Investors rush to money market funds before Fed rate cut, BofA says

Investors poured $37 billion into cash-like money market funds (MMFs) in the week to Wednesday, Bank of America (BAC) said on Friday, as they braced for the US Federal Reserve to cut interest rates in September.

It put MMFs on track for their biggest three-week cumulative inflow since January at $145 billion, BofA said, citing figures from financial data provider EPFR.

Investors put $20.4 billion into stocks, $15.1 billion into bonds, and $1.1 billion into gold, BofA said, in its weekly round up of flows in and out of world markets.

Many fund managers hope rate cuts will lower the returns on MMFs and cause a rush of cash into stocks and bonds.

Yet big investors typically flock to money market funds before the Fed cuts rates, as the range of short-term fixed income securities in the funds means they tend to offer higher returns for longer than short-term Treasury bills.

“Rate cuts not a likely spark for equity buying from the $6.2 trillion money market fund (sector),” BofA strategists, led by Jared Woodard, wrote.

“History shows the first Fed cut precedes more cash inflows in a ‘soft’ landing, and bonds the likely winner if ‘hard’.”

Recent economic data, broadly speaking, has pointed to a gradual economic slowdown, or ‘soft landing’ as opposed to a more dramatic ‘hard’ alternative.

BofA and EPFR’s data showed investment grade bonds drew their 43rd straight week of inflows at $8.1 billion.

Emerging market equities received $4.7 billion in their 12th straight week of inflows, the longest streak since February 2024.

(Reporting by Harry Robertson, editing by Alun John and Dhara Ranasinghe)

Elon Musk, Donald Trump, and X: Why Tesla investors are in a quagmire

Listen and subscribe to Opening Bid on Apple Podcasts, Spotify, or wherever you find your favorite podcasts.

One longtime Tesla (TSLA) shareholder is looking for a reason to believe in a company taking on fire from all sides.

But he admits that it’s getting tough to stay a believer in Elon Musk’s electric vehicle maker.

“[I] fear that Tesla’s best days are behind it,” Gerber Kawasaki Wealth & Investment Management CEO Ross Gerber told Yahoo Finance executive editor Brian Sozzi on the Opening Bid podcast (watch video above or listen below).

Gerber said he recently slashed his stake in Tesla to 266,000 shares, valued at around $50 million. Last year, he owned a reported 420,000 shares and was more of a Tesla optimist.

The very active poster on X, formerly Twitter, says he invested heavily in Tesla in 2018 and 2019. At the time, “things were really tough. I stuck by [Elon Musk] and invested money when nobody else would,” he said. “It paid off for me.”

But that was then, and since, Musk has taken to calling Gerber an “idiot” on X for voicing frequent concerns about the company’s business.

As Musk has pivoted toward building humanoid robots at Tesla, reviving X, and launching rockets via SpaceX, Gerber is worried the billionaire is leaving opportunities on the table at Tesla — at the risk of Tesla shareholders such as himself.

“Elon is not focused on building Tesla,” Gerber said.

Meanwhile, the fundamentals of Tesla have taken a turn for the worse.

In late July, the company reported second quarter results that included an earnings miss while revenue exceeded expectations. Vehicle deliveries came in at 440,000, only slightly above consensus.

Gerber believes Tesla is in for a few more challenging quarters.

The used car market is presently “flooded” with languishing Teslas because the “CEO now owns [X],” Gerber warned.

Tesla shares are trading at $213, down from the 52-week high of $278.98 but higher than the low of $138.80 during that same period.

Not helping sentiment on Tesla’s stock is Musk’s pivot to support former President Donald Trump.

Musk’s close-knit status with Trump is doing the company few favors, Gerber said, referring to Trump as “the worst thing for Tesla you could ask for” since he won’t help sell cars.

Trump’s proposed policies, such as repealing the $7,500 EV tax credit and supporting the oil industry, are in opposition “to the concept of what Tesla is,” said Gerber, adding that if Musk were to get a cabinet position in a second Trump administration, “it would be because of Twitter.”

Musk and Trump “want to control the narrative on Twitter,” he said. “That’s why they have a relationship.”

To be sure, Musk and Tesla still have an intensely loyal retail investor base unshaken by volatile news of the day.

“I’m very convinced this [stock] goes to $5,000 or $10,000 [long-term] once people understand what Tesla is all about,” retail investor and Tesla shareholder Alexandra Merz said on Opening Bid. Merz is a former financial adviser and current CEO of L&F Investor Services.

To Merz, Tesla’s stock remains undervalued for two main reasons.

First, the market is not properly pricing in the company’s earnings power from the widespread adoption of its Optimus humanoid robots over time.

These robots have their doubters, including former Meta head of AI Jerome Pesenti. “Sometimes we have to call it what it is, right? I mean, have you seen this [robot] thing do anything? It’s bulls**t,” Pesenti said on Opening Bid.

Second, Tesla’s AI is a competitive advantage that can widen its moat against car rivals such as General Motors (GM).

Gerber thinks the belief in Tesla’s Optimus robot is overdone and shouldn’t play a factor in a rational analysis of the stock.

“The last thing I need is some robot built by Elon Musk in my house,” Gerber added.

Three times each week, Yahoo Finance Executive Editor Brian Sozzi fields insight-filled conversations and chats with the biggest names in business and markets on Opening Bid. Find more episodes on our video hub or watch on your preferred streaming service.

Click here for the latest technology news that will impact the stock market

Read the latest financial and business news from Yahoo Finance

Ask an Advisor: I'm Selling My Home for $750k-How Much Will I Owe in Capital Gains Taxes?

I am selling my house and the price is $504,999. After paying off this house I will net $400,000. Do I have to pay a capital gains tax as I’m planning to pay off my retirement home with the money I netted?

– Thomas

The answer is solidly “it depends,” both in terms of whether you’ll have to pay capital gains tax and how much you might have to pay. Let’s talk about the rules around this situation first, and then we can get into some examples to see how they work.

Is Your Home Sale Taxable?

The IRS allows single filers to exclude up to $250,000 of capital gains from the sale of their home, and married couples filing jointly to exclude up to $500,000, if they meet certain criteria.

In order to qualify for either of those exclusions, all of the following have to be true:

-

You must have owned the home for at least two of the five years immediately preceding the sale.

-

You must have used the home as your primary residence for at least two of the five years immediately preceding the sale.

-

You can’t have claimed the exclusion in the two years immediately preceding the sale.

If you meet all of those criteria, you can claim the exclusion. If any of those criteria are not true for you, you will have to pay capital gains taxes on all of the proceeds.

Let’s look at some examples. A financial advisor can also walk you through the details in your specific situation. Get matched with a fiduciary financial advisor for free.

Example 1: Meets Exclusion Criteria, Married Filing Jointly

Let’s say that you’re selling the home you have owned and been living in for the past few years and that you are married and file taxes jointly.

In that case, you would qualify for a $500,000 exclusion on the sale of your home. Since you are netting $400,000, which is less than the exclusion, you would not have to pay any capital gains tax on those proceeds.

Example 2: Meets Exclusion Criteria, Single

Let’s assume the same situation as above, except that in this scenario you are single instead of married filing jointly. In that case, you would qualify for an exclusion but it would only be $250,000. With $400,000 in proceeds, that means that $150,000 would be subject to capital gains tax. The question then is at what rate those proceeds would be taxed. You can click here for a full breakdown of capital gains tax rates, but let’s assume that you would fall in the 15% bracket.

Multiplying $150,000 by 15%, you would have to pay $22,500 in taxes, leaving you with total net proceeds of $377,500. Of course, you may be subject to state income tax as well, which would increase the amount you have to pay.

A financial advisor can help you make calculations for your situation. Get matched with an advisor today.

Example 3: Does Not Meet Exclusion Criteria

If you don’t meet the exclusion criteria then the entire $400,000 will be taxed as capital gains. In that case, the first big question is whether those gains are taxed as short-term or long-term capital gains.

If you have owned the home for one year or less, your proceeds will be taxed as short-term capital gains, which means they will be subject to the same tax rates as ordinary income.

Let’s say that you are married filing jointly and that you and your spouse have $100,000 in income aside from your home sale. The $400,000 in proceeds would push your total ordinary income to $500,000 and into the 35% tax bracket, but because of our progressive tax code not all of that money would be taxed at the 35% rate.

Again, you can click here for a full breakdown of the 2023 tax brackets, but here’s how it would apply to your $400,000 home proceeds in this case:

-

$90,750 would be taxed at 22% = $19,965 in taxes

-

$173,450 would be taxed at 24% = $41,628 in taxes

-

$98,300 would be taxed at 32% = $31,456 in taxes

-

$37,500 would be taxed at 35% = $13,125 in taxes

That’s a total tax bill of $106,174 on just your home sale, leaving you with net proceeds of $293,826. Though again there may be state income taxes on top of that.

If you’ve held your home for one year or longer, you will only have to pay the lower long-term capital gains rate. Using the same example as above, with $100,000 in taxable income aside from the sale of your home, the entire $400,000 would be subject to a 15% capital gains tax. That’s a tax cost of $60,000, for net proceeds on your home sale of $340,000.

There Are Exceptions

There are exceptions to the general rules laid out above. You can click here for an overview of those exceptions, and you can click here for details regarding all of these rules.

But for the most part, it comes down to whether you’ve owned and lived in the home for at least two of the past five years. If so, you will qualify for a significant exclusion. If not, you will have to pay capital gains tax on the entire amount. Consider speaking with a fiduciary financial advisor if you have more questions.

Bottom Line

Figuring capital gains tax that may be owed on a home sale depends on several factors. One is whether you meet the criteria for excluding $250,000 for single filers and $500,000 for couples filing jointly. A second factor is how long you have lived in the house and whether it has been your primary residence. In addition, you must not have claimed the exclusion in the two years previous to the home sale. Keep in mind, though, that there are exceptions

Tips on Taxes

-

If you don’t have a financial advisor yet, finding one doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have free introductory calls with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Our free capital gains calculator, for both short-term and long-term, can be used for gains on the sale of a wide variety of assets, not just a residence.

-

Check out our no-cost property tax calculator to get a quick estimate of what you will owe based on the property’s location and its assessed value.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Matt Becker, CFP®, is a SmartAsset financial planning columnist and answers reader questions on personal finance and tax topics. Got a question you’d like answered? Email AskAnAdvisor@smartasset.com and your question may be answered in a future column.

Please note that Matt is not a participant in the SmartAsset AMP platform, nor is he an employee of SmartAsset, and he has been compensated for this article.

Photo credit: ©iStock.com/:ArLawKa AungTun, ©iStock.com/designer491

The post AAA: I’m Selling My House and Netting $400k to ‘Pay Off My Retirement Home.’ Do I Have to Pay Capital Gains Tax? appeared first on SmartReads by SmartAsset.

2 Stocks Down 51% and 43% That I Just Made Huge Investments In

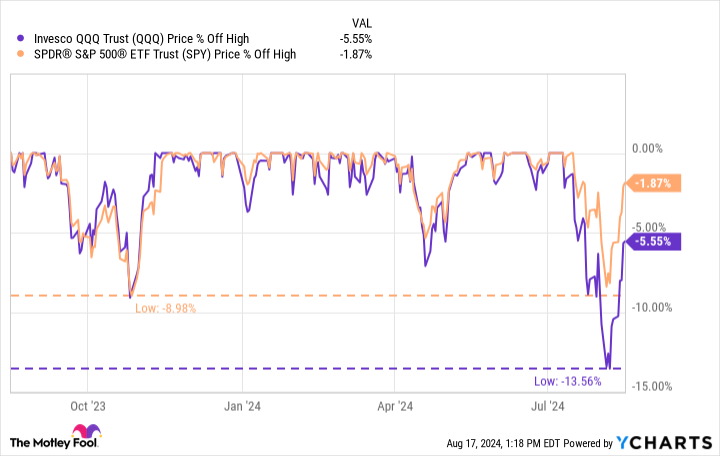

Although the early August market pullback may have been short-lived, it created opportunities to purchase excellent companies at much lower valuations. The Nasdaq Composite entered correction territory (defined as 10% off its recent high) and pulled back nearly 14%, while the S&P 500 flirted with a correction. However, both indexes recouped the majority of their losses in more recent trading sessions.

While some see sharp market pullbacks and run for the exits, savvy investors see them as fantastic opportunities. Corrections are normal and necessary events in the market. They generally occur about once a year on average and are actually healthy. Without periodic corrections, bull markets can become overheated and lead to bubbles, which are often followed by deeper crashes that can seriously harm not just the economy, but seriously dent long-term investors’ wealth building process.

And so, the best action for long-term investors amid corrections is to keep emotions at bay, and stay calm and take advantage of the volatility by purchasing shares of compelling companies at a discount.

I did this with Dell (NYSE: DELL) and Micron (NASDAQ: MU), two companies that are benefiting from the boom in artificial intelligence (AI) and data centers.

Data centers are critical to AI

The shift to cloud computing over the last couple of decades necessitated the construction of a host of massive data centers (buildings filled with infrastructure, servers, network, and storage equipment, etc.) to process and store data. Without them, software for businesses, online banking, streaming television, gaming, and many other applications wouldn’t function. The boom driven by AI programs creates another technical challenge.

Generative AI software requires much more processing power than other applications, so more capacity is needed now. Some data centers are small, less than 10,000 square feet, while others are massive, at more than 1 million square feet. So-called hyperscalers like Amazon, Meta, and Alphabet build these massive centers. Here are a few fun facts:

-

The U.S. is home to more than half of the world’s approximately 10,000 data centers.

-

120 new hyperscale data centers could become operational each year for the next 10 years.

-

Elon Musk’s xAI plans to build a gigantic data center in Tennessee that could include 100,000 Nvidia (NASDAQ: NVDA) liquid-cooled GPUs.

Dell and Micron will benefit significantly from rising data center demand. Both have industry expertise, critical products, and long-standing partnerships with AI chip leader Nvidia. But the recent correction sent their stocks tumbling, at one point down 51% and 43%, respectively, before recovering slightly, as depicted below.

Despite their strength over the past year and a half or so, the stocks are still down significantly from their recent highs. Here’s why I picked up significant positions in both.

Is Dell an overlooked AI stock?

Dell divides its business into two segments: the client solutions group (CSG) and the infrastructure solutions group (ISG). The client side includes PCs, laptops, and gaming products. CSG revenue was relatively flat in its fiscal 2025 first quarter (which ended May 3, 2024) due to a weak consumer market. However, my focus is on the infrastructure solutions segment. This segment supplies data center infrastructure, including AI-ready servers, data storage, and liquid cooling technology.

The ISG segment posted 22% growth in fiscal Q1 to reach $9.2 billion in revenue, while servers and networking sales grew 42% year over year to $5.5 billion, illustrating the increasing demand from data centers. The company also reported $1.7 billion in AI-optimized servers shipped in fiscal Q1, double the amount shipped in the prior quarter.

Dell stock trades at a price-to-earnings ratio (P/E) of 22, higher than its 3-year average. However, its forward P/E is just 14 based on analysts’ forecasts. Given the current demand, Dell has a great chance to beat these estimates.

Management believes the AI runway is long, and announced a refocused effort tailored to AI in the last earnings call. The recent pullback in its stock price should be compelling for long-term investors.

Is Micron stock a buy now?

Data centers and AI programs require boatloads of memory in addition to the infrastructure discussed above. Micron is one of the leading memory providers in the world. It operates in three main end markets: data center, PC, and mobile and intelligent edge (which includes automotive and industrial). While sales into the PC and mobile markets are expected to rise slightly, the excitement is around the data center business.

Micron produces a product called high-bandwidth memory (HBM), which is designed for AI and high-performance computing (HPC). In the latest earnings report, Micron points out that:

-

HBM sales hit $100 million in the quarter. Management expects several hundred million dollars of HBM sales this fiscal year and “several billion” next fiscal year;

-

It has already sold out of HBM through the end of 2025;

-

Its customer base is expanding.

Total revenue in its fiscal 2024 third quarter (which ended May 30) was $6.8 billion, a year-over-year increase of 82%. AI-related sales grew 50% over the prior quarter. Strong demand allowed Micron to significantly expand its margins, operating profits, and cash flow.

Micron stock is difficult to value using a simple P/E ratio because the company has substantial non-cash expenses, primarily depreciation and amortization, that skew its net income. However, analysts have more sophisticated methods of valuing companies. Currently, an overwhelming majority of analysts following the stock have given it buy or strong buy recommendations, and their average price target on it is $157. Micron stock would need to gain 45% to reach that level.

Dell and Micron will benefit from the AI/data center up cycle, which could last years. Long-term investors should consider them after the recent pullback.

Should you invest $1,000 in Dell Technologies right now?

Before you buy stock in Dell Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Dell Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $787,394!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Bradley Guichard has positions in Amazon, Dell Technologies, and Micron Technology. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, and Nvidia. The Motley Fool has a disclosure policy.

2 Stocks Down 51% and 43% That I Just Made Huge Investments In was originally published by The Motley Fool

Can You Guess What Percent Of People Actually Retire With A $2 Million Nest Egg? Here's A Hint – Aim Really Low

Imagine sitting on a beach, the waves gently lapping at the shore as you sip on a drink with a tiny umbrella. That’s the $2 million retirement dream. The idea of kicking back worry-free, because you’ve saved enough to enjoy your golden years in style. But here’s the twist: how many people realize that dream? Can you guess what percentage of retirees manage to bank $2 million before they call it quits?

Don’t Miss:

Spoiler Alert: It’s a Tiny Fraction

The dream of retiring with $2 million is just that for most – a dream. According to the Federal Reserve’s Survey of Consumer Finances, only about 3.2% of retirees have over $1 million in their accounts. And if you’re aiming for the $2 million club? Well, the number of those who make it is even smaller. We’re talking about a sliver of a sliver – somewhere between that 3.2% and the razor-thin 0.1% who’ve got $5 million or more.

See Also: Can you guess how many retire with a $5,000,000 nest egg? – How does it compare to the average?

How Does $2 Million Stack Up Against Average Savings?

The average retirement savings for people 65 and older? Just $232,710 as of 2022, according to Vanguard. That’s less than one-tenth of $2 million! Even if you look at different age groups, it’s clear that the $2 million milestone is out of reach for the vast majority. Those aged 65 to 74 average around $609,230; for those 75 and older, it drops to $462,410. Both figures are impressive compared to the general population, but they’re still far from that magical $2 million mark.

What Sets the $2 Million Achievers Apart?

So, what’s the secret for those few who hit $2 million? It’s not just luck – though that never hurts. Several key factors play a role:

-

Early Start: Time is your friend when it comes to retirement savings. Start at 25, and you’d need to save about $5,677 annually to hit $2 million by age 72, assuming a 7% annual return. Delay it, and the numbers get a lot scarier.

-

Consistency is Key: It’s all about regular contributions. Financial pros often recommend saving away 10-15% of your income for retirement. It’s not glamorous, but it works.

-

Smart Investing: This isn’t just about saving – it’s about making your money work for you. Stocks, index funds, ETFs – these tools have historically provided the best returns. Just letting cash sit in a savings account won’t cut it.

-

Higher Income, Higher Savings: Whether you like it or not, those with higher incomes have an easier time saving big. The top 10% of households have an average of $769,000 saved up for retirement.

-

Education Matters: College grads tend to have more than triple the retirement savings of those with just a high school diploma. It’s a reminder of how education can impact your financial future.

-

Homeownership Helps: Homeowners typically have way more saved for retirement – 267% more, to be precise. They’ve got an average of $303,000 saved up, compared to renters.

Trending: The number of ‘401(k)’ Millionaires is up 43% from last year — Here are three ways to join the club.

Is $2 Million Enough?

Here’s the kicker: even if you hit $2 million, is it enough? The answer isn’t one-size-fits-all. It depends on where you live, your lifestyle, your health care needs, and whether you plan to keep working part-time. For some, $2 million might be more than enough. For others, it might just scratch the surface.

But one thing’s for sure: reaching that $2 million milestone puts you in an elite group of retirees. Whether it’s enough? That’s up to you and your unique situation. It may be a smart move to discuss your goals with a financial advisor. These experts can help you develop a game plan to reach your retirement or any other financial goals.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Can You Guess What Percent Of People Actually Retire With A $2 Million Nest Egg? Here’s A Hint – Aim Really Low originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The guest list for Mike Lynch’s fatal yacht party was a who’s who of players from the Autonomy scandal

On board the doomed Bayesian superyacht that claimed Mike Lynch’s life were not only his family and friends but also crucial business figures who encapsulated the key phases of his career.

High-flying former employees at his tech group Autonomy, allies who helped push through its multibillion-dollar sale to HP, and the legal brains who defended him after that deal turned sour were all in attendance on the Mediterranean when it ran into storms on Monday morning.

Lynch was pronounced dead on Thursday after the yacht he boarded with 21 other passengers sank off the coast of Sicily.

He was celebrating his recent acquittal on fraud charges linked to HP’s $11.7 billion acquisition of Lynch’s tech group Autonomy in 2011.

Lynch was joined by his wife, Angela Bacares, who survived, and his 18-year-old daughter, Hannah Lynch, whose body was recovered on Friday morning.

Other passengers included critical allies who had supported Lynch through the tech mogul’s most turbulent period.

The getaway was a symbolic voyage on what Lynch had described as the beginning of a “second life.”

The coincidental car crash: Steven Chamberlain

Rumors have now swirled about the connections between the guests on the boat and the coincidental death of Steven Chamberlain in a collision with a driver in Cambridgeshire, just days before the boat sank.

Chamberlain was a veteran at Autonomy and went on to become chief operating officer at Darktrace, a company widely connected with Autonomy. He took a “leave of absence” to defend himself during Lynch’s recent trial in the United States.

Former Autonomy NED: Jonathan Bloomer

The body of Jonathan Bloomer, 70, as well as that of his wife, Judy Bloomer, 71, were recovered alongside Lynch’s on Wednesday.

Autonomy appointed Bloomer as a non-executive board member in 2010. He chaired the group’s audit committee during the HP sale and was a key witness for Lynch’s defense during his fraud trial in California. At the time of his passing, Bloomer was an international chair at Morgan Stanley International.

Bloomer told prosecutors that Lynch “wasn’t particularly interested in the finance side” of Autonomy, preferring to focus on strategy and the company’s products.

Lynch’s lawyers: Chris Morvillo and Ayla Ronald

Chris Morvillo, 59, passed away aboard the Bayesian yacht with his wife, American jewelry designer Neda Morvillo, 57.

Morvillo, a lawyer at magic circle firm Clifford Chance, represented Lynch in his criminal trial in the U.S.

He told the legal podcast For the Defense that the case “covered one-third of my career” after his first meeting with Lynch in 2012, as HP’s unrest grew.

In a rare LinkedIn post following the trial, which would also prove to be one of his last, Morvillo thanked his daughters and his late wife, Neda.

“I am so glad to be home,” Morvillo wrote.

“And they all lived happily ever after…”

Ayla Ronald, a 36-year-old senior associate at Clifford Chance, was also on board the Bayesian with her partner, Matthew Fletcher. Both survived the sinking.

Ronald’s company profile details how she also defended Lynch in his fraud trial with HP.

Extensive links to Darktrace

After Lynch sold Autonomy, for which he is reported to have received £500 million ($656 million), he set up the venture capital fund Invoke Capital in 2012, which would see his influence expand deep into the U.K. tech scene in his final years.

Invoke was an early-stage investor in Darktrace, now subject to a $5.3 billion acquisition from U.S. private equity firm Thoma Bravo. The VC fund also invested in British AI company Luminance, which closed a $40 million funding round in April.

Lynch and his wife Angela held millions of their net worth in their final years through Darktrace, with a source telling Fortune they collectively had a 3% stake in the £4 billion ($5.25 billion) valued company at the time of their passing. Fortune exclusively revealed the deal is expected to still complete later in 2024.

Several former high flyers from Lynch’s Autonomy days leaped into key positions at Darktrace. Poppy Gustafsson, Darktrace’s current CEO, was a corporate controller at Autonomy. In a LinkedIn post commemorating the lives lost, Gustafsson said “Without Mike, there would be no Darktrace. We owe him so much.”

The links appear deep; Darktrace’s founding CEO Nicole Eagan also served as chief marketing officer at Autonomy, during the acquisition period involving HP. Neither Eagan or Gustafsson were on the boat, and both continue to hold leadership positions at Darktrace today.

Invoke Capital: Charlotte Golunski

Charlotte Golunski is another person with long-held business ties to Lynch. She is a partner at Invoke Capital, joining during its formation in 2012. Invoke Capital shared offices with Darktrace near London’s Trafalgar Square for a number of years.

Before joining Invoke, Golunski worked for Lynch at Autonomy and HP Autonomy for a year after the acquisition.

Golunski, 35, survived the sinking of the Bayesian alongside her partner, James Emsley, and their 1-year-old daughter. She had been asleep on the deck of the yacht with her baby when the storm hit, describing how she felt oscillations in the boat before it went down minutes later.

She told the Italian outlet La Repubblica how she held her baby above her arms in the water before she was rescued.

This story was originally featured on Fortune.com

How to prepare for the Fed's forthcoming interest rate cuts

NEW YORK (AP) — The Federal Reserve is poised to cut its benchmark interest rate next month from its 23-year high, with consequences for consumers when it comes to debt, savings, auto loans and mortgages. Right now, most experts envision three quarter-point Fed cuts — in September, November and December — though even steeper rate cuts are possible.

“The time has come” for the Fed to reduce interest rates, Powell said Friday in his keynote speech at the Fed’s annual economic conference in Jackson Hole, Wyoming. “The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

Based on Powell’s remarks and recent economic data, the central bank is expected to cut its key rate by a quarter-point when it meets next month and to carry out additional rate cuts in the coming months.

Read more: What the Fed rate decision means for bank accounts, CDs, loans, and credit cards

Here’s what consumers should know:

What would the Fed’s rate cuts mean for savers?

According to Greg McBride, chief credit analyst for Bankrate, savers should lock in attractive yields right now, before the expected rate cuts begin.

“For those who might be looking at Certificates of Deposit or bonds — you want to jump on that now,” he said. “There is not a benefit to waiting because interest rates are going to be moving lower.”

McBride stressed that anyone closer to retirement has a good opportunity to lock in CDs at the current relatively high rates.

“If you do so, you’ll provide yourself a predictable flow of interest income at rates that should outpace inflation by a pretty healthy margin,” said McBride.

How would the rate cuts affect credit card debt and other borrowing?

“Your credit card bill is not going to plunge the day after the next Fed meeting,” cautions LendingTree chief credit analyst Matt Schulz. “Nobody should expect miracles.”

That said, the declining benchmark rate will eventually mean better rates for borrowers, many of whom are facing some of the highest credit card interest rates in decades. The average interest rate is 23.18% for new offers and 21.51% for existing accounts, according to WalletHub’s August Credit Card Landscape Report.

Still, “it’s really important for people to understand that rates probably aren’t going to fall that quickly,” Schulz said.

He said it’s important to take steps such as seeking a 0% interest balance transfer or a low-interest personal loan. You can also call your credit card issuer to see if you can negotiate a better rate.

Read more: What credit card users need to know if the Fed cuts rates in September

“In the short term, those things will have a much bigger effect than falling interest rates,” Schulz said.

How about mortgages?

The Federal Reserve’s benchmark rate doesn’t directly set or correspond to mortgage rates, but it does have an influence, and the two “tend to move in the same direction,” said LendingTree senior economist Jacob Channel.

In recent weeks, mortgage rates have already declined ahead of the Fed’s predicted cut, he pointed out.

“It goes to show that even when the Fed isn’t doing anything and just holding steady, mortgage rates can still move,” Channel said.

Melissa Cohn, the regional vice president of William Raveis Mortgage, echoed this, saying that the most important thing is what signal the Fed is sending to the market, rather than the rate change itself.

“I’ve heard from a lot of people who locked in (their mortgage rate) over the course of the past 18 months, when rates were at their peak, already asking whether it’s time to refinance and what savings they could have,” she said. “I think that the outlook is good, and hopefully that spills into the real estate market, and we get more buyers in the market.”

Channel said that the majority of Americans have mortgages at 5%, so rates may have to fall further than their current average of 6.46% before many people consider refinancing.

Read more: How the Federal Reserve rate decision affects mortgage rates

And auto loans?

“With auto loans, it’s good news that rates will be falling, but it doesn’t change the basic blocking and tackling of things, which is that it’s still really important to shop around and not just accept the rate that a car dealer would offer you at the dealership,” said Bankrate’s McBride. “It’s also really important to save what you can and be able to try to put as much down on that vehicle as you can.”

McBride does predict that the beginning of rate cuts and the avoidance of a recession will lead to lower auto loan rates in 2024 — at least for borrowers with strong credit profiles. For those with lower credit profiles, double digit rates will likely persist for the remainder of the year.

What’s going on with inflation and the job market?

Last week, the government reported that consumer prices rose just 2.9% in July from a year ago, the smallest increase in over three years. Employment data, however, gives some economists pause. New data has showed hiring in July was much less than expected and the jobless rate has reached 4.3%, the highest in three years — one measure of a weakening economy. That said, robust retail sales have helped quell fears of a recession.

The rate at which the Fed continues to cut rates after September will depend in part on what happens next with inflation and the job market, in the coming weeks and months.

___

The Associated Press receives support from Charles Schwab Foundation for educational and explanatory reporting to improve financial literacy. The independent foundation is separate from Charles Schwab and Co. Inc. The AP is solely responsible for its journalism.

Senior Homeowners: When Can You Stop Paying Property Taxes?

As a senior citizen, you probably will end up paying property taxes for as long as you are a homeowner. However, depending on the state you live in and often once you hit your 60s (usually around the ages of 61 to 65), you may be eligible for a property tax exemption. This exemption is often referred to as a homestead exemption for seniors and sometimes as a “senior freeze.” It’s important to understand how this works in order to determine if you’ll be able to take advantage of this property tax exemption. You can also work with a financial advisor who can help you make a retirement plan, including any tax savings or exemptions that you may qualify for.

How Do These Property Tax Exemptions Work?

Every state handles property tax exemptions differently, but generally, a homestead tax exemption program does not mean that you will stop paying any property taxes as a senior. These typically are programs that reduce your future property taxes but not do end them. After all, most local governments are funded by property taxes. If property taxes disappeared entirely for seniors, cities and town budgets would likely suffer.

Frequently, the way these programs work, the assessed value of the property freezes, once you have successfully applied and been accepted for a homestead exemption. So if your home’s property value was frozen at $200,000, five years from now, if your home is now worth $220,000, you’ll be paying taxes on a $200,000 home and not a $220,000 home.

As noted above, the taxes homeowners pay will differ from state to state. For instance, Ohio allows qualifying homeowners to exempt up to $25,000 of the market value of their homes from all local property taxes. So if you were eligible for the state’s property tax exemption and have a $150,000 home, once you crunched the numbers with a property tax calculator, the property taxes would possibly be calculated as though your home’s market value was $125,000.

Ultimately, these senior freezes don’t just provide a needed monetary break for seniors, it can help keep them in their homes and neighborhood. After all, a senior citizen is often living on a fixed income. If property values keep climbing, a senior making a low to moderate income may struggle to remain in a home that they’ve spent most of their life in.

Factors You’ll Want to Keep in Mind With a “Senior Freeze”

Because states all handle property tax exemptions differently, you may find that you don’t live in a state that isn’t yet offering a homestead exemption. Or you may find that your state offers a senior freeze, but you make too much money to qualify. So you definitely want to investigate your own state, before you determine whether you will be able to put the brakes on paying property taxes.

But there are several factors you’ll want to keep in mind:

-

There are rules: Because these state programs are often but not always aimed at low-income seniors, it should come as no surprise that there are generally always going to be rules baked into these property tax exemptions, such as second homes or vacation homes not being eligible for a senior freeze.

-

You may just get a credit: Often these tax exemptions come in the form of a credit on property tax bills.

-

Only one homeowner may need to qualify: Don’t assume that both homeowners have to be the eligible age to participate in a senior freeze. You may be able to take advantage of the property tax exemption as long as one homeowner is the eligible age.

-

This may not just apply to homeownership: These senior freezes generally don’t only apply to houses. Often, if you’re 65 or older, you’ll be able to reduce your property tax bill not only on a house but mobile and manufactured homes, houseboats, townhomes, condominiums and so on.

-

You will have to apply: You typically need to apply for a senior freeze. You may not need to renew it every year, but generally, the first year you would have to apply for a property tax exemption. It likely won’t automatically be granted to you.

-

You’ll provide more information after applying: When you apply for a senior freeze, you’ll typically furnish your age and date of birth on the application. You may later need to provide, perhaps to a county auditor, documentation in the form of a driver’s license or birth certificate.

The senior freeze can be a good fit for many to cut down on property taxes that might prevent them from owning their homes during retirement. Just keep these rules in mind before deciding to apply. Consider speaking with a financial advisor to build an appropriate tax strategy.

The Bottom Line

Saving for retirement was hard and managing your money while retired is even harder. If you are eligible for a homestead exemption for seniors in your state you may want to consider applying for one. You won’t get out of paying property taxes entirely but the senior freeze will stop property taxes in their tracks. You may want to sell your home someday for a variety of reasons but thanks to a property tax exemption, if you do move out it likely won’t be because property taxes were too high.

Tips for Retirement Planning

-

Retiring can be hard enough without having to worry about whether you have enough money or not. You may want to work with a financial advisor to help you create a retirement plan so that you don’t have to worry. You’ll be able to make long-term financial goals and get a roadmap on how to achieve those goals. Finding the right financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

You can also take advantage of SmartAsset’s free retirement calculator to help you determine if you’re saving enough to meet your long-term goals.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Photo credit: ©iStock.com/Andrii Zastrozhnov, ©iStock.com/Jinda Noipho, ©iStock.com/Jirapong Manustrong

The post At What Age Do Seniors Stop Paying Property Taxes? appeared first on SmartAsset Blog.

Alphabet and Meta Platforms Just Sent a Major Warning to Nvidia Shareholders

Nvidia (NASDAQ: NVDA) has been one of the biggest beneficiaries of the booming spending on artificial intelligence (AI) development. Its graphics processing units (GPUs) are a key piece of infrastructure for training and running large language models, the backbone of generative AI. Big tech companies like Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) and Meta Platforms (NASDAQ: META) are spending billions of dollars to get their hands on as many Nvidia GPUs as possible right now.

That’s been great for Nvidia and its shareholders. Sales more than tripled in its fiscal first quarter, reaching a record $26 billion in total revenue. But that kind of growth can’t last forever.

Analysts expect more modest sales growth of “just” 38.4% next year. But some comments from Nvidia’s biggest customers suggest that number might be too high.

Nvidia’s biggest customers just admitted they’re overspending on AI

While Nvidia has seen its profits soar as a result of all the AI spending, the same isn’t necessarily true of a lot of its biggest customers. A step up in capital expenditures like those required to build AI data centers can be a crunch on cash flow. That’s especially true if those investments don’t produce an immediate impact on revenue.

That’s the challenge for cloud providers that rent computing infrastructure to developers. The three largest cloud providers are Microsoft, Amazon, and Google. If a developer comes to one of them and needs access to compute power they don’t have, it will go to one of its competitors. As a result, they need to build data centers fast enough amid the current AI boom to ensure when a new customer comes to them, or an existing customer asks for more capacity, they can serve them.

Alphabet CEO Sundar Pichai made this clear when asked about spending on AI during the company’s second-quarter earnings call. “I think the one way I think about it is when we go through a curve like this, the risk of under-investing is dramatically greater than the risk of over-investing for us here,” he told analysts. In other words, he’s intentionally overspending right now to ensure he gets as many customers as possible. Microsoft and Amazon are likely taking a similar approach.

Meanwhile, Meta Platforms is building its own data center capacity to support its AI development. CEO Mark Zuckerberg has ambitions of turning Meta into the leading AI company in the world. And that requires having the infrastructure in place before the company’s software is ready for training and deployment.

“It’s hard to predict how this will trend multiple generations out into the future, but at this point I’d rather risk building capacity before it is needed, rather than too late, given the long lead times for spinning up new infra projects,” he said during Meta’s second-quarter earnings call.

His comments echo Pichai’s. Meta is spending now with the expectation that it will grow into its capacity. At some point, however, it will rightsize its data centers. At that point, it will significantly slow down its spending on servers and chips like Nvidia’s.

These comments hold a lot of weight (on Nvidia’s income statement)

The reason Nvidia shareholders should pay attention to everything Pichai, Zuckerberg, and a few other big-tech executives say about their AI spending is that the business has become heavily concentrated on those customers.

Twenty-four percent of Nvidia’s total sales in the first quarter came from just two customers. Between 60% and 70% of its revenue comes from just 10 customers, according to Seligman Investments analyst Paul Wick.

With all that revenue highly concentrated among just a handful of customers, a single change in the capital expenditure policy at one of them could drastically impact Nvidia’s results. If Alphabet or Meta decide to cut back on spending in a couple of years after aggressively building capacity, Nvidia will see its growth slow considerably.

The stock is in a precarious position, with Nvidia shares trading at valuation multiples, with around 50x forward earnings and 40x enterprise value to revenue. If it continues to outperform management’s guidance and analysts’ expectations, the stock will continue zooming higher. But one quarter of poor results could send shares reeling. The comments from Alphabet and Meta suggest it may be only a matter of time before there’s a stark pullback in AI spending.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $758,227!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Adam Levy has positions in Alphabet, Amazon, Meta Platforms, and Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Alphabet and Meta Platforms Just Sent a Major Warning to Nvidia Shareholders was originally published by The Motley Fool

Prediction: 1 Stock-Split AI Stock to Buy Before It Soars 100% in the Next Year (Hint: Not Nvidia)

Two artificial intelligence (AI) stocks have led the S&P 500 (SNPINDEX: ^GSPC) higher this year. Semiconductor company Nvidia (NASDAQ: NVDA) and server manufacturer Super Micro Computer (NASDAQ: SMCI) have see their share prices surge 159% and 119%, respectively.

Both companies recently announced 10-for-1 stock splits to make shares more affordable. Nvidia completed its split in June, and Super Micro Computer will follow suit in late September. But Wall Street analysts expect both stocks to move even higher over the next 12 months.

Nvidia’s median target of $140 per share implies 10% upside from its current share price of $127. And Super Micro’s median target of $693 per share implies 16% upside from its current share price of $600. But I think Super Micro stock will soar 100% in the next year, achieving a split-adjusted share price of $120 by August 2025.

That said, patient investors should consider buying both stocks.

Nvidia: Delayed Blackwell shipments create uncertainty ahead of earnings

Nvidia reported stellar financial results in the first quarter, crushing estimates on the top and bottom lines. Revenue rose 262% to $26 billion and non-GAAP net income climbed 461% to $6.12 per diluted share. CEO Jensen Huang said, “Our data center growth was fueled by strong and accelerating demand for generative AI training and inference on the Hopper platform.”

However, shipments of Nvidia’s Blackwell GPUs will be delayed three months due to a design flaw “discovered unusually late in the production process,” according to The Information. Blackwell chips can run training and inference workloads more quickly than the previous Hopper generation, which should further cement Nvidia’s leadership position in AI chips.

Following the report, Nvidia shares slipped to their lowest level since May, but the stock has since rebounded, suggesting the market sees little reason to worry. Indeed, Deutsche Bank analyst Ross Seymore doubts the delayed launch of Blackwell will have a material impact on the Nvidia’s near-term outlook or its ability to achieve Wall Street estimates.

However, investors should proceed cautiously. Management has yet to address the issue, so it represents an unknown that demands explanation when the company reports earnings on Aug. 28. Expectations are already high given that Nvidia has crushed Wall Street estimates in recent quarters, so bad news could cause the stock to decline sharply.

Looking ahead, Wall Street expects Nvidia’s earnings to grow at 37% annually over the next three year. That makes the current valuation of 75 times earnings look a little pricey, though not absurdly expensive. Patient investors can buy a very small position today, provided they are comfortable with the possibility of a post-earnings decline. In that scenario, investors should consider buying a slightly larger position on the pullback.

Super Micro Computer: The market leader in AI servers is expected to gain share

Super Micro Computer designs servers and storage solutions for cloud and private data centers. Internal manufacturing capabilities and a unique building-block approach to product development allow the company to rapidly build servers with the latest chips from suppliers like Nvidia. As a result, Super Micro typically beats competitors to market by two to six months, according to CEO Charlies Liang.

That advantage has made Super Micro the leader in artificial intelligence (AI) servers, and analysts expect the company to gain share quickly. Bank of America analysts expect Super Micro to account for 17% of AI server sales by 2026, up from 10% last year. Tom Blakely at KeyBanc is more bullish. He thinks Super Micro’s market share could top 20% this year. He also says the company has “competitive moats that should sustain if not expand this share in coming years.”

Supermicro reported mixed financial results in the fourth quarter of fiscal 2024 (ended June 30). Revenue surged 143% to $5.3 billion on record demand for AI infrastructure. However, gross margin contracted 5.8 percentage points to 11.2% and non-GAAP net income climbed just 78% to $6.25 per diluted share. Wall Street expected non-GAAP earnings to increase 130% to $8.14 per diluted share.

The stock plunged following the report, reflecting concerns that margins contracted because Super Micro lacks pricing power in an increasingly competitive market. But CEO Charles Liang attributed the margin crunch to costs associated with direct liquid cooling (DLC) components. Moreover, he expects gross margin to normalize between 14% and 17% by the end of fiscal 2025 (ends June 2025) as DLC servers begin shipping in higher volume.

Importantly, investments in DLC technology could reinforce Super Micro’s position as the market leader in AI servers. Liquid cooling is more cost effective than traditional air cooling, so demand for DLC servers is expected to grow rapidly in the coming years as data centers are filled with powerful AI hardware generating tremendous amounts of heat. Super Micro has positioned itself as an early leader in DLC technology.

Looking ahead, Super Micro’s guidance for fiscal 2025 implies revenue growth between 74% and 101%. If the company hits the high end of that range, its share price could increase 100% without any change in the price-to-sales ratio. And the stock currently trades at 2.5 times sales, which is a discount to the 12-month average of 3.3 times sales. That’s why I believe Super Micro stock will double by August 2025.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $787,394!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Trevor Jennewine has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Prediction: 1 Stock-Split AI Stock to Buy Before It Soars 100% in the Next Year (Hint: Not Nvidia) was originally published by The Motley Fool