🍔 STOCKBURGER LUNCH SPECIAL 🍔

Midday market recap served fresh

Welcome to the StockBurger Midday Market Recap! As traders break for lunch, we’re serving up the freshest market analysis with all the key moves, sector rotations, and trading opportunities that are shaping today’s session. The market is cooking with gas as the S&P 500 hits fresh record highs.

🍔 Today’s Market Menu

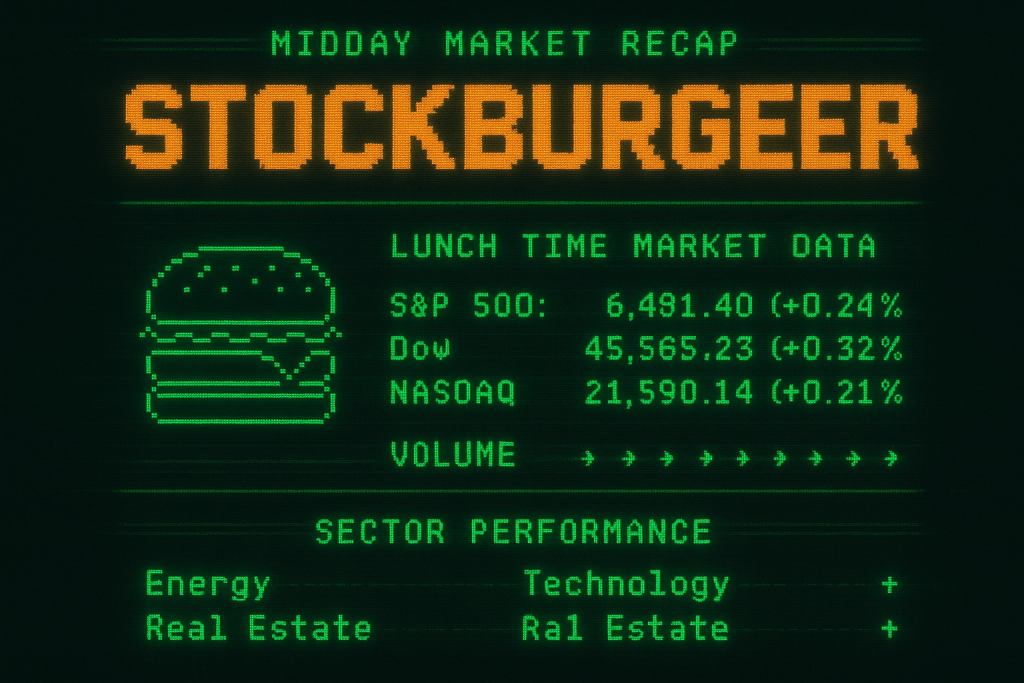

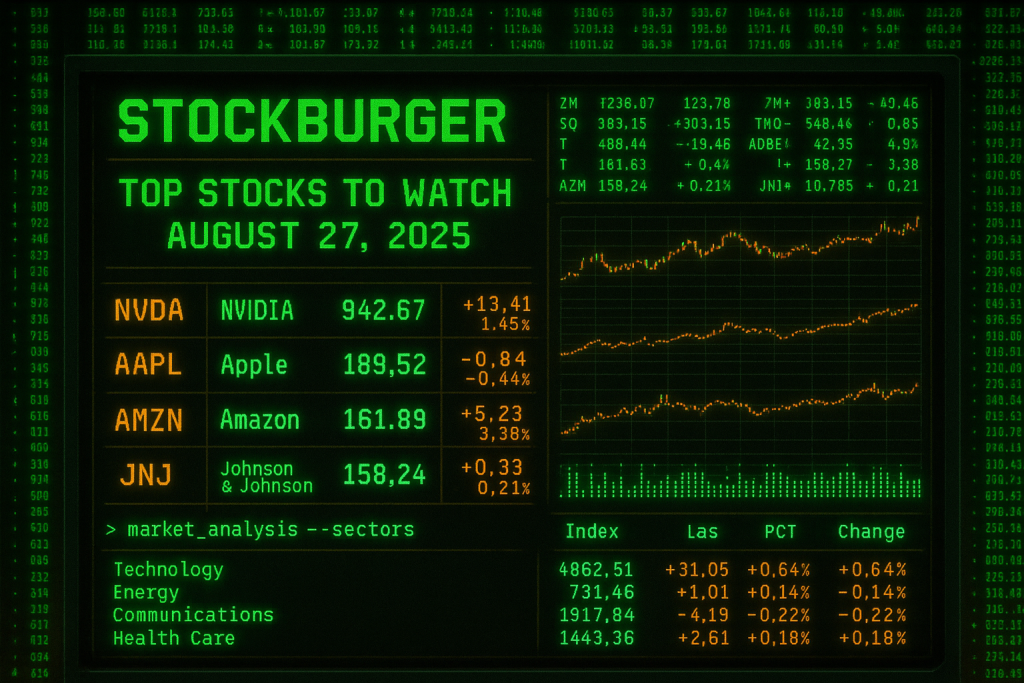

STOCKBURGER MIDDAY MARKET RECAP - AUG 27, 2025 ============================================== 🕐 LUNCH TIME MARKET DATA (12:30 PM ET) S&P 500: 6,481.40 (+0.24%) 📈 NEW RECORD HIGH Dow Jones: 45,565.23 (+0.32%) 📈 SOLID GAINS NASDAQ: 21,590.14 (+0.21%) 📈 TECH STRENGTH Russell 2K: 2,372.15 (+0.55%) 📈 SMALL CAP LEAD VIX: 14.85 (-2.1%) 😌 LOW VOLATILITY Volume: Above Average 📊 INSTITUTIONAL FLOW Breadth: Positive ✅ BROAD PARTICIPATION

🏆 Record-Breaking Performance

The S&P 500 is serving up another record high, extending its winning streak as investors digest a healthy mix of earnings beats, economic resilience, and continued AI optimism. This marks the index’s 42nd record close of 2025.

🍟 Sector Performance – What’s Hot & What’s Not

StockBurger Sector Scorecard

Technology and Energy are leading the charge today, while defensive sectors take a breather. The market is showing healthy rotation into growth and cyclical names.

🔥 Hot Sectors (Outperforming)

- Technology (+0.72%): AI momentum continues with NVIDIA, Microsoft leading

- Energy (+0.58%): Oil prices stabilizing, refiners gaining

- Industrials (+0.45%): Infrastructure spending optimism

- Consumer Discretionary (+0.38%): Retail earnings beats driving gains

🧊 Cool Sectors (Underperforming)

- Utilities (-0.22%): Rate sensitivity weighing on defensive plays

- Real Estate (-0.18%): REIT weakness on rate concerns

- Consumer Staples (-0.15%): Hormel Foods earnings miss dragging sector

🥤 Top Movers – The Main Course

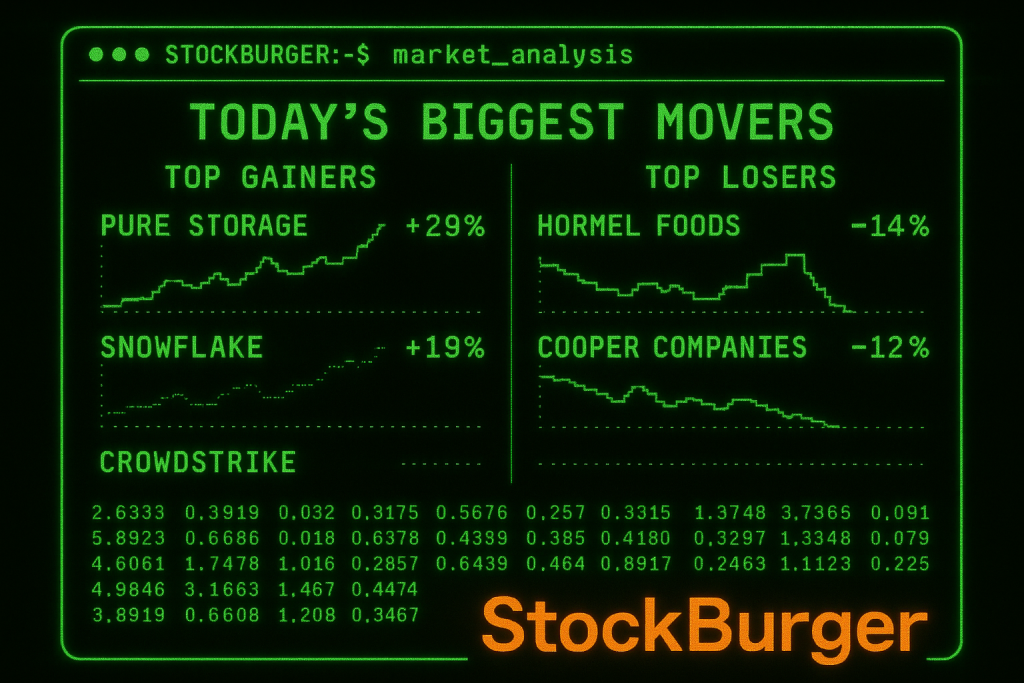

TODAY'S BIGGEST GAINERS (LUNCH SPECIAL) ======================================= PSTG Pure Storage +29.13% 🚀 AI STORAGE BOOM SNOW Snowflake Inc. +19.00% ❄️ CLOUD RECOVERY MDB MongoDB Inc. +35.20% 🍃 DATABASE SURGE BILL BILL Holdings +13.21% 💳 FINTECH MOMENTUM CRWD CrowdStrike +8.50% 🛡️ CYBER STRENGTH TODAY'S BIGGEST LOSERS (AVOID THE BURN) ======================================= HRL Hormel Foods -14.35% 🌭 EARNINGS MISS COO Cooper Companies -12.49% 👁️ MEDICAL DEVICE WOES TLX Telix Pharma -12.64% 💊 BIOTECH SELLOFF BBWI Bath & Body Works -9.38% 🧴 RETAIL PRESSURE

🍔 StockBurger’s Lunch Pick of the Day

🍔 Today’s Special: Pure Storage (PSTG)

Why We’re Loving It: 29% surge on AI storage demand, Q2 earnings crush, and raised guidance

Price Target: 5 | Current: 8.59 | Upside: 8.2%

Risk Level: Moderate – Momentum play with strong fundamentals

📊 Market Breadth Analysis

The market is showing healthy internal dynamics at midday:

Positive Indicators

- Advancing vs Declining: 1,847 advancing vs 1,203 declining (NYSE)

- New Highs: 127 stocks hitting 52-week highs

- Volume Distribution: 68% of volume in advancing stocks

- Sector Participation: 7 of 11 sectors positive

Areas of Caution

- Small Cap Divergence: Russell 2000 outperforming may signal rotation

- Bond Yields: 10-year Treasury at 4.25%, watching for rate sensitivity

- Earnings Reactions: Mixed responses to Q2 results creating volatility

⚡ STOCKBURGER MIDDAY RATING

🍔 StockBurger Market Rating: BULLISH

Market Sentiment: Constructive with record highs and broad participation

Key Themes: AI infrastructure, earnings beats, economic resilience

Afternoon Outlook: Expect continued strength into close

🕐 Afternoon Trading Outlook

As we head into the afternoon session, several factors will drive market action:

Catalysts to Watch

- NVIDIA Earnings (After Close): The most anticipated event of the day

- Fed Officials Speaking: Any commentary on September rate cut expectations

- Earnings Reactions: Continued digestion of Q2 results

- Options Expiration: Weekly options creating potential volatility

Trading Strategies

- Momentum Plays: Continue riding AI and database themes

- Sector Rotation: Technology leadership likely to persist

- Earnings Plays: Focus on companies with raised guidance

- Risk Management: Take profits on extended moves, maintain stops

📈 Stock Tickers & Performance

FEATURED MIDDAY STOCK TICKERS: PSTG - Pure Storage, Inc. SNOW - Snowflake Inc. MDB - MongoDB, Inc. CRWD - CrowdStrike Holdings Inc. NVDA - NVIDIA Corporation MSFT - Microsoft Corporation AAPL - Apple Inc. GOOGL- Alphabet Inc. TSLA - Tesla, Inc. AMZN - Amazon.com, Inc.

🎯 StockBurger Afternoon Game Plan

🍔 StockBurger Pro Strategy

Stay Long: Technology leadership and AI themes remain strong

Watch NVIDIA: Earnings after close could drive tomorrow’s direction

Sector Focus: Continue overweighting tech, energy, and industrials

Risk Management: Maintain 5% cash position for opportunities

🚨 Risk Factors

⚠️ Afternoon Risks

- NVIDIA Disappointment: Could trigger tech selloff

- Rate Sensitivity: Bond yields moving higher

- Profit Taking: Extended moves may see consolidation

- Geopolitical Events: Monitor for any developments

The StockBurger midday recap shows a healthy market environment with record highs, strong sector rotation, and continued AI momentum. As we digest lunch and prepare for the afternoon session, the bulls remain in control with technology leading the charge.

Disclaimer: This midday recap is for informational purposes only and not financial advice. Market conditions can change rapidly during trading hours. Always conduct your own research and consider your risk tolerance before making investment decisions.