Investors with a lot of money to spend have taken a bullish stance on Cava Group CAVA.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with CAVA, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 9 options trades for Cava Group.

This isn't normal.

The overall sentiment of these big-money traders is split between 44% bullish and 22%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $30,250, and 8, calls, for a total amount of $529,357.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $60.0 and $160.0 for Cava Group, spanning the last three months.

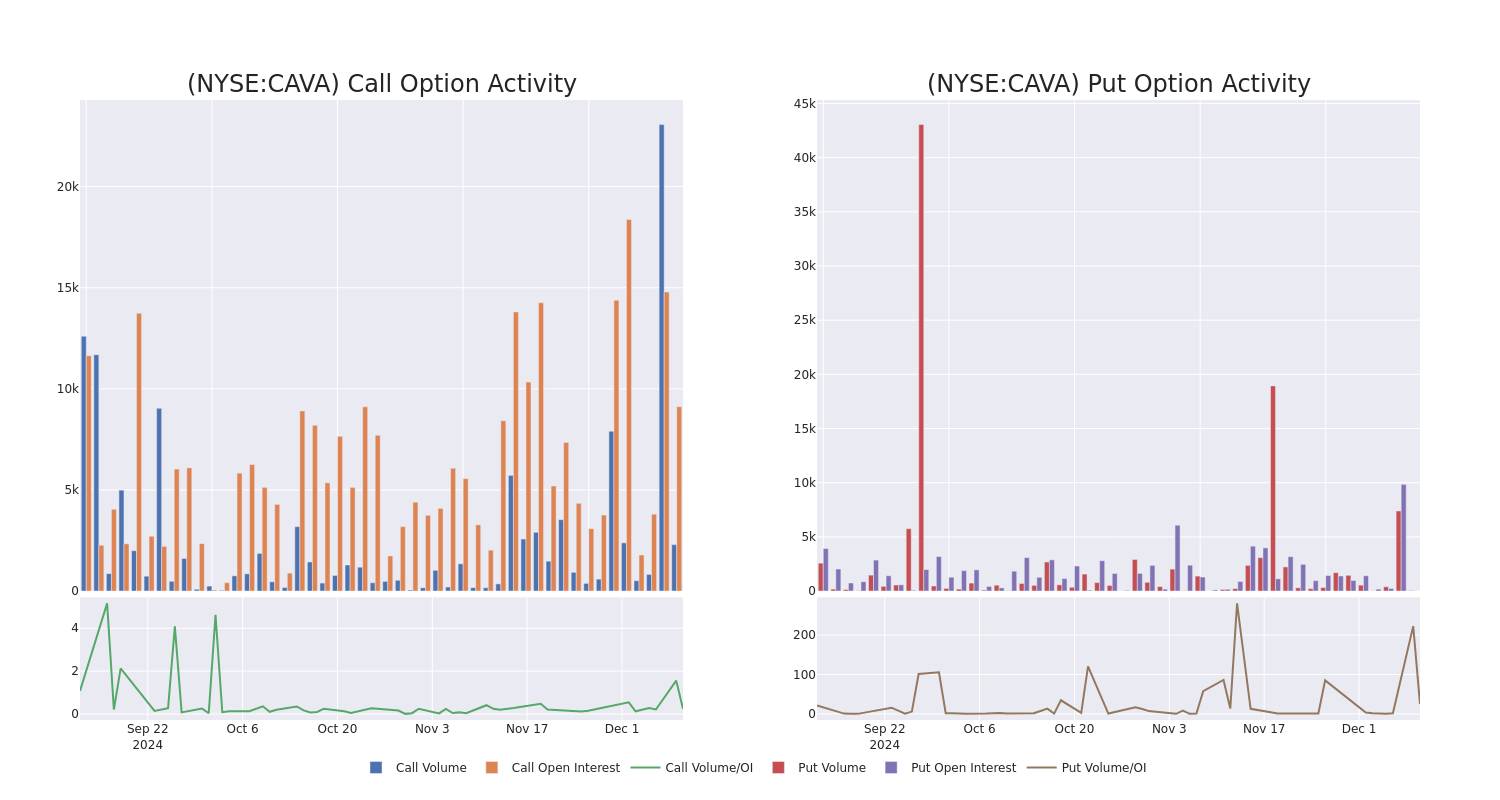

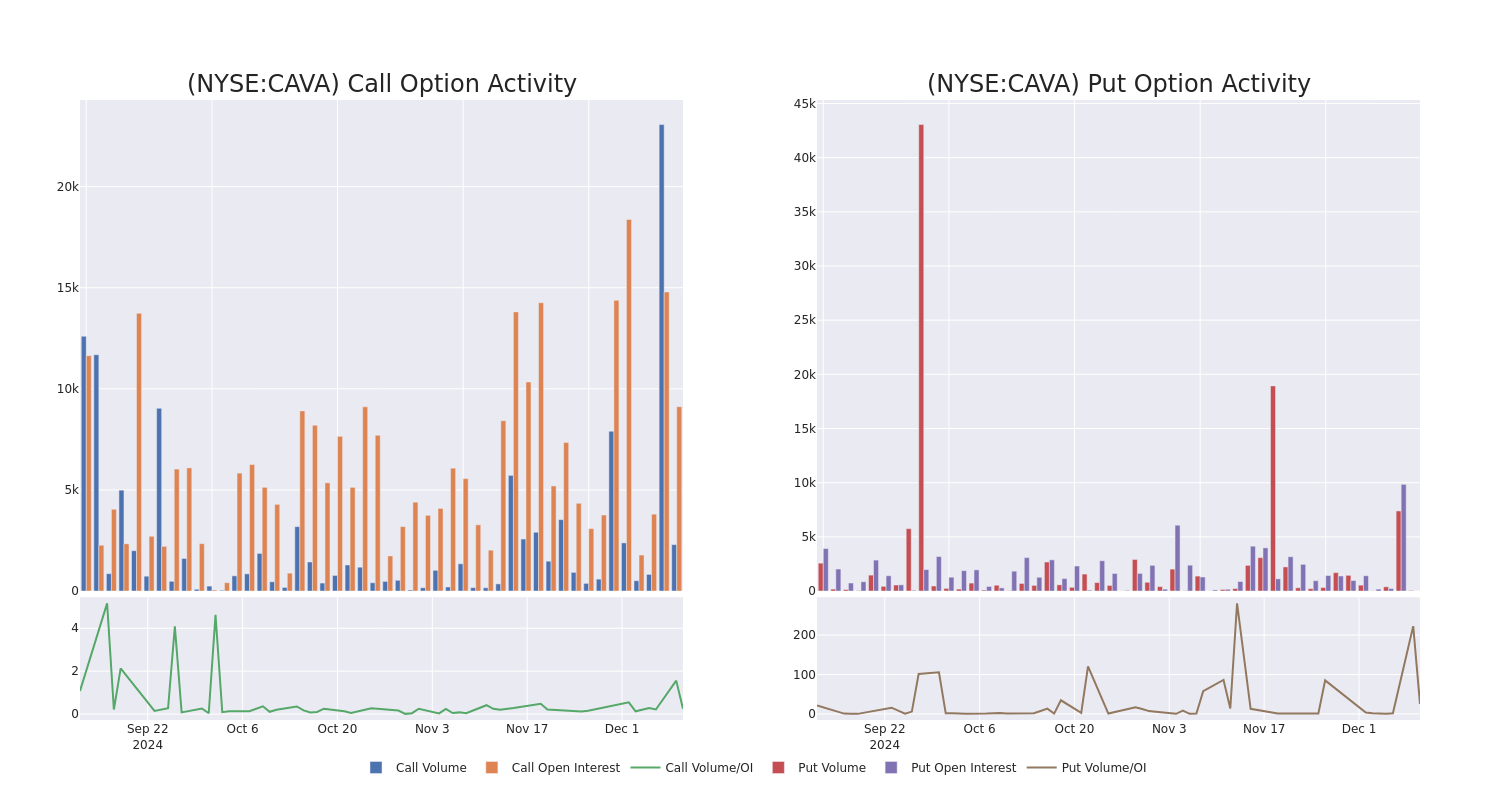

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Cava Group options trades today is 1139.88 with a total volume of 2,296.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Cava Group's big money trades within a strike price range of $60.0 to $160.0 over the last 30 days.

Cava Group Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CAVA | CALL | SWEEP | BEARISH | 02/21/25 | $9.0 | $8.9 | $8.9 | $140.00 | $200.2K | 744 | 239 |

| CAVA | CALL | TRADE | NEUTRAL | 04/17/25 | $32.0 | $31.4 | $31.75 | $110.00 | $79.3K | 201 | 50 |

| CAVA | CALL | SWEEP | BULLISH | 12/20/24 | $0.85 | $0.8 | $0.8 | $150.00 | $69.2K | 4.6K | 1.7K |

| CAVA | CALL | TRADE | BULLISH | 07/18/25 | $23.6 | $22.9 | $23.6 | $135.00 | $47.2K | 167 | 20 |

| CAVA | CALL | SWEEP | BEARISH | 12/18/26 | $37.9 | $36.0 | $36.0 | $160.00 | $36.0K | 15 | 10 |

About Cava Group

Cava Group Inc owns and operates a chain of restaurants. It is the category-defining Mediterranean fast-casual restaurant brand, bringing together healthful food and bold, satisfying flavors at scale. The company's dips, spreads, and dressings are centrally produced and sold in grocery stores. The company's operations are conducted as two reportable segments: CAVA and Zoes Kitchen. The company generates the majority of its revenue from the CAVA segment.

Having examined the options trading patterns of Cava Group, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Cava Group

- Trading volume stands at 1,063,165, with CAVA's price down by -1.31%, positioned at $130.83.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 77 days.

What The Experts Say On Cava Group

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $147.8.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * An analyst from Loop Capital persists with their Hold rating on Cava Group, maintaining a target price of $147. * Consistent in their evaluation, an analyst from JP Morgan keeps a Neutral rating on Cava Group with a target price of $110. * An analyst from TD Cowen has decided to maintain their Buy rating on Cava Group, which currently sits at a price target of $150. * Consistent in their evaluation, an analyst from Piper Sandler keeps a Neutral rating on Cava Group with a target price of $142. * An analyst from Wedbush persists with their Outperform rating on Cava Group, maintaining a target price of $190.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Cava Group, Benzinga Pro gives you real-time options trades alerts.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.