Nio’s Mass Market Push Draws Scorn as EV Maker Promises a Profit

(Bloomberg) -- It’s a wonder three little headlights can stir up such debate. But that’s what many netizens in China have been driven to comment on following the launch of Nio Inc.’s newest sub-brand, Firefly.

Most Read from Bloomberg

The electric hatchback was unveiled last weekend at Nio’s annual gathering for its customers, partners and media. The compact car will start from 148,800 yuan ($20,400) and features a rather plain design punctuated by three little round lights at the front and rear, which look more cutesy than chic.

Nio watchers were quick to point out the resemblance to the Honda e and its symmetrical ‘eye-like’ LED headlights, which most said look a lot better. Many derided the car, saying it undermines Nio’s premium eponymous brand and the automaker’s positioning of itself as a luxury marque. (Also over the weekend Nio showcased its most expensive car ever, the ET9, a four-seater sedan meant to take on Porsche’s Panamera series or Mercedes-Benz’s luxury S range.)

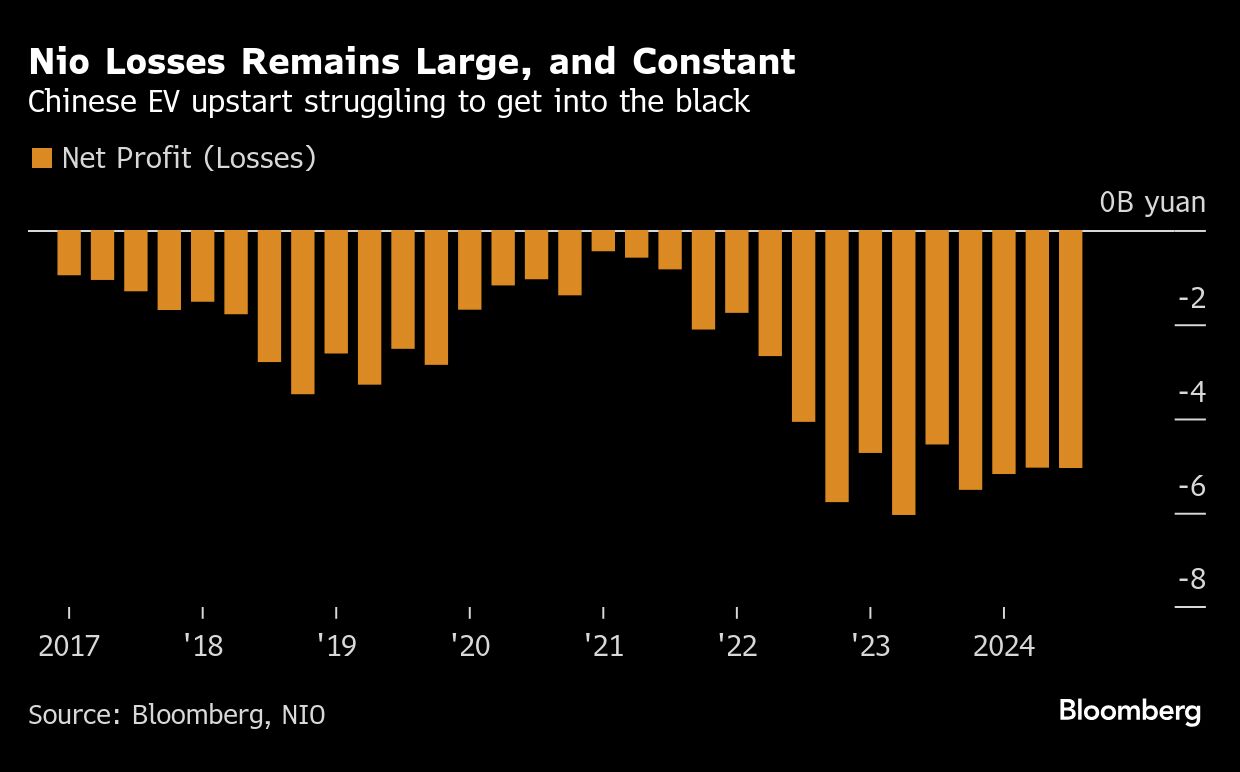

But for Nio, passing its 10-year anniversary and yet to turn a profit, heading down into the mass market to ramp up sales volumes may be the most sensible way forward.

Once regarded as one of China’s brightest electric vehicle stars, Nio has had several near-death experiences.

The first came in 2019 after heavy spending on marketing and splashy showrooms failed to generate demand for its ES8 and ES6 electric sport utility vehicles, and the municipal government of Hefei stepped in with a $1 billion rescue package.

Prospects improved in 2021, when Nio recorded some its highest-ever gross margins, but by 2023, Nio was struggling financially again. In July of that year, Abu Dhabi-backed fund CYVN Holdings invested $738.5 million and later acquired shares in Nio from an affiliate of Tencent for $350 million. In December 2023, CYVN committed to invest a further $2.2 billion in return for a 20.1% stake.

According to Nio CEO William Li, the automaker has fallen short of its own expectations for three consecutive years and is now at least two years behind schedule. At home, BYD is a much bigger threat than it was a decade ago while Nio’s overseas expansion plans have encountered a number of setbacks, including, in Europe, tariffs on Chinese EV imports and a slower-than-expected build out of its battery-swap stations.

External factors, including lithium price hikes and Covid lockdown disruptions, have added to the challenge.

Fronting a media scrum earlier this month in Shanghai, Li was peppered with more than 200 questions and was at pains to assure the public. “We survived five years since 2019, and now with a healthy operating cash flow, we can for sure survive longer than another five, don’t worry,” he said.

Breaking news

See all