Oracle Corporation ORCL posted weaker-than-expected earnings and sales results for its second quarter on Monday.

The company reported second-quarter revenue of $14.06 billion, up 9% year-over-year. The revenue total missed a Street consensus estimate of $14.11 billion. The company reported adjusted earnings per share of $1.47, missing a Street consensus estimate of $1.48.

“Record level AI demand drove Oracle Cloud Infrastructure revenue up 52% in Q2, a much higher growth rate than any of our hyperscale cloud infrastructure competitors,” Oracle CEO Safra Catz said. “GPU consumption was up 336% in the quarter – and we delivered the world’s largest and fastest AI SuperComputer scaling up to 65,000 NVIDIA H200 GPUs.”

Oracle shares fell 0.7% to close at $190.45 on Monday.

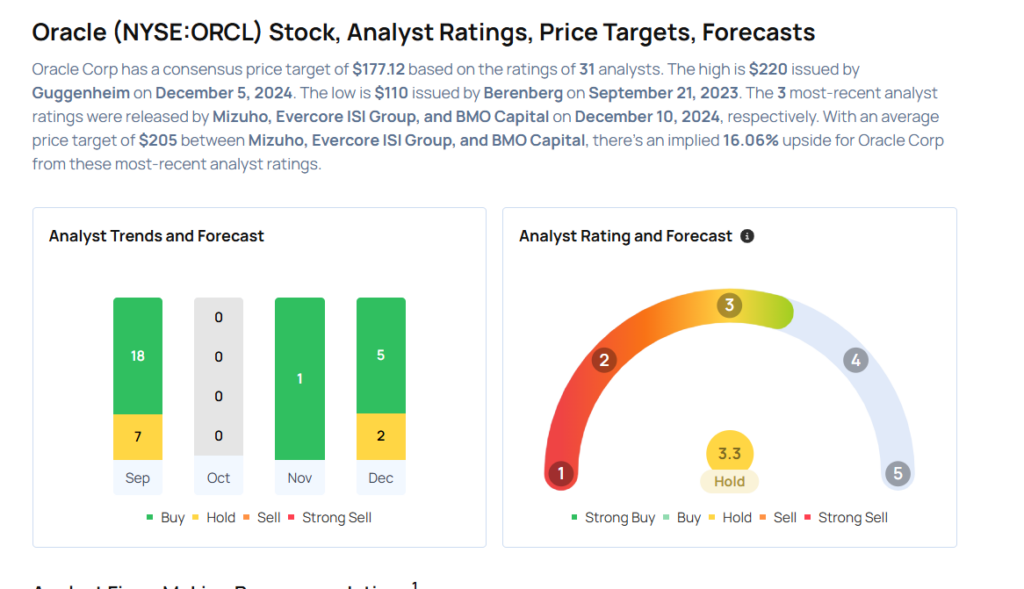

These analysts made changes to their price targets on Oracle following earnings announcement.

- Piper Sandler analyst Brent Bracelin maintained Oracle with an Overweight and raised the price target from $185 to $210.

- Morgan Stanley analyst Keith Weiss maintained Oracle with an Equal-Weight and raised the price target from $145 to $175.

- BMO Capital analyst Keith Bachman maintained Oracle with a Market Perform and raised the price target from $173 to $205.

- Evercore ISI Group analyst Kirk Materne maintained the stock with an Outperform and raised the price target from $190 to $200.

- Mizuho analyst Siti Panigrahi maintained Oracle with an Outperform and raised the price target from $185 to $210.

Considering buying ORCL stock? Here’s what analysts think:

Read This Next:

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.