Whales with a lot of money to spend have taken a noticeably bullish stance on Lam Research.

Looking at options history for Lam Research LRCX we detected 8 trades.

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 37% with bearish.

From the overall spotted trades, 5 are puts, for a total amount of $1,398,938 and 3, calls, for a total amount of $284,388.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $67.0 and $90.0 for Lam Research, spanning the last three months.

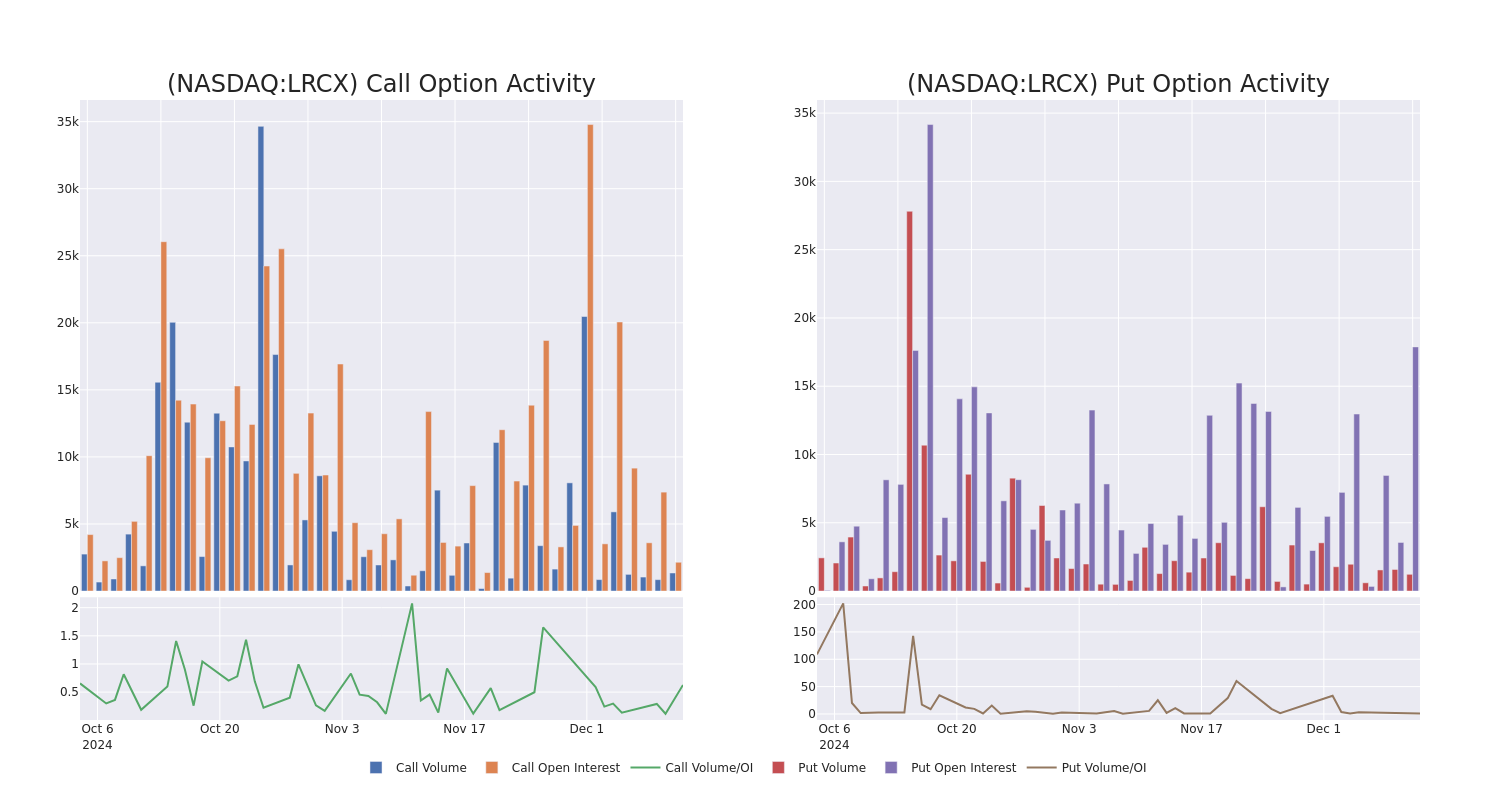

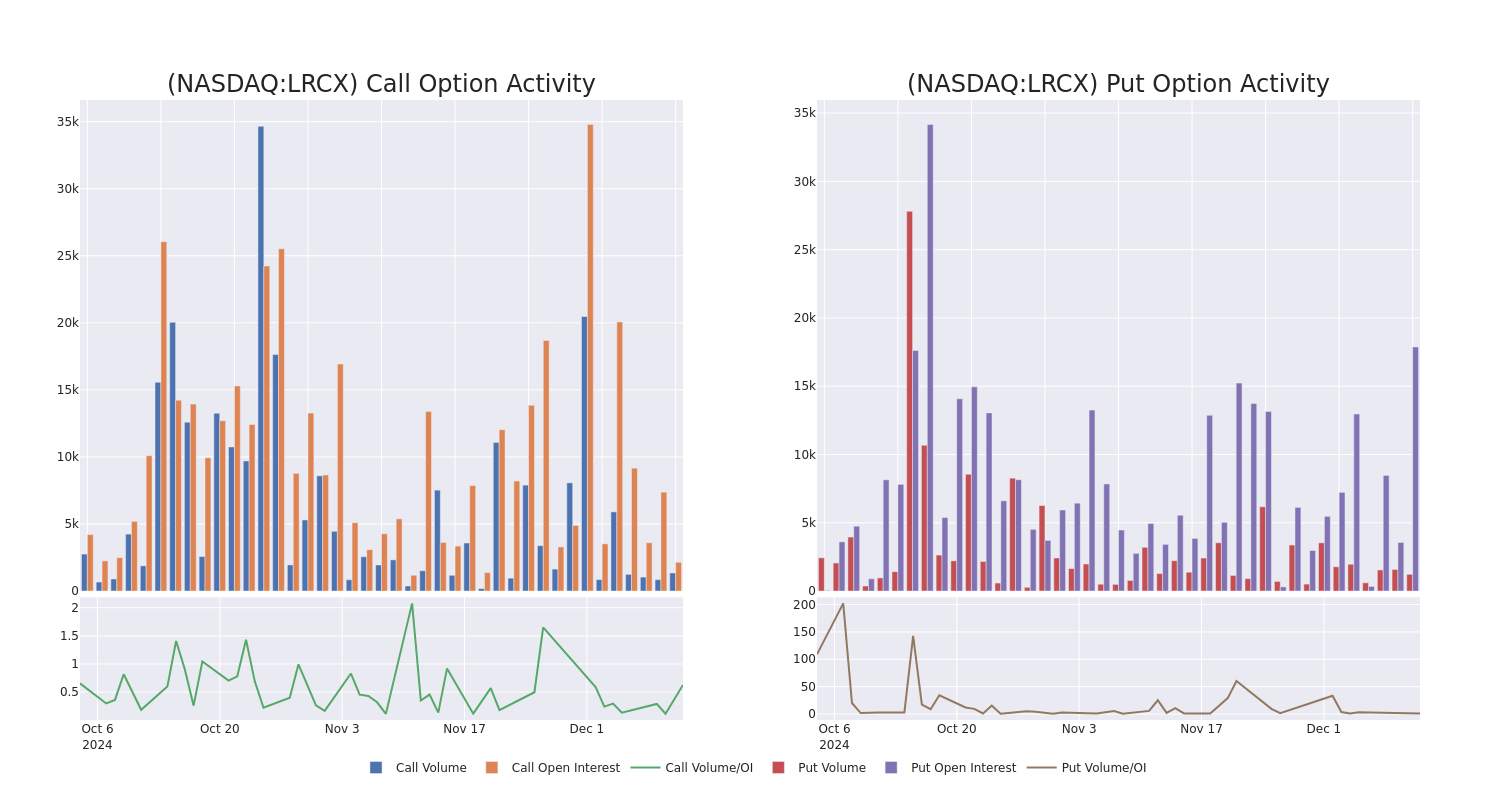

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Lam Research's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Lam Research's whale trades within a strike price range from $67.0 to $90.0 in the last 30 days.

Lam Research Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LRCX | PUT | TRADE | BULLISH | 01/16/26 | $13.5 | $13.3 | $13.3 | $80.00 | $861.8K | 2.8K | 698 |

| LRCX | PUT | SWEEP | BEARISH | 02/21/25 | $4.35 | $4.3 | $4.35 | $74.00 | $217.9K | 6.4K | 8 |

| LRCX | CALL | SWEEP | BEARISH | 06/20/25 | $6.5 | $6.4 | $6.4 | $85.00 | $208.0K | 367 | 326 |

| LRCX | PUT | SWEEP | NEUTRAL | 06/20/25 | $4.4 | $4.3 | $4.35 | $67.00 | $188.8K | 1.2K | 438 |

| LRCX | PUT | TRADE | BULLISH | 01/17/25 | $1.9 | $1.83 | $1.84 | $72.00 | $92.0K | 4.7K | 15 |

About Lam Research

Lam Research is one of the largest semiconductor wafer fabrication equipment manufacturers in the world. It specializes in deposition and etch, which entail the buildup of layers on a semiconductor and the subsequent selective removal of patterns from each layer. Lam holds the top market share in etch and holds the clear second share in deposition. It is more exposed to memory chipmakers for DRAM and NAND chips. It counts as top customers the largest chipmakers in the world, including TSMC, Samsung, Intel, and Micron.

Present Market Standing of Lam Research

- With a trading volume of 4,135,291, the price of LRCX is down by -2.88%, reaching $75.98.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 41 days from now.

What The Experts Say On Lam Research

In the last month, 3 experts released ratings on this stock with an average target price of $82.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * An analyst from Bernstein persists with their Market Perform rating on Lam Research, maintaining a target price of $85. * Maintaining their stance, an analyst from Wells Fargo continues to hold a Equal-Weight rating for Lam Research, targeting a price of $83. * An analyst from Morgan Stanley persists with their Equal-Weight rating on Lam Research, maintaining a target price of $78.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Lam Research, Benzinga Pro gives you real-time options trades alerts.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.