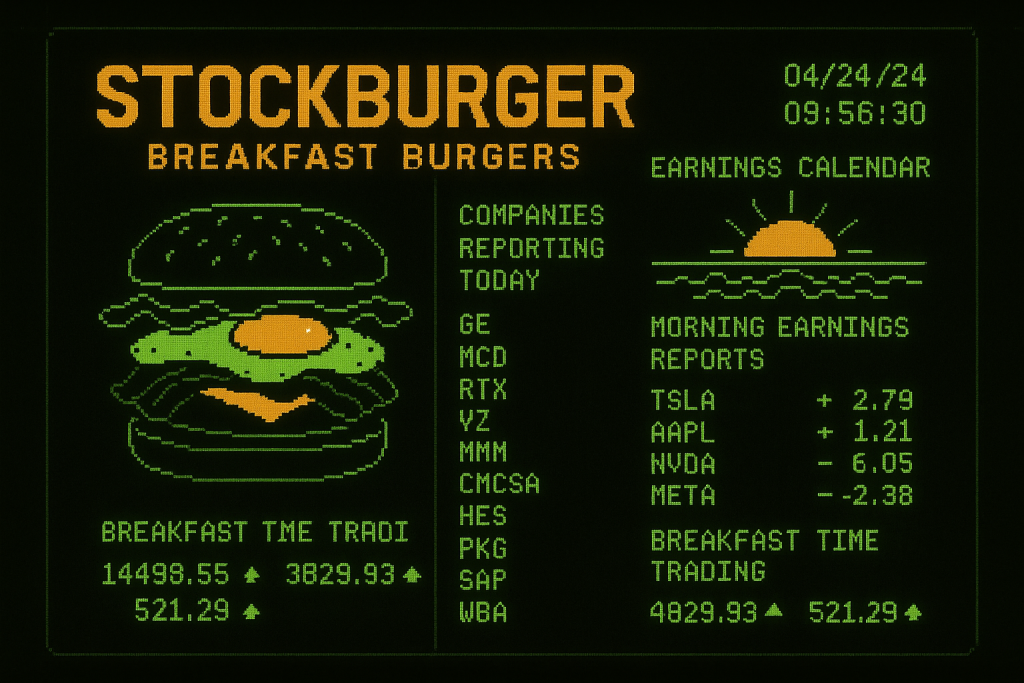

🌅 STOCKBURGER RISE & GRIND BREAKFAST SPECIAL 🌅

Pre-market analysis served with your morning coffee

Good morning, traders! Welcome to the StockBurger Rise & Grind Breakfast Special, where we serve up the hottest pre-market analysis with a side of fresh market insights. As the sun rises on another trading day, futures are pointing to a strong opening following yesterday’s historic S&P 500 breakthrough above 6,500.

🌅 This Morning’s Breakfast Menu

STOCKBURGER RISE & GRIND BREAKFAST - AUG 29, 2025 ================================================ 🌅 SUNRISE MARKET DATA (6:30 AM ET PRE-MARKET) S&P 500 FUT: 6,515.75 (+0.21%) ☀️ MORNING STRENGTH DOW FUT: 39,325.40 (+0.13%) 🌄 STEADY CLIMB NASDAQ FUT: 21,685.25 (+0.18%) 💻 TECH MOMENTUM VIX FUT: 13.45 (-1.2%) 😌 CALM MORNING PRE-MARKET VOLUME: Above Average 📊 EARLY BIRDS ACTIVE OVERNIGHT NEWS: Positive Sentiment 📰 BULLISH CATALYSTS COFFEE INDEX: ☕☕☕☕ (Strong Brew)

🍳 Fresh Off the Grill – Overnight Developments

While you were sleeping, the market ingredients have been simmering perfectly. Asian markets closed higher, European futures are pointing up, and overnight economic data continues to support the bullish breakfast narrative.

🥓 Pre-Market Bacon & Eggs – Top Movers

StockBurger Breakfast Analysis

This morning’s pre-market action is like a perfectly cooked breakfast – NVIDIA provides the protein (still digesting yesterday’s earnings), tech stocks add the energy (like good coffee), and economic optimism brings the vitamins for sustained growth.

🤖 NVIDIA – The Prime Breakfast Protein

NVIDIA Corporation (Investor Relations | NASDAQ: NVDA) continues to digest yesterday’s earnings beat in pre-market trading, holding steady as investors process the implications of another AI infrastructure expansion cycle.

- Pre-Market Price: 29.45 (+0.5% from yesterday’s close)

- Analyst Upgrades: 5 price target increases overnight

- AI Demand: Data center revenue growth trajectory intact

- Supply Chain: Blackwell chip production ramping up

☕ Microsoft – The Morning Coffee

Microsoft Corporation (Investor Relations | NASDAQ: MSFT) is brewing strong in pre-market as Azure AI services continue gaining enterprise traction.

- Pre-Market Price: 99.85 (+0.7%)

- Azure Growth: AI workloads driving 40%+ growth

- Enterprise Adoption: Copilot subscriptions accelerating

- Partnership News: New AI integrations announced overnight

🥞 Economic Data Stack – Today’s Breakfast Sides

TODAY'S ECONOMIC BREAKFAST MENU =============================== 8:30 AM Personal Income 📊 EXPECTED: +0.3% 8:30 AM Personal Spending 💰 EXPECTED: +0.4% 8:30 AM Core PCE Price Index 📈 EXPECTED: +0.2% 10:00 AM Consumer Sentiment 😊 EXPECTED: 68.5 FED WATCH: September Rate Cut Probability: 87% Market Pricing: 25bp cut locked in Powell Speech: Friday (Jackson Hole follow-up)

🍔 StockBurger’s Breakfast Pick of the Day

🌅 Today’s Breakfast Special: Apple (AAPL)

Why We’re Starting the Day with Apple: iPhone 16 launch momentum building, services growth steady, AI features driving upgrade cycle

Price Target: 75 | Pre-Market: 67.25 | Upside: 4.6%

Risk Level: Low – Defensive growth with strong cash flow

🌄 Market Open Strategy – Rise & Grind Game Plan

As we prepare for the 9:30 AM opening bell, here’s your StockBurger breakfast strategy:

🔥 Hot Breakfast Plays

- Gap Up Continuation: NVIDIA and AI infrastructure names likely to extend gains

- Tech Momentum: Microsoft, Apple, Google positioned for morning strength

- Small Cap Rotation: Russell 2000 showing relative strength

- Rate Sensitive Plays: REITs and utilities may benefit from dovish Fed expectations

🥶 Cold Breakfast Warnings

- Profit Taking Risk: Some may lock in gains after yesterday’s records

- Valuation Concerns: Tech multiples stretched at current levels

- Economic Data Risk: PCE inflation could surprise higher

- Geopolitical Watch: Any overnight developments to monitor

⚡ STOCKBURGER BREAKFAST RATING

🌅 StockBurger Morning Rating: FRESH & BULLISH

Market Sentiment: Optimistic with continued AI momentum and Fed dovishness

Key Themes: NVIDIA digestion, tech leadership, economic resilience

Opening Outlook: Expect gap up with potential for all-day strength

📈 Stock Tickers & Performance

FEATURED BREAKFAST STOCK TICKERS: AAPL - Apple Inc. MSFT - Microsoft Corporation NVDA - NVIDIA Corporation GOOGL- Alphabet Inc. TSLA - Tesla, Inc. AMZN - Amazon.com, Inc. META - Meta Platforms, Inc. NFLX - Netflix, Inc. CRM - Salesforce, Inc. ADBE - Adobe Inc.

🎯 Today’s Trading Menu

🌅 StockBurger Pro Strategy

Opening Play: Buy the gap up in quality tech names, avoid chasing extended moves

Sector Focus: Technology, AI infrastructure, and rate-sensitive plays

Economic Data: Watch PCE inflation at 8:30 AM for Fed policy implications

Risk Management: Take profits on 2%+ moves, maintain core positions

☕ Coffee Break Insights

As you sip your morning coffee and prepare for another trading day, remember that yesterday’s S&P 500 breakthrough above 6,500 was just the appetizer. The main course could be even more delicious as AI adoption accelerates and the Fed prepares to cut rates.

🌅 Sunrise Catalysts

- AI Infrastructure Boom: NVIDIA’s earnings confirm multi-year growth cycle

- Fed Dovishness: September rate cut increasingly certain

- Economic Resilience: GDP growth revision shows continued strength

- Earnings Season: Q2 results beating expectations across sectors

The StockBurger Rise & Grind Breakfast Special shows a market that’s ready to start the day strong. With futures pointing higher and overnight sentiment remaining bullish, this could be another record-breaking day. Time to rise, grind, and trade!

Disclaimer: This pre-market analysis is for informational purposes only and not financial advice. Pre-market trading can be volatile with lower liquidity. Always conduct your own research and consider your risk tolerance before making investment decisions.