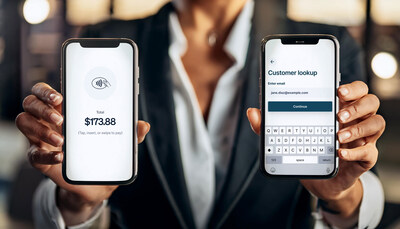

SAN FRANCISCO, Sept. 10, 2024 /PRNewswire/ — IBS Software is partnering with Stripe, a financial infrastructure platform for businesses, to ease friction in the travel industry by providing an increased range of payment solutions for those using IBS Software’s iStay. This technical integration is available immediately for IBS Software customers. iStay and Stripe built this partnership using Stripe’s Connect product, the fastest and easiest way to integrate payments and financial services into the user’s software platform or marketplace.

This partnership enables hospitality groups to improve the traveler experience and personalize key steps of the traveler’s journey – making purchase moments easier and potentially more frequent. In an effort to give travelers more options, the Stripe integration will support both online and in-person payment processing.

For customers, this seamless integration allows them to benefit from modern payment solutions and an abundance of choice when it comes to how they pay for their travel. Businesses will be able to offer features like one-click booking experience and access to popular payment options like installments and buy now, pay later methods. Not only will these options be available at the time of booking, but at multiple points throughout the guest’s journey from in-room dining to tours and activities to parking, all bookable through saved payment methods, reducing friction and time spent on the customer’s side arranging payment during repeat visits.

Through this partnership, IBS Software continues to build out its best-in-class unified iStay platform to ensure the best possible travel experience from booking to the journey back home.

About IBS Software

IBS Software is a leading SaaS solutions provider to the travel industry globally, managing mission-critical operations for customers in the aviation, tour & cruise, hospitality, and energy resources industries. IBS Software’s solutions for the aviation industry cover fleet & crew operations, aircraft maintenance, passenger services, loyalty programs, staff travel and air cargo management. Across the hospitality sector, IBS Software offers a cloud-native, unified platform for hotels and travel sellers, including central reservation (CRS), property management (PMS), revenue management (RMS), call centre, booking engine, loyalty and distribution. For the tour & cruise industry, IBS provides a comprehensive, customer-centric, digital platform that covers onshore, online and on-board solutions. Across the energy & resources industry, we provide logistics management solutions that cover logistics planning, operations & accommodation management. The Consulting and Digital Transformation (CDx) business focuses on driving digital transformation initiatives of its customers, leveraging its domain knowledge, digital technologies and engineering excellence. IBS Software operates from 17 offices across the world.

Further information can be found at www.ibsplc.com Follow us: Blog | Twitter | LinkedIn | Facebook | Instagram

Photo: https://new.stockburger.news/wp-content/uploads/2024/09/Stripe_IBS_SOFTWARE.jpg

Logo: https://new.stockburger.news/wp-content/uploads/2024/09/IBS_Software_Logo.jpg

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/ibs-softwares-istay-solution-now-offers-stripe-thanks-to-new-partnership-302242186.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/ibs-softwares-istay-solution-now-offers-stripe-thanks-to-new-partnership-302242186.html

SOURCE IBS Software

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.