Nvidia (NVDA) surged past Microsoft (MSFT) on Tuesday to become the world’s most valuable publicly traded company, with a market capitalization of $3.444 trillion, narrowly topping Microsoft’s $3.441 trillion.

The chipmaker’s meteoric rise—fueled by booming demand for artificial intelligence technologies—has seen its stock climb nearly 50% since dipping just above $94 in early April. That rebound has added more than $1 trillion in market value, placing Nvidia once again at the center of the “Magnificent Seven” Big Tech rally.

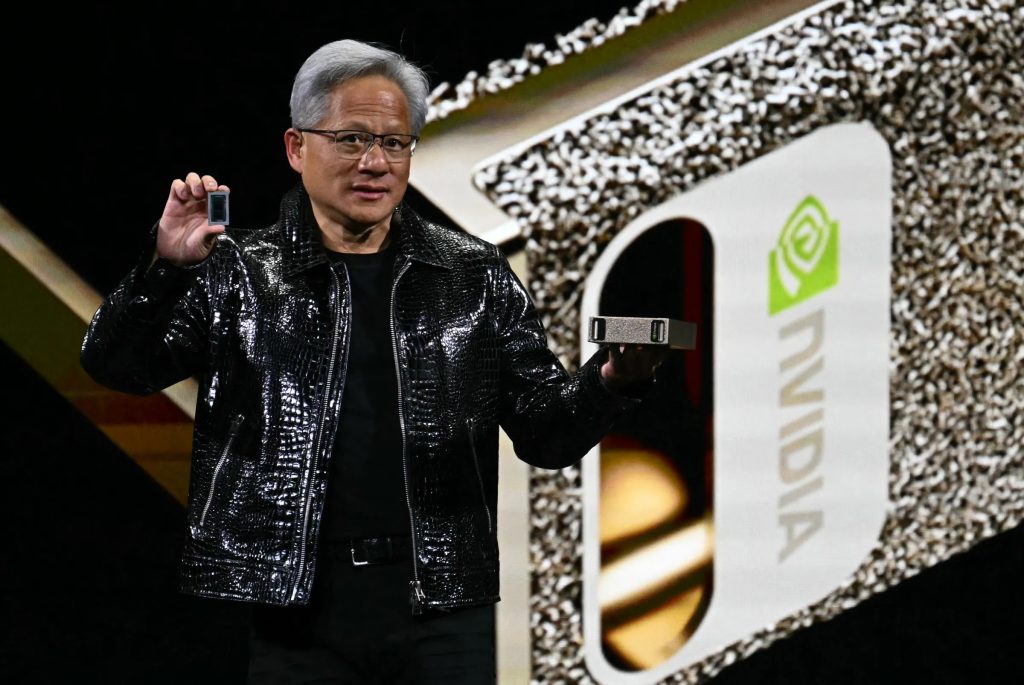

Nvidia’s latest ascent follows a blockbuster earnings report on May 28, which exceeded Wall Street expectations and demonstrated the company’s resilience despite headwinds from a U.S. export ban that severely curtailed sales to China. The report showed Nvidia successfully navigating supply chain challenges and delivering its cutting-edge Blackwell AI systems to major customers like Microsoft.

On Tuesday, Nvidia shares rose 2.8% as key supplier TSMC reaffirmed strong AI chip demand. Additionally, enterprise cloud provider CoreWeave secured a major data center lease expected to run on Nvidia’s hardware—further boosting investor confidence.

Despite facing volatility earlier in the year due to questions around AI sustainability and trade tensions under President Trump, Nvidia has returned to positive territory for 2025, now up around 5% year-to-date. By comparison, Microsoft is up nearly 10%, while Apple (AAPL), once a frontrunner, has seen its shares fall 19% this year amid intensifying AI competition and looming threats of iPhone tariffs from the Trump administration.

Microsoft had held the top spot since early May, alternating with Apple throughout the year. Nvidia last briefly claimed the crown in January.

The AI chipmaker’s stock has skyrocketed nearly 50% since early April—when shares were trading just above $94—adding over $1 trillion in market value. This surge has once again placed Nvidia at the forefront of the “Magnificent Seven” tech leaders powering market gains.

The company’s latest rally was fueled by a strong earnings report on May 28, which beat analyst expectations and highlighted Nvidia’s ability to withstand challenges, including a U.S. export ban that cut off significant sales to China. Despite the setback, Nvidia has continued delivering its high-performance Blackwell AI systems to major clients like Microsoft, while successfully managing supply chain complexities.

Investor optimism was further lifted Tuesday as shares gained 2.8%, supported by confirmation from chip supplier TSMC that AI demand remains robust. Cloud infrastructure company CoreWeave also signed a major data center lease, which is expected to be powered by Nvidia chips—adding momentum to the stock’s climb.

After a turbulent start to the year marked by concerns over the durability of AI-driven growth and U.S.-China trade friction, Nvidia has now turned positive for 2025 with a 5% year-to-date gain. Microsoft, in comparison, is up nearly 10%, while Apple (AAPL) has dropped 19% amid fierce AI competition and renewed threats from President Trump to impose tariffs on iPhone imports.

Microsoft had held the top spot in market value since early May, trading the title with Apple multiple times throughout the year. Nvidia last briefly reached the summit in January, and with its current trajectory, may stay there longer this time.