What is the national average money market account rate?

A money market account (MMA) is a type of deposit account that offers features of both savings and checking accounts. They allow you to earn competitive interest rates on your balance, while easily accessing those funds via a debit card and/or checks.

Like other deposit accounts, most money market accounts are federally insured up to $250,000 per depositor, per institution, and per ownership category. This insurance protects your account balance if your bank or credit union fails.

If you’re thinking about opening a money market account, it’s important to shop around and compare interest rates so you know you’re getting the most out of your savings. But what is a good money market rate? Interest rates vary widely, but it can help to know the average money market rate today, which can serve as a benchmark for comparing accounts.

Average money market account rates

Money market accounts pay variable interest rates, meaning they can go up or down at any time. Typically, when the Federal Reserve increases its target rate, MMA rates also go up, and vice versa.

Here’s a look at how average money market rates have changed over the past year:

And zooming out, here’s how money market account rates have changed since 2010:

As of the time of writing, the national average rate for a money market account is 0.64%. Though this is fairly high by historical standards, it still isn’t much.

The good news is that many banks and credit unions offer MMA rates that are much higher than the national average. In fact, the best money market accounts are paying as much as 5% APY or more.

Doing some research to find the best rates available can make a significant difference in your savings balance over time.

See our picks for the 10 best money market accounts today>>

How to get the best money market account rate

Money market account rates fluctuate, but there are steps you can take to ensure that you get the best possible rate:

-

Shop around: Take time to compare MMA rates from different banks and credit unions, since interest rates vary quite a bit between financial institutions. Online banks, in particular, are known for offering the most competitive rates.

-

Check with your current bank: Some financial institutions offer higher rates to existing customers, known as relationship rates. As you’re shopping around, be sure to check with your existing bank to see if you qualify for a relationship interest rate.

-

Make a larger opening deposit: Many money market accounts are tiered, where higher rates are offered on higher balances. Making a larger opening deposit and maintaining a higher minimum balance could help you earn a better rate.

-

Watch out for fees: Many bank accounts, including money market accounts, come with certain fees. For example, you may be charged a monthly maintenance fee, or a fee if your balance drops below a certain threshold. These fees can cancel out interest earnings, so it’s important to choose an account that charges few fees or offers ways to get fees waived.

Forget Devon Energy, These Unstoppable High-Yield Stocks Are Better Buys

Devon Energy (NYSE: DVN) just agreed to buy the Williston Basin business of Grayson Mill Energy, further expanding its onshore U.S. footprint. Just days after that news, Devon reported that it was already achieving record production levels. If you are looking for a pure-play energy producer, Devon should probably be on your list of candidates. But if you are also looking for dividends, well, you might want to consider these two other energy stocks instead. Here’s why.

The problem with Devon Energy’s dividend

Devon Energy’s dividend yield is listed at around 4.4% by online quote services. That is a pretty attractive number, given that the S&P 500 index is only yielding 1.2% and the average energy stock, using Energy Select Sector SPDR ETF (NYSEMKT: XLE) as an industry proxy, has a yield of 3.1%. The problem is that the 4.4% yield listed is something of a mirage.

The problem isn’t the data feed, it’s Devon’s dividend. The top and bottom lines for this pure-play energy producer are inherently driven by volatile oil and natural gas prices. That means revenue and earnings can swing wildly at times. Devon has decided that the best way to reward investors during the good times, while protecting its business during the bad, is to have a variable dividend policy. That way the dividend rises along with energy prices, but falls with them, too. The end result is that you can’t really trust the dividend yield figure because, by design, it will change. That won’t be agreeable to most dividend investors and particularly to those trying to live off of the income their portfolio generates in retirement.

Chevron is a through-the-cycle dividend stock

Chevron (NYSE: CVX) also has a dividend yield of around 4.4%, but its dividend has been increased annually for 37 consecutive years. The big difference between this energy giant and Devon is that Chevron’s business is spread across the upstream (energy production), midstream (pipelines), and downstream (refining and chemicals). This helps to soften the blow from volatile energy prices, since the different segments of the energy sector perform differently at different times.

Chevron increases its resilience by making sparing use of leverage. Its debt-to-equity ratio is currently around 0.15 times, which would be low for any company. But that low leverage during the good times gives Chevron the leeway to add leverage during the bad times, supporting both its business and dividend-paying abilities through the entire energy cycle. To be fair, Chevron probably won’t be as rewarding a stock to own while energy is rising, but for most income-oriented investors that will be more than made up for by the company’s dividend resilience during energy crashes.

Enbridge is a boring and reliable dividend grower

Enbridge (NYSE: ENB) is even more conservative than Chevron, as it hails from the midstream segment of the energy sector. The midstream largely charges fees for helping to connect the upstream to the downstream (and the rest of the world) via vital energy infrastructure assets, such as pipelines. Thus, energy demand is more important than energy prices. Energy demand tends to remain robust even during industry downturns. This is how Enbridge has increased its dividend annually for 29 consecutive years. The yield is a huge 6.6%, supported by the reliable cash flows its assets generate.

But Enbridge isn’t just a midstream company. It also owns regulated natural gas utilities and clean energy assets, as it looks to provide the world with the energy it is demanding. Or, put another way, it is trying to shift its business along with the world as the world moves toward cleaner energy sources. The key, however, is that the company’s utility and clean energy assets are reliable cash-flow generators, too. So Enbridge is an attractive high-yield energy stock that will give you exposure to the energy sector and more, which might make it the best option for conservative, long-term income investors.

If you want reliable income, look beyond Devon Energy

Devon Energy is not a bad company. And its dividend could actually be an interesting way to hedge against real-world energy costs (for things like heating and transportation). However, it is not a good way to generate a reliable income stream. For that, you’ll be better off with Chevron, if you are looking for oil exposure; or Enbridge, if your primary goal is to maximize income over time.

Should you invest $1,000 in Enbridge right now?

Before you buy stock in Enbridge, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Enbridge wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Reuben Gregg Brewer has positions in Enbridge. The Motley Fool has positions in and recommends Chevron and Enbridge. The Motley Fool has a disclosure policy.

Forget Devon Energy, These Unstoppable High-Yield Stocks Are Better Buys was originally published by The Motley Fool

Is the Stock Market Going to Crash? Who Knows? That's Why I'd Own This High-Yield Dividend Stock.

If you’re like most investors, you love the market’s long-term upside. You just don’t want to suffer its occasional (and sometimes painful) setbacks. Problem? You don’t know when crashes are coming. The best you can hope for is minimizing their misery once they arrive. And the best way to do that is by being properly positioned before big pullbacks take shape.

With that as the backdrop, there’s one name in particular I’d consider owning now just in case a market crash is looming. That’s Annaly Capital Management (NYSE: NLY).

Never heard of it? Don’t sweat it. You’re not alone. It’s not exactly a household name, and with a market cap of only $10 billion, it’s not like it garners a great deal of the financial media’s attention.

It does its job for investors incredibly well, though.

What’s Annaly Capital Management?

Annaly Capital Management is a real estate investment trust (REIT). Just as the name suggests, REITs are real estate-focused organizations. REITs own properties ranging from hotels and office buildings to strip malls, apartment buildings, and more. Their primary purpose, however, is the same in all cases: generating reliable, recurring income for shareholders.

Annaly is unique even by REIT standards, though. Rather than holding rent-bearing or revenue-bearing real estate, this company’s business is a combination of managing mortgage loan service rights, buying and selling mortgage-backed securities issued by government agencies, like Fannie Mae or Freddie Mac, and what is essentially engaging in interest rate arbitrage between its own borrowing costs and the yields on the mortgage-based securities it holds.

It sounds crazy, and in some ways it is. The business model is 100% tethered to the United States mortgage market, which ebbs and flows in relation to ever-changing interest rates. Sometimes, this business is predictable. Other times, it isn’t. And sometimes, even when it is predictable, that doesn’t necessarily mean there’s an easy way for a mortgage REIT to defend itself against looming setbacks.

At the end of the day, though, Annaly Capital Management makes it work. Since its inception in 1996, this REIT’s total return has kept up with the S&P 500‘s gain for the same timeframe, with most of Annaly’s net gains coming in the form of what’s usually an oversized dividend that continues being paid, even when the broad market is on the ropes.

An advantageous disconnect

Don’t misread the message. For anyone needing consistent, predictable investment income, Annaly Capital Management can be a rather tough ticker to count on. The payout doesn’t necessarily grow in step with inflation, if it grows at all. Sometimes, it shrinks, reflecting the ongoing changes in the underlying mortgage loan market within which this REIT solely operates. This ticker’s price changes — often being lowered — to make its yield more accurately reflect the prevailing, risk-adjusted yields at any given time.

The REIT’s underlying earnings (called earnings available for distribution) are also impacted by changes in interest rates themselves, which can force the organization to adjust its dividend payments from time to time.

Annaly Capital Management is still a great defensive option in the event of market crashes, though, for a couple of different but related reasons: (1) This business doesn’t necessarily rise and fall with the stock market’s ebb and flow, and (2) the dividend behind Annaly’s current yield of 13% is going to be paid regardless of the market’s performance in the foreseeable future.

That’s better than the S&P 500’s average annual gain, by the way.

To be clear, owning a stake in this REIT doesn’t guarantee you’ll be better off than not should stocks suffer a sizable pullback. There are no guarantees in this business, after all. Anything can and will eventually happen.

But that’s not the point. The most you can do is give yourself the best chance of fending off the full brunt of a sweeping sell-off. Annaly at least offers you a reasonable chance of doing that. In the meantime, it’s dishing out a good amount of cash in an environment where growth stocks may not be logging a great deal of gains for a while.

Keep it in perspective

The defensive benefits here are obvious, but even so, interested investors should keep things in perspective. Annaly isn’t well suited to serve as a major, foundational holding in a long-term portfolio. And if your current goal is just to survive a market crash, you should think about picking up other kinds of defensive trades, like gold or bonds.

Nevertheless, Annaly Capital Management is a top prospect for at least a small sliver of your portfolio right now, if only because it’s so far removed from the mainstream stock market yet still capable of producing stock market-like net returns.

Should you invest $1,000 in Annaly Capital Management right now?

Before you buy stock in Annaly Capital Management, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Annaly Capital Management wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Is the Stock Market Going to Crash? Who Knows? That’s Why I’d Own This High-Yield Dividend Stock. was originally published by The Motley Fool

The Recent Tech Sell-Off Made This Artificial Intelligence (AI) Stock an Even Better Buy

Buying Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) stock is rarely a bad idea.

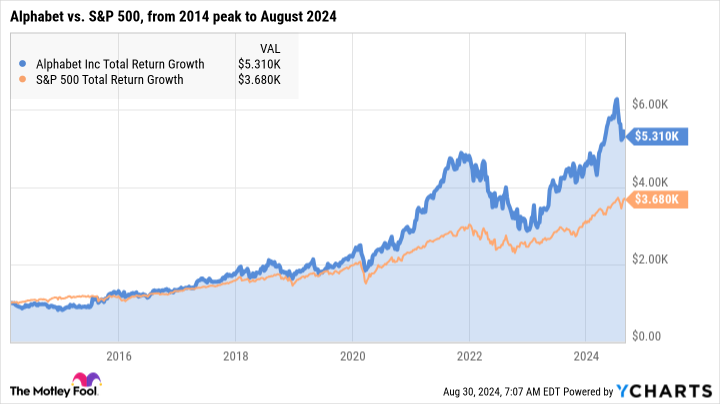

Imagine picking up $1,000 of Alphabet stock on Feb. 25, 2014. That turned out to be the worst day of that year to get into the technology giant’s shares. The day’s peak, with a record price of $30.50 per split-adjusted share, was followed by an 18% plunge over the next 10 months. The bear bait stacked up as European regulators considered breaking up the company, Android phone sales struggled, top executives left, and new product ideas like Google Glass and Waymo self-driving cars weren’t catching on.

That’s all right, though. If you had held on to that $1,000 investment through thick and thin, you’d have a market-beating $5,310 in your pocket roughly 10 years later.

Alphabet’s stock has stumbled before — and come back swinging

You would of course have done even better if you invested in Alphabet on any other day of that year, but the company overcame its issues and stomped the broader market even from the worst possible starting point of 2014. I expect future generations to say similar things about buying Alphabet stock in 2024 — that investment should beat the market for many years or even decades to come, no matter how poorly you may have timed the purchase.

Time in the market beats timing the market, you know. And this company was built to last for a very long time.

I can’t think of any single company more likely than Alphabet to deliver robust returns in 2040, 2050, and beyond. That terrible price drop in 2014 is a barely detectable chart squiggle by now. And Alphabet’s business results just continued to grow:

Alphabet’s stock is a bargain right now

Wait — it still gets better. On top of Alphabet’s tank-like staying power, the stock happens to be unusually affordable right now.

After reaching another all-time record of $191.40 per share in July, Alphabet shares have retreated 15% to roughly $162 per share. As I write this, they trade at 23.4 times trailing earnings with a price-to-earnings-to-growth (PEG) ratio of 1.1. These are the most affordable earnings-based valuation ratios among the “Magnificent Seven” of tech giants.

Moreover, Alphabet has taken a leading role in the artificial intelligence (AI) boom. Google Cloud is a popular cloud computing platform where other companies can train and run their own AI platforms. The Google Gemini chatbot competes directly with OpenAI’s ChatGPT in language understanding and generation. The company is poised to make the most of generative AI as a long-term growth catalyst.

I could go on, but you get my point. Alphabet’s stock was a fine investment before the recent sell-off, and it’s an even better buy today. Market sell-offs can be your friend when you’re looking to invest in a great company like Alphabet.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Anders Bylund has positions in Alphabet and Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Alphabet and Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.

The Recent Tech Sell-Off Made This Artificial Intelligence (AI) Stock an Even Better Buy was originally published by The Motley Fool

Why you should name a beneficiary for all of your bank accounts

If you care about what happens to your money after you die, you’ll want to think about who you should designate as a bank account beneficiary.

Having somebody who can quickly access the money in your bank account after you depart is important. If you died unexpectedly and you didn’t designate a beneficiary, your cash could be tied up in a probate court for quite a while.

Depending on your situation, however, it may not be obvious who you should choose as your beneficiary. If you’re struggling with who your beneficiary should be or wondering if you really do need beneficiaries, there are several things you’ll want to keep in mind.

Benefits of having bank account beneficiaries

Designating bank account beneficiaries has quite a few benefits and no significant drawbacks. Here are some of the main advantages.

You have a say in what happens to your money

This is at the heart of why bank account beneficiaries matter. If you have family members who would benefit from the money in your checking and savings accounts, and you want them to have that income promptly after your death, you’ll want to designate one or more of those family members as a beneficiary.

If you want your kids to have your money, and they’re under 18, it’s a good idea to talk to a financial adviser or estate planner about setting up a trust where the funds would be held and managed by a trustee until the minor reaches a specified age.

Even if you don’t have any loved ones that you’d want to receive funds, you still may want a bank account beneficiary. For instance, you could give the honor to a favorite nonprofit. In this case, you would grant the nonprofit — just as you would a family member or friend — as a POD (payable on death) designation.

You may save your heirs time and money

Without designated beneficiaries, it can take a while for a probate judge to sort through who should get what. Even if the probate process goes smoothly and a family member quickly gets the money in your bank accounts, there will likely be costs involved. Once your spouse, kids, uncle, or whomever you hope the money goes to gains access to the funds, several hundred dollars (at least) may need to go toward court fees.

You may avoid family fights

Granted, you may start a family fight when you list your bank account beneficiaries if, for instance, you favor one adult child as a beneficiary over another. Or if you have an ex-spouse as the bank account beneficiary instead of your current spouse. (In other words, you may want to update your bank account beneficiaries occasionally.)

Still, similar to creating a will, designating beneficiaries lets it be known what you want to happen to your money if you were to die. And hopefully, having bank account beneficiaries in place will reduce any potential family friction after you’re gone.

Read more: What happens to credit card debt when you die?

How to choose a bank account beneficiary

Choosing beneficiaries for your bank account is an important decision that can impact how your assets are distributed after your death.

When deciding who to designate, consider the current financial status of potential beneficiaries. Do they need the money for specific purposes such as education, medical expenses, or housing?

Many people choose their spouse as a primary beneficiary, especially if they share finances and financial responsibilities. If you have children, you may also want to designate them as beneficiaries. But it doesn’t have to be limited to immediate household members; anyone you financially support, such as an elderly parent or a grandchild, could be a good candidate for becoming a beneficiary.

How to designate a beneficiary

Designating a bank account beneficiary is simple. You’ll do it when you set up the bank account, either listing the bank account beneficiary on a form, or add them via your online banking platform or mobile app.

If you have trouble finding where to add your beneficiaries, you can always call customer service or visit your bank’s branch. And you can always contact the bank after opening the account to add or change a beneficiary.

You’ll need your beneficiary’s full legal name and probably additional information, such as their mailing address, email, phone number, and Social Security number.

Some states may handle things differently, but typically, you can put as many beneficiaries down as you like. You can also specify the percentage of funds each beneficiary should receive, but must ensure that the total adds up to 100%. For example, say you wanted to put your spouse and your sister down as beneficiaries. You could choose to split their funds 50/50, or select different proportions, like 60/40.

Bank account beneficiary rules

Bank account beneficiary rules are typically a combination of what your financial institution allows and state laws. Here are a few guidelines to keep in mind:

-

There is no rule that says you have to have a bank account beneficiary, though it’s highly recommended.

-

Bank forms don’t always ask for a beneficiary; you may need to contact your bank to add a beneficiary.

-

In order for the beneficiary to get their money, they will likely need to first furnish the account holder’s death certificate.

-

If the account is overdrawn at the time of your death, there won’t be any funds to give to beneficiaries. On the bright side, your beneficiary won’t be responsible for making the account current.

Bank account beneficiary vs. will

It may seem like designating a beneficiary could replace the need for a will, but it really isn’t a substitute for a good estate plan. For instance, a bank account beneficiary doesn’t determine who should get a house or a car, or how your other assets should be distributed.

Life is often complicated, and if you own a lot of assets beyond the money in your bank accounts, you probably also need a will.

If you put together a will, you’ll also want to make sure that if you list a bank account beneficiary in the will, it should be the same as the name you’ve given your bank. If you want to replace that person at any point, that’s fine, but make the change with your bank, too. If the names are different, the bank account beneficiary will generally be the recipient of the funds and not who you named in the will.

Exclusive-China's Sinochem plans to exit US shale JV with Exxon, sources say

By Shariq Khan

NEW YORK (Reuters) – Chinese state-backed oil and chemicals company Sinochem is planning to sell its 40% stake in a U.S. shale joint venture with oil major Exxon Mobil, valued upwards of $2 billion, people familiar with the matter told Reuters.

Sinochem in recent weeks hired investment bankers at Barclays to advise it on the potential sale of its stake in the Wolfcamp joint venture, one of the sources said. Exxon, majority owner and operator of the JV, has the right of first refusal in the sale, the source added.

The sources cautioned that the sale considerations are at an early stage and a deal with Exxon or other interested parties, which could include rival Asian national oil corporations, is not guaranteed. They said Sinochem could still decide to retain its stake. The sources requested anonymity to discuss confidential talks.

Sinochem, Exxon and Barclays did not immediately respond to requests for comment.

A sale would end Sinochem’s over 11-year involvement in the Permian Basin of Texas, the heartland of the U.S. shale revolution. Meteoric production growth in the region over those 11 years has catapulted the U.S. to the top of global oil production and export charts.

Sinochem acquired the stake from Pioneer Resources in 2013 for $1.7 billion, when production on the roughly 83,000 net acres (33,590 net hectares) of land under the JV was just about 10,000 barrels of oil equivalent per day (boepd).

Most recent output from the land averaged over 44,000 boepd, of which roughly 75% is oil, one of the sources said.

Exxon completed a $60 billion purchase of Pioneer in May, the biggest deal in a record-breaking wave of consolidation in the U.S. oil industry. The deal made Exxon the top producer in the Permian Basin.

Sinochem has been re-evaluating its struggling oil exploration and production business in recent years to shift focus to new materials and life sciences, its former chairman, Frank Ning, said in 2017.

The Wolfcamp JV is Sinochem’s largest oil and gas producing asset outside China, according to a company source.

The company has also been trying to sell its 40% stake in Brazil’s Peregrino oilfield since 2017.

A state-mandated merger with ChemChina in 2021 brought Sinochem new headaches as the company was forced to shutter several oil refineries in eastern China earlier this year to stem losses amid sluggish Chinese fuel demand, Reuters has reported.

(Reporting by Shariq Khan in New York, additional reporting by Chen Aizhu in Singapore; Editing by Jonathan Oatis)

Super Micro Computer's Stock Sinks: Time to Buy or Sell?

Super Micro Computer (NASDAQ: SMCI), more commonly known as Supermicro, was one of the hottest artificial intelligence (AI) stocks this year. Its shares closed at a record high of $1,188.07 on March 13, representing a 2,760% gain over the previous two years, as its sales of dedicated AI servers skyrocketed.

But as of this writing, Supermicro’s stock trades at $424. Four issues caused that slide: concerns about its declining gross margins, troubling allegations from a prolific short-seller, a delayed filing of the company’s annual report, and Nvidia‘s (NASDAQ: NVDA) decelerating sales growth. Let’s see if investors should buy or avoid this fallen AI stock.

The bull case for Supermicro

Supermicro controls a smaller slice of the server market than Dell Technologies or Hewlett Packard Enterprise, but it carved out a niche with its high-performance liquid-cooled servers. That strategy made Supermicro an ideal partner for Nvidia, which provided the company with a steady supply of its high-end data center GPUs.

As a result, Supermicro’s sales of dedicated AI servers skyrocketed as the rapid expansion of the AI market drove many companies to upgrade their data centers. The company’s revenue rose only 7% in fiscal 2021 (which ended in June 2021) but surged 46% in fiscal 2022, 37% in fiscal 2023, and 110% in fiscal 2024 as those AI tailwinds kicked in. Analysts expect its revenue to grow another 89% in fiscal 2025 and 12% in fiscal 2026.

Bank of America estimates that Supermicro already controls 10% of the dedicated server market, and it expects it to grow its share to 17% within the next three years as the entire market expands 150%. The bulls believe that Supermicro’s booming AI server business, which already accounts for over half of its revenue, will offset its slower sales of traditional servers. That’s why its stock has rallied alongside Nvidia’s over the past two years.

The bear case against Supermicro

Supermicro has grown like a weed over the past year, but a few cracks in the bull thesis appeared during its fourth-quarter earnings report on Aug. 6. Its 144% year-over-year revenue growth exceeded Wall Street’s expectations, but its 78% adjusted earnings growth broadly missed the consensus forecast for 130% growth.

|

Metric |

Q4 2023 |

Q1 2024 |

Q2 2024 |

Q3 2024 |

Q4 2024 |

|---|---|---|---|---|---|

|

Revenue growth (YOY) |

33% |

15% |

103% |

201% |

144% |

|

Gross margin |

17% |

16.7% |

15.4% |

15.5% |

11.2% |

|

Adjusted EPS growth (YOY) |

34% |

0% |

71% |

308% |

78% |

Data source: Super Micro Computer. YOY = year over year.

The main culprit was the gross margin, which fell both sequentially and year over year as the company sold a less lucrative mix of mostly lower-margin products and ramped up spending on its newest direct liquid cooling (DLC) solutions. That contraction is troubling because it indicates Supermicro is selling its AI servers at considerably lower margins than its traditional servers.

That loss of pricing power was already weighing down Supermicro’s stock when Hindenburg Research released a short-seller report on Aug. 27. Short-sellers make money when a stock on which they are “short” falls. The firm alleges Supermicro “faces significant accounting, governance and compliance issues and offers an inferior product and service being eroded away by more credible competition.” It points out that Supermicro’s cloud deal with Amazon Web Services (AWS) ultimately failed and that its “exclusive” deal with Tesla actually ended when the EV maker struck a similar deal with Dell this May.

Hindenburg leveled other allegations and the following day Supermicro postponed its 10-K filing, saying it needed “additional time” to assess its “internal controls over financial reporting.” Its stock plummeted after that startling announcement, and it continued dropping after Nvidia posted its latest earnings report — which featured strong but slowing sales of its data center chips.

Is it time to buy or sell Supermicro’s stock?

Supermicro’s stock trades at just 13 times forward earnings after its near-40% decline over the past month. That’s a low valuation, but its shrinking gross margins, the troubling short-seller accusations, and its delayed 10-K filing raise some bright red flags. Its insiders also didn’t buy a single share of the stock as it collapsed over the past three months.

I thought Supermicro was an undervalued growth play after its postearnings plunge, but until Supermicro clears up the cloud around it with a clear 10-K filing, it’s smarter to avoid or sell its stock and stick with more promising AI plays instead.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Bank of America is an advertising partner of The Ascent, a Motley Fool company. Leo Sun has positions in Amazon. The Motley Fool has positions in and recommends Amazon, Bank of America, Nvidia, and Tesla. The Motley Fool has a disclosure policy.

Super Micro Computer’s Stock Sinks: Time to Buy or Sell? was originally published by The Motley Fool

How Costco leveraged its supply chain to become 3rd largest retailer on Earth | WHAT THE TRUCK?!?

On episode 753 of WHAT THE TRUCK?!? Dooner is joined by supply chain super consultant Brittain Ladd to talk about how Costco leveraged its supply chain to become the third largest retailer in the world. Nearly one third of Americans count themselves as members and the company is now expanding into East Asia. Ladd shares how Costco is using tech to scale the business even further.

MoLo co-founder and podcaster Andrew Silver returns to the show to talk about the state of the industry and lessons learned from his time in the trenches. We’ll also find out how he’s building his show The Freight Pod and what insights he’s gleaned from top leaders in freight.

Plus, a wild truck chase; should truckers be allowed to sing; JAS Worldwide’s ransomware attack; Chicago sports and more.

Subscribe to the WTT newsletter

The post How Costco leveraged its supply chain to become 3rd largest retailer on Earth | WHAT THE TRUCK?!? appeared first on FreightWaves.

Japan wants its hardworking citizens to try a 4-day workweek

TOKYO (AP) — Japan, a nation so hardworking its language has a term for literally working oneself to death, is trying to address a worrisome labor shortage by coaxing more people and companies to adopt four-day workweeks.

The Japanese government first expressed support for a shorter working week in 2021, after lawmakers endorsed the idea. The concept has been slow to catch on, however; about 8% of companies in Japan allow employees to take three or more days off per week, while 7% give their workers the legally mandated one day off, according to the Ministry of Health, Labor and Welfare.

Hoping to produce more takers, especially among small and medium-sized businesses, the government launched a “work style reform” campaign that promotes shorter hours and other flexible arrangements along with overtime limits and paid annual leave. The labor ministry recently started offering free consulting, grants and a growing library of success stories as further motivation.

“By realizing a society in which workers can choose from a variety of working styles based on their circumstances, we aim to create a virtuous cycle of growth and distribution and enable each and every worker to have a better outlook for the future,” states a ministry website about the “hatarakikata kaikaku” campaign, which translates to “innovating how we work.”

The department overseeing the new support services for businesses says only three companies have come forward so far to request advice on making changes, relevant regulations and available subsidies, illustrating the challenges the initiative faces.

Perhaps more telling: of the 63,000 Panasonic Holdings Corp. employees who are eligible for four-day schedules at the electronics maker and its group companies in Japan, only 150 employees have opted to take them, according to Yohei Mori, who oversees the initiative at one Panasonic company.

The government’s official backing of a better work-life balance represents a marked change in Japan, a country whose reputed culture of workaholic stoicism often got credited for the national recovery and stellar economic growth after World War II.

Conformist pressures to sacrifice for one’s company are intense. Citizens typically take vacations at the same time of year as their colleagues — during the Bon holidays in the summer and around New Year’s — so co-workers can’t accuse them of being neglectful or uncaring.

Long hours are the norm. Although 85% of employers report giving their workers two days off a week and there are legal restrictions on overtime hours, which are negotiated with labor unions and detailed in contracts. But some Japanese do “service overtime,” meaning it’s unreported and performed without compensation.

A recent government white paper on “karoshi,” the Japanese term that in English means “death from overwork, said Japan has at least 54 such fatalities a year, including from heart attacks.

Japan’s “serious, conscientious and hard-working” people tend to value their relationships with their colleagues and form a bond with their companies, and Japanese TV shows and manga comics often focus on the workplace, said Tim Craig, the author of a book called “Cool Japan: Case Studies from Japan’s Cultural and Creative Industries.”

“Work is a big deal here. It’s not just a way to make money, although it is that, too,” said Craig, who previously taught at Doshisha Business School and founded editing and translation firm BlueSky Academic Services.

Some officials consider changing that mindset as crucial to maintaining a viable workforce amid Japan’s nosediving birth rate. At the current rate, which is partly attributed to the country’s job-focused culture, the working age population is expected to decline 40% to 45 million people in 2065, from the current 74 million, according to government data.

Proponents of the three-days-off model say it encourages people raising children, those caring for older relatives, retirees living on pensions and others looking for flexibility or additional income to remain in the workforce for longer.

Akiko Yokohama, who works at Spelldata, a small Tokyo-based technology company that allows employees to work a four-day schedule, takes Wednesdays off along with Saturdays and Sundays. The extra day off allows her to get her hair done, attend other appointments or go shopping.

“It’s hard when you aren’t feeling well to keep going for five days in a row. The rest allows you to recover or go see the doctor. Emotionally, it’s less stressful,” Yokohama said.

Her husband, a real estate broker, also gets Wednesdays off but works weekends, which is common in his industry. Yokohama said that allows the couple to go on midweek family outings with their elementary-school age child.

Fast Retailing Co., the Japanese company that owns Uniqlo, Theory, J Brand and other clothing brands, pharmaceutical company Shionogi & Co., and electronics companies Ricoh Co. and Hitachi also began offering a four-day workweek in recent years.

The trend even has gained traction in the notoriously consuming finance industry. Brokerage SMBC Nikko Securities Inc. started letting workers put in four days a week in 2020. Banking giant Mizuho Financial Group offers a three-day schedule option.

Critics of the government’s push say that in practice, people put on four-day schedules often end up working just as hard for less pay.

But there are signs of change.

A annual Gallup survey that measures employee engagement ranked Japan as having among the least engaged workers of all nationalities surveyed; in the most recent survey, only 6% of the Japanese respondents described themselves as engaged at work compared to the global average of 23%.

That means relatively few Japanese workers felt highly involved in their workplace and enthusiastic about their work, while most were putting in their hours without investing passion or energy.

Kanako Ogino, president of Tokyo-based NS Group, thinks offering flexible hours is a must for filling jobs in the service industry, where women comprise most of the work force. The company, which operates karaoke venues and hotels, offers 30 different scheduling patterns, including a four-day workweek, but also taking long periods off in between work.

To ensure none of the NS Group’s workers feel penalized for choosing an alternative schedule, Ogino asks each of her 4,000 employees twice a year how they want to work. Asserting individual needs can be frowned upon in Japan, where you are expected to sacrifice for the common good.

“The view in Japan was: You are cool the more hours you work, putting in free overtime,” Ogino said with a laugh. “But there is no dream in such a life.”

___

Yuri Kageyama is on X: https://x.com/yurikageyama

Why Super Micro Computer Stock Crashed 28.6% This Week

Super Micro Computer (NASDAQ: SMCI) stock got hit hard over the last week of trading. The company’s share price ended the period down 28.6% from last Friday’s market close, according to data from S&P Global Market Intelligence.

On Tuesday, Hindenburg Research published bearish coverage and alleged that Supermicro was a serial offender when it came to bad accounting practices. The short-seller also raised other concerns about the strength of the business. Just one day later, the server specialist announced that it was delaying the filing of its annual 10-K report with the Securities and Exchange Commission (SEC).

Supermicro’s filing delay added weight to Hindenburg’s report

With its short note, Hindenburg stated that it had found evidence of new accounting manipulations by Supermicro. The report highlighted $983.1 million in payments made over the last three years to private companies owned by brothers of Supermicro CEO Charles Liang as being suspicious. The company previously had significant accounting scandals in 2018 and 2020.

Hindenburg also said that it believed the server specialist was guilty of evading sanctions imposed by the U.S. government. Supermicro’s high-performance rack servers use advanced processors from Nvidia that are prohibited from being exported to China, and reports have suggested that the server company has continued to sell these technologies to Chinese customers.

Just one day after Hindenburg’s report was published, Supermicro said it was delaying its 10-K filing to complete an assessment of the design and operating effectiveness of its internal controls over financial reporting. The company did not provide a timing window as to when the 10-K filing might be submitted.

Wall Street doesn’t like Supermicro’s uncertain outlook

In a note published Wednesday, Wells Fargo maintained an equal-weight rating on Supermicro but lowered its price target on the stock from $650 per share to $375 per share. The firm’s analysts cited uncertainty about the company’s revenue picture and previous history with accounting problems as reasons for the target cut.

The next day, Bank of America (BofA) lifted its rating on Supermicro and shifted its status on the stock to under review. Citing the review of the company’s financials and internal oversight processes, BofA’s analysts said that they were unable to get a read on Supermicro’s fundamentals.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $720,542!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Wells Fargo is an advertising partner of The Ascent, a Motley Fool company. Bank of America is an advertising partner of The Ascent, a Motley Fool company. Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bank of America and Nvidia. The Motley Fool has a disclosure policy.

Why Super Micro Computer Stock Crashed 28.6% This Week was originally published by The Motley Fool