Billionaire Bill Ackman has an idea for getting the ultrawealthy to finally pay a fair share of taxes

Acknowledging the growing number of Americans fed up with yawning income inequality, billionaire investor Bill Ackman has come up with a way to get the ultrawealthy to pay their fair share.

The founder of Pershing Square Capital Management suggested on Thursday a tailored approach to ensure people like Elon Musk and Jeff Bezos shoulder more of the burden, arguing against the blunt instrument of a proposed federal tax levied on unrealized capital gains.

In order to avoid endangering America’s entrepreneurial spirit, Ackman argued, the wealthy should be taxed on the basis of how much they borrow against stock in their own companies, closing arguably the most controversial loophole in the tax code.

“If you have $10 billion of stock in a company you founded,” he wrote on social media, “loans secured by the stock should be taxable as if you sold a like amount of stock.”

The way to fix this problem is to make borrowing an amount in excess of your basis in a stock taxable. In other words, if you have $10 billion of stock in a company you founded with zero basis, loans secured by the stock should be taxable as if you sold a like amount of stock.… https://t.co/uOcfYYfAAP

— Bill Ackman (@BillAckman) August 21, 2024

Ackman’s suggestion comes after Democratic presidential nominee Kamala Harris lent her support to a Biden administration plan to tax unrealized capital gains for those households whose net worth is a minimum of $100 million. The tax has met with fierce opposition from the likes of venture capitalists including Marc Andreessen, who believe it will smother the incentive for the innovation founders of tech startups provide.

How would Ackman’s idea work?

Under Ackman’s proposal, those risking their fortune would only be taxed if they encumbered their businesses with personal debt above and beyond what they put into it.

Let’s apply that to a practical example. Elon Musk is currently locked in a legal battle with investors to retain his 2018 pay package, which grants him the right to purchase nearly 304 million shares of Tesla at $23.34 each, a steep 89% discount to the current price.

Were he to win in Delaware court, he could, in theory, exercise the options by paying $7.1 billion, then turn around and immediately sell them for $64 billion (minus whatever the resulting drop in price would be with such a large sale). The difference he would then pocket, roughly $57 billion, would be taxable as a capital gain.

But what if he just wanted to free up a little cash to buy a megayacht like his rival, Amazon founder Jeff Bezos? Or a small island like his friend Larry Ellison? Under Ackman’s plan, he would be free to borrow against his shares up to the amount he invested to acquire them under the plan, but anything on top of that would be taxable.

If he then ever paid off that loan—unencumbering the underlying shares in the process—that money would be off-limits for the government going forward. That way, were Musk to actually liquidate that stock in the future, Uncle Sam could not tax it twice, first as an unrealized and then once again as a realized capital gain.

Pandemic-era asset price inflation a boon for the ultrawealthy

Much like the subprime crisis triggered banker-bashing, the outbreak of COVID has made billionaire-bashing fashionable and, crucially, very popular politically. Even JPMorgan CEO Jamie Dimon has dabbled in it.

During the pandemic, governments around the world unleashed a tsunami of fiscal and monetary stimulus. Much of that translated into inflation in the price of assets. In 2020, the value of Tesla stock alone soared 10-fold, catapulting Elon Musk’s already sizable wealth into the stratosphere.

“The pandemic—full of sorrow and disruption for most of humanity—has been one of the best times in recorded history for the billionaire class,” Oxfam concluded afterward.

In June 2021, a ProPublica investigation revealed some of the world’s richest Americans often paid little to no tax. Instead they pay for everything by tapping loans backed by their equity much like a homeowner would extract value from their house, by borrowing against its rising value.

Musk has borrowed against $50 billion worth of Tesla stock

Musk is a perfect example of someone who profited from unrealized capital gains. He hasn’t earned a salary in years: His entire pay package requires him to meet milestone targets in order to unlock tranches of stock options. No salary means no income tax. (He did pay a windfall tax in late 2021, which he claimed was the most in U.S. history after converting some of his stock options.)

Tesla’s annual proxy statement filed in April indicated he has borrowed against 238.4 million shares as of March 31, worth a collective $50 billion at the current price. And that’s just Tesla—who knows if he has done the same with his privately owned companies like SpaceX.

Weeks after ProPublica’s revelations sent “shock waves through Washington,” Senate Finance Committee chair Ron Wyden, a Democrat, proposed in October 2021 the first federal tax on unrealized capital gains. But the idea was still considered too radical at the time. It was also heavily opposed by Musk, who warned it would interfere with his plans to expand civilization to Mars.

In April, Biden adopted the “sea change” approach, and November’s federal elections will likely determine its fate. If the idea lacks enough support, there’s always Ackman’s proposal.

Musk couldn’t be reached by Fortune for comment.

This story was originally featured on Fortune.com

Stocks Rally as Powell ‘Locks In’ a September Cut: Markets Wrap

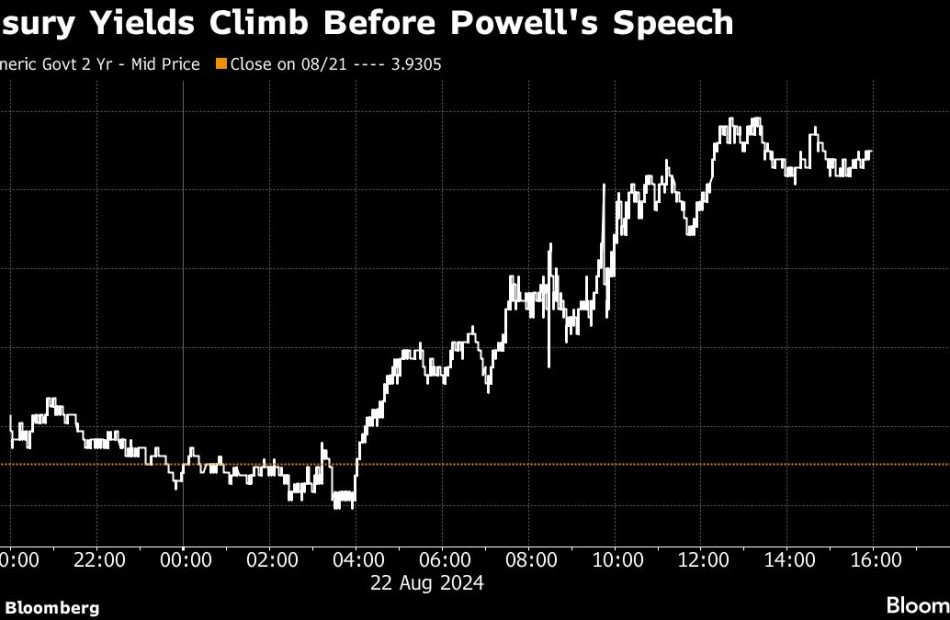

(Bloomberg) — Stocks rallied across the board and bond yields tumbled, with Jerome Powell giving its clearest signal yet that the Federal Reserve will begin cutting interest rates in September.

Most Read from Bloomberg

While Wall Street had already priced in the start of policy easing next month, Powell’s comments that the “time has come” validated those views. Now there are plenty of other aspects in his Jackson Hole speech that shouldn’t be overlooked. For one, the Fed chief acknowledged recent progress on inflation. Then there’s the fact the he sees the economy growing at a “solid pace” — which provides reassurance after the recent growth jitters.

But it was actually his emphasis on the “cooling labor market” that got the attention of many market observers. Basically, it was seen as an indication the Fed will do whatever it can to avoid a pronounced slowdown.

“The market should be happy with this speech because it wasn’t hawkish in any way, gave the green light for 25 basis-point rate cuts — and left the door open for even larger cuts if that becomes necessary,” said Chris Zaccarelli at Independent Advisor Alliance.

To be sure, bigger cuts could also be a warning sign for equities as they could indicate a rush prevent an economic contraction.

“It is important at this time to take a balanced approach to investing and neither plan for an imminent recession, nor chase risk and get complacent just because the Fed will be lowering rates in less than a month,” Zaccarelli noted.

Absent from Powell’s speech was any specific discussion of the destination for the federal funds rate at the end of this easing cycle or the pace of rate cuts along the way, noted Richard Clarida at Pacific Investment Management Co.

“The details are yet to come into focus, but for the Fed, the direction of travel seems clear,” said Clarida, also a former Fed vice chair. The August jobs report will likely be significant in the “25 versus 50” discussion, he said.

In the meantime, investors cheered. All major groups in the S&P 500 gained, with the gauge up over 1%. An MSCI gauge of global shares hit an all-time high. The Bloomberg “Magnificent Seven” gauge of megacaps rose 1.7%. The Russell 2000 of small firms jumped 3.2%.

A rally in Treasuries was led by shorter maturities. The two-year yield broke below 4%. The dollar lost 1%. Swap traders are now pricing in 102 basis points of easing this year, which implies a reduction at every remaining policy meeting through December, including one jumbo 50-basis-point cut.

“Here comes the punchbowl,” said David Russell at TradeStation. “Jerome Powell came out swinging today with a litany of dovish signals. He drove the point home with a clear call for adjusting policy. This keeps a tailwind at the market’s back into year-end, making it harder to expect a retest of this month’s lows.”

To Krishna Guha at Evercore, while Powell did not explicitly reference the “size” of cuts, “pace” incorporates the possibility of moving faster than 25 basis points per meeting.

“Powell has rung the bell for the start of the cutting cycle,” said Seema Shah at Principal Asset Management. “Powell has not pre-committed to a 50 basis-point cut. But make no mistake, if the labor market shows signs of further cooling, the Fed will cut with conviction.”

Neil Dutta at Renaissance Macro Research noted that the word “gradual” was missing from his speech. Unlike some of the recent Fed speakers, Powell is not removing the optionality of doing large moves as policy adjusts, he said.

“The strike price on the fabled ‘Powell Put’ is now rising,” Dutta added.

While many had their eyes peeled on Powell’s speech at the Jackson Hole symposium, to Morgan Stanley’s Michael Wilson, the jobs data in early September will be of even bigger importance.

“It’s about the labor data, period — that’s what’s going to dictate what the Fed does, they’ve said that,” Wilson, the bank’s chief US equity strategist, said in an interview with Bloomberg Television. “And that’s what the market is going to trade off of.”

Former Treasury Secretary Lawrence Summers said that, while the Fed hit a “low point” in its monetary policy history by failing to act quickly against the 2021 inflation surge, in the end it did enough to right the economy.

“I’ve got to give the Fed credit,” Summers said on Bloomberg Television’s Wall Street Week with David Westin on Friday. “While it wasn’t always obvious that this would be the case, they moved strongly enough and vigorously enough to keep expectations anchored” for inflation, he said.

Corporate Highlights:

-

Apple Inc. is planning to hold its biggest product launch event of the year on Sept. 10, when the company will unveil the latest iPhones, watches and AirPods, according to people familiar with the situation.

-

McKesson Corp. is in advanced talks to buy a controlling stake in Florida Cancer Specialists & Research Institute, a privately-held operator of oncology clinics, according to people familiar with the matter.

-

Slowing sales at Topgolf Callaway Brands Corp.’s namesake driving ranges and a hefty debt load that threatens to frighten off buyers spurred Raymond James to slash the company’s rating.

-

Workday Inc. surged after executives said the software company would sharply increase profitability over the next three years.

-

Cava Group Inc. soared after raising its full-year outlook after posting second-quarter results that beat expectations, the latest indicator that diners see good value in fast-casual restaurants.

Some of the main moves in markets:

Stocks

-

The S&P 500 rose 1.15% as of 4 p.m. New York time

-

The Nasdaq 100 rose 1.2%

-

The Dow Jones Industrial Average rose 1.1%

-

The MSCI World Index rose 1.2%

-

Bloomberg Magnificent 7 Total Return Index rose 1.7%

-

The Russell 2000 Index rose 3.2%

Currencies

-

The Bloomberg Dollar Spot Index fell 1%

-

The euro rose 0.7% to $1.1190

-

The British pound rose 0.9% to $1.3210

-

The Japanese yen rose 1.4% to 144.27 per dollar

Cryptocurrencies

-

Bitcoin rose 4.9% to $63,655.86

-

Ether rose 4.7% to $2,749.77

Bonds

-

The yield on 10-year Treasuries declined six basis points to 3.80%

-

Germany’s 10-year yield declined two basis points to 2.22%

-

Britain’s 10-year yield declined five basis points to 3.91%

Commodities

-

West Texas Intermediate crude rose 2.6% to $74.91 a barrel

-

Spot gold rose 1% to $2,510.80 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Alex Nicholson, Robert Brand and Lynn Thomasson.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Want Decades of Passive Income? Buy This ETF and Hold It Forever

There is so much to love about dividends, the cash payments investors receive when a company shares its profits with them. Dividends help shareholders realize an investment return without having to sell the stock.

You can reinvest the cash or do whatever else you want. A large enough dividend portfolio can grow into a wealth machine, pumping out thousands of dollars in annual passive income.

Building such a portfolio requires high-quality stocks in companies that can grow their earnings and dividend payments year after year.

Fortunately, you don’t need to spend time and work determining which companies to own. Instead, consider this well-rounded exchange-traded fund (ETF) that will pay you decades of growing passive income.

Here are three reasons to buy and hold the Schwab U.S. Dividend Equity ETF (NYSEMKT: SCHD).

1. It’s an all-in-one blue chip stock portfolio

Dividend investing is pretty straightforward, but there are two essential tips.

First, investors should avoid excessive dividend yields. Most healthy dividend stocks yield somewhere between 0.5% and 4%. There are exceptions, but stocks with very high yields are often risky; they are high because the market doesn’t trust that the company can afford its payout.

Second, investors should build a diversified portfolio so as not to rely on a few stocks for their dividend income. A diverse portfolio of blue chip dividend stocks will almost certainly keep the passive income flowing.

Schwab’s U.S. Dividend Equity ETF consists of 103 dividend stocks trading under one ticker symbol. Its top positions include established blue chips like Lockheed Martin, AbbVie, BlackRock, Home Depot, Coca-Cola, and Texas Instruments. Many of these have already raised their dividends for decades.

The beauty of an ETF like this is that you can have instant portfolio diversification. The fund managers balance the ETF and add and remove stocks for you. Investors pay a 0.06% expense fee for these services — just $0.06 for every $100 invested in the ETF. That seems like a fair price for easy access to a hands-off dividend machine.

2. A generous and growing dividend

The ETF also delivers plenty of passive income. It pays distributions (dividends) and yields 3.4% at its current price. Remember, most healthy blue chip stocks will yield up to around 4%, so this is toward the high end of that. For reference, the S&P 500 currently yields 1.3%, so investors are getting far more income than your broader market funds.

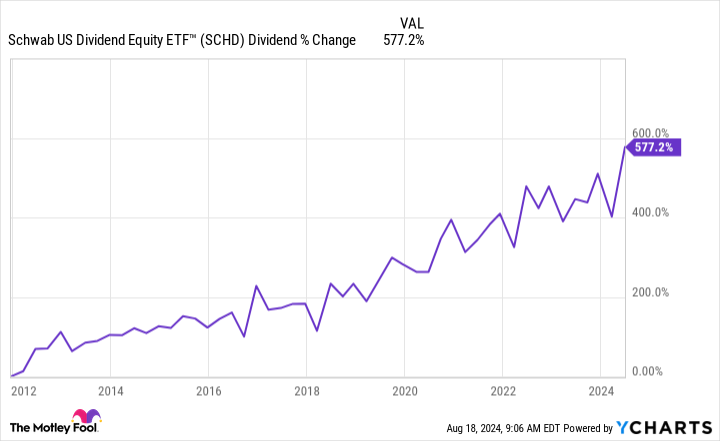

Sometimes, high yield means low growth, but that’s not the case here. The ETF has grown its dividend by more than 577% since late 2011:

That’s roughly 13 years with an annualized growth rate of over 16%! Want to build up loads of passive income? This ETF is how: Take a high starting yield and grow the payout by double digits every year. It turns out that investors can have their cake and eat it, too, with Schwab’s U.S. Dividend Equity ETF.

3. Future total return potential

The biggest knock on the ETF is that its total returns have trailed those of the S&P 500 in recent years. But that could change in the future.

You can see below that recent history is a bit of an outlier. In reality, the fund has tracked the S&P 500 pretty closely:

So, what happened?

The emergence of artificial intelligence (AI) has fueled a strong rally in technology and growth stocks, which generally exclude the types of stocks in this ETF. Most stocks in the Schwab U.S. Dividend Equity ETF are value stocks. Market conditions change over time; sometimes, growth stocks will do well, and other times, value stocks will have the spotlight.

Today, the Schwab U.S. Dividend Equity ETF trades at a price-to-earnings ratio (P/E) of 17 versus the S&P 500’s current P/E of 27. The S&P 500 is currently above its average over the past several decades.

In other words, AI stocks have stretched the broader market to a higher valuation than usual. This probably won’t last forever. Eventually, value stocks will gain favor in the market as these high-flying tech stocks come back down to earth. The ETF should perform better, and maybe even outperform the market when that happens.

You’re probably not buying the Schwab U.S. Dividend Equity ETF for potential share price gains. However, dividend investors who want competitive total returns should feel confident that it can deliver over the long term.

Should you invest $1,000 in Schwab U.S. Dividend Equity ETF right now?

Before you buy stock in Schwab U.S. Dividend Equity ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Schwab U.S. Dividend Equity ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $787,394!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Home Depot and Texas Instruments. The Motley Fool recommends Lockheed Martin. The Motley Fool has a disclosure policy.

Want Decades of Passive Income? Buy This ETF and Hold It Forever was originally published by The Motley Fool

62% of Warren Buffett's $314 Billion Portfolio Is Invested in These 4 Unstoppable Stocks

On Wall Street, Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett is truly in a class of his own. Without using fancy software or trading algorithms, the Oracle of Omaha has, over nearly six decades, nearly doubled up the annualized total return, including dividends paid, of the benchmark S&P 500. On an aggregate return basis, we’re talking about Berkshire’s Class A shares (BRK.A) increasing in value by roughly 5,387,100% under Buffett’s watch.

When you deliver outsized returns on Wall Street, you tend to draw a crowd. Berkshire Hathaway’s annual meeting regularly lures in the neighborhood of 40,000 investors eager to hear Buffett speak about the U.S. economy, the stocks Berkshire holds, and his investment philosophy.

But thanks to quarterly filed Form 13Fs, we don’t have to wait a full year to get the skinny on what Warren Buffett and his top investment aides, Ted Weschler and Todd Combs, have been buying and selling.

Although Berkshire Hathaway closed out the June quarter with 45 stocks and two exchange-traded funds in its approximately $314 billion investment portfolio, one of the key traits that’s allowed Buffett and his team to vastly outperform the S&P 500 for so long is concentration. In other words, Buffett and his team strongly believe in putting extra capital to work in their best ideas.

As of the closing bell on Aug. 16, 62% ($193.3 billion) of the $314 billion portfolio Warren Buffett oversees at Berkshire Hathaway was invested in just four unstoppable stocks.

Apple: $90.42 billion (28.8% of invested assets)

As has been the case for many years, tech stock Apple (NASDAQ: AAPL) remains Berkshire’s top holding.

However, the Oracle of Omaha and his team have dumped a significant percentage of their company’s stake in Apple over the prior three quarters. This position once briefly accounted for up to 50% of Berkshire’s invested assets.

Although Buffett opined during his company’s latest annual shareholder meeting that he believes Apple is a great company, he also hinted that corporate tax rates are liable to climb in the coming years. With Berkshire Hathaway sitting on a mountain of unrealized gains from its Apple stake, Buffett presumed that investors would eventually come to appreciate he and his team locking in gains and paying a historically low tax rate.

Warren Buffett is also an unabashed fan of Apple’s market-leading share repurchase program. Adding the $26.5 billion spent on share buybacks during the company’s fiscal third quarter (ended June 29, 2024), Apple has put a whopping $700 billion to work repurchasing its stock since the start of 2013. Buybacks can incrementally increase the ownership stakes of investors, as well as provide a lift to earnings per share.

But the cautionary tale with Apple is that its growth engine has mostly stalled. While revenue tied to its subscription ecosystem have steadily grown, sales for physical devices, including iPhone, have been less than impressive.

American Express: $38.2 billion (12.2% of invested assets)

The second longest-tenured stock in Berkshire Hathaway’s portfolio, credit-services goliath American Express (NYSE: AXP), is currently Buffett’s second-largest holding. AmEx, as American Express is commonly known, has been a continuous holding since 1991 and is considered by Buffett to be one of his company’s eight “indefinite” holdings.

Financials are Buffett’s favorite sector to put his company’s money to work in, and the reason why is simple: they’re cyclical.

The Oracle of Omaha and his top aides are fully aware that economic contractions and recessions are normal and inevitable. Rather than foolishly (small ‘f’) trying to guess when these downturns will occur, Berkshire’s brightest minds are playing a numbers game that’s very much in their favor. Since recessions are short-lived — nine out of 12 recessions since the end of World War II resolved in less than 12 months — and most periods of expansion last multiple years, it pays to buy and hold high-quality businesses that grow in lockstep with the U.S. economy.

What makes AmEx special is its ability to benefit from both sides of the transaction aisle. It’s currently the No. 3 payment processor by credit card network purchase volume in the U.S., which allows it to collect fees from merchants.

But it’s also a lender to consumers and businesses via its various credit cards. This helps facilitate the collection of annual fees and interest income. Being able to double dip during lengthy periods of economic expansion and play from both sides of the retail counter has been its not-so-subtle secret to success.

Bank of America: $37.08 billion (11.8% of invested assets)

The third-largest holding in Berkshire Hathaway’s 45-stock, $314 billion portfolio overseen by Buffett is money-center giant Bank of America (NYSE: BAC). Following the sale of more than $3.8 billion worth of BofA shares by Berkshire’s investment team between July 17 and Aug. 1, Bank of America has fallen behind AmEx in the pecking order.

Buffett’s love for bank stocks also revolves around their cyclical nature. During recessions, banks usually contend with higher loan losses and credit delinquencies. By comparison, their loan portfolios typically expand during substantially longer periods of economic growth.

What’s made Bank of America such an attractive investment over the last two years is its sensitivity to changes in interest rates.

Beginning in March 2022, the Federal Reserve kicked off its steepest rate-hiking cycle since the early 1980s. No money-center bank has benefited more, in terms of added net interest income, than BofA. Conversely, an expected rate-easing cycle has the potential to adversely affect Bank of America’s net interest income more than its peers. This may be why Buffett has his crew have been sellers of late.

Furthermore, Bank of America’s management team hasn’t been shy about investing in digitization. As of the midpoint of 2024, 77% of its consumer households were banking digitally and 53% of all consumer loans were completed online or via mobile app. Digital transactions are considerably cheaper for banks than in-person interactions, which should eventually lead to improved operating efficiency for BofA.

Coca-Cola: $27.67 billion (8.8% of invested assets)

The fourth top holding in Buffett’s $314 billion portfolio at Berkshire Hathaway that, along with Apple, American Express, and Bank of America, collectively accounts for 62% of invested assets is beverage kingpin Coca-Cola (NYSE: KO). Coca-Cola is Buffett’s longest continuously held investment at 36 years (since 1988).

The beautiful thing about consumer staples stocks is they’re a necessity no matter what’s going on with the U.S./global economy or the stock market. As a provider of brand-name beverages, demand for the company’s products tends to be highly predictable year after year.

It also doesn’t hurt that Coca-Cola is one of the most recognized brands in the world. Its marketing team leans on digital media channels and artificial intelligence (AI) to reach younger audiences, while relying on well-known brand ambassadors and over a century of history to connect with its mature consumers.

To add to this point, Kantar’s annual “Brand Footprint” study found that Coke’s products have been the most-chosen from retail shelves for 12 consecutive years. Having strong branding usually translates into exceptional pricing power.

The cherry on top for Coca-Cola is that it’s a geographically diverse company. With the exception of Cuba, North Korea, and Russia, it has operations ongoing in every country. This ensures consistent operating cash flow from developed markets, as well as the ability to move the organic growth needle in emerging markets.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $787,394!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

American Express and Bank of America are advertising partners of The Ascent, a Motley Fool company. Sean Williams has positions in Bank of America. The Motley Fool has positions in and recommends Apple, Bank of America, and Berkshire Hathaway. The Motley Fool has a disclosure policy.

62% of Warren Buffett’s $314 Billion Portfolio Is Invested in These 4 Unstoppable Stocks was originally published by The Motley Fool

If Jerome Powell Signals Rate Cuts On Friday, What Does That Mean For Crypto?

After more than two and a half years of aggressive monetary tightening, U.S. Federal Reserve Chairman Jerome Powell is widely expected to indicate an impending shift towards easing monetary policy.

What Happened: Powell’s highly anticipated keynote address at the Kansas City Fed’s Jackson Hole Economic Symposium is scheduled for Friday at 10 a.m. ET, and this event has historically been used by Fed chairs, including Powell, to signal significant changes in central bank policy, Coindesk reported.

Read Next:

Market participants have been preparing for this shift for some time, with traders already pricing in a 100% probability of at least a 25 basis point rate cut at the Fed’s upcoming September meeting.

This sentiment was further reinforced by the release of the FOMC minutes from the Fed’s July policy meeting, which revealed that a “vast majority” of participants believe a rate cut in September is “likely appropriate.”

Analysts expect Powell to not only confirm the September rate cut but also to adopt a cautious stance on further easing.

Trending: Don’t miss out on the next Nvidia – you can invest in the future of AI for only $10.

This could mean that the Fed might reduce rates by just 25 basis points in September and signal to markets that a continuous series of cuts should not be anticipated in the near future.

In the lead-up to this anticipated easing cycle, U.S. financial markets have largely remained buoyant.

Despite a brief dip from mid-July to early August, the S&P 500 is currently trading only about 1% below its all-time high reached in early July, while the Nasdaq is approximately 4% off its peak.

Gold has also seen a surge, hitting a record high of $2,566 earlier this week.

The bond market is similarly optimistic, with the yield on the 10-year U.S. Treasury dropping to a multi-year low of 3.77%.

Also Read: According to Cathie Wood, holding 6 Ethereum (ETH) could make you a millionaire, here’s why it can be true.

Why It Matters: However, Bitcoin (CRYPTO: BTC) has been struggling to gain traction.

Although it has recovered from the early August sell-off that briefly pushed prices below $50,000, Bitcoin remains significantly below its all-time high of around $73,500, reached back in March.

This lackluster performance is notable given other positive factors in the crypto space, including rising institutional interest and continued inflows into spot ETFs.

Moreover, Bitcoin could benefit from recent developments on the regulatory front.

According to an ABC News report, crypto-friendly Robert F. Kennedy Jr. is considering withdrawing from the presidential race on Friday and endorsing GOP candidate Donald Trump, who is also known for his favorable stance towards cryptocurrencies.

On the Democratic side, a senior official from Kamala Harris‘s campaign hinted that a Harris administration would be more supportive of the crypto industry than the current Biden administration.

The upcoming Benzinga Future of Digital Assets event on Nov. 19 will be particularly relevant in this context.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article If Jerome Powell Signals Rate Cuts On Friday, What Does That Mean For Crypto? originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Alibaba to upgrade Hong Kong listing in a bid to attract Chinese investment

(Reuters) — Shareholders of Chinese e-commerce giant Alibaba (BABA, 9988.HK) have approved a plan to upgrade its Hong Kong listing to primary status, the company said on Friday, a move that is expected to attract huge investments from mainland China.

The Jack Ma founded firm had originally proposed the idea a couple of years ago at a time when there was heightened geopolitical tensions between China and the U.S.

The listing status upgrade allows Alibaba to be part of a program which would connect the respective bourses in Shenzhen and Shanghai to the Hong Kong stock exchange.

The decision was expected to be approved by the company’s investors who have long been concerned over the firm’s growth prospects as it faces new market rivals such as PDD Holdings.

The conversion to dual primary listing does not involve any issue of new shares or even raising of funds by the company, Alibaba said.

Hong Kong-listed shares of the company gained as much as 0.7% to HK$82.2 in early trade.

(Reporting by Rishav Chatterjee in Bengaluru; Editing by Rashmi Aich)

Semiconductor veteran Lip-Bu Tan exits Intel's board

(Reuters) -Intel’s director Lip-Bu Tan, a semiconductor industry veteran brought in two years ago to help with the chipmaker’s comeback effort, has stepped down from its board, the chipmaker disclosed in a filing on Thursday.

Tan informed the company on Monday that he was resigning from the board effective immediately.

The news of Tan’s departure comes at a challenging time for Intel, which recently forecast third-quarter revenue below market estimates and announced plans to cut more than 15% of its workforce, approximately 17,500 employees, and suspend its dividend starting in the fourth quarter.

“This is a personal decision based on a need to reprioritize various commitments, and I remain supportive of the company and its important work,” Tan said in a statement.

Tan, who has served as executive chair and CEO of Cadence Design Systems Inc, joined Intel’s board in Sept. 2022.

Shares of the company were slightly up in extended trading. They closed down 6.1% at $20.10 on Thursday.

Bloomberg News first reported on the departure of Tan.

(Reporting by Juby Babu in Mexico City and Jaspreet Singh in Bengaluru; Editing by Tasim Zahid)

Here Are My Top 5 Dividend Stocks to Buy in August

After a spectacular performance in 2023 and a roaring start to 2024, the capital markets have started to cool down as of late.

Naturally, the recent selling activity can be attributed to a variety of factors including mixed job data, the Federal Reserve’s monetary policy outlook, and of course the upcoming presidential election. During times like these investors may opt to exit more growth-oriented opportunities and seek safer, steadier positions.

Let’s explore five dividend stocks that I think look like screaming buys right now. Investors interested in reliable passive income don’t want to miss out on these stocks.

1. Hercules Capital

Hercules Capital (NYSE: HTGC) is a business development company (BDC) that specializes in high-yield loans to venture-backed companies. BDCs are required to pay out at least 90% of their taxable income each year in the form of a dividend, hence they can be lucrative sources of passive income.

Generally speaking, a bank may avoid making a loan to a young company. And if it does, it likely won’t be a material enough amount to provide adequate runway.

Hercules differentiates itself from banks due to the way it structures deals. For example, while a bank may have a dollar threshold, Hercules generally offers larger term loan sizes but at a higher interest rate. Moreover, Hercules also generally attaches warrants to its deals, which act as a sweetener if a portfolio company ends up getting acquired or goes public.

A good measure of a BDC’s health is to look at its non-accrual investments. Essentially, these are investments that the company sees as highly unlikely to pay back principal and interest.

For the quarter ended June 30, only 2.5% of Hercules’ $3.6 billion portfolio was categorized as non-accrual status.

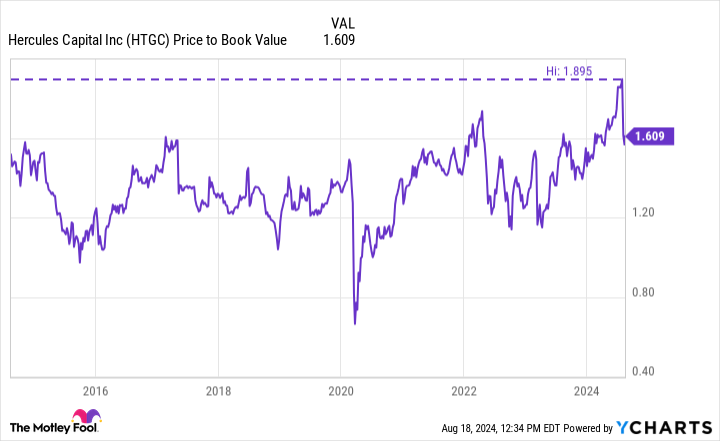

Right now, Hercules trades at a price-to-book (P/B) ratio of 1.6, which is close to its highest level in 10 years. Its total return over the last decade is 229%, handily outperforming the S&P 500‘s total return of 184%. So even though Hercules stock isn’t exactly cheap, I think the premium is well deserved.

With shares trading at a 10.4% dividend yield, I think now is as good a time as ever to load up on Hercules and prepare to hold for the long run.

2. Ares Capital

Another BDC on my list is Ares Capital (NASDAQ: ARCC). Ares is quite different than Hercules, however, as the company has wider industry coverage and offers more sophisticated financial products.

Furthermore, with 50% of its total portfolio allocated toward first lien senior secured loans, investors can rest easy that Ares is well positioned even in downside scenarios.

Per the chart above, investors can see that Ares has handily outperformed the S&P 500 as well as leading BDC-focused exchange-traded funds (ETFs) over the last couple of years. Considering how strong the S&P 500 has been since its massive sell-off in 2022, it’s impressive just how much Ares has outperformed its peers and the broader market.

While it may not be as attractive as a high-growth AI stock, Ares has quietly been a multibagger opportunity for its shareholders. Investors may want to consider augmenting their gains with this passive income player, as shares yield around 9.3% right now.

3. AT&T

I’ll admit right off the bat that telecom businesses aren’t overly exciting, and AT&T (NYSE: T) is no exception. The telecom industry is pretty commoditized, which essentially forces the big players to compete on price.

When you’re in the business of offering the lowest-cost solution, it can be hard to grow. As the chart above illustrates, AT&T’s revenue has dropped considerably over the last decade. Again, an overcrowded market coupled with ongoing churn dynamics plaguing the communications sector isn’t exactly a recipe for hypergrowth.

Nevertheless, AT&T has demonstrated a disciplined approach to costs during this time of decelerating sales. For that reason, the company has been able to actually increase its free cash flow despite some dramatic ebbs and flows in the top line.

It is important to note that some of this cash flow was augmented by AT&T slashing its dividend nearly in half back in 2022. Although that’s not overly encouraging, I’ll give AT&T’s management some credit.

As of the end of the second quarter, AT&T’s net debt was $127 billion. This was an improvement of about $5 billion compared to the second quarter of 2023. Should AT&T remain focused on strengthening its balance sheet, I see little reason for the company to cut its dividend again.

So while AT&T isn’t going to supercharge your portfolio by any means, I think the stock offers a compelling turnaround opportunity. Moreover, AT&T’s current price-to-earnings (P/E) ratio of 11.1 is hovering near all-time lows. While some may have soured on AT&T for good, I think now is a good opportunity to scoop up shares at dirt cheap levels and take advantage of the 5.7% yield.

4. Verizon

Next up on my list is one of AT&T’s biggest competitors, Verizon Communications (NYSE: VZ). The bulk of my thesis for investing in Verizon is illustrated in the graphic below.

Last September marked 17 consecutive years of dividend raises for Verizon. Moreover, when speaking about commitment to subsequent dividend raises, Verizon’s CEO Hans Vestberg said that he wants to “continue to put the Board in a position to do that” during the company’s second-quarter earnings call.

To me, Verizon is not only a reliable dividend opportunity; I think a raise could be on the horizon next month. Such action could inspire a little jolt in the stock, so I’d be a buyer right now. Verizon’s P/E of just 15.2 pales in comparison to the S&P 500’s P/E of 27.5. With shares yielding about 6.5%, now looks like a terrific opportunity to invest at a steep discount to the broader market.

5. Altria

In my opinion, I’ve saved the best for last. Altria (NYSE: MO) is the tobacco company behind notable cigarette brands such as Marlboro and Black & Mild, and is also notably a Dividend King. The tobacco industry is no doubt experiencing an existential crisis. A larger cohort of consumers are becoming more mindful of health and wellness, making tobacco products a tough sell.

But like all great companies, Altria has found ways to navigate this challenge. Management has stated that Altria’s next phase hinges on “moving beyond smoking.”

Namely, the company is focusing more attention on vaping products as well as oral nicotine pouches as opposed to traditional smoking products. Although this transition is in its early stages, there are strong indications that this pivot is working.

Last June, Altria acquired vaping company NJOY. At the time, NJOY products could be found in roughly 35,000 stores nationwide. Per Altria’s second-quarter earnings presentation, NJOY’s footprint has almost tripled to 100,000 stores.

Although the aggressive expansion efforts might suggest NJOY is in high demand, the brand currently only owns about 5% of U.S. retail share. To me, this bodes well for NJOY’s long-run momentum and validates Altria’s investments and focus on smokeless tobacco.

Another reason why I love Altria stock is that the company has been actively buying back shares for some time now. Through the first six months of 2024, Altria repurchased $2.4 billion of stock at an average price of $44.50.

Companies may opt to buy back shares when management thinks the stock is undervalued. Considering Altria currently trades at about $51 per share, the company’s repurchase program is looking pretty savvy right about now.

Given its consistent history of raising its dividend, coupled with an exciting new chapter featuring the next frontier of the tobacco industry, I see Altria as an outstanding opportunity for investors seeking a combination of gains and reliable passive income.

Should you invest $1,000 in Altria Group right now?

Before you buy stock in Altria Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Altria Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $787,394!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool recommends Verizon Communications. The Motley Fool has a disclosure policy.

Here Are My Top 5 Dividend Stocks to Buy in August was originally published by The Motley Fool

A bullish signal in the stock market is pointing to double-digit gains for the S&P 500 next year, research firm says

-

The stock market flashed a bullish technical indicator on Monday, according to Ned Davis Research.

-

NDR strategist Ed Clissold noted the market is its the fourth stage of bottoming as it approaches record highs.

-

Since July, three breadth thrust signals have flashed, indicating a strong market recovery.

The stock market just flashed a bullish technical indicator that suggests double-digit gains are in store for the S&P 500 over the next year.

That’s according to a Wednesday note from Ned Davis Research strategist Ed Clissold, who said the stock market has entered the fourth stage of its bottoming process following its early August sell-off.

The stock market fell more than 5% in early August amid a confluence of risks, including a weak July jobs report, a yen carry-trade unwind, and Warren Buffett slashing his stake in Apple.

But since then, the S&P 500 has rallied nearly 10% and is just 1% shy of record highs.

“New breadth thrust signals confirm that the market is in step four of the bottoming process and moving past the recent pullback,” Clissold explained, adding that the four stages of a stock market bottom are oversold, rally, retest, and breadth thrusts.

On August 19, a new breadth thrust signal flashed, which occurs when the stock market swiftly transitions from very few stocks participating in the upside to many stocks moving higher at the same time.

“The rationale is that if a few stocks run into trouble, others can propel the popular averages higher,” Clissold said. “The beginning of major moves is often marked by breadth thrusts, or an extremely high percentage of stocks rallying together.”

A breadth thrust “fired” on Monday when over 90% of stocks in NDR’s internal Multi-Cap Equity Series jumped above their 10-day moving average.

Since 1980, there have been 42 such instances, and stocks were higher 95% of the time one-year later with an average gain of 10%.

Such a gain from current levels would put the S&P 500 at just above 6,100, which is nearly in-line with one Wall Street bull’s 2025 price target.

Another breadth thrust flashed on August 8 when stocks saw an “11:1 up day,” which occurs when volume in advancing stocks is 11 times that of the cumulative volume in declining stocks.

Ultimately, Clissold wants to see at least five breadth thrust signals flash in a three-month period to be certain that the stock market has more upside ahead.

So far three signals have flashed since July 16, but even if two more don’t flash by the middle of October, stocks are likely still in a good spot thanks to the expected decline in interest rates, according to the note.

“We may not get five breadth thrust signals, but additional trend indicators are turning bullish,” Clissold said. “Falling rates are another check in the bulls’ favor.”

Read the original article on Business Insider

Prominent Billionaires Just Bought the Dip With These 3 Stocks

Hedge funds and investment firms with over $100 million in assets are required to disclose their stock portfolios throughout the year. The updates for the second quarter of 2024 are rolling in now, and this includes updates from the financial vehicles managed by prominent billionaires Warren Buffett and Bill Ackman, as well as by multimillionaire Michael Burry.

This wealthy trio has been busily buying the dips for three value stocks: Ulta Beauty (NASDAQ: ULTA), Nike (NYSE: NKE), and Shift4 Payments (NYSE: FOUR). Here’s why these bargains were too good for these investors to pass up.

1. Ulta Beauty: Down 33%

As of this writing, Ulta Beauty stock is down 33% from its all-time high and down 22% in 2024. Shares started sliding after management warned of slowing sales for cosmetic products, leading it to lower the company’s full-year financial guidance.

It was a dip too good for Warren Buffett to pass up. His Berkshire Hathaway opened a roughly $260 million position in Ulta Beauty stock during Q2. Granted, that’s a small position for a company as big as Berkshire, but it’s still noteworthy nonetheless.

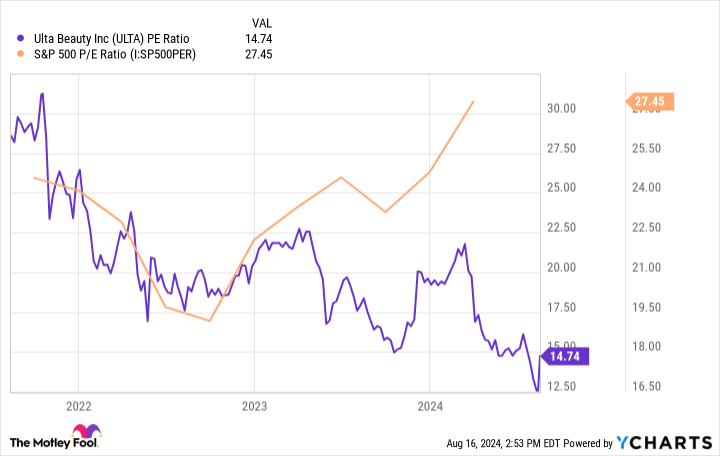

Buffett is a renowned value investor, and he likely sees potential in Ulta Beauty. The stock trades at less than 15 times earnings, which is significantly cheaper than the average price-to-earnings (P/E) ratio for the S&P 500, as seen below.

Sales growth may be slow. However, Ulta Beauty still expects to earn over $1.5 billion in operating profit in 2024, and it plans to return $1 billion to shareholders via share repurchases. Given the stable demand for cosmetic products, I expect strong profits and share repurchases to continue for years to come, providing high chances of positive long-term returns for Ulta Beauty stock from here.

2. Nike: Down 53%

In Q2, Bill Ackman’s Pershing Square bought more than 3 million shares of athletic apparel company Nike — a position worth roughly $229 million. It’s the smallest position in Ackman’s portfolio, but with only eight stocks in the total portfolio, any addition is noteworthy.

Ackman is a value investor who studied Warren Buffett’s style before getting his own start. Nike indeed looks like a value stock, considering it has been trading at its cheapest valuation since 2012.

In short, Nike stock is down because sales are slumping and profits are contracting. The company’s fiscal 2025 started in June, and management is calling it a “transition year.” Management expects its revenue to be down single digits compared to fiscal 2024, but profits could be down more than that.

Ackman is likely betting that a consumer brand as strong as Nike will find its way eventually, making the stock a strong candidate for a rebound once its business stabilizes.

3. Shift4 Payments: Down 20%

Like Ackman, Michael Burry manages a concentrated portfolio of just 10 stocks through his Scion Asset Management. The investor famously made his fortune by shorting the U.S. housing market during the Great Recession. Judging by his portfolio today, I’d say he’s still not very bullish on America.

Three of Burry’s top five positions are Chinese stocks, showing his preference for those companies. However, in Q2, he took a big swing at financial technology (fintech) company Shift4 Payments, making it nearly 14% of the portfolio.

Shift4 stock may not be down as much as the other two in this article. However, shares have gone nowhere for the last three years as the chart below shows, even though its profitable growth during this time has been impressive.

Shift4 has focused on winning large, high-volume customers, which has provided strong revenue growth. Adjusting for network fees (a common adjustment for fintech companies), the company expects to grow its revenue by at least 44% this year. And it expects to generate free cash flow of nearly $400 million.

For perspective, Shift4’s market cap is only $5.4 billion as of this writing, meaning it trades at a cheap forward price-to-free-cash-flow valuation of about 14. Coupled with its impressive top-line growth, I believe Shift4 Payments stock might be the best buy of these three stocks.

To be clear, Ulta Beauty and Nike are cheap based on multiple valuation metrics, which is good. But they’re also more mature companies with limited top-line growth potential. Either stock could have upside, but Shift4 is still growing at a fast pace, in addition to being cheaply valued. That may carry it to bigger gains in the coming years.

Should you invest $1,000 in Ulta Beauty right now?

Before you buy stock in Ulta Beauty, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Ulta Beauty wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $779,735!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

Jon Quast has positions in Shift4 Payments. The Motley Fool has positions in and recommends Berkshire Hathaway, Nike, and Ulta Beauty. The Motley Fool recommends Shift4 Payments and recommends the following options: long January 2025 $47.50 calls on Nike. The Motley Fool has a disclosure policy.

Prominent Billionaires Just Bought the Dip With These 3 Stocks was originally published by The Motley Fool