📊 STOCKBURGER EXCLUSIVE ANALYSIS 📊

Professional insights for serious investors

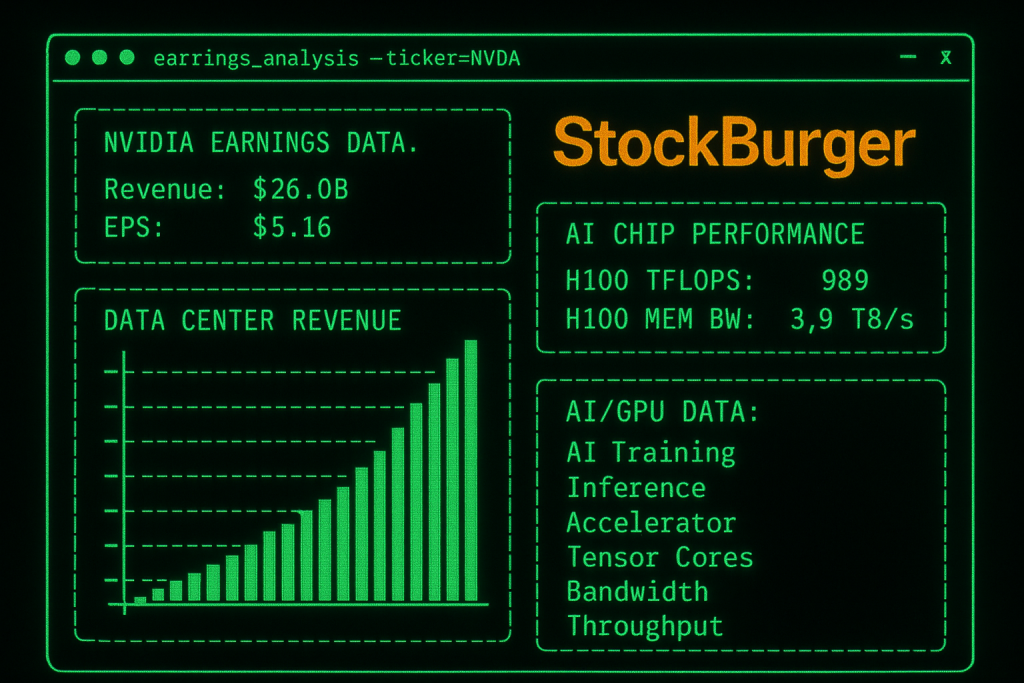

NVIDIA Corporation (Official Website | NASDAQ: NVDA) is set to report Q2 2026 earnings after market close today, with analysts expecting another record-breaking quarter driven by unprecedented AI chip demand. The semiconductor giant’s results could significantly impact the broader technology sector and market sentiment.

📈 Earnings Expectations

NVIDIA Q2 2026 EARNINGS PREVIEW =============================== Expected EPS: .01 vs bash.68 prior quarter Expected Revenue: 6.0B vs 2.1B prior quarter Data Center Revenue Est: 2.5B (+15% QoQ) Gaming Revenue Est: .8B (stable) Professional Viz: 50M (+5% QoQ) Automotive: 80M (+8% QoQ) KEY METRICS TO WATCH: - H100/H200 shipment volumes - Blackwell architecture timeline - AI inference vs training mix - Gross margin sustainability (75%+)

AI Revolution Driving Unprecedented Demand

NVIDIA Corporation (Official Website | NASDAQ: NVDA) [NVDA+1.2%](https://stockburger.news/stock-tickers/NVDA) continues to benefit from the global AI infrastructure buildout, with data center revenue expected to reach 2.5 billion, representing a 15% quarter-over-quarter increase.

Key Growth Drivers:

- Enterprise AI adoption accelerating across all sectors

- Cloud service providers expanding GPU capacity

- Sovereign AI initiatives driving government demand

- Next-generation Blackwell architecture pre-orders

🎯 Market Impact Analysis

StockBurger Research Team Analysis

NVIDIA’s earnings report represents the most significant market catalyst this week. A strong beat could propel the stock toward 50+ levels, while any guidance disappointment could trigger a broader tech selloff. The company’s commentary on AI demand sustainability will be crucial for sector sentiment.

🔍 Technical Analysis

NVDA TECHNICAL SETUP - PRE-EARNINGS =================================== Current Price: 28.45 Support Levels: 25.00, 20.00, 15.00 Resistance: 35.00, 42.50, 50.00 52-Week Range: 9.23 - 40.76 MOMENTUM INDICATORS: - RSI: 62.4 (bullish but not overbought) - MACD: Positive divergence forming - Volume: 15% above 20-day average - Options Flow: Heavy call buying at 30-40 strikes EARNINGS MOVE EXPECTATIONS: - Implied Volatility: 8.5% (±1 move expected) - Historical avg: 7.2% post-earnings move - Bullish scenario: Break above 35 → 50 target - Bearish scenario: Drop below 20 → 10 support

💰 Financial Metrics Deep Dive

Data Center Dominance

NVIDIA’s data center business has become the primary growth engine, with revenue expected to represent 85% of total sales. The segment’s gross margins remain exceptionally high at 75%+, driven by limited competition in high-performance AI chips.

Gaming Segment Stabilization

After several quarters of decline, the gaming segment appears to be stabilizing around .8 billion quarterly revenue. New RTX 4000 series adoption and upcoming RTX 5000 series launch should provide modest growth.

Emerging Opportunities

- Automotive: Self-driving technology partnerships expanding

- Professional Visualization: AI-enhanced creative workflows driving demand

- Edge AI: Jetson platform gaining traction in robotics

⚡ STOCKBURGER INVESTMENT RATING

Pre-Earnings Rating: STRONG BUY – AI infrastructure leader with sustainable competitive advantages

Price Target: 55 | Risk Level: Moderate (earnings volatility)

🚨 Key Risks to Monitor

⚠️ Risk Factors

- Geopolitical Tensions: China export restrictions could impact revenue

- Competition: AMD and Intel advancing AI chip capabilities

- Valuation Concerns: Trading at 65x forward earnings

- Cyclical Nature: Semiconductor industry historically volatile

- Supply Chain: TSMC dependency for advanced node production

📊 Analyst Sentiment

Wall Street (NASDAQ Analyst Research) remains overwhelmingly bullish on NVIDIA, with 35 of 38 analysts rating the stock a Buy or Strong Buy. Average price target stands at 48, implying 15% upside from current levels.

ANALYST CONSENSUS - AUGUST 2025 =============================== Strong Buy: 28 analysts (74%) Buy: 7 analysts (18%) Hold: 3 analysts (8%) Sell: 0 analysts (0%) Price Target Range: 35 - 65 Average Target: 48.50 Upside Potential: +15.6% TOP BULL CASES: - Morgan Stanley: 65 (AI infrastructure cycle) - Goldman Sachs: 60 (market share expansion) - JPMorgan: 55 (margin sustainability)

🎯 Trading Strategy

For Earnings Play:

- Conservative: Wait for post-earnings dip to add positions

- Aggressive: Buy calls with 35-40 strikes expiring in 2-3 weeks

- Long-term: Accumulate shares on any weakness below 25

Post-Earnings Scenarios:

📈 Bull Case (70% probability)

Triggers: Revenue beat, strong guidance, Blackwell update

Target: 45-55 within 2 weeks

Strategy: Hold existing positions, add on any morning dip

📉 Bear Case (30% probability)

Triggers: Guidance disappointment, margin pressure, China concerns

Target: 15-20 within 1 week

Strategy: Trim positions, wait for 20 support to re-enter

🔮 Long-term Outlook

NVIDIA remains the dominant force in AI acceleration, with a multi-year runway driven by:

- AI Infrastructure Buildout: trillion market opportunity

- Software Ecosystem: CUDA moat strengthening

- Next-Gen Architecture: Blackwell platform launching 2025

- Emerging Markets: Autonomous vehicles, robotics, edge AI

💡 StockBurger Pro Tip

Focus on NVIDIA’s commentary about AI demand sustainability and Blackwell architecture timeline. These factors will drive the stock more than current quarter results. Any mention of supply constraints or extended lead times would be particularly bullish.

📈 Stock Tickers & Performance

FEATURED STOCK TICKERS:

NVDA - NVIDIA Corporation

AMD - Advanced Micro Devices

INTC - Intel Corporation

TSM - Taiwan Semiconductor

QCOM - Qualcomm Inc.

Disclaimer: This analysis is for informational purposes only and not financial advice. Earnings reports can cause significant volatility. Always conduct your own research and consider your risk tolerance before investing.