Financial giants have made a conspicuous bearish move on ARM Holdings. Our analysis of options history for ARM Holdings ARM revealed 10 unusual trades.

Delving into the details, we found 20% of traders were bullish, while 70% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $138,888, and 7 were calls, valued at $390,015.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $95.0 to $140.0 for ARM Holdings over the recent three months.

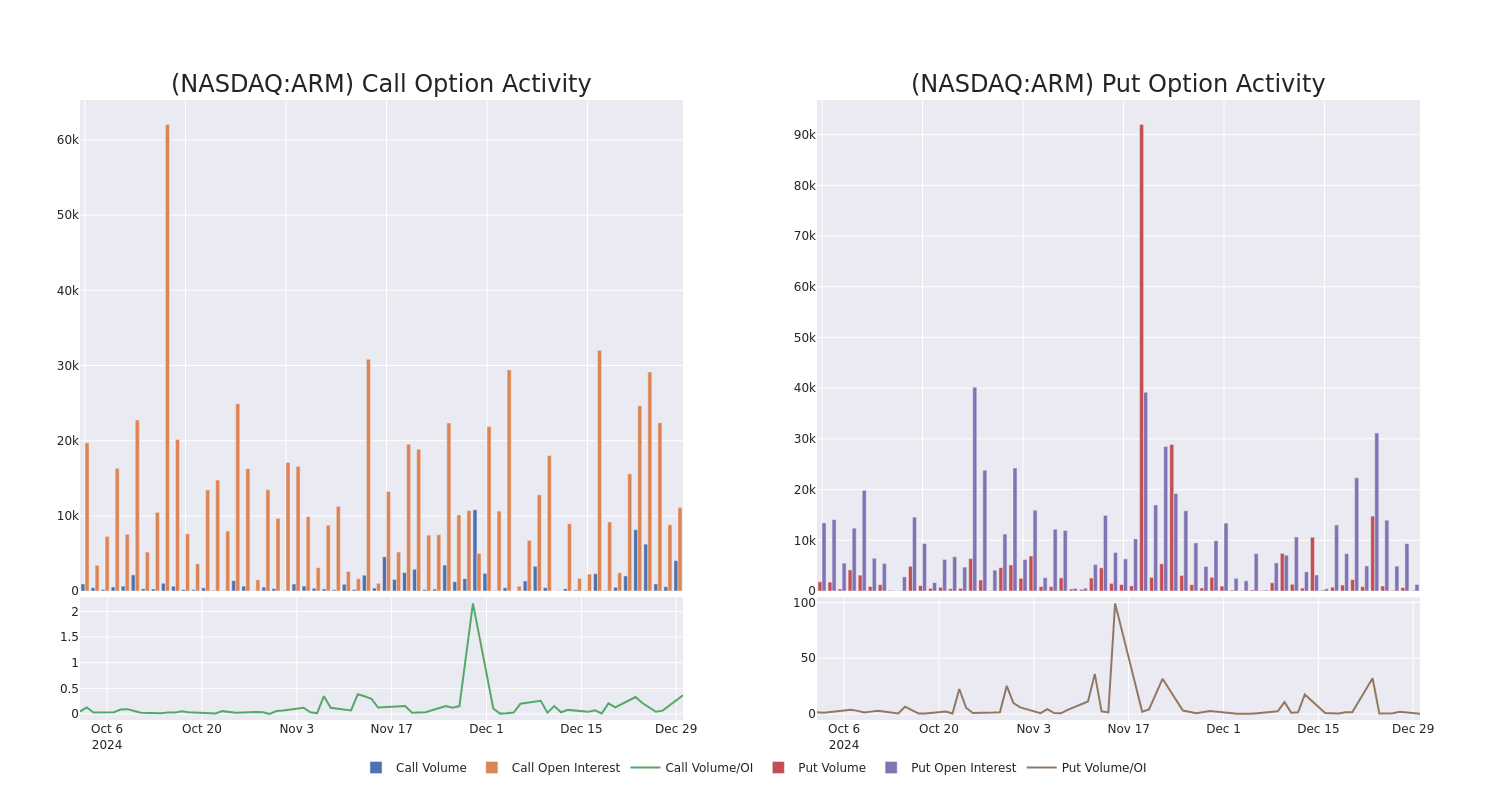

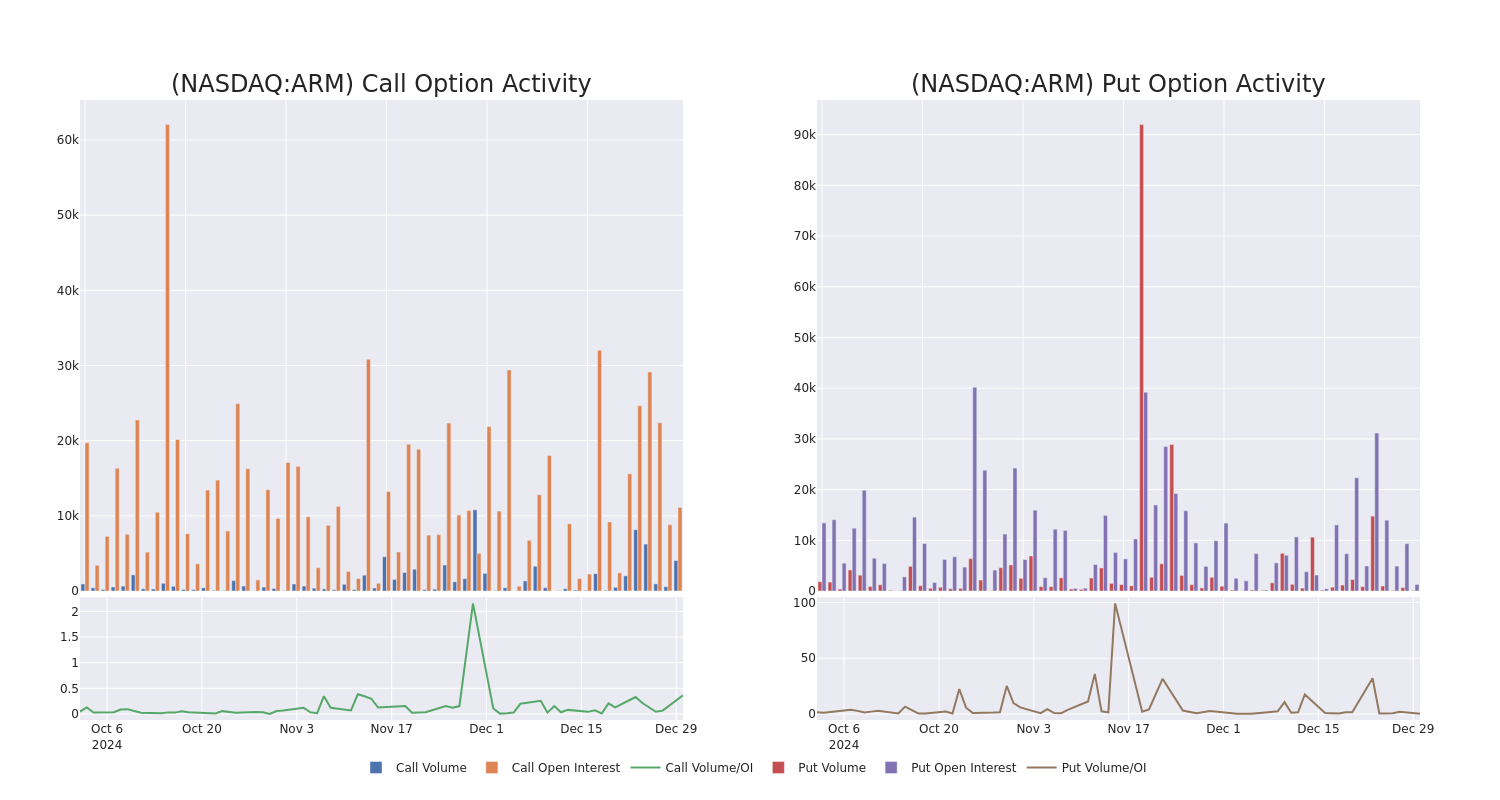

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for ARM Holdings's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across ARM Holdings's significant trades, within a strike price range of $95.0 to $140.0, over the past month.

ARM Holdings 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ARM | CALL | TRADE | BEARISH | 01/16/26 | $26.9 | $26.45 | $26.45 | $140.00 | $119.0K | 9.7K | 46 |

| ARM | CALL | SWEEP | BEARISH | 01/03/25 | $2.01 | $1.88 | $1.95 | $127.00 | $58.3K | 134 | 1.0K |

| ARM | CALL | TRADE | NEUTRAL | 06/18/26 | $54.05 | $52.15 | $53.05 | $95.00 | $53.0K | 24 | 10 |

| ARM | PUT | SWEEP | BEARISH | 12/18/26 | $26.6 | $25.1 | $26.3 | $110.00 | $52.5K | 396 | 10 |

| ARM | CALL | TRADE | BEARISH | 01/03/25 | $2.03 | $1.97 | $1.97 | $127.00 | $49.2K | 134 | 1.5K |

About ARM Holdings

Arm Holdings is the IP owner and developer of the ARM architecture (ARM stands for Acorn RISC Machine), which is used in 99% of the world's smartphone CPU cores, and it also has high market share in other battery-powered devices like wearables, tablets, or sensors. Arm licenses its architecture for a fee, offering different types of licenses depending on the flexibility the customer needs. Customers like Apple or Qualcomm buy architectural licenses, which allows them to modify the architecture and add or delete instructions to tailor the chips to their specific needs. Other clients directly buy off-the-shelf designs from Arm. Off-the-shelf and architectural customers pay a royalty fee per chip shipped.

In light of the recent options history for ARM Holdings, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of ARM Holdings

- With a volume of 895,252, the price of ARM is down -2.52% at $125.95.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 37 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for ARM Holdings with Benzinga Pro for real-time alerts.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.