Madison Covered Call and Equity Strategy Fund (MCN) Declares Quarterly Dividend

MADISON, Wis., Sept. 03, 2024 (GLOBE NEWSWIRE) — The Madison Covered Call and Equity Strategy Fund MCN (the “Fund”) declares its quarterly dividend of $0.18/share. The dividends will be payable September 30, 2024, to shareholders of record on September 17, 2024. The ex-dividend date will be September 17, 2024. If it is determined that a notification is required pursuant to Section 19(a) of the Investment Company Act of 1940, as amended, such notice will be posted to the Fund’s website after the close of business three business days before the payable date. If a distribution rate is largely comprised of sources other than income, it may not reflect Fund performance.

The Fund’s objective is to achieve a high level of current income and current capital gains, with long-term capital appreciation as a secondary objective. The Fund intends to pursue its objective by investing in a portfolio of common stocks and utilizing an option strategy, primarily by writing (selling) covered call options on a substantial portion of the common stocks in the portfolio in order to generate current income and gains from option writing premiums and, to a lesser extent, from dividends. Market action can impact dividend issuance as the Fund’s total assets affect the Fund’s future dividend prospects. The Fund provides additional information on its website at www.madisonfunds.com.

Certain statements in this release are forward-looking. The Fund’s actual results may differ from current expectations or projections due to numerous factors, including but not limited to changes in the equity markets, changes in the portfolio’s value and other risks generally discussed in the Fund’s filings with the SEC. Neither the Fund nor Madison undertakes any obligation to publicly update or revise any forward-looking statements.

“Madison” and/or “Madison Investments” is the unifying tradename of Madison Investment Holdings, Inc., Madison Asset Management, LLC (“MAM”), and Madison Investment Advisors, LLC (“MIA”). MAM and MIA are registered as investment advisers with the U.S. Securities and Exchange Commission. Madison Funds are distributed by MFD Distributor, LLC. MFD Distributor, LLC is registered with the U.S. Securities and Exchange Commission as a broker-dealer and is a member firm of the Financial Industry Regulatory Authority. The home office for each firm listed above is 550 Science Drive, Madison, WI 53711. Madison’s toll-free number is 800-767-0300.

CONTACT:

Madison

Greg Hoppe: gregh@madisonadv.com

800-767-0300

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Asana Partners Promotes Clare Walsh to Managing Director

CHARLOTTE, N.C., Sept. 3, 2024 /PRNewswire/ — Asana Partners, a retail-focused real estate private equity firm, today announced that Clare Walsh has been promoted to Managing Director.

In her role as Managing Director, Walsh will oversee retail leasing strategy and execution in addition to her continued role on the firm’s Investment Committee.

Walsh joined Asana Partners in 2018 as Director — Leasing Strategy and has more than 14 years of experience in retail leasing. Prior to joining Asana Partners, Walsh was a Senior Leasing Representative at Brookfield Properties Retail Group (BPRG), where she led restaurant leasing efforts in the Western region. Prior to BPRG, Walsh worked for EDENS, a privately held REIT, where she was responsible for retail leasing efforts in the Mid-Atlantic region.

“Clare assumed overall leadership of retail leasing in 2022 and is a well-respected leader within the firm, throughout the retail marketplace, and with our investors,” said Sam Judd, Managing Partner. “Clare’s creative vision and deep relationships with top retailers have been instrumental in the successful activation of countless neighborhoods throughout the United States.”

Walsh graduated from American University with a Bachelor of Arts in International Business and Marketing and is an active member of the International Council of Shopping Centers.

About Asana Partners

Asana Partners is a retail real estate investment firm creating value in vibrant neighborhoods by leveraging vertically integrated capabilities and retail expertise. With more than $7 billion of neighborhood assets under management, the firm is active in growth markets throughout the United States and is driven to make a positive impact within communities. Asana Partners champions a strong collaborative culture with offices in Charlotte, Columbia, Atlanta, Los Angeles, Denver, Boston, and New York. For more information, visit www.asanapartners.com or follow @asanapartners.

Media Contact

Julie Ducworth: (803) 465-1198; julie@jcdcommunications.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/asana-partners-promotes-clare-walsh-to-managing-director-302237180.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/asana-partners-promotes-clare-walsh-to-managing-director-302237180.html

SOURCE Asana Partners

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Algoma Steel Group to Participate in the Jefferies 2024 Industrials Conference

SAULT STE. MARIE, Ontario, Sept. 03, 2024 (GLOBE NEWSWIRE) — Algoma Steel Group Inc. ASTLASTL (“Algoma” or “the Company”), a leading Canadian producer of hot and cold rolled steel sheet and plate products, today announced that the Company will be participating in the Jefferies 2024 Industrials Conference on Wednesday, September 4 and Thursday, September 5, 2024. Prior to Algoma’s attendance at this conference, the Company will post a copy of the presentation it will use in the Investors section of its website on ir.algoma.com.

Cautionary Statement Regarding Forward-Looking Statements

This news release contains “forward-looking information” under applicable Canadian securities legislation and “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 (collectively, “forward-looking statements”), including statements regarding, Algoma’s transition to electric arc furnace (EAF) steelmaking, Algoma’s future as a leading producer of green steel, Algoma’s modernization of its plate mill facilities, transformation journey, ability to deliver greater and long-term value, ability to offer North America a secure steel supply and a sustainable future, and investment in its people, and processes. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “design,” “pipeline,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions. Many factors could cause actual future events to differ materially from the forward-looking statements in this document. Readers should also consider the other risks and uncertainties set forth in the section entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Information” in Algoma’s Annual Information Form, filed by Algoma with applicable Canadian securities regulatory authorities (available under the company’s SEDAR+ profile at www.sedarplus.com) and with the SEC, as part of Algoma’s Annual Report on Form 40-F (available at www.sec.gov), as well as in Algoma’s current reports with the Canadian securities regulatory authorities and SEC. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Algoma assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

About Algoma Steel Group Inc.

Based in Sault Ste. Marie, Ontario, Canada, Algoma is a fully integrated producer of hot and cold rolled steel products including sheet and plate. Driven by a purpose to build better lives and a greener future, Algoma is positioned to deliver responsive, customer-driven product solutions to applications in the automotive, construction, energy, defense, and manufacturing sectors. Algoma is a key supplier of steel products to customers in North America and is the only producer of discrete plate products in Canada. Its state-of-the-art Direct Strip Production Complex (“DSPC”) is one of the lowest-cost producers of hot rolled sheet steel (HRC) in North America.

Algoma is on a transformation journey, modernizing its plate mill and adopting electric arc technology that builds on the strong principles of recycling and environmental stewardship to significantly lower carbon emissions. Today Algoma is investing in its people and processes, working safely, as a team to become one of North America’s leading producers of green steel.

As a founding industry in their community, Algoma is drawing on the best of its rich steelmaking tradition to deliver greater value, offering North America the comfort of a secure steel supply and a sustainable future as your partner in steel.

For more information, please contact:

Michael Moraca

Vice President – Corporate Development and Treasurer

Algoma Steel Group Inc.

Phone: 705.945-3300

E-mail: IR@algoma.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

AMH to Participate in BofA Securities 2024 Global Real Estate Conference

LAS VEGAS, Sept. 3, 2024 /PRNewswire/ — AMH AMH, a leading large-scale integrated owner, operator, and developer of single-family rental homes, today announced that members of the Company’s management team will participate in a roundtable discussion at the BofA Securities 2024 Global Real Estate Conference on Wednesday, September 11, 2024 at 10:20 a.m. Eastern Time.

A live audio webcast of the presentation will be available on the Company’s website at www.amh.com under the “Investor Relations” tab. A replay of the webcast will be available through September 25, 2024.

About AMH

AMH AMH is a leading large-scale integrated owner, operator and developer of single-family rental homes. We’re an internally managed Maryland real estate investment trust (REIT) focused on acquiring, developing, renovating, leasing and managing homes as rental properties. Our goal is to simplify the experience of leasing a home and deliver peace of mind to households across the country.

In recent years, we’ve been named one of Fortune’s 2023 Best Workplaces in Real Estate™, a 2024 Great Place to Work®, a 2024 Most Loved Workplace®, a 2024 Top U.S. Homebuilder by Builder100, and one of America’s Most Responsible Companies 2024 and Most Trustworthy Companies in America 2024 by Newsweek and Statista Inc. As of June 30, 2024, we owned nearly 60,000 single-family properties in the Southeast, Midwest, Southwest and Mountain West regions of the United States. Additional information about AMH is available on our website at www.amh.com.

AMH refers to one or more of American Homes 4 Rent, American Homes 4 Rent, L.P. and their subsidiaries and joint ventures. In certain states, we operate under AMH Living or American Homes 4 Rent. Please see www.amh.com/dba to learn more.

AMH Contacts

Media Relations

Phone: (855) 774-4663

Email: media@amh.com

Nicholas Fromm

Investor Relations

Phone: (855) 794-2447

Email: investors@amh.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/amh-to-participate-in-bofa-securities-2024-global-real-estate-conference-302237155.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/amh-to-participate-in-bofa-securities-2024-global-real-estate-conference-302237155.html

SOURCE AMH

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This 4.6% Yielding Finance Stock Raised Its Dividend Through the Past 4 Recessions

Recessions can be scary and have real-world consequences on jobs and the stock market. However, they are a part of life as a long-term investor. Recessions can threaten weak companies that lack the fundamental strength to survive economic downturns.

How do you know a business can survive tough times? Dividends are a great litmus test. Look for companies that can share their earnings with investors and continue increasing that payout through recessions. The U.S. economy has fallen into recession four times since 1990.

Investment management company T. Rowe Price (NASDAQ: TROW) has raised its dividend in all four recessions as well as annually for the last 38 years. Here is the secret behind T. Rowe Price’s longevity and why it could be an excellent buy for any long-term investor today.

A business built on the markets

The financial markets are the core avenue to building wealth in the modern world, but most people don’t have the time, desire, or education to manage all their investments independently. Investment management companies like T. Rowe Price sell various financial products, such as mutual funds, offer advisory services to clients, and operate retirement plans for employers. T. Rowe Price primarily generates revenue by charging fees on the collective $1.6 trillion in assets it manages.

T. Rowe Price’s assets under management (AUM) grow when clients invest more money in its products and services or when the assets themselves appreciate. The U.S. stock market continues to increase over the long term, and that builds growth into T. Rowe Price’s business. However, it also makes the company susceptible to market crashes because asset prices decline, and scared clients might pull their funds out of the markets.

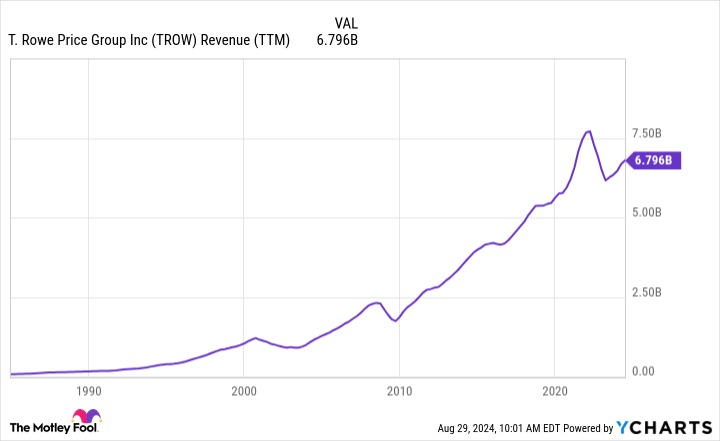

You can see the occasional decline during recessions (2001, 2008, 2020), but the long-term trend points up:

Iron-clad financials support generous shareholder returns

T. Rowe Price gushes cash profits; the company has few expenses besides its employees, which means management can be very generous to shareholders. The company has gone beyond annual dividend raises and paid special dividends twice over the past decade. These are one-time dividends and usually far larger amounts than the typical payout. During that time, T. Rowe Price repurchased 15% of its total shares, which helped boost the stock’s price by increasing earnings per share.

Most importantly, management can do this without sacrificing the company’s financial health. Today, T. Rowe Price has $2.7 billion in cash and zero debt. When the next recession comes, management can supplement any dip in its profits with the cash it already has.

Why T. Rowe Price is a buy today

One risk T. Rowe Price faces is that investors have increasingly moved to passive investment funds over the past decade. T. Rowe Price specializes in actively managed funds that charge higher fees than a passive fund that might follow a market index and charge investors less. This year, total assets in passive investments surpassed active for the first time, which could stunt T. Rowe Price’s long-term growth.

That said, the stock seems priced appropriately for that risk. Shares trade at a forward P/E ratio of 12 today, below its decade average of 15. Analysts believe T. Rowe Price will still grow earnings by almost 7% annually over the long term. Again, the stock’s valuation is pretty reasonable for that expected growth. Even if the stock’s valuation remains the same, investors could still see total annualized returns of around 11% because the dividend yield is 4.6% today.

T. Rowe Price could fall short of growth, and investors are getting a high-yield dividend stock that will likely continue raising its payout. That’s a solid worst-case scenario. On the other hand, the stock could outperform the market if the business delivers as expected. This heads-you-win, tails-you-still-win investment scenario makes the stock a buy today.

Should you invest $1,000 in T. Rowe Price Group right now?

Before you buy stock in T. Rowe Price Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and T. Rowe Price Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool recommends T. Rowe Price Group. The Motley Fool has a disclosure policy.

This 4.6% Yielding Finance Stock Raised Its Dividend Through the Past 4 Recessions was originally published by The Motley Fool

Here's Why GE Aerospace Stock Slumped Today

GE Aerospace‘s (NYSE: GE) shares declined by more than 5% as of 11 a.m. ET today. It’s not often you can blame a stock price decline on an analyst downgrade of another company, but in this case, it’s applicable. Wells Fargo‘s downgrade of GE’s principal partner, Boeing, sent a shock wave through both companies’ share prices.

Should GE Aerospace prospects also be downgraded?

A Wells Fargo analyst downgraded Boeing stock to underweight, arguing that Boeing’s cash-flow difficulties will run into the next investment cycle for the airplane manufacturer. That’s an issue for GE because it’s the leading engine provider to Boeing. Its joint venture, CFM International, provides the sole engine on the Boeing 737 MAX, and GE provides the sole engine the Boeing 777X and one of two engine options on the 787.

Any push-out of the development of a new Boeing model will negatively impact GE, not least as the company develops engines in anticipation of Boeing’s development. GE typically makes money from multiyear servicing of airplane engines after they are sold into new airplanes.

What it means to GE Aerospace investors

While this is merely an analyst opinion, it is based on solid arguments. Boeing looks highly unlikely to meet its medium-term cash-flow target, and new airplane development will take years and cost significant amounts of money.

Still, it’s worth noting that Boeing isn’t abandoning airplane manufacturing anytime soon. Moreover, while a potential equity raise (to help fund new airplane development) isn’t great news for Boeing shareholders, it’s something GE investors should be agnostic over.

After all, an airplane produced with the financial backing of an equity raise will likely be similar to one made without it, and GE Aerospace will benefit all the same.

Should you invest $1,000 in GE Aerospace right now?

Before you buy stock in GE Aerospace, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and GE Aerospace wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Wells Fargo is an advertising partner of The Ascent, a Motley Fool company. Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Here’s Why GE Aerospace Stock Slumped Today was originally published by The Motley Fool

Mar-a-Lago Profits Quadruple Since Donald Trump's Presidency, Could Money-Making Property Keep Him From Selling DJT Stake?

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Mar-a-Lago Profits Quadruple Since Donald Trump’s Presidency, Could Money-Making Property Keep Him From Selling DJT Stake?

Former President Donald Trump will be free to sell his stake in Trump Media & Technology Group Corp (NASDAQ:DJT) soon, but he might not have to thanks to the success of his Mar-a-Lago club.

What Happened: Trump’s Mar-a-Lago club and residence has made headlines for years and was one of the many talking points during a civil fraud case against the former president.

Trump purchased the 1100 S. Ocean Boulevard property in Palm Beach, Florida for a reported $7 million to $8 million back in 1985.

Check It Out:

Mar-a-Lago was valued at $18 million to $27 million by an assessor and valued at $24.15 million by Zillow. An expert who spoke on behalf of Trump’s team during the civil trial said the property could be sold for $1 billion to the likes of Bill Gates or Elon Musk as it is a one-of-a-kind property.

While the $1 billion price tag is high, a new report sheds light on how much money Trump’s famous property is making.

A Forbes report said profits at Mar-a-Lago have quadrupled since Trump left the White House in 2021. Among the ways the club makes money are rising membership dues, political fundraisers and other hosted events like weddings.

In 2023, the club took in around $40 million, which is double what the club made in 2019 before the COVID-19 pandemic put a damper on events. The figure is also triple what Mar-a-Lago made in 2014 before Trump started his political career.

The report says Mar-a-Lago brought in $90 million in the four years Trump was serving as the president of the United States. The three years after Trump left the White House have brought in $105 million in business.

Along the growing revenue, the annual costs to run Mar-a-Lago have mostly stayed in the $12 million to $16 million range. The profit margin went from 9% in 2011 to 60% in 2023 according to the report, with $22 million in 2023 profit.

“It is actually the best year we’ve ever had at Mar-a-Lago,” a manager told Forbes.

The club currently caps members at 500, who pay annual dues estimated at $15,000. Initiation fees are $700,000 and could rise to $1 million soon, with Forbes said the club has started a waiting list with all 500 spots filled.

Read More:

-

Don’t miss out: earn 8-15% expected returns by investing in fractional real estate. Get started with only $10.

-

With returns as high as 300%, it’s no wonder this asset is the investment choice of many billionaires. Uncover the secret.

Why It’s Important: Trump’s political rise and past history as a president has helped boost the notoriety of the club and also the demand for memberships and to host events at the Florida property.

With Trump owning 100% of the club, the rising profits could help the former president with his mounting legal costs and 2024 election campaign. This could be potential good news for shareholders of Trump Media & Technology Group.

Trump owns 114,750,000 shares of the media company he co-founded, representing 64.9% of the company. By the end of September, Trump will be able to sell his stake in the company and maintain control, as Benzinga previously reported.

The decision of whether or not he will sell a portion or his entire stake comes as the social media stock, which owns the Truth Social network Trump frequently posts on, has hit new lows since completing a SPAC merger in March 2024.

The sale of the shares could lead to a further decline in the share price of Trump Media & Technology Group shares, while also freeing up additional capital for Trump to use in his election battle against Kamala Harris.

Trump’s stake is worth around $2.2 billion based on a price of $19.51 at the time of writing.

Trump Media & Technology Group shares opened for trading at $70.90 on March 26 when its long-awaited SPAC merger with Digital World Acquisition was completed.

While the company had a market capitalization of $8 billion and Trump’s net worth soared to $6.4 billion, the stock quickly fell after the public debut and has fallen in recent weeks after Trump was found guilty of 34 counts of falsifying business records.

Trump faces a $355 million fine from a previous ruling in a New York court, and has spent hundreds of millions on legal fees related to several court cases.

Lock In High Rates Now With A Short-Term Commitment

Leaving your cash where it is earning nothing is like wasting money. There are ways you can take advantage of the current high interest rate environment through private market real estate investments.

EquityMultiple’s Basecamp Alpine Notes is the perfect solution for first-time investors. It offers a target APY of 9% with a term of only three months, making it a powerful short-term cash management tool with incredible flexibility. EquityMultiple has issued 61 Alpine Notes Series and has met all payment and funding obligations with no missed or late interest payments. With a minimum investment of $5,000, Basecamp Alpine Notes makes it easier than ever to start building a high-yield portfolio.

Don’t miss out on this opportunity to take advantage of high-yield investments while rates are high. Check out Benzinga’s favorite high-yield offerings.

This article Mar-a-Lago Profits Quadruple Since Donald Trump’s Presidency, Could Money-Making Property Keep Him From Selling DJT Stake? originally appeared on Benzinga.com

Guardian Capital Group Limited completes its acquisition of Galibier Capital Management Ltd.

TORONTO, Sept. 03, 2024 (GLOBE NEWSWIRE) — Guardian Capital Group Limited (Guardian) GCG GCG.A))) announced today that it has completed its acquisition of Galibier Capital Management Ltd. (Galibier), a Toronto, Canada-based investment management firm. Guardian completed the transaction on the terms announced on June 20, 2024. The addition of Galibier increases Guardian’s assets under management by approximately C$1 billion and adds a team of high-quality, experienced investment professionals focused on fundamental equity research and valuation.

“We are truly pleased that Galibier founder, Joe Sirdevan, and his team are joining Guardian and look forward to jointly building on the opportunities ahead. There is a good cultural alignment between the firms, and we welcome incorporating Galibier’s distinctive investment approach into our existing lineup of strategies,” said George Mavroudis, Guardian’s President and Chief Executive Officer.

“Having access to Guardian’s deep resources will provide us with added support as we grow and continue to implement Galibier’s rigorous investment philosophy and process for our clients,” said Joe Sirdevan, Galibier’s Chief Executive Officer. “All of us at Galibier are excited to join the Guardian group.”

Galibier will retain its brand, and the current management and investment team will remain in place, continuing to invest on behalf of institutions, foundations and individuals through segregated accounts and pooled funds.

For further information, please contact:

Angela Shim

416-947-8009

About Guardian Capital Group Limited

Guardian Capital Group Limited (Guardian) is a global investment management company servicing institutional, retail and private clients through its subsidiaries. As at June 30, 2024, Guardian had C$58.6 billion of total client assets while managing a proprietary investment portfolio with a fair market value of C$1.1 billion. On July 2, 2024, Guardian completed its acquisition of Sterling Capital Management, LLC, a Charlotte, North Carolina-based investment management firm, adding approximately C$104.0 billion (US$76.0 billion) in client assets. Founded in 1962, Guardian’s reputation for steady growth, long-term relationships and its core values of authenticity, integrity, stability and trustworthiness have been key to its success over six decades. Its Common and Class A shares are listed on the Toronto Stock Exchange as GCG and GCG.A, respectively. To learn more about Guardian, visit www.guardiancapital.com.

This press release contains forward-looking statements with respect to Guardian Capital Group Limited and its products and services, including its business operations and strategy and financial performance and condition. Although management believes that the expectations reflected in such forward-looking statements are reasonable, such statements involve risks and uncertainties. Actual results may differ materially from those expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially from expectations include, among other things, general economic and market factors, including interest rates, business competition, changes in government regulations or tax laws, and other factors discussed in materials filed with applicable securities regulatory authorities from time to time.

Any forward-looking statements included in this press release are provided as of the date of this press release and should not be relied upon as representing Guardian’s views as of any date subsequent to the date of this press release. Guardian undertakes no obligation, except as required by applicable law, to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

All trademarks, registered and unregistered, are owned by Guardian Capital Group Limited and are used under licence.

About Galibier Capital Management Ltd.

Galibier Capital Management Ltd., founded in 2012, is an investment process-driven investment management firm based in Toronto, Ontario. Galibier provides investment advisory services through separately managed accounts and pooled funds, in accordance with its philosophy of Growth. At a Reasoned Price™. Its client base includes corporations, pensions, charitable foundations and endowments. To learn about Galibier, visit galibiercapital.com.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.