Forget ExxonMobil: Buy This High-Yield Dividend Stock Instead

ExxonMobil (NYSE: XOM) is a fine and worthy dividend-stock candidate for investors looking for exposure to oil, but it doesn’t trade at Devon Energy‘s (NYSE: DVN) cash-flow valuation. Moreover, while ExxonMobil’s stock is up almost 19% this year, Devon’s stock is flat this year and presents an excellent value for investors. Here’s why.

Devon Energy continues to progress

Devon Energy’s recent second-quarter results contained several positives that helped confirm the investment case for the stock, including the company’s upgraded production target. In a year when management decided to focus investment in its core assets in the Delaware Basin, it’s reasonable to expect an improvement in well productivity and total production. Indeed, management started the year predicting a 10% improvement in well productivity and the production of 650,000 barrels of oil equivalent per day (Boe/d) in 2024.

The good news is that management reaffirmed the target for well-productivity improvement and, for the second time this year, upgraded its full-year production target to a new range of 677,000 Boe/d to 688,000 Boe/d — a 5% upgrade from the original target. It’s an even better result when considering that the price of oil started the year at around $70 a barrel but has spent most of it above $75 a barrel.

Cash-flow valuation

As noted above, Devon Energy trades at a more attractive valuation than many other oil stocks. For example, Wall Street analysts expect ExxonMobil to generate $34.7 billion in free cash flow (FCF) in 2024. Based on ExxonMobil’s current market cap of $527.5 billion, that FCF is equivalent to 6.6% of the company’s market cap.

It’s an attractive cash-flow yield, but Devon’s is even higher. Based on the company’s market cap of around $26.8 billion at the time of the results, Devon’s management believes it will trade at a 9% FCF yield at a price of oil of $70 a barrel in 2024, 11% at $80 a barrel, and 13% at $90 a barrel. Looking at the current market cap puts these figures at roughly 8.5% at $79 a barrel, 10.3% at $80 a barrel, and 12.2% at $90 a barrel.

With the current price of oil at $76 a barrel, Devon clearly trades at a very attractive FCF valuation.

An acquisition isn’t in the numbers

Devon’s management expects to complete the acquisition of the Williston Basin business of Grayson Mill Energy for $5 billion ($3.25 billion in cash and $1.75 billion in stock) by the end of the third quarter. Investors should note that neither the upgraded production forecast nor the FCF yield calculations assume any contribution from this acquisition in 2024.

Capital-allocation policy

Devon Energy’s capital allocation policy targets using 30% of FCF to support the balance sheet, partly in connection with the acquisition. (Devon will initiate a $2.5 billion debt-reduction program.) The remaining 70% will be used for share repurchases, a quarterly fixed dividend of $0.22 per share, and a variable dividend.

The total dividend in the first quarter was $0.35 per share, and $0.44 per share in the second quarter, with management prioritizing share repurchases over the variable dividend. While some investors may not like that, it reduces shares in issue and increases the claim of existing shareholders on future cash flow.

Putting things into perspective, the abovementioned FCF yields make it clear that Devon could potentially pay significantly higher dividends if it so desired. However, the idea of investing in a company is that management can generate better returns on investment than an investor can, so it makes sense to let them do that by retaining cash to add value.

A stock to buy

Devon’s FCF generation (which will be boosted by the acquisition in the third quarter) and its policy of returning cash to shareholders in the form of share buybacks and dividends ensures that investors can look forward to significant returns from Devon in the coming years, provided the price of oil stays relatively high.

Should you invest $1,000 in Devon Energy right now?

Before you buy stock in Devon Energy, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Devon Energy wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $779,735!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Forget ExxonMobil: Buy This High-Yield Dividend Stock Instead was originally published by The Motley Fool

Cava beats estimates across the board, raises outlook as stock reaches all-time high

Cava (CAVA) is serving up some savory numbers for its investors.

After the market close on Thursday, the Mediterranean fast-casual chain reported second quarter results that beat estimates across revenue, earnings, and same-store sales.

Net sales jumped 35.2% year over year to $233.5 million, compared to expectations of $219 million. Adjusted earnings per share came in at $0.17, versus the $0.13 expected.

Same-store sales jumped 14.4%, more than the 7.45% Wall Street expected. Sales growth was driven by higher foot traffic (up 9.5% year over year), an increase in menu price, new locations, and the launch of grilled steak on June 3.

CEO Brett Schulman said on the earnings call that the steak launch surpassed its expectations by a landslide. The company is at the “nexus of consumer convergence” as consumers trade down from fine-dining restaurants but trade up from fast food.

“At a time when consumers are increasingly feeling the pressure of an uncertain economy and are more discerning about where and how they spend their money, they are choosing to dine at Cava,” he said.

Wedbush analyst Nick Setyan said it expects “accelerating two-year transaction trends, led most importantly by the launch of steak.”

On Wednesday, Cava stock hit a record-high close of $102.39, and on Thursday, it hit an intraday high of $104.84. In after-hours trading, shares jumped to as much as $112.

Shares are up 137% year to date, compared to 17% for both Chipotle (CMG) and the S&P 500 (^GSPC).

Slow and steady is Cava’s go-to approach to expansion. By 2032, the company plans to have 1,000 Cava locations.

Citi analyst Jon Tower said there’s still room left for growth in a note to clients. “A unit growth opportunity that continues to re-set higher, discrete same-store sales, price, and margin opportunities as the system densifies and margin tailwinds as the footprint shifts towards lower cost markets.”

In Q2, Cava opened 18 new locations, bringing the total to 341. That’s compared to 14 new locations in Q1.

Schulman said within existing markets, there is still runway to build more brand awareness. Other future growth drivers include the relaunch of its loyalty program in October and catering.

The company aims to market test catering in major metros in 2025 and launch it on a national scale in 2026.

It currently has 10 digital kitchen hubs and 10 hybrid kitchen hubs in various locations, as well as regular Cava locations that are testing catering.

Cava continues to perform at a time when fast-casual dining seems to be bucking a broader slowdown across the food industry as consumers double down on value.

“Cava was one of just a handful of publicly traded restaurant brands with positive traffic growth in the second quarter,” Schulman said. “We believe our performance is a reflection of our unique and compelling value proposition.”

He added that from 2019 to 2023, the company raised prices 12%. He emphasized that’s less than fast food price increases and grocery price increases overall, per CPI data.

“Now you’ve got a situation where for $1 or $2 more … you can get a bowl of fresh Mediterranean food for the same price as a traditional fast food freezer-to-fryer meal,” he said.

Chipotle blew past expectations in its report after same-store sales jumped 11.1% year over year, versus the 9.23% Wall Street anticipated. Shake Shack (SHAK) saw same-store sales climb 4%, beating estimates of 3.2%.

Sweetgreen (SG) reported its best same-store sales growth in two years, up 9%, driven by higher foot traffic and prices.

Its CEO, Jonathan Neman, told Yahoo Finance that “we’re going to be very judicious in how we use it [pricing power].” Neman claimed the chain took fewer price hikes than its rivals since the pandemic.

“As you look at the relative pricing difference between Sweetgreen, some of our fast-casual competitors and then QSR, the gap has really narrowed. QSR, you can’t get in and out of there for under $15 today,” he told Yahoo Finance.

Here’s what Cava reported, compared to Wall Street estimates, per Bloomberg consensus data:

-

Revenue: $233.5 million versus $219.5 million

-

Adjusted earnings per share: $0.17 versus $0.13

-

Same-store sales growth: 14.4% versus 7.45%

The company raised its fiscal 2024 outlook for restaurant openings, sales growth, and restaurant-level profit margin.

It now expects sales growth of 8.5% to 9.5%, up from 4.5% to 6.5% in Q1 and its previous guidance of 3% to 5%.

The total number of new restaurants will now be between 54 and 57, up from 50 to 54. The restaurant-level profit margin is expected to be between 24.2% and 24.7%, up from 23.7% to 24.3%.

—

Brooke DiPalma is a senior reporter for Yahoo Finance. Follow her on X at @BrookeDiPalma or email her at bdipalma@yahoofinance.com.

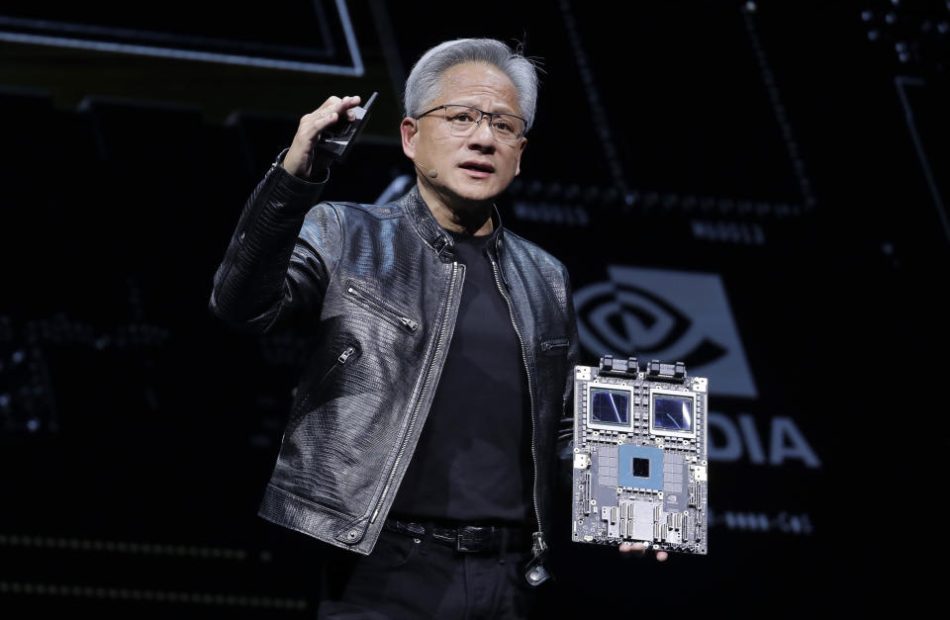

Nvidia’s Jensen Huang sells $14 million in stock almost daily—raising questions about his successor

Five years ago Nvidia CEO Jensen Huang was worth a respectable $3.73 billion. At the time of writing, his net worth has ballooned to a little over $92 billion—and even then it’s down from its high of $119 billion earlier this summer.

While Huang has worked on Nvidia for more than three decades, it has only been over the past 12 months or so that the chipmaker’s stock price has really begun to take off, and with that comes scrutiny.

Investors are largely thrilled with their bet on the Santa Clara, Calif., business, and the man Mark Zuckerberg dubbed the “Taylor Swift of tech.”

But Nvidia’s meteoric growth has led some experts to question whether the company’s corporate governance has matured as quickly.

They point to the fact that CEO Huang has been off-loading approximately $14 million worth of shares on a near-daily basis for months this summer. He still retains more than a 3.5% stake in the business.

This, inevitably, raises questions about why Huang is selling instead of holding.

And that, in turn, leads to the issue of why Huang has so many shares in the first place, and whether his compensation package incentivizes the performance shareholders want to see.

Investors want more intel on the business at the top. They want to see more transparent corporate governance, open succession planning, and a change in pay structure to motivate the next era of management, according to executive compensation experts who spoke to Fortune.

‘Huang selling shares doesn’t look good’

Huang is selling his shares under a very specific plan—a Rule 10b5-1 agreement—which allows executives and employees to buy or sell stock in their own company without violating insider trading laws by using a predetermined schedule.

Rule 10b5-1 has a number of specific requirements, chief among them that a formula for the sales (not an individual) be used to determine the number, price, and date of the trade. A third party must also be employed to conduct the sales, who cannot be influenced by the client.

So while Huang is comfortably removed from any concerns about insider selling, the fact still remains that he is choosing to sell after a period of high share performance and then a dip.

This, according to Nell Minow, vice chair of corporate governance specialists ValueEdge Advisors, is not a good look.

Minow, who also owns shares in Nvidia herself, explained to Fortune: “What I want from an executive [is] to be very bullish on the stock. I want the executive to be thinking all the time: ‘Boy, this is really going to be worth a lot more soon’ and not, ‘Oof, I better sell some because I’m … experiencing the vertigo of having all my eggs in one basket.’

“I want all of their eggs in one basket.”

This year isn’t the first time Huang has employed a Rule 10b5-1—though it is a more tenacious selloff than previous trades.

In September last year, for example, Huang off-loaded 237,500 shares valued at just over $117 million under a 10b5-1 trading agreement. This year, by comparison, Huang sold $323 million in Nvidia stock in July alone.

Huang wasn’t the only Nvidia exec to confirm a Rule 10b5-1 trading agreement in the April filing.

Debora Shoquist, executive vice president of operations; Colette M. Kress, executive vice president and CFO; and Ajay K. Puri, executive vice president of worldwide field operations, disclosed similar plans.

“It signals that the stock has jumped tremendously and they’re getting a little nervous about it,” Minow believes. “It’s certainly concerning for investors; we ask ourselves: ‘Well, maybe I should be selling mine, too. What are they telling me? If they don’t have the confidence in the stock, then why should I?’”

Fortune approached Nvidia for comment on how many shares in total Huang plans to off-load, and when his selloff will end. The company did not respond to the question.

Nvidia told Fortune: “Mr. Huang’s sales are based on a 10b5-1 plan, in which the price, amount, and dates of the sales are established in advance.”

Calming the ripple effect

James Reda is a managing director at Chicago-based consultancy Gallagher’s HR and compensation practice. He has worked on a number of high-profile compensation cases, from Howard Schultz at Starbucks in the early 2000s to advising on Satya Nadella’s Microsoft package.

Why is Huang drip-feeding the sale of his stock, day after day, as opposed to off-loading larger sums all at once, we asked him.

“If you just dump that in the market the stock’s going to go down,” Reda told Fortune. “So you have to be very sensitive about it … If you have a large position that some of these founders and CEOs have, it could be a better strategy.

“I’ve seen a lot of cases where things are executed improperly and the stock tanks. Not because people think something’s going on, and all that stuff, but the excess supply. The market’s confused about what they do with it.”

The fact that Huang is selling on a near-daily basis as opposed to wider intervals is also not a surprise to Reda. The 10b5-1 plan is public, so markets will be aware of the stock influx and won’t be caught off guard.

And while some analysts like Minow want founders to be singularly focused on their own stock, Reda disagrees: “Ultimately, if you don’t sell the stock you’re gonna have to be like Elon Musk and some others that are putting stock up for collateral and getting these humongous loans.

“That just makes everybody more leveraged, why do that? Peel off a little stock on a regular basis and sell it.”

Too much stock?

A look through the SEC filings of every Big Tech company presents a range of often complex compensation provisions. Meta’s Zuckerberg is famously paid a single dollar for his salary but takes $24.4 million in security costs. Apple’s Tim Cook has performance-based restricted stock units in a compensation package worth $49 million. Alphabet’s Sundar Pichai is given a triennial stock grant, which led to a $226 million payday in 2022.

The range of options also reveals a common practice in Silicon Valley: CEOs—particularly founders—are often continually awarded stock not only so they maintain a sense of power over a rapidly expanding empire, but also because it is a tried-and-tested method to motivate those at the top.

Nvidia’s 2024 proxy filing for fiscal year 2024 discloses that Huang was paid a salary of $996,514, with stock awards worth $26 million and additional incentivized cash compensation of $4 million. His total compensation package was worth approximately $34.17 million.

The filing also revealed Huang’s holdings in Nvidia prior to the stock sales beginning this spring, with the figure sitting at more than 93 million shares—3.79% of the business.

This is a sign that Huang has been given too much stock, Minow believes.

In her estimation, Huang’s shares should be locked in “golden handcuffs”—meaning he can’t sell until years after he leaves the business.

“Stop giving him stock. He’s clearly got too much, and that’s why he’s getting rid of it,” Minow said. “The marginal value of additional stock grants is negligible.”

Nvidia has a “pay for performance” strategy, per its SEC filing, based on revenue, operating income, and shareholder returns relative to the S&P 500.

But Minow wants more detail. She said: “I would create very specific goals—and this is the job of the board—around market share, innovation, expansion, improving operations. Whatever the board decides the priorities should be.

“And let the market know what those goals are. That helps us as investors know if it’s something that we want to participate in.”

The succession plan, or lack thereof

The board itself presents further potential for improvement, in Minow’s opinion. Of the 12 individuals on the $2.93 trillion company’s board, only one cites experience in “corporate governance” in their official biography (although some of the others have served on other boards).

Minow also wants to see Nvidia ticking off the corporate to-do list by updating the market on a successor to the CEO. After all, CEOs can’t lead forever.

“His board of directors [is] very strong on technology, not as much on corporate governance,” Minow explains. “I would really like to see them say: ‘We have a process in place to make sure we’re cultivating our top people, making sure we have a deep bench; here’s how we’re going about it.’

“We don’t need a name, but they need to be very forthright about the value that Huang presents and that they’re taking very seriously the idea that he could just decide to go spend his money … They’ve got to be prepared for that.”

Huang, famed for his never-off work schedule and endless pushes for perfectionism, is the beating heart of Nvidia—and he has a price tag attached.

“Huang is the heart and soul of the company; his reputation is almost as important as the quality of the product,” Minow adds. “Particularly when you’re talking about the [15th] richest man in the world—how do you keep him motivated? It’s certainly not by allowing him to diversify his holdings.

“I would give him more of his compensation in cash tied to very specific, quantifiable goals.”

Fortune asked Nvidia what its succession plan was and whether it would be more transparent with shareholders about compensation practices. Nvidia declined to comment.

What does a post-Huang Nvidia look like?

A push for transparency is needed across the market, says Aalap Shah, managing director at compensation and leadership consultancy Pearl Meyer.

Some of the pillars of American commerce have already learned this lesson: Just ask JPMorgan’s Jamie Dimon, who has been open about the banking behemoth’s succession planning process—even naming his “hit-by-a-bus CEO.”

Elsewhere, Morgan Stanley was subject to immense speculation prior to its selection last year of Ted Pick to replace James Gorman.

“We should be significantly more transparent than we are currently about succession planning,” Shah tells Fortune. “From my perspective for an incoming CEO … one of the top five things they should be doing is succession planning. That to me is a company that is truly looking at the future and is appropriately considering corporate governance.

“When succession planning is not transparent and thoughtfully considered you have to make rash decisions, and that, from a shareholder and investor perspective, is what causes volatility.”

This story was originally featured on Fortune.com

3 High-Yield Dividend Stocks That Could Soar More than 20%, According to Wall Street

The Rolling Stones were right when they sang, “You can’t always get what you want.” But can’t doesn’t mean never. Sometimes, you can get what you want.

Income investors want solid income (of course). However, they also like their investments to grow. However, they must often trade off growth in exchange for higher income. But some stocks offer both. Here are three high-yield dividend stocks that could soar more than 20%, according to Wall Street.

1. Brookfield Renewable

Brookfield Renewable‘s (NYSE: BEP) (NYSE: BEPC) forward distribution yield stands at nearly 5.9%. That’s actually the yield for the limited partnership (LP), which trades under the BEP ticker. The corporate entity, which trades under the BEPC ticker, has a forward yield of a little over 5%. I doubt income investors will turn their noses up at either distribution.

Granted, they probably won’t like Brookfield Renewable’s recent stock performance. Both stocks of the renewable energy provider are down year to date. However, the average price target of analysts surveyed by LSEG reflects an upside potential of more than 21% over the next 12 months for both the LP and corporate stocks.

Can Brookfield Renewable really deliver such a hefty gain? I think it’s possible. The demand for renewable energy is rising. Brookfield’s acquisitions should fuel its growth, especially with its acquisition of around 53% of global renewable energy provider Neoen expected to close in the fourth quarter of 2024.

Even if Brookfield Renewable doesn’t hit analysts’ expectations, though, income investors can count on its distributions. Roughly 90% of the company’s cash flows are contracted, which translates to reliable distributions. Since 2001, Brookfield Renewable has increased its distribution per unit by a compound annual growth rate of 6%. It targets annual distribution growth between 5% and 9% over the long term.

2. Chevron

Chevron (NYSE: CVX) has been a favorite for many income investors for decades. That’s still the case, with the oil and gas giant boasting a forward dividend yield of 4.5%.

Although Chevron’s shares were up by more than 10% year to date in early May, they’ve since given up all of those gains and then some. Wall Street remains bullish despite the recent decline. Of the 24 analysts surveyed by LSEG in August, 16 rate Chevron as a “buy” or a “strong buy.” The average 12-month price target for the stock is nearly 21% above the current share price.

There’s some uncertainty about Chevron’s pending acquisition of Hess. ExxonMobil claims a right of first refusal over Hess’ 30% stake in a joint operating agreement in Guyana. The issue is going to arbitration with a hearing scheduled for next year. Should ExxonMobil win in this dispute, Chevron has said it would abandon its effort to acquire Hess.

However, Chevron doesn’t need to acquire Hess for its stock to perform well going forward. And it definitely can continue to pay its juicy dividend regardless of what happens on the mergers and acquisitions front.

3. Devon Energy

Devon Energy‘s (NYSE: DVN) forward dividend yield is hard to nail down. Why? The company’s dividend consists of two components — a fixed portion and a variable portion based on excess free cash flow. However, I think investors can count on Devon to deliver a yield of at least 4% and perhaps much higher.

The future performance of any oil stock is even more difficult to predict. Like Chevron, Devon has taken investors on a roller coaster ride this year with its shares soaring by double-digit percentages then falling. Analysts, though, look for the ride to become fun again. The average 12-month price target for Devon reflects an upside potential of nearly 29%.

I’m not sure if Devon will achieve those kinds of gains over the next 12 months. However, I wouldn’t rule out the possibility. The company’s oil production reached an all-time high in Q2. Devon raised its full-year 2024 production outlook. Its acquisition of Grayson Mill Energy’s Williston Basin business, which should close in Q3, will significantly boost the company’s production capability.

Investors could also benefit from an “invisible” dividend — Devon’s stock buybacks. The company recently expanded its share repurchase authorization by 67% to $5 billion. Devon bought back $2.7 billion of stock in the first half of this year.

Should you invest $1,000 in Brookfield Renewable Partners right now?

Before you buy stock in Brookfield Renewable Partners, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Brookfield Renewable Partners wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $779,735!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

Keith Speights has positions in Brookfield Renewable, Brookfield Renewable Partners, Chevron, Devon Energy, and ExxonMobil. The Motley Fool has positions in and recommends Brookfield Renewable and Chevron. The Motley Fool recommends Brookfield Renewable Partners. The Motley Fool has a disclosure policy.

3 High-Yield Dividend Stocks That Could Soar More than 20%, According to Wall Street was originally published by The Motley Fool

Analyst Report: Host Hotels & Resorts Inc

Summary

Host Hotels & Resorts Inc. is the largest hotel REIT by market capitalization and revenue. HST’s portfolio consists of mostly upscale properties. Host owns 72 properties in the U.S. and five international properties (in Brazil and Canada) with about 42,100 rooms and has an interest in eight other properties. Premier brands include Marriott and Hyatt, and almost 90% of hotels are brand managed. The domestic portfolio is in 20 top U.S. markets, including Orlando, Florida, and high-performing Jackson Hole, Wyoming, and Hawaii.

Twelve hotels are large-scale, convention properties, and locations in Hawaii and Florida have golf courses. The company also has several condominium properties and offers commercial ground-level leases. In 2023, room sales accounted for

Upgrade to begin using premium research reports and get so much more.

Exclusive reports, detailed company profiles, and best-in-class trade insights to take your portfolio to the next level

Analyst Report: Target Corp

Summary

Target Corp. is the second-biggest U.S. discount retailer. It differentiates itself by selling stylish products at reasonable prices. The company has partnerships with an evolving group of designers. Based in Minneapolis, Target ended FY24 with 1,956 stores in the U.S., with a total of 246 million square feet. In January 2015, the company announced its exit from the Canadian market, along with plans to close approximately 130 stores in Canada. Target sold its in-store pharmacies to CVS in December 2015. For the fiscal year ended February 3, 2024, the company had total revenues of $105.8 billion, including approximately $30 billion from Target’s own brands. Sales on Target.com represented about 18% of the total in FY24, up from 8.8% in pre-pandemic FY20. The company’s fiscal year ends on the Saturday closest to Jan

Upgrade to begin using premium research reports and get so much more.

Exclusive reports, detailed company profiles, and best-in-class trade insights to take your portfolio to the next level

Billionaires Are Selling Nvidia Stock and Buying an Index Fund That May Soar Up to 83,000%, According to Wall Street Experts

Recently filed Forms 13F show that two high-profile hedge fund managers sold shares of Nvidia during the second quarter while reallocating capital to the iShares Bitcoin Trust (NASDAQ: IBIT), an exchange-traded fund (ETF) that tracks Bitcoin (CRYPTO: BTC).

-

David Shaw at D.E. Shaw sold 12.1 million shares of Nvidia, trimming his position by 52%. Meanwhile, he bought 2.4 million shares of the iShares Bitcoin Trust, increasing his position by 1,658%.

-

Steven Cohen at Point72 Asset Management sold 409,042 shares of Nvidia, trimming his position by 16%. He bought 1.6 million shares of the iShares Bitcoin Trust, diversifying into cryptocurrency for the first time.

The trades made by Shaw and Cohen are noteworthy because both fund managers have credentials beyond their status as billionaires. D.E. Shaw and Point72 rank second and 13th, respectively, among the 20 best-performing hedge funds in history, according to LCH Investments.

That said, investors shouldn’t interpret their trades to mean Nvidia is a bad investment, but rather, that portfolio diversification is important. Artificial intelligence (AI) stocks like Nvidia could create substantial wealth over time, but the same is true of cryptocurrencies like Bitcoin. Some Wall Street experts think Bitcoin (and consequently, the iShares Bitcoin Trust) could surge 83,000%.

Select Wall Street experts are forecasting colossal gains for Bitcoin holders

Bitcoin entered the year at full steam. Its price had more than doubled in 2023, and the gains accelerated in early 2024 when the U.S. Securities and Exchange Commission (SEC) approved the trading of spot Bitcoin ETFs on U.S. stock exchanges. Excitement surrounding the April halving event also contributed to the upward momentum.

Bitcoin hit a record high above $73,000 in March before stumbling when investors lost their appetites for risk. Economic uncertainty caused the sentiment reversal. Investors entered the year thinking the Federal Reserve would cut its benchmark interest rate by June, but policymakers have kept rates at their highest level in two decades.

The situation changed from bad to worse in early August. Recession fears resurfaced when a weak jobs report raised questions about whether the Federal Reserve was moving too slowly. That concern caused the stock market to plunge, and the cryptocurrency market suffered its worst sell-off since FTX collapsed in 2022.

Bitcoin currently trades at $59,000, about 20% below its March peak. But these Wall Street experts remain exceedingly bullish on the cryptocurrency.

-

Bernstein analysts Gautam Chhugani and Mahika Sapra think Bitcoin will trade at $200,000 by 2025, $500,000 by 2029, and $1 million by 2033 as spot Bitcoin ETFs unlock demand from retail and institutional investors. The high end of that forecast implies 1,595% upside.

-

Ark Invest published a valuation model in 2023 that priced Bitcoin at $1.5 million per coin by 2030. But CEO Cathie Wood revised that figure to $3.8 million at a Bitcoin conference in March, based on the idea that institutional investors will allocate about 5% of their assets to Bitcoin in the future. That forecast implies 6,440% upside.

-

MicroStrategy executive chairman Michael Saylor recently delivered a keynote speech at a Bitcoin conference that included an ultra-bullish price target. “It could be a $3 million bear case, it could be a $49 million bull case,” he said. The low end of his predicted range implies 5,085% upside, and the high end implies 83,000% upside.

Spot Bitcoin ETFs could unlock demand for Bitcoin from retail and institutional investors

Bitcoin’s price is a function of supply and demand. However, Bitcoin supply is limited to 21 million coins, meaning demand is the most consequential variable.

That’s where spot Bitcoin ETFs could make a big difference. Those new funds eliminate traditional sources of friction by letting investors add Bitcoin exposure to existing brokerage accounts.

In other words, investors no longer need a separate account with a cryptocurrency exchange or have to pay exorbitant fees for each transaction. Several spot Bitcoin ETFs bear relatively low expense ratios. For instance, the iShares Bitcoin Trust charges an annual fee of 0.25%, so investors will pay $25 for every $10,000 invested in the fund.

By reducing friction, spot Bitcoin ETFs are bringing more retail and institutional investors to the market. For instance, the iShares Bitcoin Trust accumulated more assets during its first 50 trading days than any ETF in history, according to Eric Balchunas at Bloomberg. The fund also reached $10 billion in assets faster than any ETF on record, according to The Wall Street Journal.

That said, spot Bitcoin ETFs have a ways to go before reaching 5% of institutional assets under management (AUM), which is what Cathie Wood expects over time. Institutional AUM totaled $120 trillion last year, and 5% of that figure is roughly $6 trillion. Collectively, spot Bitcoin ETFs have less than $60 billion in assets right now.

History says Bitcoin will hit a new high between April 2025 and October 2025

Bitcoin miners earn block subsidies (newly minted Bitcoin) for solving the cryptographic puzzles required to verify transactions. But the payout is reduced by 50% every time 210,000 blocks are added to the blockchain. Those so-called halving events happen about once every four years, and the most recent one took place in April.

That is significant for two reasons. First, the halving event means miners will be minting less Bitcoin over the next four years, which will reduce one source of selling pressure simply because they have less Bitcoin to sell. Second, Bitcoin has gone through three halving cycles previously, and its price has always peaked 12 to 18 months later, as shown in the chart below.

Halving Date

Peak Return

Time to Peak Return

November 2012

10,485%

371 days

July 2016

3,103%

525 days

May 2020

707%

546 days

Source: Fidelity Digital Assets.

In short, history says Bitcoin will reach a new record high sometime between April 2025 and October 2025.

A word of caution for prospective investors

Past performance is never a guarantee of future returns, and investors shouldn’t take the forecasts I’ve discussed for granted. I find the price target of $49 million (which implies an upside of 83,000%) absurd.

Additionally, Bitcoin is a relatively new asset class, so there’s limited data available to make predictions about how it may perform in different economic climates. Bitcoin has also been very volatile throughout its short history. The cryptocurrency has declined more than 50% on several occasions and similar drawdowns are likely in the future.

Risk-tolerant investors comfortable with that possibility should consider investing a small percentage of their portfolios in Bitcoin, either by purchasing the cryptocurrency directly or through a spot Bitcoin ETF. I think investors should limit their exposure to 5% of invested assets.

Should you invest $1,000 in iShares Bitcoin Trust right now?

Before you buy stock in iShares Bitcoin Trust, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and iShares Bitcoin Trust wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $779,735!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

Trevor Jennewine has positions in Nvidia. The Motley Fool has positions in and recommends Bitcoin and Nvidia. The Motley Fool has a disclosure policy.

Billionaires Are Selling Nvidia Stock and Buying an Index Fund That May Soar Up to 83,000%, According to Wall Street Experts was originally published by The Motley Fool

What's Going On With Super Micro Computer Stock On Thursday?

Artificial intelligence server company Super Micro Computer, Inc (NASDAQ:SMCI) stock is trading lower Thursday in sympathy with the broader semiconductor selloff led by its clients, including Nvidia Corp (NASDAQ:NVDA) and Advanced Micro Devices, Inc (NASDAQ:AMD).

Despite the selloff, analysts continue to hail Nvidia as the critical AI play, implying the continued potential for the AI frenzy. The selloff has rendered the valuation of the semiconductor companies as more attractive entry points.

Super Micro Computer stock has increased 136% in the last 12 months and is currently trading at a price-to-earnings multiple of 13.73x. Nvidia, up 176%, is currently trading at a 33.16 PE multiple.

Recently, Taiwanese rail kit supplier Nan Juen International Co, a Super Micro Computer partner, inked a deal with Nvidia to ramp up rail kit production for GB200 AI servers.

The market value of AI servers has the potential to surpass $187 billion in 2024, implying a growth rate of 69% driven by the demand for advanced AI servers from major CSPs and brand clients, as per TrendForce.

The market potential for AI servers backed by demand from Big Tech giants, including Nvidia, AMD, Amazon.Com Inc (NASDAQ:AMZN), Amazon Web Services, and Meta Platforms Inc (NASDAQ:META) explains Super Micro Computer’s stock price trajectory.

Super Micro Computer reported a topline growth of 144% in the fourth quarter. Analysts expected the AI server company’s margin weakness to recover by fiscal 2025, easing the competitive pricing environment.

Investors can gain exposure to Super Micro Computer through Invesco QQQ Trust, Series 1 (NASDAQ:QQQ), and SPDR S&P 500 (NYSE:SPY).

Price Action: SMCI shares traded lower by 2.77% at $606.50 at the last check on Thursday.

Photo via Company

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article What’s Going On With Super Micro Computer Stock On Thursday? originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia stock slips ahead of earnings release as Wall Street reiterates bullish outlook

Nvidia (NVDA) stock fell more than 3% on Thursday as Wall Street analysts reiterated their bullish views of the chip giant ahead of its highly anticipated earnings report next week.

Nvidia shares have gained more than 25% since early August.

KeyBanc’s John Vinh was among the latest Wall Street analysts to outline why the company should be poised to beat lofty forecasts in its report on Aug. 28.

“We believe modest expectations for Blackwell shipments in FQ3 have been backfilled with higher Hopper bookings,” Vinh wrote in a recent note.

“We expect NVDA to report beat/raise results, in which upside will be driven by strong demand for Hopper GPUs.”

The analyst reiterated a Buy rating on the stock with a price target of $180.

Nvidia’s next-generation Blackwell chips were reported to be facing delays of up to three months, potentially pushing out future orders and weighing on plans from key customers like Microsoft, (MSFT) Meta (META), Google (GOOG, GOOGL), and Amazon (AMZN), which collectively account for about 40% of the company’s revenue.

Citi analysts also reiterated their Buy rating on the stock this week, writing that they expect “Blackwell comments [from Nvidia] to reassure investors on a strong 2025 outlook, and [the] stock to make fresh 52 week high.” The firm’s analysts have a $150 price target on the stock.

Goldman Sachs analysts also restated their Buy rating on Nvidia, which also sits on the firm’s “Conviction List.”

Wall Street remains positive on Big Tech’s AI infrastructure spending, with Goldman Sachs recently saying it believes “customer demand across the large Cloud Service Providers and enterprises is strong and Nvidia’s robust competitive position in AI/accelerated computing remains intact.”

Analyst forecasts have Nvidia’s revenue set to grow 112% in its latest quarter, though this would mark a slowdown from the over 250% growth seen by the company in the same quarter last year.

Nvidia shares have been a major driver of the August market rebound, as the stock roared back roughly from its August low, when it fell below $100.

Shares last touched an intraday high north of $140 in June, closing at an all-time high of $135.58 on June 18. The majority of analysts are bullish on the AI chip heavyweight, with 66 Buy recommendations, eight Hold ratings, and zero Sell recommendations.

Ines Ferre is a senior business reporter for Yahoo Finance. Follow her on X at @ines_ferre.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance