Why Micron, Arm Holdings, and ASML Holdings Crashed Today

Shares of semiconductor sector favorites Micron Technology (NASDAQ: MU), Arm Holdings (NASDAQ: ARM), and ASML Holdings (NASDAQ: ASML) fell hard to start off September, down 8%, 6.9%, and 6.5%, respectively, as of the close of trading Tuesday.

Weaker-than-expected macroeconomic data sent the entire chip sector down hard, and ASML drew attention in a trade war spat regarding China over the weekend. But is this pullback a buying opportunity?

Weaker-than-expected manufacturing sends chips into a tailspin

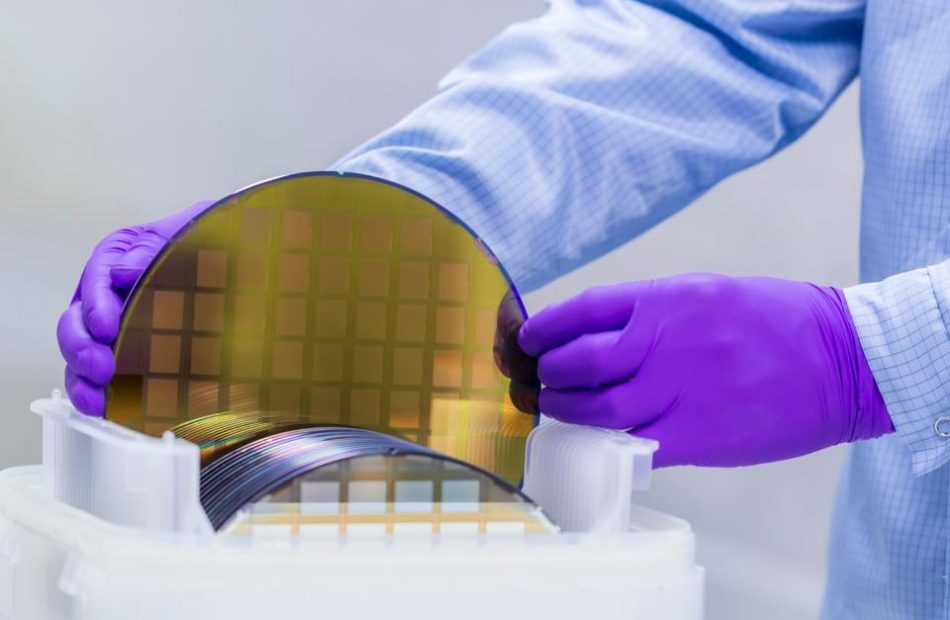

Coming into Tuesday, each of these three stocks had good-to-great results in the market year to date, which perhaps set them up for more pronounced sell-offs on bad news. As of Friday’s close, Arm Holdings had soared 77% in 2024 as AI enthusiasm took hold for its newer data center and PC solutions. ASML, which is the dominant provider of the EUV lithography machines that are crucial for the production of cutting-edge chips and memory for AI, was up by 20%, despite a July swoon. And Micron was up by just 13% as earlier enthusiasm for its AI prospects had moderated amid soft economic readings for the highly cyclical memory player.

While these three companies have benefited from the optimism around the future of AI, each is also somewhat cyclical, and their results can ebb and flow with the economy.

On that front, there was pessimistic news regarding U.S. and Chinese manufacturing. On Tuesday morning, the Institute for Supply Management released its Manufacturing Purchasing Managers’ Index for August, which came in weaker than analysts expected. The August reading was 47.2. While that was up from 46.8 in July, it was below the Dow Jones analyst consensus expectation of 47.9.

But some details were more worrying. The New Orders Index was worse than the overall reading at 44.6, down from 47.4 in July. But the Prices Index actually rose to 54 from last month’s 52.9 reading. And the Inventories Index rose 5.8 points to 50.3.

The combination of lower orders, rising inventories, and still-rising labor and freight costs points to the worst of all possible worlds: a stagflationary setup. That could hamstring the Fed’s ability to cut rates aggressively, despite Tuesday’s downward lurch in the manufacturing sector.

Of note, there was also trouble with China over the weekend: A report showed that its manufacturing activity fell to a six-month low of 49.1 in July, marking its fourth straight reading below 50. China’s economy has been mired in a slump for some time, and doesn’t appear to be coming out of it anytime soon. Of note, China is a big purchaser of semiconductors, so weak economic activity there could have an effect on all three of these companies.

In addition, China threatened Monday to stop buying ASML’s equipment. Last week, it was reported that the Netherlands may restrict ASML’s sales and service even for certain older deep ultraviolet lithography machines in China. But on Monday, an article in China’s government-backed Global Times said that China could cut off ASML “permanently” from the country if the Dutch government went ahead with those restrictions.

ASML is the outright global leader in lithography, so it’s unclear how China could replace all those machines. Still, losing that country as a market would be a bad scenario for ASML — it got 49% of its revenue from China last quarter. While some of the machines that would have gone there would likely be sold to companies in other geographies if China couldn’t make its own chips, ASML might not recover 100% of those lost sales, and that kind of move would be highly disruptive.

But it may not be all bad news

August’s manufacturing reading was certainly not great, which fueled fears that the Federal Reserve has fallen behind the curve on its fiscal policy pivot, which could potentially lead to lower U.S. economic growth or even recession in the coming quarters.

However, there were a couple of things for semiconductor bulls to hold onto. First, while a reading below 50 indicates a contraction for the manufacturing sector, the threshold of 42.5 is the level that indicates a broader economic downturn overall, and the U.S. is still well above that.

Second, delving into the quotes from purchasing managers included in the report, the electronics industry manager’s quote was actually bullish: “Business outlook is good. Recovery from the electronics slowdown is strong for the second half of the year.” Furthermore, the institute reported that out of the six largest manufacturing sectors, only the computer and electronics segment reported growth in new orders and increased production.

The personal electronics industry entered its downturn in late 2022 and appears to be recovering, while industrials and autos are now mired in the middle of their own downturns. So while higher benchmark interest rates appear to have contributed to a slowdown across most manufacturing sectors, the computer and electronics sector appears to be a strong outlier — at least for now.

Since the chip sector is largely selling off on Tuesday’s bad economic headlines, investors may want to take the opportunity to add to their positions in their favorite chip stocks.

Should you invest $1,000 in Micron Technology right now?

Before you buy stock in Micron Technology, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Micron Technology wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Billy Duberstein and/or his clients have positions in ASML and Micron Technology. The Motley Fool has positions in and recommends ASML. The Motley Fool has a disclosure policy.

Why Micron, Arm Holdings, and ASML Holdings Crashed Today was originally published by The Motley Fool

Why Verizon Stock Topped the Market on Tuesday

On a down Tuesday for U.S. equities, incumbent telecom stock Verizon (NYSE: VZ) managed to land well in positive territory. On speculation that the company is about to raise its already considerable dividend, investors snapped up its shares. This pushed its stock price nearly 3% higher, on a day when the S&P 500 index was in the red with a more than 2% decline.

Dividend raise on the way, say analysts

That morning, an analyst team at white-shoe investment bank Morgan Stanley opined that Verizon is days away from declaring a dividend raise. The prognosticators said that such an announcement is likely to occur this Thursday, Sept. 5. Morgan Stanley anticipates a $0.05-per-share annual hike to the big telecom‘s quarterly common stock payout, putting the next quarterly distribution at nearly $0.68 per share.

If realized, such an increase would be in line with Verizon’s recent dividend raises. While the company is a frequent lifter, consistently adding to its payout every year, its bumps tend to be small. On a quarterly basis, the most recent one, declared last September, was barely over $0.01 per share.

Although Verizon is an effective, very profitable telecom services provider and has good fundamentals, its shareholder distribution is clearly a major part of its appeal for many investors. It is a high-yield dividend at a rate of nearly 6.3%; this rate would remain unchanged with a $0.05 annual increase.

The company can afford it

Verizon’s cash flow is thick and heavy, as it operates a business with millions of regularly paying subscribers. This means it has plenty of financial muscle helping it flex that high dividend. At the moment, its cash dividend payout ratio is under 80%, which indicates the distribution is well-funded and sustainable, barring any sudden catastrophe with the company.

Should you invest $1,000 in Verizon Communications right now?

Before you buy stock in Verizon Communications, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Verizon Communications wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Eric Volkman has no position in any of the stocks mentioned. The Motley Fool recommends Verizon Communications. The Motley Fool has a disclosure policy.

Why Verizon Stock Topped the Market on Tuesday was originally published by The Motley Fool

Charlie Munger Predicted Inflation Surge Was 'Inevitable' Because of Democracies and Told How to Protect Against It – 'Most People are Going to Suffer'

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Charlie Munger passed away last year, but his broad outlook on life and decades of experience in the financial markets continue to guide millions worldwide. There is hardly a problem in the economic arena about which Munger didn’t talk. As inflation remains a hot topic in America amid elevated costs of living, we decided to dig deeper into Charlie Munger’s archives of his letters to shareholders and transcripts of his speeches to see what he predicted about the phenomenon.

Trending Now:

‘More Inflation is Inevitable’ Over the Next 100 Years

During a Q&A session at a Daily Journal Corporation shareholder meeting in 2023, Charlie Munger was asked about the inflation crisis. Munger made some prescient comments in response:

“I think more inflation over the next 100 years is inevitable with – given the nature of democratic politics – politics in a democracy. So I think we’ll have more inflation.”

Munger also said that the Daily Journal owns securities instead of government bonds because of inflation.

According to Charlie Munger archives compiled by The Inoculated Investor, the billionaire was asked about inflation during a conversation at the Pasadena Convention Center in 2011.

Munger replied that it was “pretty likely” that we’d have inflation over the next 50 to 100 years. However, he said that inflation did not halt civilization’s success. At another point, Munger reiterated this point:

“I remember buying ice cream cones and hamburgers for a nickel. On the other hand, after inflation, the country has done wonderfully. Many of the people who were the Jeremiahs of that age have been proven wrong; the country could stand as much inflation as it got.”

‘Most People Are Going to Suffer’ Due to Inflation

In 2022, while speaking at an event for the Singleton Foundation for Financial Literacy and Entrepreneurship, Munger predicted that life would become harder for common people because of inflation.

“I don’t think most people are going to do really well with inflation. I think most people are going to be way better off, at least the people that have any money will be way better off, if there weren’t any inflation. And so it’s just a question of how most of them aren’t going to profit. Most people are going to suffer.”

The Relationship Between Democratic Governments and Inflation According to Charlie Munger

During his talk, Munger said that he believed inflation would rise because “democratically elected politicians” would “eventually” print too much money.

Whitney Tilson, the Editor of Stansberry Investment Advisory and founder of Empire Financial Research, has been a close follower of Charlie Munger’s life. He’s compiled vast archives of transcripts of Charlie Munger’s speeches, dating back to when no recordings were allowed during Berkshire Hathaway’s meetings.

According to Tilson’s notes, Charlie Munger once said the following about inflation and its strange relationship to democratic governments:

“I think democracies are prone to inflation because politicians will naturally spend [excessively] – they have the power to print money and will use money to get votes.”

Munger said that while inflation continues to tick up in the long term, it increases more under democracies. He said there was “no inflation” in the U.S. from 1860 through 1914, which saw “strong growth.”

“I don’t think we’ll get deflation. The bias is way more pro-inflation than it was between 1860-1914. But I don’t think other forms of government will necessarily do better. Some of the worst excesses occur under tyrannies,” Munger said.

Read More:

-

With returns as high as 300%, it’s no wonder this asset is the investment choice of many billionaires. Uncover the secret.

-

You don’t have to own a property to make money from fix-and-flip investments. Get started with only $10.

Munger Believed There Is No ‘Perfect Correlation’ Between Inflation and Interest Rates

According to the archives, Charlie Munger once said that he had never believed there was a “perfect correlation” between interest rates and inflation.

“I think there’s some relation, but it’s complex and not easily quantifiable.”

High-Quality Businesses During Inflation

Charlie Munger thought companies making high-quality products for a specific niche of customers who can afford higher prices are better positioned to raise prices. He gave the example of ISCAR, the metal-cutting tools company that Warren Buffett’s Berkshire acquired in 2006.

“Iscar is so good at delivering good products, it is hard for me to imagine them not selling more to customers who are making more money.”

How to Protect Against Inflation According to Charlie Munger

At a WESCO annual meeting in 2009, Munger was asked by multiple people about the inflation problem and how to protect against it. Here’s what he said:

“I remember 2c stamps, 5c hamburgers, and the minimum wage of 30c/hr. In 80 years since those prices, there has been lots of inflation. Did it ruin investment opportunities? No. It isn’t easy, there are always huge risks, and of course, there will be inflation.”

Munger also mentioned buying government bonds as a hedge against inflation.

“We bought utility bonds to yield nine or 10%. What about inflation, you might ask? Well, government bonds are yielding 3%, so 9% isn’t bad. We don’t have one size fits all.”

Lock In High Rates Now With A Short-Term Commitment

Leaving your cash where it is earning nothing is like wasting money. There are ways you can take advantage of the current high interest rate environment through private market real estate investments.

EquityMultiple’s Basecamp Alpine Notes is the perfect solution for first-time investors. It offers a target APY of 9% with a term of only three months, making it a powerful short-term cash management tool with incredible flexibility. EquityMultiple has issued 61 Alpine Notes Series and has met all payment and funding obligations with no missed or late interest payments. With a minimum investment of $5,000, Basecamp Alpine Notes makes it easier than ever to start building a high-yield portfolio.

Don’t miss out on this opportunity to take advantage of high-yield investments while rates are high. Check out Benzinga’s favorite high-yield offerings.

This article Charlie Munger Predicted Inflation Surge Was ‘Inevitable’ Because of Democracies and Told How to Protect Against It – ‘Most People are Going to Suffer’ originally appeared on Benzinga.com

Stocks Hit by Biggest Selloff Since August Crash: Markets Wrap

(Bloomberg) — Stocks posted their worst day since the Aug. 5 market meltdown, with the S&P 500 falling more than 2%, as growth and monetary anxieties combined to torch risky assets much as they did a month earlier.

Most Read from Bloomberg

Just as in the August episode, tech got hit the hardest, with Nvidia Corp. driving a plunge in chipmakers. And the parallels don’t stop there. The yen jumped, a closely watched manufacturing gauge again missed forecasts, and oil plummeted on concern about tepid global demand. Wall Street’s “fear gauge” – the VIX – soared. Treasury yields tumbled, with traders keeping their bets on an unusually large half-point Federal Reserve rate cut this year.

The S&P 500 and the Nasdaq 100 saw their worst starts to a September since 2015 and 2002, respectively. With inflation expectations anchored, attention has shifted to the health of the economy as signs of weakness could speed up policy easing. While rate cuts tend to bode well for equities, that’s not usually the case when the Fed is rushing to prevent a recession.

Traders are anticipating the Fed will reduce rates by more than two full percentage points over the next 12 months — the steepest drop outside of a downturn since the 1980s. The trepidation after the latest rise in unemployment will leave traders “on edge” until Friday’s payrolls data, said Ian Lyngen and Vail Hartman at BMO Capital Markets.

“This week’s jobs report, while not the sole determinant, will likely be a key factor in the Fed’s decision between a 25 or 50 basis-point cut,” said Jason Pride and Michael Reynolds at Glenmede. “Even modest signals in this week’s jobs report could be a key decision point as to whether the Fed takes a more cautious or aggressive approach.”

The S&P 500 dropped to around 5,530. The Nasdaq 100 and the Russell 2000 each lost over 3%. The Dow Jones Industrial Average fell 1.5%. The $22 billion VanEck Semiconductor ETF saw its biggest plunge since March 2020. Nvidia tumbled 9.5%, erasing $279 billion in a record one-day wipeout for a US stock. The US Justice Department sent subpoenas to Nvidia and other companies as it seeks evidence that the chipmaker violated antitrust laws.

US 10-year yields fell seven basis points to 3.84%. A record number of blue-chip firms tapped the corporate-bond market, taking advantage of cheaper borrowing. The yen climbed as Bank of Japan’s Kazuo Ueda reiterated the central bank will continue to raise rates if the economy and prices perform as expected.

The Morgan Stanley strategist who foresaw last month’s market correction says firms that have lagged the rally in US stocks could get a boost if Friday’s jobs data provide evidence of a resilient economy. A stronger-than-expected payrolls number would likely give investors “greater confidence that growth risks have subsided,” Michael Wilson wrote.

The equity-market rally may stall near record highs even if the Fed starts a highly anticipated rate-cutting cycle, JPMorgan Chase & Co. strategists said earlier this week. The team led by Mislav Matejka noted that any policy easing would be in response to slowing growth, making it a “reactive” reduction.”

“We are not out of the woods yet,” Matejka wrote in a note, reiterating his preference for defensive sectors against the backdrop of a pullback in bond yields. “Sentiment and positioning indicators look far from attractive, political and geopolitical uncertainty is elevated, and seasonals are more challenging again in September.”

September has been the biggest percentage loser for the S&P 500 since 1950, according to the Stock Trader’s Almanac. A contrarian sentiment gauge from Bank of America Corp. rose to its highest level in nearly two and a half years last month — creeping closer to a “sell” signal for US stocks.

To Callie Cox at Ritholtz Wealth Management, aside from the macro picture, there’s also the fact that we’re entering what’s often a “miserable time” of the year for equities.

“While history isn’t gospel, it’s not crazy to think that this September could be especially volatile,” Cox noted. “But this isn’t the conclusion to draw from decades of seasonal market data. Instead, your attention should be on why this is a “buyable dip, because there are a lot of reasons to be optimistic here.”

Among those, she cited: earnings growth, the Fed about to start easing policy against the backdrop of controlled inflation and the fact that investors are sitting on a massive pile of cash “that could make its way back into stocks.”

“A key lesson from the last few weeks is that big-tech stocks have not proven defensive during the recent market pullbacks,” said Philip Straehl at Morningstar Wealth. “While there is little evidence of a slowdown in AI spending, valuations have set a high bar for incoming corporate and macro data.”

Rich Ross at Evercore says the S&P 500 has had at least a 5% drawdown from the August/September highs in nine of the last 10 years.

“This year should be no different after the late August squeeze into resistance at an all-time high,” Ross noted. “The S&P has a strong downside bias buttressed only by a bent towards ‘low volatility’ defensives and financials — which benefit from lower rates and steeper curves.”

As investors navigate through the historically weak September, Anthony Saglimbene at Ameriprise remarked the October-December period is the S&P 500’s strongest three-month stretch.

“In our view, investors should remain focused on using volatility to their advantage,” Saglimbene said. “Importantly, lean on time-tested dollar-cost averaging strategies and portfolio diversification to weather a potentially bumpier push into year end.”

Marking the start of a busy week for economic data, a report showed US manufacturing activity shrank in August for a fifth month.

This coming Friday, the August jobs report is expected to show payrolls in the world’s largest economy increased by about 165,000, based on the median estimate in a Bloomberg survey of economists.

While above the modest 114,000 gain in July, average payrolls growth over the most recent three months would ease to a little more than 150,000 — the smallest since the start of 2021. The jobless rate probably edged down in August, to 4.2% from 4.3%.

While the Fed is finally coming around to cutting rates, it does not feel like stringing out a bunch of 25 basis-point rate cuts will do the job, said Neil Dutta at Renaissance Macro Research. Under that scenario, it will take a long time to return the funds rate to neutral and in the process, you’ll keep policy restrictive, keeping open downside risks to growth.

“That muddling through scenario will probably risk further increases in the unemployment rate. So, if they aren’t going 50 in September, they are going to need to go 50 at some point later this year,” he concluded.

Corporate Highlights:

-

Boeing Co. slumped as Wells Fargo & Co. lowered the planemaker to a sell-equivalent recommendation, saying it’s hard to see any upside in the shares.

-

Vice President Kamala Harris joined President Joe Biden in declaring that United States Steel Corp. should remain domestically owned and operated, the latest headwind to the proposed sale of the company to Japan-based Nippon Steel Corp.

-

Deutsche Bank AG cut the recommendation on JPMorgan Chase & Co. to hold from buy, while upgrading Bank of America Corp. and Wells Fargo & Co. on changing preferences within the banks sector.

-

The German government plans to cut its stake in Commerzbank AG as it seizes on a recent share rally to initiate an exit from the lender it rescued over a decade ago.

-

Illumina Inc.’s blocked $7 billion takeover of cancer-detection provider Grail Inc. should never have been probed by the European Union, according to a top court ruling that undermines the EU’s attempt to vet more global deals.

-

Cathay Pacific Airways Ltd.’s inspection of its Airbus SE A350 fleet is focused on deformed or degraded fuel lines in the engines of the widebody aircraft, after the discovery of the issue caused multiple flight cancellations as engineers switch out parts.

Key events this week:

-

China Caixin services PMI, Wednesday

-

Eurozone HCOB services PMI, PPI, Wednesday

-

Canada rate decision, Wednesday

-

US job openings, factory orders, Beige Book, Wednesday

-

Eurozone retail sales, Thursday

-

US initial jobless claims, ADP employment, ISM services index, Thursday

-

Eurozone GDP, Friday

-

US nonfarm payrolls, Friday

-

Fed’s John Williams speaks, Friday

Some of the main moves in markets:

Stocks

-

The S&P 500 fell 2.1% as of 4 p.m. New York time

-

The Nasdaq 100 fell 3.1%

-

The Dow Jones Industrial Average fell 1.5%

-

The MSCI World Index fell 1.7%

-

Bloomberg Magnificent 7 Total Return Index fell 3.4%

-

Philadelphia Stock Exchange Semiconductor Index fell 7.8%

-

The Russell 2000 Index fell 3.1%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.1%

-

The euro fell 0.3% to $1.1042

-

The British pound fell 0.3% to $1.3109

-

The Japanese yen rose 0.9% to 145.64 per dollar

Cryptocurrencies

-

Bitcoin fell 1.6% to $58,072.73

-

Ether fell 4% to $2,451.58

Bonds

-

The yield on 10-year Treasuries declined seven basis points to 3.84%

-

Germany’s 10-year yield declined six basis points to 2.28%

-

Britain’s 10-year yield declined six basis points to 3.99%

Commodities

-

West Texas Intermediate crude fell 4.4% to $70.31 a barrel

-

Spot gold fell 0.3% to $2,491.71 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Lu Wang.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Nvidia is flashing a sell signal and its huge rally marks the peak of a 40-year market cycle, veteran strategist says

-

Nvidia’s stock is flashing a sell signal, says strategist Bill Blain.

-

Blain cites Nvidia’s high valuation and its wealthy employees as reasons to bail.

-

He says the run-up in the chip maker’s stock marks the peak of a decadeslong market cycle.

Nvidia’s stock is flashing a big “sell” sign to investors, according to the veteran strategist Bill Blain.

Blain, the founder of Wind Shift Capital and a longtime financial strategist, pointed out in a note on Tuesday that Nvidia’s sky-high valuation has made many of its employees very wealthy. He referred to a recent poll that found 40% of those who worked at Nvidia had a net worth between $1 million and $20 million, while 37% had a net worth of over $20 million.

Blain said that leaves less than a third of Nvidia’s staff with “any real daily financial pressure upon them.”

“Do you think that poor quarter of Nvidia peons are really going to bust their guts for guys who are already rich and highly motivated to protect their wealth and position? Do they think Nvidia will rise a further 700%? Will they be happy remaining exceedingly poor relative to their peers and bosses? Or is it more likely the enormous wealth in the office means the poorer but still highly motivated staff are going to figure their wealth chances will be better elsewhere?” Blain wrote.

Nvidia’s enormous valuation could also signal a peak in the broader stock market, Blain said. While investors are pricing in ambitious rate cuts over the next year, policy easing will likely be “limited” from the Fed, he said, adding that he believed 4%-6% interest rates would constitute the market’s new normal.

“Some folk think lower interest rates, as promised by the Fed later this month, spell joy unlimited for markets. (I think it may still be a sell-the-fact moment.)” Blain said. “And many, including myself, believe a new long-term economic cycle could reverse the last 40 years of diminished inflationary pressures.”

Markets began their current long-term cycle in 1980s as inflation steadily decreased following a difficult period of inflation during the prior decade, Blain said. He suggested that markets could enter a fresh cycle as soon as 2025, pointing to inflationary pressures stemming from geopolitical tensions, commodities, and the mounting US debt balance.

“I just found my best reason to sell Nvidia, confirming we’re at the top of the market. What might come next? How about 20-years of rising inflation, rising rates, and a global commodities super-cycle as nations scrabble to secure future strategic resources?” he added.

Other strategists have warned of continued inflationary pressures, despite price growth trending downward from its peak in 2022. Inflation could see a resurgence, BlackRock strategists previously predicted, pointing to the risk of a big spike in oil prices, as well as demand outpacing supply in the US economy.

Read the original article on Business Insider

The stock market's biggest risk this week is a hot August jobs report, BofA says

-

Bank of America warns a hot August jobs report on Friday could send the stock market lower.

-

A big nonfarm payroll number may recalibrate rate cut expectations, affecting investor sentiment.

-

Economists predict 162,000 jobs added in August, but some expect up to 225,000.

The biggest risk for the stock market this week is a hotter-than-expected August jobs report, according to Bank of America.

The bank highlighted the risk in a note on Monday, arguing that a too-hot employment reading would reprice the number of expected interest rate cuts this year.

“Equities seem more excited about the cuts than concerned about a potential recession, gauging by their return to near highs and the outperformance of small caps and equal-weighted S&P,” Bank of America strategist Ohsung Kwon said.

He added: “If that’s true, the main risk for equities this week is a hot NFP that reprices short-term rates higher.”

The August non-farm payrolls report is set to be released Friday morning. Economists expect 162,000 jobs to be added to the economy last month, which, if accurate, would lower the unemployment rate to 4.2% from 4.3%.

Economists at Bank of America expect just two 25 basis point interest rate cuts this year, while the market is pricing in “recession-sized” rate cuts of 100-basis points, according to the CME FedWatch Tool.

If the US economy sees a strong rebound from the weak July jobs report, it could drive a sentiment change in the market and prove that investors are overly confident in the Fed’s rate cut path.

According to the note, this would likely put downward pressure on the stock market, as Kwon recommended investors hedge the downside risk with October put spreads on the S&P 500.

Recent signs of a resilient economy include second-quarter GDP growth being revised higher to 3.0% from 2.8%, as well as solid personal spending data, which jumped 0.5% month-over-month in July.

“The economy continues to disprove skeptics. Growth has certainly cooled relative to last year, but it has done so at a gradual pace,” Kwon said.

One Wall Street strategist who expects a hot jobs report on Friday is Ed Yardeni of Yardeni Research.

In a note to clients on Monday, Yardeni said he expects 200,000 to 225,000 jobs were added to the economy last month.

If accurate, this would blow away economist estimates and align with the strong jobs reports seen in May and June, playing into the idea that the Fed doesn’t need to cut interest rates all that much.

“It is very unlikely that the Fed will have to lower the federal funds rate as rapidly and by as much as was necessary during previous monetary easing cycles when financial crises triggered credit crunches and recessions,” Yardeni said.

While Yardeni’s optimistic outlook would be great news for the economy, it could prove to be a headwind for stock prices in the short term.

Read the original article on Business Insider

Why Nvidia Stock Is Plummeting Today

Nvidia (NASDAQ: NVDA) stock is getting hit hard in Tuesday’s trading. The semiconductor company’s share price was down 8.7% as of 2:15 p.m. ET, according to data from S&P Global Market Intelligence.

The artificial intelligence (AI) leader’s share price is falling in response to rising concerns about the health of the U.S. economy. News out of China and other geopolitical dynamics are also prompting sell-offs for Nvidia and other chip stocks today.

Investors are feeling jittery ahead of this week’s jobs report

The U.S. Department of Labor is expected to release its latest employment data on Friday, and Wall Street is seeing an uptick in bearish sentiment ahead of the report. Investors have been looking forward to interest-rate cuts that are expected to be delivered by the Federal Reserve this month, and the rate reduction could be larger than many analysts initially expected. But there’s a catch.

Some analysts now expect that the Fed will cut interest rates by a full point this year. If so, that could be a sign that the central banking authority believes the economy is on track for a recession. Investors are bracing for a worrying jobs report at the end of this week, and Nvidia and other high-profile growth stocks are seeing big valuation pullbacks.

Concerns that China will invade Taiwan hit chip stocks, again

In an interview on Sunday, Taiwanese President Lai Ching-te said that China should also move to reclaim land from Russia if it wants to officially make Taiwan its territory. Rather than suggesting that China should take back Russian land that used to be within its own borders, Lai was making a statement about whether the Chinese government was being logically consistent in some of its stated reasons for plans to exert greater control over Taiwan. Nevertheless, it looks like the comments from Taiwan’s president are highlighting the risk that China could invade Taiwan at some point in the not-too-distant future.

While the Chinese government has long made claims that Taiwan is already part of its territory, the contention has taken on added importance in light of the crucial role that Taiwan plays in semiconductor manufacturing and artificial intelligence trends. The island nation is home to Taiwan Semiconductor Manufacturing — the leading contract manufacturer of semiconductors that’s responsible for the fabrication of advanced chips for AI applications. Nvidia relies on TSMC for the fabrication of its chips, and any disruptions to the fab leader’s output could have major implications for the company’s performance.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

Why Nvidia Stock Is Plummeting Today was originally published by The Motley Fool

Nvidia Receives DOJ Subpoena In Antitrust Investigation: What To Know

NVIDIA Corp NVDA shares are trading lower after hours Tuesday after the company received a subpoena from the U.S. Department of Justice (DOJ).

According to a Bloomberg report, the DOJ sent subpoenas to Nvidia and other companies in an escalation of its investigation into possible antitrust law violations by the AI computing giant.

Read Next: What’s Going On With Lululemon Stock After Earnings?

The DOJ is concerned with whether Nvidia penalizes buyers that don’t exclusively use Nvidia chips and if the company is making it difficult for customers to switch to other chip suppliers. According to the report, the investigation is being led by the DOJ’s San Francisco office.

When trying to assess whether or not Nvidia will trade higher from current levels, it’s a good idea to take a look at analyst forecasts.

Wall Street analysts have an average 12-month price target of $152.71 on Nvidia. The Street high target is currently at $200 and the Street low target is $90. Of all the analysts covering Nvidia, 47 have positive ratings, two have neutral ratings and none have negative ratings.

In the past month, 28 analysts have adjusted price targets. Here’s a look at recent price target changes [Analyst Ratings]. Benzinga also tracks Wall Street’s most accurate analysts. Check out how analysts covering Nvidia have performed in recent history.

Stocks don’t move in a straight line. The average stock market return is approximately 10% per year. Nvidia is 124.22% up year-to-date. The average analyst price target suggests the stock could have further upside ahead.

For a broad overview of everything you need to know about Nvidia visit here. If you want to go above and beyond, there’s no better tool to help you do just that than Benzinga Pro. Start your free trial today.

NVDA Price Action: According to Benzinga Pro, Nvidia shares are down 2.13% after-hours at $105.70 after falling 9.53% during regular trading Tuesday.

Read Also:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 High-Yield Dividend Stocks That Are Screaming Buys in September

High-yielding dividend stocks have underperformed in recent years. Higher interest rates have weighed down many.

However, that could be about to change, given the expectations that the Federal Reserve will start cutting interest rates soon. That’s left several high-quality, high-yield dividend stocks looking like screaming buys this September for those seeking income and upside potential. Three top ones to buy this month are Kinder Morgan (NYSE: KMI), Brookfield Renewable (NYSE: BEPC)(NYSE: BEP), and Enbridge (NYSE: ENB).

Plenty of gas to continue growing

Kinder Morgan currently yields over 5%. That’s several times higher than the S&P 500‘s dividend yield of less than 1.5%. The primary reason is Kinder Morgan’s dirt cheap valuation.

The natural gas pipeline giant expects to produce around $2.26 per share of distributable free cash flow this year. With its share price recently around $21.50 apiece, it trades at less than 10 times earnings. That’s significantly cheaper than the S&P 500’s 24.

Kinder Morgan might not stay that cheap for long if the Fed starts raising rates. However, that’s not Kinder Morgan’s only upside catalyst. The pipeline company retains about half its cash flow after paying dividends, which it uses to grow shareholder value by investing in high-return capital projects, repurchasing shares, and enhancing its financial flexibility. The company currently has about $5.2 billion of high-return capital projects under construction, half of which will come online by the end of next year. The growing cash flow from those capital projects will give it more fuel to increase its dividend, which it has done for seven straight years.

Powerful potential

Brookfield Renewable currently yields around 5%. The leading global renewable energy producer generates lots of stable cash flow to pay dividends. It produced $0.96 per share of funds from operations (FFO) during the first half of this year, about 75% of which it paid out in dividends. Annualize its FFO and Brookfield trades at 15 times earnings, given its recent share price at around $28.50.

The company is dirt cheap compared with the broader market and its growth potential. Brookfield Renewable expects several catalysts to grow its FFO per share by more than 10% annually through 2028. That should give it the power to increase its dividend by 5% to 9% annually. The company has grown its payout at a 6% compound annual rate over the past two decades.

Brookfield Renewable has significant long-term upside potential, given the accelerating demand for power, especially renewable energy. The world needs to deploy an unprecedented amount of electricity-generating capacity over the next 20 years to power electric vehicles, homes, businesses, and new technologies like AI. The market is severely underestimating this opportunity, which could power robust growth for Brookfield Renewable for decades to come.

The fuel to keep its streak alive

Enbridge currently yields more than 6.5%. The Canadian pipeline and utility company generates lots of stable cash flow to pay dividends. It expects to produce about $5.60 Canadian, or $4.15, of distributable cash flow per share this year at the mid-point of its outlook. With its share price right around $40, it trades at less than 10 times free cash flow.

The company pays out 60% to 70% of its stable cash flow in dividends. It retains the rest to fund expansion projects and maintain its financial flexibility. The company has a massive CA$24 billion ($17.8 billion) of capital projects currently under construction that should come online through 2028. Those projects include additional oil storage and export capacity, natural gas pipelines, gas utility expansions, and renewable-energy projects.

Enbridge expects a combination of expansion projects, cost savings and optimizations, and acquisitions to fuel 3% annual cash flow per share growth through 2026 and 5% per year after that. That should give the company the fuel to continue increasing its dividend by as much as 5% annually. It’s managed to raise its payout for 29 straight years.

Bargain buys this September

Because Kinder Morgan, Brookfield Renewable, and Enbridge trade at dirt cheap valuations, they offer high dividend yields and upside potential. They could easily generate double-digit total annual returns from here. That compelling combination makes them look like screaming buys this September.

Should you invest $1,000 in Kinder Morgan right now?

Before you buy stock in Kinder Morgan, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Kinder Morgan wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Matt DiLallo has positions in Brookfield Renewable, Brookfield Renewable Partners, Enbridge, and Kinder Morgan. The Motley Fool has positions in and recommends Brookfield Renewable, Enbridge, and Kinder Morgan. The Motley Fool recommends Brookfield Renewable Partners. The Motley Fool has a disclosure policy.

3 High-Yield Dividend Stocks That Are Screaming Buys in September was originally published by The Motley Fool

Why stocks could drop 10% over the next 8 weeks, according to a bullish forecaster who's nailed his calls this year

-

Stocks could pull back as much as 10% in the next eight weeks, Fundstrat’s Tom Lee said.

-

He told CNBC that investors should be cautious ahead of Fed interest-rate cuts and the election.

-

Lee says the sell-off will be an ideal time to buy the dip.

Stocks are facing a possible double-digit drawback in the next eight weeks as a slew of market-moving events temporarily challenge this year’s gains, Fundstrat’s Tom Lee told CNBC.

Lee suggested that the market could fall between 7% to 10%, and recommended that investors gear up for elevated turbulence.

“I think investors should be cautious for the next eight weeks,” the typically bullish investor said. “Market’s been up seven of the eight months this year. So we know it’s an incredibly strong market. But we also have the September cuts, and we have the election: things that’ll get people nervous.”

That’s partly a reference to the Federal Reserve’s upcoming policy meeting in mid-September, during which the central bank is expected to slash interest rates by at least 25 basis points.

Analysts have separately indicated that the market might not welcome deeper cuts. Bank of America wrote on Tuesday that if the Fed had to cut by 50 basis points instead, this would likely be in response to elevated recession risk.

Friday’s jobs report will determine the Fed’s decision later this month, with some on Wall Street fearing it may come in weaker than expected. But Lee cited that a pullback could ensue even if it beats forecasts, as investors readjust interest rate outlooks.

“If it’s too strong and investors worry and so the stock market’s down Friday, I’d be buying that dip,” he told the outlet.

Lee has been largely on the mark with his stock market calls in 2024, heading into the year as one of Wall Street’s bullish forecasters. His optimism has been met in the form of an 18% year-to-date gain for the S&P 500 through Friday.

Meanwhile, election uncertainty may put off investors until the results are known, experts told Business Insider.

Even outside an election year, September is a challenging month for stocks in a non-election year. But when voters head to the polls, seasonal volatility can extend as far as mid-October. SoFi’s Liz Young Thomas told the outlet.

There’s a silver lining: investors can expect a relief rally once a president is chosen, she said.

Lee similarly cited that the “tough” weeks ahead should be viewed as a buying opportunity.

“I think in the next eight weeks, people get a chance to buy,” he told CNBC. “I think it’s good to be cautious, but just ready to buy that dip.”

The strategist has been one of the market’s staunchest bulls. In June, he argued that the S&P 500 could triple this decade, reaching 15,000 by 2030.

Read the original article on Business Insider