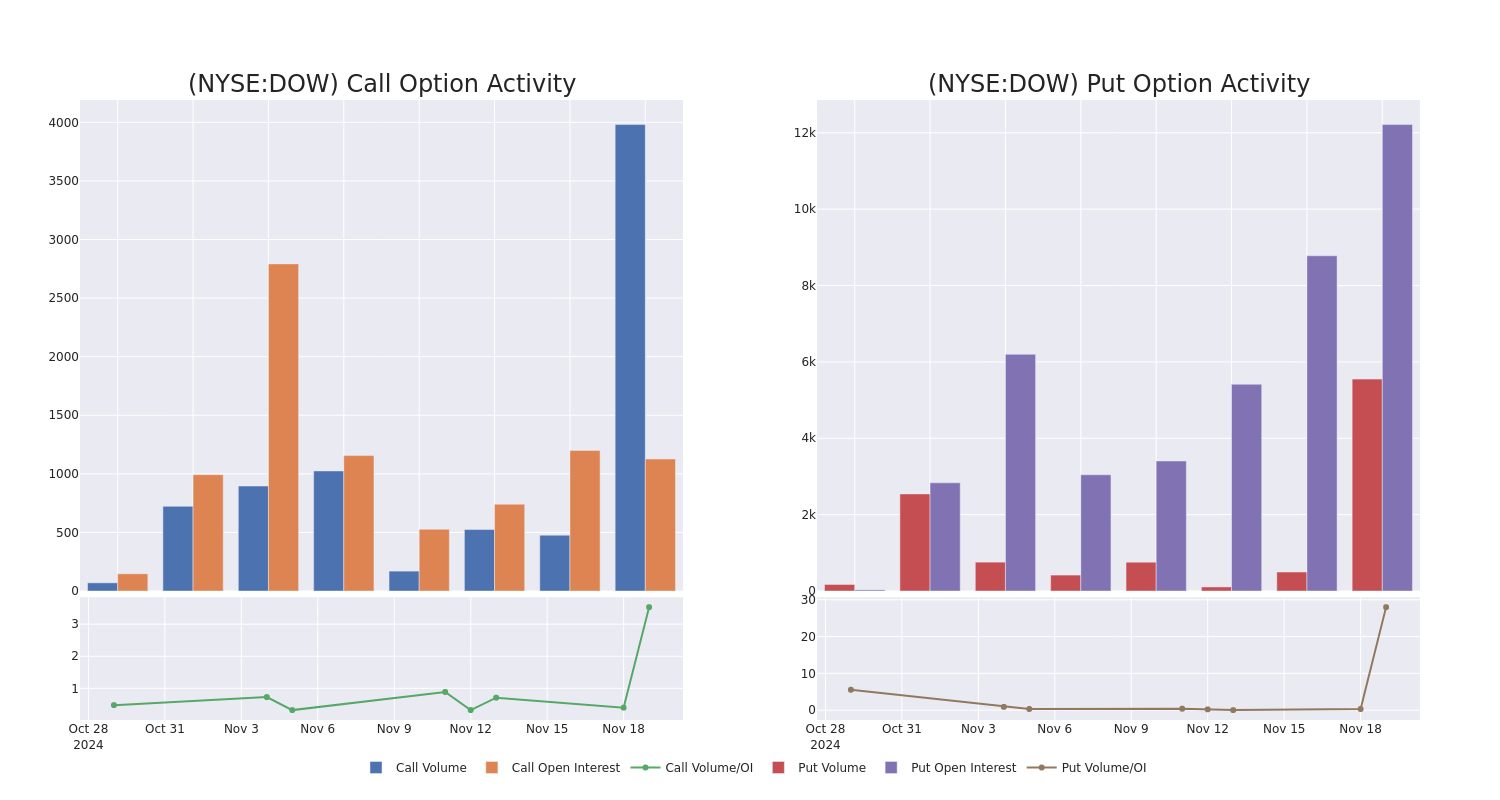

Dow's Options: A Look at What the Big Money is Thinking

Deep-pocketed investors have adopted a bearish approach towards Dow DOW, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in DOW usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 13 extraordinary options activities for Dow. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 30% leaning bullish and 38% bearish. Among these notable options, 5 are puts, totaling $1,267,514, and 8 are calls, amounting to $278,560.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $25.0 to $47.5 for Dow over the recent three months.

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Dow options trades today is 1667.75 with a total volume of 9,530.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Dow’s big money trades within a strike price range of $25.0 to $47.5 over the last 30 days.

Dow Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DOW | PUT | TRADE | BULLISH | 06/20/25 | $3.2 | $3.1 | $3.14 | $42.50 | $628.0K | 1.5K | 2.0K |

| DOW | PUT | SWEEP | BEARISH | 02/21/25 | $1.88 | $1.88 | $1.89 | $42.50 | $283.8K | 37 | 975 |

| DOW | PUT | SWEEP | BEARISH | 03/21/25 | $2.28 | $2.01 | $2.28 | $42.50 | $208.7K | 6.9K | 915 |

| DOW | PUT | TRADE | BULLISH | 03/21/25 | $2.29 | $2.25 | $2.25 | $42.50 | $92.0K | 6.9K | 1.4K |

| DOW | CALL | TRADE | BULLISH | 01/15/27 | $6.9 | $6.6 | $6.8 | $40.00 | $68.0K | 77 | 100 |

About Dow

Dow Chemical is a diversified global chemicals producer, formed in 2019 as a result of the DowDuPont merger and subsequent separations. The firm is a leading producer of several chemicals, including polyethylene, ethylene oxide, and silicone rubber. Its products have numerous applications in both consumer and industrial end markets.

In light of the recent options history for Dow, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Dow

- Trading volume stands at 1,898,002, with DOW’s price down by -1.29%, positioned at $43.65.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 72 days.

Professional Analyst Ratings for Dow

3 market experts have recently issued ratings for this stock, with a consensus target price of $58.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Piper Sandler has decided to maintain their Overweight rating on Dow, which currently sits at a price target of $60.

* Consistent in their evaluation, an analyst from BMO Capital keeps a Market Perform rating on Dow with a target price of $54.

* An analyst from Wells Fargo has decided to maintain their Overweight rating on Dow, which currently sits at a price target of $60.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Dow with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stock market today: Dow slides as S&P 500, Nasdaq bounce back from losses after Russia-Ukraine tensions rattle markets

US stocks recovered from steeper losses in late morning trading on Tuesday as fears over a nuclear escalation to the Russia-Ukraine war rattled markets, stealing focus from Nvidia (NVDA) earnings and other corporate results.

The Dow Jones Industrial Average (^DJI) led the declines, down about 0.5% but off of the lows of the session. The benchmark S&P 500 (^GSPC) battled to back to trade just above the flatline after the index fell below its election breakout level earlier in the trading day.

Meanwhile, the tech-heavy Nasdaq Composite (^IXIC) reversed declines to gain around 0.3% on the heels of a mixed day for the major gauges.

Investors are assessing news that President Vladimir Putin has signed a revised nuclear doctrine that allows Russia to expand its use of atomic weapons.

The changes mean a large-scale aerial attack could prompt a nuclear response, and any attack by a non-nuclear state that is supported by a nuclear power will be viewed as a joint assault. It comes just days after President Joe Biden gave Ukraine the go-ahead to use US long-range missiles to strike inside Russia. Ukraine carried out its first such aerial attack in a border region on Tuesday morning.

US bond prices climbed alongside gains for gold (GC=F), and other safe-haven assets as the risk-off trade kicked in. Treasury yields — which move inversely to bond prices — fell, with the 10-year benchmark yield (^TNX) down 4 basis points to around 4.37%. Gold jumped almost 1% to trade above $2,600 an ounce.

Bitcoin (BTC-USD) prices rose to trade above $92,400 a token.

The geopolitical situation blotted out themes such as corporate earnings, President-elect Trump’s cabinet picks, the path of interest rates, and Wall Street’s view of where stocks are headed.

Meanwhile, the countdown is on to Nvidia earnings on Wednesday, seen as a test of the AI trade that has powered gains on Wall Street. The chipmaker’s stock edged higher in premarket trading after getting bruised by a report of overheating issues with its flagship new AI product.

LIVE 9 updatesA Peek at Banco BBVA Argentina's Future Earnings

Banco BBVA Argentina BBAR is set to give its latest quarterly earnings report on Wednesday, 2024-11-20. Here’s what investors need to know before the announcement.

Analysts estimate that Banco BBVA Argentina will report an earnings per share (EPS) of $0.45.

The market awaits Banco BBVA Argentina’s announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It’s important for new investors to understand that guidance can be a significant driver of stock prices.

Here’s a look at Banco BBVA Argentina’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.25 | |||

| EPS Actual | 0.61 | 0.20 | 0.59 | 0.15 |

| Price Change % | -6.0% | -10.0% | 13.0% | -13.0% |

Banco BBVA Argentina Share Price Analysis

Shares of Banco BBVA Argentina were trading at $17.68 as of November 18. Over the last 52-week period, shares are up 295.42%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for Banco BBVA Argentina visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.