Unsold Homes Surge, Eight States Have More Unsold Homes Than Five Years Ago

The U.S. housing market is currently experiencing an unexpected surge in unsold inventory. Eight states now have more unsold homes than in 2019, indicating a significant shift in the market dynamics. The increase in unsold homes, however, is not evenly distributed across the country.

What Happened: Research firm Altos Research reported a 40% increase in homes on the market at the end of August 2024 compared to the same period last year. This equates to over 700,000 unsold single-family homes, with about 10% going into contract each week.

The rise in inventory is not uniform across the country. States like Florida and Arizona have seen a 70% increase in unsold homes compared to last year, while New York has only a 10% increase, reports Housingwire.

Eight states – Alabama, Arkansas, Florida, Idaho, Oklahoma, Tennessee, Texas and Utah – have more unsold inventory than in 2019.

John Burns Real Estate Consulting attributes these inventory trends to migration patterns during the pandemic. Many of these states were popular destinations for inbound migration, leading to increased home construction.

Also Read: Warren Buffett’s Real Estate Firm Coughs Up $250M To Avoid Bigger Payout Over Commissions

However, the rise in mortgage rates since 2022 has slowed down migration, contributing to the inventory build-up.

Other factors, such as increased costs of homeownership, including taxes and insurance, have also contributed to the rise in unsold inventory. For instance, homeowners in Texas and Florida are grappling with higher taxes and insurance costs, respectively.

Why It Matters: The trend of unsold inventory could be a sign of a return to “normal” markets, offering more selection for homebuyers. However, it could also indicate potential price adjustments in areas with a greater supply of unsold homes.

The housing market dynamics are influenced by a variety of factors, including migration patterns, mortgage rates, and costs of homeownership.

Understanding these factors can help potential buyers and sellers make informed decisions.

Read Next:

Americans Face Historic Lack Of Affordability In Housing Market, Data Shows

This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Tech market values fall on AI costs and recession fears; Eli Lilly, Berkshire gain

(Reuters) – Market values of major tech firms declined in August amid concerns over escalating artificial intelligence infrastructure costs and rising recession risks that would make the stocks particularly vulnerable during a market correction.

Last month, Alphabet Inc’s lost 4.7% of its market value as a slowdown in YouTube’s advertising sales fuelled concerns about its earnings. A U.S. judge’s ruling that Google had violated antitrust laws and the emergence of new competition from OpenAI, which is developing an AI-based search engine prototype, also contributed to its shares’ decline.

Amazon.com Inc’s market value fell 4.5%, affected by slowing online sales.

Tesla’s market capitalisation fell 7.7% last month after weaker Q2 earnings and following the news that Canada planned a new 100% tariff on Chinese-made electric vehicles.

The world’s most valuable automaker started shipping Shanghai-made EV’s to Canada last year and Ottawa’s plans raised concerns about the potential profit impact of exporting from its higher-cost U.S. production base.

Meanwhile, Nvidia’s market value fell in the last week of August by 7.7% to $2.92 trillion, after it projected third-quarter gross margins below market estimates and reported revenues that only met expectations, disappointing investors who were expecting a stronger performance.

Nvidia, which commands more than 80% of the AI chip market, stands in a unique position as both the largest enabler as well as beneficiary of surging AI development.

On a positive note, U.S. drugmaker Eli Lilly’s market value surged nearly 20%, leading market gainers, driven by robust sales and the launch of a weight-loss drug that significantly reduces the risk of developing type 2 diabetes in overweight adults.

Berkshire Hathaway’s market value closed above $1 trillion for the first time at the end of August, reflecting investor confidence in the conglomerate that Warren Buffett built over nearly six decades into what many consider a proxy for the U.S. economy.

Meta’s market value also climbed nearly 10% after it beat market expectations for its second-quarter revenues and forecast strong revenue growth in the July-September quarter, indicating that strong digital ad spending on its platforms could offset the costs of its AI investments.

(Reporting By Patturaja Murugaboopathy and Gaurav Dogra in Bengaluru; Editing by Tomasz Janowski)

If I Could Only Buy 1 Stock in the Last Half of 2024, I'd Pick This

After a short-lived dip that started in the second half of July, the S&P 500 quickly bounced back and is now flirting with a new record high. Investors looking to put some money to work might be discouraged because they believe there aren’t many compelling opportunities in today’s market.

But that’s a flawed perspective. In fact, I believe one company looks like a no-brainer portfolio addition right now.

If I could buy only one stock in the last half of 2024, I’d pick Walt Disney (NYSE: DIS). Here’s why.

Disney’s transition

One of the most notable secular shifts happening across the economy has been the rise of streaming entertainment at the expense of traditional cable TV. The monster success of Netflix propelled this change. Now, Disney is in the middle of a major transition to its business model.

The company’s once-thriving linear networks, like ABC and ESPN, are still generating loads of profits. However, they are in secular decline as more households cut the cord. Consequently, revenue will remain under pressure here.

At the same time, to keep up with the shifting industry, Disney has had to invest aggressively in technology and content to build out its streaming operations, which include Disney+, Hulu, and ESPN+. Direct-to-consumer (DTC) services have so far posted billions in operating losses, which is a key factor that has weighed on the stock.

Disney’s latest financial update, though, reveals solid improvements in the DTC segment. Combined, the streaming services generated a positive operating income of $47 million in the fiscal 2024 third quarter (ended June 29). That’s not anything to write home about, but executives believe the company will improve in this area going forward.

However, it’s not all encouraging news. The experiences segment, which is where results for parks, cruises, and consumer products are included, is facing some challenges. Revenue was up just 2% in Q3, with operating income down 3%. “The demand moderation we saw in our domestic businesses in Q3 could impact the next few quarters,” the press release reads.

I will adopt a more upbeat perspective as it pertains to the long term. My view is that the experiences segment is a lucrative one that’s essential to Disney’s competitive standing. That’s why the company is planning to invest $60 billion over the next decade to bolster its offerings here, forcing my confidence that the segment will be stronger in the future.

Disney’s valuation

The market hates uncertainty. That’s the best word to describe Disney’s situation over the past few years as the media landscape shifts to streaming.

Consequently, Disney shares are cheap. They trade at a forward price-to-earnings (P/E) ratio of 17 based on fiscal 2025’s consensus earnings per share estimate. If you believe the bottom line will expand meaningfully in the years ahead, like I do, then valuation is only going to get more attractive the further out you look. For what it’s worth, the S&P 500 trades at a forward P/E multiple of over 23, so Disney goes for a significant discount to the overall market.

In my opinion, that valuation creates a wonderful opportunity to buy shares. Investors can purchase a business that has an economic moat that discourages new entrants from coming in and adds durability over the long term.

Disney’s intellectual property, including its characters, storylines, and franchises, many of which were created decades ago, holds a special place in the minds and hearts of consumers across the globe. I think it’s impossible for any business to match or replace this type of position.

Of course, investors looking to buy the stock must have the patience to wait for solid improvements to happen, particularly around the view that earnings will soar. However, I believe that over the next three to five years, Disney will prove to be a successful investment.

Should you invest $1,000 in Walt Disney right now?

Before you buy stock in Walt Disney, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Walt Disney wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Neil Patel and his clients have positions in Walt Disney. The Motley Fool has positions in and recommends Netflix and Walt Disney. The Motley Fool has a disclosure policy.

If I Could Only Buy 1 Stock in the Last Half of 2024, I’d Pick This was originally published by The Motley Fool

First Mover Americas: Bitcoin Sits Around $58.5K at Start of Historically Bearish September

This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

CoinDesk 20 Index: 1,843.91 +0.88%

Bitcoin (BTC): $58,458 +0.67%

Ether (ETH): $2,519 +1.89%

S&P 500: 5,658 +1%

Gold: $2400 −0.15%

Nikkei 225: 38,700.87 +0.14%

Top Stories

Bitcoin fluctuated around the $58,000 mark amid a generally sedate market on Labor Day in the U.S. The largest cryptocurrency was trading around $58,600 at the time of writing, about 1% higher in 24 hours. The broader digital asset market has risen 0.9%%, according to CoinDesk Indices data, with ETH and SOL gaining around 1.9% and 0.5%, respectively. U.S.-listed exchange-traded funds (ETFs) tracking BTC posted total net outflows of $175 million on Friday, extending a losing streak to four days. Ether ETFs had zero net inflows or outflows despite $173 million in trading volume, data tracked by SoSoValue shows.

Some traders noted that September is generally one of bitcoin’s most bearish months, but said that an interest-rate cut by the Fed could break the trend. “September is a historically negative month for bitcoin, as data shows it has an average value depletion rate of 6.56%,” Innokenty Isers, founder of crypto exchange Paybis, said. “Should the Feds cut the interest rate in September, it might help bitcoin rewrite its negative history as rate cuts generally lead to excessive US dollar flow in the economy – further strengthening the outlook of bitcoin as a store of value.”

Election punters on Polymarket are favoring Republican candidate Donald Trump again as Democrat Kamala Harris’ odds slipped to 47% over the weekend from even odds earlier. Harris’ appeal has drifted lower in the past weeks among traders on Polymarket, while Trump’s has gradually climbed back over 50%. He is again in the lead after nearly two weeks of even odds. Traders have placed $99 million in on-chain bets on Trump winning the election, with over $95 million put on Harris. Harris’ odds have slipped amid outcry for a proposal to tax unrealized gains for people worth over $100 million. Meanwhile, Trump’s odds have increased as he promotes a forthcoming decentralized finance project that could offer “high yields” for crypto users.

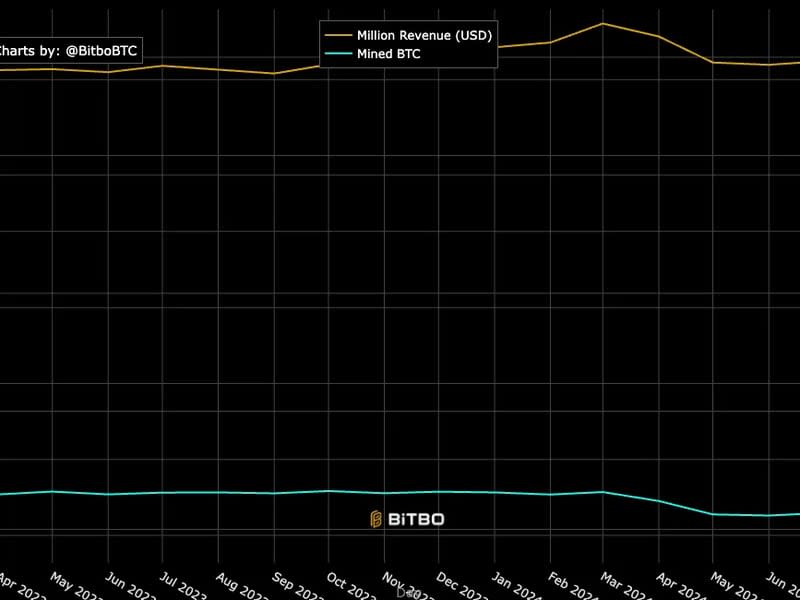

Chart of the Day

-

The chart shows that bitcoin miners’ revenue fell in August to the lowest level since September 2023.

-

This was accompanied by an increase in the bitcoin mining difficulty and decrease in the number of BTC mined.

-

This highlights the challenge that miners face in adapting to the post-halving world.

-

Source: Bitbo

– Jamie Crawley

Trending Posts

AT&T or Verizon: Which Stock Offers the Safer Dividend?

AT&T (NYSE: T) and Verizon (NYSE: VZ) have been popular income stocks for decades. Both emerged in the era of landlines, supporting dividends through stable businesses. Even as AT&T and Verizon pivoted into wireless and broadband internet services, they increased their payouts over time.

However, staying competitive against one another and the rising threat of T-Mobile left both companies with massive debt loads. That obligation led to AT&T slashing its payout in 2022. In contrast, Verizon maintains a streak of payout hikes.

Companies have free reign to adjust payout levels at any time. Verizon’s annual payout hikes might make it the more desirable dividend, but its need to pay down debt increases the odds of a dividend cut.

Thus, the question for investors is whether AT&T’s lower payout makes it a better dividend stock, or should they stay with Verizon? Let’s take a closer look.

How the dividends compare

At first glance, AT&T looks like the weaker dividend stock. The company walked away from a 35-year history of payout hikes in 2021, then slashed its dividend by just under 50% to $1.11 per share annually the next year. This gives it a dividend yield of 5.6% at current prices.

In contrast, Verizon has built a 17-year history of payout hikes. Also, since ending such a streak can diminish confidence in a stock, such companies tend to continue the annual payout hikes. That has led to a yearly dividend of $2.66 per share, a cash return of 6.4% at current prices.

Although Verizon offers a higher return, both dividends far exceed the S&P 500 average of 1.3%. Also, both come at a significant cost to their companies.

AT&T spends just over $8 billion per year to maintain its dividend. Free cash flow was $7.7 billion in the first half of 2024 and $11.6 billion in the last two quarters of 2023, for a total of $19.3 billion in free cash flow over the 12 months.

In Verizon’s case, its higher yield comes with a higher cost. It spends just over $11 billion annually to cover the cost of its payout. Still, free cash flow closely matched AT&T, with $8.5 billion in the first two quarters of 2024 and $10.8 billion in the last half of 2023.

That means that Verizon coincidentally also generated $19.3 billion in free cash flow over the trailing twelve months. It also implies that Verizon can generate the cash needed to maintain its payout while leaving cash free for other purposes.

Financial challenges

Unfortunately for both companies, they also need to generate enough free cash flow to service and, ideally, reduce their debt burdens.

As of the end of the second quarter of 2024, AT&T claims just under $131 billion in total debt, slightly above the $119 billion the company holds in stockholders’ equity.

Despite the apparent strain on the balance sheet, AT&T’s debt stood at over $143 billion in the year-ago quarter, meaning it eliminated $12 billion. Also, it has $5.2 billion of that debt maturing over the next year. At that rate, it could retire that debt without the need for refinancing.

In contrast, Verizon carries a higher absolute and relative debt burden. It holds more than $149 billion in debt when its stockholders’ equity is a mere $98 billion.

Moreover, the total debt did not fall significantly, dropping from just under $153 billion in the year-ago quarter. Additionally, its debt maturing in one year stands at more than $22 billion. At its current pace, it will probably have to refinance most of that obligation, likely at higher interest rates.

Which is the safer dividend?

When comparing the two companies, AT&T appears to offer a safer dividend.

Admittedly, AT&T stock offers a slightly lower dividend yield. Also, since it does not currently increase its payout yearly, a dividend cut would probably hurt its stock less. Nonetheless, AT&T maintains its dividend while significantly reducing its debt, meaning it probably does not need to slash its payout.

In contrast, Verizon’s situation is more precarious. While it can technically afford its dividend, it has a higher debt burden relative to its stockholders’ equity and has reduced that debt more slowly. Assuming it has to refinance maturing debt, the pressure to follow AT&T’s lead and slash its payout could prove too difficult to resist.

Ultimately, income investors tend to be more risk-averse. Considering the debt situation of each company, they probably face less risk going with AT&T.

Should you invest $1,000 in AT&T right now?

Before you buy stock in AT&T, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AT&T wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Will Healy has no position in any of the stocks mentioned. The Motley Fool recommends T-Mobile US and Verizon Communications. The Motley Fool has a disclosure policy.

AT&T or Verizon: Which Stock Offers the Safer Dividend? was originally published by The Motley Fool

MDB INVESTOR ALERT: Bronstein, Gewirtz & Grossman LLC Announces that MongoDB, Inc. Investors with Substantial Losses Have Opportunity to Lead Class Action Lawsuit!

NEW YORK, Sept. 02, 2024 (GLOBE NEWSWIRE) — Attorney Advertising–Bronstein, Gewirtz & Grossman, LLC, a nationally recognized law firm, notifies investors that a class action lawsuit has been filed against MongoDB, Inc. (“MongoDB” or “the Company”) MDB and certain of its officers.

Class Definition

This lawsuit seeks to recover damages against Defendants for alleged violations of the federal securities laws on behalf of all persons and entities that purchased or otherwise acquired MongoDB securities between August 23, 2023, and May 30, 2024, inclusive (the “Class Period”). Such investors are encouraged to join this case by visiting the firm’s site: bgandg.com/MDB.

Case Details

The complaint alleges that on March 7, 2024, MongoDB reported strong Q4 2024 results and then announced lower-than-expected full-year guidance for 2025. The Complaint adds that the Company attributed this to a change in its “sales incentive structure,” which led to a decrease in revenue related to “unused commitments and multi-year licensing deals.” Following this news, MongoDB’s stock dropped $28.59 per share to close at $383.42. Then, on May 30, 2024, MongoDB further lowered its guidance for the full year 2025, attributing it to “macro impacting consumption growth.” Analysts commenting on the reduced guidance questioned whether changes to the Company’s marketing strategy “led to change in customer behavior and usage patterns.” Following this news, MongoDB’s stock dropped $73.94 per share to close at $236.06.

What’s Next?

A class action lawsuit has already been filed. If you wish to review a copy of the Complaint, you can visit the firm’s site: bgandg.com/MDB or you may contact Peretz Bronstein, Esq. or his Client Relations Manager, Nathan Miller, of Bronstein, Gewirtz & Grossman, LLC at 332-239-2660. If you suffered a loss in MongoDB you have until September 9, 2024, to request that the Court appoint you as lead plaintiff. Your ability to share in any recovery doesn’t require that you serve as lead plaintiff.

There is No Cost to You

We represent investors in class actions on a contingency fee basis. That means we will ask the court to reimburse us for out-of-pocket expenses and attorneys’ fees, usually a percentage of the total recovery, only if we are successful.

Why Bronstein, Gewirtz & Grossman

Bronstein, Gewirtz & Grossman, LLC is a nationally recognized firm that represents investors in securities fraud class actions and shareholder derivative suits. Our firm has recovered hundreds of millions of dollars for investors nationwide.

Attorney advertising. Prior results do not guarantee similar outcomes.

Contact

Bronstein, Gewirtz & Grossman, LLC

Peretz Bronstein or Nathan Miller

332-239-2660 | info@bgandg.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

1 Growth Stock Down 81% to Buy Right Now

Not that long ago, Etsy (NASDAQ: ETSY) was one of the top companies that investors could have owned. From the pandemic low in March 2020 to their all-time high in November 2021, shares skyrocketed 837%.

But slowing growth and the market’s disdain for growth tech stocks pressured investor sentiment. Etsy currently trades 81% below its peak price. But it’s still a smart buying opportunity right now.

Zoom in

Etsy’s growth was through the roof in 2020 and 2021. The company was adding buyers and sellers to its platform. Its gross merchandise sales (GMS) were soaring. Demand was very strong.

However, the normalization of consumer behavior, with people starting to leave their homes to shop again, created the perfect headwind for Etsy. It also didn’t help that inflation started to rear its ugly head about three years ago.

The slowdown has continued. In the most recent quarter (Q2 2024, ended June 30), Etsy posted a 2.1% year-over-year GMS decline. That figure was slightly lower than in the same period three years before. It makes sense that consumers are pulling back on discretionary spending when it seems like the price of everything has gone up in the past couple of years.

GMS is expected to fall again in the current quarter.

Zoom out

It’s understandable for investors to get caught up in quarterly financial figures. But if you’re a long-term stock market participant, then it’s always best to zoom out and focus on the bigger picture. With this perspective, it’s easy to still have a favorable view of Etsy’s business.

The company is truly differentiating itself. There are wide product assortments in various categories, like home furnishings, apparel, jewelry, and craft supplies tailored to specific needs. According to a survey, 83% of buyers agreed that Etsy sold items that they couldn’t find anywhere else.

The retail sector broadly, and the e-commerce niche specifically, is hyper-competitive. All companies operating in the industry must constantly worry about Amazon‘s presence. But while the tech titan thrives when it comes to mass-produced goods and fast shipping, Etsy draws in shoppers looking for unique offerings. This is a key competitive strength.

What’s more, Etsy’s two-sided ecosystem, as demonstrated by its 96.6 million active buyers and 8.8 million active sellers, is supported by network effects. Consumers want to come to the site because there are so many specialized goods being sold. Small merchants and entrepreneurs looking to showcase their craft might find no better platform to set up shop to target a global customer base.

Cheap stock

The S&P 500 has climbed 19% since Etsy hit its all-time high. However, the e-commerce stock has lost 81% of its value during the same time. That’s an alarming trend.

However, it means that shares are cheap. They trade at a forward price-to-earnings ratio of 12.2, the lowest valuation in almost the last three years. This depressed multiple suggests that Etsy is a terrible business. And that’s just not true. I already talked about its differentiated marketplace offerings and the presence of network effects.

Also, consider the total addressable market, which management estimates is $500 billion (counting online sales of all relevant product categories) in its six core geographies, which includes the U.S., U.K., Canada, Australia, France, and Germany.

Plus, Etsy is a consistently profitable enterprise that rakes in lots of free cash flow every quarter. This reduces financial risk.

Depending on the state of the economy and the direction of interest rates and inflation, the fear is that the difficult times for Etsy could last for a few more quarters before things start to improve. But this is precisely where the opportunity lies for investors. I believe that three to five years down the road, this stock could be a big winner for your portfolio.

Should you invest $1,000 in Etsy right now?

Before you buy stock in Etsy, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Etsy wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Neil Patel and his clients have no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Etsy. The Motley Fool has a disclosure policy.

1 Growth Stock Down 81% to Buy Right Now was originally published by The Motley Fool

UBS Sees the S&P 500 Surging to 6,200 by Next Year — Here Are 2 Stocks to Ride the Wave

As summer draws to a close, market watchers are witnessing a mix of resilience and challenges. The S&P 500 has showcased its strength with an 18% year-to-date gain, currently just 19 points shy of its all-time high. However, with uncertainties around US growth and the November elections, investors are carefully weighing their next moves.

So, where might the markets go from here? This is what every investor wants to know, and what every savvy analyst is striving to predict.

In a recent note, UBS’ investment office shared its forecast for the market’s direction in the coming months, noting: “We see room for US equities to rise further in a constructive environment driven by Fed rate cuts, the growth story around artificial intelligence (AI), and healthy earnings growth. We forecast the S&P 500 to rise to 5,900 by year-end and 6,200 by June 2025.”

The stock analysts at UBS are backing up this outlook by selecting the stocks they believe will ride this wave to gains. Let’s dive into two of their picks, each with a potential upside of at least 50%.

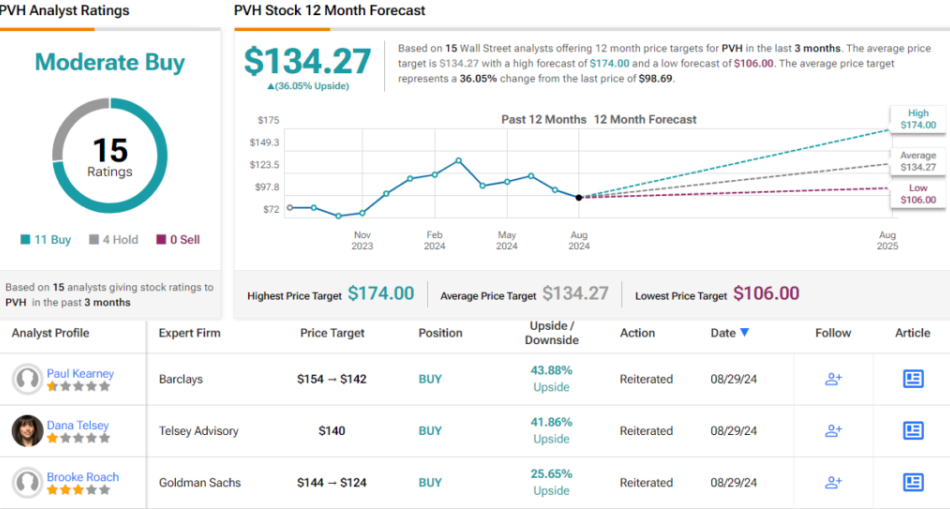

PVH Corporation (PVH)

The first stock we’ll look at is PVH, a clothing company that traces its roots, in part, to the garment industry of New York City in the 1880s and 1890s. Today, the company is the owner of the popular Tommy Hilfiger and Calvin Klein clothing lines, marketing these brands, and others, through department stores and branded retail locations. The company is truly international, generating more than 65% of its revenue outside of the US markets, and operating in over 40 countries around the world.

PVH’s goal is simple: the company aims to make Hilfiger and Calvin into the world’s most desirable lifestyle brands. The company has a detailed plan to accomplish this, including developing the best products and the best customer engagement, and using data-driven operations and efficiencies to win in a digital world. PVH’s activities are split among three main regions: North America, Europe, and the Asia-Pacific.

Despite some recent challenges, including a decline in revenue due to sluggish sales, PVH has managed to remain highly profitable. In its latest report for fiscal 2Q24, PVH posted a 6.3% year-over-year revenue decline, bringing in $2.07 billion. While this represented a dip from the previous year, it was in line with expectations. On the earnings front, PVH delivered strong results, with a non-GAAP EPS of $3.01 per share, surpassing forecasts by 73 cents.

Furthermore, PVH has been able to shore up its cash position. In the prior-year quarter, the company reported $372.8 million in cash liquid assets; in the current report, that figure was up significantly, to $610 million.

The sound cash balance and the ability to maintain earnings growth caught the attention of UBS analyst Jay Sole, who writes about the company: “We think PVH has the brand strength and balance sheet to drive earnings growth over the long term. We forecast the company delivering a 10.5% 5-yr. EPS CAGR. We also expect major margin unlocks in the next few years, as CEO Stefan Larsson’s PVH+ Plan goes into full effect. As PVH’s earnings rebound and long-term drivers become clear, we expect stock’s ~8x FY2 P/E to expand towards our ~12x target valuation.”

For Sole, PVH deserves a clear Buy rating, with a $174 price target that implies a one-year upside potential of 76%. (To watch Sole’s track record, click here)

Overall, PVH has earned a Moderate Buy rating from the Street’s analyst consensus, based on 15 recent reviews, including 11 Buys and 4 Holds. Currently trading at $98.69, the stock has an average target price of $134.27, suggesting a 36% gain over the next 12 months. (See PVH stock forecast)

Dayforce, Inc. (DAY)

The next UBS pick we’ll look at is Dayforce, an HCM software company. Until earlier this year, the company was called Ceridian; this past February, it changed its branding to Dayforce, which lines up with its chief product, the Dayforce HCM software platform.

HCM, or human capital management, is the moniker for a holistic approach to human resources in business. The Dayforce platform allows its users to manage vital functions of HR, payroll, and workforce management in a single, unified platform. The company has been in business since the early 1990s and generated more than $1.5 billion in revenue last year.

The company achieved that by offering a solid product that is tailored for today’s complex digital world. Dayforce promotes its platform as a solution to diverse HCM needs, leveraging AI technology to address complex issues and adapt to evolving challenges. Known for delivering ‘simplicity at scale,’ Dayforce facilitates easy management of functions and clear visibility of results. With over 6 million users globally, the platform serves a broad array of prominent organizations, including the City of Columbus, Danone, Gannett, and others. It’s available in more than 200 countries and territories, making it a truly global solution.

In its last reported financial results for Q2 2024, Dayforce achieved total revenues of $423.3 million, marking a nearly 16% year-over-year increase and surpassing forecasts by $5.87 million. Recurring revenue accounted for $321.6 million of this total, comprising nearly 76% of the revenue and growing 20% year-over-year. Net cash from operations also saw a significant year-over-year increase of 16%, reaching $108.3 million. At the bottom line, Dayforce delivered non-GAAP earnings of 48 cents per share, outperforming expectations by 12 cents per share.

UBS analyst Kevin McVeigh takes an unabashedly positive view of Dayforce, writing: “We continue to have substantial confidence in our thesis as we believe DAY stock is poised to outperform on cloud revenue remix + improving free cash flow conversion—we believe recent underperformance is mostly due to risk-off sentiment amid higher treasury yields and macro concerns. We believe this is more than discounted in the stock, which is poised to benefit on more constructive 10-year yields + fundamental performance.”

McVeigh’s optimism is reflected in his Buy rating for Dayforce stock, accompanied by a $90 price target – indicating a potential 57% gain in the months ahead. (To watch McVeigh’s track record, click here)

That’s the UBS perspective, but what does the broader Street think about Dayforce? With 8 additional Buys and 4 Holds, the stock claims a Moderate Buy consensus rating. The average target price of $68.92 suggests a potential 20.5% gain over the next year. (See Dayforce stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Warren Buffett's Career Advice: 'Don't Think About Money, Take The Job That You Would Take If You Didn't Need The Job'

Billionaire investor Warren Buffett shared some career advice as his company, Berkshire Hathaway, hit a $1 trillion market cap – a milestone that coincides with Buffett’s 94th birthday.

What Happened: The “Oracle of Omaha” has had a significant week. Berkshire Hathaway reached a market capitalization of $1 trillion on Wednesday. Buffett also celebrated his 94th birthday on Friday, with no intentions of retiring.

Buffett, who has led Berkshire Hathaway since 1965, offered his unique viewpoint on career decisions. He suggested to those seeking employment to “take the job that you would take if you didn’t need the job.”

Don’t Miss:

“You want to be doing something you would do if you didn’t need the money. And most people do need the money. But if you’re in the position where you don’t, you should be doing what you would if you didn’t need the money,” Buffett once told Fortune.

He added that he still finds joy in his role at Berkshire Hathaway, despite not needing to continue to work out of financial necessity.

Buffett admitted that his energy levels aren’t as high as they used to be, but feels lucky to be in an industry that allows him to continue working. He also confirmed that Greg Abel, his chosen successor, will assume control when he chooses to retire.

Trending: These five entrepreneurs are worth $223 billion – they all believe in one platform that offers a 7-9% target yield with monthly dividends

“I am fortunately in a business where even though my muscles are gone, my balance is gone, my stamina is gone, it doesn’t make any difference in what I do, so I am very lucky in that way,” Buffett added.

Why It Matters: Buffett’s career advice comes at a time when his company has reached a significant milestone. His insights, drawn from decades of experience in the industry, could be invaluable for those navigating their career paths.

Furthermore, the confirmation of Greg Abel as his successor provides a sense of continuity for Berkshire Hathaway, ensuring that the company is in capable hands when Buffett decides to step down.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Warren Buffett’s Career Advice: ‘Don’t Think About Money, Take The Job That You Would Take If You Didn’t Need The Job’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Blackstone buys stake in $1.2 billion European logistics fund

LONDON (Reuters) – Private equity giant Blackstone has agreed to buy an 80% stake in a European warehouse portfolio run by landlord Burstone, the latest push by the U.S. investment manager into warehouses that have boomed alongside the rise of e-commerce.

The Johannesburg-listed company – formerly Investec’s property fund – has agreed to sell the controlling stake in the 1.1 billion euros ($1.2 billion) portfolio with properties in seven countries including Germany, France and the Netherlands to Blackstone, according to a Burstone stock exchange announcement.

Burstone will receive immediate cash proceeds of 250 million euros from the sale, the statement said, adding that the deal would help it fund expansion of the business. Burstone will retain a 20% interest in the portfolio and its European team will continue to manage it.

Blackstone has made a series of investments in European warehouse businesses in recent years including under the brand Mileway, a last-mile logistics company which Blackstone and existing investors recapitalised in 2022.

Logistics including warehouses have been a bright spot in a struggling commercial real estate market, as the boom in e-commerce creates demand for more space.

($1 = 0.9035 euros)

(Reporting by Iain Withers,; Editing by Tommy Reggiori Wilkes and Ed Osmond)