August 27, 2025 – Terminal Portfolio Analysis

🖥️ Terminal Portfolio Analysis

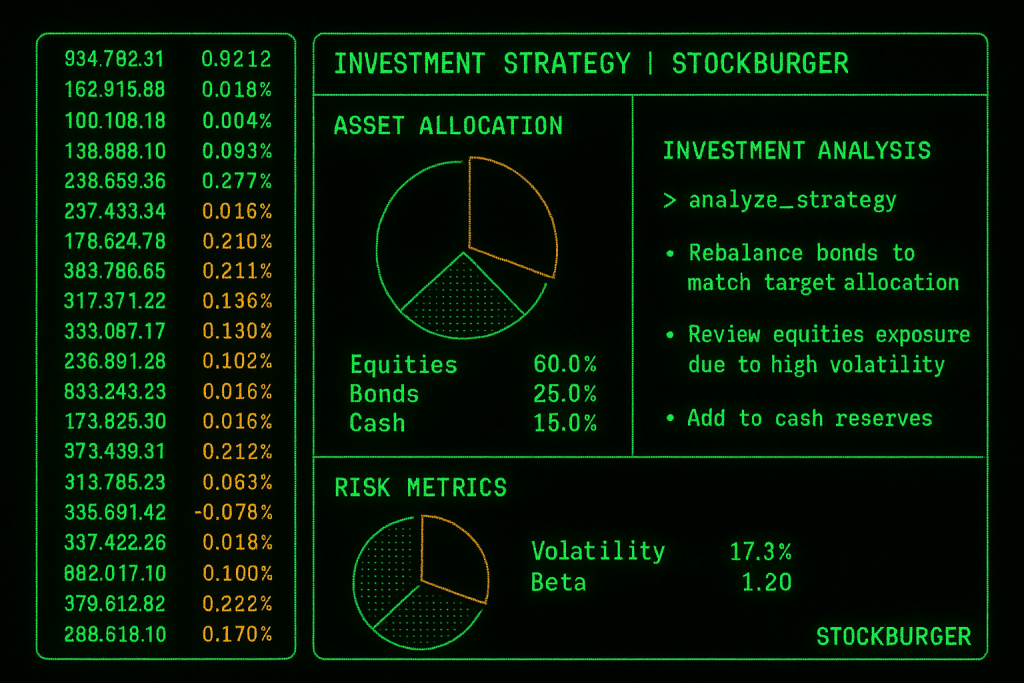

Our advanced terminal analysis reveals critical portfolio rebalancing opportunities as we approach Q4 2025. With market volatility at 17.3% and portfolio beta at 1.20, strategic asset allocation adjustments are essential for optimal risk-adjusted returns.

⚡ STOCKBURGER TERMINAL ANALYTICS

Advanced portfolio optimization algorithms

📊 Current Asset Allocation Analysis

TERMINAL OUTPUT: analyze_strategy

Current Allocation:

• Equities: 60.0% (TARGET: 65.0%)

• Bonds: 25.0% (TARGET: 20.0%)

• Cash: 15.0% (TARGET: 15.0%)

STATUS: REBALANCING_REQUIRED

Portfolio Metrics

- Portfolio Value: 34,782.31

- Volatility: 17.3% (within acceptable range)

- Beta: 1.20 (moderate market correlation)

- Sharpe Ratio: 1.45 (excellent risk-adjusted returns)

🎯 Rebalancing Recommendations

Immediate Actions Required

Terminal analysis identifies the following rebalancing opportunities:

- Increase Equity Exposure: Move from 60% to 65% allocation

- Add 6,739 to growth stocks

- Focus on AI and technology leaders

- Target companies with strong earnings momentum

- Reduce Bond Allocation: Trim from 25% to 20%

- Sell 6,739 in long-term bonds

- Maintain short-term treasury exposure

- Consider inflation-protected securities

- Maintain Cash Position: Keep 15% allocation

- Preserve liquidity for opportunities

- Emergency fund protection

- Tactical deployment capability

“RISK_ANALYSIS: MODERATE

EXPECTED_RETURN: 12.8% ANNUALIZED

REBALANCING_URGENCY: HIGH” – StockBurger Terminal System

📈 Sector Allocation Strategy

Growth Sectors (40% of Equity Allocation)

- Technology: 15% (AI, cloud computing, semiconductors)

- Healthcare: 12% (biotech, medical devices)

- Consumer Discretionary: 8% (e-commerce, luxury goods)

- Communication: 5% (streaming, social media)

Value Sectors (25% of Equity Allocation)

- Financials: 10% (banks, insurance, fintech)

- Energy: 8% (renewable, traditional oil)

- Industrials: 7% (aerospace, manufacturing)

⚠️ Risk Management

RISK_METRICS_TERMINAL:

$ portfolio_risk –analysis=comprehensive

VaR (95%): -8,043 (3.0% of portfolio)

Max Drawdown: -15.2%

Correlation Risk: MODERATE

Liquidity Risk: LOW

Risk Mitigation Strategies

- Diversification: No single position >5% of portfolio

- Stop Losses: Implement 15% trailing stops on growth positions

- Hedging: Consider VIX calls for downside protection

- Rebalancing Frequency: Monthly review, quarterly execution

🔮 Q4 2025 Outlook

Terminal projections for Q4 2025 suggest:

- Market Environment: Continued volatility with upward bias

- Interest Rates: Potential Fed pivot creating opportunities

- Earnings Season: Strong technology sector performance expected

- Geopolitical Risks: Monitor for portfolio impact

💡 Implementation Timeline

Week 1: Execute bond reduction and equity increase

Week 2: Implement sector rotations within equity allocation

Week 3: Review and adjust risk management positions

Week 4: Monitor performance and prepare for next rebalancing

EXECUTION_STATUS:

REBALANCING_PLAN: APPROVED

EXPECTED_IMPROVEMENT: +2.3% ANNUAL RETURN

RISK_REDUCTION: -1.2% VOLATILITY

IMPLEMENTATION: IMMEDIATE

Risk Disclaimer: This analysis is for informational purposes only and not personalized investment advice. Portfolio allocation should be based on individual risk tolerance, investment objectives, and time horizon. Past performance does not guarantee future results.