Nvidia (NVDA) reported its fiscal Q1 earnings Wednesday after market close, surpassing revenue expectations but missing on adjusted earnings per share (EPS) due to a $4.5 billion write-down tied to the U.S. ban on exports of its H20 AI chips to China.

The company posted EPS of $0.81 on revenue of $44.1 billion, beating analyst revenue estimates of $43.3 billion but falling short of the expected $0.93 EPS, per Bloomberg consensus. Excluding the H20 charge, adjusted EPS would have reached $0.96. For comparison, Nvidia reported EPS of $0.61 on $26 billion in revenue during the same quarter last year.

Shares rose 5% following the announcement.

Nvidia now expects to lose about $8 billion in H20-related sales in Q2, as the export ban took effect April 7. The company is reportedly working on a modified H20 chip to comply with new U.S. restrictions.

Revenue from Nvidia’s data center segment surged to $39.1 billion, up from $22.5 billion a year ago, though slightly below Wall Street’s $39.2 billion target. CFO Colette Kress noted that nearly 50% of data center revenue came from hyperscalers such as Amazon (AMZN), Google (GOOG), and Microsoft (MSFT).

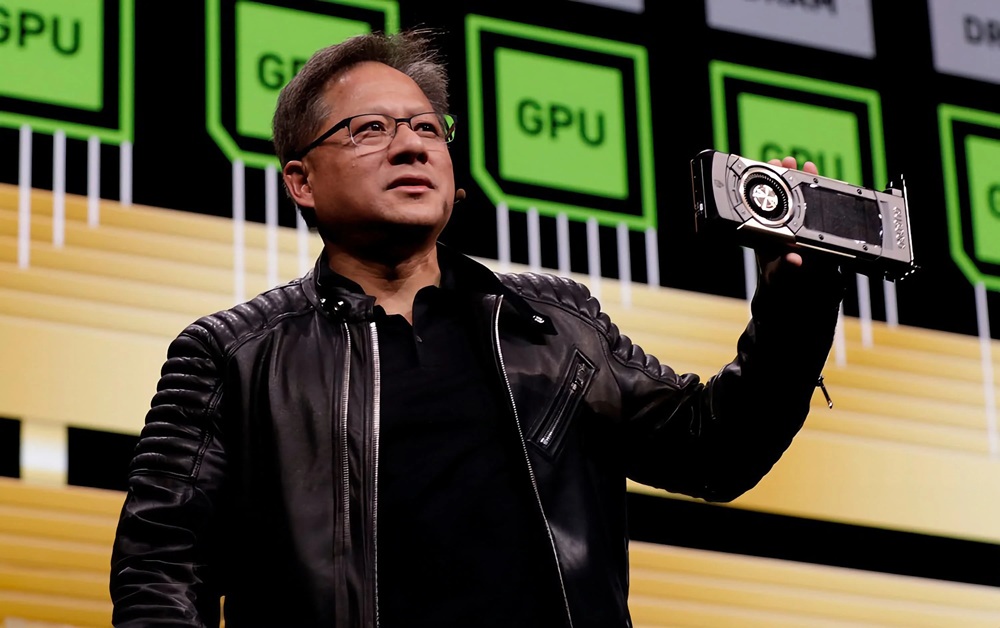

CEO Jensen Huang emphasized strong global demand for AI infrastructure, likening AI to essential infrastructure alongside electricity and the internet. He pointed to a tenfold increase in AI inference over the past year as a signal of accelerating momentum.

“Global demand for NVIDIA’s AI infrastructure is incredibly strong,” CEO Jensen Huang said in a release.

The U.S. ban on H20 chip sales to China, originally intended to limit advanced AI capabilities, backfired, according to Huang, who criticized U.S. policy at a press conference in Taipei. He argued that the restrictions are benefiting China’s domestic AI chipmakers.

Meanwhile, Nvidia has received temporary relief after the Trump administration scrapped Biden-era AI diffusion rules, which would have imposed tighter export controls. However, new export guidelines are expected in the future.

“Let me share my perspective on some topics we’re frequently asked on export control. China is one of the world’s largest AI markets and a springboard to global success with half of the world’s AI researchers based there,” Huang said. “The platform that wins China is positioned to lead globally today. However, the $50 billion China market is effectively closed to U.S. industry. The H20 export ban ended our Hopper data center business in China. We cannot produce Hopper further to comply. As a result, we are taking a multibillion-dollar write-off on inventory that cannot be sold or repurposed. We are exploring limited ways to compete, but hopper is no longer an option.”

Huang said that, with or without U.S. chips, China has to compute to train and deploy advanced models.

“The question is not whether China will have it. It already does,” he said. “The question is whether one of the world’s largest AI markets will run on American platforms. Shielding Chinese chip makers from U.S. competition only strengthens them abroad and weakens America’s position.”

He added, “Export restrictions have spurred China’s” competitiveness. He said, “The race is not just about chips. It’s about which stack the world runs as that stack grows. Global infrastructure leadership is at stake. The U.S. has based its policy on the assumption that China cannot make any chips. That assumption was always questionable, and now it’s very wrong. China has enormous manufacturing capability. In the end, the platform that wins the AI developers wins AI. AI export controls should strengthen U.S. platforms, not drive half the world’s AI talent” to other shores.

Nvidia’s presence at the Computex trade show highlighted its continued innovation, including new cloud-based GPU offerings via partners like CoreWeave and Foxconn.

Amid rising AI demand, Nvidia announced a major supply deal with Saudi-backed startup Humain, pledging to deliver hundreds of thousands of GPUs over five years. The deal was revealed during Trump’s Middle East trip, which also included a new Project Stargate in the UAE featuring Nvidia’s Blackwell systems.

Bernstein analyst Stacy Rasgon called the announcement a positive signal for AI capex sustainability, noting the involvement of deep-pocketed international partners.

Despite early-year volatility from trade tensions and chip restrictions, Nvidia’s stock has gained nearly 20% over the past 12 months and is now trading above $136 — up roughly 2% year-to-date.