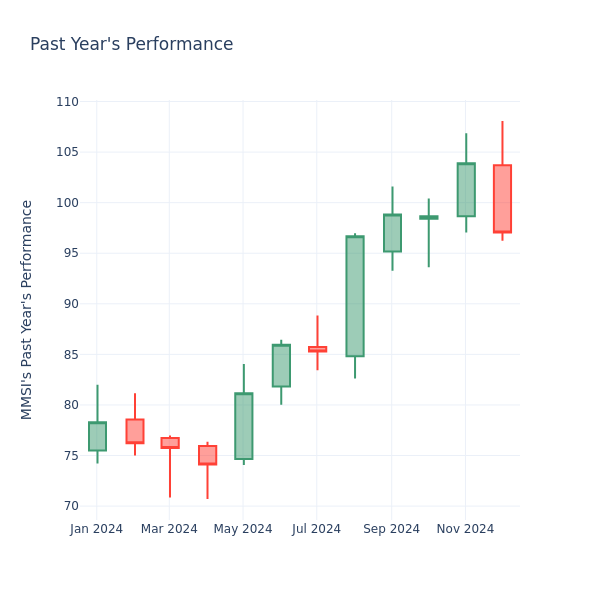

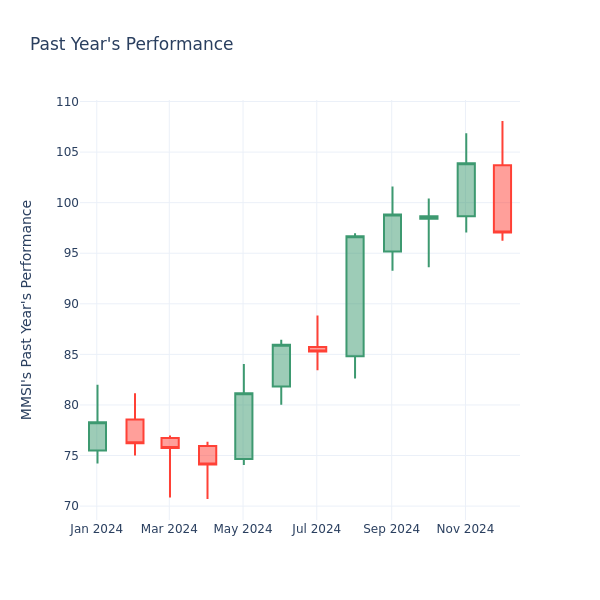

In the current market session, Merit Medical Systems Inc. MMSI share price is at $97.14, after a 0.01% increase. Moreover, over the past month, the stock decreased by 7.52%, but in the past year, went up by 28.50%. Shareholders might be interested in knowing whether the stock is overvalued, even if the company is performing up to par in the current session.

Comparing Merit Medical Systems P/E Against Its Peers

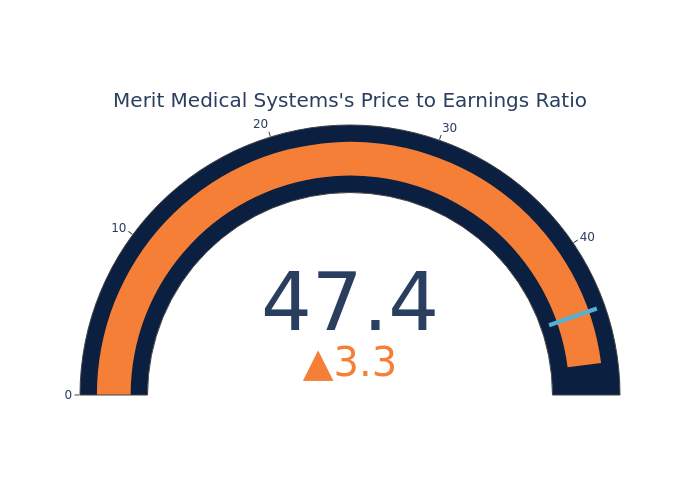

The P/E ratio is used by long-term shareholders to assess the company's market performance against aggregate market data, historical earnings, and the industry at large. A lower P/E could indicate that shareholders do not expect the stock to perform better in the future or it could mean that the company is undervalued.

Compared to the aggregate P/E ratio of 44.09 in the Health Care Equipment & Supplies industry, Merit Medical Systems Inc. has a higher P/E ratio of 47.38. Shareholders might be inclined to think that Merit Medical Systems Inc. might perform better than its industry group. It's also possible that the stock is overvalued.

In conclusion, the price-to-earnings ratio is a useful metric for analyzing a company's market performance, but it has its limitations. While a lower P/E can indicate that a company is undervalued, it can also suggest that shareholders do not expect future growth. Additionally, the P/E ratio should not be used in isolation, as other factors such as industry trends and business cycles can also impact a company's stock price. Therefore, investors should use the P/E ratio in conjunction with other financial metrics and qualitative analysis to make informed investment decisions.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.