Stock Futures Slip Before Wholesale Inflation Data: Markets Wrap

(Bloomberg) -- US stock futures dropped as investors waited to see if wholesale inflation data due later would confirm signs of a slowdown in price growth, while President Donald Trump issued a fresh threat of trade tariffs against Europe.

Most Read from Bloomberg

S&P 500 contracts retreated 0.5% while those on the Nasdaq 100 were down 0.7% after gains on Wednesday spurred by a softer-than-expected consumer inflation print. A slew of weak earnings from the likes of software firms Adobe Inc. and SentinelOne Inc. hit their shares in premarket trading, though Intel Inc. jumped as much as 11% after the chipmaker named a new chief executive officer.

Subscribe to the Bloomberg Daybreak podcast on Apple, Spotify or anywhere you listen.

Gold was a notable mover, with prices rising toward record highs as several banks predicted further gains for the haven asset amid the escalation in global trade tensions.

Investors are now awaiting readings on wholesale inflation and initial jobless claims. While price growth is seen moderating to 0.3% last month, the data will not take into account fresh tariffs that have raised fears of an economic slowdown. Those risks were highlighted by Trump’s threat on Thursday to retaliate if the European Union did not immediately remove levies imposed in response to US tariff hikes.

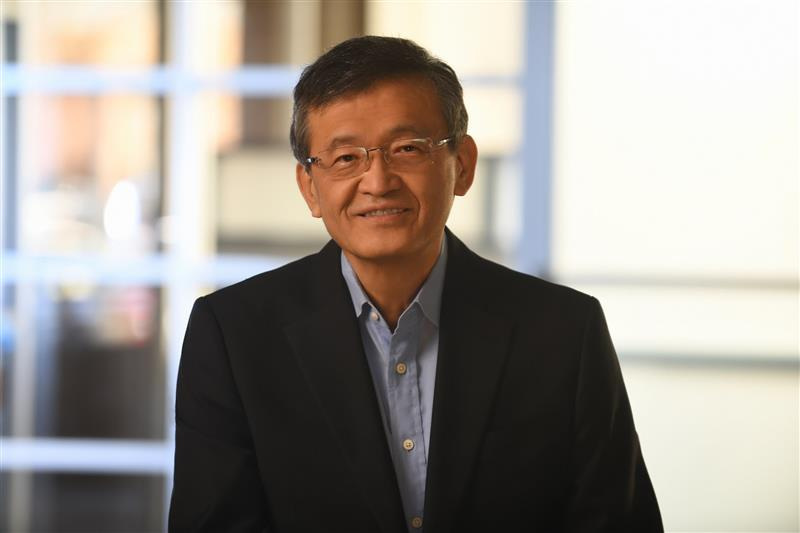

Daniel Murray, CEO of EFG Asset Management in Zurich, said while the previous day’s CPI reading “has reinvigorated belief in the declining inflation narrative,” markets are unable to shake off their broader concerns over the damage from President Donald Trump’s tariff policies.

“If there was a reasonable degree of certainty regarding what is going to be implemented, when and how other countries will respond, then markets could price the likely outcomes more easily and move on,” EFG’s Murray said. “However, that clarity is sadly missing at the moment.”

All that has driven a slew of Wall Street banks, including Goldman Sachs Group Inc. and Citigroup Inc., to cut their forecasts for the S&P 500. Yardeni Research added to that bearish chorus, noting that Trump’s tariff policies have heightened the risk of stagflation.

Still, some strategists reckon a bottom for US stocks is “probably” here, with JPMorgan Chase & Co. saying the worst of the correction may be over.